Elastic Narrow Fabric Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441770 | Date : Feb, 2026 | Pages : 253 | Region : Global | Publisher : MRU

Elastic Narrow Fabric Market Size

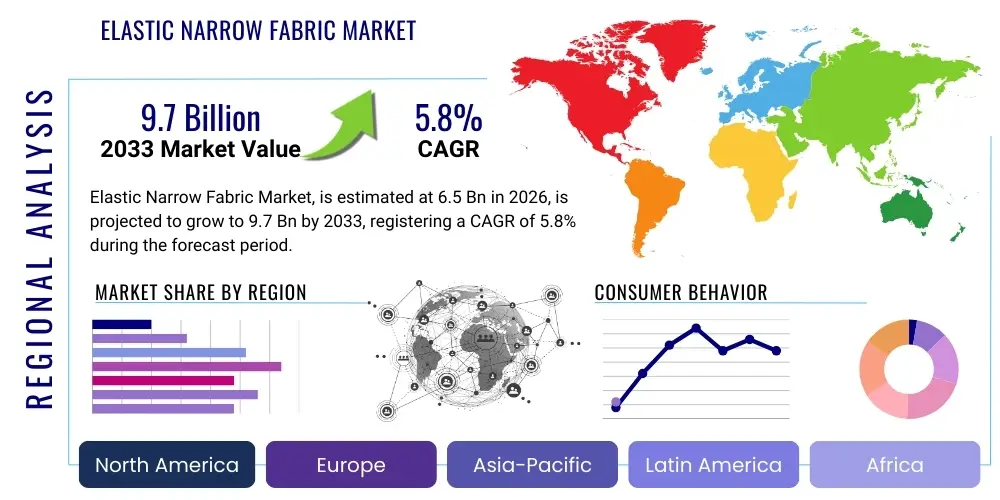

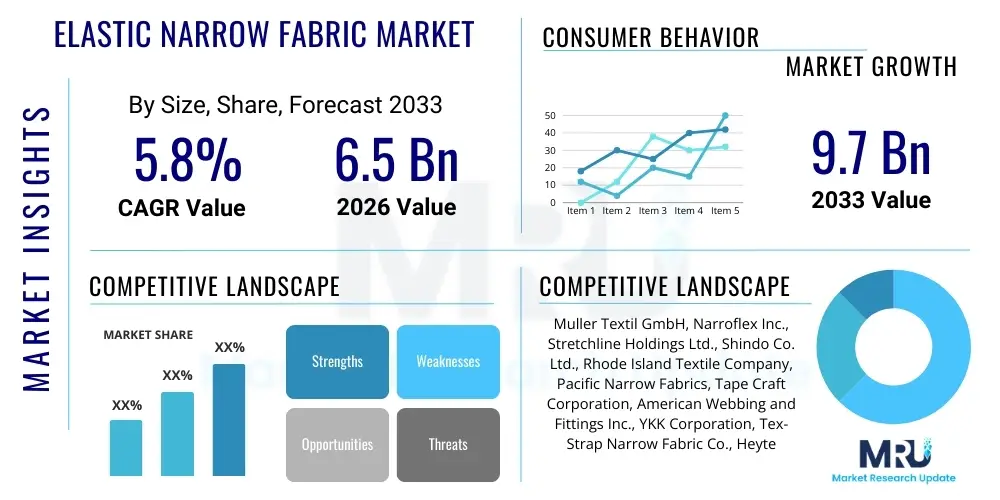

The Elastic Narrow Fabric Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 6.5 Billion in 2026 and is projected to reach USD 9.7 Billion by the end of the forecast period in 2033. This consistent expansion is driven primarily by the escalating demand from the apparel industry, particularly in activewear and innerwear, which rely heavily on high-performance elastic materials for comfort and durability. Furthermore, the increasing application of technical narrow fabrics in automotive and medical sectors for specialized functional requirements contributes significantly to market valuation growth, cementing the narrow fabric segment as a critical component in the modern textile supply chain.

Elastic Narrow Fabric Market introduction

The Elastic Narrow Fabric Market encompasses the production and distribution of stretchable woven, knitted, or braided textiles that are typically 12 inches (30 centimeters) or less in width. These fabrics are engineered to provide stretch, recovery, and reinforcement, making them indispensable components in a multitude of consumer and industrial products. Key products include elastic tapes, webbing, straps, drawcords, and binding elastics, utilizing raw materials such as polyester, nylon, and natural rubber or spandex (elastane) cores to achieve the required elasticity and strength profiles. The manufacturing processes leverage advanced machinery like needle looms and braiding machines to ensure precise tension control and consistent quality required for high-performance applications. These technical textiles form the backbone of functional design across various end-use sectors.

Major applications of elastic narrow fabrics span several critical industries. In the apparel sector, they are fundamental components in waistbands, shoulder straps, cuffs, and supportive panels in sportswear, lingerie, and swimwear, enhancing fit and mobility. The medical and hygiene industry utilizes these fabrics extensively in bandages, surgical gowns, respiratory masks, and orthopedic supports, where flexibility and skin-friendliness are paramount. Beyond consumer goods, technical applications include seatbelt webbing in the automotive industry, strapping systems in industrial safety equipment, and specialized components in aerospace applications. The versatility and adaptability of elastic narrow fabrics allow manufacturers to meet stringent functional specifications across diverse environments, from high-temperature industrial settings to moisture-wicking athletic gear.

The primary driving factors for this market include the global rise in disposable incomes leading to increased consumption of performance-based apparel, the shift towards functional textiles that offer enhanced comfort and ergonomics, and stringent safety regulations demanding high-tensile elastic webbing in automotive and industrial safety applications. Furthermore, innovation in material science, particularly the development of sustainable elastic polymers and bio-based synthetic fibers, presents significant opportunities. The inherent benefits of using elastic narrow fabrics—such as superior tensile strength, excellent dimensional stability, and customized stretch percentages—ensure their continued growth trajectory, positioning them as essential materials in advanced manufacturing.

Elastic Narrow Fabric Market Executive Summary

The Elastic Narrow Fabric Market is characterized by robust growth, propelled by sustained demand from the activewear and automotive safety industries. Key business trends indicate a strong focus on sustainability, with leading manufacturers investing heavily in recycling technologies for nylon and polyester bases and integrating organic cotton or bio-based elastomers to appeal to environmentally conscious brands and consumers. Furthermore, digitalization of the supply chain, incorporating IoT-enabled machinery for precise quality control and optimized production scheduling, is becoming standard practice, enhancing efficiency and reducing material waste. Strategic mergers and acquisitions among regional specialized players are occurring as larger, global textile conglomerates seek to consolidate technology and expand their geographic footprint, particularly in high-growth economies in Asia Pacific.

Regionally, Asia Pacific dominates the market, driven by the presence of massive textile manufacturing hubs, competitive labor costs, and rapidly expanding domestic consumer markets, especially in China, India, and Vietnam. North America and Europe, while mature, remain crucial centers for high-value, high-performance, and specialized narrow fabrics, often dictated by stringent technical specifications required for medical devices and military textiles. These regions are focused on technological advancements, rapid prototyping, and ensuring compliance with complex environmental, social, and governance (ESG) standards, thereby maintaining a premium price point for specialized products. Investments in automated weaving and knitting technologies are common across developed economies to mitigate rising labor costs.

Segmentation trends reveal strong performance in the woven segment due to its superior durability and use in heavy-duty applications like safety harnesses and cargo strapping. However, the knitted segment, offering enhanced elasticity and softer finishes, is experiencing the highest growth CAGR, fueled by its widespread adoption in innerwear and premium athleisure wear. By material, Spandex/Elastane remains the crucial component defining elastic performance, though blends incorporating recycled polyester are gaining significant traction. End-user analysis highlights the Apparel sector as the primary revenue generator, while the Healthcare/Medical segment is poised for accelerated growth owing to the increasing global focus on non-invasive medical support products and rising standards for personal protective equipment (PPE).

AI Impact Analysis on Elastic Narrow Fabric Market

User queries regarding AI's impact on the Elastic Narrow Fabric Market primarily revolve around operational efficiency, predictive quality control, and advanced material innovation. Common concerns include how AI can optimize complex loom settings to minimize defects in high-speed production, whether machine learning algorithms can accurately predict material fatigue and lifespan in high-stress applications (like automotive seatbelts), and the potential for AI-driven design tools to simulate new fiber blends and elasticity profiles rapidly. Users expect AI to streamline inventory management of raw materials (yarns and elastomers) and enhance supply chain resilience by predicting demand fluctuations with greater accuracy. The core theme is leveraging AI to move from reactive quality assurance to proactive, predictive manufacturing environments, thereby improving yield and reducing cost.

Artificial Intelligence and machine learning (ML) are beginning to revolutionize the manufacturing processes within the narrow fabric industry. In manufacturing, AI-powered computer vision systems are deployed on high-speed weaving and knitting machines to continuously monitor fabric quality, instantly detecting minute flaws such as broken filaments, uneven tension, or misplaced stitches. This real-time detection minimizes waste and ensures that fabric quality adheres strictly to specifications, which is crucial for safety-critical applications. Furthermore, ML models are being utilized to optimize machinery parameters, adjusting tension, speed, and temperature based on historical performance data and raw material variability, leading to significant energy savings and operational efficiency gains.

Beyond the factory floor, AI profoundly influences R&D and supply chain management. AI algorithms can analyze vast datasets of material properties and performance results, accelerating the development of novel elastic composites with enhanced durability, recovery, or specific functional attributes (e.g., flame resistance or antimicrobial properties). In the supply chain, predictive analytics tools use AI to forecast demand variability with high precision, enabling manufacturers to optimize inventory levels of specialty yarns and reduce lead times, thus enhancing overall market responsiveness. This integration of AI supports the industry's shift toward high-mix, low-volume customization required by the specialized technical textiles sector.

- AI-driven real-time defect detection improves fabric quality and minimizes material waste during production.

- Machine learning optimizes loom parameters, enhancing efficiency and reducing energy consumption.

- Predictive maintenance schedules for high-speed machinery minimize unexpected downtime and repair costs.

- AI models accelerate material science R&D by simulating new polymer blends and elasticity profiles.

- Predictive analytics enhances supply chain forecasting, ensuring optimal inventory levels of specialty raw materials.

- Automated visual inspection systems replace manual quality checks, boosting throughput consistency.

DRO & Impact Forces Of Elastic Narrow Fabric Market

The Elastic Narrow Fabric Market dynamics are shaped by a complex interplay of rapid technological advancements in textile chemistry and fiber engineering, coupled with evolving consumer preferences for functional apparel. Primary drivers include the massive growth in the global activewear and athleisure markets, which demand high volumes of durable, moisture-wicking elastic materials, and stringent regulatory mandates in transportation requiring certified safety restraints. Restraints largely center on the volatility of raw material prices, particularly petrochemical-derived polymers like nylon and spandex, and the increasing pressure from environmental groups and regulations to transition away from synthetic, non-biodegradable materials. Opportunities are abundant in the development of sustainable, recycled, and bio-based elastic fibers, along with expansion into emerging technical applications such as smart textiles and wearable technology, where lightweight, conductive elastics are required. These factors collectively create significant impact forces on pricing, innovation cycles, and strategic investments across the value chain, dictating market direction.

The driving forces are robust and structurally embedded in several large industries. The increasing global geriatric population requires more medical textiles, including compression garments and orthopedic supports, which rely heavily on specialized elastic narrow fabrics for therapeutic efficacy. Furthermore, rapid urbanization and industrial growth, particularly in Asia, necessitate improved industrial safety equipment, leading to higher demand for heavy-duty elastic webbing and strapping. The constant innovation cycles in the textile machinery sector, yielding faster and more precise weaving and knitting equipment, also contribute positively by lowering unit manufacturing costs and improving output volume, making high-quality elastics more accessible for mass-market applications.

Conversely, the market faces significant challenges, primarily related to sustainability and raw material sourcing. The manufacturing process for many synthetic elastics is energy and water intensive, posing a compliance challenge in regions with strict environmental regulations. The high energy consumption required for thermal setting and finishing processes adds to the overall operational expenditure, particularly when global energy prices are volatile. Overcoming these restraints necessitates substantial capital investment in green manufacturing processes and the development of cost-effective, high-performance biodegradable elastic alternatives that can match the tensile strength and recovery properties of traditional spandex and rubber-based elastics. Successfully addressing these constraints will define competitive success over the forecast period.

Segmentation Analysis

The Elastic Narrow Fabric Market is extensively segmented based on structure, material, application, and end-use industry, providing a granular view of demand drivers and competitive landscapes. Segmentation by structure primarily distinguishes between woven, knitted, and braided fabrics, each offering unique performance characteristics regarding elasticity, thickness, and edge finish. Woven elastics typically offer superior strength and are used in load-bearing applications, while knitted elastics provide softer handling and greater stretch suitable for intimate apparel. Material segmentation focuses on the core elastic component—spandex (elastane), natural rubber, and synthetic rubber—and the covering fibers, such as polyester, nylon, cotton, and blends, which determine durability and aesthetic properties.

Application-based segmentation is crucial for targeted marketing and product development, differentiating between apparel accessories (waistbands, straps), industrial applications (lifting slings, tie-downs), and specialized technical textiles (medical bands, automotive webbing). The largest contributing segment remains the apparel industry, which is further subdivided into innerwear, activewear, and outerwear, each demanding specific widths, stretch ratios, and finishes. Analyzing these segments helps manufacturers align their production capabilities with precise end-user requirements, ensuring compliance with industry-specific standards, such as flame resistance requirements in the automotive sector or hypoallergenic properties in the medical sector.

Regional segmentation highlights differences in consumption patterns and manufacturing capacity, with APAC being the dominant production hub, while North America and Europe lead in the consumption of high-end, specialized narrow fabrics. Understanding these geographic nuances is essential for effective supply chain management and competitive pricing strategies. The market structure is highly fragmented, with numerous local specialized producers coexisting alongside a few global market leaders, leading to intense competition focused on product differentiation, quality certification, and cost leadership across all key segments.

- By Structure:

- Woven Elastic Narrow Fabric

- Knitted Elastic Narrow Fabric

- Braided Elastic Narrow Fabric

- By Material:

- Spandex/Elastane

- Natural Rubber

- Synthetic Rubber

- Nylon

- Polyester

- Others (Cotton, Polypropylene, Aramid)

- By Application:

- Apparel (Innerwear, Outerwear, Activewear, Swimwear)

- Automotive (Seatbelts, Tie-downs)

- Medical & Healthcare (Bandages, Compression Wear, Orthopedics)

- Industrial & Safety (Strapping, Webbing, Safety Harnesses)

- Others (Home Furnishings, Sportswear Accessories)

- By Region:

- North America (U.S., Canada)

- Europe (Germany, U.K., France, Italy)

- Asia Pacific (China, India, Japan, South Korea)

- Latin America (Brazil, Mexico)

- Middle East & Africa (GCC Countries, South Africa)

Value Chain Analysis For Elastic Narrow Fabric Market

The value chain for the Elastic Narrow Fabric Market begins with the upstream suppliers responsible for raw material procurement, primarily synthetic polymers (Nylon, Polyester) and elastomers (Spandex, Natural/Synthetic Rubber). These upstream activities involve complex chemical processing and extrusion necessary to produce high-quality, continuous filament yarns suitable for narrow fabric production. Pricing fluctuations in crude oil and petrochemical derivatives significantly impact the cost structure at this initial stage. Efficient procurement, focusing on long-term contracts and diversification of suppliers, is crucial for mitigating risks associated with raw material volatility. Technological innovation at the upstream level, such as the development of specialized high-recovery elastomers or flame-retardant fibers, provides a competitive advantage down the chain.

The core manufacturing process constitutes the midstream, where yarn preparation (twisting, dyeing, warping) and fabric formation (weaving, knitting, braiding) occur. This stage is capital-intensive, requiring advanced machinery like high-speed needle looms and dyeing ranges. Value addition is maximized through technical expertise in achieving specific stretch coefficients, tensile strengths, and color fastness. Quality control and precision engineering are paramount, especially for regulatory-sensitive applications like medical textiles or automotive webbing. Finishing processes—including heat setting, coating, and specialized treatments (e.g., antimicrobial or UV resistance)—further enhance the functionality and market value of the narrow fabric before distribution.

The downstream segment involves distribution channels and reaching end-users. Distribution is often bifurcated into direct sales to large textile mills and original equipment manufacturers (OEMs) in the automotive and medical sectors, and indirect sales through specialized textile wholesalers, agents, and distributors serving smaller apparel manufacturers and general industrial users. The effectiveness of the distribution channel depends on inventory management capability, the ability to provide small, custom-run orders, and efficient logistics. Customer relationships are critical, as end-users often require technical support and specific product certifications. Manufacturers increasingly employ e-commerce platforms and digital tools for direct engagement, especially with medium-sized brands, streamlining the complex ordering process for customized narrow fabrics.

Elastic Narrow Fabric Market Potential Customers

The primary consumers of elastic narrow fabrics are large-scale manufacturers and original equipment manufacturers (OEMs) across diverse industrial sectors requiring components that offer both flexibility and durability. The largest single buyer segment is the apparel industry, which includes global brands and contract manufacturers specializing in activewear, sportswear, intimate apparel (lingerie and brassieres), and sleepwear. These customers prioritize elasticity consistency, soft touch, and aesthetic versatility (color and texture) to meet demanding fashion and comfort standards. Suppliers must offer wide customization capabilities, including specific widths, finishes, and the ability to handle high-volume, rapid-turnaround orders to service this segment effectively.

Another significant customer base resides within the technical textiles domain, specifically the automotive, safety, and healthcare sectors. Automotive manufacturers and their Tier 1 suppliers are critical customers, requiring highly regulated products like certified seatbelt webbing, specialized tie-downs for interior components, and durable elastics for sun visors, all subject to stringent performance and flammability standards. The healthcare sector, including medical device companies and producers of non-woven hygiene products, purchases elastics for applications such as compression bandages, surgical mask loops, and orthopedic braces, where skin compatibility, sterilization resistance, and precise tension control are non-negotiable requirements. These customers demand strict traceability and adherence to medical-grade material certifications.

Industrial users, comprising manufacturers of cargo control equipment, sporting goods (backpacks, tents), and military/defense gear, represent customers seeking maximum tensile strength and resistance to harsh environmental conditions. These customers often procure specialized high-performance materials such as aramid-blended or heavy-duty polyester elastics. Furthermore, the retail market, though serviced indirectly, constitutes a latent potential customer base for repair, modification, and DIY projects, driven by independent craft suppliers and haberdashery distributors. Meeting the needs of this diverse customer portfolio requires manufacturers to maintain a broad product catalog alongside specialized, high-certification production lines.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 6.5 Billion |

| Market Forecast in 2033 | USD 9.7 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Muller Textil GmbH, Narroflex Inc., Stretchline Holdings Ltd., Shindo Co. Ltd., Rhode Island Textile Company, Pacific Narrow Fabrics, Tape Craft Corporation, American Webbing and Fittings Inc., YKK Corporation, Tex-Strap Narrow Fabric Co., Heytex Group, Apex Mills, KTS Group, Balaji Narrow Fabrics, Bally Ribbon Mills |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Elastic Narrow Fabric Market Key Technology Landscape

The technological landscape of the Elastic Narrow Fabric Market is dominated by advancements in high-speed, precision weaving and knitting machinery, primarily needle looms and specialized braiding equipment, designed to maximize throughput while ensuring minimal defect rates. Modern needle looms are equipped with electronic jacquard capabilities and sophisticated tension control systems that allow for the intricate weaving of complex patterns and variable width structures necessary for specialized webbing, such as anti-slip elastics or multi-colored safety harnesses. Furthermore, these machines are increasingly integrated with digital monitoring systems (Industry 4.0 compliant) that provide real-time data on production efficiency, tension deviation, and machine health, optimizing overall equipment effectiveness (OEE) and facilitating remote diagnostic capabilities, crucial for global operations.

Material science and finishing technologies represent another critical area of innovation. Manufacturers are increasingly utilizing specialized extrusion technologies to create composite yarns that combine high elasticity with superior covering fiber performance, such as incorporating recycled ocean plastic polyester or bio-based TPE (Thermoplastic Elastomers) cores. Finishing processes now include plasma treatment and advanced chemical coatings to impart functional properties like water repellency, antimicrobial characteristics, UV stability, and specific hand feel demanded by high-end apparel brands. Dyeing technology has shifted towards ecologically friendly, low-water consumption processes, such as supercritical CO2 dyeing, addressing environmental concerns and reducing the operational footprint associated with traditional water-intensive methods.

The emergence of smart textiles is driving the need for conductive elastic narrow fabrics. Research focuses on embedding micro-electronics or conductive polymers directly into the elastic structure without compromising stretch or durability. These conductive elastics are essential components for wearable technology, allowing for seamless integration of sensors and connectivity within clothing and medical devices. This intersection of textile engineering and microelectronics requires manufacturers to develop new bonding and encapsulation techniques that protect sensitive components during repeated stretching and washing cycles, positioning advanced elastic narrow fabrics as fundamental enablers of the burgeoning smart clothing market segment.

Regional Highlights

Asia Pacific (APAC) stands as the undisputed epicenter of the Elastic Narrow Fabric Market, both in terms of manufacturing output and rapidly expanding consumption. Countries like China, India, and Vietnam host massive, vertically integrated textile manufacturing ecosystems, leveraging competitive labor costs and significant investments in modern machinery to dominate global production. The region not only serves as the primary supplier for global apparel brands but also experiences accelerating domestic demand fueled by rising disposable incomes and rapid adoption of Western-style sportswear and high-end technical garments. The sheer scale of industrialization and the continuous expansion of the automotive and medical device manufacturing sectors further solidify APAC’s leading market position, driving innovation particularly in high-volume, cost-effective narrow fabric solutions. Government incentives supporting textile exports and infrastructure improvements contribute significantly to the region's competitive edge.

North America and Europe represent mature, high-value markets characterized by a strong emphasis on specialized, performance-driven, and highly regulated narrow fabrics. These regions are leaders in demanding premium quality and compliance, especially for automotive seatbelts (FMVSS standards), certified industrial safety harnesses, and advanced medical textiles (FDA/CE approved products). While manufacturing volumes are lower compared to APAC, the average selling price (ASP) is substantially higher due to the complexity of the products and the requirement for stringent certification and traceability. Key growth drivers include the continuous innovation in the activewear market, the focus on sustainable and recycled material content demanded by regional brands, and strategic niche manufacturing of defense and aerospace-grade elastic webbing, ensuring these regions maintain their strong influence on technological development and high-end market pricing.

Latin America (LATAM) and the Middle East & Africa (MEA) are emerging markets showing significant potential. LATAM, particularly Brazil and Mexico, benefits from a robust domestic apparel industry and growing automotive manufacturing base, driving demand for locally sourced narrow fabrics to mitigate import complexities and logistics costs. The MEA region, anchored by the Gulf Cooperation Council (GCC) countries and South Africa, is experiencing market expansion driven by infrastructural projects, increased demand for professional workwear and safety gear, and regional efforts to diversify manufacturing away from oil dependence. While these markets currently rely heavily on imports for complex technical fabrics, localized production is gradually increasing, often focusing on basic woven and knitted elastics for general apparel and consumer goods, representing long-term growth opportunities for global manufacturers seeking market penetration.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Elastic Narrow Fabric Market.- Muller Textil GmbH

- Narroflex Inc.

- Stretchline Holdings Ltd.

- Shindo Co. Ltd.

- Rhode Island Textile Company

- Pacific Narrow Fabrics

- Tape Craft Corporation

- American Webbing and Fittings Inc.

- YKK Corporation (Narrow Fabric Division)

- Tex-Strap Narrow Fabric Co.

- Heytex Group

- Apex Mills

- KTS Group

- Balaji Narrow Fabrics

- Bally Ribbon Mills

- Maurer Textile Solutions

- Ribbon Narrow Fabric Co.

- Webbing Industries P/L

- Jiangsu Hengli Chemical Fiber Co. Ltd.

- Specialty Narrow Fabrics

Frequently Asked Questions

Analyze common user questions about the Elastic Narrow Fabric market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary raw materials used in the production of elastic narrow fabrics?

The primary raw materials are synthetic polymers for the covering yarn (Polyester and Nylon) and elastomers for the core (Spandex/Elastane, Natural Rubber, and Synthetic Rubber). The choice depends on the required strength, recovery, and resistance characteristics for the final application.

Which end-use industry contributes most significantly to the demand for elastic narrow fabrics?

The Apparel industry is the largest contributor to demand, particularly the sectors of activewear, sportswear, and innerwear (lingerie), due to the necessity of elastic materials for comfort, fit, and movement functionality in these garments.

What technological advancements are currently shaping the manufacturing of narrow fabrics?

Key technological advancements include the deployment of high-speed electronic needle looms, integration of Industry 4.0 systems for real-time quality control, and innovation in sustainable material science, such as the use of recycled and bio-based elastomers.

How does the segmentation by structure (woven, knitted, braided) impact the fabric's performance?

Woven elastics offer high tensile strength and durability, ideal for industrial strapping and automotive safety. Knitted elastics provide superior stretch and a softer hand feel, favored for apparel. Braided elastics are lightweight and offer elasticity from multiple directions, often used in drawcords.

What major regulatory factors influence the market, particularly in the automotive segment?

The automotive segment is highly influenced by global safety standards like the Federal Motor Vehicle Safety Standards (FMVSS) in the US and equivalent European regulations, which mandate strict performance criteria for seatbelt webbing regarding tensile strength, energy absorption, and flammability.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager