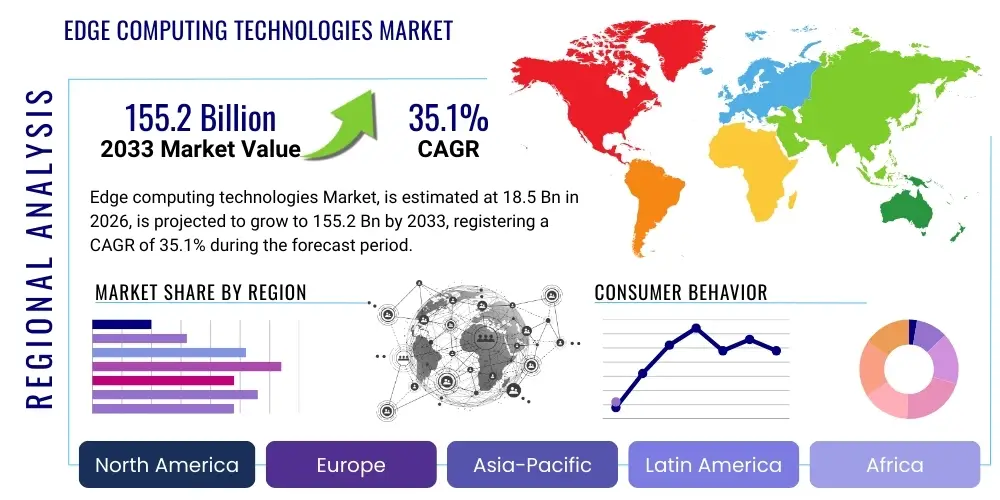

Edge computing technologies Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443292 | Date : Feb, 2026 | Pages : 245 | Region : Global | Publisher : MRU

Edge computing technologies Market Size

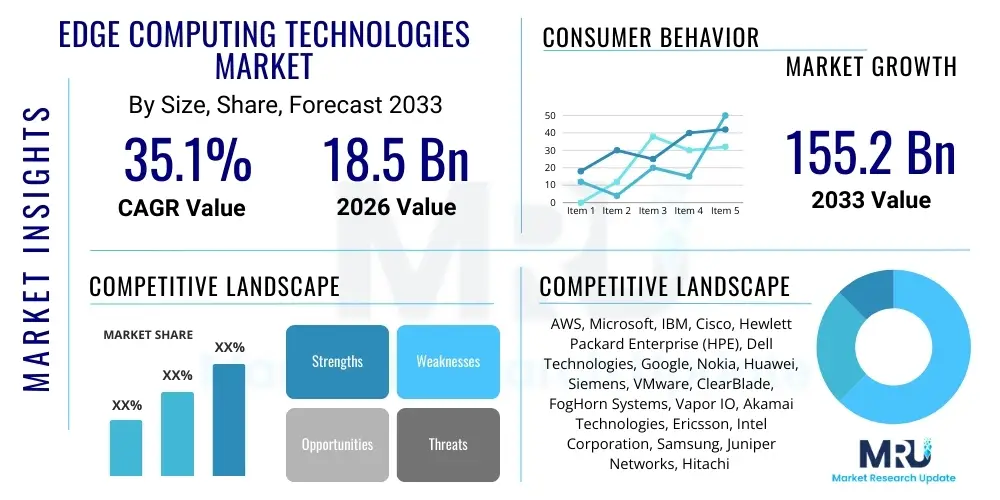

The Edge computing technologies Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 35.1% between 2026 and 2033. The market is estimated at USD 18.5 Billion in 2026 and is projected to reach USD 155.2 Billion by the end of the forecast period in 2033. This exponential growth trajectory is driven by the imperative need for reduced latency, enhanced data processing capabilities near the source of generation, and the massive proliferation of Internet of Things (IoT) devices across all major industrial and consumer sectors. The maturation of 5G infrastructure further catalyzes this expansion, enabling high-speed, reliable connectivity essential for distributed computing models.

Edge computing technologies Market introduction

The Edge computing technologies Market encompasses distributed computing architectures that bring computational resources and data storage closer to the physical location where data is generated or consumed, rather than relying solely on centralized cloud or distant data centers. Products include specialized edge hardware (gateways, servers, routers), sophisticated edge software platforms for orchestration and data management, and professional services supporting deployment and integration. Major applications span critical sectors such as Industrial IoT (IIoT) for real-time asset monitoring, autonomous vehicles requiring immediate decision-making, smart city infrastructure managing complex traffic flows, and healthcare systems necessitating rapid diagnostics. The primary benefits include ultra-low latency, reduced bandwidth usage, enhanced operational resilience, and improved data security through localized processing. Key driving factors include the explosion of data generated by billions of IoT endpoints, the rollout of high-performance 5G networks, and the increasing demand for real-time insights across enterprise operations.

Edge computing technologies Market Executive Summary

The Edge computing technologies market is experiencing profound shifts, characterized by rapid convergence between IT and OT environments, and significant investment from both established cloud hyperscalers and specialized hardware manufacturers. Business trends indicate a move toward subscription-based, 'Edge-as-a-Service' models, providing scalable and managed solutions to enterprises hesitant about large initial infrastructure investments. Regional trends show North America maintaining market dominance due to early adoption across sectors like telecommunications and aerospace, while the Asia Pacific (APAC) region is demonstrating the fastest growth, propelled by vast manufacturing bases and large-scale smart city projects, particularly in countries like China, Japan, and South Korea. Segment trends highlight the software and services components exhibiting the highest growth rates, reflecting the market’s pivot from purely infrastructural needs to sophisticated application orchestration, security provisioning, and AI model deployment directly at the network edge, thereby optimizing performance for latency-sensitive applications.

AI Impact Analysis on Edge computing technologies Market

Users frequently inquire about how Artificial Intelligence (AI) and Machine Learning (ML) can be effectively deployed outside traditional centralized cloud environments, specifically concerning data privacy, computational efficiency, and the management of model drift at distributed nodes. Key concerns revolve around the capability of limited-resource edge devices to handle complex inference tasks and the security protocols necessary to protect proprietary AI models deployed in remote, often unsecured locations. There is high expectation that AI at the edge will revolutionize predictive maintenance in industrial settings, enable truly autonomous operations in transportation, and drastically improve personalized customer experiences in retail by processing localized data instantly. The consensus theme emerging from user analysis is that AI deployment is the primary catalyst transitioning edge computing from a niche infrastructure solution to a core, transformative business strategy, providing the necessary intelligence layer to capitalize on real-time data streams.

- AI drives the necessity for edge hardware acceleration (GPUs, TPUs, NPUs).

- Enables real-time decision-making without reliance on backhaul latency to the cloud.

- Facilitates optimized predictive maintenance and operational efficiency in Industrial IoT (IIoT).

- Improves data privacy by performing sensitive data filtering and processing locally.

- Spurs the development of specialized Federated Learning algorithms optimized for distributed edge networks.

- Transforms autonomous systems (vehicles, robotics) by embedding essential cognitive capabilities.

DRO & Impact Forces Of Edge computing technologies Market

The dynamic expansion of the Edge computing market is governed by a robust combination of compelling drivers, necessary restraints, and significant long-term opportunities, all shaped by intense impact forces arising from technological convergence and global digitalization initiatives. The primary driver is the critical need for ultra-low latency, essential for applications such as robotic control and augmented reality, coupled with the massive increase in data volume generated by ubiquitous IoT deployments, making centralized processing impractical. However, significant restraints impede growth, notably the persistent challenges related to complex security management across thousands of distributed endpoints and the existing lack of unified global standards for interoperability, forcing organizations into vendor-specific solutions. Substantial opportunities exist in the development of highly customized, vertical-specific edge solutions, particularly integrating AI/ML for real-time analytics, and capitalizing on the burgeoning mobile edge computing (MEC) segment driven by telecom carriers. The impact forces are predominantly high, characterized by rapid technological obsolescence and the significant competitive pressure exerted by major hyperscale cloud providers aggressively moving their services closer to the end-user.

Segmentation Analysis

The Edge computing technologies market is analyzed across several critical dimensions, including components, application areas, and end-user industries, reflecting the diverse deployment modalities and varied business requirements driving adoption. Segmentation provides clarity on where investment capital and technological innovation are concentrated. The component segmentation, encompassing hardware, software, and services, reveals the high value placed on robust management and orchestration platforms (software) required to handle the complexity of distributed infrastructure. Application analysis underscores the dominance of latency-critical use cases such as content delivery networks (CDNs) and industrial automation. Furthermore, end-user segmentation clearly indicates that highly regulated or data-intensive industries—such as manufacturing and telecommunications—are leading the current wave of enterprise adoption due to immediate quantifiable returns on investment in localized processing capabilities.

- By Component: Hardware, Software, Services

- By Application: Smart Cities, Industrial IoT, Remote Monitoring, Content Delivery Networks (CDN), Augmented and Virtual Reality (AR/VR), Autonomous Systems

- By Deployment Model: On-Premise Edge, Cloud Gateway Edge, Device Edge

- By End-User: Manufacturing, Energy & Utilities, Healthcare, Retail, Transportation & Logistics, Telecommunications, Government & Defense

Value Chain Analysis For Edge computing technologies Market

The Edge computing value chain is characterized by a high degree of integration and cooperation spanning multiple layers, from chip fabrication to final deployment and application hosting. Upstream activities involve specialized hardware manufacturing, focusing on ruggedized, low-power microprocessors, sensors, and network equipment suitable for diverse and often harsh operating environments. Key players in this segment are semiconductor companies providing optimized silicon for AI inference. Downstream analysis reveals a critical dependency on software platform providers who offer the crucial orchestration layer, enabling zero-touch provisioning, secure data ingestion, and workload management across disparate edge nodes. Distribution channels are complex, involving direct sales to large enterprises, significant reliance on system integrators and managed service providers (MSPs) who package solutions, and strong partnerships with telecommunications companies for mobile edge delivery. Both direct models (large enterprise partnerships) and indirect models (channel partners and telco distribution) are vital, ensuring scalability and localized support necessary for geographically dispersed edge deployments.

Edge computing technologies Market Potential Customers

Potential customers for Edge computing technologies are predominantly large enterprises and organizations operating environments where real-time decision-making, operational autonomy, and large-scale data processing are mission-critical requirements. Industrial manufacturers are prime buyers, leveraging edge solutions for predictive maintenance, quality control via real-time vision systems, and optimizing complex supply chain logistics. Telecommunication providers are crucial customers, utilizing Mobile Edge Computing (MEC) to enhance 5G network performance and enable low-latency services for their consumer and enterprise clients. Furthermore, the retail sector is increasingly investing in edge for localized inventory management, in-store personalized customer experiences, and immediate fraud detection. These end-users are characterized by high volume data streams generated outside traditional cloud data centers and an inability to tolerate the network latency associated with central processing architectures.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 18.5 Billion |

| Market Forecast in 2033 | USD 155.2 Billion |

| Growth Rate | 35.1% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | AWS, Microsoft, IBM, Cisco, Hewlett Packard Enterprise (HPE), Dell Technologies, Google, Nokia, Huawei, Siemens, VMware, ClearBlade, FogHorn Systems, Vapor IO, Akamai Technologies, Ericsson, Intel Corporation, Samsung, Juniper Networks, Hitachi Vantara |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Edge computing technologies Market Key Technology Landscape

The technological landscape of the Edge computing market is diverse and rapidly evolving, encompassing specialized hardware, advanced networking protocols, and sophisticated software stacks designed for distributed environments. Key enabling technologies include ruggedized and fanless industrial computers, micro data centers optimized for non-traditional environments, and specialized silicon components such as ASICs and FPGAs engineered to handle low-power, high-efficiency AI inference tasks directly at the device level. The core network technology leveraged is 5G, which provides the necessary high-bandwidth, low-latency backbone to connect the dispersed edge nodes effectively, supplementing traditional fiber and wireless connections. Furthermore, containerization technologies, particularly Kubernetes and Docker, are fundamental to managing and orchestrating application deployment and scaling across thousands of edge devices, ensuring portability and operational consistency between the cloud core and the network periphery.

Software platforms represent a crucial innovation area, focusing on sophisticated edge orchestration and data governance tools. These platforms must manage device lifecycles, ensure zero-trust security across all nodes, and synchronize data and models back to centralized cloud repositories for training and long-term storage. Specific methodologies like Digital Twins and serverless computing models are increasingly being adapted for edge environments to simulate real-world physical assets and execute code in response to local events without managing server infrastructure. The integration of robust security protocols, including hardware root-of-trust implementations and secure boot mechanisms, is paramount given the inherent vulnerability of physically exposed edge infrastructure. These technological advancements collectively aim to simplify the deployment and maintenance of complex distributed architectures, making edge computing accessible for mainstream enterprise adoption beyond early-stage pilots.

Moreover, the adoption of open-source frameworks for edge application development is accelerating market momentum, providing standardized mechanisms for developers to build and deploy tailored edge solutions. Project Fledge and various Linux Foundation initiatives are contributing significantly to interoperability, mitigating the risk of vendor lock-in which often deters large-scale deployments. The combination of high-performance, purpose-built hardware coupled with open, flexible software platforms creates an ecosystem that supports rapid innovation in vertical-specific applications, moving the focus from mere connectivity to delivering profound business intelligence and autonomous capability at the farthest reaches of the network. This technological duality ensures both the performance needed for latency-critical tasks and the flexibility required for rapid market iteration.

Regional Highlights

The global Edge computing market exhibits varied maturity levels and adoption drivers across major geographical regions, influencing investment and deployment strategies significantly.

- North America (NA): Represents the largest market share, driven by high technological maturity, significant early investments in 5G infrastructure, and the presence of major cloud hyperscalers and key technology vendors. Adoption is robust across telecommunications, autonomous driving R&D, and financial services. The focus is on complex, high-value AI applications at the edge.

- Europe: Characterized by strong regulatory frameworks (e.g., GDPR), which inadvertently promote edge adoption by favoring local data processing. Germany and the UK lead in industrial automation and manufacturing (Industry 4.0) deployments, utilizing edge computing for optimized factory floors and supply chain traceability.

- Asia Pacific (APAC): Expected to register the highest Compound Annual Growth Rate (CAGR). Growth is fueled by massive government investment in smart cities (especially in China and India), rapid industrialization, and high consumer density requiring sophisticated mobile edge delivery services. The region’s focus is on scaling infrastructure quickly and efficiently.

- Latin America (LATAM): Currently represents a smaller but expanding market. Adoption is primarily concentrated in the energy and mining sectors for remote asset monitoring and security surveillance, driven by the necessity to manage operations in geographically dispersed and often remote locations.

- Middle East and Africa (MEA): Growth is primarily centered around Gulf Cooperation Council (GCC) countries, heavily investing in smart oilfields, futuristic mega-cities (like NEOM), and modernizing public infrastructure. Telecommunications carriers are leading the charge, rapidly deploying MEC to support new digital services.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Edge computing technologies Market.- Amazon Web Services (AWS)

- Microsoft Corporation

- International Business Machines (IBM)

- Cisco Systems, Inc.

- Hewlett Packard Enterprise (HPE)

- Dell Technologies Inc.

- Google LLC

- Nokia Corporation

- Huawei Technologies Co., Ltd.

- Siemens AG

- VMware, Inc. (now part of Broadcom)

- ClearBlade, Inc.

- FogHorn Systems

- Vapor IO

- Akamai Technologies

- Ericsson

- Intel Corporation

- Samsung Electronics Co., Ltd.

- Juniper Networks

- Hitachi Vantara

Frequently Asked Questions

Analyze common user questions about the Edge computing technologies market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between Edge Computing and Cloud Computing?

Edge computing processes data locally, closer to the source of generation (e.g., IoT device or factory floor), minimizing latency and bandwidth use. Cloud computing involves transmitting data to large, centralized data centers for processing and storage, which offers scalability but introduces network delays. Edge computing often complements the Cloud, handling immediate tasks while the Cloud manages long-term storage and large-scale model training.

Which industry vertical is driving the fastest adoption of Edge Computing technology?

The Manufacturing sector, particularly within the scope of Industrial IoT (IIoT) and Industry 4.0 initiatives, is demonstrating the fastest rate of adoption. Manufacturers utilize edge computing for real-time quality control, predictive maintenance of machinery, and optimization of assembly lines, where milliseconds of latency can impact production efficiency and safety.

What are the key security risks associated with deploying Edge Computing infrastructure?

Key security risks include the physical vulnerability of edge devices deployed in remote or exposed environments, challenges in maintaining consistent patch management across thousands of distributed nodes, and the risk of unauthorized access or tampering with sensitive localized data and deployed AI models. Robust authentication and zero-trust architectures are essential mitigation strategies.

How does 5G technology accelerate the growth of the Edge Computing market?

5G provides the necessary high-speed connectivity (enhanced mobile broadband) and ultra-low latency (around 1-4ms) required for Mobile Edge Computing (MEC). This allows telecom operators to effectively host enterprise applications at the cellular base station level, dramatically improving performance for critical mobile applications such as autonomous vehicles and augmented reality that rely on instantaneous data feedback.

What role does Artificial Intelligence play in the Edge Computing ecosystem?

AI is foundational to the current evolution of edge computing. Edge devices are increasingly used to run AI/ML inference models locally, enabling immediate, intelligent decisions without contacting the cloud. This capability is critical for computer vision, natural language processing, and advanced industrial automation, transforming raw edge data into actionable, real-time insights.

The proliferation of interconnected devices globally, encompassing industrial sensors, consumer electronics, and smart infrastructure components, has created an unprecedented data deluge that centralized data centers are increasingly unable to process efficiently in real time. This infrastructural stress has cemented Edge computing's role as a necessary architectural paradigm, shifting processing power closer to the data source. For organizations operating across geographically vast areas—such as logistics, resource extraction, and public safety—the inherent ability of edge technology to maintain operational continuity even during network outages proves invaluable, promoting resilience that traditional cloud models often cannot guarantee. The competitive advantage derived from sub-millisecond decision latency, especially in high-frequency trading or complex robotic coordination, further solidifies the economic necessity of adopting robust edge frameworks.

Investment in edge middleware and orchestration software has surged, recognizing that hardware is only one part of the equation. Companies are heavily focused on developing simplified management layers that can securely deploy, update, and monitor thousands of diverse edge devices simultaneously, spanning from resource-constrained gateways to powerful micro data centers. This focus on software standardization and ease of management is critical for driving broader enterprise adoption, particularly among firms lacking specialized IT personnel for distributed systems. Furthermore, regulatory environments, particularly those focused on data sovereignty and privacy, are implicitly encouraging localized processing, thereby strengthening the business case for adopting regional or on-premise edge solutions to ensure compliance and avoid costly cross-border data transfer limitations.

The telecommunications industry stands as a major accelerator, actively deploying Mobile Edge Computing (MEC) solutions to capitalize on the capabilities of 5G. MEC transforms network assets into computation platforms, offering lucrative new services to enterprises that demand guaranteed service levels and minimal latency. This partnership between connectivity providers and application developers is forging a powerful ecosystem where the network edge is not just a routing point but a fully functional compute environment. The convergence of operational technology (OT) in manufacturing and information technology (IT) further accelerates edge deployment, as organizations seek unified visibility and control over their physical assets and digital processes. This integration facilitates advanced use cases like augmented reality assistance for field technicians and real-time energy consumption optimization across complex factory floors, maximizing operational returns on digitalization efforts.

Examining the market growth drivers more closely reveals that regulatory tailwinds, particularly those concerning environmental monitoring and public safety standards, necessitate localized data analysis and immediate alerting mechanisms that only edge infrastructure can reliably provide. For instance, air quality monitoring in smart cities requires sensors to process pollution levels instantaneously and trigger automated responses without waiting for centralized cloud processing. Furthermore, the inherent economic efficiency derived from optimizing bandwidth usage is a powerful financial incentive. By processing only the most critical data locally and only sending summarized insights to the cloud, organizations drastically cut down on expensive backhaul transmission costs, offering a tangible return on investment that supports large-scale infrastructure deployment.

On the restraint side, fragmentation remains a significant impediment. The lack of universal standards for hardware interfaces, operating systems, and security protocols forces enterprises to navigate a complex landscape of proprietary solutions, often leading to vendor lock-in and high integration costs. Addressing this requires greater commitment from industry consortia and open-source initiatives to provide standardized blueprints for edge deployment across various vertical segments. Another critical restraint is the physical challenge of deployment and maintenance. Edge devices are often located in remote, harsh, or physically unsecured locations, demanding ruggedized hardware and specialized management capabilities for remote diagnostics and repair, adding layers of operational complexity that are non-trivial to overcome.

Opportunities, however, are substantial and multi-faceted. The integration of AI/ML into edge hardware is transitioning the market from simple data aggregation to real-time intelligence execution. This opens up lucrative specialized markets, such as high-fidelity video analytics for security and retail applications, and sophisticated industrial controls using computer vision. Moreover, the evolution of edge infrastructure into "serverless edge" platforms, managed entirely by cloud providers, promises to simplify consumption and lower the entry barrier for small and medium-sized enterprises (SMEs). This shift allows companies to focus purely on application logic rather than infrastructure management, democratizing access to high-performance localized computing power and dramatically expanding the total addressable market globally.

The segment analysis of the Edge computing technologies Market by Component highlights the foundational role of Hardware, which includes ruggedized servers, gateways, and specialized accelerators (GPUs, ASICs, FPGAs). These components must be reliable under extreme conditions (temperature, vibration) and must offer high computational density with minimal power consumption. The Software segment, however, is the growth engine, encompassing operating systems (e.g., lightweight Linux distributions), virtualization and container orchestration platforms (e.g., K3s, Kubernetes), and sophisticated data management tools designed to handle data synchronization, filtering, and security across heterogeneous environments. The Services component, including professional consulting, integration, and managed services (Edge-as-a-Service), is crucial for enterprise adoption, mitigating the complexity associated with large-scale distributed infrastructure management and providing ongoing operational support.

Within the Application segmentation, Industrial IoT (IIoT) applications—such as asset tracking, predictive maintenance, and operational parameter monitoring in factories—demand the highest reliability and lowest latency, making them primary drivers. Smart Cities applications, encompassing traffic management, public safety video surveillance, and utility grid optimization, leverage edge for real-time aggregation and localized processing to enhance civic responsiveness. Content Delivery Networks (CDNs) utilize edge nodes to cache high-demand content closer to end-users, drastically improving streaming quality and download speeds, a crucial factor in consumer experience. The rapidly emerging segment of Autonomous Systems, including self-driving cars and advanced robotics, is highly dependent on edge computing for immediate sensor data processing and path planning, where even fractional delays are intolerable, necessitating dedicated edge processing units embedded within the systems themselves.

The End-User analysis confirms the dominance of the Manufacturing sector, where digital transformation efforts are heavily reliant on edge technology to fully realize the promise of Industry 4.0. Telecommunications providers are simultaneously end-users and facilitators, deploying MEC solutions to support their own network optimization and offering these enhanced capabilities to their enterprise clients. The Healthcare sector is another critical segment, utilizing edge for remote patient monitoring, processing medical imagery at the source, and ensuring compliance with strict data residency regulations like HIPAA. In Retail, edge computing enables advanced personalization, inventory optimization via smart cameras and sensors, and instantaneous Point-of-Sale (POS) transactions, directly impacting customer satisfaction and operating margins. These diverse requirements across major verticals underscore the pervasive necessity for localized processing across the modern digital economy.

Detailed insight into the Value Chain’s upstream layer reveals intense competition and high capital expenditure in the semiconductor space, where companies like Intel, NVIDIA, and specialized ASIC designers are constantly innovating to produce chips optimized for the power and thermal constraints of edge environments while maximizing AI inference performance. This competition directly impacts the price and performance of subsequent hardware offerings. Moving to the midstream, the market is characterized by powerful system integrators (SIs) and Original Equipment Manufacturers (OEMs) who bundle hardware, software, and networking components into deployable solutions. Their ability to tailor standardized offerings to meet highly specific industrial needs, such as ruggedization for extreme temperatures or integration with legacy OT systems, is a critical differentiating factor.

The downstream segment, focused on application delivery and services, highlights the increasing influence of cloud service providers (CSPs) like AWS, Azure, and Google Cloud, which are extending their centralized management frameworks outward to the customer premises. This allows enterprises to manage their distributed edge deployments using familiar cloud tools, simplifying operational complexity and accelerating deployment timelines. The interplay between CSPs, telecommunications providers, and independent software vendors (ISVs) creates a multi-layered ecosystem where partnerships and interoperability agreements dictate market reach. Consequently, the most successful market players are those who demonstrate flexibility in integrating their platforms with diverse ecosystems and supporting open standards to attract a wide range of application developers.

Analyzing Potential Customers further, the Government and Defense sectors represent robust, though highly regulated, customers. These agencies require secure, localized computing for surveillance, command and control, and border security, often in environments with intermittent or nonexistent traditional network connectivity. Edge computing provides the necessary autonomy and resilience for these critical national security applications. The Transportation & Logistics industry is rapidly adopting edge for real-time tracking, fleet management, and optimizing delivery routes, relying on edge devices embedded in vehicles and distribution centers. Furthermore, smaller regional utility companies are increasingly recognized as high-potential customers, utilizing edge computing to manage distributed energy resources (DERs) and optimize microgrids, responding dynamically to energy demands at the grid periphery, thereby enhancing efficiency and reducing system instability. The common thread among all these end-users is the non-negotiable requirement for high reliability and instant data processing, often in remote or high-stakes environments, making the investment in decentralized edge infrastructure an operational necessity rather than a mere technological upgrade.

The competitive landscape within the Edge computing technologies Market is intensely fragmented yet highly concentrated at the platform level, creating a dual dynamic for market entry and consolidation. Hyperscalers (AWS, Microsoft, Google) leverage their dominant cloud positions and established developer ecosystems to push managed edge services, making integration seamless for existing cloud customers. Hardware manufacturers (Dell, HPE, Cisco, Intel) compete by offering optimized, ruggedized appliances designed for specific industrial workloads and challenging environments, often partnering closely with specialized software vendors to provide full-stack solutions. This platform war is driving innovation in software-defined infrastructure (SDI) and open standards, aiming to provide customers with the flexibility to deploy and manage workloads consistently across the entire cloud-to-edge continuum, regardless of the underlying hardware vendor.

In terms of technological advancements, the focus is increasingly shifting toward developing energy-efficient edge processors capable of sophisticated heterogeneous computing—handling traditional CPU tasks alongside specialized AI acceleration. Micro-electromechanical systems (MEMS) sensors integrated directly with System-on-Chip (SoC) edge processors are creating smarter, more autonomous edge devices that require less power and space. Furthermore, advancements in network function virtualization (NFV) and software-defined networking (SDN) are critical for telcos, allowing them to rapidly provision and manage edge resources dynamically, supporting the deployment of customized 5G and MEC services on demand. This ongoing technological race, driven by the demand for higher performance and lower power consumption, ensures continuous cycles of innovation, maintaining high barriers to entry for new competitors lacking significant R&D capabilities or intellectual property portfolios in specialized hardware or distributed software management.

The future technology trajectory points toward greater utilization of quantum-resistant cryptography for securing edge deployments, anticipating future threats to the distributed architecture. Additionally, there is significant research dedicated to optimizing operating systems to run efficiently on severely constrained edge devices, moving beyond general-purpose OSes towards minimalistic, purpose-built kernels that prioritize security and real-time performance. The successful commercialization of these technologies will determine the long-term feasibility of expanding edge computing into highly sensitive public and defense sectors, solidifying its status as an indispensable component of the global digital infrastructure. The convergence of hardware and software capabilities, fueled by significant venture capital funding in specialized edge startups, promises a highly dynamic market evolution over the forecast period.

Within the regional analysis, a deeper dive into APAC reveals that countries like Japan and South Korea are driving high-value deployments focused on robotics and high-precision manufacturing, leveraging edge for advanced quality inspection and machine coordination. Their mature technological infrastructures and dense urban environments provide ideal testing grounds for large-scale smart city applications that require intricate sensor networks and instantaneous data response. In contrast, the market growth in India and Southeast Asian nations is primarily driven by massive population scales and the need for scalable digital public infrastructure, prioritizing cost-effective edge gateways for connecting millions of new IoT endpoints and extending internet services to underserved rural areas. This bifurcation of needs—high-precision in East Asia versus high-volume scalability in South Asia—highlights the diverse regional drivers shaping investment.

Europe’s adoption strategy is notably influenced by industrial policy and strong data protection mandates. The emphasis on sovereign cloud and trusted data spaces, particularly driven by initiatives like GAIA-X, strongly favors decentralized architectures where data remains localized within national or regional boundaries, aligning perfectly with the core principles of edge computing. This regulatory landscape is fostering innovation in secure, private edge solutions, particularly benefiting European companies specialized in industrial control systems and cybersecurity. Meanwhile, the Middle East and Africa (MEA) region, while smaller in overall size, is characterized by concentrated mega-projects and rapid infrastructure modernization. Government-led initiatives to create world-class digital economies are funding large-scale MEC rollouts and smart infrastructure projects, creating significant high-value opportunities for global technology providers specializing in integrated edge solutions for oil & gas and government services.

Latin America’s market expansion is slowly gaining momentum, primarily in resource-intensive sectors like agriculture, mining, and oil & gas, where monitoring remote assets and ensuring operational safety relies heavily on autonomous, local processing capabilities. The challenge in LATAM often lies in bridging the digital divide and overcoming fragmented telecom infrastructure in less densely populated areas, necessitating rugged, satellite-enabled edge solutions capable of functioning independently for extended periods. As 5G penetration increases in major urban centers like São Paulo and Mexico City, Mobile Edge Computing deployments are expected to significantly accelerate, unlocking new opportunities for consumer and business applications reliant on low-latency mobile connectivity, thereby diversifying the market from purely industrial use cases toward broader enterprise and consumer applications in the latter half of the forecast period.

The strategic actions of key players demonstrate a strong focus on ecosystem development and vertical integration. Companies such as Microsoft and AWS are aggressively releasing specialized edge operating systems and application marketplaces (e.g., Azure IoT Edge, AWS IoT Greengrass) to lock customers into their overall cloud architecture, leveraging familiarity and ease of integration as competitive differentiators. Conversely, hardware specialists like Dell and HPE are building strategic alliances with telecom providers and industrial automation giants (like Siemens) to deliver pre-validated, turnkey edge stacks tailored for demanding operational technology (OT) environments, effectively creating specialized distribution channels focused on highly regulated industries. This dual strategy—cloud-centric ecosystem dominance versus industrial-centric operational specialization—defines the current competitive maneuvering within the Edge computing technologies Market.

Further analysis of the competitive landscape shows that acquisition activity is accelerating as established players seek to absorb specialized software capabilities, particularly in AI inference and edge security. For example, the acquisition of smaller firms specializing in optimized Kubernetes distributions or federated learning frameworks is common, demonstrating the urgency to incorporate advanced intelligence capabilities directly into the edge platform offering. This focus on acquiring intellectual property and talent suggests that the next phase of competition will hinge less on raw hardware performance and more on the sophistication, security, and manageability of the software layers deployed at the edge. Companies that can successfully abstract the complexity of distributed computing for the end-user will emerge as long-term market leaders.

Moreover, partnerships between chip manufacturers and application developers are becoming crucial to optimize AI workloads from the silicon up, ensuring maximum efficiency and speed for critical tasks like real-time video processing in security systems or complex sensor fusion in autonomous industrial vehicles. This deep collaboration across the value chain, from semiconductor design to final application deployment, is necessary to meet the demanding performance metrics required by mission-critical edge use cases. The ongoing maturation of open-source frameworks for edge application development also forces all key players to actively contribute to and support these community initiatives, ensuring their proprietary platforms remain interoperable and relevant within the rapidly evolving, standards-driven edge ecosystem.

The complexity and mission-critical nature of many edge deployments mandate comprehensive professional and managed services, making the Services segment a high-growth area. Organizations often lack the internal expertise to design, deploy, and maintain robust edge infrastructure across hundreds or thousands of sites. Consequently, they turn to service providers for assistance with network design, security auditing, ongoing monitoring, and remote lifecycle management. This reliance on expert third parties validates the strategic importance of system integrators and telecom carriers offering Edge-as-a-Service (EaaS) models, which significantly lower the barrier to entry for enterprises and allow them to consume edge capabilities on an operational expense (OpEx) basis rather than through large capital expenditure (CapEx) investments. This service-centric approach is vital for sustaining the rapid market growth projected throughout the forecast period.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager