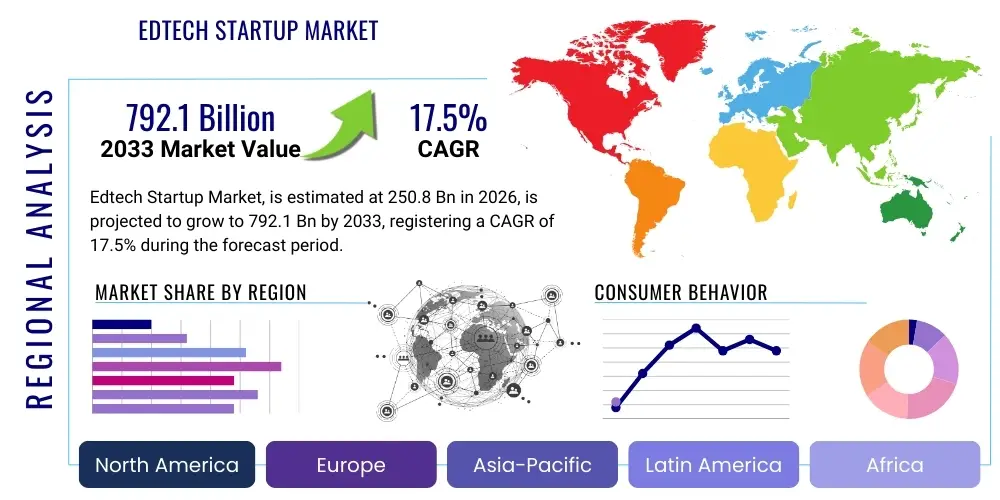

Edtech Startup Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443415 | Date : Feb, 2026 | Pages : 248 | Region : Global | Publisher : MRU

Edtech Startup Market Size

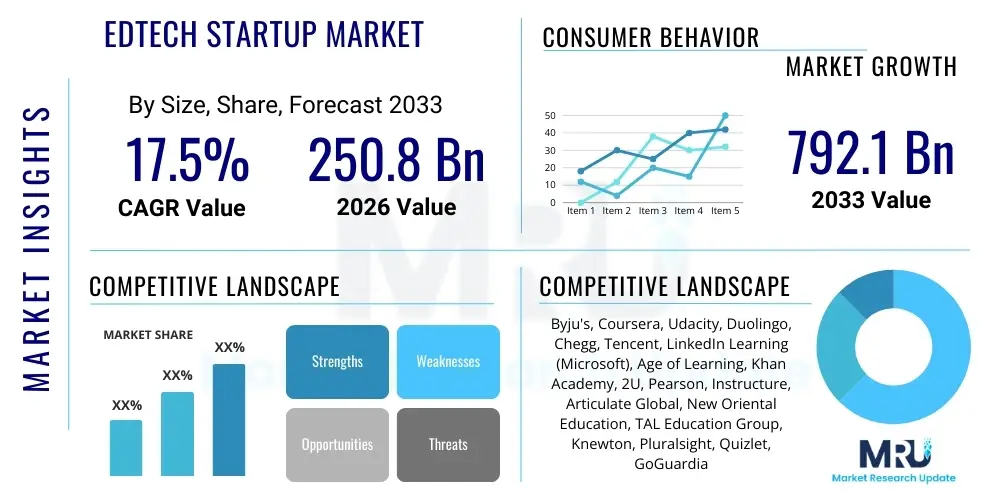

The Edtech Startup Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 17.5% between 2026 and 2033. The market is estimated at USD 250.8 Billion in 2026 and is projected to reach USD 792.1 Billion by the end of the forecast period in 2033.

Edtech Startup Market introduction

The Edtech Startup Market encompasses organizations utilizing innovative technology to enhance educational delivery, assessment, and learning outcomes across various sectors, including K-12, higher education, and corporate training. These products range from learning management systems (LMS) and personalized tutoring platforms powered by Artificial Intelligence (AI) to immersive content delivered via Augmented Reality (AR) and Virtual Reality (VR). The core objective of these startups is to democratize education, increase accessibility, and tailor learning experiences to individual student needs, driving significant disruption in traditional pedagogical models globally. The fundamental shift towards blended and fully online learning models, accelerated by global connectivity improvements, serves as the structural backbone for market expansion.

Key product descriptions within this market include SaaS-based platforms for administrative tasks, adaptive learning systems that adjust curriculum difficulty in real-time, and tools for skill-based micro-credentialing focused on workforce development. Major applications span academic remediation, language learning, professional upskilling, and standardized test preparation. The overarching benefits delivered by Edtech solutions include improved learner engagement, demonstrable gains in efficiency for educators, cost reduction in educational infrastructure, and the ability to scale high-quality content rapidly to underserved populations worldwide. This technological enablement is fostering a paradigm where lifelong learning is facilitated through accessible digital ecosystems.

The primary driving factors fueling the growth of Edtech startups are the increasing global internet penetration, widespread adoption of smart devices (mobile learning), significant venture capital investment flows into the sector, and governmental initiatives emphasizing digital literacy and educational equity. Furthermore, the persistent demand from employers for a workforce with up-to-date digital skills necessitates continuous learning solutions, which Edtech startups are uniquely positioned to provide. The market dynamism is also driven by continuous technological integration, especially in areas like generative AI and predictive analytics, which refine the personalization capabilities of educational tools.

Edtech Startup Market Executive Summary

The Edtech Startup Market is experiencing robust acceleration driven by synergistic trends across business models, geographical expansion, and technology integration. Business trends are characterized by a strong focus on Subscription-as-a-Service (SaaS) models, offering recurring revenue streams and scalable deployment, particularly in the B2B sector targeting institutions and corporations for professional development. There is also a significant market consolidation trend, with larger Edtech unicorns acquiring specialized niche providers to expand their service portfolio—a strategy aimed at creating integrated, end-to-end learning ecosystems. Furthermore, the shift from purely academic content to future-proof skill development (e.g., coding, data science, soft skills) represents a crucial pivot in revenue generation and customer acquisition strategies across the competitive landscape.

Regional trends indicate that while North America and Europe maintain technological leadership and high average contract values (ACV), the Asia Pacific (APAC) region, particularly India and China, remains the primary engine of volume growth, fueled by vast young populations, high disposable income allocated to education, and strong parental engagement in academic success. Latin America and the Middle East & Africa (MEA) are emerging as high-potential regions due to expanding digital infrastructure and government mandates to modernize public education systems, presenting substantial opportunities for localized Edtech content and low-cost delivery models. These emerging markets often bypass traditional infrastructure limitations by adopting mobile-first learning solutions immediately.

Segment trends highlight the dominance of the K-12 and Corporate Learning sectors. In K-12, the integration of personalized learning tools and administrative automation is key, whereas in Corporate Learning, demand is focused on bespoke upskilling and reskilling platforms to address rapid technological obsolescence (the skills gap). Technology segmentation shows that platforms leveraging Artificial Intelligence and Machine Learning for adaptive assessments and content recommendation are capturing the highest investment and user traction. Furthermore, niche segments such as gamification for enhanced engagement and blockchain for secure credential verification are witnessing accelerated adoption, moving from experimental deployment to critical features, thereby redefining product differentiation within the competitive Edtech landscape.

AI Impact Analysis on Edtech Startup Market

User queries regarding the impact of Artificial Intelligence (AI) on the Edtech Startup Market predominantly revolve around three key areas: the effectiveness of personalized learning at scale, the implications for educator roles, and ethical concerns surrounding data privacy and algorithmic bias. Users frequently ask if AI-powered tutors will replace human teachers, how generative AI (GenAI) will affect academic integrity, and which specific AI applications (e.g., adaptive testing, automated grading, content creation) offer the highest measurable Return on Investment (ROI) for educational institutions. The overall consensus anticipated by market participants is that AI will act as a powerful co-pilot, enhancing instructional efficiency and enabling hyper-customization, rather than serving as a simple replacement for human interaction. This expectation drives investment towards sophisticated AI models capable of complex pedagogical interactions.

The integration of AI, particularly deep learning and natural language processing (NLP), allows Edtech platforms to move beyond simple content delivery toward sophisticated diagnostic and prescriptive capabilities. AI algorithms analyze vast datasets of student performance, identifying specific knowledge gaps and tailoring learning paths, resources, and timing for optimal retention. This shift represents a major competitive differentiator for startups, enabling them to offer services that significantly outperform generalized, static educational content. For investors, the ability of a startup to leverage proprietary educational datasets to train robust AI models is a primary indicator of long-term viability and market penetration potential, leading to increased valuation for AI-native platforms.

Furthermore, GenAI tools are rapidly transforming content creation, allowing educators and platform providers to generate complex study guides, diverse assessment questions, and even interactive simulations far faster and cheaper than traditional methods. However, this proliferation of automated content introduces crucial challenges regarding quality assurance and the prevention of academic dishonesty. Edtech startups are therefore focusing significant research and development efforts on AI-driven plagiarism detection and developing sophisticated mechanisms to authenticate student work in the age of large language models (LLMs). Addressing these ethical and structural challenges is vital for maintaining stakeholder trust in AI-enhanced learning environments.

- AI-driven personalized learning paths and adaptive assessment engines.

- Automated grading and feedback systems increase educator efficiency.

- Generative AI (GenAI) facilitates rapid, scalable creation of educational content.

- Predictive analytics to identify at-risk students and intervene proactively.

- Development of intelligent tutoring systems (ITS) providing real-time, personalized guidance.

- Enhanced data privacy and security requirements due to sensitive learning data processing.

- Streamlining administrative tasks through AI-powered Learning Management Systems (LMS).

DRO & Impact Forces Of Edtech Startup Market

The Edtech Startup Market is highly influenced by a confluence of driving factors, structural restraints, and significant long-term opportunities, all channeled through dynamic impact forces that shape investment and adoption patterns. A primary driver is the necessity for workforce reskilling and upskilling globally, as technological shifts render existing skills obsolete rapidly, creating constant demand for accessible professional development. This is amplified by favorable government policies worldwide promoting digital infrastructure investment and integrating technology into public schooling. Conversely, significant restraints include high initial setup costs for institutional adoption, particularly in developing economies, the persistent challenge of digital equity (the digital divide), and resistance from traditional educational stakeholders who fear technological disruption to established curricula and pedagogical practices. Successfully mitigating user concerns regarding data security and the effectiveness of online learning versus in-person instruction remains critical for sustained growth.

Opportunities in the market are concentrated in several emerging areas. The expansion into niche vocational and skill-based learning, leveraging micro-credentialing and blockchain technology for verified certifications, offers high-growth potential. Furthermore, the development of immersive learning experiences using AR/VR technology promises significantly higher engagement and retention rates, particularly for complex subjects requiring visualization or simulation (e.g., medical training, engineering). Geographic expansion into highly populous but underserved markets, especially Africa and Southeast Asia, presents a substantial chance for rapid user acquisition, often focusing on mobile-centric, low-bandwidth solutions. These opportunities require flexible, region-specific business models and strong partnerships with local telecommunication providers to overcome infrastructure hurdles and latency issues.

Impact forces structure the rate of adoption and market profitability. Technological readiness, measured by broadband penetration and device ownership, is the foundational force; higher readiness correlates directly with successful deployment of sophisticated Edtech solutions. Economic volatility affects discretionary spending on education, particularly in consumer-facing segments like tutoring, while robust corporate spending sustains the B2B training sector. Societal impact forces, such as changing parental attitudes towards online learning and the cultural acceptance of digital degrees and micro-credentials, determine the total addressable market size. Ultimately, regulatory environments—ranging from data protection laws like GDPR to standardized curriculum requirements—act as crucial filters, dictating the operational parameters and necessary compliance investments for Edtech startups operating across multiple jurisdictions.

- Drivers:

- Increasing global internet penetration and mobile device adoption.

- Rising demand for lifelong learning and professional skill development (reskilling).

- Favorable government policies promoting digital education transformation.

- Significant inflow of Venture Capital (VC) funding into specialized Edtech solutions.

- Restraints:

- The persistent digital divide limits access in low-income regions.

- Data privacy and security concerns regarding sensitive student information.

- Resistance to change among traditional educational institutions and faculty.

- High costs associated with content localization and platform maintenance.

- Opportunities:

- Expansion of immersive learning (AR/VR) for specialized training and simulation.

- Growth of corporate L&D focused on AI and automation skill gaps.

- Development of accredited micro-credentialing pathways and blockchain certification.

- Untapped potential in emerging economies (Africa, LatAm) via mobile learning models.

- Impact Forces:

- Technological advancements (AI, 5G deployment) increasing platform sophistication.

- Regulatory compliance requirements dictating data handling and cross-border operations.

- Economic conditions influencing institutional and consumer expenditure on education.

Segmentation Analysis

The Edtech Startup Market is segmented based on Sector, Learning Model, Deployment Type, and Technology used, reflecting the diverse application landscape and varying user needs across the educational spectrum. Sector segmentation (K-12, Higher Education, Corporate) is critical as it defines content requirements, funding sources, and sales cycles; K-12 often requires curriculum alignment and parental marketing, while Corporate learning necessitates measurable ROI metrics for skill transfer. Learning Model segmentation distinguishes between purely online platforms, blended learning environments (hybrid), and self-paced versus instructor-led formats, influencing platform design and interactive features. This granular segmentation allows startups to highly tailor their offerings to specific user journeys and institutional budgetary constraints, ensuring product-market fit in diverse educational contexts.

Deployment type typically bifurcates the market into Cloud-based (SaaS) and On-premise solutions. Cloud-based deployment currently dominates due to its scalability, low entry barrier, and ease of maintenance, favored by most startups and individual consumers. However, On-premise solutions remain relevant for large governmental institutions or specific corporate clients with stringent regulatory requirements for data sovereignty and security, often requiring bespoke implementation. Furthermore, the segmentation by Technology adopted—such as AI/ML, AR/VR, and Blockchain—is increasingly vital for distinguishing competitive advantages, as technological sophistication directly correlates with personalization capabilities and content delivery innovation, attracting premium pricing models.

Understanding these segments is essential for strategic planning, allowing startups to concentrate resources on high-growth niches. For instance, a startup focusing on Higher Education might prioritize integrations with existing university LMS (Learning Management Systems) and accreditation bodies, while a Corporate Learning startup would focus on seamless integration with Human Resource Information Systems (HRIS) and verifiable skill metrics. Cross-segment analysis reveals opportunities, such as applying AI-driven adaptive testing (technology segment) to vocational training (sector segment) delivered primarily via mobile devices (deployment model), thereby defining precise target markets and optimizing resource allocation for maximum impact in a highly competitive digital ecosystem.

- Sector: K-12 (Primary & Secondary Education), Higher Education (University & College), Corporate Learning & Development (L&D), Vocational & Skill-Based Training

- Learning Model: Online Learning (Synchronous/Asynchronous), Blended Learning (Hybrid), Self-paced Learning, Instructor-Led Training (ILT)

- Deployment Type: Cloud-based (SaaS), On-premise

- Technology: Artificial Intelligence & Machine Learning (AI/ML), Augmented Reality & Virtual Reality (AR/VR), Gamification, Blockchain, Robotics

Value Chain Analysis For Edtech Startup Market

The Edtech value chain is fundamentally structured around four key stages: Content Creation (Upstream), Platform Development and Delivery (Midstream), Distribution and Sales, and End-User Adoption (Downstream). The upstream segment involves the creation and curation of instructional materials, which is increasingly outsourced to subject matter experts, instructional designers, and content production houses. With the rise of Generative AI, content creation is becoming automated, shifting the competitive focus from sheer volume of content to quality verification and pedagogical integrity. Key upstream suppliers include authors, curriculum specialists, and technological components providers (e.g., cloud computing services and specific AI model licenses necessary for core product functionality).

The midstream stage is dominated by the Edtech startups themselves, focusing on developing, hosting, and maintaining the core platform (LMS, adaptive engines, simulation software). This stage is capital-intensive, requiring specialized expertise in software engineering, data science, and user experience (UX) design. Efficiency in this stage is achieved through robust cloud infrastructure and scalable microservices architectures. Distribution channels represent a crucial bottleneck and opportunity. Direct channels involve startups selling subscriptions directly to consumers (B2C) or institutions/corporations (B2B). Indirect channels involve partnerships with telecommunication companies, regional channel partners, or system integrators who help deploy large-scale institutional contracts, especially in emerging markets where local presence is vital.

The downstream segment centers on user adoption, support, and feedback loops. Successful downstream operations require dedicated customer success teams and robust technical support to ensure high utilization rates and low churn. The feedback gathered downstream (usage data, completion rates, performance metrics) directly feeds back into the midstream platform development for continuous improvement and personalization—a critical cycle in the Edtech ecosystem. The reliance on indirect channels is growing, particularly in international markets, as third-party distributors possess the necessary regulatory knowledge and localized sales networks, significantly lowering the barrier to entry for global expansion efforts.

Edtech Startup Market Potential Customers

Potential customers for Edtech startups span three main demographic groups: individual learners, educational institutions (K-12 schools, universities), and corporate organizations. Individual learners, particularly those focused on professional development, test preparation, or language acquisition, represent the high-volume, transactional B2C segment. These end-users prioritize affordability, ease of access (mobile-first), highly personalized content, and demonstrable return on investment, often subscribing to platforms based on monthly or annual subscription models. The primary drivers for this group are career advancement and continuous personal upskilling in a rapidly changing labor market, making the perceived effectiveness and quality of content paramount in their purchasing decisions.

Educational institutions form the core institutional B2B segment, characterized by longer sales cycles, larger contract values, and requirements for deep integration with existing administrative and teaching infrastructure (LMS integration, compliance with academic standards). K-12 schools often purchase curriculum-aligned resources, administrative software, and intervention tools, while Higher Education institutions seek platforms that enhance student retention, facilitate research, and deliver accredited online degree programs. These buyers prioritize features such as security, scalability, ease of use for faculty, and evidence-based efficacy metrics proving improved student outcomes, often requiring pilot programs and extensive professional development training for successful deployment.

Corporate organizations and government entities constitute the Corporate Learning segment, focusing predominantly on specialized vocational training, compliance education, and strategic reskilling initiatives for their workforce. These customers require enterprise-grade platforms offering extensive customization, robust analytics tracking employee progress, and seamless integration with human resources systems. For this segment, the ability of the Edtech platform to directly address specific organizational skill gaps and demonstrate a clear link between training expenditure and enhanced organizational performance is the key determinant of procurement. The demand here is increasingly shifting towards platforms that offer certifications recognized within the industry, ensuring the training directly translates to marketable skills.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 250.8 Billion |

| Market Forecast in 2033 | USD 792.1 Billion |

| Growth Rate | 17.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Byju's, Coursera, Udacity, Duolingo, Chegg, Tencent, LinkedIn Learning (Microsoft), Age of Learning, Khan Academy, 2U, Pearson, Instructure, Articulate Global, New Oriental Education, TAL Education Group, Knewton, Pluralsight, Quizlet, GoGuardian, Udemy |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Edtech Startup Market Key Technology Landscape

The technology landscape for Edtech startups is currently defined by the maturity and integration of four core innovative pillars: Artificial Intelligence (AI) and Machine Learning (ML), Immersive Technologies (AR/VR), Data Analytics, and Cloud Computing infrastructure. AI/ML is arguably the most transformative, enabling advanced personalization, automated content recommendations, and sophisticated adaptive testing that dynamically adjusts to learner performance in real-time. Startups are heavily investing in proprietary ML models trained on vast educational datasets to create highly differentiated learning experiences, moving beyond simple content delivery systems toward true cognitive engagement platforms. This technological capability underpins the scalability and effectiveness of the next generation of Edtech products, particularly in tutoring and professional skill verification.

Immersive Technologies, specifically Augmented Reality (AR) and Virtual Reality (VR), are moving out of the experimental phase and into practical application, particularly in vocational training, higher education laboratories, and complex corporate simulations. AR allows for enhanced interaction with real-world objects using overlayed digital information (e.g., field maintenance guides), while VR offers fully simulated environments for high-stakes training (e.g., surgical procedures or flight simulation) without physical risk. While the hardware cost remains a constraint, falling prices and advancements in mobile VR (e.g., Meta Quest series) are rapidly accelerating adoption, particularly in areas where practical experience is paramount but physical access is limited or expensive. Gamification, often integrated via these immersive platforms, leverages motivational psychology to increase learner engagement and completion rates.

Furthermore, robust Data Analytics and seamless integration via Cloud Computing are foundational to modern Edtech. Cloud platforms (AWS, Azure, Google Cloud) provide the necessary scalability and resilience to handle massive concurrent user loads and process the enormous volumes of generated student data. Advanced analytics dashboards provide institutional clients and parents with actionable insights into student progression, curriculum efficacy, and teacher performance, enabling data-driven educational decisions. Blockchain technology is also emerging as a critical tool, not primarily for content delivery, but for securing academic records and verifying credentials, offering immutable proof of learning achievements that is universally recognized, thus enhancing the value proposition of digital micro-credentials.

Regional Highlights

Regional dynamics play a crucial role in shaping the Edtech Startup Market, reflecting disparities in digital maturity, regulatory environments, and educational priorities. North America (NA) remains the global epicenter for innovation and investment, characterized by high Average Revenue Per User (ARPU) and a mature ecosystem of VC funding. The market here focuses heavily on K-12 administrative software, specialized higher education tools, and advanced corporate L&D solutions, often leveraging sophisticated AI and personalized learning platforms. US startups tend to dominate in cutting-edge technology adoption, but face high competition and saturation in core curriculum areas, necessitating expansion into niche vocational training and cross-border delivery models to sustain exponential growth.

The Asia Pacific (APAC) region is the undisputed leader in terms of market volume and user acquisition, driven predominantly by China and India. This market is characterized by intense parental pressure for academic excellence and massive populations, fueling demand for consumer-focused tutoring and test preparation platforms (B2C), often adopting mobile-first, highly localized content. While China faces regulatory challenges regarding after-school tutoring (e.g., the 'Double Reduction' policy), the broader APAC market continues to thrive through skill-based platforms and large-scale government digitization initiatives in Southeast Asia. This region necessitates scalable, often low-cost business models to capture the vast, diverse user base.

Europe exhibits a fragmented but steadily growing market, driven by governmental emphasis on digital skills and harmonization of educational standards across the EU. European Edtech startups often excel in language learning, professional compliance training, and platforms that strictly adhere to stringent data protection regulations, such as GDPR. Investment is solid but generally more cautious than in NA, favoring solutions that can be easily integrated into existing public education systems. Latin America (LATAM) and the Middle East & Africa (MEA) represent significant emerging markets. Growth in these regions is spurred by increasing mobile connectivity, a young demographic, and the need to rapidly address educational access gaps through affordable, scalable solutions. Challenges remain concerning infrastructure reliability and payment processing complexity, pushing startups to develop innovative, localized partnerships and payment structures.

- North America (NA): Leading in venture capital funding, AI integration, and B2B corporate L&D solutions. Focus on adaptive learning and administrative efficiency tools for K-12 and Higher Education.

- Asia Pacific (APAC): Highest volume and growth rate, dominated by B2C tutoring and test preparation (India, Southeast Asia). Emphasis on mobile-first deployment and localized content delivery models due to vast population density.

- Europe: Strong focus on regulatory compliance (GDPR), language learning, and integrating digital tools into public sector education systems. Market growth driven by governmental digital transformation mandates.

- Latin America (LATAM): High potential market driven by rapid mobile internet penetration and addressing educational equity gaps. Requires low-cost, scalable solutions and strategic partnerships with telecom providers.

- Middle East & Africa (MEA): Emerging hotspot with significant government investment in educational modernization. Demand for vocational training and basic digital literacy solutions, often bypassing traditional infrastructure directly to mobile platforms.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Edtech Startup Market.- Byju's

- Coursera

- Udacity

- Duolingo

- Chegg

- Tencent (WeChat Education)

- LinkedIn Learning (Microsoft)

- Age of Learning

- Khan Academy

- 2U

- Pearson (Digital Initiatives)

- Instructure (Canvas)

- Articulate Global

- New Oriental Education

- TAL Education Group

- Knewton

- Pluralsight

- Quizlet

- GoGuardian

- Udemy

Frequently Asked Questions

Analyze common user questions about the Edtech Startup market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth rate (CAGR) for the Edtech Startup Market?

The Edtech Startup Market is projected to exhibit a robust Compound Annual Growth Rate (CAGR) of 17.5% between 2026 and 2033, driven primarily by technological integration and increasing global demand for upskilling and personalized learning solutions.

How is Artificial Intelligence (AI) fundamentally changing Edtech platforms?

AI is fundamentally transforming Edtech by enabling hyper-personalized adaptive learning paths, automating complex grading and feedback processes, and allowing platforms to scale high-quality content generation using sophisticated generative models, significantly improving learning outcomes and operational efficiency.

Which geographical region leads the Edtech market in terms of user volume?

The Asia Pacific (APAC) region, particularly driven by high population density and intense focus on academic achievement in countries like India, leads the global Edtech market in terms of sheer user volume and rapid adoption of mobile-first learning solutions.

What are the primary restraints affecting the expansion of the Edtech market?

The primary restraints include the persistent global digital divide (unequal access to internet and devices), concerns regarding student data privacy and security compliance, and organizational resistance to adopting new technologies within traditional academic institutions.

What role does micro-credentialing play in the future of corporate Edtech?

Micro-credentialing is becoming vital in corporate Edtech as it offers verifiable, skill-specific certifications through blockchain technology. This facilitates rapid workforce upskilling and provides employers with clear, validated proof of competency, addressing the critical skills gap efficiently.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager