Dynamic Thermomechanical Analyser Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441631 | Date : Feb, 2026 | Pages : 242 | Region : Global | Publisher : MRU

Dynamic Thermomechanical Analyser Market Size

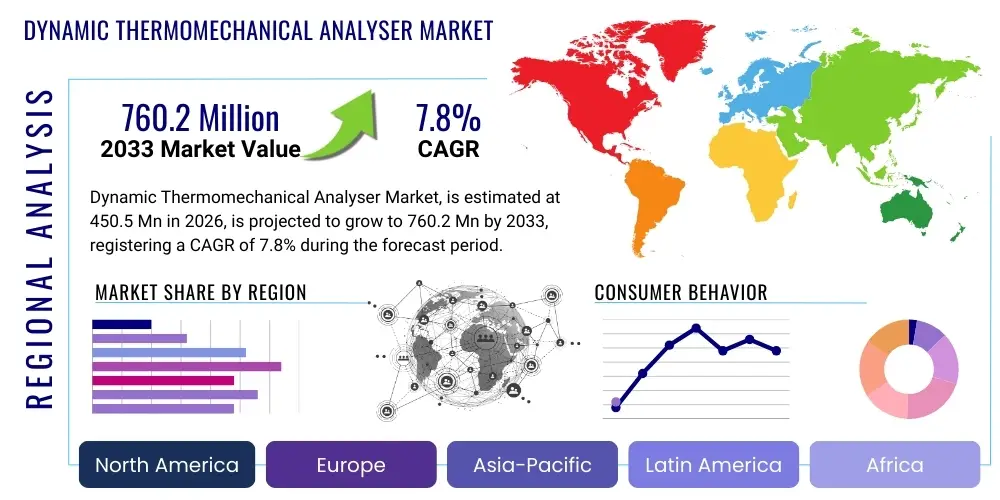

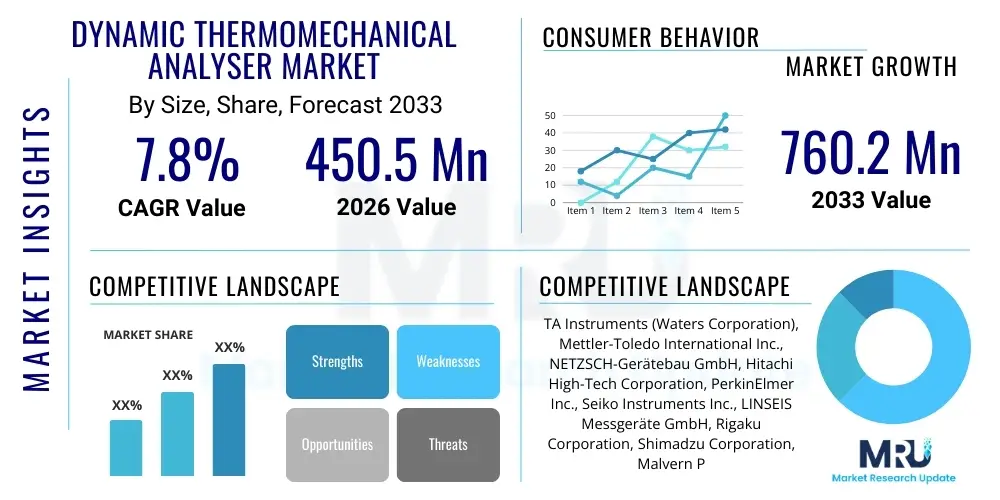

The Dynamic Thermomechanical Analyser Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 450.5 Million in 2026 and is projected to reach USD 760.2 Million by the end of the forecast period in 2033.

Dynamic Thermomechanical Analyser Market introduction

The Dynamic Thermomechanical Analyser (DTMA) Market encompasses specialized analytical instrumentation used to measure the mechanical properties of materials—such as viscoelasticity, modulus, and damping—as a function of temperature, time, and frequency under oscillating stress. This technology is critical for materials scientists and engineers who need to understand how polymers, composites, ceramics, and metals respond to varying thermal and mechanical conditions. DTMA instruments provide superior insight compared to traditional Thermomechanical Analysis (TMA) by applying a sinusoidal stress or strain wave, allowing for the precise determination of storage modulus (elastic behavior), loss modulus (viscous behavior), and the tangent delta (damping factor), which is vital for quality control and new material development in high-performance applications. The demand is primarily fueled by stringent material performance requirements across sectors like aerospace, automotive, and electronics, where failure prediction and thermal stability assessment are paramount.

The core product description revolves around high-precision testing apparatus capable of controlling temperature environments from sub-ambient to extremely high temperatures, coupled with sophisticated mechanical systems for applying dynamic loads. Modern DTMA systems often feature modular designs, enabling users to switch between various deformation modes (e.g., tension, compression, bending, shear, and indentation) to suit diverse material geometries and testing standards. Key technological advancements driving the market include enhanced temperature control accuracy, increased force resolution, and the incorporation of automated sample handling systems, which significantly improve testing throughput and repeatability. These instruments are indispensable tools in research and development settings focused on discovering and validating next-generation materials with superior mechanical and thermal performance profiles.

Major applications of DTMA span quality control in manufacturing, failure analysis, and fundamental materials research. In the polymer industry, DTMA is utilized to determine the glass transition temperature (Tg), secondary relaxations, and curing characteristics of thermosets and thermoplastics. The benefits derived from using DTMA are numerous, including precise prediction of material behavior under service conditions, optimization of formulation processes, and reduction in time-to-market for new products. Driving factors for market expansion include the global increase in R&D expenditure, particularly in emerging economies, the burgeoning demand for lightweight and durable composite materials in the automotive and aerospace industries, and the growing regulatory requirements demanding detailed characterization of materials used in critical infrastructure and biomedical devices. The necessity for advanced material characterization to address complex engineering challenges firmly establishes DTMA as a cornerstone technology in analytical testing.

Dynamic Thermomechanical Analyser Market Executive Summary

The Dynamic Thermomechanical Analyser Market is currently experiencing robust growth, driven primarily by technological advancements facilitating higher sensitivity and wider operational ranges, particularly in temperature and frequency application. Key business trends include the increasing integration of DTMA with other thermal analysis techniques (such as DSC or TGA) into single, unified platforms, enhancing comprehensive material characterization while optimizing laboratory space and operational efficiency. Furthermore, there is a distinct shift toward highly specialized instrumentation tailored for niche applications, such as high-temperature DTMA for ceramics and metals, and micro-DTMA for testing thin films and biomedical scaffolds. Companies are focusing on developing user-friendly software interfaces and incorporating sophisticated data analysis capabilities, leveraging machine learning algorithms to predict material performance based on experimental data, thereby transforming complex analytical output into actionable engineering insights for end-users.

Regional trends indicate that North America and Europe remain mature but significant markets, acting as primary hubs for advanced R&D and housing a large base of established pharmaceutical, aerospace, and chemical companies necessitating continuous material testing. However, the Asia Pacific (APAC) region is demonstrating the highest growth trajectory, fueled by massive investments in infrastructure development, rapid expansion of the automotive and electronics manufacturing sectors in countries like China, India, and South Korea, and increasing government support for academic and industrial research centers. This region’s high growth is also attributed to the adoption of international quality standards, compelling local manufacturers to invest in advanced characterization equipment like DTMA to ensure product reliability and competitiveness in the global supply chain. The competitive landscape is marked by strategic mergers, acquisitions, and collaborations aimed at expanding geographic reach and integrating complementary technologies, ensuring market leaders maintain their competitive edge through innovation and enhanced service delivery.

Segmentation trends highlight the increasing prominence of high-performance DTMA instruments capable of testing materials under extreme conditions, often surpassing standard industry requirements. By Application, the Polymers and Composites segment continues to dominate due to the critical role DTMA plays in assessing glass transition and curing behavior, which are essential for structural integrity. The Pharmaceutical sector is also showing accelerated growth, requiring DTMA for studying the physical stability of dosage forms, excipients, and packaging materials under varying thermal stresses. In terms of business model, the service segment, including calibration, maintenance, and contract testing labs utilizing DTMA, is expanding rapidly, providing cost-effective access to advanced analysis for small and medium-sized enterprises (SMEs) that cannot afford outright instrument purchase. Overall, the market remains technologically progressive, focused on providing researchers with faster, more accurate, and more versatile tools for materials innovation.

AI Impact Analysis on Dynamic Thermomechanical Analyser Market

Common user questions regarding the influence of Artificial Intelligence (AI) on the Dynamic Thermomechanical Analyser Market typically center on how AI can streamline data interpretation, automate complex testing procedures, and accelerate the discovery of novel material formulations. Users frequently inquire about the feasibility of integrating AI algorithms for real-time defect detection during testing, optimizing temperature ramping protocols to minimize testing duration, and enhancing the predictive accuracy of material lifetime modeling under various stress conditions. There is a strong interest in AI’s capability to handle the massive datasets generated by high-throughput DTMA experiments, allowing researchers to quickly identify subtle correlations between molecular structure, processing history, and observed viscoelastic behavior that might be missed by manual analysis. The key themes revolve around automation, predictive maintenance, enhanced decision support, and the utilization of AI to transform raw DTMA curves into highly valuable, immediately actionable engineering parameters, thereby reducing the dependency on specialized expertise for routine data analysis and interpretation.

The integration of AI and Machine Learning (ML) is fundamentally changing the operational paradigm of DTMA instruments, moving them from sophisticated measurement tools toward smart diagnostic systems. AI models are increasingly deployed to perform automatic baseline correction, peak identification (such as Tg or secondary relaxations), and curve fitting, which dramatically reduces post-processing time and minimizes human error in data reporting. Furthermore, ML algorithms trained on vast material libraries can identify anomalies or deviations from standard material profiles in real-time during quality control operations, providing instantaneous feedback to manufacturing lines. This shift is essential for industries, such as aerospace and defense, where material consistency and failure prevention are non-negotiable requirements, necessitating the highest level of analytical rigor and automated quality assurance.

Future expectations indicate that AI will play a critical role in 'Inverse Material Design,' where engineers input desired mechanical and thermal properties, and the AI suggests optimal polymer blends or composite formulations, which are then validated using DTMA. This predictive capability significantly truncates the iterative experimental cycle that defines traditional materials R&D. Moreover, AI is enhancing the performance of the instruments themselves by optimizing dynamic oscillation parameters, ensuring the viscoelastic response is measured within the linear viscoelastic region (LVER), and performing predictive maintenance on sensors and mechanical components, maximizing instrument uptime and ensuring data integrity throughout extended testing campaigns. The adoption of AI is therefore viewed not just as an analytical enhancement but as a strategic imperative for market competitiveness.

- AI-driven automation of data processing, including baseline subtraction and peak identification, reducing analysis time by up to 50%.

- Predictive modeling of material performance and lifetime based on DTMA data trends, enhancing failure analysis capabilities.

- Optimization of experimental parameters (frequency, temperature ramp rate) using ML algorithms for high-throughput testing.

- Integration of AI for real-time quality control checks and immediate detection of material inconsistencies in production environments.

- Development of smart DTMA instruments with self-diagnosis and predictive maintenance capabilities, increasing instrument reliability.

DRO & Impact Forces Of Dynamic Thermomechanical Analyser Market

The Dynamic Thermomechanical Analyser (DTMA) Market is significantly influenced by a confluence of drivers, restraints, and opportunities, shaping its future trajectory. A primary driver is the escalating demand for high-performance materials (e.g., advanced composites, high-temperature polymers) across critical sectors like electric vehicles (EVs), renewable energy infrastructure, and aerospace, which mandates precise characterization of material behavior under service-relevant dynamic loads and extreme temperatures. The rising global investment in materials science research and academic institutions, particularly concerning nanotechnology and polymer engineering, provides a consistent influx of demand for sophisticated analytical instruments. Additionally, strict regulatory frameworks in industries such as medical devices and construction materials require comprehensive thermal and mechanical testing, making DTMA an essential tool for compliance and product validation. These factors collectively exert a strong upward force on market expansion, compelling manufacturers to continuously innovate their offerings.

Conversely, the market faces significant restraints that temper its growth potential. The high initial capital investment required for purchasing and installing advanced DTMA systems, along with the subsequent costs associated with specialized maintenance and calibration, presents a major barrier, especially for small and medium-sized enterprises (SMEs) and academic labs with limited funding. Furthermore, the operation and interpretation of complex DTMA data require highly skilled and trained personnel, a shortage of which can impede widespread adoption in developing regions. Technological restraints also exist, particularly the complexity of testing anisotropic or highly heterogeneous materials, and the challenges in accurately simulating real-world aging and fatigue effects over long periods within laboratory conditions. These restraints necessitate innovative financing models and greater focus on simplified, automated systems to broaden the accessibility of the technology.

Opportunities within the DTMA market are numerous and primarily center around technological breakthroughs and geographical expansion. The development of miniaturized and portable DTMA systems tailored for field testing or integration into manufacturing processes offers a significant avenue for growth. The burgeoning interest in bio-based and sustainable materials, requiring detailed assessment of their long-term stability and mechanical response, creates a dedicated application segment. Furthermore, the integration of DTMA with sophisticated simulation software (Finite Element Analysis or FEA) provides researchers with powerful tools for validating computational models, thereby accelerating the material development lifecycle. The overall impact forces are moderate to high, leaning toward expansion, as the fundamental driver—the continuous global need for lighter, stronger, and more resilient materials—outweighs the capital investment hurdles, compelling industries to adopt this indispensable characterization technique.

Segmentation Analysis

The Dynamic Thermomechanical Analyser Market is comprehensively segmented based on product type, testing mode, application, and end-user, reflecting the diverse requirements of the materials science community. Analyzing these segments provides crucial insights into targeted growth areas and technological demands. Product segmentation often distinguishes between high-performance research-grade systems offering wide frequency and temperature ranges, and quality control systems optimized for high-throughput, routine analysis. Testing mode segmentation, particularly focusing on tension, compression, and shear, reflects the specific mechanical properties sought by different industries, such as tensile testing being critical for fibers and thin films, while compression is vital for foams and structural materials. This granularity in segmentation allows vendors to tailor their marketing and product development strategies to specific industry verticals and technical challenges, ensuring maximum market penetration and user satisfaction across the entire materials testing spectrum.

- By Product Type:

- Standard/Benchtop DTMA Systems

- High-Performance Research-Grade DTMA

- Micro-DTMA (for thin films and fibers)

- High-Temperature DTMA (up to 1500°C)

- Integrated Systems (DTMA/DMA-TGA/DSC Combinations)

- By Testing Mode:

- Tension Mode

- Compression Mode

- Bending Mode (3-point and 4-point)

- Shear Mode (Single and Dual Cantilever)

- Indentation and Torsion Mode

- By Application:

- Polymers and Plastics Characterization

- Composites and Advanced Materials Testing

- Pharmaceutical and Biomedical Analysis

- Automotive and Aerospace Component Testing

- Electronics and Semiconductor Materials Analysis

- Coatings and Adhesives Evaluation

- Food Science and Packaging Research

- By End-User:

- Academic and Research Institutes

- Chemical and Petrochemical Industry

- Materials Testing Laboratories (Contract Labs)

- Automotive and Transportation Industry

- Aerospace and Defense Sector

- Pharmaceutical and Biotechnology Companies

- By Region:

- North America (U.S., Canada)

- Europe (Germany, UK, France, Italy)

- Asia Pacific (China, Japan, India, South Korea)

- Latin America (Brazil, Mexico)

- Middle East & Africa (MEA)

Value Chain Analysis For Dynamic Thermomechanical Analyser Market

The value chain for the Dynamic Thermomechanical Analyser (DTMA) market begins with the upstream suppliers responsible for providing highly specialized components, including ultra-precision temperature sensors (thermocouples and platinum resistance thermometers), sophisticated mechanical actuators and motors for force application, and high-fidelity signal processing electronics. The quality and reliability of these upstream inputs are paramount, as they directly determine the accuracy and sensitivity of the final DTMA instrument. Key technological alliances with component manufacturers are often crucial for maintaining a competitive edge, ensuring access to cutting-edge material science sensors and proprietary control systems. The primary manufacturing stage involves complex assembly, software development, calibration, and rigorous quality assurance testing, where core DTMA manufacturers integrate these specialized components into fully operational, thermally and mechanically stable analytical instruments, requiring significant expertise in metrology and thermal engineering.

The downstream activities involve distribution and sales, servicing, and end-user adoption. Distribution channels are typically bifurcated into direct sales models, where major manufacturers maintain dedicated sales teams and application specialists for large institutional and corporate clients, and indirect channels, utilizing regional distributors or certified third-party vendors, particularly in emerging markets. These indirect channels play a vital role in local market penetration, technical support, and managing import logistics. The effectiveness of the distribution network relies heavily on the technical competence of the channel partners, as DTMA requires extensive pre-sales consultation and post-sales application support to ensure optimal utilization by the end-user. Effective technical training and robust maintenance contracts are essential components of the downstream service offerings, significantly influencing customer satisfaction and long-term retention.

The ultimate beneficiaries are the end-user segments, including large R&D divisions, academic labs, and contract testing facilities. Direct interaction with end-users provides critical feedback that drives innovation cycles—for example, requests for higher frequency ranges or specialized sample holders. The value captured at the end of the chain is the highly accurate, reliable material data used for critical decision-making in product design, failure investigation, and quality assurance. This robust feedback loop, linking the component suppliers through the manufacturers and distributors to the end-users, ensures continuous improvement in instrument performance and relevance to evolving industrial needs. Furthermore, the growth of third-party testing labs has created a distinct distribution channel focusing on service-based access to DTMA technology, impacting the overall market structure by broadening accessibility to smaller entities.

Dynamic Thermomechanical Analyser Market Potential Customers

The primary potential customers for Dynamic Thermomechanical Analyser (DTMA) systems are highly diverse organizations characterized by a strong emphasis on materials innovation, quality assurance, and fundamental research into mechanical and thermal material properties. Major customers include large multinational corporations in the chemical and polymer manufacturing sectors who require DTMA to monitor polymerization reactions, determine the glass transition temperatures of new plastics, and ensure the long-term stability of proprietary blends. These industrial users leverage DTMA for optimizing processing parameters and conducting rapid failure analysis on production batches. The aerospace and defense industry represents another critical buyer segment, utilizing DTMA for rigorous testing of advanced composite structures and high-temperature alloys, ensuring they meet the demanding safety and performance specifications required for extreme operational environments.

Academic and government research institutes form a foundational customer base, purchasing DTMA instruments for fundamental scientific inquiry, graduate student training, and developing novel testing methodologies. These institutions typically require the most versatile and research-grade systems, often demanding custom sample holders and specialized environmental control capabilities to study unique materials or phenomena under non-standard conditions. The biomedical and pharmaceutical sectors are emerging as rapidly growing consumer segments, using DTMA to analyze the viscoelastic properties of medical-grade polymers, hydrogels, and drug delivery systems. For pharmaceuticals, DTMA helps characterize the physical state of amorphous solids and assesses the impact of environmental factors on packaging materials, directly influencing drug stability and shelf life, making the instrument indispensable for regulatory compliance in these fields.

Finally, independent contract testing laboratories (CTLs) and forensic material analysis facilities represent a dynamic customer segment. These labs provide testing services to SMEs or companies lacking in-house DTMA capabilities. CTLs seek robust, high-throughput DTMA systems that can handle a wide range of sample types and comply with multiple international testing standards (e.g., ASTM, ISO). Their business model relies on rapid turnaround and accurate results, driving demand for automated systems with minimal operational variability. Therefore, manufacturers focus on providing these labs with integrated software solutions and comprehensive service contracts. Understanding these distinct customer needs—from academic flexibility to industrial throughput—is vital for successful market positioning and product development.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450.5 Million |

| Market Forecast in 2033 | USD 760.2 Million |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | TA Instruments (Waters Corporation), Mettler-Toledo International Inc., NETZSCH-Gerätebau GmbH, Hitachi High-Tech Corporation, PerkinElmer Inc., Seiko Instruments Inc., LINSEIS Messgeräte GmbH, Rigaku Corporation, Shimadzu Corporation, Malvern Panalytical (Spectris), SETARAM Instrumentation (Kéosys Group), Sineo Technology Co., Ltd., Elveflow, Anton Paar GmbH, Admet Inc., GABO Quali-Test GmbH (TA Instruments), C-Therm Technologies Ltd., Testometric Company Ltd., ZwickRoell GmbH & Co. KG. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Dynamic Thermomechanical Analyser Market Key Technology Landscape

The Dynamic Thermomechanical Analyser (DTMA) market's technology landscape is defined by continuous innovation aimed at enhancing instrument sensitivity, expanding operational envelopes, and improving data throughput. A crucial technological advancement is the shift towards advanced force motors, utilizing non-contact linear drive technology, such as magnetics or voice coil systems, which provide superior force resolution and faster response times compared to traditional motor setups. This allows for precise measurement of very low modulus materials, such as soft biological tissues or delicate thin films, significantly broadening the application scope. Furthermore, the integration of advanced temperature control mechanisms, including specialized cryo-cooling and high-frequency induction heating elements, permits testing across extreme temperature ranges (from -180°C to over 1000°C) with unparalleled uniformity and ramp rate accuracy, which is essential for characterizing next-generation thermal protection systems and cryogenic materials. The continuous development of specialized sample clamping accessories also addresses the challenge of securely holding materials with diverse geometries under dynamic loads, ensuring accurate strain transmission and minimizing compliance errors during measurement.

Software and digital integration represent another critical technological pillar. Modern DTMA systems feature highly sophisticated operating software that includes built-in quality assurance protocols, automated calibration routines, and real-time visualization of complex viscoelastic data (e.g., Cole-Cole plots, master curves using the Time-Temperature Superposition Principle, TTSP). The implementation of TTSP software allows users to predict the long-term behavior of materials from short-term experiments, a capability highly valued in product development cycles. Furthermore, connectivity features, including cloud-based data storage and remote access capabilities, facilitate collaborative research and allow for the centralized management of testing protocols and results across geographically dispersed laboratory networks. This enhanced digital ecosystem improves data integrity, traceability, and workflow efficiency, aligning the instruments with Industry 4.0 principles.

The convergence of DTMA with other analytical techniques, resulting in integrated thermal analysis suites (e.g., combining DTMA with TGA or FTIR), is a defining feature of the current technological landscape. This multi-modal approach enables the simultaneous correlation of mechanical responses with mass loss or chemical changes, providing a holistic view of material degradation or transition processes. For instance, a combined DTMA-FTIR system can simultaneously track the change in modulus while identifying evolving volatile decomposition products, offering comprehensive insights into thermal oxidative stability. Looking ahead, the focus is increasingly on modularity, high throughput, and the application of Artificial Intelligence (AI) for predictive diagnostics and automated interpretation, moving the technology toward becoming an indispensable component in automated materials discovery platforms, dramatically accelerating the pace of innovation across materials science and engineering disciplines.

Regional Highlights

The global Dynamic Thermomechanical Analyser Market exhibits distinct regional dynamics driven by varying industrial maturity, R&D intensity, and regulatory environments. North America, particularly the United States, commands a significant market share owing to its robust aerospace, defense, and biomedical sectors, all of which require continuous, high-precision material characterization. The presence of leading research universities, coupled with substantial government and private funding for advanced materials research, ensures sustained demand for high-end, research-grade DTMA instruments. Innovation in sensor technology and software integration often originates from this region, setting global standards for analytical performance. Europe follows closely, characterized by stringent environmental and safety regulations in the automotive (especially in Germany and France) and chemical industries, necessitating comprehensive material testing for compliance and product safety. The concentration of global leaders in thermal analysis instrumentation manufacturing within Europe also contributes to its market strength, fostering strong regional supply chains and specialized technical expertise.

The Asia Pacific (APAC) region is forecasted to demonstrate the fastest growth rate throughout the forecast period. This rapid expansion is primarily attributed to exponential industrialization, especially in high-tech manufacturing hubs like China, South Korea, and Japan, which are aggressively investing in domestic R&D capabilities to become global leaders in electronics, electric vehicles, and infrastructure materials. The rising disposable income and increasing regulatory emphasis on quality control in manufacturing processes are compelling local industries to adopt advanced analytical techniques like DTMA. Government initiatives in countries like India, focusing on domestic manufacturing and establishing dedicated research parks, are further stimulating demand for state-of-the-art laboratory equipment. While price sensitivity remains a factor, the increasing focus on export quality and international competitiveness ensures a growing acceptance of high-precision instrumentation.

In contrast, Latin America (LATAM) and the Middle East & Africa (MEA) currently hold smaller market shares but are projected to experience steady growth. LATAM’s growth is driven by the expansion of the petrochemical and construction sectors, particularly in Brazil and Mexico, requiring material testing for quality assurance in large-scale projects. The MEA region is seeing increased investment in research related to oil and gas exploration, requiring DTMA for analyzing specialized pipeline coatings and composites that perform reliably under harsh environmental conditions. However, market penetration in these regions is often hampered by import restrictions, currency volatility, and the limited availability of specialized technical support and skilled operators, making localized training and robust after-sales service critical success factors for vendors targeting these emerging economies.

- North America (U.S., Canada): Market leader; driven by Aerospace, Defense, and Biomedical R&D; high adoption of research-grade systems.

- Europe (Germany, UK, France): Strong demand from Automotive (EV materials) and Chemical industries; focus on regulatory compliance and high-quality instrumentation.

- Asia Pacific (APAC, China, Japan, India): Fastest-growing region; fueled by massive manufacturing base, electronics expansion, and governmental R&D investment.

- Latin America (Brazil, Mexico): Steady growth supported by Petrochemical and Construction sector expansion; price sensitivity influences purchasing decisions.

- Middle East & Africa (MEA): Emerging market; demand centered around Oil & Gas infrastructure materials and regional academic expansion.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Dynamic Thermomechanical Analyser Market.- TA Instruments (Waters Corporation)

- Mettler-Toledo International Inc.

- NETZSCH-Gerätebau GmbH

- Hitachi High-Tech Corporation

- PerkinElmer Inc.

- Seiko Instruments Inc.

- LINSEIS Messgeräte GmbH

- Rigaku Corporation

- Shimadzu Corporation

- Malvern Panalytical (Spectris)

- SETARAM Instrumentation (Kéosys Group)

- Anton Paar GmbH

- GABO Quali-Test GmbH (TA Instruments)

- C-Therm Technologies Ltd.

- Testometric Company Ltd.

- ZwickRoell GmbH & Co. KG

- Thermo Fisher Scientific Inc.

- Sineo Technology Co., Ltd.

- Admet Inc.

- Micro Materials Ltd.

Frequently Asked Questions

Analyze common user questions about the Dynamic Thermomechanical Analyser market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between standard TMA and Dynamic Thermomechanical Analysis (DTMA)?

Standard Thermomechanical Analysis (TMA) measures dimensional changes under a static load as a function of temperature. DTMA, however, applies an oscillating (dynamic) stress or strain, allowing researchers to measure viscoelastic properties, such as storage modulus (stiffness) and loss modulus (damping), which are critical for predicting material performance under dynamic service conditions and understanding molecular relaxations.

Which industries benefit most from utilizing DTMA technology?

The industries benefiting most include aerospace and defense (for composite fatigue testing), automotive (for EV battery component stability and polymer durability), chemical and polymer manufacturing (for quality control and glass transition temperature determination), and the biomedical sector (for analyzing stability of implants and drug delivery systems). Any industry reliant on the long-term mechanical reliability of materials under varying thermal stress utilizes DTMA.

How does the integration of AI influence the future utility of DTMA systems?

AI integration significantly enhances DTMA utility by automating complex data analysis, enabling predictive modeling of material lifetimes, optimizing testing protocols for efficiency, and providing real-time quality control checks in manufacturing. AI allows users to extract deeper, more actionable insights from viscoelastic data, speeding up the materials discovery and validation cycle.

What are the key factors driving the high adoption rate of DTMA in the Asia Pacific region?

The key drivers in APAC are rapid growth in electronics and automotive manufacturing, substantial government investment in regional R&D centers and materials science research, and an increasing regional focus on meeting stringent international quality and performance standards for exported goods, necessitating advanced characterization tools like DTMA.

What are the critical considerations when selecting a Dynamic Thermomechanical Analyser instrument?

Critical considerations include the required temperature range and heating/cooling speed, the accuracy and resolution of force and displacement sensors, the variety of available testing modes (tension, shear, bending), compliance with international standards (e.g., ISO, ASTM), and the sophistication of the data analysis software for complex viscoelastic modeling, such as Time-Temperature Superposition (TTSP).

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager