ED and EDR Systems Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442486 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

ED and EDR Systems Market Size

The ED and EDR Systems Market is undergoing rapid expansion driven by the escalating frequency and sophistication of cyber threats targeting organizational endpoints. Endpoint Detection and Response (EDR) systems, which form the core of this market, move beyond traditional antivirus protection by providing real-time monitoring, advanced threat hunting capabilities, and automated incident response workflows. The necessity for comprehensive visibility into endpoints, coupled with the shift towards remote and hybrid work models, establishes EDR as a foundational layer in modern cybersecurity architectures across all major industry verticals.

The market encompasses solutions deployed across various environments, including cloud-native, on-premise, and hybrid setups, catering to the diverse operational needs of Small and Medium Enterprises (SMEs) and large multinational corporations alike. Furthermore, the integration of Artificial Intelligence (AI) and Machine Learning (ML) within EDR platforms is catalyzing growth by enhancing the accuracy of threat detection and reducing the dwell time of attacks, thereby delivering superior security outcomes. Regulatory mandates requiring robust data protection and incident reporting mechanisms are further compelling organizations to invest strategically in these advanced defensive technologies.

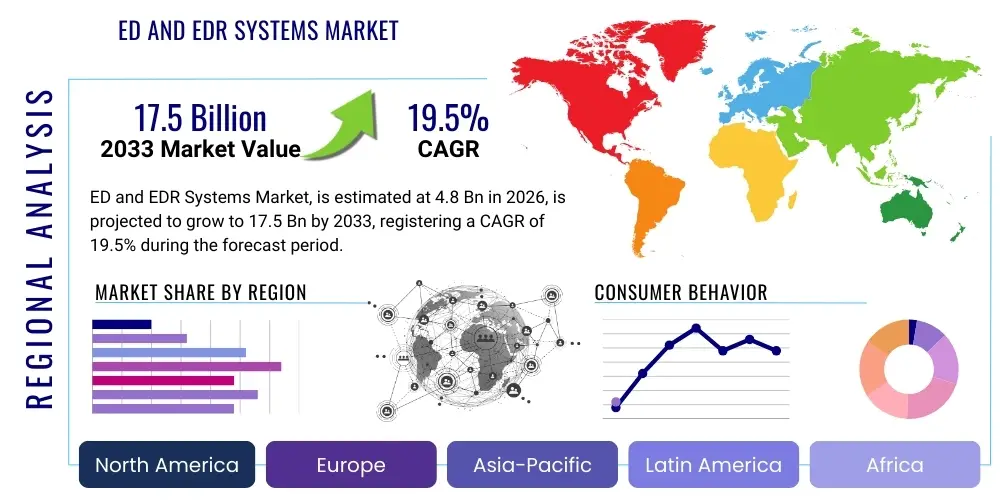

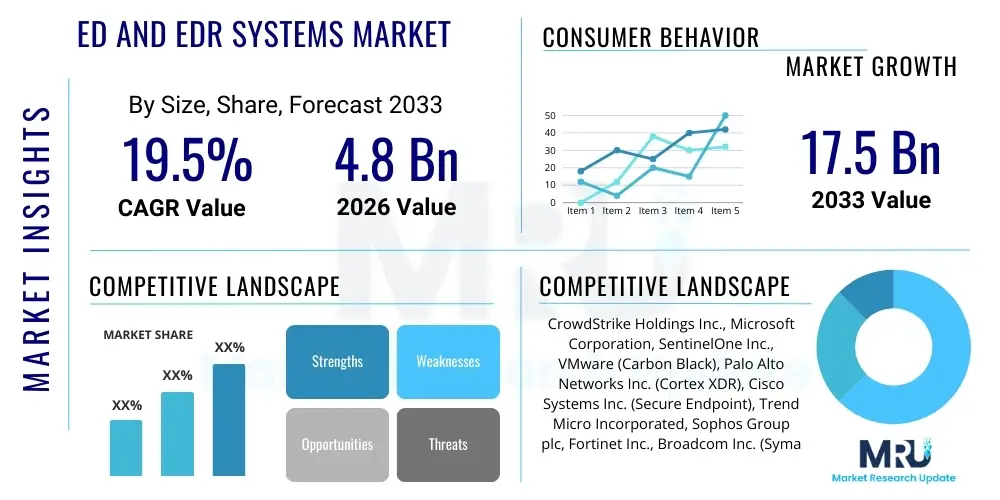

The ED and EDR Systems Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 19.5% between 2026 and 2033. The market is estimated at USD 4.8 Billion in 2026 and is projected to reach USD 17.5 Billion by the end of the forecast period in 2033, indicating a substantial shift in enterprise security spending towards proactive defense and response mechanisms.

ED and EDR Systems Market introduction

The ED and EDR Systems Market primarily focuses on Endpoint Detection and Response solutions designed to continuously monitor endpoints (laptops, servers, mobile devices) to detect, investigate, and mitigate malicious activities. These systems provide deep visibility into endpoint events, enabling security teams to hunt for threats proactively and respond swiftly to confirmed incidents, thereby minimizing damage and data loss. Major applications span across critical infrastructure protection, financial fraud prevention, intellectual property protection in manufacturing, and maintaining patient data security in healthcare. The inherent benefits include improved security posture, reduced mean time to detect (MTTD) and mean time to respond (MTTR), and enhanced compliance with global data protection regulations.

The market is defined by continuous technological innovation, characterized by the shift from legacy signature-based defenses to behavioral analysis and threat intelligence integration. Product descriptions often highlight features such as continuous recording of endpoint data, contextual analysis of security events, automated containment capabilities, and root cause analysis tools. Key driving factors accelerating market adoption include the proliferation of sophisticated ransomware and fileless malware, the increasing complexity of organizational IT footprints due to cloud migration, and the critical shortage of skilled cybersecurity professionals, making managed EDR (MEDR) services increasingly appealing.

Adoption is further bolstered by the necessity for centralized management of security across distributed environments, especially as organizations rely more heavily on digital transformation initiatives. The ability of EDR platforms to integrate seamlessly with other security tools, such as Security Information and Event Management (SIEM) and Security Orchestration, Automation, and Response (SOAR) platforms, ensures a holistic security ecosystem. This integration capability is paramount for large enterprises seeking unified visibility and streamlined security operations.

ED and EDR Systems Market Executive Summary

The ED and EDR Systems Market Executive Summary highlights a pronounced shift towards platform consolidation, where vendors are expanding EDR capabilities into Extended Detection and Response (XDR) frameworks that integrate network, cloud, and email security data. Business trends indicate strong venture capital investment in pure-play EDR providers and aggressive merger and acquisition activity among legacy security firms seeking to acquire next-generation detection technology. The subscription-based licensing model dominates the market, offering customers flexibility and continuous updates, thereby ensuring a predictable revenue stream for vendors. Furthermore, the market is highly competitive, pushing vendors to incorporate advanced capabilities such as deception technology and predictive analytics to gain a competitive edge.

Regional trends demonstrate North America maintaining the largest market share due to the early adoption of advanced cybersecurity technologies, stringent regulatory environments (e.g., NIST, CISA guidelines), and the presence of numerous key market players. Asia Pacific (APAC) is emerging as the fastest-growing region, fueled by rapid digitization, increasing governmental focus on data sovereignty, and mounting investments in critical sectors like banking and telecommunications, particularly in high-growth economies such as India, China, and Japan. Europe also exhibits strong growth, driven by rigorous adherence to the General Data Protection Regulation (GDPR) and the Network and Information Systems (NIS) Directive.

Segment trends confirm that the Solutions segment, particularly the AI-powered analytics component, holds the largest market share, while the Services segment, specifically Managed EDR (MEDR) services, is projected to register the highest CAGR. In terms of deployment, the cloud-based model is rapidly gaining traction over on-premise solutions, primarily driven by its scalability, lower upfront infrastructure costs, and ease of maintenance, appealing significantly to Small and Medium Enterprises (SMEs). The BFSI and IT & Telecom verticals remain the largest end-users due to the high volume of sensitive data processed and the criticality of service continuity.

AI Impact Analysis on ED and EDR Systems Market

User inquiries concerning AI's influence on the ED and EDR Systems Market primarily revolve around the effectiveness of AI in neutralizing zero-day threats, the trustworthiness of AI-driven automation in incident response, and the potential for AI models to be bypassed or poisoned by sophisticated adversaries. Users are keenly interested in how AI enhances proactive threat hunting, specifically whether AI can accurately identify subtle anomalies indicative of an attack without generating an excessive volume of false positives that fatigue security teams. There is also significant anticipation regarding AI's role in synthesizing vast amounts of threat data across disparate endpoints to provide cohesive, context-rich narratives for incident investigation, moving beyond mere alert generation to actionable intelligence. Expectations center on AI significantly lowering the reliance on human intervention for initial triage and containment.

The practical application of AI and Machine Learning (ML) algorithms is revolutionizing the core functions of EDR systems, enabling vendors to deploy sophisticated behavioral analytics that learn normal user and endpoint behavior over time. This capability allows the system to instantaneously flag deviations that suggest compromise, such as unusual process execution chains or unauthorized data access patterns, which are invisible to traditional signature-based detection engines. Furthermore, AI powers predictive capabilities by analyzing global threat intelligence feeds and correlating local endpoint telemetry, effectively forecasting potential attack vectors specific to an organization’s environment and facilitating pre-emptive security adjustments. This shift from reactive defense to predictive resilience is paramount to the market's ongoing evolution.

However, the deployment of AI also introduces complexities, specifically regarding data governance and model explainability. Security professionals require transparency into why an AI model classified an activity as malicious to ensure accurate validation and compliance. Addressing these concerns is crucial for market penetration, leading vendors to focus on explainable AI (XAI) capabilities within their EDR platforms. Ultimately, AI functions as a force multiplier, automating mundane tasks, prioritizing high-risk alerts, and accelerating the overall speed and accuracy of the security operations center (SOC), thereby mitigating the impact of the cybersecurity skill shortage.

- AI-driven behavioral analytics detects fileless malware and zero-day exploits effectively.

- Machine Learning enhances threat prioritization by reducing false positive rates significantly.

- AI supports automated remediation actions, including endpoint isolation and process termination.

- Adversarial AI techniques require EDR systems to constantly update and harden their detection models.

- Generative AI tools are being implemented to accelerate threat hunting queries and reporting generation.

DRO & Impact Forces Of ED and EDR Systems Market

The ED and EDR Systems Market is primarily driven by the escalating global volume of sophisticated cyberattacks, including targeted nation-state attacks and pervasive ransomware campaigns, compelling organizations to adopt advanced defensive layers beyond perimeter security. Key restraints revolve around the high initial capital expenditure required for implementation, the complexity of integrating EDR systems into legacy IT infrastructures, and the persistent global shortage of trained security analysts capable of maximizing the utility of these complex platforms. Opportunities are vast, primarily fueled by the accelerating convergence of EDR with Network Detection and Response (NDR) and Cloud Security Posture Management (CSPM) into unified XDR solutions, alongside significant untapped potential in the Managed Detection and Response (MDR) services segment, which provides critical operational support to resource-constrained organizations.

Impact forces currently shaping the market dynamics include the accelerating pace of technological innovation, where vendors must constantly upgrade their platforms with the latest AI and cloud-native capabilities to stay ahead of evolving threats. Regulatory pressure, stemming from global data protection laws like GDPR, CCPA, and industry-specific regulations (e.g., HIPAA, PCI DSS), enforces compliance mandates that necessitate the deployment of robust logging, monitoring, and incident response systems that EDR provides. Furthermore, the geopolitical landscape, marked by increasing cyber warfare and espionage, acts as a continuous external force accelerating government and defense sector spending on proactive endpoint defense.

The shift towards cloud adoption and the increasing reliance on remote work environments represent a foundational socio-technological shift that intrinsically boosts the need for modern EDR solutions capable of protecting endpoints regardless of physical location. These forces collectively ensure sustained high growth for the EDR market, as traditional defenses prove inadequate against modern, multi-stage attacks that exploit endpoints as the primary entry vector. Successful vendors must therefore navigate the restraint of complexity by delivering intuitive, highly automated platforms delivered primarily as a service.

Segmentation Analysis

The ED and EDR Systems Market segmentation provides a granular view of solution delivery, consumption patterns, and end-user adoption across different industry verticals and deployment types. The market is broadly segmented by Component (Solutions vs. Services), Deployment Mode (Cloud, On-Premise, Hybrid), Organization Size (SMEs vs. Large Enterprises), and End-Use Vertical (BFSI, Government, Healthcare, etc.). Analyzing these segments is crucial for understanding specific growth pockets, tailoring product offerings, and identifying regional demand drivers. The dominance of the Solutions segment reflects the foundational need for proprietary software platforms, while the rapid growth of the Services segment, particularly Managed EDR, underscores the current market demand for outsourced security expertise and continuous monitoring.

The shift in deployment preference towards cloud-based EDR is a defining trend, driven by the need for scalability, centralized management across disparate geographical locations, and resilience against endpoint attacks even when devices are disconnected from the corporate network. This transition is highly favorable for organizations undergoing digital transformation or operating with lean IT teams. Conversely, certain heavily regulated sectors, such as defense and critical infrastructure, continue to show a preference for on-premise or hybrid solutions due to strict data residency and security control requirements, creating sustained demand across all deployment models.

The segmentation by Organization Size highlights divergent needs; large enterprises seek comprehensive, customizable platforms with advanced threat hunting and integration capabilities, often managed in-house or through co-managed services. SMEs, constrained by budget and personnel, prioritize ease of deployment, low maintenance requirements, and rely heavily on fully managed EDR services (MEDR) to achieve an enterprise-grade security posture without significant internal investment. This dual-market demand necessitates vendors to offer scalable and modular solutions catering effectively to both high-end and entry-level requirements.

- By Component:

- Solutions (Platform Software, Threat Intelligence Feeds, Analytics Tools)

- Services (Managed EDR, Professional Services, Training and Consultation, Implementation Services)

- By Deployment Mode:

- Cloud-Based

- On-Premise

- Hybrid

- By Organization Size:

- Small and Medium Enterprises (SMEs)

- Large Enterprises

- By End-Use Vertical:

- Banking, Financial Services, and Insurance (BFSI)

- Information Technology (IT) and Telecommunication

- Government and Defense

- Healthcare and Pharmaceutical

- Retail and E-commerce

- Manufacturing and Industrial Automation

- Energy and Utilities

Value Chain Analysis For ED and EDR Systems Market

The value chain for the ED and EDR Systems Market begins with upstream activities dominated by hardware component suppliers and foundational software developers specializing in kernel-level visibility and operating system integration. This initial stage involves the creation of low-level agents and telemetry collection mechanisms crucial for the entire system’s operation. Key upstream providers include developers of AI/ML libraries optimized for rapid processing of vast data streams, and semiconductor manufacturers producing secure enclave technologies utilized in endpoint devices, ensuring the integrity of the collected data before it is transmitted for analysis. The quality and security of these upstream components directly influence the overall efficacy and reliability of the final EDR solution deployed to end-users.

The core value addition occurs at the midstream stage, where EDR platform developers integrate these components, build proprietary threat detection engines, develop sophisticated cloud-based analysis backends, and curate global threat intelligence networks. Distribution channels are varied, incorporating direct sales models for large, strategic accounts, particularly in the government and defense sectors, and indirect channels relying heavily on a global network of Value-Added Resellers (VARs), System Integrators (SIs), and Managed Security Service Providers (MSSPs). MSSPs play a critical role by embedding EDR into comprehensive Managed Detection and Response (MDR) offerings, handling deployment, continuous monitoring, and incident response for clients, thereby extending market reach significantly, especially to SMEs lacking internal expertise.

Downstream activities center on deployment, training, and continuous post-implementation support provided to end-users across diverse industry verticals. Direct channels facilitate deep, customized integration and service delivery, ensuring the EDR platform is perfectly aligned with the client’s unique security policy and infrastructure complexity. Indirect channels, primarily MSSPs, simplify adoption for the mass market by offering EDR as a fully managed service, bundling it with 24/7 security monitoring and expert incident handling. The effectiveness of the downstream support, particularly rapid response capabilities and transparent threat reporting, significantly influences customer retention and perceived product value within this specialized security domain.

ED and EDR Systems Market Potential Customers

Potential customers for ED and EDR Systems are primarily organizations that possess high-value intellectual property, process sensitive consumer data, or operate critical infrastructure, making them prime targets for sophisticated cyber adversaries. The largest buyers are typically within the Financial Services sector (BFSI), including banks, insurance firms, and payment processors, driven by stringent regulatory compliance (e.g., PCI DSS, financial regulations) and the necessity to protect significant monetary assets and customer privacy. These institutions require advanced threat hunting and rapid forensic capabilities that EDR platforms inherently offer, aiding in fraud detection and preventing financial system disruption.

The Government and Defense sector represents another vital customer segment, seeking systems for electronic defense (ED) and endpoint security to safeguard highly confidential state secrets, military plans, and classified communications from espionage. Procurement in this area often emphasizes on-premise or highly secure hybrid deployments, mandatory certifications, and platform customization to meet specific national security protocols. Similarly, the Healthcare sector, facing a dramatic increase in ransomware attacks targeting patient records (e.g., HIPAA-regulated data), is a rapidly expanding market for EDR solutions, prioritizing systems capable of maintaining continuous operational uptime and ensuring data integrity across complex hospital networks.

Furthermore, large IT and Telecommunication providers, which serve as foundational infrastructure for numerous businesses, require robust EDR to protect their expansive networks and intellectual property. The Manufacturing industry, particularly those involved in high-tech machinery and industrial control systems (ICS/OT environments), is increasingly adopting EDR to secure endpoints against operational disruption, realizing that attacks on industrial endpoints can translate directly into physical production halts and significant financial losses. End-users across all these verticals share a common purchasing driver: the necessity to elevate security posture from preventative measures to comprehensive detection and rapid response capabilities, transitioning their investment from reactive firefighting to proactive threat management.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.8 Billion |

| Market Forecast in 2033 | USD 17.5 Billion |

| Growth Rate | 19.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | CrowdStrike Holdings Inc., Microsoft Corporation, SentinelOne Inc., VMware (Carbon Black), Palo Alto Networks Inc. (Cortex XDR), Cisco Systems Inc. (Secure Endpoint), Trend Micro Incorporated, Sophos Group plc, Fortinet Inc., Broadcom Inc. (Symantec), Trellix (McAfee/FireEye), Cybereason Inc., BlackBerry Limited (Cylance), ESET, Kaspersky Lab |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

ED and EDR Systems Market Key Technology Landscape

The foundational technology landscape of the ED and EDR Systems market is defined by several core innovations, foremost among them being continuous data recorder agents deployed across all managed endpoints. These agents utilize kernel-level hooks to capture a comprehensive stream of system events, including file execution, process creation, network connections, and registry modifications. This telemetry is then securely streamed to a central cloud-based repository or on-premise server for real-time analysis. Critical to this process is the efficient handling of massive data volumes, which necessitates the use of high-performance, scalable cloud infrastructure and efficient compression algorithms, making cloud computing platforms like AWS, Azure, and Google Cloud integral partners to EDR vendors. The ability to collect and store rich data is paramount for historical analysis and sophisticated threat hunting operations.

Advancements in Artificial Intelligence (AI) and Machine Learning (ML) constitute the second crucial pillar of the technology landscape. EDR systems rely heavily on ML models trained on billions of benign and malicious data points to establish a baseline of normal behavior and detect statistical outliers or deviations that signify compromise, such as living-off-the-land techniques or lateral movement. Behavioral analysis engines, often powered by neural networks, enable the detection of sophisticated fileless malware that bypasses traditional signature-based detection methods. Furthermore, integration with sandboxing and virtualization technologies allows EDR platforms to safely detonate suspicious files and analyze their behavior in an isolated environment before determining a threat score and triggering remediation actions.

The current technological trajectory is increasingly moving towards Extended Detection and Response (XDR) architectures, representing a convergence effort where EDR data is synthesized with telemetry from email, network, cloud, and identity systems. XDR leverages standardized data formats and deep learning techniques to provide a unified, contextualized view of an attack chain that spans multiple security layers, dramatically improving the ability to trace and contain complex attacks. Additionally, integrated Security Orchestration, Automation, and Response (SOAR) capabilities are becoming standard, allowing EDR platforms to automatically execute pre-defined workflows for containment, forensic data collection, and remediation, reducing manual effort and ensuring rapid response at machine speed.

Regional Highlights

The ED and EDR Systems market exhibits distinct adoption patterns and growth drivers across major geographic regions, influenced by regulatory climate, technological maturity, and the intensity of cyber threats specific to each area.

- North America (U.S. and Canada): This region maintains the largest market share, characterized by high cybersecurity spending, the early adoption of cloud-native EDR solutions, and a culture of regulatory adherence (e.g., HIPAA, CMMC, SEC requirements). The presence of numerous leading security vendors and a high incidence of sophisticated, high-profile cyberattacks targeting large corporations and federal agencies drive continuous investment in cutting-edge detection and response capabilities. The U.S. government and financial services sectors are primary consumers, demanding advanced platforms capable of integrating into complex IT environments and meeting strict reporting mandates.

- Europe (Germany, U.K., France, Italy): Europe is a significant market driven primarily by the strict enforcement of the General Data Protection Regulation (GDPR) and subsequent national security mandates. Organizations across the continent are mandated to demonstrate proactive measures for detecting and reporting data breaches, directly boosting the demand for EDR platforms that provide immutable logs and detailed forensic capabilities. The U.K., Germany, and France represent mature markets, while Southern and Eastern European countries show accelerated growth as they rapidly modernize their IT security infrastructure to align with EU directives.

- Asia Pacific (APAC) (China, Japan, India, South Korea): APAC is poised to be the fastest-growing market globally, fueled by rapid industrialization, massive digital transformation initiatives, and increasing geopolitical tensions that translate into elevated cyber espionage risks. Countries like China and India are seeing substantial government investments in cybersecurity for critical infrastructure protection, while markets like Japan and South Korea, which host major technology and manufacturing hubs, are adopting EDR to safeguard intellectual property. The high reliance on mobile and cloud technologies across the region necessitates scalable, cloud-based EDR deployments.

- Latin America (LATAM) (Brazil, Mexico): The LATAM market is characterized by medium adoption rates, with growth driven by increasing financial sector digitalization and growing awareness of global cyber threats. Economic volatility often restricts high upfront investments, leading to a strong preference for subscription-based Managed EDR (MEDR) services that offer predictable operational expenses and access to high-level expertise without large capital outlay. Brazil and Mexico are the largest contributors to regional market revenue due to their large economies and critical infrastructure projects.

- Middle East and Africa (MEA) (GCC Countries, South Africa): Growth in MEA is highly concentrated in the Gulf Cooperation Council (GCC) countries (UAE, Saudi Arabia, Qatar), propelled by ambitious national digitization visions (e.g., Saudi Vision 2030) and massive government spending on defense and energy sector security. These nations prioritize security platforms that adhere to sovereign cloud mandates. South Africa leads the African market, focusing on compliance requirements related to financial services and communications, driving slow but steady adoption of EDR solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the ED and EDR Systems Market, highlighting their strategic initiatives, product offerings, recent mergers and acquisitions, and geographic presence to provide a comprehensive competitive analysis.- CrowdStrike Holdings Inc.

- Microsoft Corporation

- SentinelOne Inc.

- VMware (Carbon Black)

- Palo Alto Networks Inc. (Cortex XDR)

- Cisco Systems Inc. (Secure Endpoint)

- Trend Micro Incorporated

- Sophos Group plc

- Fortinet Inc.

- Broadcom Inc. (Symantec)

- Trellix (McAfee/FireEye)

- Cybereason Inc.

- BlackBerry Limited (Cylance)

- ESET

- Kaspersky Lab

- Qualys, Inc.

- FireEye Mandiant (Google Cloud)

- Rapid7, Inc.

- Check Point Software Technologies Ltd.

- WatchGuard Technologies, Inc.

Frequently Asked Questions

Analyze common user questions about the ED and EDR Systems market and generate a concise list of summarized FAQs reflecting key topics and concerns.What distinguishes EDR systems from traditional endpoint security or antivirus software?

EDR systems fundamentally differ by offering continuous, comprehensive endpoint monitoring, rather than relying solely on signature-based prevention. EDR records all endpoint activities (process execution, network activity), uses behavioral analytics and AI for detection, and provides tools for rapid investigation, threat hunting, and automated remediation post-infection, moving beyond simple prevention to holistic response.

Is cloud-based EDR deployment more secure than on-premise solutions?

Cloud-based EDR often offers superior scalability, centralized management, and immediate access to global, real-time threat intelligence updates, which enhances security efficacy against emerging threats. While on-premise offers strict data control, cloud solutions are generally preferred for distributed environments and often provide higher resilience and availability through vendor-managed security infrastructures.

How is the convergence into XDR affecting the standalone EDR market?

The convergence into Extended Detection and Response (XDR) is causing the standalone EDR market to evolve into the foundational component of a broader, unified security platform. XDR integrates EDR data with network, cloud, and email security to provide contextualized alerts and coordinated response across the entire IT infrastructure, making future investment decisions lean towards XDR-capable vendors.

What are the primary hurdles to widespread EDR adoption in Small and Medium Enterprises (SMEs)?

The primary hurdles for SMEs include the perceived high cost of implementation and maintenance, coupled with a lack of dedicated, skilled in-house cybersecurity staff required to effectively manage complex EDR consoles and conduct specialized threat hunting. This challenge is increasingly mitigated by the availability and popularity of outsourced Managed EDR (MEDR) services.

Which industry vertical is expected to drive the highest growth for EDR services?

The Healthcare and Pharmaceutical vertical is projected to drive substantial growth, mainly due to the critical nature of patient data, the increasing frequency of high-impact ransomware attacks targeting hospitals, and intensifying regulatory scrutiny (e.g., HIPAA) demanding advanced endpoint visibility and incident response capabilities to maintain service continuity and data privacy.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager