Echocardiography (ECG) Devices Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442107 | Date : Feb, 2026 | Pages : 243 | Region : Global | Publisher : MRU

Echocardiography (ECG) Devices Market Size

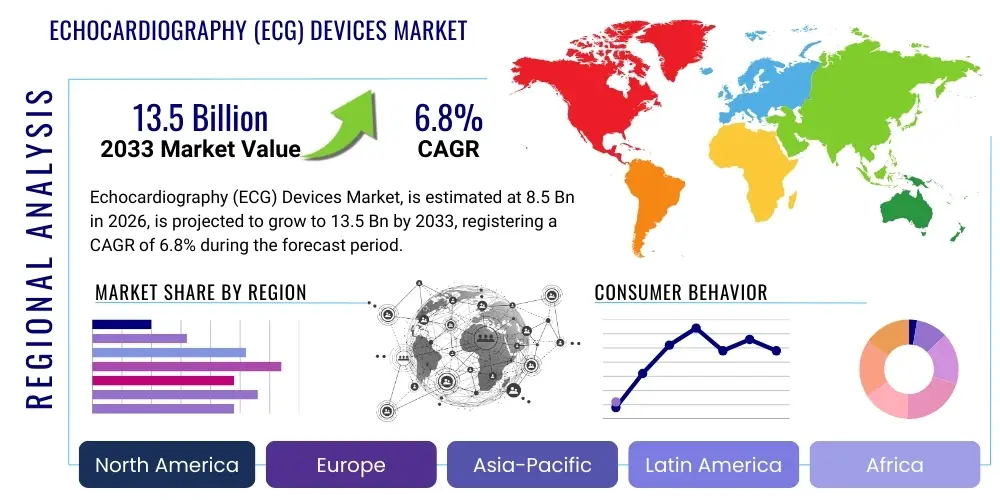

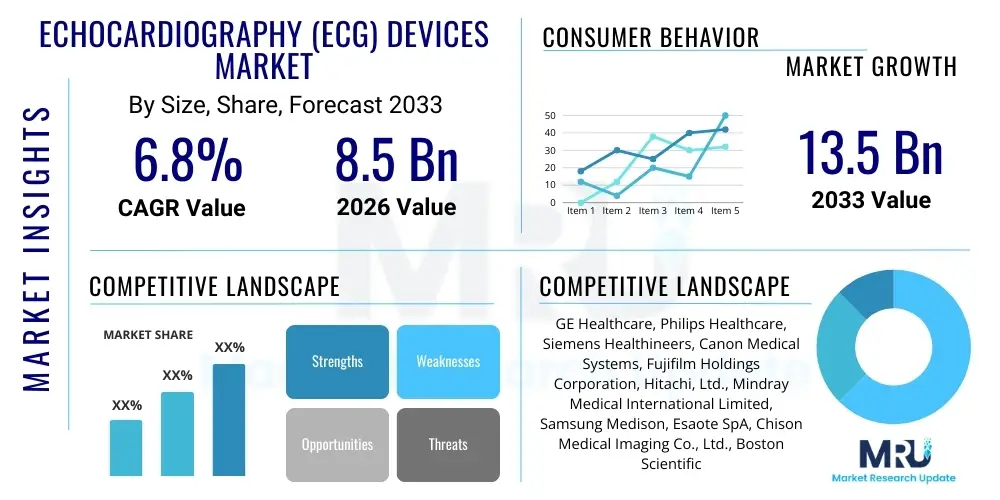

The Echocardiography (ECG) Devices Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 8.5 Billion in 2026 and is projected to reach USD 13.5 Billion by the end of the forecast period in 2033. This consistent expansion is underpinned by the increasing incidence of complex cardiovascular diseases globally, demanding precise and non-invasive diagnostic tools for routine screening, procedural guidance, and post-operative monitoring. The valuation reflects significant ongoing investment in advanced imaging modalities, including matrix array transducers and sophisticated signal processing software, which enhance diagnostic fidelity and broaden clinical applicability across diverse patient populations. Furthermore, the shift towards decentralized and community-based care mandates the proliferation of compact and cost-effective devices, acting as a crucial market accelerator.

Echocardiography (ECG) Devices Market introduction

The Echocardiography (ECG) Devices Market encompasses specialized medical instruments utilizing high-frequency sound waves (ultrasound) to generate detailed, real-time images of the heart's structure, chambers, valves, and blood flow dynamics. These sophisticated systems are foundational diagnostic assets within cardiology, facilitating the assessment of myocardial function, detection of congenital heart defects, evaluation of valvular competency, and quantification of cardiac output. Key product categories range from traditional, high-fidelity cart-based units featuring advanced 3D/4D capabilities and Transesophageal Echocardiography (TEE) probes, to highly mobile, battery-operated, handheld Point-of-Care Ultrasound (POCUS) devices. The non-invasive nature of echocardiography, coupled with its capacity to provide immediate hemodynamic and morphological information, establishes it as the cornerstone diagnostic modality for the initial assessment and long-term management of cardiovascular disorders (CVDs).

Product description highlights the technological sophistication embedded within modern ECG devices. Contemporary systems integrate advanced beamforming technology, broad-bandwidth transducers utilizing single-crystal piezoelectric materials, and specialized software packages designed for comprehensive quantitative analysis, such as strain and strain rate imaging (speckle tracking). These enhanced capabilities allow for the early detection of subtle myocardial dysfunction, often preceding measurable changes in ejection fraction, thereby improving patient risk stratification. The major applications span general screening for hypertension and coronary artery disease, precise guidance during minimally invasive structural heart procedures (e.g., TAVR), and continuous monitoring in critical care settings. The evolution toward digital connectivity and robust data management systems (PACS integration) ensures seamless workflow efficiency within complex hospital environments, positioning these devices as indispensable components of modern cardiac care pathways.

The market benefits significantly from its commitment to non-ionizing radiation imaging, distinguishing it favorably from computed tomography (CT) and nuclear medicine techniques, making it ideal for pediatric use and serial examinations. Key driving factors propelling market expansion include the demographic shift toward an aging population globally, which inherently elevates the incidence of age-related cardiac conditions, and substantial government and private sector investment in CVD prevention and diagnosis across emerging economies. Moreover, continuous innovation in artificial intelligence (AI) integration is automating complex measurements and standardizing image acquisition, thereby reducing dependence on expert sonographers and unlocking new markets for decentralized care. These confluence of factors ensures sustained double-digit growth potential across specialized segments, particularly those focusing on portability and automated analysis, cementing the device's role in proactive health management.

Echocardiography (ECG) Devices Market Executive Summary

The global Echocardiography Devices Market trajectory is characterized by strategic innovation and intense competitive activity focused on miniaturization and software excellence. Current business trends illustrate a paradigm shift where pure hardware manufacturing is augmented by recurring revenue streams derived from AI-driven software licenses, cloud storage solutions, and subscription-based maintenance services. Major industry players are increasingly leveraging strategic alliances and targeted acquisitions to quickly integrate cutting-edge AI diagnostic algorithms and proprietary transducer technology, seeking to secure intellectual property advantages in the rapidly expanding POCUS segment. Furthermore, sustainability considerations are influencing product lifecycle management, with focus placed on modular designs and energy-efficient systems to comply with evolving environmental and clinical demands, optimizing total cost of ownership for end-users globally and driving consolidation among specialized tech providers.

Geographic market performance shows significant disparity, with established regional trends maintaining momentum while high-growth regions accelerate rapidly. North America retains its dominant revenue share due to high clinical adoption rates of premium 3D/4D Transesophageal Echocardiography (TEE) systems and a mature ecosystem supporting extensive research and development. In contrast, the Asia Pacific (APAC) region is forecasted to achieve the highest Compound Annual Growth Rate (CAGR) primarily due to escalating demand for entry-level and mid-range portable devices necessary to serve vast, dispersed populations and developing urban healthcare centers. Regulatory reforms simplifying medical device approvals in key APAC economies, coupled with significant public health investment aimed at tackling endemic cardiovascular risk factors, are foundational to this regional surge. Europe remains a robust, technology-demanding region, exhibiting strong uptake in advanced strain analysis and vascular ultrasound extensions, often driven by centralized public health procurement focused on long-term value and efficiency.

Segmentation trends highlight the increasing fragmentation of the market based on clinical needs and budgetary constraints. The 3D/4D Echocardiography segment, essential for detailed pre-procedural planning and intraoperative guidance in structural heart interventions, is outperforming overall market growth due to its superior anatomical detail. Simultaneously, the Handheld/Portable Systems segment is experiencing explosive demand due to its utility in emergency medicine, primary care triage, and remote diagnostics, effectively disrupting the traditional dominance of cart-based units. Among end-users, specialty cardiology clinics and diagnostic imaging centers are demonstrating the fastest procurement rates, driven by the feasibility and efficiency afforded by POCUS. Hospitals continue to be the largest consumer segment, ensuring stable demand for high-end, multi-functional imaging platforms capable of supporting a full spectrum of cardiovascular services, from basic screening to complex catheterization lab integration, requiring continuous software and hardware updates.

AI Impact Analysis on Echocardiography (ECG) Devices Market

User engagement concerning Artificial Intelligence (AI) in the Echocardiography Devices Market reveals intense scrutiny regarding its potential to revolutionize diagnostic precision and workflow automation. Frequently posed inquiries center on the validation of AI algorithms for quantifying complex parameters, specifically the accuracy of automated strain calculation and valvular regurgitation assessment compared to expert human interpretation. Clinicians are keen to understand how AI-driven tools can reduce the inter- and intra-observer variability that historically plagues manual measurements, leading to more reproducible results across different technicians and facilities. Furthermore, a substantial segment of user concern addresses integration challenges, asking how seamlessly these new AI modules can interface with existing Picture Archiving and Communication Systems (PACS) and Electronic Health Records (EHRs) while ensuring compliance with stringent patient data privacy regulations, such as HIPAA and GDPR, highlighting security as a critical adoption hurdle.

The practical application of AI is profoundly impacting operational efficiency by automating numerous tedious steps in the echocardiography workflow. Deep learning models are now routinely employed for automated view recognition, image optimization, and real-time guidance during scanning, enabling even novice users to capture diagnostic-quality images efficiently. This capability is critical for the wide-scale success of handheld POCUS devices, effectively decentralizing high-quality cardiac imaging. By providing immediate, objective quantitative data—such as automated border detection for chamber volume and calculation of ejection fraction—AI significantly decreases the time required for a full study analysis, thus increasing patient throughput in busy cardiology departments. The net effect is a tangible reduction in diagnostic cycle time, freeing up skilled cardiologists to interpret complex cases and consult with patients rather than spending valuable time on basic quantification tasks, thereby enhancing the overall productivity of the echo lab.

Beyond automation, the most transformative impact of AI lies in its potential for enhancing diagnostic capability and risk stratification. Advanced machine learning techniques can identify complex patterns within ultrasound data that are often invisible or too subtle for the human eye, potentially leading to earlier detection of subclinical cardiac dysfunction and improved predictive modeling for adverse cardiovascular events. The industry is also witnessing the rise of AI as a quality control tool, where algorithms assess the completeness and quality of acquired images in real-time, guiding the technician to correct deficiencies instantly, thereby minimizing the need for patient callbacks or repeated studies. As regulatory bodies continue to approve these innovative AI tools, their integration is transitioning from novel research features into standard clinical operating procedure, solidifying AI as a primary driver for next-generation echocardiography systems and dictating future investment strategies for leading manufacturers and healthcare systems prioritizing objective, data-driven diagnostics.

- AI accelerates image acquisition and standardization, minimizing operator dependence and training requirements.

- Automated segmentation and quantification algorithms reduce complex cardiac analysis time (e.g., ejection fraction, chamber volumes) by over 50%, improving lab throughput.

- Deep learning models enhance diagnostic accuracy for challenging measurements like myocardial strain analysis and subtle disease pattern recognition, enabling earlier intervention.

- AI-driven real-time quality control improves consistency across different scanning environments and technician skill levels, standardizing diagnostic outcomes.

- Predictive analytics integrate echo data with clinical history for advanced patient risk stratification and personalized treatment planning, moving toward precision medicine.

- Streamlined workflows achieved through AI integration facilitate widespread point-of-care ultrasound (POCUS) adoption in primary care and emergency settings, expanding market accessibility.

- AI supports remote diagnostics by standardizing data input and ensuring quality control for teleradiology/tele-echocardiography interpretation services, addressing specialist shortages in rural areas.

DRO & Impact Forces Of Echocardiography (ECG) Devices Market

The dynamics of the Echocardiography (ECG) Devices Market are significantly influenced by a powerful interplay of macro and micro economic forces, categorized as Drivers, Restraints, and Opportunities (DRO). A primary and undeniable Driver is the escalating global prevalence of chronic cardiovascular diseases (CVDs), including structural heart defects, heart failure, and coronary artery disease, which necessitates frequent, high-resolution cardiac imaging for timely diagnosis and ongoing therapeutic assessment. This clinical imperative is coupled with continuous technological refinement, specifically the advancement of higher-frequency, broadband transducers and the commercial viability of compact 3D/4D imaging, enhancing the depth of diagnostic information available to clinicians and solidifying echocardiography’s position as a primary imaging modality over more expensive or invasive alternatives. The increasing utility of echocardiography in non-traditional settings, such as oncology for monitoring cardiotoxicity, further broadens the addressable market.

Conversely, significant Restraints hinder the market’s full realization, chiefly centered around economic and human resource constraints. The considerable high initial capital investment required for cutting-edge, cart-based 4D TEE systems remains a critical barrier, particularly for healthcare providers in resource-limited settings and many emerging economies, forcing them to rely on refurbished or older generation equipment. Furthermore, the global shortage of highly skilled sonographers, specialized cardiologists, and echo laboratory technicians proficient in complex imaging acquisition and interpretation poses a pervasive operational challenge. This skill gap limits the adoption rate of advanced features and often results in underutilization of sophisticated equipment, compounding the problem of high initial investment and training costs for specialized personnel, necessitating significant investment in training infrastructure by providers.

Opportunities for exponential growth are concentrated in two major areas: geographic expansion and technological leverage. Emerging markets, especially in APAC and parts of Latin America, represent massive untapped patient populations where governmental investments in primary care infrastructure are creating demand for durable, affordable POCUS devices suitable for outreach and basic screening. Technologically, the integration of Artificial Intelligence (AI) and machine learning provides the most significant long-term opportunity, promising to mitigate the restraint imposed by the skill shortage by automating critical tasks and standardizing results. Furthermore, the burgeoning field of tele-echocardiography, facilitated by 5G connectivity and cloud computing, allows for remote image acquisition and expert interpretation, dramatically expanding the effective operational footprint of cardiac specialists and device utilization rates across diverse geographical locations, thereby creating robust avenues for recurring service revenue and enhancing diagnostic reach, ultimately offsetting some of the high initial hardware costs.

Segmentation Analysis

Segmentation analysis of the Echocardiography Devices Market provides essential insights into product preference, technological maturity, and end-user adoption patterns, crucial for defining targeted market strategies. The market is fundamentally segmented by Device Type, differentiating between the historical dominance of 2D systems and the rapid ascent of advanced 3D/4D platforms. While 2D systems maintain the largest unit volume due to their cost-effectiveness and broad clinical acceptance for basic screening, the 3D/4D segment commands higher revenue due to the premium pricing associated with superior anatomical rendering, which is indispensable for guiding complex interventional cardiology procedures, particularly in structural heart disease management. Furthermore, segmentation by Technology emphasizes the move towards specialized applications, including the growing clinical necessity for Contrast Echocardiography (CE) to improve endocardial border visualization and Intravascular Ultrasound (IVUS) integrated systems used in catheterization labs for detailed vessel analysis, expanding the scope of ultrasound utilization.

The segmentation based on Portability, dividing the market into cart-based and portable/handheld systems, reflects a profound shift in care delivery models. Cart-based units, characterized by powerful processing and comprehensive functionality, remain the standard for dedicated echo labs and research settings where maximal image quality and specialized features (like TEE) are paramount. Conversely, portable and handheld systems (POCUS) are the fastest-growing category, driven by demand from emergency departments, intensive care units (ICUs), and primary care settings, where rapid diagnosis at the bedside is critical. This trend towards decentralization is highly visible in the End-User segmentation, where Diagnostic Imaging Centers and specialty cardiology clinics are rapidly increasing their purchasing volumes of POCUS devices, often prioritizing flexibility and rapid deployment over the full feature set of traditional cart systems, yet still demanding robust image quality aided by miniaturized technology.

Application segmentation illustrates the diversification of echocardiography beyond general screening into high-value procedures. Interventional Cardiology and Structural Heart Procedures represent a high-growth application segment, directly leveraging advanced 3D/4D and TEE capabilities for procedural guidance, significantly increasing the profitability and technical specifications required of devices used in this area. Pediatric Cardiology remains a crucial niche, demanding specialized probes and software optimized for smaller anatomies and unique congenital defects. This detailed market fragmentation necessitates that manufacturers maintain a diverse product portfolio, addressing the distinct needs for high-throughput screening, specialized procedural guidance, and rugged, accessible point-of-care diagnostics to secure a competitive edge across the entire spectrum of cardiovascular care delivery globally, leveraging strategic pricing across different segments to maximize revenue.

- By Device Type:

- 2D Echocardiography Systems (Standard Diagnostic Platform, High Volume)

- 3D/4D Echocardiography Systems (Premium Visualization and Guidance, High Growth)

- Doppler Echocardiography Systems (Blood Flow Dynamics Assessment)

- Stress Echocardiography Systems (Ischemia and Function Reserve Testing)

- By Portability:

- Cart-Based Systems (High-Fidelity, Dedicated Labs, Comprehensive Functionality)

- Portable/Handheld Systems (POCUS - Emergency, Bedside, Decentralized Care, Fastest Growth)

- By Technology:

- Array Transducers (Single Crystal Technology for Enhanced Resolution)

- Phased Array Technology

- Intravascular Ultrasound (IVUS)

- Contrast Echocardiography (Myocardial Perfusion, Cavity Opacification Enhancement)

- By Application:

- General Cardiology (Routine Screening and Monitoring)

- Interventional Cardiology & Structural Heart Procedures (TAVR, Mitral Clip Guidance)

- Pediatric Cardiology (Specialized Imaging for Congenital Defect Diagnosis)

- Perioperative Monitoring (Anesthesia and Surgery Support)

- Emergency Medicine (Rapid Triage and Trauma Assessment)

- By End-User:

- Hospitals & Cardiology Centers (Largest Volume, High-End Systems Procurement)

- Diagnostic Imaging Centers (Focused on efficiency and throughput)

- Ambulatory Surgical Centers (ASCs)

- Specialty Clinics & Physician Offices (POCUS adoption driving growth)

Value Chain Analysis For Echocardiography (ECG) Devices Market

The Value Chain for the Echocardiography Devices Market is highly specialized and knowledge-intensive, beginning with the crucial upstream phase of sophisticated component manufacturing and intellectual property development. Upstream activities are dominated by R&D expenditure focused on developing proprietary hardware, including advanced piezoelectric materials for transducers—the core technology dictating image quality and bandwidth. Key upstream suppliers specialize in producing custom application-specific integrated circuits (ASICs) for complex digital beamforming and parallel processing, essential for real-time 3D and 4D rendering. Success at this stage relies heavily on securing patents for novel transducer geometries and signal processing algorithms, which constitute a significant competitive moat for leading OEMs. This phase is characterized by high barriers to entry due to the technical complexity and substantial investment required, leading to reliance on a few global specialized component manufacturers who supply leading ECG device OEMs (Original Equipment Manufacturers).

The midstream process involves the complex assembly, software integration (including diagnostic and AI algorithms), rigorous quality control testing, and mandatory regulatory certification (e.g., FDA, CE Mark). This stage requires robust manufacturing protocols and specialized engineering talent to integrate hardware and software seamlessly, ensuring the final medical device meets stringent clinical safety and performance standards. Downstream activities involve distribution, sales, installation, training, and extensive after-sales support. Given the high cost and technical nature of ECG devices, the distribution channel is highly structured. Direct sales forces are typically deployed by large OEMs in developed markets to manage large-scale tenders from major hospital networks, allowing for direct control over pricing, negotiation, and specialized installation requirements. This direct approach fosters stronger customer relationships crucial for service contract renewals and upselling of software modules, often guaranteeing a stable revenue stream for the manufacturer well beyond the initial sale.

Indirect distribution, utilizing third-party distributors and local agents, is predominantly employed to penetrate fragmented or challenging geographical markets, particularly across Asia Pacific, Latin America, and the Middle East. These local partners provide crucial logistical support, manage regional regulatory compliance, and often possess established relationships with smaller clinics and local government procurement bodies, mitigating the high market entry costs for international manufacturers and offering rapid localized support. Crucially, post-sale support, including software updates (especially for AI modules), remote diagnostics, and comprehensive preventative maintenance programs, represents an increasing portion of the value captured downstream. The shift towards software-as-a-service (SaaS) models for integrated AI features is lengthening the customer lifecycle and generating stable, recurring revenue streams, effectively optimizing the overall value proposition for both manufacturers and end-users by ensuring continuous technological relevance and maximizing equipment uptime in demanding clinical environments.

Echocardiography (ECG) Devices Market Potential Customers

The primary customer base for Echocardiography Devices is segmented across various clinical settings, reflecting diverse needs for image fidelity, portability, and cost. Leading the procurement scale are academic medical centers and large, multi-specialty acute-care hospitals. These institutions serve complex patient populations and operate specialized cardiac catheterization laboratories and structural heart programs, demanding premium, cart-based 3D/4D Transesophageal Echocardiography (TEE) systems. Their purchasing decisions prioritize advanced technological features, high throughput capacity, seamless integration with existing Hospital Information Systems (HIS) and PACS, and comprehensive vendor service agreements, often involving large capital expenditure budgets for equipment lifecycle management and complex training requirements for specialized staff.

The secondary, but fastest-growing, customer segment includes standalone diagnostic imaging centers, specialized cardiology clinics, and physician offices. The purchasing behavior within this segment is heavily influenced by the rise of portable and handheld Point-of-Care Ultrasound (POCUS) devices. These customers require systems that balance high clinical utility with low capital investment and minimal space requirements, enabling decentralized diagnostic services. POCUS devices empower general practitioners and non-cardiologist specialists (e.g., pulmonologists, intensivists) to perform immediate cardiac screening and assessment, improving efficiency and reducing the need for patient referral to large hospitals, thereby expanding the market reach significantly into primary care and outpatient environments globally, which necessitates scalable training solutions from manufacturers.

Additional significant customer groups include ambulatory surgical centers (ASCs), particularly those focused on cardiac or vascular procedures, which require dedicated intraoperative monitoring capabilities, often provided by specialized compact systems. Furthermore, governmental health organizations and international non-governmental organizations (NGOs) focused on global health initiatives constitute important large-scale buyers, often preferring rugged, durable, and easily operable portable systems suitable for deployment in remote or underserved areas for mass screening programs. Finally, the military and emergency medical services (EMS) represent niche customers valuing extreme portability, durability, and the ability to perform rapid, life-saving assessments in highly mobile or challenging field conditions, further diversifying the market landscape and driving demand for next-generation ruggedized equipment with robust connectivity for remote data transmission.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 8.5 Billion |

| Market Forecast in 2033 | USD 13.5 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | GE Healthcare, Philips Healthcare, Siemens Healthineers, Canon Medical Systems, Fujifilm Holdings Corporation, Hitachi, Ltd., Mindray Medical International Limited, Samsung Medison, Esaote SpA, Chison Medical Imaging Co., Ltd., Boston Scientific Corporation, Teleflex Incorporated, Vyaire Medical, Inc., Konica Minolta, Inc., Trivitron Healthcare, Analogic Corporation, EDAP TMS S.A., Fukuda Denshi Co., Ltd., ALPINION MEDICAL SYSTEMS Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Echocardiography (ECG) Devices Market Key Technology Landscape

The Echocardiography Devices Market is defined by a dynamic technological landscape driven by the pursuit of superior image quality, enhanced functional assessment, and greater operational flexibility. A central technological pillar is the evolution of Transducer Technology, moving towards single-crystal and matrix array designs. Single-crystal transducers provide ultra-broad bandwidth, dramatically improving both penetration and resolution simultaneously, which is critical for difficult-to-image patients. Matrix array transducers enable real-time 3D/4D volume acquisition, a technology essential for complex interventional procedures where instantaneous, multi-planar visualization of cardiac structures (like the mitral valve apparatus) is required for precise device placement and minimizing procedural risk, thereby driving demand for high-end systems and necessitating advanced computing capabilities within the cart platform.

The second major technological force is the integration of advanced computational techniques, specifically Artificial Intelligence (AI) and Deep Learning. These technologies are applied across the workflow, from optimized signal processing (AI-based noise reduction and clarity enhancement) to automated post-processing analysis. AI algorithms are crucial for speckle tracking echocardiography, enabling faster and more reproducible quantification of myocardial strain, a key metric for early detection of heart failure and cardiotoxicity. Furthermore, the convergence of AI with miniature hardware has given rise to robust, intuitive handheld Point-of-Care Ultrasound (POCUS) devices. These systems use machine vision to automatically identify optimal scan planes and calculate critical measurements without requiring extensive user training, effectively democratizing access to high-quality cardiac imaging outside specialized centers and improving global health access.

Connectivity and data management represent another vital dimension. Modern ECG devices are increasingly being designed as fully digital, network-ready assets, supporting HIPAA-compliant cloud storage and seamless integration with PACS and vendor-neutral archives. This digital connectivity facilitates the rise of Tele-echocardiography, allowing remote interpretation by expert cardiologists, which is a major technological advancement addressing the geographic maldistribution of specialized medical talent and increasing equipment utilization rates. Other specialized technologies contributing to market growth include Intravascular Ultrasound (IVUS) for detailed coronary artery assessment within the cath lab, and the continuous refinement of Contrast Echocardiography protocols, which utilize microbubble agents to visualize myocardial perfusion defects or enhance endocardial border definition, ensuring comprehensive and precise diagnostic capability across the full range of cardiovascular pathology and supporting highly specialized diagnostic procedures.

Regional Highlights

Regional market performance in the Echocardiography Devices sector demonstrates a stark contrast between the mature, high-value markets of the West and the rapidly developing, high-volume potential of the East. North America, encompassing the U.S. and Canada, continues to hold the largest revenue share, primarily due to established healthcare reimbursement models that favor the adoption of expensive, state-of-the-art 3D/4D TEE and AI-integrated cart systems. The region benefits from high per capita healthcare spending, a high burden of lifestyle-related cardiovascular diseases, and the widespread presence of major technology innovators, leading to frequent replacement cycles and early commercial adoption of technologically superior products. Research collaborations and a robust regulatory framework also facilitate rapid market entry for new diagnostic tools, sustaining its leading position in high-end equipment procurement and specialized cardiology procedures.

Europe represents the second most significant market, characterized by technological sophistication and a strong emphasis on evidence-based medicine. Key countries like Germany, France, and the UK prioritize systems that demonstrate clinical efficiency and integration capabilities. The European market exhibits a strong demand for advanced functional assessment tools, such as strain analysis and contrast enhancement capabilities, driven by national health services seeking to optimize diagnostic pathways and reduce the need for more invasive tests. Furthermore, regulatory alignment through the European Union aids in the smooth distribution of advanced systems. However, procurement decisions, particularly in public health systems, are often subject to stringent cost-benefit analysis, promoting demand for durable mid-range systems alongside premium devices required for research and specialized intervention centers, creating a balanced market demand profile.

Asia Pacific (APAC) is undoubtedly the fastest-growing region, poised for exponential expansion throughout the forecast period. This growth is predominantly fueled by massive population bases, rising disposable incomes, and increasing government investment in public health infrastructure modernization across China, India, and Southeast Asia. While Japan maintains high standards of technological adoption similar to the West, the primary growth momentum stems from the immense, unmet need for basic and accessible cardiac screening in populous developing nations. This has created a massive market opportunity for high-volume sales of cost-effective, portable, and durable POCUS devices, enabling community health programs and primary care clinics to deliver essential diagnostics rapidly, positioning APAC as the engine for global unit volume growth and attracting significant investment from manufacturers seeking scalable production capabilities.

Latin America and the Middle East & Africa (MEA) constitute emerging markets with substantial long-term potential, provided macroeconomic stability and healthcare funding improve consistently. In Latin America, urbanization and lifestyle changes are driving up CVD prevalence, spurring demand for reliable diagnostic tools, with Brazil and Mexico leading the regional adoption of mid-to-high-range systems to support growing private healthcare sectors. The MEA region's growth is concentrated in the Gulf Cooperation Council (GCC) countries, which are investing heavily in establishing international-standard medical facilities and developing medical tourism sectors, necessitating the procurement of sophisticated 3D/4D and TEE equipment. However, the rest of Africa continues to rely heavily on refurbished equipment or basic portable systems, making affordability, local maintenance capability, and service infrastructure the critical determinants of market penetration outside the major investment hubs, requiring unique distribution strategies.

- North America (U.S., Canada): Largest market share, driven by high R&D investment, robust reimbursement, and rapid adoption of premium 3D/4D and AI-integrated systems for structural heart procedures.

- Europe (Germany, UK, France): Stable market, characterized by stringent regulatory standards, high demand for specialized TEE and functional imaging, and strong implementation of telemedicine frameworks for remote interpretation.

- Asia Pacific (China, India, Japan): Fastest-growing region, fueled by massive population bases, infrastructural healthcare development, and surging demand for accessible, cost-effective portable devices (POCUS) for large-scale screening and primary care.

- Latin America (Brazil, Mexico): Emerging growth sector focusing on expanding access to mid-range and portable devices in response to increasing urbanization and associated chronic disease burdens.

- Middle East & Africa (MEA): Growth driven primarily by heavy capital investment in advanced cardiology centers within GCC nations; affordability and infrastructure remain key challenges in broader African markets, leading to selective adoption.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Echocardiography (ECG) Devices Market.- GE Healthcare

- Philips Healthcare

- Siemens Healthineers

- Canon Medical Systems

- Fujifilm Holdings Corporation

- Hitachi, Ltd.

- Mindray Medical International Limited

- Samsung Medison

- Esaote SpA

- Chison Medical Imaging Co., Ltd.

- Boston Scientific Corporation

- Teleflex Incorporated

- Vyaire Medical, Inc.

- Konica Minolta, Inc.

- Trivitron Healthcare

- Analogic Corporation

- EDAP TMS S.A.

- Fukuda Denshi Co., Ltd.

- ALPINION MEDICAL SYSTEMS Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Echocardiography (ECG) Devices market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the Echocardiography Devices Market?

The primary driver is the accelerating global prevalence of cardiovascular diseases (CVDs), coupled with the increasing demand for non-invasive, real-time diagnostic tools. Technological innovations, particularly miniaturization (POCUS) and AI integration, further stimulate market expansion by improving accessibility and efficiency across various healthcare settings.

How is Artificial Intelligence (AI) changing the use of ECG devices?

AI is transforming the market by enabling automated image acquisition, optimizing image quality, and providing rapid, quantitative analysis (like automated ejection fraction and strain). This significantly reduces workflow time, minimizes inter-operator variability, and facilitates the effective use of devices in point-of-care settings by non-specialists, decentralizing diagnostic capability.

Which geographical region is expected to show the highest growth rate?

The Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR) through 2033. This high growth is driven by substantial public and private investments in healthcare infrastructure modernization and the massive, underserved patient population in emerging economies like China and India, creating immense demand for accessible diagnostic solutions.

What are the key differences between cart-based and portable echocardiography systems?

Cart-based systems offer superior processing power, comprehensive 3D/4D capabilities, and are designed for dedicated lab settings requiring maximal diagnostic fidelity. Portable/Handheld systems (POCUS) prioritize mobility, rapid deployment, cost-effectiveness, and real-time bedside assessment in critical care, emergency medicine, and primary care settings, often utilizing AI for operational simplicity.

What are the main restraints impacting the adoption of advanced ECG devices?

The primary restraints include the high initial capital investment required for sophisticated 3D/4D equipment, particularly impacting budget-constrained providers, and the pervasive global shortage of highly trained sonographers and cardiologists skilled in operating and interpreting complex, advanced cardiac imaging data.

What role does 4D echocardiography play in modern clinical practice?

4D echocardiography, providing real-time, volumetric imaging, is crucial for guiding complex structural heart interventions, such as transcatheter valve repair (TAVR/TMVR) and closure procedures. It offers superior visualization of cardiac anatomy and device placement, minimizing complications and improving procedural success rates compared to traditional 2D guidance.

How does the shift towards telemedicine affect the ECG Devices Market?

The adoption of telemedicine is significantly boosting the market for portable and connected ECG devices. Tele-echocardiography allows for images acquired in remote locations to be securely transmitted to specialized centers for expert, centralized interpretation, effectively extending the reach of cardiology services and increasing the geographical utility of the installed device base.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager