Eddy Current Sensor Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443362 | Date : Feb, 2026 | Pages : 241 | Region : Global | Publisher : MRU

Eddy Current Sensor Market Size

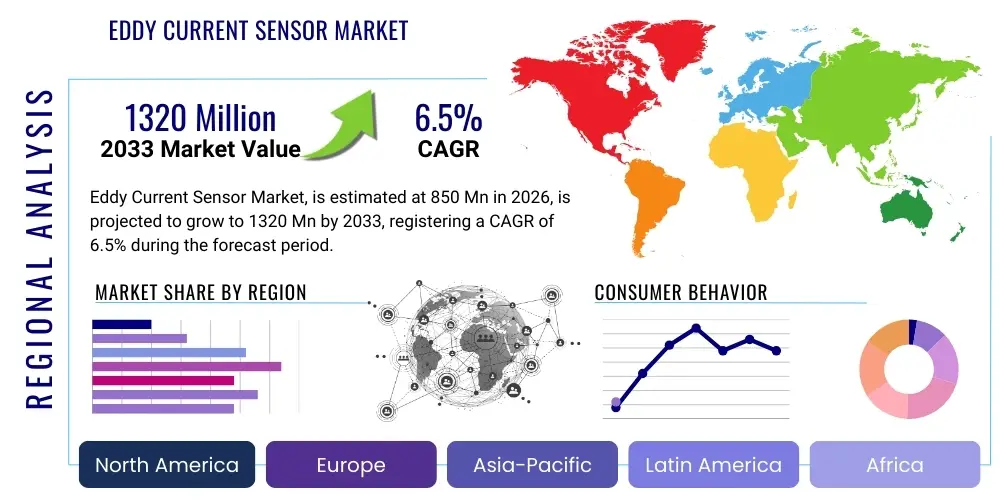

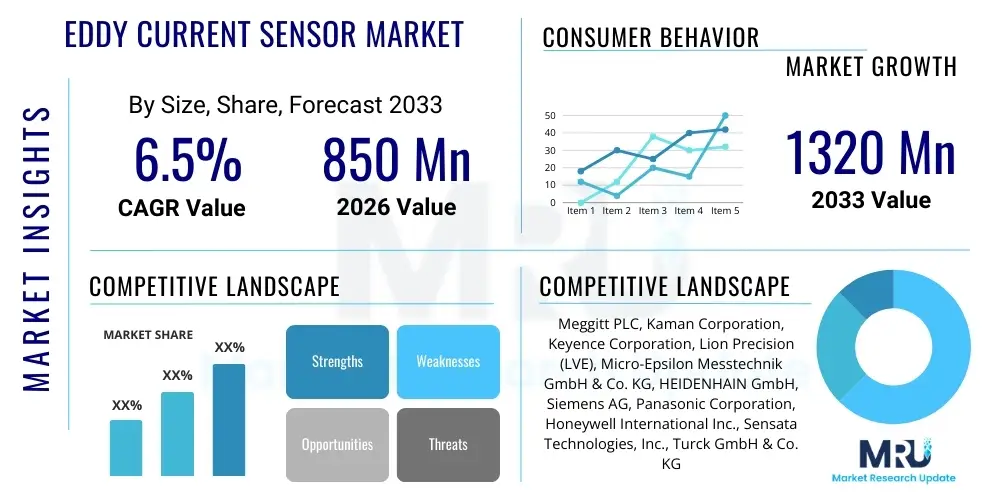

The Eddy Current Sensor Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 850 Million in 2026 and is projected to reach USD 1320 Million by the end of the forecast period in 2033.

Eddy Current Sensor Market introduction

The Eddy Current Sensor Market encompasses non-contact measuring devices that utilize electromagnetic induction principles to measure displacement, position, thickness, and vibration in conductive targets. These sensors operate by generating an alternating magnetic field that induces eddy currents on the surface of the target material; changes in the target's distance or characteristics alter the impedance of the sensor coil, providing highly precise and repeatable measurements. Eddy current technology is favored in industrial environments characterized by harsh conditions, including extreme temperatures, high pressure, and the presence of contaminants such as oil, dirt, or radiation, where traditional contact sensors fail or degrade rapidly. The robustness and reliability of these sensors make them indispensable in critical monitoring applications across various capital-intensive industries.

Major applications of Eddy Current Sensors span across aerospace, automotive manufacturing, turbomachinery, and heavy machinery condition monitoring. In aerospace, they are critical for monitoring blade tip clearance and rotor dynamics in jet engines, ensuring operational efficiency and safety. Within the automotive sector, they are increasingly utilized for high-precision gauging in automated production lines, quality control, and testing of structural components, including battery positioning in Electric Vehicles (EVs). The core benefit derived from utilizing these sensors is their capability to deliver sub-micron resolution measurements without physical contact, thereby eliminating wear and tear on both the sensor and the monitored target, ensuring longevity and accuracy.

The primary driving factors propelling the growth of the Eddy Current Sensor Market include the accelerating adoption of Industry 4.0 standards, which necessitate high-fidelity, real-time data collection for predictive maintenance and automated quality control. Furthermore, the burgeoning demand for reliable condition monitoring systems in high-speed rotating machinery, particularly within power generation and oil and gas sectors, underscores the need for these resilient and accurate displacement and vibration measurement tools. Miniaturization of sensor components and integration with modern digital signal processing (DSP) capabilities are further enhancing their applicability and adoption rates globally, positioning them as fundamental components in advanced industrial automation architectures.

Eddy Current Sensor Market Executive Summary

The Eddy Current Sensor Market is experiencing robust expansion driven by global industrial digitalization and increasing regulatory focus on operational uptime and asset integrity. Key business trends indicate a significant technological shift toward digital sensors offering embedded signal processing and network connectivity, moving away from purely analog systems. This integration of smart features facilitates seamless interfacing with industrial internet of things (IIoT) platforms, enabling sophisticated data analysis and remote diagnostics, thus enhancing the sensor's utility beyond simple measurement acquisition. Manufacturers are also focusing on developing specialized high-temperature and high-frequency sensors to meet the exacting requirements of new energy production technologies and advanced material testing, securing a competitive edge in high-value segments.

Regionally, the Asia Pacific (APAC) market dominates in terms of consumption and growth potential, primarily fueled by the rapid expansion of manufacturing capabilities, particularly in China, Japan, and South Korea, across automotive, semiconductor, and industrial machinery sectors. North America and Europe maintain significant market share due to substantial investment in aerospace and defense, alongside rigorous standards for precision manufacturing and stringent environmental regulations promoting optimized machine performance. The European market, in particular, is witnessing strong adoption in complex factory automation systems and renewable energy infrastructure maintenance, while North America continues to lead in research, development, and integration of cutting-edge sensing technologies into mission-critical systems.

Segment trends highlight the displacement/position sensor category as the dominant product type, crucial for applications requiring exact dimensional control, such as spindle runout measurements and automated assembly verification. In terms of end-user industries, the Automotive sector is demonstrating the highest growth velocity, largely attributable to the massive investment in electric vehicle production, where eddy current sensors are vital for precision gap measurement in battery packs, motor alignment, and automated body panel assembly. Concurrently, the increasing complexity and capital intensity of industrial machinery and power generation assets are cementing the importance of vibration monitoring applications, driving the demand for specialized multi-channel eddy current systems.

AI Impact Analysis on Eddy Current Sensor Market

Common user questions regarding AI's impact on the Eddy Current Sensor Market center on how artificial intelligence can transform raw sensor data into actionable insights, specifically addressing predictive maintenance accuracy, sensor calibration complexity, and data fusion capabilities. Users are keen to understand if AI integration will reduce false positives in vibration monitoring, automate the time-consuming process of sensor linearization and environmental compensation, and enable the seamless blending of eddy current data with inputs from temperature or pressure sensors for more holistic machine diagnostics. The key themes revolve around enhancing the value proposition of the sensor data—moving beyond simple physical measurement to sophisticated condition assessment and autonomous decision-making in industrial environments, thereby maximizing asset lifespan and minimizing unplanned downtime.

The integration of AI algorithms profoundly enhances the utility of Eddy Current Sensors by transitioning their role from mere data providers to active components in a predictive intelligence ecosystem. AI models, particularly deep learning networks, are now being employed to analyze the high-frequency analog signals generated by these sensors, distinguishing subtle anomalies that precede critical component failure. This advanced pattern recognition capability drastically improves the accuracy and timeliness of predictive maintenance warnings, especially in complex systems like gas turbines or high-speed CNC machines where environmental noise and operational variations can mask early signs of fault. Furthermore, AI enables self-calibration and drift compensation, mitigating the long-standing challenge of maintaining sensor accuracy over extended periods under fluctuating operational conditions, significantly reducing maintenance overhead.

Beyond diagnostics, AI is instrumental in optimizing sensor deployment and operational parameters. By learning the correlation between specific machine states and sensor output characteristics, AI systems can suggest optimal sensor placement, sampling rates, and filtering techniques tailored to specific asset types or operating modes. This optimization process maximizes the data quality derived from the Eddy Current Sensors while minimizing the computational load required for analysis. The ability of AI to interpret vast historical datasets also facilitates the development of digital twins, where high-precision eddy current measurements provide the vital real-time input necessary to accurately model and simulate the wear and tear dynamics of physical assets, creating a robust feedback loop for continuous operational improvement and risk management.

- Enhanced Predictive Maintenance: AI models analyze vibration and displacement trends for highly accurate fault prediction in turbomachinery.

- Automated Sensor Calibration: Machine learning algorithms dynamically compensate for temperature drift and target material variations.

- Optimized Data Fusion: AI effectively integrates eddy current measurements with other sensor data (e.g., thermal, acoustic) for holistic machine health assessment.

- Reduced False Positives: Advanced algorithms filter out operational noise and environmental interference, increasing the reliability of monitoring alerts.

- Self-Diagnostic Capabilities: Sensors equipped with edge AI can perform initial data processing and classification locally, minimizing bandwidth requirements.

- Improved Quality Control: AI accelerates non-destructive testing (NDT) processes by rapidly comparing sensor output against complex, learned manufacturing tolerances.

DRO & Impact Forces Of Eddy Current Sensor Market

The dynamics of the Eddy Current Sensor Market are fundamentally shaped by a set of interacting Drivers, Restraints, and Opportunities (DRO), collectively constituting the market's Impact Forces. Key drivers include the global proliferation of automation across manufacturing and processing industries, demanding precise and reliable measurement technologies to uphold stringent quality standards and accelerate production cycles. The increasing adoption of Industry 4.0 principles, which mandate interconnected, data-driven operational environments, strongly favors eddy current technology due to its compatibility with digital signal processing and IIoT integration. Furthermore, the critical need for asset protection and minimizing unplanned downtime in capital-intensive sectors such like aerospace, power generation, and oil & gas significantly drives the demand for high-performance vibration and position monitoring systems, where eddy current sensors are the established standard. These technological and operational imperatives are collectively propelling market growth across industrialized regions.

Conversely, the market faces significant restraints, primarily stemming from the relatively high initial cost associated with high-precision eddy current systems compared to alternative contact sensors, which can deter adoption, particularly in small and medium-sized enterprises (SMEs). Moreover, the complexity involved in the calibration and linearization of eddy current sensors, especially when dealing with varying target materials, geometries, or extreme temperature ranges, requires specialized technical expertise, posing a barrier to widespread implementation. Market penetration is also challenged by the rise of highly accurate optical and laser displacement sensors in certain clean-room applications, offering competing non-contact measurement solutions. These restraining forces necessitate continuous innovation in sensor design focused on ease of use and reduced total cost of ownership to maintain market competitiveness.

Significant opportunities exist in emerging high-growth application areas. The transition to electric vehicles (EVs) creates a substantial new market for eddy current sensors in battery cell alignment, motor gap sensing, and quality control during assembly, requiring unprecedented levels of non-contact precision. Furthermore, the expansion of renewable energy infrastructure, particularly wind turbines and large-scale solar tracking systems, relies heavily on continuous condition monitoring for gearboxes and structural alignment, providing lucrative avenues for specialized robust sensors. Integrating these sensors with advanced digital platforms and cloud services for enhanced diagnostics and remote monitoring offers another strategic opportunity, moving the market toward a Sensors-as-a-Service model. The synergy between high-precision eddy current technology and ongoing industrial electrification and digitization efforts guarantees sustained growth for key players capitalizing on these transformative trends.

Segmentation Analysis

The Eddy Current Sensor Market is systematically segmented based on various factors, including the type of output signal, the primary application, the specific end-user industry, and geographical distribution. This detailed segmentation provides granular insights into market dynamics, enabling manufacturers to tailor product development and marketing strategies to specific high-growth niches. Key segments differentiate sensors based on their functionality, such as displacement, proximity, or vibration monitoring, reflecting distinct measurement needs across industrial applications. Understanding these segments is vital for analyzing competitive landscapes and identifying where technological advancements are driving the most significant commercial value, especially in areas demanding ultra-high precision or environmental resilience.

The segmentation by end-user industry is critical, revealing the differing demands of sectors like automotive (high volume, precision gauging), aerospace (mission-critical, high-temperature operation), and industrial machinery (long lifespan, continuous monitoring). While the automotive and industrial sectors currently account for the largest market shares due to high volume production and expansive factory automation needs, the aerospace and power generation segments represent higher value per unit due to the stringent performance requirements and specialized certifications necessary for operational deployment. Furthermore, the evolving landscape of materials science necessitates segmentation by material compatibility, as eddy current sensing precision is inherently linked to the conductivity and permeability of the target material being measured, driving the need for specialized calibration routines and sensor designs for targets like aluminum, stainless steel, or composites.

- By Type:

- Proximity Sensors (Switching)

- Displacement Sensors (Analog Output)

- Vibration Monitoring Sensors

- By Application:

- Position Sensing

- Thickness and Gap Measurement

- Vibration Monitoring and Analysis

- Material Sorting and Identification

- Runout and Eccentricity Measurement

- By End-User Industry:

- Automotive (EV Manufacturing, Quality Control)

- Aerospace & Defense (Turbomachinery, Test Benches)

- Industrial Machinery and Factory Automation

- Power Generation (Turbines, Hydro Power)

- Oil and Gas (Compressor and Pump Monitoring)

- Electronics and Semiconductor Manufacturing

- By Operating Principle:

- Absolute Type

- Differential Type

- By Range:

- Short-Range (Micrometers)

- Mid-Range (Millimeters)

Value Chain Analysis For Eddy Current Sensor Market

The value chain for the Eddy Current Sensor Market begins with upstream activities focused on the sourcing and processing of critical raw materials. This includes high-purity copper or specialized alloys for coil winding, magnetic materials (ferrites or soft iron cores) that define the sensor's operating characteristics, and high-performance housing materials, often stainless steel or PEEK, required to withstand harsh industrial environments. Key challenges in the upstream segment involve managing volatility in commodity prices and ensuring the consistent quality of materials critical for maintaining the high precision and thermal stability intrinsic to eddy current technology. Efficient sourcing and vertical integration capabilities in the manufacturing of high-frequency components provide a significant competitive advantage to major market players, optimizing cost structures and supply reliability.

The middle segment of the value chain involves the complex manufacturing processes, including precision coil winding, integrated circuit (IC) fabrication for signal conditioning electronics, and final sensor assembly and meticulous calibration. A core differentiator in this stage is the integration of advanced digital signal processing (DSP) units, converting raw analog signals into stable, linearized digital data suitable for industrial networks. Following production, the distribution channel plays a pivotal role. Direct distribution is common for highly specialized, high-value systems, where original equipment manufacturers (OEMs) or system integrators purchase directly from the sensor supplier for installation in large-scale machinery like turbines or CNC machines. This allows for direct technical support and customized solutions.

Indirect distribution, typically involving technical distributors, value-added resellers (VARs), and maintenance, repair, and operations (MRO) channels, services the broader industrial automation and aftermarket maintenance segments. These indirect channels provide geographical reach and inventory access for standard, off-the-shelf proximity and displacement sensors. Downstream activities involve the final installation, integration, and continuous servicing of the sensors within the end-user environment. System integrators, often working closely with end-users in sectors like power generation, are crucial for coupling eddy current sensor outputs with control systems (PLCs, DCSs) and implementing sophisticated predictive maintenance software platforms, completing the full value cycle from raw measurement to actionable asset management intelligence.

Eddy Current Sensor Market Potential Customers

Potential customers for Eddy Current Sensors are primarily enterprises operating in environments where non-contact, high-precision measurement, and resistance to harsh operating conditions are paramount requirements. A key segment consists of original equipment manufacturers (OEMs) specializing in rotating machinery, such as turbine manufacturers (gas, steam, and wind), large-scale compressor manufacturers for the oil and gas sector, and high-speed machine tool builders. These customers integrate eddy current sensors directly into their products to ensure stringent quality control, monitor machine health, and provide crucial operational feedback to operators, making the sensor an integral part of the final manufactured asset.

Another major category of potential buyers includes end-user organizations that perform high-stakes predictive maintenance and asset integrity management (AIM). This encompasses power plant operators, petrochemical refineries, and aerospace maintenance, repair, and overhaul (MRO) facilities. For these customers, the sensors are purchased either directly or through system integrators to retrofit existing machinery for condition monitoring, allowing them to detect bearing failures, shaft eccentricity, and structural misalignment long before catastrophic failure occurs, thereby preventing multi-million dollar losses associated with downtime. The precision of eddy current sensors in detecting sub-micron changes in position provides an indispensable tool for these critical preventative maintenance strategies.

Finally, the growing sectors of electric vehicle manufacturing and semiconductor production represent rapidly expanding customer bases. EV manufacturers require highly precise gap measurements for automated battery module assembly and motor component positioning to ensure optimal performance and safety. Semiconductor fabrication facilities utilize eddy current technology for highly accurate wafer positioning and micro-component alignment in cleanroom environments, where other sensing technologies may be affected by contaminants or magnetic interference. The consistent demand for enhanced automation and miniaturization in these fields guarantees sustained purchasing power and technological pull for advanced eddy current solutions, solidifying their status as highly valued buyers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 850 Million |

| Market Forecast in 2033 | USD 1320 Million |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Meggitt PLC, Kaman Corporation, Keyence Corporation, Lion Precision (LVE), Micro-Epsilon Messtechnik GmbH & Co. KG, HEIDENHAIN GmbH, Siemens AG, Panasonic Corporation, Honeywell International Inc., Sensata Technologies, Inc., Turck GmbH & Co. KG, IFM Electronic GmbH, PCB Piezotronics, Inc., Rockwell Automation, Inc., Pruftechnik Dieter Busch AG, Parker Hannifin Corporation, AMETEK, Inc., Metrix Instrument Co. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Eddy Current Sensor Market Key Technology Landscape

The technological landscape of the Eddy Current Sensor Market is rapidly evolving, moving beyond traditional analog systems towards highly sophisticated digital architectures that enhance precision, stability, and integration capabilities. A primary focus is the development of digital eddy current sensors (DECS) that incorporate advanced microcontrollers and embedded signal conditioning directly into the sensor head or associated electronics. This transition to digital output minimizes signal degradation over long cable runs and facilitates seamless integration into industrial fieldbus networks, such as EtherCAT and Profinet, which are essential components of modern factory automation systems. Furthermore, manufacturers are investing heavily in reducing the size and improving the thermal stability of these digital front-ends, allowing for robust operation in extremely restricted spaces and high-temperature environments, particularly crucial for downhole oil and gas tools and compact aerospace systems.

Another significant technological trend is the advancement in high-frequency operation and multi-channel sensing arrays. High-frequency eddy current sensors are necessary for monitoring extremely high-speed phenomena, such as rotor dynamics in advanced turbomachinery running at tens of thousands of revolutions per minute, requiring sampling rates far exceeding those of conventional sensors. Coupled with this, multi-channel systems, often utilizing differential coil configurations, are becoming standard for simultaneously measuring multiple degrees of freedom (e.g., X-Y displacement and Z-axis runout). These integrated systems often employ sophisticated algorithms for cross-channel compensation and linearization, drastically improving overall measurement fidelity and simplifying the installation and calibration process for end-users, especially in complex machine setups requiring ISO standard compliance for vibration monitoring.

Furthermore, sensor networking capabilities and the implementation of embedded intelligence (Edge Computing) are defining the next generation of eddy current technology. By equipping sensors with internal memory and processing power, they can execute condition monitoring algorithms locally, filtering non-essential data and transmitting only actionable diagnostic information to the central control system. This decentralization reduces reliance on centralized processing units and minimizes network traffic, enhancing real-time responsiveness. Research into new coil fabrication techniques, including printed and MEMS-based coils, promises further miniaturization and cost reduction, opening up new high-volume applications in consumer electronics and specialized medical devices where non-contact measurement of micro-displacement or film thickness is required. These innovations collectively solidify the position of eddy current technology as a high-performance cornerstone of industrial metrology.

Regional Highlights

The Eddy Current Sensor Market exhibits diverse adoption patterns across key geographical regions, largely reflective of industrial maturity, regulatory frameworks, and sector-specific investments.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing and largest market, driven by massive investments in high-volume automotive manufacturing (especially EVs), rapid expansion of the semiconductor and electronics industries, and robust infrastructure development in countries like China, India, and South Korea. The region's focus on modernizing factory automation and integrating Industry 4.0 systems creates relentless demand for cost-effective, high-precision sensors for quality control and predictive maintenance.

- North America: This region maintains a strong market share, characterized by high adoption rates in technologically advanced sectors such as Aerospace & Defense, advanced Oil & Gas exploration, and high-end industrial machinery. The presence of leading sensor manufacturers and significant governmental and private sector funding for research and development ensures that North America remains at the forefront of technological innovation and high-value system integration, particularly for mission-critical applications.

- Europe: Europe is a mature market distinguished by stringent regulatory standards concerning machine safety and environmental efficiency, fueling demand for precise condition monitoring in power generation (including offshore wind), heavy machinery, and high-precision manufacturing (Germany, Italy). The strong presence of premium automotive manufacturers and a pervasive culture of adopting high-quality, reliable sensing technology sustain consistent, steady growth across the continent.

- Latin America (LATAM): Market growth in LATAM is primarily focused on the expansion and modernization of the mining, petrochemical, and basic industrial infrastructure sectors. Adoption is concentrated in asset integrity management for large fixed assets, driven by the need to optimize operational lifespan and reduce dependence on expensive foreign maintenance services.

- Middle East and Africa (MEA): Growth is tied heavily to the Oil & Gas sector, where eddy current sensors are essential for monitoring highly critical assets like compressors, pipelines, and liquefied natural gas (LNG) terminals. Significant state-backed projects focused on diversifying industrial bases and improving energy infrastructure are also driving increased sensor demand in power generation and emerging manufacturing centers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Eddy Current Sensor Market.- Meggitt PLC

- Kaman Corporation

- Keyence Corporation

- Lion Precision (LVE)

- Micro-Epsilon Messtechnik GmbH & Co. KG

- HEIDENHAIN GmbH

- Siemens AG

- Panasonic Corporation

- Honeywell International Inc.

- Sensata Technologies, Inc.

- Turck GmbH & Co. KG

- IFM Electronic GmbH

- PCB Piezotronics, Inc.

- Rockwell Automation, Inc.

- Pruftechnik Dieter Busch AG

- Parker Hannifin Corporation

- AMETEK, Inc.

- Metrix Instrument Co.

Frequently Asked Questions

Analyze common user questions about the Eddy Current Sensor market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the fundamental working principle of an Eddy Current Sensor and its key advantage?

Eddy Current Sensors operate on the principle of electromagnetic induction. An alternating current generates a magnetic field in the sensor coil, inducing circulating eddy currents on a conductive target surface. The sensor measures the change in coil impedance caused by the target's proximity. The key advantage is highly accurate, non-contact measurement in harsh environments (dirt, oil, high pressure).

In which specific industries are Eddy Current Sensors most crucial for predictive maintenance?

They are most crucial in sectors utilizing high-speed rotating machinery, including power generation (gas and steam turbines), aerospace (jet engines, test stands), and Oil & Gas (compressors and pumps). They provide critical real-time data on shaft displacement, vibration, and bearing health, preventing catastrophic equipment failure.

How is the Electric Vehicle (EV) industry driving the growth of the Eddy Current Sensor Market?

The EV industry requires extreme precision during manufacturing, particularly for battery cell and module assembly, motor air gap measurements, and chassis alignment. Eddy current sensors provide the necessary non-contact, high-resolution gauging to ensure safety, efficiency, and quality control in high-volume EV production lines.

What is the primary technical limitation or restraint associated with Eddy Current Sensor technology?

The primary technical restraint is their dependence on the target material's conductivity and permeability, meaning they can only measure conductive targets. Furthermore, achieving optimal accuracy often requires complex, specialized calibration and linearization processes for specific target materials and temperature conditions.

What is the difference between a Proximity Sensor and a Displacement Sensor in this market?

An eddy current proximity sensor typically functions as a digital switch (on/off), detecting the presence of a target within a set distance. A displacement sensor provides a continuous, analog or digital output signal proportional to the exact distance or gap between the sensor and the target, offering high-resolution measurement (gauging).

The strategic importance of continuous non-contact monitoring in high-stakes industrial applications is driving sustained investment in high-performance eddy current sensor technology. The market sees a clear bifurcation: volume-driven demand in the automotive and general automation sectors requires cost-effective, standardized units, while high-value applications in aerospace and power generation necessitate customized, temperature-compensated, and highly certified specialized sensors. Manufacturers are responding by focusing R&D on both miniaturization for integration into complex assemblies and robust environmental shielding to extend operational longevity in extreme conditions. The competitive landscape is characterized by a mix of specialized precision metrology companies and large industrial automation conglomerates, all vying for market share through innovation in digital signal processing and IIoT readiness. The shift towards predictive asset management ensures that the data derived from these sensors is not merely recorded but actively utilized for optimizing machine health and operational cycles, thereby maximizing ROI for end-users across the globe.

Regional dynamics continue to shape deployment strategies; while Europe and North America prioritize regulatory compliance and performance in legacy infrastructure, the APAC region is adopting the latest digital sensor architectures in greenfield manufacturing facilities, fostering a faster rate of technology turnover. Market expansion is also noticeably tied to global energy transitions. As power utilities decommission older assets and integrate more intermittent renewable sources, the need for precision monitoring of remaining rotating assets (gas turbines, hydro generators) and newer wind turbine gearboxes becomes paramount. Eddy current systems provide the necessary reliability to manage these complex, often remote, assets effectively. Furthermore, the integration with non-metallic sensing technologies, although not direct competition, often involves data fusion platforms that accept eddy current inputs, creating collaborative technology ecosystems where high-precision displacement data is combined with other parameters for comprehensive situational awareness. This ecosystem approach solidifies the long-term relevance and essential nature of eddy current technology within the broader context of industrial digitalization.

Technological refinement is heavily focused on addressing the traditional challenges of eddy current sensors, notably cross-talk in multi-sensor setups and thermal drift. New sensor designs incorporate sophisticated shielding and differential coil arrangements to mitigate magnetic interference when multiple sensors are mounted closely, critical for monitoring multi-stage turbomachinery. Furthermore, embedded temperature compensation algorithms utilizing AI and machine learning are dramatically improving measurement stability across wide temperature swings, reducing the need for manual recalibration. The move toward standardizing digital communication protocols (e.g., Modbus TCP, PROFINET) simplifies integration into complex factory networks, lowering the total cost of ownership and accelerating deployment timelines. These advancements reflect a market mature enough to optimize core technology while simultaneously adapting to the demands of modern data infrastructure, ensuring that eddy current sensors remain the preferred choice for reliable, non-contact position and vibration measurement across the global industrial base.

The value proposition of modern eddy current sensing solutions increasingly rests on software capabilities rather than purely hardware specifications. Leading vendors are offering comprehensive software suites that translate raw displacement and vibration data into predictive health scores, remaining useful life estimates, and automated diagnostic reports. These software platforms often include features for remote configuration, firmware updates, and cloud-based data storage, transforming the sensor from a standalone measuring device into a connected asset health node. The aerospace and defense sectors, due to their zero-tolerance policy for failures, are driving demand for highly certified and ruggedized versions of these smart sensors, pushing performance envelopes regarding radiation hardness and operational temperature limits. This segment’s strict procurement processes mandate long-term supply relationships and technological partnership, reinforcing the market position of established, certified suppliers.

Market penetration in the burgeoning semiconductor manufacturing sector is particularly dependent on ultra-high-resolution sensors capable of measuring nanometer-scale displacements for lithography and wafer handling equipment. The requirement for non-magnetic, contamination-free components in cleanroom environments aligns well with the non-contact nature of eddy current technology, although specialized materials are often required for sensor housing to meet cleanliness standards. Conversely, in the heavy industrial and mining sectors, the emphasis shifts towards extreme robustness and resistance to physical damage, dust, and moisture. Here, the sensors must be oversized and encased in heavy-duty materials, often leveraging longer measurement ranges, highlighting the vast application spectrum and customization required across the diverse customer base. This continuous need for highly tailored solutions, driven by specific end-user environmental and precision demands, ensures high margins in specialized product segments despite competitive pricing pressures in the generalized automation space.

The competition intensity is moderated by the high barrier to entry related to precision calibration and intellectual property surrounding advanced coil design and linearization algorithms. Smaller entrants often specialize in particular niches, such as micro-displacement or extreme temperature applications, while larger players leverage global distribution networks and established relationships with major OEMs (e.g., turbine manufacturers) to dominate the high-volume industrial markets. Furthermore, the growing trend of sensor fusion—integrating eddy current data with inputs from accelerometers, proximity switches, and temperature probes—is creating opportunities for system integrators who can package and deliver holistic machine health monitoring solutions, indirectly boosting the demand for high-quality eddy current sensor inputs. This strategic integration is crucial for maximizing the effectiveness of centralized control systems and enabling automated diagnostic decision-making processes across modern industrial facilities. The market is thus defined by innovation in data interpretation as much as in physical measurement technology.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager