Dump Trailer Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442883 | Date : Feb, 2026 | Pages : 243 | Region : Global | Publisher : MRU

Dump Trailer Market Size

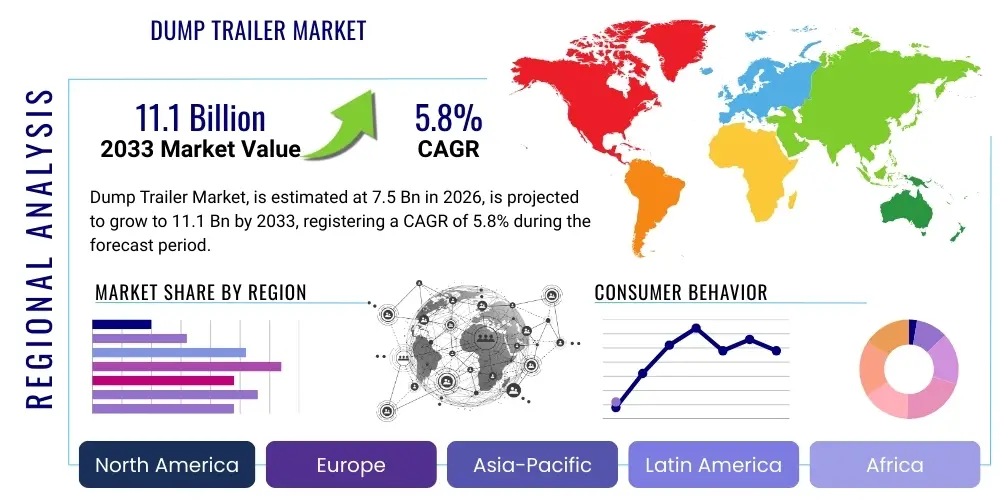

The Dump Trailer Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 7.5 Billion in 2026 and is projected to reach USD 11.1 Billion by the end of the forecast period in 2033.

Dump Trailer Market introduction

The Dump Trailer Market encompasses the manufacturing, distribution, and utilization of specialized trailers designed for bulk material transportation and self-unloading, primarily serving the critical sectors of construction, infrastructure development, mining, waste management, and agriculture. These robust vehicles, characterized by hydraulic mechanisms allowing the tilting of the trailer bed to discharge loads efficiently, are indispensable assets in large-scale projects globally. Product types vary significantly based on application needs, including standard end dumps, side dumps offering greater stability on uneven terrain, belly dumps (bottom dumps) preferred for controlled material laying such as aggregates, and demolition-specific scrap trailers built for durability. The demand correlation is highly sensitive to governmental infrastructure spending, particularly in emerging economies where urbanization projects and road network expansion necessitate continuous material transport, alongside regulatory requirements focusing on payload efficiency and safety standards, which drive fleet modernization cycles toward lighter, high-strength material construction like high-tensile steel and aluminum alloys. Furthermore, the increasing complexity of waste disposal logistics, including the management of construction and demolition (C&D) debris, fuels a consistent baseline demand for specialized refuse handling dump trailers, ensuring the market's resilience even during cyclical downturns in specific construction segments, making it a critical barometer of global heavy industry health.

The core utility and value proposition of dump trailers stem from their capability to handle high volumes of abrasive and heavy materials—ranging from sand, gravel, and asphalt to coal and specialized mining overburden—with optimized turnaround times. Major applications are concentrated in large public works projects such as highway construction and dam building, quarry operations necessitating the movement of crushed stone, and agricultural enterprises using them for grain and silage transport. Key benefits derived by end-users include enhanced operational efficiency due to rapid unloading cycles, reduction in manual labor costs associated with material handling, and improved safety features mandated by industry regulations, particularly concerning anti-tip systems and brake reliability. The continuous innovation in hydraulics systems, axle configurations (such as lift axles for weight management), and coupling technologies further enhances their versatility across diverse operational environments, from congested urban construction sites requiring high maneuverability to remote mining locations demanding maximum durability and off-road capability, underscoring their vital role in the supply chain of foundational raw materials necessary for economic activity.

Driving factors for sustained market growth are multifaceted and structurally linked to macroeconomic trends. Firstly, global population growth necessitates massive investments in residential, commercial, and social infrastructure, creating a perpetual need for earthmoving and material transport equipment. Secondly, the push toward sustainable infrastructure and renewable energy projects—such which require extensive site preparation and material movement for solar farms, wind turbine bases, and battery manufacturing facilities—is generating new application niches. Thirdly, technological advancements focusing on digitalization and connectivity, such as integrating telematics and IoT sensors into trailer fleets for real-time tracking, utilization monitoring, and predictive maintenance, offer compelling value propositions to fleet owners seeking to minimize downtime and maximize asset utilization. These driving forces collectively ensure that despite short-term economic fluctuations, the foundational requirements for efficient bulk material transport continue to propel the Dump Trailer Market forward, supported by ongoing regulatory harmonization attempts across different regional markets aimed at standardizing safety and weight limitations, fostering cross-border trade and equipment standardization.

Dump Trailer Market Executive Summary

The Dump Trailer Market is currently defined by robust business trends centered on fleet modernization, driven primarily by stringent environmental regulations and the ongoing global infrastructure boom, particularly prominent in North America and Asia Pacific. Key business dynamics include a pronounced shift towards lightweight, high-capacity aluminum trailers to maximize payload efficiency and mitigate rising fuel costs, offering a strategic advantage over traditional steel structures while adhering to increasingly complex federal and state weight limits. Manufacturers are focusing heavily on integrating advanced safety mechanisms, such as electronic stability control (ESC) and advanced anti-lock braking systems (ABS), which are quickly transitioning from optional features to industry standards in response to heightened regulatory scrutiny over hauling accidents. Furthermore, the market exhibits consolidation tendencies among leading global players seeking to leverage economies of scale and expand their service networks, particularly in offering comprehensive aftermarket support, including telematics integration packages and certified parts availability, acknowledging that total cost of ownership (TCO) is a paramount purchasing criterion for large construction and logistics firms. The persistent volatility in raw material prices, specifically steel and aluminum, continues to influence pricing strategies, pushing manufacturers to explore optimized supply chain resilience and multi-sourcing strategies to stabilize production costs.

Regionally, the market presents distinct growth trajectories and demand patterns. North America remains the dominant revenue contributor, characterized by massive governmental infrastructure spending initiatives (like the Infrastructure Investment and Jobs Act in the U.S.) that generate significant, sustained demand for high-spec, customized trailers, often prioritizing safety and advanced material technology. The European market, while mature, is undergoing transformation due to strict EU directives on vehicle emissions and safety, spurring investment in electric or hybrid-compatible dump trailers, albeit at a slower pace due to differing national road limits and construction practices. Asia Pacific (APAC) stands out as the fastest-growing region, fueled by rapid urbanization, extensive road and rail network expansion, and burgeoning mining activities in countries like India, Indonesia, and Australia; demand here is often characterized by a focus on durability and cost-effectiveness, favoring standard end-dump and heavy-duty configurations suitable for large-scale, high-volume operations. Latin America and the Middle East & Africa (MEA) represent emerging opportunities, contingent upon commodity market stability and foreign direct investment into energy and infrastructure projects, where demand is typically focused on robust, basic models capable of handling rugged operating environments with limited maintenance infrastructure.

Segment trends highlight a preference shift across various product categories and end-use sectors. The End Dump Trailer segment maintains the largest market share due to its versatility and established use across general construction and aggregate hauling, although Side Dump Trailers are gaining traction, especially in road construction and tunneling projects, owing to their enhanced safety profile (lower center of gravity) and rapid side-unloading capability which minimizes traffic disruption. Regarding materials, aluminum dump trailers are experiencing accelerated adoption rates over traditional steel, particularly in highway transport applications where every pound saved translates directly into increased legal payload capacity and fuel savings, justifying their higher initial capital outlay through superior long-term operational economics. End-user segmentation confirms that the Construction and Infrastructure sector remains the largest consumer, but the Waste Management and Recycling segment is exhibiting robust, counter-cyclical growth, driven by global mandates for improved waste handling logistics and increasing necessity for efficiently transporting specialized waste streams, including contaminated soil and recycled materials, requiring dedicated, sealed, and often higher-cube trailer designs.

AI Impact Analysis on Dump Trailer Market

User queries regarding the impact of Artificial Intelligence (AI) on the Dump Trailer Market generally converge on themes of operational efficiency, safety enhancements, and the timeline for autonomous integration. Key concerns revolve around the return on investment (ROI) for costly AI-driven telematics and sensing systems, data security and ownership issues stemming from continuous data capture, and the necessity of upskilling current fleet management personnel to effectively interpret and utilize predictive analytics output. Users, particularly medium to small fleet operators, frequently inquire about accessible, retrofit AI solutions that can improve existing trailer health monitoring without requiring complete fleet replacement. Expectations are high regarding AI's potential to revolutionize preventive maintenance schedules by accurately predicting component failures (especially tires, hydraulics, and braking systems) based on real-time usage data and environmental factors, thereby minimizing unforeseen operational downtime, which is extremely costly in the materials transport sector. There is also a strong interest in how AI can optimize trailer utilization through sophisticated route planning that considers factors beyond simple mileage, such as traffic congestion, construction zone limitations, and variable load weights across multiple job sites, ensuring the optimal trailer type is dispatched for specific material demands, maximizing load factor and efficiency.

The primary direct impact of AI implementation is currently seen in sophisticated telematics and fleet management systems. These systems utilize machine learning algorithms to process vast amounts of data—including GPS location, hydraulic pressure sensor readings, weight measurements, braking force application, and driver behavior inputs—to generate actionable insights. For dump trailers specifically, AI facilitates enhanced load monitoring by verifying compliance with legal weight limits automatically, reducing the risk of fines and vehicle strain. Furthermore, predictive modeling analyzes historical patterns of wear and tear, coupled with real-time operational stress, to schedule maintenance activities precisely when needed, rather than relying on fixed time intervals or basic mileage readings. This shift from reactive or scheduled maintenance to predictive maintenance significantly extends the lifespan of expensive components like hydraulic cylinders and suspensions while improving fleet availability. This analytical capability is foundational for next-generation fleet asset management, moving the industry closer to a true "trailer-as-a-service" model where maintenance is proactive and utilization is optimized based on highly granular data.

Looking ahead, AI is the foundational technology enabling greater levels of automation and advanced driver assistance systems (ADAS) in the towing vehicles, which indirectly impacts the trailer market by demanding higher levels of sensor integration and standardized communication protocols (such as CAN bus data sharing) on the trailer itself. While fully autonomous dump trailers operating on public roads face significant regulatory hurdles and technological challenges (e.g., precise positioning for dumping in varying site conditions), AI-driven systems are already enhancing job site safety through proximity sensing and automated anti-tip warnings, utilizing spatial awareness algorithms to detect uneven ground or improperly distributed loads before a critical failure occurs. These safety enhancements address a significant risk factor in dump trailer operations—tipping accidents—which remains a major concern for insurance providers and safety regulators. The evolution toward autonomous hauling in controlled environments, such as large mines and quarries, where repetitive routes and controlled speeds are common, serves as a crucial testing ground for advanced AI integration, paving the way for eventual adoption in broader industrial logistics applications that require enhanced precision and 24/7 operational capability.

- AI-driven Predictive Maintenance: Utilizing sensor data (hydraulics, tires, brakes) to forecast equipment failures and optimize repair scheduling, drastically reducing costly unplanned downtime.

- Optimized Route and Dispatch: Machine learning algorithms enhance routing efficiency, minimizing fuel consumption and travel time based on real-time traffic and site access constraints.

- Enhanced Load Compliance and Safety: Automated monitoring systems ensure accurate load weight distribution and adherence to legal limits, mitigating regulatory risks and structural damage.

- Advanced Anti-Tip Systems: AI algorithms analyze tilt angle, ground stability, and load dynamics during the dumping process to prevent dangerous rollovers, improving operational safety.

- Autonomous Operation Pilots: Testing and deployment in closed environments (mines, large construction sites) using AI for self-driving capability, setting precedents for future integration.

- Data Integration and Telematics: Seamless integration of trailer operational data with central fleet management platforms for high-level performance analysis and asset utilization reporting.

- Driver Behavior Analysis: Monitoring and scoring driver interactions with the trailer (braking, acceleration, cornering) to promote safer handling and reduce maintenance wear and tear.

DRO & Impact Forces Of Dump Trailer Market

The dynamics of the Dump Trailer Market are fundamentally shaped by a complex interplay of Drivers, Restraints, and Opportunities (DRO), which collectively exert significant Impact Forces on market growth trajectory, technological investment, and regional competitiveness. The primary Drivers center on global population increase and subsequent urbanization, requiring continuous investment in extensive infrastructure projects, particularly in developing nations where rapid construction necessitates high-volume material transport. Government stimulus packages targeting road, bridge, and utility maintenance across mature markets further solidify this demand base. Secondly, the regulatory environment acts as a strong driver for modernization, as stricter safety standards (e.g., required ESC/ABS systems) and evolving emissions targets push fleet operators to decommission older, non-compliant equipment in favor of new, technologically advanced trailers designed for optimal fuel efficiency and safety. Finally, the sustained expansion of extraction industries, specifically aggregate mining and bulk commodity handling (e.g., coal, iron ore), maintains a high, non-negotiable demand floor for heavy-duty dump trailers capable of operating under severe stress conditions, thereby injecting capital into the manufacturing sector and ensuring continuous innovation in material durability.

Conversely, significant Restraints impede market expansion and profitability. The inherent cyclical nature of the construction industry exposes the dump trailer market to considerable volatility; economic downturns or delays in large-scale government projects immediately depress demand for new equipment purchases. Furthermore, the high initial capital expenditure associated with purchasing specialized, high-capacity dump trailers, particularly those built with advanced aluminum alloys and sophisticated telematics, acts as a barrier to entry or fleet expansion for smaller operators, driving demand toward the secondary (used) market. Persistent volatility in raw material costs, especially steel and aluminum, directly impacts production costs, compelling manufacturers to frequently adjust pricing or absorb margins, creating uncertainty in long-term supply agreements. Finally, the increasing complexity of international trade tariffs and differing regional weight and dimension regulations pose logistical and design challenges for global manufacturers aiming for standardized product lines, forcing costly customization and fragmented production strategies across key geographic markets, thereby slowing global market penetration and raising end-user costs.

Despite these challenges, substantial Opportunities exist that promise future growth and innovation. The most potent opportunity lies in the rapid technological adoption of Smart Trailer technologies, integrating IoT, 5G connectivity, and sophisticated sensor arrays for real-time diagnostics, remote monitoring, and predictive failure analysis. This technological pivot allows manufacturers to transition from merely selling equipment to offering comprehensive fleet management solutions, adding significant value and recurring revenue streams through software services. Secondly, the accelerating trend toward sustainable construction practices, including increased emphasis on recycling construction and demolition waste (C&D debris), generates a specialized demand for lightweight, high-cube waste management trailers designed for specific material densities and stringent containment requirements. Thirdly, the expansion into niche applications, such as specialized environmental remediation projects, disaster relief logistics, and the transport needs of the burgeoning renewable energy sector (e.g., hauling concrete for wind turbine bases and land preparation for utility-scale solar farms), provides resilient, often non-cyclical, demand segments that manufacturers can strategically target, diversifying their revenue base beyond general infrastructure projects and stabilizing overall market exposure to traditional construction cycles. These opportunities incentivize continuous R&D investment and collaborative efforts between trailer manufacturers, telematics providers, and material science experts to develop lighter, safer, and more data-rich hauling solutions.

Segmentation Analysis

The Dump Trailer Market is structurally segmented based on crucial parameters including product type, material, axle configuration, and end-use application, reflecting the diverse and specialized requirements of the heavy logistics and construction industries. Understanding these segments is vital for manufacturers to tailor product offerings and for investors to gauge market dynamics, as performance often varies significantly between high-volume, standard segments and low-volume, high-value specialized segments. The segmentation by Product Type—encompassing End Dump, Side Dump, Bottom Dump, and specialized variants like Grain Trailers and Transfer Trailers—directly addresses different operational needs related to payload volume, required discharge method, and site maneuverability; for instance, end dumps dominate general construction while bottom dumps are preferred for linear infrastructure projects like road paving due to their controlled discharge capability. Material segmentation differentiates between traditional steel (known for durability and lower cost) and lightweight aluminum (favored for payload maximization and fuel efficiency), a division that increasingly determines the total cost of ownership (TCO) calculation for large fleet operators and heavily influences purchasing decisions based on regional weight regulations.

Further granularity is achieved through segmenting by Axle Configuration and Capacity, which dictates the trailer’s legal load rating and geographical applicability. Common configurations include tandem axle (two axles), tri-axle, and multi-axle setups with lift axles, designed to maximize legal gross vehicle weight ratings (GVWR) under varying jurisdictional rules and road quality conditions. High-capacity trailers (typically over 30 tons) are critical for mining and large quarry operations, whereas medium capacity trailers dominate general municipal and commercial construction. This segmentation highlights the complexity of manufacturing, as trailers must be designed to meet numerous localized road regulations simultaneously. The capacity segmentation also correlates strongly with end-user requirements, where specialized applications like bulk refuse transport require high-volume, lower-density capacities, contrasting with aggregate transport which demands higher density, weight-focused capacities, driving different material and structural choices in the manufacturing process.

Finally, the most impactful segmentation for forecasting market demand is the End-Use Application segment, which directly ties trailer demand to macroeconomic activities. Key sectors include Construction & Infrastructure (the largest consumer), Mining & Quarrying (demanding the most rugged trailers), Waste Management & Recycling (requiring specialized sealed units), and Agriculture (using specialized grain and silage trailers). The performance of the infrastructure segment is often driven by governmental policy and long-term public works funding, providing stability, while the mining segment is highly sensitive to global commodity prices. The burgeoning waste management segment is experiencing steady, non-cyclical growth driven by environmental mandates for improved municipal solid waste (MSW) and C&D debris handling. Analyzing these end-user segments allows for precise identification of high-growth niches, such as the increasing demand for transfer trailers utilized in urban waste transfer stations, which necessitate high-efficiency, multi-trailer hauling systems to reduce inner-city traffic congestion and operational footprint.

- Product Type:

- End Dump Trailers (Standard, Frame, Frameless)

- Side Dump Trailers

- Bottom Dump Trailers (Belly Dump)

- Transfer Trailers

- Specialty Trailers (Grain, Scrap, Demo)

- Material:

- Steel (High-Tensile Steel)

- Aluminum Alloys

- Combination (Hybrid Designs)

- Axle Configuration:

- Tandem Axle

- Tri-Axle

- Multi-Axle/Lift Axle Configurations

- Capacity:

- Low Capacity (Under 15 tons)

- Medium Capacity (15 to 30 tons)

- High Capacity (Over 30 tons)

- End-Use Application:

- Construction and Infrastructure

- Mining and Quarrying

- Waste Management and Recycling

- Agriculture

- Oil & Gas and Logistics

Value Chain Analysis For Dump Trailer Market

The Value Chain of the Dump Trailer Market is complex, beginning with upstream raw material sourcing and culminating in comprehensive aftermarket services, with significant opportunities for value addition at each stage. The Upstream Analysis focuses heavily on the procurement of primary manufacturing inputs: high-strength steel alloys (crucial for structural integrity and durability), aluminum alloys (essential for lightweight, payload-maximizing designs), specialized hydraulic components (cylinders, pumps, valves that drive the dumping mechanism), and high-quality tires and axles. Price volatility in global commodity markets for steel and aluminum is the foremost risk factor in the upstream segment, directly impacting production costs and requiring sophisticated supply chain risk management strategies, including long-term supply contracts and hedging. Successful manufacturers establish strong, often global, relationships with specialized suppliers of advanced hydraulics and suspension systems to ensure component reliability, performance, and compliance with stringent operational safety standards, focusing particularly on achieving economies of scale in component sourcing to maintain competitive pricing.

The central phase of the value chain involves design, manufacturing, and assembly. Manufacturers add value through proprietary engineering designs that optimize trailer weight distribution, aerodynamic profile, and operational safety features (e.g., enhanced stability during dumping). Production involves specialized processes, including automated welding, precision metal fabrication, and integration of complex hydraulic and electronic systems. Quality control is paramount, particularly concerning weld integrity and hydraulic system reliability, which are critical safety components. The manufacturing stage is characterized by a high degree of customization to meet diverse regional road regulations and specific end-user requirements (e.g., abrasion-resistant liners for hot asphalt vs. sealed bodies for municipal waste). The distribution phase, involving both Direct and Indirect Channels, is crucial for market access. Direct channels are typically utilized for large fleet sales and highly specialized custom orders, allowing manufacturers to maintain close customer relationships and maximize margin. Indirect channels, relying on regional dealer networks and authorized distributors, are essential for penetrating geographically dispersed markets, providing local sales, financing support, and critical maintenance services, ensuring rapid response times for spare parts supply which minimizes customer operational downtime.

The Downstream Analysis encompasses sales, delivery, financing, and the indispensable aftermarket segment. For dump trailers, aftermarket services—including scheduled maintenance, certified spare parts supply, repairs, and fleet modernization services (e.g., retrofitting telematics)—represent a significant and often high-margin revenue stream, crucial for long-term customer retention. Effective downstream management is characterized by robust parts availability and a highly skilled service technician network capable of handling complex repairs involving hydraulic and electrical systems. Potential integration of manufacturers into the downstream via proprietary telematics platforms allows for continuous monitoring of trailer health, facilitating predictive maintenance contracts and leasing/rental services. This downstream data loop is increasingly valuable, providing manufacturers with real-world performance feedback necessary for continuous product improvement and technological updates, thereby enhancing the overall customer lifecycle value. Efficient management of the entire value chain, from upstream material sourcing to downstream service provision, is the key determinant of market leadership and sustained competitive advantage.

Dump Trailer Market Potential Customers

The market for dump trailers is characterized by a high concentration of institutional and commercial buyers whose purchasing decisions are dictated by operational efficiency, regulatory compliance, and total cost of ownership (TCO). The primary category of end-users is large-scale Construction and Infrastructure Contractors, including general contractors involved in residential and commercial development, and specialized heavy civil engineering firms focused on public works such as highways, bridges, dams, and airports. These customers require diverse fleets of dump trailers, ranging from high-capacity tri-axle end dumps for earthmoving to precise bottom dumps for pavement base application. Their demand is highly sensitive to government project timelines and macroeconomic funding cycles. These buyers prioritize durability, payload capacity, and sophisticated safety features to minimize liabilities and ensure project schedules are met, often leading them to opt for premium, high-specification models with integrated telematics for project cost accounting and asset utilization tracking.

A second major segment comprises Mining and Quarrying Operations, which are distinct in their demand profile, requiring the most rugged, heavy-duty trailers capable of handling abrasive materials like crushed stone, overburden, and mineral ore in harsh, off-road environments. These potential customers focus intensely on structural robustness, component longevity, and high-volume capacity, often operating in remote locations where maintenance resources are scarce. The decision-making unit often includes procurement specialists, mine managers, and safety officers, leading to purchasing criteria centered on minimizing catastrophic failure risk and maximizing uptime. The growing Waste Management and Recycling Industry forms a resilient customer base, including municipal waste collectors, private refuse haulers, and specialized environmental cleanup companies. These buyers require specific trailer designs, such as sealed transfer trailers for municipal solid waste (MSW) and specialized roll-off or demolition trailers for C&D debris, prioritizing volume capacity, leak prevention, and ease of cleaning to meet stringent environmental and public health regulations, making demand in this sector less cyclical than construction.

Additional significant buyers include Large-Scale Agricultural Enterprises and Industrial Logistics Providers. Agricultural customers use dump trailers primarily for seasonal transport of commodities like grain, feed, potatoes, and silage, often requiring specialized features like secure covers and smooth interior surfaces to prevent material contamination and damage. Logistics providers, while not directly using the trailers for material manipulation, often lease or rent these assets to various construction and industrial clients, acting as crucial intermediaries who focus on fleet versatility, standardization, and rapid deployment capabilities. These rental companies are increasingly adopting sophisticated tracking and maintenance technologies to manage their diverse asset portfolio efficiently. For all customer segments, the decision to purchase new equipment is strongly influenced by financing options, comprehensive maintenance contracts, and the availability of local, certified dealer support, emphasizing the importance of a robust downstream service network provided by the manufacturer.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 7.5 Billion |

| Market Forecast in 2033 | USD 11.1 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Wabash National Corporation, Great Dane Trailers, Utility Trailer Manufacturing Co., Heil Trailer International, Trail King Industries, East Manufacturing, MAC Trailer Manufacturing, Talbert Manufacturing, Dorsey Trailer, Rhodes Trailers, Felling Trailers, Load King, Stellar Industries, Etnyre, Clement Industries, Cornhusker 800, Reiten Inc., Manac Inc., Ranco Trailers, Galyean Equipment |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Dump Trailer Market Key Technology Landscape

The Dump Trailer Market’s technological landscape is evolving rapidly, moving beyond basic mechanical functionality towards integrated, smart systems focused on safety, efficiency, and data monetization, fundamentally shifting trailer from passive assets to connected components of a logistics network. A primary technological focus is on Advanced Material Science, specifically the widespread adoption of high-strength, lightweight aluminum alloys and specialized high-tensile steel (HTS). HTS offers superior strength-to-weight ratios compared to conventional mild steel, enabling lighter frames that increase legal payload capacity without compromising durability. Aluminum, while having a higher initial cost, provides substantial long-term fuel savings and reduced stress on towing vehicles, making it the preferred choice for long-haul highway operations. Furthermore, specialized bed liners made from materials like ultra-high-molecular-weight polyethylene (UHMW) or proprietary composite materials are increasingly used to resist abrasion from coarse aggregates and hot asphalt, significantly extending the lifespan of the trailer body and reducing maintenance frequency, a critical performance metric for end-users operating in demanding environments such as quarrying.

The most transformative technology permeating the market is the integration of Smart Trailer and Telematics Systems. These systems involve embedding Internet of Things (IoT) sensors into critical components—including the hydraulic system, axle suspension, tire pressure monitoring systems (TPMS), and brake lining sensors—to capture and transmit real-time operational data via cellular or satellite networks. This data is processed by cloud-based fleet management software, often utilizing AI and machine learning algorithms, to provide predictive analytics regarding maintenance needs (e.g., forecasting hydraulic pump failure based on pressure fluctuations) and optimizing route efficiency. Specific to dump trailers, specialized sensors monitor critical safety parameters such as load distribution and tilt angle during the dumping cycle, providing automated warnings or even overriding maneuvers to prevent catastrophic tip-overs. The rise of these connected trailers provides manufacturers with a crucial opportunity to establish ongoing software service revenue streams, transforming the business model toward a lifecycle-centric service offering, focused on maximizing asset uptime through data-driven operational intelligence rather than solely manufacturing hardware.

Furthermore, significant technological advancements are visible in Hydraulics and Braking/Stability Systems. Modern hydraulic systems are designed for faster cycle times, increased energy efficiency, and improved control precision, often incorporating proportional valves and advanced filtering to enhance longevity and reliability under heavy loads. The push for improved road safety is driving the standardization of sophisticated Electronic Stability Control (ESC) and Roll Stability Control (RSC) systems, borrowed from tractor unit technology but adapted for trailer stability management, especially crucial for high-center-of-gravity dump trailers navigating uneven terrain or high-speed curves. Similarly, advancements in pneumatic and air suspension systems allow for dynamic load leveling and precise adjustment of ride height, which is essential for optimizing weight distribution and improving tire wear, ultimately contributing to reduced operational costs and improved compliance with strict road regulations. The convergence of these material science, digital telematics, and mechanical safety technologies defines the competitive edge in the modern dump trailer market, emphasizing efficiency, safety, and data-driven fleet management capability over sheer capacity alone.

Regional Highlights

- North America (U.S. and Canada): This region dominates the global dump trailer market, characterized by large fleet sizes, high average equipment specification, and a consistent demand floor fueled by massive public sector infrastructure investments, such as the U.S. Infrastructure Investment and Jobs Act. The market here is highly mature and competitive, with a strong preference for high-payload aluminum trailers due to stringent federal and state weight limits that incentivize efficiency. Manufacturers benefit from a standardized regulatory environment across the continent (despite variations in specific weight laws) and a robust ecosystem for advanced trailer technology integration, including leading telematics providers. The demand is particularly high for specialized side dump and frameless end dump models, which offer superior maneuverability and stability for highway and major construction projects. The necessity for fleet turnover driven by EPA emissions standards on towing vehicles and associated safety mandates ensures a steady flow of replacement demand, supporting continuous market stability and premium pricing structures.

- Europe (Germany, UK, France): The European market is defined by diversity in national road regulations, which presents challenges for standardization but promotes highly specialized, custom designs. While generally characterized by lower individual load limits than North America, the market is rapidly advancing in adopting environmentally friendly technologies. Strict EU regulations on vehicle weights, dimensions, and emissions are driving innovation towards lighter materials and potentially future-proofing electric or hybrid compatible trailers, although adoption rates vary. Demand is stable, driven by the need for maintenance and refurbishment of extensive existing road and rail networks, particularly in Western and Central Europe. The UK and Germany are significant markets, focusing on efficient waste management trailers (transfer stations) and aggregate transport, with a noticeable trend toward robust safety features and integrated load-monitoring systems to comply with localized urban transport restrictions.

- Asia Pacific (APAC) (China, India, Australia, Southeast Asia): APAC is the fastest-growing region globally, propelled by unprecedented rates of urbanization and massive national infrastructure projects, especially in China and India. The demand volume is enormous, driven by the need for basic, robust, and cost-effective end dump trailers for initial heavy civil construction, road building, and the extraction industry (particularly iron ore in Australia and coal/minerals across Southeast Asia). While price sensitivity is generally higher than in Western markets, leading to dominance by steel construction, there is a growing segment in developed parts of the region (e.g., Australia) adopting advanced aluminum specifications to meet demanding regulatory environments and optimize long-haul logistics efficiency. Infrastructure investment by governments across the region, including China's Belt and Road Initiative, guarantees sustained, long-term high-volume demand for dump trailers, though market entry requires careful navigation of diverse standards and local manufacturing partnerships.

- Latin America (Brazil, Mexico): The market in Latin America is heavily influenced by commodity prices and mining sector activity, which dictates demand for high-capacity, durable trailers suitable for rugged terrain and bulk material hauling over long distances, particularly for copper, iron ore, and agricultural commodities. Market growth is cyclical and tied to foreign direct investment in energy and infrastructure. Mexico shows strong cross-border dynamics tied to U.S. trade, while Brazil represents the largest standalone market, dominated by agricultural transport and large construction projects. Key purchasing criteria center on reliability, low maintenance, and capacity to withstand challenging operational conditions, with less immediate emphasis on the most advanced telematics, although digitalization is an emerging trend among major international operators.

- Middle East and Africa (MEA): This region is characterized by project-specific bursts of demand, driven by large-scale oil & gas initiatives, massive urban development (e.g., Saudi Arabia’s megaprojects), and mineral extraction in Africa. Demand often focuses on extreme heat resistance and high durability. While fleet sizes are generally smaller than in North America, the trailers purchased are often specialized for desert operations and heavy-duty logistics. The market is dependent on political stability and oil revenue for funding infrastructure projects, making it potentially volatile but offering high-value opportunities for manufacturers capable of providing robust, bespoke solutions for difficult operating environments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Dump Trailer Market.- Wabash National Corporation

- Great Dane Trailers

- Utility Trailer Manufacturing Co.

- Heil Trailer International

- Trail King Industries

- East Manufacturing

- MAC Trailer Manufacturing

- Talbert Manufacturing

- Dorsey Trailer

- Rhodes Trailers

- Felling Trailers

- Load King

- Stellar Industries

- Etnyre

- Clement Industries

- Cornhusker 800

- Reiten Inc.

- Manac Inc.

- Ranco Trailers

- Galyean Equipment

Frequently Asked Questions

Analyze common user questions about the Dump Trailer market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving demand in the Dump Trailer Market?

The primary driver is sustained global investment in infrastructure, particularly governmental stimulus packages aimed at road construction, civil engineering projects, and urbanization, necessitating high-volume material transport for aggregates and construction debris.

How do aluminum dump trailers compare to steel trailers in terms of market value?

Aluminum dump trailers typically have a higher initial capital cost but offer superior long-term value due to increased payload capacity, resulting in higher revenue per trip, and better fuel efficiency, making them increasingly preferred for long-haul operations where weight savings are maximized.

Which regional market shows the fastest growth potential for dump trailers?

The Asia Pacific (APAC) region, led by extensive infrastructure development and rapid urbanization in countries like China and India, exhibits the fastest growth potential due to the massive scale of required construction and material handling projects.

How is AI impacting the operational efficiency of dump trailer fleets?

AI impacts efficiency primarily through predictive maintenance, utilizing sensor data to forecast component failures, and through advanced telematics that optimize routes, monitor load compliance, and improve safety by preventing tipping incidents through real-time stability analysis.

What are the key segments within the Dump Trailer Market by application?

The key application segments include Construction and Infrastructure (the largest user), Mining and Quarrying, Waste Management and Recycling, and Agriculture, each demanding specialized trailer configurations tailored to specific material types and operating environments.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager