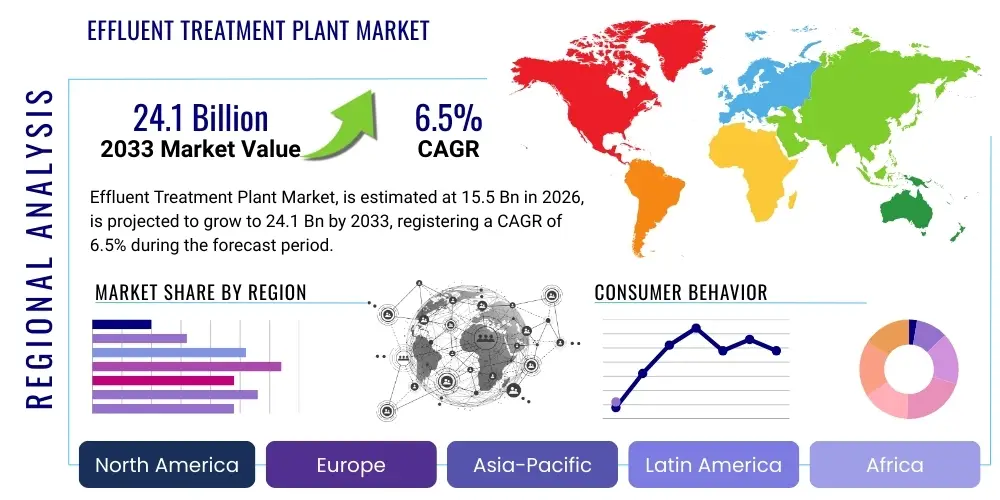

Effluent Treatment Plant Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443291 | Date : Feb, 2026 | Pages : 253 | Region : Global | Publisher : MRU

Effluent Treatment Plant Market Size

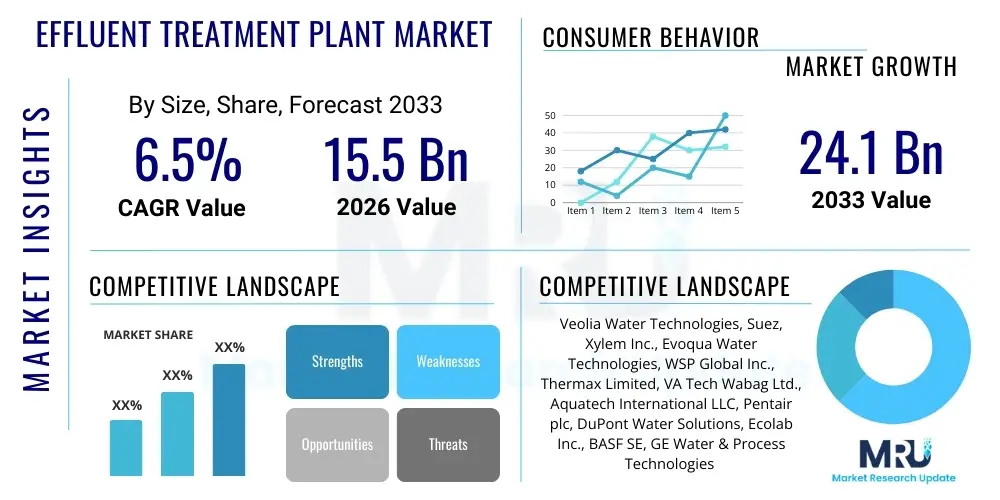

The Effluent Treatment Plant Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 15.5 Billion in 2026 and is projected to reach USD 24.1 Billion by the end of the forecast period in 2033.

Effluent Treatment Plant Market introduction

The Effluent Treatment Plant (ETP) Market encompasses the comprehensive suite of engineering services, physical infrastructure, and chemical processes dedicated to purifying industrial wastewater prior to environmental discharge or internal reuse. These specialized facilities are essential for managing the complex and often hazardous mixture of pollutants generated across various manufacturing processes, including high concentrations of Chemical Oxygen Demand (COD), Biological Oxygen Demand (BOD), Total Suspended Solids (TSS), refractory organic compounds, heavy metals such as cadmium and lead, and emerging contaminants like microplastics and pharmaceutical residues. The fundamental necessity for ETPs stems from the imperative to protect public health and ecological systems from irreversible damage caused by untreated industrial discharge, making them a critical component of modern industrial environmental management protocols globally. The design complexity of an ETP is directly proportional to the variability and toxicity of the influent stream, requiring robust solutions ranging from basic neutralization and sedimentation to highly advanced membrane separation and thermal treatment systems.

The operational scope of the ETP market spans various crucial phases, beginning with detailed wastewater characterization, process selection, infrastructure design and construction (often handled by specialized EPC firms), and continuing through long-term operational and maintenance (O&M) contracts. Major applications traverse high-throughput, water-intensive sectors such as chemical manufacturing, where the need to handle aggressive, toxic solvents is paramount; the pharmaceutical industry, focused on mitigating Active Pharmaceutical Ingredients (APIs) in discharge; the textile industry, necessitated by the management of complex, persistent dyes and high salinity; and the food and beverage industry, which generates high organic loads. The demand for productized solutions, such as skid-mounted and modular ETP units, is rising, offering faster deployment times and scalability for medium-sized enterprises, thus broadening market accessibility beyond large industrial conglomerates. The successful deployment of an ETP is not only measured by compliance with discharge parameters but also by the system's resilience to fluctuating loads and its long-term cost efficiency in energy and chemical consumption.

Key driving factors underpinning the sustained market expansion are intrinsically linked to global regulatory rigor and mounting economic pressure related to water scarcity. Governmental bodies worldwide, including the United States Environmental Protection Agency (U.S. EPA), the European Environment Agency (EEA), and India's Central Pollution Control Board (CPCB), are continuously updating and tightening discharge norms, effectively mandating capital investment in more sophisticated, reliable treatment technologies. Furthermore, the economic viability of water reuse is significantly improving, particularly in arid regions and locations with high water tariffs. The ability of modern ETPs to recover valuable byproducts, such as concentrated salts or high-quality process water, transforms the initial compliance cost into a justifiable return on investment (ROI) based on resource management and operational resilience. This shift from a purely cost center perspective to a resource recovery utility is profoundly accelerating market adoption of advanced treatment solutions, including highly efficient Zero Liquid Discharge (ZLD) systems and integrated water management platforms. The global imperative for corporate ESG reporting further reinforces the demand for demonstrated environmental stewardship through advanced wastewater management practices.

Effluent Treatment Plant Market Executive Summary

The Effluent Treatment Plant market exhibits sustained growth, characterized by significant technological acceleration focused on digitalization and circular economy adoption. Major business trends include increased market consolidation among leading multinational water technology firms through strategic mergers and acquisitions (M&A) aimed at integrating niche technological capabilities, particularly in sludge treatment and advanced membrane filtration. Competitive strategies are increasingly centered on offering complete, integrated service packages, spanning from initial compliance consulting and plant design to outsourced operational management (DBO contracts), which shifts the risk profile and ensures performance guarantees for the end-user. The rising deployment of smart infrastructure, leveraging IoT sensors and cloud-based analytics, is driving the market towards prescriptive maintenance models and autonomous operational adjustments, establishing a new baseline for efficiency standards across the sector. Innovation in sustainable chemistry and bio-engineering for enhanced biological treatment systems is also a core competitive area.

Regionally, Asia Pacific remains the central engine of market volume expansion, primarily driven by rapid urbanization and the necessity to manage vast quantities of industrial wastewater generated by expanding manufacturing sectors. While APAC contributes significantly to new build projects, North America and Europe lead in the adoption of premium, high-efficiency technologies, such as Membrane Bioreactors (MBR) and advanced oxidation processes (AOPs), necessary for meeting exceptionally low nutrient and contaminant discharge limits. Regulatory harmonization across the European Union compels consistent investment in advanced tertiary treatment, particularly among industries like agrochemicals and specialty pharmaceuticals, driven by directives promoting net environmental gain. The Middle East and Africa (MEA) region focuses uniquely on scarcity-driven solutions, with petrochemical and heavy industrial players investing heavily in bespoke ZLD systems tailored for extremely high saline feedwater conditions, often utilizing costly but reliable thermal separation techniques due to the critical mandate for water independence and resilience.

Analysis of market segments reveals that the Advanced Treatment technology segment, encompassing Reverse Osmosis (RO), Ultrafiltration (UF), and Zero Liquid Discharge (ZLD) solutions, is poised for the highest growth trajectory, reflecting the global mandate for water reuse and resource recovery. Within end-user categories, the Chemical, Pharmaceutical, and Food & Beverage industries are expected to demonstrate robust spending, driven by complex waste streams and the need for hygiene standards, respectively, often requiring specialized chemical and biological interfaces. Furthermore, there is a pronounced trend toward modular ETP designs across all segments, addressing the need for rapid deployment and flexibility in an increasingly uncertain operational environment, facilitating penetration into the distributed small and medium enterprise sector. The shift toward higher capacity plants (Above 1,000 CMD) aligns with the global scaling up of production facilities, requiring providers to deliver reliable, robust, and digitally managed systems capable of ensuring continuous, high-volume compliance and maximum resource utilization efficiency.

AI Impact Analysis on Effluent Treatment Plant Market

User inquiries concerning Artificial Intelligence (AI) in the ETP sector overwhelmingly highlight interest in predictive control systems and data-driven process stability. Common questions center on how Neural Networks (NNs) or Fuzzy Logic Controllers (FLCs) can handle the inherent stochastic nature of industrial wastewater—where inflow composition, flow rate, and temperature can fluctuate wildly—to maintain optimal biological and chemical conditions. Users are keen to understand the Return on Investment (ROI) derived from AI implementation, specifically quantifying the savings from reduced chemical consumption (e.g., precise coagulant dosing) and diminished energy expenditure (e.g., optimized aeration in activated sludge tanks), which are often the largest contributors to OPEX. Concerns often revolve around the initial capital expenditure required for sensor deployment, the necessary cybersecurity infrastructure to protect sensitive operational data, and the availability of specialized operational personnel capable of managing and maintaining sophisticated AI models. The general consensus views AI as the definitive technology capable of bridging the gap between mandatory regulatory compliance and economically sustainable ETP operation by transforming raw data into actionable, automated intelligence.

The profound operational impact of AI integration is realized through enhanced forecasting and automated process optimization. AI models utilize complex algorithms, including deep learning techniques and reinforcement learning, to correlate multiple input variables—such as flow rates, pH, turbidity, Oxidation-Reduction Potential (ORP), Dissolved Oxygen (DO), and even weather predictions—to generate highly accurate forecasts of effluent quality or system load in the immediate future. This predictive capability allows the system to proactively adjust control mechanisms, such as adjusting the speed of aeration blowers in a biological treatment stage hours before a predicted organic load spike arrives, thereby stabilizing the biological ecosystem and preventing system failure. Advanced AI applications extend to complex optimization problems, such as maximizing membrane flux while minimizing fouling risk, a critical factor in RO and MBR systems. Without AI, these adjustments are typically reactive and conservative, resulting in inefficient use of energy, excessive chemical consumption, or, critically, momentary non-compliant effluent discharge events, whereas AI enables a continuous state of optimum efficiency.

While the benefits are clear, widespread adoption is currently hindered by several practical constraints. The effectiveness of AI is entirely dependent on the quality and volume of sensor data; legacy ETP infrastructure often lacks the necessary dense network of reliable, calibrated IoT sensors, necessitating significant upgrade costs. Furthermore, the development and training of specialized machine learning models, particularly those calibrated for site-specific wastewater characteristics, require sophisticated domain expertise that many water utilities and industrial operators do not possess internally, necessitating reliance on specialized third-party software and service providers. Despite these barriers, competitive pressures and tightening environmental legislation are rapidly accelerating AI uptake, particularly among large multinational ETP vendors who integrate these intelligent control systems as proprietary features. Future trends indicate a move toward easily deployable, cloud-based, subscription AI services that democratize these advanced optimization capabilities for smaller industrial facilities, establishing AI-driven optimization as standard practice across the market within the forecast period and fundamentally enhancing the reliability and sustainability profile of the water sector.

- Predictive Maintenance: AI algorithms analyze vibration, temperature, and performance data from pumps, blowers, and mixers to forecast equipment failure, minimizing unplanned downtime and extending asset life.

- Chemical Optimization: Machine learning models optimize chemical dosing (coagulants, polymers, pH modifiers) in real-time based on fluctuating inflow parameters, reducing consumption by up to 20% and material costs associated with treatment reagents.

- Energy Efficiency: AI controls energy-intensive processes, such as aeration blower speeds and high-volume pump operations, based on immediate process demand (e.g., precise DO control), achieving significant savings in overall electricity usage.

- Process Control Automation: Real-time decision-making systems automatically adjust critical treatment parameters (pH, flow, reaction times, sludge recirculation rates) to maintain optimal effluent quality and ensure continuous regulatory compliance under variable load conditions.

- Anomaly Detection: Rapid identification and alerting for subtle process upsets, unusual sensor readings, or unauthorized discharges via pattern recognition against expected operational norms, mitigating environmental risk.

- Sludge Management Optimization: Prediction of sludge volume and characteristics to optimize dewatering, digestion, and disposal processes, minimizing costly residual waste handling and maximizing biogas yield where applicable.

- Compliance Forecasting: AI models forecast potential short-term breaches of discharge permits, allowing operators to intervene proactively and avoid significant financial penalties and regulatory scrutiny.

DRO & Impact Forces Of Effluent Treatment Plant Market

The ETP market is strongly propelled by global Drivers rooted in policy and resource necessity, moderated by significant Restraints related to cost and technical complexity, and punctuated by clear Opportunities driven by innovation. The overarching Driver is the global tightening of environmental regulations, most notably the implementation of strict limits on nutrient discharge (nitrogen and phosphorus), heavy metals, and Total Dissolved Solids (TDS), often encapsulated in regional directives like the European Union's Industrial Emissions Directive (IED). This regulatory environment transforms discretionary environmental protection spending into mandatory compliance expenditures. Concurrently, the increasing scarcity of potable water and the associated rising cost of fresh water supply compel industries, especially those in arid or drought-prone regions, to invest in high-recovery ETPs, making water reuse an economic necessity rather than just an environmental ideal. This confluence of regulatory push and resource pull creates a robust foundation for market growth, ensuring consistent demand for advanced treatment solutions across all industrial sectors.

However, the market faces considerable Restraints that slow the pace of adoption, particularly among smaller and medium enterprises (SMEs). The primary constraint is the massive upfront capital investment required for constructing and installing advanced ETPs, such as ZLD systems, which demand specialized civil works and high-cost, proprietary components like sophisticated membrane arrays and thermal evaporators. Furthermore, the operational expenditure (OPEX) remains persistently high, driven chiefly by energy consumption (pumping, aeration, heating for evaporation) and the recurring cost of specialized chemicals, membranes, and filters that require frequent replacement. A secondary, but growing restraint is the critical shortage of highly skilled technical personnel needed to design, operate, and maintain these complex, digitally integrated water treatment facilities, particularly in rapidly industrializing emerging markets where specific chemical engineering expertise is lacking. These high entry and operational barriers challenge widespread adoption, necessitating innovative financing models and simplified, standardized, modular solutions.

The market Opportunities are fundamentally concentrated in technological innovation and new service models. The most significant opportunity lies in the rapid adoption of Zero Liquid Discharge (ZLD) and Near-ZLD technologies, transitioning from niche application in power plants to broad implementation across chemical and textile manufacturing, driven by economic returns from reclaimed resources (salts, purified water). Furthermore, the integration of digital technologies, encompassing IoT, AI, and Big Data analytics, offers a crucial opportunity to significantly mitigate the core restraint of high OPEX by optimizing energy use and predictive maintenance, enabling verifiable cost reduction. This shift enables solution providers to offer performance-based contracts, guaranteeing discharge quality and efficiency outcomes. The pursuit of sustainable sludge management, moving away from high-cost landfill disposal toward resource recovery (e.g., energy generation via anaerobic digestion or phosphorus recovery), also presents substantial revenue potential and regulatory compliance advantages, further reinforcing market dynamics toward circular economy solutions.

Segmentation Analysis

The Effluent Treatment Plant market is fundamentally segmented to reflect the diverse operational needs and technological requirements across the industrial landscape. Segmentation by Technology is essential as the choice of treatment process—be it physical separation, chemical precipitation, biological digestion, or advanced membrane techniques—is critically dictated by the specific characteristics and pollutant profile (BOD, COD, heavy metals) of the industrial effluent, necessitating tailored solutions. Technology preferences also vary by regulatory region, with North America favoring digital integration and advanced oxidation, while APAC prioritizes robust, high-throughput biological and primary chemical treatment systems to handle large volumes. Segmenting by End-User Industry highlights critical differences in waste stream composition; for example, effluents from the food industry are high in biodegradable organics but low in toxicity, contrasting sharply with the refractory, high-saline waste from the petrochemical sector. This divergence mandates specialized vendor expertise and equipment customization for each industry vertical.

Segmentation by Capacity addresses the economic and logistical differences between large, centralized industrial parks or major refineries and smaller, decentralized manufacturing units. Large capacity plants (over 1,000 CMD) require highly customized, often site-built infrastructure demanding extensive EPC capabilities and complex O&M protocols, typically serving Tier 1 industrial clients with high flow stability. Conversely, smaller capacity requirements are increasingly met by standardized, skid-mounted, or modular solutions that offer rapid deployment, lower initial civil costs, and ease of relocation, broadening the market access for small and medium enterprises (SMEs). This modular approach also mitigates some of the specialized labor risks associated with bespoke large-scale construction. The granularity offered by this structured segmentation allows market participants to precisely tailor their product offerings, marketing strategies, and R&D investments toward the most profitable and fastest-growing niches within the global ETP ecosystem, focusing on either high-margin advanced technologies or high-volume, standardized systems.

- By Technology:

- Physical Treatment (e.g., Screening, Coarse Filtration, Sedimentation, Flotation (DAF), Oil-Water Separation)

- Chemical Treatment (e.g., Coagulation, Flocculation, Neutralization, Chemical Precipitation, Dechlorination)

- Biological Treatment (e.g., Activated Sludge Process (ASP), Moving Bed Biofilm Reactor (MBBR), Membrane Bioreactor (MBR), Sequencing Batch Reactor (SBR), Anaerobic Digestion)

- Advanced Treatment (e.g., Reverse Osmosis (RO), Ultrafiltration (UF), Nanofiltration (NF), Electrodeionization (EDI), Advanced Oxidation Processes (AOP), Zero Liquid Discharge (ZLD))

- By End-User Industry:

- Chemical and Petrochemical (High toxicity, complex organic compounds, high salinity)

- Pharmaceutical and Healthcare (APIs, high BOD/COD, solvent traces, stringent disinfection needs)

- Pulp and Paper (High TSS, color, lignin content, and fiber recovery potential)

- Food and Beverage (High organic load, fats, oils, and grease (FOG), requiring robust biological and separation techniques)

- Textile and Tannery (High color, high salinity, heavy metals, complex dye molecules)

- Automotive and Metal Finishing (Heavy metals, cyanides, oil emulsions, necessitating chemical precipitation)

- Power Generation (Cooling tower blowdown, high TDS, focused on ZLD and high-purity water recycling)

- By Capacity:

- Small (Up to 100 CMD)

- Medium (101 to 1,000 CMD)

- Large (Above 1,000 CMD)

Value Chain Analysis For Effluent Treatment Plant Market

The ETP value chain commences with the Upstream Segment, focusing on the procurement of high-specification raw materials and the manufacturing of proprietary core components. This stage includes sourcing specialized chemicals like high-molecular-weight polymers, inorganic coagulants (e.g., poly-aluminum chloride), and specialized media for filtration beds (e.g., activated carbon, ion exchange resin). Crucially, the manufacturing of high-tech components, such as durable membrane elements (RO, UF modules), submersible pumps designed for corrosive environments, high-efficiency blowers, and sophisticated digital control panels, forms the technological bedrock of the ETP solution. Key suppliers in this upstream market often maintain stringent quality controls and proprietary intellectual property, dictating cost and performance limits further down the chain. The shift toward higher-pressure, fouling-resistant membranes and highly energy-efficient pumping and aeration systems is currently driving innovation at this foundational level, demanding significant R&D investment from component manufacturers.

The Midstream Segment is dominated by Engineering, Procurement, and Construction (EPC) firms, system integrators, and specialized ETP solution providers. This stage involves detailed process design, customization of treatment trains based on comprehensive effluent analysis, fabrication of plant components (often utilizing modular approaches for speed and quality control), and on-site installation and commissioning. Success in the midstream relies heavily on technical project management expertise, adherence to stringent local and international construction standards, and the ability to integrate diverse, often proprietary technologies seamlessly—for instance, combining specialized anaerobic reactors with subsequent aerobic treatment and final membrane filtration. The selection of the appropriate treatment sequence and the optimization of hydraulic and chemical sizing are critical activities that determine the capital expenditure (CAPEX) and the long-term operational viability of the ETP facility. Increasingly, midstream players are adopting digital twin modeling during design to predict and optimize long-term operational performance before physical construction begins, reducing costly late-stage modifications.

The Downstream Segment covers the Operation, Maintenance (O&M), and Aftermarket Services, which generate substantial, stable recurring revenue for vendors. This stage includes providing scheduled and unscheduled maintenance, managing the timely supply of consumables (chemicals, media, membranes), and performing necessary retrofits or capacity upgrades driven by regulatory changes or production increases. Distribution channels are typically bifurcated: Direct Channels involve major global ETP solution providers contracting directly with large industrial clients, often providing full-scope Design-Build-Operate (DBO) or Build-Own-Operate-Transfer (BOOT) contracts, particularly for complex, mission-critical ZLD installations. Indirect Channels involve leveraging regional distributors, independent consulting engineers, and local service partners who manage sales, installation support, and routine maintenance for smaller, geographically dispersed facilities, acting as essential localized support networks. The rising importance of predictive, digitally managed O&M contracts—enabled by IoT monitoring and AI analytics—is redefining downstream service delivery, focusing on guaranteed operational uptime and optimized effluent quality compliance, shifting performance risk from the customer back to the specialized service provider.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 15.5 Billion |

| Market Forecast in 2033 | USD 24.1 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Veolia Water Technologies, Suez, Xylem Inc., Evoqua Water Technologies, WSP Global Inc., Thermax Limited, VA Tech Wabag Ltd., Aquatech International LLC, Pentair plc, DuPont Water Solutions, Ecolab Inc., BASF SE, GE Water & Process Technologies (SUEZ heritage), Dow Inc., Trojan Technologies, Lenntech B.V., Safbon Water Technology Co., Ltd., Alfa Laval AB, 3M Company, Hitachi Zosen Corporation, Ovivo Inc., Hydro International. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Effluent Treatment Plant Market Potential Customers

The principal customer base for Effluent Treatment Plants comprises large multinational corporations and national industrial enterprises operating in sectors defined by high-volume, continuous process operations and the generation of highly contaminated wastewater. These organizations, which include integrated chemical complexes, major pharmaceutical manufacturers, large textile mills, and utility-scale power generation facilities, are not merely seeking compliance solutions but are strategically investing in ETPs as essential infrastructure for operational continuity and competitive advantage. Their purchasing decisions are driven by sophisticated risk analysis concerning regulatory fines, reputational damage related to environmental incidents (ESG compliance), and the imperative to secure future water supplies through internal recycling efforts. These large-scale customers typically demand highly reliable, large-capacity, customized ETP solutions, often preferring comprehensive Design-Build-Operate (DBO) or Build-Own-Operate-Transfer (BOOT) contracts that guarantee performance metrics and minimize internal management burden, reflecting a preference for risk transfer to specialist providers.

Specifically, customers in the Chemical and Petrochemical sectors represent high-value targets due to the extreme complexity of their effluent, which often contains refractory compounds, volatile organics, and high salinity, necessitating specialized biological treatment followed by advanced membrane separation or thermal treatment. For instance, a major petrochemical refinery requires complex oil-water separation alongside technologies capable of handling highly corrosive waste streams and achieving near-ZLD mandates for cooling tower blowdown to preserve scarce resources. In contrast, Pharmaceutical customers, while generating lower flow volumes, demand technologies capable of neutralizing Active Pharmaceutical Ingredients (APIs) and persistent contaminants that require specific Advanced Oxidation Processes (AOPs) and robust disinfection to ensure discharge safety into sensitive aquatic environments, thereby driving demand for high-cost, specialized tertiary treatment processes where precision is paramount.

Furthermore, the Food and Beverage (F&B) industry is a rapidly expanding customer segment, driven by global production increases and local environmental pressure. Although their effluents are primarily high in easily biodegradable organic load (BOD/COD), they often contain high concentrations of fats, oils, and grease (FOG), necessitating rigorous pretreatment via Dissolved Air Flotation (DAF) before robust anaerobic or aerobic biological treatment. F&B companies are increasingly focusing on water reuse in non-contact applications like cleaning or cooling, driving demand for Ultrafiltration (UF) systems and non-chemical disinfection solutions. In emerging markets, governmental and municipal water authorities also represent critical customers, investing heavily in centralized industrial wastewater treatment facilities to regulate and manage the collective discharge of numerous smaller industrial park tenants. These municipal customers prioritize scalable, robust, and cost-effective biological solutions like MBBRs or conventional activated sludge, often financed through public-private partnership models to distribute the financial and operational responsibility.

Effluent Treatment Plant Market Key Technology Landscape

The contemporary ETP technology landscape is defined by a hybrid approach, moving away from relying solely on sequential conventional methods toward integrated, high-performance systems centered on resource recovery and minimal discharge. Membrane technology is arguably the most transformative area, with Reverse Osmosis (RO) leading the charge for desalination and achieving high-purity water suitable for boiler feed or sensitive manufacturing processes. However, membrane fouling remains a perennial challenge, driving parallel innovation in pre-treatment (e.g., electrocoagulation and flocculation optimization) and the development of robust, self-cleaning membrane materials, often utilizing ceramic or specialized polymeric compositions. Membrane Bioreactors (MBR) combine biological treatment with membrane separation in a single step, offering superior effluent quality and a significantly reduced physical footprint compared to traditional Activated Sludge Processes (ASP), making them highly attractive for space-constrained industrial sites and urban areas with escalating land costs.

A second crucial technological vector is the rapid development and implementation of Zero Liquid Discharge (ZLD) systems. These systems are highly complex, often involving a multi-stage process flow: advanced primary treatment, chemical softening (to prevent scaling), concentrated membrane separation (to maximize brine concentration), and finally, thermal separation (evaporation and crystallization via technologies like Multi-Effect Evaporators or crystallizers) to recover distilled water and produce saleable or landfill-safe solid salts. While ZLD ensures complete water recovery, its adoption is constrained by the substantial capital expenditure and extremely high energy requirements for the thermal stage. Consequently, Near-ZLD technologies, which target 80% to 95% recovery using more energy-efficient mechanical processes like specialized brine concentrators or osmotic technologies, are gaining market acceptance as a cost-effective intermediate solution, particularly in non-critical reuse applications where slight liquid discharge is permissible.

Finally, the convergence of physical infrastructure with digital technologies—termed Water 4.0—is fundamentally altering ETP operation. The proliferation of affordable, high-fidelity IoT sensors (measuring parameters like TOC, heavy metals, and acute toxicity in real-time) provides the massive data streams necessary for the functionality of advanced software control systems. These systems leverage AI to implement sophisticated Predictive Maintenance (PM) schedules, optimizing the replacement of expensive assets like pumps and membranes before catastrophic failure, thereby extending asset life and minimizing O&M costs. Furthermore, Advanced Oxidation Processes (AOPs), utilizing powerful oxidants like ozone (O3), hydrogen peroxide (H2O2) activated by UV light, or electrochemical methods, are becoming indispensable for treating emerging contaminants (ECs) and persistent organic pollutants (POPs) that are not biodegradable, ensuring compliance with extremely strict chemical discharge standards and opening pathways for new patented treatment formulations and sophisticated engineering service contracts.

Regional Highlights

- Asia Pacific (APAC): APAC is characterized by explosive market demand, driven by massive infrastructure investments in China, India, and emerging Southeast Asian nations such as Vietnam and Indonesia. The focus is dual: tackling legacy pollution through vigorous enforcement of stricter environmental laws (e.g., river action plans and CPCB mandates) and deploying large-scale treatment facilities to support new, planned industrial zones. The market is highly price-sensitive but sees rapid adoption of advanced, high-volume technologies like MBR and robust primary chemical treatment systems required by the high density and volume of manufacturing hubs. China remains the largest single market, heavily investing in centralized industrial wastewater treatment parks to manage decentralized waste sources effectively and promote regional water quality targets.

- North America: This market is mature, highly regulated, and focused on modernization, resilience, and addressing micropollutants. Investments are directed toward upgrading aging municipal and industrial ETPs with high-efficiency membrane technologies (RO/UF) for non-potable and future potable reuse applications, alongside advanced oxidation (AOP) systems to manage pharmaceuticals, personal care products, and emerging contaminants like per- and polyfluoroalkyl substances (PFAS). Technological adoption is high, driven by federal and state regulatory initiatives promoting water conservation and the rapid deployment of digital twins and AI-based predictive analytics for enhanced operational reliability and optimized compliance reporting efficiency.

- Europe: Europe is the global pacesetter for sustainability and circular economy implementation, driving strong demand for resource recovery technologies, particularly systems that recover high-purity water, energy (biogas from sludge), and valuable materials (phosphates, metals). The Industrial Emissions Directive (IED) mandates the use of Best Available Techniques (BAT), ensuring continuous technological upgrades, including advanced biological nutrient removal and highly efficient sludge processing and dewatering. Market activity is also focused on decentralized, modular systems designed to reduce site footprint and minimize the carbon emissions associated with the transportation and treatment of industrial wastewater, aligning with EU Green Deal objectives.

- Latin America (LATAM): Market expansion in LATAM is closely linked to resource extraction industries (mining, oil & gas) and large-scale agricultural processing. Brazil, Mexico, and Chile are the dominant markets, where regulatory enforcement is increasing, albeit inconsistently across sub-regions. The demand is often for robust, low-maintenance physical and biological treatment systems capable of handling variable flow rates and complex mineral waste. Investment is increasingly influenced by foreign direct investment and multilateral bank funding requiring stringent environmental safeguards, pushing regional operators toward globally recognized ETP standards and higher levels of treatment infrastructure quality assurance.

- Middle East and Africa (MEA): The Middle East is a necessity-driven market, compelled by critically low natural water reserves to invest heavily in recycling and reuse, particularly in the UAE, Saudi Arabia, and Qatar. Key customers are large utilities and state-owned enterprises in the petrochemical and oil & gas sectors, demanding complex, tailor-made ZLD systems to treat high-salinity brines and ensure maximum water recovery rates (often exceeding 98%). Africa’s market is nascent, focused primarily on sanitation and basic industrial compliance, with growth concentrated in economic hubs in South Africa and Nigeria, driven largely by international industrial development projects that import high-standard ETP technology.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Effluent Treatment Plant Market.- Veolia Water Technologies

- Suez

- Xylem Inc.

- Evoqua Water Technologies

- WSP Global Inc.

- Thermax Limited

- VA Tech Wabag Ltd.

- Aquatech International LLC

- Pentair plc

- DuPont Water Solutions

- Ecolab Inc.

- BASF SE

- GE Water & Process Technologies (SUEZ heritage)

- Dow Inc.

- Trojan Technologies

- Lenntech B.V.

- Safbon Water Technology Co., Ltd.

- Alfa Laval AB

- 3M Company

- Hitachi Zosen Corporation

- Ovivo Inc.

- Hydro International

Frequently Asked Questions

Analyze common user questions about the Effluent Treatment Plant market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driver for investment in Effluent Treatment Plants (ETPs)?

The primary driver is the necessity to comply with increasingly stringent global environmental regulations and discharge limits set by governmental and regional bodies, such as the U.S. EPA and the European Union, coupled with internal corporate ESG goals focused on water stewardship and minimizing operational risks.

Which industrial sector is the largest end-user of advanced ETP technologies?

The Chemical and Petrochemical sector, alongside the Pharmaceutical industry, are the largest consumers of advanced ETP technologies due to the complexity, variability, and toxicity of their waste streams, requiring specialized tertiary treatments like membrane filtration and Advanced Oxidation Processes (AOPs) for compliance.

What is Zero Liquid Discharge (ZLD) and why is it growing in importance?

ZLD is a highly advanced process that treats wastewater entirely, recovering nearly 95-100% of the water for reuse while producing solid waste only. It is crucial for regions facing extreme water scarcity and for industries mandated to eliminate liquid discharge into public waterways, offering significant resource recovery value and operational resilience.

How is AI impacting the operational efficiency of ETPs?

AI integrates real-time sensor data and machine learning to optimize critical operational parameters such as chemical dosing, aeration rates, and process flow. This leads to substantial reductions in energy consumption, minimized chemical wastage, and predictive maintenance capabilities, boosting overall efficiency and reliability, transforming ETPs into smart utilities.

Which geographical region exhibits the fastest growth potential for ETP deployment?

The Asia Pacific (APAC) region, specifically emerging economies like India and China, demonstrates the fastest growth potential due to rapid industrialization, massive infrastructure development, and the urgent need to address severe historical water pollution issues through rigorous regulatory enforcement and new capacity build-out, driving high-volume demand.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager