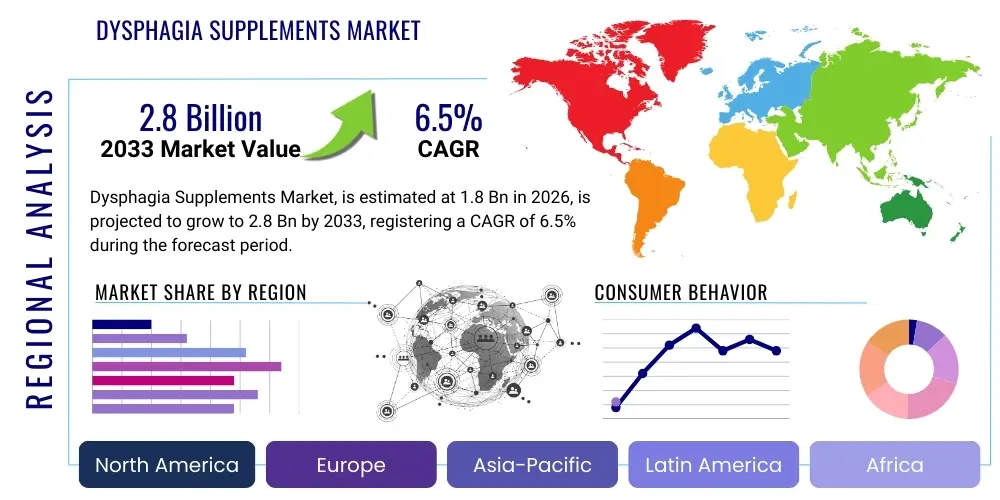

Dysphagia Supplements Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440913 | Date : Feb, 2026 | Pages : 248 | Region : Global | Publisher : MRU

Dysphagia Supplements Market Size

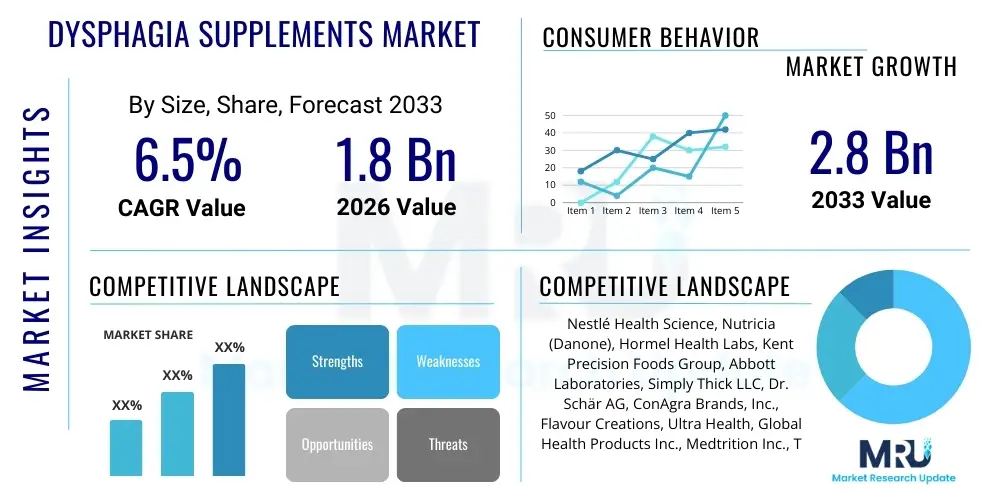

The Dysphagia Supplements Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at $1.8 Billion in 2026 and is projected to reach $2.8 Billion by the end of the forecast period in 2033.

Dysphagia Supplements Market introduction

Dysphagia, or difficulty in swallowing, is a critical medical condition primarily affecting the elderly, stroke victims, and patients suffering from neurodegenerative diseases like Parkinson's or Alzheimer's. Dysphagia supplements are specialized nutritional products and thickeners designed to modify the texture of foods and liquids, making them safer and easier for individuals with swallowing difficulties to consume, thus preventing aspiration pneumonia and ensuring adequate hydration and nutrition. These products range from instant thickening powders, which are starch- or gum-based, to pre-thickened beverages and specialized nutritional formulas that are caloric and protein-dense.

The primary applications of dysphagia supplements are prevalent across various healthcare settings, including acute care hospitals, long-term care facilities, rehabilitation centers, and increasingly, homecare settings. The products are essential for managing nutritional deficiencies and dehydration, which are common comorbidities associated with severe dysphagia. By providing a safe method for consumption, these supplements significantly enhance patient quality of life and reduce hospital readmission rates related to aspiration events. Furthermore, they contribute significantly to compliance with dietary recommendations prescribed by speech-language pathologists (SLPs).

Key benefits driving market adoption include the enhanced safety profiles they offer by reducing aspiration risk, their convenience in preparation, and their nutritional completeness. The driving factors behind the market’s expansion are fundamentally linked to the global aging population, as the prevalence of dysphagia correlates strongly with advanced age. Additionally, increased awareness and early diagnosis of swallowing disorders, coupled with technological advancements resulting in more palatable and effective thickening agents (e.g., clear thickeners), are fueling steady market growth across developed and developing economies.

Dysphagia Supplements Market Executive Summary

The Dysphagia Supplements Market is experiencing robust expansion driven by demographic shifts, particularly the rapidly increasing geriatric population globally, which inherently elevates the incidence of swallowing disorders. Business trends highlight a significant move toward research and development focusing on improving product palatability and texture consistency, moving away from traditional starch-based thickeners towards more innovative gum-based and xantham gum formulations that offer superior texture stability and less impact on the flavor profile of the thickened item. Furthermore, key market players are aggressively pursuing strategic acquisitions and partnerships with long-term care providers and hospital systems to secure supply contracts and expand distribution networks, capitalizing on the centralized purchasing power of these large institutions. A growing emphasis on personalized nutrition tailored to specific severity levels of dysphagia is also becoming a defining business characteristic.

Regionally, North America currently holds the largest market share, predominantly due to well-established healthcare infrastructure, high awareness levels regarding dysphagia management protocols, and substantial reimbursement coverage for specialized nutritional products. However, the Asia Pacific region is forecast to exhibit the highest Compound Annual Growth Rate (CAGR) throughout the forecast period. This rapid growth is fueled by improving healthcare expenditure, increasing incidence of stroke and neurological conditions in densely populated countries, and governmental initiatives aimed at improving standards of care in geriatric medicine. European markets maintain a steady growth trajectory, supported by comprehensive social security systems and rigorous clinical guidelines promoting the use of texture-modified diets.

Segment trends reveal that the gum-based thickeners segment, particularly those leveraging xanthan gum, is witnessing accelerated growth owing to their superior performance characteristics—they do not continue to thicken over time and remain clear. Among application segments, Long-Term Care Centers and Homecare settings are projected to see substantial growth, reflecting the trend towards shifting patient care from acute hospitals to more cost-effective, community-based environments. The shift towards ready-to-use, pre-thickened beverages is also a notable trend, driven by convenience and the need for standardized consistency in clinical settings, minimizing the risk of human error associated with manual preparation.

AI Impact Analysis on Dysphagia Supplements Market

User inquiries regarding the role of Artificial Intelligence (AI) in the Dysphagia Supplements Market primarily center on enhancing diagnostic accuracy, personalizing nutritional plans, and optimizing product formulation and delivery. Common questions explore whether AI can automate the assessment of swallowing function (e.g., interpreting videofluoroscopy or fiberoptic endoscopic evaluation of swallowing - FEES), how machine learning algorithms can predict aspiration risk based on patient data, and if AI can assist in creating personalized texture-modified diets that meet both safety and caloric requirements while maximizing patient acceptance. Concerns often revolve around the initial high cost of implementing AI-driven diagnostic tools and the need for seamless integration with existing clinical workflows, ensuring that AI enhances, rather than complicates, the care process for patients suffering from complex swallowing disorders.

The integration of AI offers substantial potential to revolutionize several aspects of dysphagia management, extending beyond simple product development into sophisticated clinical decision support systems. By analyzing vast datasets encompassing patient demographics, medical history, severity of dysphagia, and outcomes of various dietary interventions, AI models can significantly improve the prescription accuracy of texture-modified diets. This shift from standardized guidelines to personalized recommendations ensures that patients receive the safest and most enjoyable nutritional intake possible, directly impacting compliance and overall health outcomes. Furthermore, AI can be employed in quality control during manufacturing, ensuring the precise viscosity and consistency of dysphagia supplements, a critical factor for patient safety.

Another area where AI proves impactful is in remote patient monitoring (RPM) and telehealth. AI-powered algorithms can analyze real-time patient feedback, monitor consumption patterns, and alert clinicians to potential issues such as inadequate intake or signs of aspiration risk, especially in the growing homecare segment. This proactive approach, supported by machine learning, enables timely dietary adjustments and supplementary interventions, optimizing resource allocation within healthcare facilities and improving the efficacy of dysphagia therapy. The technology also allows manufacturers to rapidly iterate on product formulations based on aggregated patient preference data, leading to faster innovation in palatable and effective supplemental products.

- AI-driven diagnostics enhance the accuracy of dysphagia severity assessment (e.g., analysis of swallowing studies).

- Machine learning algorithms personalize texture and viscosity recommendations for supplements, optimizing patient safety and intake.

- AI improves supply chain efficiency and demand forecasting for specialized nutritional products in clinical settings.

- Predictive analytics identify patients at high risk of aspiration pneumonia, prompting timely dietary adjustments.

- Robotics and AI ensure high precision and consistency in the manufacturing process of thickening agents and pre-thickened items.

- Telehealth platforms utilize AI for remote monitoring of patient compliance and nutritional status in homecare settings.

DRO & Impact Forces Of Dysphagia Supplements Market

The Dysphagia Supplements Market is fundamentally influenced by a complex interplay of demographic pressures, clinical advancements, and regulatory environments. The primary driver is the accelerating global aging population, as advanced age is the single greatest risk factor for developing dysphagia secondary to conditions like stroke, dementia, and frailty. Coupled with this is increased medical awareness and mandatory screening protocols in hospitals and long-term care facilities, leading to earlier diagnosis and a higher utilization rate of specialized nutritional supplements. However, growth is restrained by high perceived costs associated with premium-grade thickeners and specialized formulas, especially in regions lacking comprehensive reimbursement policies. Furthermore, a persistent challenge is patient non-compliance, often stemming from the unpalatability or poor aesthetic quality of highly thickened foods and liquids, prompting continuous research efforts to improve product formulation. Opportunities abound in leveraging personalized medicine approaches, developing novel clear thickeners, and expanding market penetration into high-growth emerging economies where healthcare infrastructure is rapidly developing.

The market faces significant impact forces originating from clinical practice and public health policies. Regulatory bodies, such as the FDA and EFSA, mandate strict consistency standards for supplements, forcing manufacturers to invest heavily in quality assurance, which raises the barriers to entry but guarantees safety. Clinical guidelines, particularly the International Dysphagia Diet Standardization Initiative (IDDSI), have standardized terminology and levels of texture-modified diets globally. This standardization acts as a major driver, simplifying product specifications for manufacturers and ensuring consistent application by clinicians worldwide, thereby reducing preparation errors and increasing the trust in these specialized products. Conversely, the market is highly sensitive to the cost of raw materials (e.g., hydrocolloids like xanthan gum) and logistical challenges in maintaining the cold chain for specific liquid formulations.

An emerging opportunity lies in integrating dysphagia care with broader malnutrition screening programs, which enhances the visibility of these specialized products within the general medical community. Restraints also include the availability and education level of specialized healthcare professionals, such as Speech-Language Pathologists (SLPs), who are the primary prescribers. A shortage or lack of training in effective supplement utilization can hinder market adoption, particularly in rural or underdeveloped areas. The impact forces underscore a continuous industry mandate: products must not only be functionally safe but also aesthetically acceptable and easy for caregivers (professional and informal) to prepare correctly, ensuring optimal patient outcomes and sustained market growth across all settings.

Segmentation Analysis

The Dysphagia Supplements Market is highly diverse and can be strategically segmented based on product type, ingredient base, application, and patient age, reflecting the various clinical needs and consumer preferences across the demographic spectrum. Product segmentation highlights the dominance of thickening agents, which are versatile and adaptable, juxtaposed against the growing demand for convenient, ready-to-use pre-thickened nutritional beverages. Ingredient segmentation focuses on the functional properties of starch versus newer hydrocolloid gums, directly impacting texture stability and flavor. Application analysis reveals critical differences in usage patterns between acute hospital care, where rapid diagnosis and intervention are key, and long-term care or homecare settings, which prioritize ease of use and long-term compliance. Understanding these granular segments allows companies to tailor product portfolios and distribution strategies effectively to address specific market gaps and capitalize on evolving healthcare trends, such as the increasing emphasis on home-based care.

- Product Type:

- Thickening Powders (Instant Mix, Controlled Release)

- Pre-thickened Beverages (Water, Juice, Milk, Coffee/Tea)

- Nutritional Supplements and Formulas (High Calorie, High Protein)

- Ingredient Type:

- Starch-based Thickeners (Modified Corn Starch, Tapioca Starch)

- Gum-based Thickeners (Xanthan Gum, Guar Gum, Carrageenan)

- Mixed Blend Thickeners

- Application/End User:

- Hospitals and Clinics (Acute Care)

- Long-Term Care Centers and Nursing Homes

- Homecare Settings

- Rehabilitation Centers

- Patient Age Group:

- Pediatric

- Adult

- Geriatric

Value Chain Analysis For Dysphagia Supplements Market

The value chain for dysphagia supplements begins with upstream activities focused heavily on the sourcing and processing of specialized raw materials, primarily high-grade starches and complex hydrocolloids such as xanthan gum and modified celluloses. Reliability in sourcing these food-grade ingredients, coupled with stringent quality control to ensure purity and consistency, is paramount, as the functional performance of the final product hinges on these inputs. Key activities also include extensive research and development (R&D) focused on formulation science to improve viscosity control, stability, and sensory characteristics (taste and mouthfeel), transforming basic raw materials into highly specified, therapeutic products. This upstream segment is characterized by high technological investment and intellectual property protecting specialized formulation techniques.

The midstream activities encompass the manufacturing, blending, packaging, and regulatory approval processes. Manufacturing requires specialized machinery to ensure uniform particle size in powders or precise viscosity levels in pre-thickened liquids, meeting clinical standards like those defined by IDDSI. Quality assurance and control (QA/QC) checkpoints are critical to prevent inconsistencies that could pose safety risks to the end user. Downstream distribution is complex due to the need to reach diverse end-users: direct sales to major hospital groups and long-term care conglomerates, sales through large pharmaceutical or specialized medical device distributors to smaller clinics, and direct-to-consumer channels, often facilitated by e-commerce and specialized medical suppliers for the growing homecare segment.

The distribution channel utilizes both direct and indirect routes. Direct distribution involves large manufacturers negotiating specific supply contracts with major healthcare institutions, ensuring high volume sales and streamlined logistics. Indirect distribution, leveraging specialized medical distributors and wholesalers, is crucial for market penetration into independent pharmacies, smaller clinics, and reaching individual patients at home. This multi-channel approach ensures wide availability, but logistical complexities related to storage requirements for pre-thickened liquids and managing vast inventories across different geographies necessitates sophisticated inventory management systems and strong partnership networks. The final step involves the clinical recommendation and sale to the end-user, heavily influenced by prescribers (SLPs and dieticians) and reimbursement policies.

Dysphagia Supplements Market Potential Customers

The primary customers and end-users of dysphagia supplements are individuals diagnosed with chronic or acute swallowing difficulties, spanning all age groups, though predominantly concentrated in the elderly demographic. These patients are often admitted to healthcare facilities or require long-term care management. The direct buyers often include institutional purchasers such as hospital procurement departments, which manage centralized supplies for acute patients, and long-term care facility administrators, who require continuous, high-volume supply to manage resident nutritional needs. These institutional buyers prioritize cost-effectiveness, consistency, and ease of preparation for nursing staff.

The secondary, yet rapidly expanding, segment of potential customers includes homecare patients and their informal caregivers. This group typically purchases products through retail pharmacies, specialized medical supply stores, or online platforms, often relying heavily on recommendations from their discharging hospital or speech-language pathology team. For this segment, factors such as convenience (ready-to-use format), product palatability, and availability in smaller, manageable quantities are crucial purchase determinants. Furthermore, pediatric care facilities and specialized neonatal units form a niche but important customer base, requiring specialized, highly safe formulations tailored to infant nutritional needs and physiological tolerances.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.8 Billion |

| Market Forecast in 2033 | $2.8 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Nestlé Health Science, Nutricia (Danone), Hormel Health Labs, Kent Precision Foods Group, Abbott Laboratories, Simply Thick LLC, Dr. Schär AG, ConAgra Brands, Inc., Flavour Creations, Ultra Health, Global Health Products Inc., Medtrition Inc., ThixoGel, Resource ThickenUp, Precise Thick-N INSTANT, Fresenius Kabi, Functional Formularies, Real Food Blends, B. Braun Melsungen AG, Teleflex Incorporated |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Dysphagia Supplements Market Key Technology Landscape

The technology landscape in the Dysphagia Supplements Market is defined less by mechanical hardware and more by advanced food science and formulation technology, specifically focusing on hydrocolloid chemistry and precision manufacturing. A significant technological advancement is the shift from traditional modified corn starch to hydrocolloid gums, predominantly xanthan gum. Xanthan gum offers superior shear stability, meaning the thickened liquid retains its consistency even after stirring or heating, and it exhibits "non-amylase resistance," ensuring that the thickening effect is not prematurely degraded by salivary enzymes in the mouth, thereby maintaining safety profile until swallowed. The technology enables the creation of clear thickeners, which are more visually appealing and palatable, significantly addressing patient compliance issues.

Manufacturing technology also plays a crucial role, involving precision blending and particle size control (micronization) techniques for powder thickeners to ensure rapid dispersion and consistent viscosity without clumping. For pre-thickened beverages, aseptic processing and Ultra-High Temperature (UHT) sterilization technology are essential to maintain microbial safety and extend shelf life while minimally affecting the product’s flavor and therapeutic consistency. Furthermore, novel packaging technologies are being developed to offer single-serve, dose-controlled sachets, minimizing preparation errors in home and clinical settings, aligning products perfectly with the stringent IDDSI consistency standards (Levels 1 through 4).

Emerging technology includes the use of spectroscopic analysis and viscometry during production to achieve real-time quality control checks on viscosity, ensuring every batch meets the precise fluid dynamics required for safe swallowing. Research is also ongoing into developing specialized gelation technologies that create complex fluid structures, mimicking the mouthfeel of natural, unprocessed foods more closely than current viscous liquids. This sensory optimization, driven by consumer science and advanced rheology, aims to further normalize the eating experience for dysphagia patients, enhancing long-term dietary adherence and overall quality of life by reducing the stigma often associated with texture-modified diets.

Regional Highlights

- North America: Dominates the market share due to high prevalence of chronic diseases contributing to dysphagia (stroke, neurodegeneration), sophisticated healthcare infrastructure, established reimbursement systems, and high public awareness. The U.S. remains the largest national market, characterized by intense competition among leading manufacturers and early adoption of innovative gum-based thickeners and pre-thickened formats.

- Europe: Represents a mature and stable market, driven by universal healthcare coverage and standardized clinical protocols for geriatric care. Western European countries like Germany, France, and the UK are major contributors. The implementation of IDDSI standards across the continent further solidifies the demand for consistently formulated supplements.

- Asia Pacific (APAC): Expected to be the fastest-growing region. This explosive growth is attributed to the rapidly aging populations in China, Japan, and India, coupled with rising healthcare investments and increasing incidence of non-communicable diseases (NCDs). Market penetration is currently lower but is expanding rapidly as specialized care awareness increases and disposable incomes improve.

- Latin America (LATAM): Growth is steady but restrained by economic volatility and varying levels of healthcare access and reimbursement. Key drivers include urbanization and the growing focus on improving clinical nutrition standards in major economies like Brazil and Mexico.

- Middle East and Africa (MEA): Represents the smallest market currently, but is projected for modest growth fueled by investments in hospital infrastructure, particularly in Gulf Cooperation Council (GCC) countries. Challenges include a lack of specialized training and varying regulatory landscape, necessitating localized product solutions and targeted educational initiatives.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Dysphagia Supplements Market.- Nestlé Health Science

- Nutricia (Danone)

- Hormel Health Labs

- Kent Precision Foods Group

- Abbott Laboratories

- Simply Thick LLC

- Dr. Schär AG

- ConAgra Brands, Inc.

- Flavour Creations

- Ultra Health

- Global Health Products Inc.

- Medtrition Inc.

- ThixoGel

- Resource ThickenUp

- Precise Thick-N INSTANT

- Fresenius Kabi

- Functional Formularies

- Real Food Blends

- B. Braun Melsungen AG

- Teleflex Incorporated

Frequently Asked Questions

Analyze common user questions about the Dysphagia Supplements market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of dysphagia supplements and how do they prevent aspiration?

Dysphagia supplements, primarily thickening agents, increase the viscosity of liquids and foods. This higher viscosity slows the fluid’s flow rate, giving the patient more time to coordinate the swallow safely, thereby reducing the risk of accidental entry (aspiration) into the trachea and lungs.

What is the IDDSI framework and why is it important for the dysphagia market?

The International Dysphagia Diet Standardization Initiative (IDDSI) is a global framework providing standardized terminology and descriptions for texture-modified foods and thickened liquids. It ensures consistent product preparation and clinical application worldwide, dramatically improving patient safety and minimizing human error in care settings.

Are gum-based thickeners superior to starch-based thickeners?

Gum-based thickeners, such as those using xanthan gum, are often preferred because they maintain consistency over time and are resistant to degradation by salivary amylase, which can thin starch-based products prematurely. This superior stability makes gum-based supplements safer and more reliable for clinical use.

Which end-user segment is driving the greatest growth in dysphagia supplements?

The Long-Term Care Centers and Homecare segments are driving significant growth. This trend is fueled by the rapid aging population and the increasing shift of patient management from expensive acute care settings to community-based and residential care environments, demanding convenient and easy-to-use products.

How is technology addressing the issue of poor patient compliance with thickened diets?

Technological advancements focus on improving sensory appeal through advanced hydrocolloid chemistry, creating clear, flavor-neutral thickeners. Additionally, precision manufacturing ensures smooth textures and standardized consistency, leading to better palatability and higher patient adherence to prescribed nutritional plans.

The Dysphagia Supplements Market is experiencing a transformative phase, moving from rudimentary starch-based solutions to high-tech, chemically sophisticated formulations designed for optimal safety and sensory satisfaction. The central driver remains the global demographic shift towards an older population, necessitating widespread adoption of specialized nutritional care. Standardization efforts, particularly the IDDSI framework, have professionalized the market, ensuring global consistency in product application and clinical guidelines. While challenges related to high cost and ensuring widespread patient compliance persist, significant opportunities exist in leveraging digital health, AI-driven personalization, and penetrating high-growth emerging economies. Strategic investments in R&D focused on palatability and functional performance will determine market leadership throughout the forecast period. Manufacturers must continue to innovate in pre-thickened, ready-to-use formats to meet the rising demand from the high-growth homecare and long-term care segments, ensuring patient safety and enhanced quality of life remain at the core of product development.

Further analysis into the market dynamics reveals that sustained growth is also dependent on improved educational outreach to both healthcare professionals and caregivers. Effective utilization of these supplements relies heavily on accurate initial assessment by Speech-Language Pathologists and precise preparation by those administering the diets. Lack of proper training can lead to supplements being prepared incorrectly, either too thin (risk of aspiration) or too thick (risk of choking and dehydration), negating their intended therapeutic benefit. Therefore, market leaders are increasingly integrating comprehensive training materials and instructional support alongside product distribution. This commitment to education not only supports safe use but also builds brand trust and loyalty within the clinical community, solidifying market position against competitors.

The competitive landscape is characterized by a few multinational giants that command significant market share due to their extensive nutritional science capabilities and vast global distribution networks. However, smaller, specialized companies focusing on niche segments, such as pediatric formulations or highly innovative clear thickeners, are applying competitive pressure. Mergers and acquisitions remain a frequent strategy as large players seek to integrate specialized technologies or secure regional market presence, particularly in rapidly urbanizing areas of Asia Pacific. Looking ahead, future research efforts are expected to focus on developing supplements that can address co-existing conditions, such as supplements that offer both texture modification and enhanced gut health benefits, further diversifying the market portfolio and increasing the overall value proposition to healthcare providers.

Regulatory scrutiny is intensifying globally, particularly concerning labeling accuracy and claims related to therapeutic effectiveness. Manufacturers are required to provide robust clinical evidence supporting the consistency levels and nutritional efficacy of their products, a barrier that favors large, established players with dedicated regulatory affairs teams and budgets for comprehensive clinical trials. The global movement towards personalized nutrition also implies a potential future shift in regulatory focus, where products might need approval not just based on standardization, but on proven effectiveness for specific sub-populations of dysphagia patients (e.g., post-stroke versus neurodegenerative). This continuous evolution in both clinical guidelines and regulatory mandates ensures that the Dysphagia Supplements Market remains dynamic, highly professionalized, and centered on maximizing patient safety outcomes.

In terms of sustainability and ethical sourcing, there is a growing consumer and institutional preference for products that utilize sustainably sourced ingredients, especially hydrocolloids. This trend subtly pressures manufacturers to optimize their supply chain for transparency and environmentally responsible practices, adding another layer of complexity to raw material sourcing. Furthermore, reducing food waste associated with pre-thickened diets is a minor but relevant concern in institutional settings. Innovations in packaging that allow for better portion control and extended freshness are being researched to address this. The market’s continued expansion is thus inextricably linked not only to clinical needs but also to broader societal expectations regarding ethical business practices and environmental stewardship.

The market for thickening powders continues to hold a dominant position due to their cost-effectiveness and versatility, allowing customization of any liquid or food item. However, the fastest growth is observed in the pre-thickened beverages category. This segment growth is primarily a response to the need for minimized preparation errors in clinical settings and the high demand for convenience in the homecare environment. Pre-thickened products guarantee standardized consistency compliant with IDDSI levels, removing the variability inherent in manual mixing, which significantly enhances patient safety compliance across large healthcare organizations. This split growth trajectory highlights the market’s responsiveness to differing end-user priorities: cost efficiency and customization for institutional bulk buying versus safety assurance and convenience for acute and long-term care management.

Technological advancement in flavor masking techniques is another critical factor influencing market acceptance. Many thickening agents, particularly starch-based ones, can leave a chalky or unpleasant aftertaste, leading to patient refusal or reduced intake. Current R&D is dedicated to incorporating microencapsulation technologies and natural flavor enhancers that effectively neutralize or mask undesirable textures and flavors without compromising the thickening function or nutritional integrity. Successful flavor profiles are crucial for geriatric patients whose sense of taste may already be diminished, making acceptance of texture-modified diets particularly challenging. By focusing on sensory attributes, manufacturers aim to transform dysphagia supplements from necessary medication into palatable food items, thereby improving compliance and nutritional status.

The rise of digital technology, beyond just AI, impacts the market through inventory and consumption tracking systems used in large hospital groups. These systems allow clinicians and procurement managers to monitor the exact usage rates of different viscosity levels and product types. Such data-driven insights inform purchasing decisions, ensuring efficient stock management and reducing waste, while also providing valuable feedback to manufacturers on product demand and efficacy in real-world clinical use. This feedback loop, enabled by digital infrastructure, accelerates product refinement and ensures that the supply chain remains closely aligned with fluctuating clinical requirements and institutional needs, further optimizing the value chain for dysphagia supplements.

In conclusion, the Dysphagia Supplements Market stands as a vital segment of specialized medical nutrition, driven by compelling demographic factors and underpinned by rigorous clinical standardization efforts. The ongoing shift toward advanced gum-based formulations and ready-to-use products reflects a clear prioritization of patient safety, convenience, and compliance. While North America currently leads, the rapid economic and healthcare development in the APAC region promises to redefine geographical market dynamics. Successful market players will be those who combine scientific innovation in formulation chemistry with robust digital and logistical capabilities to meet the growing, diverse needs of institutional and home-based dysphagia patients globally, ensuring safe and pleasant nutritional intake for those with swallowing disorders.

The increasing complexity of patient care, especially for those with multiple chronic conditions, necessitates supplements that offer more than just texture modification. The development of nutritionally dense supplements tailored for specific disease states (e.g., high protein for sarcopenia, specific micronutrients for neurological recovery) represents a key area of future market innovation. This specialized approach moves beyond basic thickening to integrated therapeutic nutrition. Furthermore, the collaboration between food scientists, clinicians, and material engineers is driving the next generation of products, focusing on bio-mimicry—creating textures that break down in the mouth similarly to normal food, enhancing the physiological satisfaction of eating without compromising safety. This interdisciplinary effort is crucial for long-term patient acceptance and market premiumization.

Market penetration in developing economies, particularly in regions across LATAM and MEA, faces unique challenges related to climate and storage conditions. Supplements designed for stable performance in high-humidity or high-temperature environments are critical, as is ensuring adequate shelf life without relying on complex cold chains that may be unreliable. Manufacturers are adapting packaging materials and formulation stabilizers to address these regional logistical hurdles, which represents a crucial area for growth and product adaptation outside of established Western markets. Overcoming these infrastructure constraints through resilient product design is key to tapping into significant potential patient populations in these underserved regions, making global accessibility a major strategic goal for market leaders.

Finally, the growing awareness of the psychological and social impact of dysphagia significantly influences product development strategies. The market is increasingly seeking ways to normalize the dietary experience. This includes offering dysphagia-friendly recipe guides, specialized food molds to make texture-modified food visually appealing, and educational materials that support caregivers in managing dietary adherence while minimizing social isolation associated with specialized diets. While not direct product components, these supporting services and resources are becoming essential value-added features offered by leading supplement manufacturers, enhancing the overall patient journey and fostering greater loyalty within the healthcare community. This holistic approach signals the maturity and compassionate direction of the Dysphagia Supplements Market.

The regulatory framework governing medical nutrition, especially in Europe and the US, plays a crucial role in maintaining quality and efficacy. For instance, the European Union's regulations concerning Food for Special Medical Purposes (FSMP) mandate rigorous compositional and labeling standards for dysphagia supplements, ensuring they meet the specific nutritional needs of patients. Compliance with these stringent standards necessitates substantial investment in quality control and documentation, which acts as a filter, allowing only highly reliable and clinically validated products to succeed. The complexity of navigating diverse international regulatory environments reinforces the competitive advantage of multinational corporations with established expertise in global compliance, further consolidating their market position and setting high industry benchmarks for safety and quality assurance.

Another emerging trend is the integration of high-protein components directly into thickening formulas, particularly targeted at the geriatric population suffering from malnutrition and sarcopenia (age-related muscle loss). Traditional thickeners often provided only caloric density or hydration benefits; modern formulations now often incorporate whey protein isolates or other bioavailable protein sources to address the crucial need for muscle maintenance and recovery, especially in post-operative or chronic disease patients. This move towards 'functional thickening' enhances the overall therapeutic value of the supplement, positioning it as a comprehensive nutritional intervention rather than just a simple textural modification tool, thereby broadening its prescribing potential across various medical specialties including geriatricians and clinical dieticians.

The economic impact of dysphagia supplements on the overall healthcare system cannot be overstated. By minimizing aspiration events, which often lead to severe and costly aspiration pneumonia, these supplements demonstrably reduce hospital length of stay and readmission rates. Healthcare systems are increasingly recognizing the cost-benefit analysis, viewing the supplements not as an expense, but as a critical preventative measure. This realization drives institutional preference for high-quality, standardized products that guarantee consistent performance. Procurement decisions are thus shifting from lowest cost to best value, considering the long-term cost savings associated with improved patient outcomes and reduced complications, significantly influencing market negotiation dynamics and pricing strategies within the B2B segment of the industry.

Furthermore, technological advancements are being applied to the creation of more sustainable and natural ingredient bases. Research is exploring alternatives to traditional hydrocolloids, investigating plant-based fibers or specific microbial fermentation products that can achieve the required viscosity and stability with a cleaner label and potentially lower environmental footprint. This 'clean label' movement, prevalent across the entire food industry, is beginning to influence medical nutrition, driven by patient preference for fewer artificial additives and more recognizable ingredients. Companies that successfully introduce natural, highly functional thickeners stand to capture a premium segment of the market, particularly among health-conscious consumers and institutions prioritizing natural food sourcing.

The role of specialized compounding pharmacies and small-scale custom manufacturers also subtly influences the market, particularly for rare or highly complex cases of dysphagia, often involving pediatric patients with unique allergies or metabolic needs. While small in volume, this niche segment drives innovation in highly specialized, custom-mixed formulas that large corporations may find uneconomical to mass-produce. These smaller players often serve as incubators for new thickening agents or flavor combinations, which, if successful, may later be scaled up or acquired by major market players. This localized innovation contributes to the overall diversity and responsiveness of the dysphagia supplements ecosystem.

Investment in supply chain resilience remains a key strategic imperative, particularly following global disruptions experienced in recent years. Ensuring a stable supply of key ingredients—xanthan gum, starches, and nutritional fortifiers—is essential to maintaining the continuity of care in hospitals and nursing homes globally. Companies are diversifying their sourcing geographically and entering into longer-term contracts with key suppliers to mitigate future price volatility and supply bottlenecks. This focus on operational resilience is integral to maintaining the trust of institutional buyers who depend entirely on reliable supply for patient care, indirectly supporting consistent market growth and stability throughout the forecast period.

Finally, the growing influence of patient advocacy groups and specialized medical organizations is helping to destigmatize the use of texture-modified diets. By promoting awareness, sharing success stories, and providing practical advice, these groups help improve patient morale and adherence. Manufacturers often collaborate with these organizations to gather user feedback and refine products, ensuring that the next generation of supplements meets both clinical safety standards and the practical, emotional needs of the individuals relying on them for safe nourishment. This collaborative ecosystem fosters continuous improvement and market relevance in a highly sensitive therapeutic domain.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager