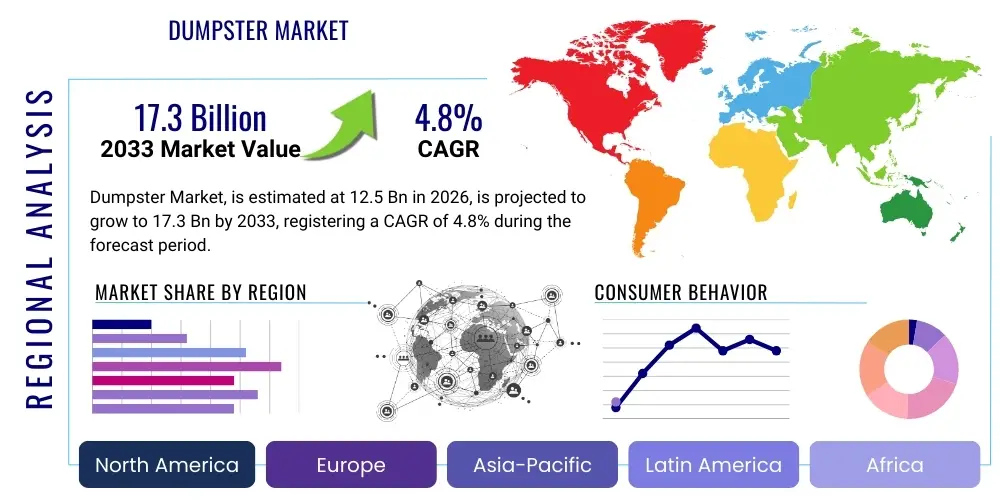

Dumpster Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442814 | Date : Feb, 2026 | Pages : 243 | Region : Global | Publisher : MRU

Dumpster Market Size

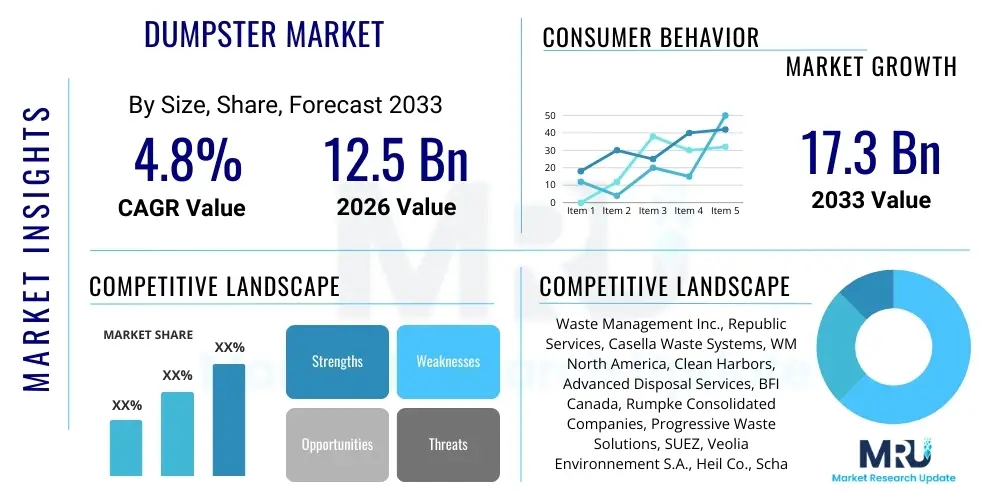

The Dumpster Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 12.5 Billion in 2026 and is projected to reach USD 17.3 Billion by the end of the forecast period in 2033.

Dumpster Market introduction

The Dumpster Market encompasses the manufacturing, distribution, and rental of large containers used for the temporary storage and transportation of waste materials, encompassing construction debris, municipal solid waste (MSW), industrial byproducts, and recyclables. This market is fundamentally driven by the need for efficient waste management logistics and is deeply interconnected with global economic health, particularly activity in the construction, infrastructure development, and manufacturing sectors. Modern dumpsters, ranging from small commercial front-load bins to large industrial roll-off containers, are essential components of the urban sanitation infrastructure, ensuring compliance with increasingly stringent environmental disposal regulations worldwide. The product is characterized by its durability, capacity variation, and specialized designs tailored for specific waste types, such as hazardous materials or specialized recyclable streams.

Major applications of dumpsters span the entire spectrum of waste generation, with construction and demolition (C&D) waste representing a significant consumer base due to the high volume of inert materials requiring disposal or recycling. Industrial applications, including manufacturing plants and large-scale processing facilities, utilize dumpsters for managing process waste and scraps. Furthermore, residential communities and commercial establishments rely heavily on front-load and rear-load containers for regular municipal solid waste collection. The foundational benefit offered by the dumpster market is the centralization and simplification of waste aggregation, which facilitates streamlined collection routes, optimizes fleet utilization for waste management companies, and significantly enhances public health standards by safely containing refuse until processing.

Key driving factors propelling market expansion include rapid global urbanization, leading to higher waste generation rates in densely populated areas, and substantial government investments in infrastructure projects, which necessitate extensive debris removal services. Moreover, the increasing focus on sustainability and circular economy principles drives demand for specialized recycling dumpsters, mandating separate collection streams for plastics, metals, and cardboard. Technological advancements, such as the integration of smart sensors (IoT) into containers for monitoring fill levels and optimizing collection schedules, are enhancing operational efficiency and reducing costs, further accelerating market growth. These innovations are transforming the dumpster from a static container into a dynamic component of smart city waste management systems, catering to the dual demands of economic efficiency and environmental stewardship.

Dumpster Market Executive Summary

The global Dumpster Market is experiencing robust expansion fueled primarily by sustained growth in construction activities across emerging economies and enhanced regulatory pressure regarding waste segregation and responsible disposal in developed nations. Current business trends indicate a strong shift towards leasing and rental models rather than outright purchase, driven by the fluctuating needs of construction projects and the capital expenditure constraints of smaller businesses. Additionally, manufacturers are increasingly focusing on developing durable, corrosion-resistant materials, often employing lightweight composites or high-grade steel to improve container longevity and reduce fuel consumption during transport. Strategic alliances and mergers between large international waste management corporations and local collection providers are reshaping the competitive landscape, aiming for economies of scale and comprehensive service coverage across urban and rural environments, thereby centralizing resource allocation and operational logistics.

Regional trends reveal that North America and Europe maintain maturity in terms of installed base but lead in the adoption of high-tech solutions like compaction technology and waste-monitoring IoT devices, capitalizing on high labor costs and sophisticated infrastructure requirements. Conversely, the Asia Pacific (APAC) region, particularly China and India, is poised for exponential growth, propelled by massive urbanization, burgeoning industrial output, and government initiatives focused on modernizing outdated waste infrastructure. These emerging markets represent significant untapped potential for both manufacturing and service provision, albeit facing challenges related to disorganized waste streams and variable regulatory enforcement. Latin America and the Middle East & Africa (MEA) are also exhibiting moderate growth, closely tied to oil and gas infrastructure development and residential construction booms, necessitating reliable debris management solutions.

Segmentation trends highlight the dominance of the Roll-Off Dumpster segment by capacity and revenue, intrinsically linked to large-scale construction and industrial projects requiring high volume removal capabilities. However, the Front-Load Dumpster segment is seeing steady growth driven by the commercial and institutional sectors demanding automated and aesthetically pleasing solutions for routine waste collection. From a material perspective, steel remains the prevalent choice due to its robustness, though lightweight plastic and composite dumpsters are gaining traction in specific applications, particularly residential and certain recycling streams where ease of handling and reduced weight are prioritized. The market is increasingly polarizing between generic, low-cost manufacturing aimed at volume and specialized, premium offerings featuring advanced sensors, hydraulic mechanisms, and enhanced safety features designed for high-efficiency integrated waste systems.

AI Impact Analysis on Dumpster Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Dumpster Market center primarily on how technology can optimize the logistical nightmares traditionally associated with waste collection. Key themes observed include interest in predictive maintenance for containers, optimal route planning to reduce fuel consumption and labor hours, and the potential for smart compaction or sorting mechanisms integrated within the dumpsters themselves. Users are highly concerned about the efficiency gains offered by AI-driven fill-level sensors and whether this technology justifies the increased capital expenditure. Furthermore, there is significant interest in how AI can assist in detailed waste stream analysis—identifying contamination rates, segregating materials more effectively, and providing real-time data crucial for compliance reporting and circular economy initiatives. The overriding expectation is that AI will move the industry from reactive service provision (collecting based on a fixed schedule) to proactive, demand-driven service, significantly improving profitability and environmental performance.

The integration of AI into the Dumpster Market transcends simple data collection; it fundamentally redesigns operational planning. Machine learning algorithms, processing data generated by IoT sensors embedded in dumpsters (monitoring weight, GPS location, and fill status), can dynamically calculate the most fuel-efficient routes for collection trucks, bypassing containers that are not yet full. This shift from static scheduling to dynamic routing minimizes unnecessary trips, drastically reducing operational costs, carbon footprint, and fleet wear-and-tear. Moreover, AI is being deployed for preventive maintenance. By analyzing usage patterns, weight fluctuations, and sensor anomaly reports, AI systems can predict potential mechanical failures in specialized compaction dumpsters or container structural weaknesses, allowing for timely repairs before critical failure occurs, maximizing asset uptime and extending the useful life of the expensive container inventory.

Beyond logistics and maintenance, AI applications are emerging in waste identification and contamination control, which is vital for the recycling sector. Specialized dumpster systems equipped with cameras and computer vision technology can instantly analyze incoming waste materials, providing feedback to the user or triggering automated sorting mechanisms. This precision in recognizing materials ensures higher quality inputs for recycling facilities, addressing a major restraint in the global recycling industry. The cumulative impact of these AI deployments is expected to lead to a significant efficiency dividend for waste management companies, transforming the labor-intensive, schedule-bound industry into a data-driven, optimized logistical network where the dumpster acts as a critical, intelligent node in the larger smart city ecosystem, contributing directly to sustainable urban development goals.

- AI-driven dynamic route optimization based on real-time fill level monitoring.

- Predictive maintenance schedules reducing dumpster downtime and extending asset life.

- Computer vision systems integrated into specialized containers for automatic waste identification and contamination detection.

- Automated generation of waste stream data for compliance, auditing, and enhanced recycling strategies.

- Improved resource allocation efficiency through centralized, machine learning-backed dispatch systems.

DRO & Impact Forces Of Dumpster Market

The Dumpster Market is shaped by a powerful confluence of driving forces, restraints, and opportunities (DRO), which collectively determine its trajectory and profitability. Principal drivers include the continuous surge in global construction and infrastructure development, particularly in rapidly urbanizing regions, necessitating robust debris removal solutions. Secondly, the enforcement of stricter environmental regulations worldwide, mandating source segregation of waste (e.g., green waste, recyclables, C&D materials), compels businesses and municipalities to utilize multiple specialized containers, thereby increasing the overall demand for dumpster units. Furthermore, the growing trend toward outsourced waste management services by commercial and industrial entities, seeking to comply with complex regulatory requirements and streamline operational costs, significantly boosts the rental and service segments of the market. These drivers ensure a consistent and expanding baseline demand for various container types across multiple economic sectors.

Despite the strong demand drivers, the market faces notable restraints, chiefly the substantial initial capital investment required for acquiring high-quality, durable steel and specialized compacting dumpsters, which can deter smaller service providers or municipalities with restricted budgets. Another significant restraint is the volatility in raw material costs, particularly steel and transportation fuel prices, which directly impact manufacturing costs and operational service fees, leading to potential margin erosion. Furthermore, space constraints in densely populated urban centers often limit the size and number of containers that can be deployed, favoring smaller, often specialized or underground waste solutions over traditional large dumpsters, thereby segmenting the market and requiring higher complexity in logistics planning.

Opportunities for growth lie prominently in the widespread adoption of smart waste management systems, which incorporate IoT sensors, GPS tracking, and AI-driven analytics. This technological shift allows service providers to offer premium, highly efficient services, generating new revenue streams beyond traditional collection fees. Moreover, the burgeoning circular economy movement offers an unparalleled opportunity: specialized dumpsters designed for high-purity material collection (e.g., electronics, specific plastics) are in growing demand, enabling manufacturers to enter niche, high-value waste stream markets. Finally, expansion into underserved emerging markets, where formal waste infrastructure is rapidly developing, presents long-term scalable growth potential for international manufacturers and service providers who can offer durable, cost-effective container solutions customized for local conditions.

Segmentation Analysis

The Dumpster Market is extensively segmented based on product type, material composition, application, and end-user, reflecting the diverse and specialized needs of waste generators globally. Understanding these segments is crucial for manufacturers and service providers to tailor their offerings—from the robust, high-capacity containers used in industrial settings to the smaller, aesthetically conscious bins deployed in residential and commercial areas. Market dynamics within each segment are heavily influenced by regulatory standards, material pricing, and technological integration, particularly concerning compaction capabilities and material-specific segregation requirements.

- Product Type

- Roll-Off Dumpsters (High capacity, used primarily for C&D and industrial waste)

- Front-Load Dumpsters (Common for commercial and institutional waste, often serviced by automated trucks)

- Rear-Load Dumpsters (Historically common, still used in specific residential and small commercial settings)

- Skip Dumpsters (Smaller, trapezoidal bins, popular in Europe for minor construction projects)

- Container and Cart Systems (Focusing on smaller, wheeled bins used in residential collection)

- Material

- Steel Dumpsters (Dominant due to durability and resistance to heavy loads)

- Plastic/HDPE Dumpsters (Used primarily for smaller, lighter loads and residential applications)

- Composite Materials (Emerging for specialized, lighter, and corrosion-resistant applications)

- Application

- Construction & Demolition (C&D) Waste Management

- Industrial Waste Management (Manufacturing, processing plants, mining)

- Residential Waste Collection (Municipal solid waste)

- Commercial & Institutional Waste (Retail, hospitals, schools, offices)

- End-User

- Waste Management Companies (Primary purchasers and renters)

- Municipalities and Government Entities

- Construction Contractors and Developers

- Industrial Manufacturers and Factories

Value Chain Analysis For Dumpster Market

The value chain of the Dumpster Market initiates with the upstream activities centered on raw material procurement, predominantly encompassing the sourcing of high-grade steel, specialized plastics (HDPE), and related manufacturing inputs like welding materials, paints, and hydraulic components for specialized units. Key upstream challenges involve managing price volatility of steel, which constitutes the major cost component of roll-off and front-load dumpsters, and ensuring a stable supply of materials that meet strict corrosion and stress standards. Suppliers of raw materials hold moderate bargaining power, especially during periods of global commodity shortages, necessitating long-term contracts and diversified sourcing strategies by dumpster manufacturers. Efficient inventory management and bulk purchasing are essential at this stage to maintain competitive pricing in the downstream market.

The midstream phase focuses on manufacturing, fabrication, assembly, and quality assurance. Leading manufacturers invest heavily in automated welding processes, advanced coating technologies, and standardized production lines to enhance durability and scalability. This stage includes the crucial integration of technology, such as installing IoT sensors, RFID tags, and GPS units into the containers, transforming them into smart assets. Distribution channels are twofold: Direct distribution, where large global waste management companies purchase directly from manufacturers based on custom specifications and large volume orders; and indirect distribution, involving specialized equipment distributors and dealers who cater to smaller regional waste haulers, construction companies, and municipalities. The complexity of distribution often revolves around the bulky nature of the product, requiring specialized logistics and warehousing capabilities.

Downstream activities are dominated by the service provision, which includes rental, hauling, and maintenance of the dumpsters, primarily managed by waste management companies (End-Users). These companies act as the primary interface with the final consumer (e.g., construction site, retailer, residential complex). The profitability in the downstream market is heavily reliant on optimizing collection logistics, maximizing capacity utilization, and providing timely service. Direct relationships are established between the service provider and the waste generator (B2B or B2C), offering flexible rental terms (daily, weekly, permanent placement). Indirect distribution also exists when general contractors subcontract debris removal to specialized waste haulers. Long-term maintenance and repair services represent a crucial, high-margin component of the downstream value chain, ensuring the operational lifespan of the high-value assets and sustained customer loyalty.

Dumpster Market Potential Customers

The potential customer base for the Dumpster Market is broad and highly diversified, spanning governmental organizations, various commercial enterprises, and large industrial operations, all unified by the need for compliant and efficient waste containment solutions. The primary end-users are Waste Management Companies, both international giants and regional specialists, who purchase or lease dumpsters in bulk to serve their expansive client base across residential, commercial, and industrial segments. These companies require a variety of dumpster types, focusing on durability, automated handling compatibility (for front-load and rear-load systems), and standardization to fit existing fleet configurations. Their purchasing decisions are driven by total cost of ownership (TCO) and expected asset longevity under harsh operational conditions, making them the most significant purchasing power segment in the market.

A secondary, yet highly critical, customer segment comprises the Construction Contractors and Real Estate Developers. This group requires Roll-Off Dumpsters for temporary deployment on construction and demolition sites to manage massive volumes of C&D debris, rubble, and inert materials. Their demand is project-based and highly cyclical, often necessitating fast turnaround times for delivery and collection services. Purchasing criteria for this segment prioritize large capacity, ease of loading, and robust design capable of handling heavy, potentially sharp materials. Developers and contractors typically rely on specialized rental services offered by waste management companies, prioritizing service reliability and compliance with site environmental regulations over direct ownership of the containers.

Lastly, Institutional and Commercial Establishments form a consistent customer base for permanent placement dumpsters. This includes hospitals, educational campuses, large retail chains, hotels, and office complexes. These entities require smaller to medium-sized containers (primarily front-load units) for managing continuous streams of municipal solid waste and recyclables. Their purchasing decisions are influenced by aesthetic considerations, noise reduction features (especially in residential proximities), and the ability to integrate with automatic access controls or compaction mechanisms. Municipalities, distinct from private waste haulers, also represent major government end-users, requiring large quantities of standardized dumpsters for public spaces and residential curb-side programs, often relying on long-term procurement contracts based on competitive bidding and stringent quality specifications.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 12.5 Billion |

| Market Forecast in 2033 | USD 17.3 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Waste Management Inc., Republic Services, Casella Waste Systems, WM North America, Clean Harbors, Advanced Disposal Services, BFI Canada, Rumpke Consolidated Companies, Progressive Waste Solutions, SUEZ, Veolia Environnement S.A., Heil Co., Schaefer Systems International, ZIEGLER, Enevo, Bigbelly Solar, OTTO Waste Systems, McNeilus Truck and Manufacturing. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Dumpster Market Key Technology Landscape

The technological landscape of the Dumpster Market is rapidly evolving beyond basic metal fabrication, driven by the imperative to improve logistical efficiency, enhance asset tracking, and comply with smart city infrastructure requirements. The most pervasive technological advancement is the integration of Internet of Things (IoT) devices, primarily low-power wireless sensors, into the dumpster fleet. These sensors are designed to monitor fill levels (ultrasonic or radar technology), weight, temperature, and GPS location. This data is transmitted to centralized platforms, allowing waste management operators to shift from fixed, time-based collection routes to dynamic, optimized routes based on actual demand. This leads to substantial reductions in fuel consumption, labor costs, and operational hours, fundamentally reshaping the economics of waste hauling and offering a superior return on investment for high-tech container adoption.

A second crucial area of innovation lies in compaction and specialized container technology. Hydraulic compaction mechanisms are increasingly integrated into commercial and industrial dumpsters to maximize the volume of waste contained, thus delaying collection cycles and minimizing street congestion. For specific hazardous or high-value recyclable waste streams, specialized containers are developed using advanced corrosion-resistant coatings or materials to ensure containment integrity and longevity. Furthermore, technology aimed at user convenience, such as solar-powered self-compacting public bins (like those used in pedestrian areas) and access control systems (RFID or key fobs) for residential communal bins, prevents unauthorized dumping and optimizes public waste infrastructure management, increasing the containers' functional utility in diverse urban environments.

The technology landscape is completed by sophisticated Fleet Management and Enterprise Resource Planning (ERP) software that aggregates the data collected from the smart dumpsters. These platforms use Machine Learning (ML) algorithms to analyze historical fill patterns, predict future capacity needs, and automate maintenance scheduling. This software layer is critical for large waste management corporations seeking to manage thousands of assets across vast geographical areas. The increasing adoption of advanced telematics and integrated camera systems on collection vehicles further links the dumpster data with real-time operational metrics, ensuring accountability, minimizing operational risk, and providing verifiable data for environmental reporting, which is increasingly mandatory for government contracts and public sector partnerships.

Regional Highlights

- North America: This region is characterized by market maturity, high technological adoption, and the presence of major industry players like Waste Management Inc. and Republic Services. The market here is driven by stringent EPA regulations, demanding robust compliance in C&D waste disposal and recycling mandates. The high cost of labor accelerates the adoption of smart dumpsters, automated sorting, and route optimization technologies, positioning North America as the leader in value-added services and innovative container deployment. Consistent housing and commercial development maintain stable demand for roll-off dumpsters.

- Europe: Europe exhibits strong growth driven primarily by ambitious circular economy policies and waste segregation targets set by the EU. Countries like Germany and the Scandinavian nations lead in the utilization of underground and semi-underground waste systems, minimizing visual impact and optimizing space in historical cities. The European market places a strong emphasis on sustainability, favoring recyclable materials and innovative access technologies (e.g., electronic key systems) to track and manage waste generation at the household level.

- Asia Pacific (APAC): APAC is the fastest-growing region, fueled by rapid urbanization, massive infrastructure projects (especially in China, India, and Southeast Asia), and rising middle-class consumption leading to skyrocketing municipal solid waste generation. While the market is highly fragmented, central governments are making significant investments in modernizing waste infrastructure, creating immense demand for all types of dumpsters. Price sensitivity is higher here, favoring cost-effective, high-volume manufacturing solutions, though sophisticated smart technologies are quickly gaining traction in megacities like Tokyo and Singapore.

- Latin America: Growth in Latin America is moderate but steady, largely dependent on specific country economic stability and construction cycles, particularly in Brazil and Mexico. The market often features a mix of formal, international waste management practices in major cities and informal systems elsewhere. Demand centers on basic, durable steel containers for general waste, with increasing regulatory push for improved industrial waste handling and environmental compliance driving future specialized container purchases.

- Middle East and Africa (MEA): The MEA region's market expansion is closely tied to massive real estate and tourism infrastructure development projects in the GCC nations, such as Saudi Arabia and the UAE. These projects require substantial numbers of roll-off dumpsters. The region is also highly receptive to modern, smart waste solutions, often incorporating integrated solar-powered compaction systems to manage waste efficiently in extreme heat conditions, prioritizing aesthetics and cleanliness in high-profile urban areas.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Dumpster Market.- Waste Management Inc.

- Republic Services

- Casella Waste Systems

- WM North America

- Clean Harbors

- Advanced Disposal Services

- BFI Canada

- Rumpke Consolidated Companies

- Progressive Waste Solutions

- SUEZ

- Veolia Environnement S.A.

- Heil Co.

- Schaefer Systems International

- ZIEGLER

- Enevo

- Bigbelly Solar

- OTTO Waste Systems

- McNeilus Truck and Manufacturing

Frequently Asked Questions

Analyze common user questions about the Dumpster market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the demand for specialized recycling dumpsters?

Demand is driven by increasingly stringent government regulations globally, particularly those mandating source segregation of waste materials (plastics, metals, organic waste) to meet national and regional recycling targets. This necessitates dedicated, specialized containers for maintaining material purity.

How do smart technologies impact the profitability of dumpster rental services?

Smart technologies, such as IoT sensors and GPS tracking, enable dynamic route optimization, ensuring trucks only service full containers. This reduction in unnecessary trips significantly cuts down fuel consumption and labor costs, leading to a substantial increase in operational profitability.

Which segment holds the largest market share in the Dumpster Market?

The Roll-Off Dumpster segment currently holds the largest market share, primarily due to its essential role in large-scale Construction and Demolition (C&D) projects and high-volume industrial waste management, reflecting ongoing global infrastructure investment.

What are the primary restraints affecting market growth for dumpster manufacturers?

Primary restraints include the volatile cost of raw materials, particularly steel, which increases manufacturing overheads. Additionally, high initial capital expenditure for advanced containers and space limitations in dense urban areas restrict large-scale market penetration.

Why is the Asia Pacific region projected to be the fastest-growing market?

The APAC region's rapid growth is underpinned by accelerating urbanization, massive infrastructure development, and substantial government investments focused on modernizing waste management systems and improving environmental sanitation standards across emerging economies like China and India.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager