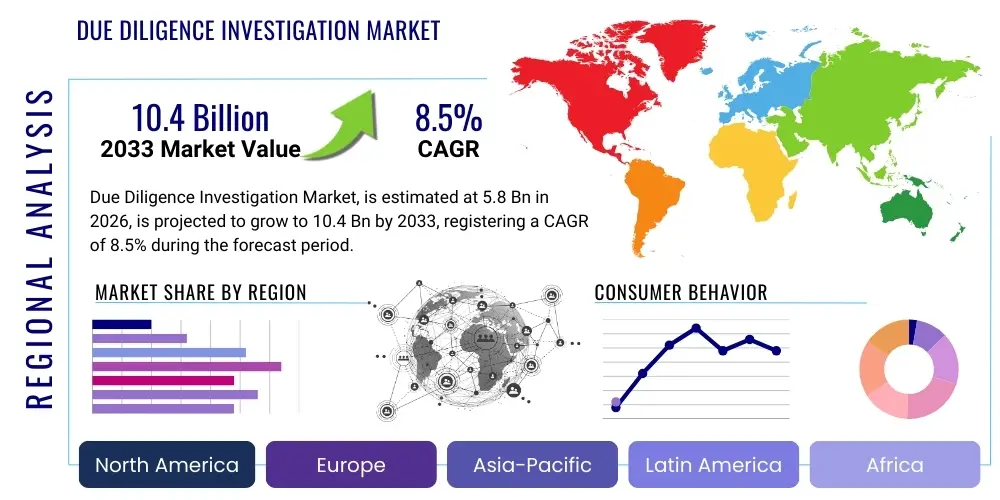

Due Diligence Investigation Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442320 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Due Diligence Investigation Market Size

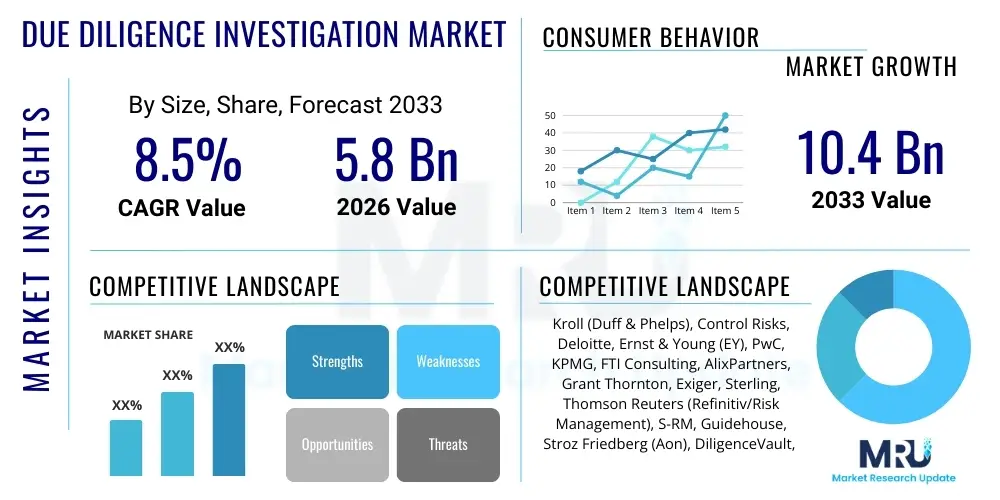

The Due Diligence Investigation Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at $5.8 Billion USD in 2026 and is projected to reach $10.4 Billion USD by the end of the forecast period in 2033. This robust expansion is primarily fueled by the increasing complexity of global regulatory environments, heightened scrutiny in cross-border mergers and acquisitions (M&A), and the imperative for organizations across all sectors to mitigate financial, reputational, and compliance risks effectively.

Market expansion is also supported by the rapid integration of advanced analytical technologies, including Artificial Intelligence (AI) and Machine Learning (ML), which enhance the efficiency, depth, and scalability of investigative processes. As corporate governance standards become more stringent globally, the reliance on third-party due diligence expertise—especially for supply chain integrity, anti-money laundering (AML), and know-your-customer (KYC) compliance—is driving sustained demand across various industry verticals. Specialized services, such as enhanced due diligence (EDD) and environmental, social, and governance (ESG) due diligence, are emerging as significant growth catalysts.

Due Diligence Investigation Market introduction

The Due Diligence Investigation Market encompasses a suite of professional services dedicated to verifying, analyzing, and assessing critical information pertaining to a potential transaction, business relationship, or investment. These investigations are essential components of risk management frameworks, providing clients with comprehensive insights into the financial stability, operational integrity, legal standing, and reputation of an entity or individual. Key services include background checks, financial statement analysis, forensic investigations, compliance auditing, litigation history searches, and specialized assessments like intellectual property (IP) and IT due diligence, all designed to identify hidden risks and validate disclosed information before capital commitments are made or partnerships are finalized.

The primary applications of these services span M&A activities, private equity investments, venture capital funding rounds, regulatory compliance mandates (such as Foreign Corrupt Practices Act compliance), and the vetting of supply chain partners and senior executives. The core product offered is actionable intelligence and risk analysis, synthesized into formal reports that inform strategic decision-making. The comprehensive nature of these investigations ensures that clients can navigate complex regulatory landscapes and opaque international markets with a clear understanding of potential liabilities, thereby maximizing investment security and ensuring adherence to ethical and legal standards.

The major benefits derived from robust due diligence include significant risk mitigation, prevention of costly litigation, protection of corporate reputation, and enhanced negotiating leverage during transaction structuring. Driving factors include the increasing velocity of global M&A activity, the proliferation of global anti-corruption and anti-bribery laws, the rising threat of cybercrime and fraud requiring specialized digital due diligence, and the regulatory pressure on financial institutions to enforce rigorous KYC and AML procedures. These factors collectively establish due diligence as a non-negotiable requirement for sustainable and responsible business operations in the modern global economy.

Due Diligence Investigation Market Executive Summary

The Due Diligence Investigation Market is currently characterized by several pivotal business trends, notably the shift toward tech-enabled solutions that integrate AI, Big Data analytics, and specialized investigative software to accelerate data collection and analysis, particularly in high-volume document review and cross-language screening. Furthermore, the market is experiencing significant growth in demand for specialized due diligence services, including cybersecurity due diligence and ESG due diligence, reflecting broader corporate priorities beyond traditional financial metrics. Consolidation among smaller, regional investigation firms by larger, global consulting and accounting powerhouses is a persistent trend, aimed at offering integrated, cross-disciplinary services that cover financial, legal, technical, and operational risks under a single mandate.

Regional trends indicate that North America and Europe continue to dominate the market in terms of revenue, driven by mature M&A markets, stringent regulatory enforcement, and a high concentration of private equity and venture capital activity. However, the Asia Pacific (APAC) region is demonstrating the highest growth trajectory, fueled by rapid economic expansion, increasing foreign direct investment (FDI), and developing regulatory frameworks, particularly in countries such as China, India, and Southeast Asian nations where market opacity necessitates enhanced investigative measures. The Middle East and Africa (MEA) region is also emerging as a high-potential market, largely driven by infrastructure investments and ongoing anti-corruption initiatives.

Segment trends reveal that financial due diligence remains the foundational segment, but operational and compliance due diligence are experiencing accelerated growth due to increased focus on supply chain resilience and global anti-bribery statutes. Within the end-user vertical, the Financial Services segment, particularly banking and insurance, maintains the largest market share owing to perpetual regulatory compliance needs (KYC/AML). However, the Technology, Media, and Telecommunications (TMT) segment and the Healthcare and Pharmaceuticals segment are exhibiting faster growth rates, driven by complex intellectual property disputes, rapid technological disruption, and high-stakes regulatory approvals that mandate rigorous vetting of partners and targets. The shift towards recurring revenue models, offering continuous compliance monitoring rather than one-off investigations, is restructuring service delivery.

AI Impact Analysis on Due Diligence Investigation Market

Analysis of common user questions regarding AI's influence on the Due Diligence Investigation Market reveals primary themes revolving around efficiency gains, data accuracy, cost reduction, and ethical implementation. Users frequently inquire about how AI tools, specifically Natural Language Processing (NLP) and machine learning algorithms, can expedite the review of massive volumes of unstructured data (e.g., emails, contracts, public records) and whether these systems maintain forensic integrity and legal defensibility. Concerns often center on the risk of algorithmic bias, data privacy when feeding sensitive information into AI models, and the potential displacement of human analysts. Expectations are high regarding AI's capability to flag subtle anomalies, predict potential litigation risks, and perform continuous monitoring far beyond the capacity of traditional human-led teams, thereby transitioning due diligence from a reactive checklist exercise to a proactive risk forecasting discipline.

The integration of AI is fundamentally transforming the investigative workflow, moving critical labor from initial document processing and preliminary screening to high-level analysis and strategic interpretation. AI tools are becoming indispensable for Enhanced Due Diligence (EDD), allowing investigators to process vast, disparate datasets—including social media data, deep web archives, and global sanctions lists—in real-time, significantly reducing the time required for pre-transaction assessments from weeks to mere days. This technological leap allows due diligence professionals to focus their expertise on complex, nuanced areas requiring human judgment, such as assessing cultural fit or interpreting localized geopolitical risk factors.

While AI offers unprecedented opportunities for depth and speed, its implementation necessitates substantial upfront investment in specialized platforms and training for investigative teams. The market is increasingly segmenting into providers who possess proprietary, AI-driven investigative tools and those who rely on conventional methods, creating a competitive advantage for technology frontrunners. Crucially, the final responsibility and legal accountability for findings remain with the human investigator, ensuring that AI acts as an augmentation tool rather than a replacement for professional assessment. This dual approach emphasizes the need for transparent, explainable AI (XAI) models to uphold the rigor and credibility required in legal and compliance contexts.

- AI accelerates document review through advanced NLP, drastically reducing investigation timelines.

- Machine Learning algorithms identify complex patterns and anomalies indicative of fraud or non-compliance hidden within large datasets.

- Predictive analytics enhances risk scoring, enabling clients to anticipate future regulatory enforcement actions or litigation risks.

- AI-driven tools facilitate multi-lingual screening and monitoring of global sanctions and adverse media lists in real time.

- Automation of repetitive data extraction tasks frees human investigators for strategic analysis and interpretation.

DRO & Impact Forces Of Due Diligence Investigation Market

The dynamics of the Due Diligence Investigation Market are governed by a robust set of Drivers, Restraints, and Opportunities (DRO), which collectively constitute significant Impact Forces shaping market structure and service demand. Key Drivers include the proliferation of highly complex global regulatory regimes (e.g., GDPR, FCPA, UK Bribery Act), which necessitate mandatory, intensive, and continuous third-party compliance verification. This is compounded by the persistent increase in global M&A activity, where successful integration and valuation depend fundamentally on accurate risk assessment. Restraints largely center on the high cost and extensive time required for comprehensive, traditional investigations, alongside growing concerns over data privacy regulations, particularly regarding cross-border data transfer, which can complicate investigative scope. Opportunities are abundant, primarily through the accelerated adoption of advanced technologies like AI and blockchain for verification, along with the significant, untapped potential presented by emerging economies and the mandated rise of specialized ESG due diligence services.

Impact Forces are pushing the market towards greater specialization and technological dependence. Regulatory Stringency is the most powerful force, driving demand for specialized legal and compliance investigations tailored to specific jurisdictions. Economic Globalization increases the complexity and volume of cross-border transactions, requiring investigators to manage diverse languages, cultures, and legal systems. The technological disruption force, powered by AI and Big Data, mandates that firms invest heavily in proprietary tools to remain competitive, creating a barrier to entry for smaller, less capitalized players. Furthermore, the increasing public and shareholder demand for corporate transparency acts as a strong reputational risk mitigation force, making thorough due diligence a fundamental expectation rather than an optional safeguard.

The interplay between these forces dictates the future trajectory of the market. While costs and data privacy concerns present significant hurdles, the overarching necessity of risk avoidance in high-stakes corporate actions ensures sustained growth. Firms that successfully leverage technology to mitigate the restraints—by offering faster, more cost-effective, and highly accurate insights—are positioned to capitalize on the opportunities presented by regulatory compliance mandates and emerging market expansion. This environment is favoring holistic service models that combine traditional forensic accounting skills with cutting-edge data science capabilities, guaranteeing comprehensive coverage across all facets of business risk.

- Drivers: Intensified global regulatory enforcement; High volume and complexity of cross-border M&A; Rising threat of corporate fraud and cyber risks; Mandatory supply chain transparency requirements.

- Restraints: High service cost; Strict global data privacy laws (e.g., GDPR, CCPA) restricting data access; Short timelines for large-scale transaction closings; Shortage of skilled, multidisciplinary forensic data specialists.

- Opportunities: Integration of AI/ML for enhanced predictive risk modeling; Expansion into fast-growing APAC and MEA markets; Increasing demand for specialized ESG and IT due diligence; Development of continuous monitoring subscription models.

- Impact Forces: Regulatory Strictness (High); Economic Globalization (High); Technological Disruption (Very High); Reputational Risk Avoidance (High).

Segmentation Analysis

The Due Diligence Investigation Market is extensively segmented based on the Type of Due Diligence, the Specific Service Offered, the Size of the Organization being investigated, and the End-Use Industry Vertical. Understanding these segmentations is critical for market participants to tailor their offerings and identify high-growth niches. Segmentation by Type, such as Financial, Legal, Operational, and Commercial, reflects the distinct aspects of a target entity that require scrutiny, with financial due diligence historically forming the largest share, although operational and commercial assessments are rapidly increasing in importance due to focus on supply chain resilience and market validity.

Service segmentation further refines the market, distinguishing between standard background checks, enhanced due diligence (EDD), forensic accounting, litigation support, and specialized technological assessments (e.g., cybersecurity audit, intellectual property valuation). EDD, which involves deeper scrutiny of politically exposed persons (PEPs) and high-risk entities, is a prime growth area driven by stringent Anti-Money Laundering (AML) and Know-Your-Customer (KYC) regulations across the banking and financial sectors. This detailed breakdown allows providers to specialize in niche, high-margin services that require sophisticated technical or forensic expertise.

Finally, industry vertical segmentation shows where demand originates. Financial Services and Legal sectors are perennial top consumers, given their regulatory burden and high transactional volumes. However, the fastest growth is observed in Technology, Media, and Telecommunications (TMT) due to frequent mergers involving complex IP portfolios, and in Manufacturing/Supply Chain, driven by the global necessity of vetting third-party suppliers for ethical compliance, labor standards, and geopolitical risk. The diversification across these segments highlights the market's maturity and its integral role across the entire corporate ecosystem.

- By Type:

- Financial Due Diligence (FDD)

- Legal Due Diligence (LDD)

- Operational Due Diligence (ODD)

- Commercial Due Diligence (CDD)

- Environmental, Social, and Governance (ESG) Due Diligence

- IT and Cybersecurity Due Diligence

- By Service:

- Enhanced Due Diligence (EDD)

- Standard Background Checks

- Forensic Accounting and Fraud Investigation

- Litigation Support and Asset Tracing

- Compliance and Regulatory Vetting

- By Industry Vertical:

- Financial Services (Banking, Insurance, Investment)

- Technology, Media, and Telecommunications (TMT)

- Healthcare and Pharmaceuticals

- Manufacturing and Industrials

- Energy and Utilities

- Government and Public Sector

- By Organization Size:

- Large Enterprises

- Small and Medium-sized Enterprises (SMEs)

Value Chain Analysis For Due Diligence Investigation Market

The Value Chain for the Due Diligence Investigation Market is characterized by a high degree of integration between specialized data sources, technology providers, human capital, and final client delivery. The upstream segment involves critical suppliers such as public record databases, specialized legal and financial data vendors (e.g., Bloomberg, LexisNexis), and advanced software developers creating AI/ML tools for data mining and analysis. These upstream partners provide the raw intelligence and technological infrastructure necessary for the investigative process. The quality and accessibility of these data sources directly impact the speed and accuracy of the subsequent investigation, making proprietary access to specialized datasets a significant competitive differentiator for investigation firms.

The core process segment is dominated by the investigation and consulting firms themselves. This stage involves the collection, verification, triangulation, and professional analysis of data by forensic accountants, legal experts, security specialists, and multilingual analysts. Value is added primarily through the interpretation of complex, often contradictory, information into actionable risk reports. Downstream activities involve the direct delivery of these risk reports and strategic advisory services to the end-user clients, which include private equity firms, corporate legal departments, investment banks, and regulatory bodies. Client success hinges on the firm’s ability to clearly communicate potential risks and provide defensible, evidence-based recommendations that withstand legal scrutiny.

Distribution channels are multifaceted. Direct client engagement, where large consulting firms maintain ongoing advisory relationships with repeat clients (e.g., global banks or major PE houses), constitutes the primary channel. Indirect channels involve referrals from crucial intermediaries, particularly corporate law firms, accounting firms, and investment banks who require independent verification services for their clients’ transactions. The trend toward digital platforms and SaaS-based continuous monitoring solutions is also emerging as a viable, technology-driven distribution channel, allowing smaller enterprises access to scaled-down, automated compliance checks that were previously cost-prohibitive. Effective control over data provenance and delivery speed throughout this chain is essential for maintaining market credibility.

Due Diligence Investigation Market Potential Customers

The primary consumers and end-users of Due Diligence Investigation services are entities engaged in high-stakes financial transactions, stringent regulatory environments, or complex international operations where risk mitigation is paramount. Private Equity (PE) and Venture Capital (VC) firms represent a foundational customer segment. These investors rely on thorough financial, operational, and commercial due diligence to validate valuation models, identify undisclosed liabilities, and ensure the successful execution of investment theses before deploying large capital sums. Given the typical high leverage and accelerated timelines involved in fund operations, these customers demand speed, accuracy, and depth of analysis.

Another major customer group comprises Corporate Legal Departments and Corporate Development teams within large multinational corporations. These departments continuously require due diligence services for internal corporate governance, supplier vetting, vendor risk management, and pre-acquisition assessment of strategic targets. Specifically, companies operating across multiple jurisdictions seek Enhanced Due Diligence (EDD) to ensure compliance with global anti-corruption statutes (e.g., FCPA, UK Bribery Act) when engaging third-party agents, distributors, or joint venture partners, making compliance vetting a recurring necessity.

Financial Institutions, including global banks, insurance companies, and wealth management firms, constitute a non-discretionary customer segment driven by perpetual regulatory requirements. These institutions utilize due diligence for mandatory Know-Your-Customer (KYC) and Anti-Money Laundering (AML) compliance, particularly when onboarding high-net-worth individuals, processing complex cross-border transactions, or monitoring correspondent banking relationships. Furthermore, specialized government agencies and regulatory bodies frequently engage due diligence firms for enforcement support, fraud investigations, and asset tracing exercises, cementing their role as critical, albeit specialized, buyers in the market.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $5.8 Billion USD |

| Market Forecast in 2033 | $10.4 Billion USD |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Kroll (Duff & Phelps), Control Risks, Deloitte, Ernst & Young (EY), PwC, KPMG, FTI Consulting, AlixPartners, Grant Thornton, Exiger, Sterling, Thomson Reuters (Refinitiv/Risk Management), S-RM, Guidehouse, Stroz Friedberg (Aon), DiligenceVault, Refinitiv, SAI Global, Risk Advisory Group, TRACE International |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Due Diligence Investigation Market Key Technology Landscape

The Due Diligence Investigation Market is undergoing a fundamental technological transformation driven by the necessity to process exponentially growing data volumes accurately and rapidly. Key technologies include advanced Big Data Analytics platforms that are essential for aggregating, structuring, and analyzing disparate datasets derived from global public records, media archives, and corporate filings. These platforms leverage massively parallel processing capabilities to handle petabytes of data, providing investigators with holistic views that traditional manual processes could never achieve. The shift is moving away from simple keyword searching toward sophisticated relationship mapping and risk visualization tools.

Artificial Intelligence (AI) and Machine Learning (ML) are central to the technological landscape. Specifically, Natural Language Processing (NLP) is crucial for efficient document review, allowing algorithms to understand context, extract relevant entities, and flag potentially problematic clauses or communications across thousands of documents in multiple languages. ML models are used for predictive risk scoring, identifying subtle patterns of fraudulent behavior, or predicting the likelihood of regulatory non-compliance based on historical data. These technologies are integrated into proprietary SaaS platforms offered by leading service providers, enabling continuous monitoring capabilities post-transaction.

Furthermore, blockchain technology is beginning to play a significant role, particularly in enhancing the integrity and verifiability of digital records, supply chain documentation, and certified credentials. While still nascent in widespread adoption for investigations, blockchain offers a potential solution for creating immutable records of corporate actions and third-party certifications, thereby simplifying and solidifying the verification component of due diligence. Cybersecurity tools are also integral, as IT and technical due diligence requires specialized forensic software to assess the digital posture, vulnerability, and overall technology stack of a target entity, ensuring that transaction risks related to data breaches or legacy systems are fully quantified.

Regional Highlights

The global Due Diligence Investigation Market exhibits distinct regional dynamics driven by local regulatory strictness, economic activity levels, and cultural attitudes toward transparency and risk management. North America, specifically the United States, represents the largest and most mature market segment, characterized by high-volume M&A activity, a deeply entrenched private equity sector, and highly litigious commercial environments. Demand here is exceptionally robust for complex financial forensics, high-tech IP due diligence, and sophisticated compliance assessments driven by SEC, DOJ, and Treasury enforcement actions. The market is highly competitive, dominated by large global consultancies and specialized boutique firms offering proprietary technological tools.

Europe holds the second-largest market share, demonstrating significant demand driven primarily by stringent regulatory mandates, particularly the General Data Protection Regulation (GDPR), the EU Anti-Money Laundering Directives, and localized anti-bribery laws across member states. The market is fragmented due to diverse legal systems and languages, necessitating investigators with deep local jurisdictional expertise. Western European nations (UK, Germany, France) are the core revenue generators, though Central and Eastern Europe are seeing increased demand corresponding to rising foreign investment and regulatory harmonization efforts.

The Asia Pacific (APAC) region is forecasted to be the fastest-growing market, propelled by rapid industrialization, massive cross-border capital flows (especially FDI), and a growing focus on corporate governance in key economies like China, India, and Australia. The complexity of operating in markets where publicly available information may be limited or unreliable drives substantial demand for Enhanced Due Diligence (EDD) and investigative services focused on ownership transparency and geopolitical risk. The developing regulatory environment across ASEAN countries further ensures sustained market growth as local companies increasingly adopt international standards of compliance and risk mitigation.

- North America: Market leader, driven by robust M&A, high concentration of financial institutions, and stringent enforcement of anti-corruption laws (FCPA). Strong adoption of AI and Big Data platforms.

- Europe: Second largest, driven by complex GDPR and AML compliance requirements. Demand focuses on legal and compliance due diligence across multiple jurisdictions.

- Asia Pacific (APAC): Highest CAGR, fueled by rapid economic expansion, increasing FDI, and the inherent difficulty of obtaining reliable public information, favoring EDD services.

- Latin America (LATAM): Growing market, linked to regional anti-corruption movements and increasing institutional investment, requiring specialized political and integrity investigations.

- Middle East and Africa (MEA): Emerging growth hub, primarily driven by large infrastructure projects and oil & gas sector investments, demanding stringent localized integrity due diligence.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Due Diligence Investigation Market.- Kroll (Duff & Phelps)

- Control Risks

- Deloitte

- Ernst & Young (EY)

- PwC

- KPMG

- FTI Consulting

- AlixPartners

- Grant Thornton

- Exiger

- Sterling

- Thomson Reuters (Refinitiv/Risk Management)

- S-RM

- Guidehouse

- Stroz Friedberg (Aon)

- DiligenceVault

- Refinitiv

- SAI Global

- Risk Advisory Group

- TRACE International

- TransUnion

Frequently Asked Questions

Analyze common user questions about the Due Diligence Investigation market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving demand in the Due Diligence Investigation Market?

The primary driver is the exponentially increasing complexity and enforcement of global regulatory and compliance mandates, such as AML, KYC, and anti-corruption laws (FCPA), coupled with high volumes of high-stakes corporate transactions like M&A.

How is technology, specifically AI, changing traditional due diligence investigations?

AI, particularly NLP and Machine Learning, is automating the time-consuming process of reviewing vast volumes of unstructured data. This shift accelerates investigation timelines, improves accuracy in identifying fraud indicators, and allows human analysts to focus on strategic risk interpretation.

Which segment of due diligence investigation services is experiencing the fastest growth?

Environmental, Social, and Governance (ESG) Due Diligence and IT/Cybersecurity Due Diligence are exhibiting the fastest growth rates, driven by mounting investor and regulatory pressure on corporate social responsibility, sustainability, and digital infrastructure security.

Which geographical region holds the highest growth potential for due diligence service providers?

The Asia Pacific (APAC) region holds the highest growth potential, fueled by robust economic development, massive inflows of foreign direct investment, and developing regulatory landscapes that necessitate advanced, localized investigative services.

Who are the typical primary buyers of Enhanced Due Diligence (EDD) services?

Primary buyers of EDD services are financial institutions (for AML/KYC compliance), private equity firms, and large multinational corporations vetting high-risk third parties, Politically Exposed Persons (PEPs), or conducting transactions in opaque jurisdictions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager