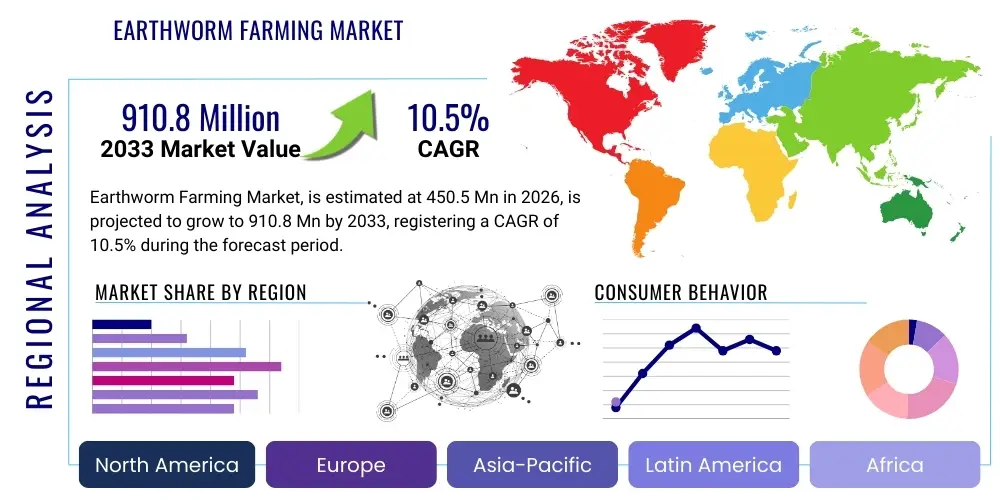

Earthworm Farming Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442488 | Date : Feb, 2026 | Pages : 257 | Region : Global | Publisher : MRU

Earthworm Farming Market Size

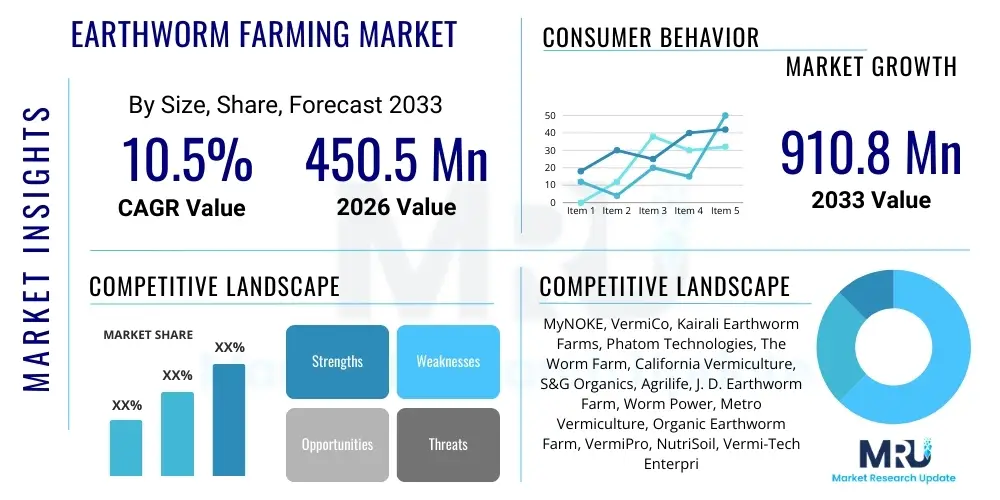

The Earthworm Farming Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 10.5% between 2026 and 2033. The market is estimated at USD 450.5 Million in 2026 and is projected to reach USD 910.8 Million by the end of the forecast period in 2033.

Earthworm Farming Market introduction

The Earthworm Farming Market, officially termed vermiculture, constitutes the systematic cultivation and management of specialized earthworm species, primarily aimed at transforming organic waste materials into highly valuable biological products, chiefly vermicompost (vermicast) and worm biomass. This market is positioned at the nexus of sustainable agriculture, waste management, and bio-resource utilization, experiencing profound growth due to global legislative and consumer shifts towards environmentally benign practices. Vermicompost, the primary output, is a bio-fertilizer distinguished by its exceptional concentration of humic acids, essential plant nutrients, beneficial microbes, and superior capability to enhance soil structure, water retention capacity, and overall plant health, offering a compelling alternative to synthetic chemical fertilizers whose long-term ecological impact is increasingly scrutinized. The economic attractiveness is bolstered by its dual function: simultaneously mitigating environmental burdens associated with waste disposal and generating high-value agricultural inputs crucial for resilient food systems globally, making the process inherently circular and economically justifiable.

Key applications of the earthworm farming output span a broad economic spectrum. In agriculture, vermicompost application extends from large commercial organic farms and horticulture to specialized greenhouse operations, where consistent, high-quality soil amendments are indispensable for maximizing yield and meeting strict organic certification requirements. Beyond soil fertility, the earthworm biomass itself is rapidly gaining prominence in the burgeoning animal feed industry. High-protein worm meal, derived from dried earthworms, serves as a sustainable and traceable source of nutrition for aquaculture (especially shrimp and fish farming) and poultry, addressing ethical and environmental concerns related to traditional feeds like fishmeal, which contribute to marine resource depletion. The ease of decentralized cultivation of earthworms allows farmers to integrate this practice seamlessly into existing farm operations, optimizing resource utilization and creating self-sustaining nutrient cycles that reduce external dependency on volatile global supply chains.

The accelerated expansion of this market is driven by several robust macroeconomic and micro-level factors. Globally, governments are enacting stricter environmental policies that penalize landfill disposal of organic waste and incentivize composting and bio-conversion, creating an artificial demand floor for vermiculture services. Furthermore, the intensifying volatility and escalating costs of synthetic fertilizers, largely linked to fossil fuel prices, highlight the cost-effectiveness and stability offered by locally produced vermicompost. Consumer demand acts as a critical pull factor; the documented preference for organic, sustainably produced food, especially across North America and Europe, compels commercial producers to adopt certified organic inputs like vermicompost. These combined factors, coupled with continuous innovation in farming methodologies—such as climate-controlled systems and automation—are rapidly transforming earthworm farming from a traditional, rudimentary practice into a sophisticated, industrialized bio-manufacturing sector capable of scaling its output to meet high-volume global market requirements and regulatory compliance standards across diverse operational geographies.

Earthworm Farming Market Executive Summary

The Earthworm Farming Market is currently undergoing a structural transformation, migrating towards large-scale, technologically sophisticated operations focused on product standardization and diversification. Current business trends heavily favor vertical integration, where companies manage the entire lifecycle from sourcing and pre-processing diverse organic feedstocks (e.g., municipal solid waste, food processing sludge, and industrial effluents) to final product distribution. This ensures control over input quality and output consistency, crucial for penetrating high-value markets like certified organic food production and specialized animal feed sectors. There is a marked strategic move towards establishing regional hubs equipped with advanced automation—utilizing conveyor systems, automated environmental monitoring, and efficient harvesting machinery—to drive down operational expenditure (OPEX) and mitigate labor dependencies, positioning the market for aggressive scalability and improved profitability margins.

Regionally, the market exhibits a dichotomy: high volume, subsidy-driven growth in Asia Pacific (APAC), particularly fueled by state-led agricultural modernization initiatives and massive waste generation; versus high-value, regulatory-driven growth in North America and Europe. In the West, strict waste diversion targets and sophisticated consumer preferences for ecologically certified products command premium pricing and demand advanced quality assurance protocols. European policy, specifically the implementation of the Circular Economy Action Plan, is accelerating investment in large, municipal-scale vermicomposting facilities designed to handle segregated food and garden waste efficiently. This regional divergence necessitates bespoke market entry strategies, requiring technology licensing and low-cost production models in APAC, contrasting with compliance-focused, high-investment strategies in highly regulated Western markets, acknowledging the differential barriers to entry and competitive landscape across these major economic blocs.

Segment analysis underscores the accelerating prominence of high-value applications beyond traditional fertilizer use. While Vermicomposting remains the market volume backbone, the Animal Feed segment is emerging as the undisputed growth leader, projected to expand rapidly due to breakthroughs in processing earthworm biomass into nutritionally superior feed ingredients that address sustainability challenges in aquaculture. Methodological trends show a clear preference shift towards Container/Bin Systems, especially in areas with land limitations or where precise environmental control is paramount for optimizing species productivity and minimizing external risks such as pest infestations or contamination. This shift reflects the industry's commitment to industrial optimization and quality consistency, ensuring that products, whether biomass or vermicast, meet the exacting specifications required by increasingly sophisticated commercial buyers, thereby sustaining the market’s projected double-digit CAGR throughout the forecast period and driving overall market maturation.

AI Impact Analysis on Earthworm Farming Market

Common user questions regarding AI's application in vermiculture center on its capacity to transform biological variability—a core challenge—into predictable, controlled inputs and outputs. Key themes include the practical deployment of machine learning for real-time feedstock analysis and optimization, crucial for maximizing nutrient conversion rates while preventing toxicity or suboptimal conditions for the earthworms. Users frequently inquire about the cost-benefit analysis of installing advanced IoT sensor arrays managed by AI, comparing manual labor costs against investment in automated environmental control systems (AECS) that manage moisture, aeration, and temperature with minimal human intervention. Furthermore, the concept of prescriptive analytics—where AI dictates precise interventions, such as adjusting the input layer depth or nutrient content based on predicted worm health and reproduction cycles—is a major area of inquiry, reflecting the industry's desire to achieve agro-industrial efficiency through intelligent automation.

The integration of AI technologies, particularly in large-scale commercial vermiculture, fundamentally enhances efficiency and mitigates risks associated with biological process management. AI algorithms process voluminous data generated by IoT devices embedded within the worm beds, creating predictive models that preemptively identify sub-optimal conditions. For instance, an AI system can detect a gradual rise in bed temperature correlated with specific feedstock batches and automatically adjust aeration or moisture levels before conditions become detrimental to the worm colony. This predictive capability significantly reduces worm mortality rates, accelerates processing times, and ensures a consistently high-quality vermicast output, directly addressing the industry’s historical challenge of operational inconsistency and sensitivity to environmental perturbations. Consequently, AI acts as the central intelligence layer that converts raw sensor data into actionable, automated decisions, allowing farms to manage complex biological systems with unprecedented precision and operational reliability, fostering significant cost savings and superior productivity.

Beyond process control, AI is revolutionizing post-processing and supply chain aspects. Advanced computer vision systems linked to robotics are being developed and deployed for automated harvesting, allowing for precise separation of earthworms from vermicast, often based on subtle size and movement characteristics, minimizing labor and maximizing the purity of the final product intended for high-grade applications. Furthermore, machine learning models analyze market demand patterns, optimizing production schedules to match seasonal agricultural requirements, thereby minimizing inventory holding costs and ensuring fresh product delivery. By providing a data-driven framework for decision- making, AI facilitates the necessary standardization and industrialization required for the Earthworm Farming Market to move beyond small-scale operations and confidently supply global agricultural and industrial supply chains with reliable, certified biological inputs, accelerating the overall maturity and economic viability of the entire sector and opening new avenues for complex bio-resource management.

- Precision Feedstock Management: AI algorithms analyze organic waste composition, determining optimal mixing ratios, pre-treatment requirements, and degradation timelines for maximum conversion efficiency and nutrient stability.

- Automated Environmental Control: IoT sensors linked to AI systems maintain ideal temperature, pH, moisture levels, and crucial aeration within worm beds through dynamic, responsive adjustments, minimizing mortality and maximizing reproductive cycles.

- Yield Prediction and Optimization: Machine Learning models forecast vermicast and biomass output based on input parameters, environmental historical data, and species-specific productivity metrics, supporting better inventory management, sales planning, and strategic resource allocation.

- Disease and Stress Detection: Computer vision and advanced data analytics identify subtle behavioral anomalies, color changes, or localized heating patterns indicative of disease outbreaks or environmental stressors, enabling rapid, targeted intervention strategies to protect the colony health.

- Supply Chain Integration and Logistics: AI optimizes logistics for efficient sourcing of diverse waste streams and distribution of bulky products like vermicompost, minimizing transportation costs, reducing carbon footprint, and ensuring timely delivery to large agricultural cooperatives.

- Automated Harvesting and Sorting: Robotic systems and optical sensors guided by AI algorithms enhance the efficiency and purity of separating mature worms, cocoons, and vermicast products, drastically improving post-processing throughput and quality control adherence for premium markets.

- Nutrient Profile Tailoring: Predictive analytics allows farmers to fine-tune and adjust feedstock input composition to produce vermicompost with specific, tailored macro- and micro-nutrient profiles required for niche crop requirements or soil remediation projects, offering specialized, high-value products.

- Financial Modeling and Risk Assessment: AI tools provide advanced economic forecasting, analyzing feedstock price volatility, energy costs for climate control, and market demand fluctuations to optimize pricing strategies and investment in facility expansion or contraction.

DRO & Impact Forces Of Earthworm Farming Market

The market is predominantly influenced by the compelling need for sustainable resource management, establishing global sustainability mandates as the paramount Driver. The escalating global environmental crisis, characterized by excessive greenhouse gas emissions from landfills and widespread soil degradation resulting from intensive chemical farming, mandates the adoption of circular economy models, positioning vermiculture as a pivotal technology for biological waste remediation and soil regeneration. This driver is supported by increasing regulatory pressures across all major economic blocs—particularly in North America, Europe, and developed parts of Asia—where policies mandate the diversion of biodegradable waste from incineration or landfill, compelling municipalities and large corporations to seek reliable, large-scale, and compliant bioconversion technologies. Furthermore, the demonstrated efficacy of vermicompost in improving crop resilience against climate variability and pests provides a powerful economic incentive for commercial growers looking to de-risk their operations, significantly bolstering market demand far beyond niche organic farming circles.

Significant Restraints, however, pose challenges to widespread, rapid industrial adoption. A primary barrier is the lingering perception of earthworm farming as an unstandardized, low-tech, and often artisanal practice, which complicates securing large-scale investment necessary for modern infrastructure. Crucially, scaling operations faces inherent biological constraints, including the susceptibility of worm populations to environmental fluctuations (temperature, humidity, pH spikes) and pathogens, demanding complex and often costly climate-controlled infrastructure in many regions. Moreover, the lack of universally recognized international quality standards and certification mechanisms for vermicompost—unlike the highly codified synthetic fertilizer industry—creates uncertainty regarding product consistency and application efficacy, hindering trust and widespread integration into established, risk-averse commercial agricultural supply chains. Overcoming these perception and standardization gaps necessitates collaborative efforts between industry, regulatory bodies, and academic research institutions to validate and quantify the consistent performance metrics of vermiculture products.

Opportunities for expansive growth are strategically aligned with emerging global demand trends and technological advancements. The most significant opportunity lies in capitalizing on the rapidly expanding Animal Feed market, specifically leveraging earthworm meal as a highly sustainable and ethical replacement for fishmeal, addressing critical sustainability gaps in the global aquaculture value chain which is experiencing unprecedented growth. Another substantial avenue involves specializing in high-end Bioremediation services; specific earthworm species possess proven capabilities in neutralizing certain soil contaminants and heavy metals, opening lucrative contracting opportunities with environmental cleanup agencies and industrial sites requiring ecological restoration. Furthermore, the convergence of vermiculture with advanced biotechnology, including the extraction of high-value compounds like fibrinolytic enzymes and antimicrobial peptides from earthworms for pharmaceutical research, offers potential for ultra-high-margin diversification, transforming the market into a true bio-industry rather than just an agricultural input supplier, thereby attracting capital from non-traditional investors seeking environmentally sound, technology-driven ventures.

Segmentation Analysis

The Earthworm Farming Market segmentation provides a critical framework for analyzing demand drivers and commercial viability across various product offerings and operational models. The segmentation by Earthworm Species is foundational, as different species possess unique biological characteristics—such as temperature tolerance, preferred feedstock type, reproductive speed, and final biomass protein content—that determine their suitability for specific commercial applications. For instance, Eisenia fetida excels at rapid composting of rich organic waste, making it dominant in fertilizer production, while larger species like African Nightcrawlers (Eudrilus eugeniae) are often preferred for biomass production due to their size and protein yield, targeting the lucrative feed market. Strategic market players optimize their species choice based on regional climatic conditions, local feedstock availability, and targeted end-market specifications, ensuring biological efficiency and maximizing profitability within the chosen niche.

The segmentation based on Application clearly delineates the market’s utility and commercial hierarchy. While Vermicomposting holds the volume leadership, driven by the vast agricultural sector, the highest growth prospects and profit margins are increasingly found in the specialized sectors of Animal Feed and Waste Management/Bioremediation. The Animal Feed segment is experiencing exponential growth due to high global demand for sustainable protein and the technological advancements in converting worm biomass into shelf-stable, nutritional feed pellets suitable for industrial livestock operations. Conversely, the Waste Management segment represents a robust B2B service market, where clients are municipal bodies and large industrial generators paying a fee for the ecologically sound processing of their sludge and organic effluent, providing a more stable revenue stream less exposed to agricultural price volatility, requiring specialized expertise in handling and neutralizing potentially complex or contaminated waste streams efficiently.

Farming Method segmentation dictates the capital intensity, operational complexity, and potential scalability of the enterprise. Traditional Bedding/Windrow Systems are low-cost but highly space-intensive and vulnerable to climatic factors, generally favored by small-scale or rural operations with ample land. In stark contrast, Container/Bin and emerging Vertical Farming Systems are characterized by high initial investment but offer unparalleled control over environmental parameters, high population density, superior yield per square foot, and efficient integration with automated monitoring systems. These intensive methods are preferred by large, industrial-scale producers and urban/peri-urban ventures where land is expensive and product consistency is paramount for high-value contracts. This methodological segmentation is crucial for evaluating competitive positioning, as intensive, technology-driven models are best placed to achieve the operational scale and quality assurance required for future global market expansion and securing long-term contracts with major food producers and waste processors.

- By Earthworm Species:

- Eisenia fetida (Red Wigglers)

- Lumbricus rubellus (Red Earthworm)

- Dendrobaena veneta (European Nightcrawlers)

- Perionyx excavatus (Blue Worm)

- Others (e.g., African Nightcrawlers)

- By Application:

- Vermicomposting (Organic Fertilizer Production)

- Animal Feed (Aquaculture, Poultry)

- Waste Management & Bioremediation

- Pharmaceutical & Research

- Bait (Fishing)

- By Farming Method:

- Bedding/Windrow System (Extensive)

- Container/Bin System (Intensive)

- Trench System

- Vertical Farming Techniques

Value Chain Analysis For Earthworm Farming Market

The upstream segment of the Earthworm Farming value chain is centered on meticulous resource acquisition and preparation, which dictates the subsequent efficiency and ultimate quality of the output. This stage includes sourcing the foundational earthworm breeding stock and securing a consistent, large volume of suitable organic feedstock. Given that worms are highly sensitive to salts, toxins, and extreme pH levels, successful upstream operation requires robust quality control and rigorous pre-processing of raw materials, such as composting or controlled decomposition, to stabilize the input before introduction to the worm beds. Strategic partnerships with waste generators—municipal waste facilities, dairy farms, brewery residue producers—are essential for securing low-cost, reliable input streams, transforming a potential liability (waste) into a valuable operational asset, thus driving competitive advantage through optimized raw material procurement and preparation logistics.

The core midstream activities encompass the complex biological process management of the vermiculture system itself. This stage is characterized by high operational intensity and the application of increasing technological sophistication. Key activities include optimizing bed density, ensuring precise environmental controls (temperature and moisture management), implementing specialized feeding protocols tailored to species, and proactive health monitoring to prevent disease or colony collapse. The quality of management directly impacts the conversion rate of waste into vermicast and the health and quantity of the earthworm biomass produced. Post-cultivation processing, including efficient harvesting, separation (crucial for maintaining product purity), stabilization, and specialized drying/packaging, is integral to meeting commercial standards. For example, biomass destined for the feed market requires rigorous thermal processing and certification, while vermicompost may require screening to meet specific particle size requirements for mechanized agricultural application, necessitating investment in appropriate post-harvest technology to maximize value capture.

The downstream component involves the distribution and final sale of the diversified product portfolio. Distribution channels are bifurcated based on the end-product: high-volume, lower-margin vermicompost is typically moved through established agricultural input distributors, garden centers, or large cooperative purchasing programs, requiring bulk logistics and localized storage. Conversely, high-margin products like worm meal, protein extracts, or specialized bioremediation services utilize highly targeted, often direct, B2B sales channels, requiring specialized contractual agreements with aquaculture firms, pharmaceutical companies, or environmental engineering consultants. The transition to indirect and large-scale distribution necessitates stringent quality assurance documentation, comprehensive product traceability, and targeted marketing that emphasizes the proven biological benefits and environmental certifications, crucial elements for building brand credibility and penetrating the highly competitive global agricultural and industrial supply markets, completing the full resource-to-market cycle successfully.

Earthworm Farming Market Potential Customers

The primary and most expansive customer base for the Earthworm Farming Market resides within the Commercial Agriculture Sector, encompassing large-scale organic and conventional farms globally. These producers are significant purchasers of vermicompost, using it as a foundational input to enhance soil fertility, improve water use efficiency, and reduce dependency on synthetic inputs, particularly where soil health remediation is a priority. This segment is highly sensitive to product consistency, certified organic status, and volume pricing, requiring suppliers capable of delivering large, reliable batches throughout planting seasons. Beyond large-scale farming, the Horticulture and Landscaping industries, including nurseries, golf courses, and commercial green space managers, constitute a key high-value consumer group, utilizing high-quality vermicompost and vermiwash for specialized applications that require pristine, disease-free, and nutrient-dense growing media to support high-value ornamental crops and pristine turf conditions.

A rapidly expanding customer segment is the Industrial Waste Management and Processing Sector. This includes municipal waste authorities, water treatment plants, and large food and beverage manufacturers (e.g., breweries, dairies, concentrated fruit processors) who are legally mandated to manage their organic waste streams sustainably. These customers engage earthworm farms not merely as suppliers but as service providers, paying gate fees for the efficient and ecologically sound treatment and conversion of their sludge and organic effluent. The demand here is for robust, reliable, and scalable vermifiltration and composting systems that can handle large, continuous volumes while meeting strict regulatory disposal standards. This B2B segment values operational reliability, compliance documentation, and the provider's ability to minimize the environmental footprint of their waste output, making operational excellence a key determinant in securing long-term service contracts.

The final, high-growth segment comprises the Animal Feed and Specialty Biotechnology Industries. Aquaculture firms, particularly those focused on high-value species like salmon, shrimp, and ornamental fish, are increasingly sourcing worm meal as a sustainable, high-protein alternative to traditional fishmeal, driven by consumer demand for ethically and sustainably sourced seafood. Poultry and swine producers are also exploring this feed source to improve animal gut health and nutrient absorption naturally. In the realm of biotechnology and pharmaceuticals, research institutions and specialized biotech firms constitute a specialized, low-volume but extremely high-margin customer base. They purchase specific earthworm species or extracts (e.g., fibrinolytic enzymes, anticoagulants) for advanced medical research and the production of novel therapeutic compounds. Targeting this customer base requires extreme biological purity, rigorous lab standards, and compliance with pharmaceutical-grade regulatory frameworks, positioning these products at the absolute apex of the market's value proposition and requiring substantial investment in R&D and quality assurance laboratories.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450.5 Million |

| Market Forecast in 2033 | USD 910.8 Million |

| Growth Rate | 10.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | MyNOKE, VermiCo, Kairali Earthworm Farms, Phatom Technologies, The Worm Farm, California Vermiculture, S&G Organics, Agrilife, J. D. Earthworm Farm, Worm Power, Metro Vermiculture, Organic Earthworm Farm, VermiPro, NutriSoil, Vermi-Tech Enterprises |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Earthworm Farming Market Key Technology Landscape

The technological landscape in the Earthworm Farming Market is rapidly evolving, moving away from rudimentary manual systems toward sophisticated, semi-automated and controlled environment agriculture (CEA) methodologies. The primary technological focus is on enhancing the efficiency of biological conversion, ensuring consistent product quality, and achieving operational scalability. Key advancements include the deployment of IoT-enabled sensor networks for real-time monitoring of critical environmental variables within the worm beds, such as moisture content, temperature profiles, oxygen levels, and pH balance. These sensors provide continuous data streams that are crucial for maintaining optimal conditions for worm reproduction and waste processing efficiency, thereby mitigating common risks associated with traditional farming, such as overheating or anaerobic conditions which negatively impact yield and worm health, dramatically improving operational reliability for commercial ventures.

Further technological integration is evident in the development of specialized machinery for the efficient handling of bulk materials throughout the operational cycle. This includes advanced feedstock preparation equipment, such as grinders and mixers designed to homogenize varied organic waste streams into a format optimal for earthworm consumption, significantly accelerating the degradation process. Crucially, innovative harvesting and separation technologies—ranging from mechanized trommel screens to electroshock separators and advanced optical sorting systems—are employed to efficiently separate the mature vermicompost from the earthworms, the eggs (cocoons), and the unprocessed material. This automation minimizes labor costs, reduces physical damage to the worms, and ensures a cleaner, higher-grade end product, which is essential for meeting stringent commercial buyer specifications for both fertilizer and feed markets, ensuring the highest level of quality control possible.

Looking ahead, the market is poised for disruption through advanced data analytics and bio-engineering techniques. Development efforts are focused on refining AI and Machine Learning models to optimize complex biological parameters, leading to precision vermiculture management that dynamically adjusts operations based on predictive data analysis of feedstock input and environmental responses. Additionally, research into selective breeding programs aims to develop superior strains of earthworms (e.g., highly tolerant to specific toxins, faster breeders, or strains producing higher levels of protein or beneficial enzymes) is underway. These technological advancements collectively enhance the economic viability of earthworm farming, transforming it into a high-tech, industrialized bio-manufacturing sector capable of sustainably managing vast quantities of organic resources and delivering certified, high-performance biological inputs globally, solidifying its role in the future of sustainable food production and waste management.

Regional Highlights

- Asia Pacific (APAC): Dominant market share due to governmental subsidies for organic farming, high agricultural waste generation, and substantial presence of large-scale vermicomposting facilities in India and China. APAC’s leadership is sustained by low operational costs and high adoption rates among traditional farming communities seeking alternatives to costly chemical inputs, coupled with significant public investment in decentralized waste management infrastructure.

- North America: Strong focus on high-value organic produce, driven by consumer willingness to pay a premium; increasing use of worm meal in sustainable aquaculture and automated, climate-controlled farming systems. The region emphasizes standardized, high-purity products for certified applications, leveraging advanced technologies to mitigate environmental risks and ensure scalability across large commercial operations.

- Europe: Growth fueled by strict EU environmental policies (Circular Economy Action Plan) mandating bio-waste recycling; emphasis on high-tech processing and certified organic standards for agricultural input safety. European demand is heavily concentrated in large, urban waste treatment contracts and specialized horticulture, prioritizing sustainability compliance and quality assurance in all product lines.

- Latin America (LATAM): High growth potential due to extensive livestock farming (manure conversion) and the need for affordable soil fertility solutions, particularly in Brazil and Mexico. Vermiculture offers a practical method for improving soil productivity on vast tracts of agricultural land, boosting food security and leveraging abundant regional organic resources efficiently.

- Middle East & Africa (MEA): Emerging market driven by necessity for sustainable agriculture, soil improvement in arid regions, and climate resilience initiatives; high demand for vermicompost’s superior water retention capabilities. Investment is concentrated in government-backed agricultural development projects and localized waste conversion initiatives aimed at ecological restoration and water-efficient farming practices.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Earthworm Farming Market.- MyNOKE

- VermiCo

- Kairali Earthworm Farms

- Phatom Technologies

- The Worm Farm

- California Vermiculture

- S&G Organics

- Agrilife

- J. D. Earthworm Farm

- Worm Power

- Metro Vermiculture

- Organic Earthworm Farm

- VermiPro

- NutriSoil

- Vermi-Tech Enterprises

- Global Worming

- Midwest Worms

- Earthworm Farming International (EFI)

- Texas Worm Ranch

- Black Dirt Farm

Frequently Asked Questions

Analyze common user questions about the Earthworm Farming market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driving force behind the growth of the Earthworm Farming Market?

The shift toward sustainable and organic agriculture, coupled with the urgent global need for efficient biological solutions for managing massive volumes of municipal and agricultural organic waste, is the primary market driver.

Which Earthworm Species is most commonly used for commercial vermicomposting?

Eisenia fetida, commonly known as the Red Wiggler, is the preferred species for commercial vermicomposting due to its resilience, high tolerance to various organic feedstocks, and rapid reproductive rate, making it highly efficient for industrial scale operations.

How does the quality of vermicompost compare to synthetic chemical fertilizers?

Vermicompost offers superior benefits by enhancing soil structure, increasing water retention, and enriching microbial diversity, providing long-term soil health improvements that chemical fertilizers, which primarily focus only on nutrient delivery, cannot replicate.

What role does technology, specifically AI, play in modern earthworm farming?

AI and IoT technologies are crucial for transitioning to precision vermiculture, enabling real-time monitoring of environmental parameters, optimizing feedstock input ratios, automating harvesting processes, and predicting yields to ensure product consistency and scalability.

What is the fastest-growing application segment in this market?

The Animal Feed segment, particularly the use of high-protein worm meal in aquaculture and poultry industries, is projected to exhibit the fastest growth rate, driven by the global demand for sustainable and traceable protein sources.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager