Electric Axle Drive Systems Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441828 | Date : Feb, 2026 | Pages : 255 | Region : Global | Publisher : MRU

Electric Axle Drive Systems Market Size

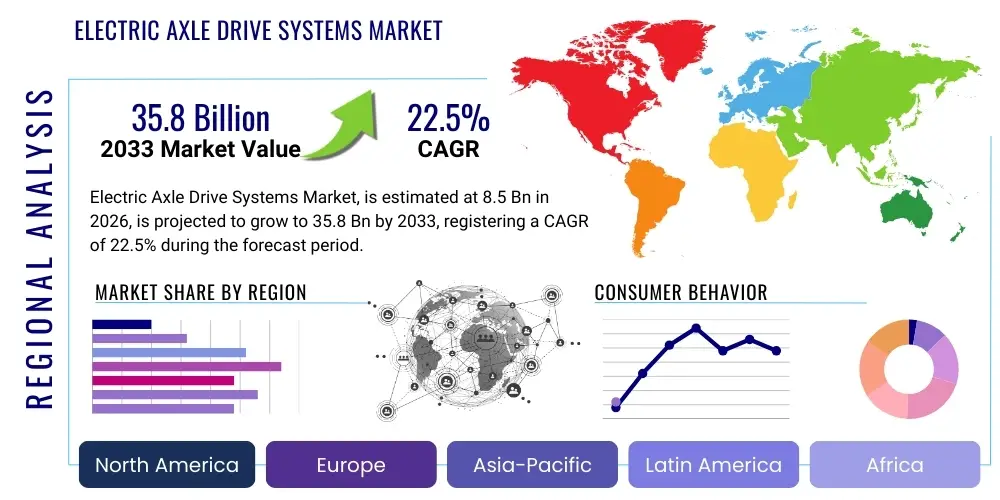

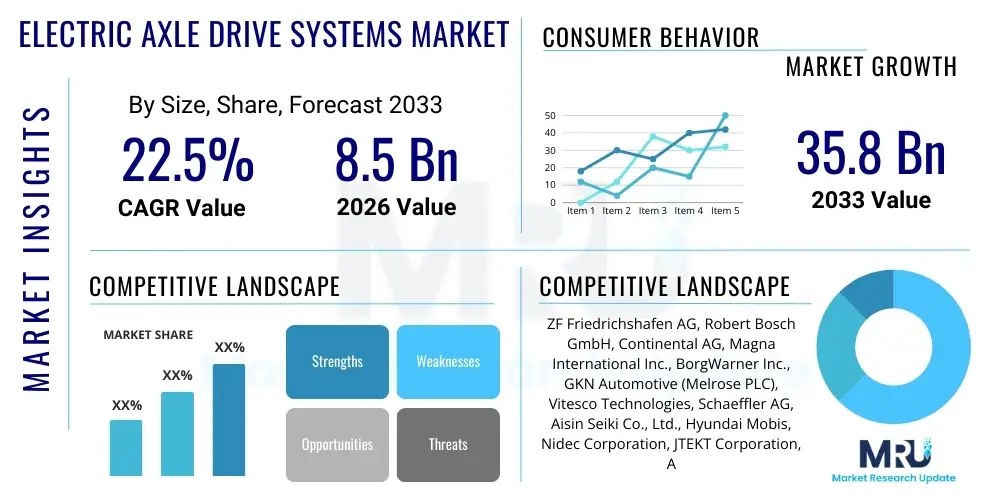

The Electric Axle Drive Systems Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 22.5% between 2026 and 2033. The market is estimated at USD 8.5 Billion in 2026 and is projected to reach USD 35.8 Billion by the end of the forecast period in 2033.

The burgeoning demand for electric vehicles (EVs), driven by stringent emission regulations and increasing consumer preference for sustainable mobility, serves as the fundamental catalyst propelling the Electric Axle Drive Systems (E-Axle) market expansion. E-Axles, which integrate the electric motor, gearbox, and power electronics into a single compact unit, offer significant advantages in terms of efficiency, packaging, and reduced complexity compared to traditional distributed EV powertrains. This integration is crucial for maximizing cabin space and optimizing battery placement, particularly in compact and medium-sized EVs, which are expected to dominate volume sales globally. Furthermore, advancements in power semiconductor technology, particularly the adoption of Silicon Carbide (SiC) inverters, are enhancing the performance and energy density of these integrated systems, thereby increasing their attractiveness to original equipment manufacturers (OEMs).

Market valuation growth is strongly supported by the rapid transition of commercial vehicles and heavy-duty trucks towards electrification. While passenger cars currently form the largest application segment, the increasing regulatory pressure on fleet emissions, coupled with the long-term operational cost savings offered by electric powertrains, is accelerating the adoption of E-Axles in commercial transport. The development of specialized, high-torque E-Axles designed for multi-speed transmission requirements in heavy-duty applications represents a significant technological frontier. The market’s future trajectory is heavily dependent on continued investment in manufacturing scalability and the successful resolution of supply chain constraints related to critical raw materials such as rare earth magnets and specialized battery components, ensuring that production capacity can meet the escalating global EV targets.

Electric Axle Drive Systems Market introduction

The Electric Axle Drive Systems Market encompasses the design, manufacturing, and deployment of fully integrated electric powertrain solutions that replace conventional internal combustion engine (ICE) drivetrains. An E-Axle is a modular unit typically incorporating an electric motor (often permanent magnet synchronous motor or asynchronous induction motor), a reduction gearbox, and power electronics, including the inverter, all housed within a compact casing mounted directly onto the axle structure. This integration significantly improves vehicle efficiency by reducing mechanical losses, simplifies vehicle architecture, and provides flexibility in chassis design. Major applications span Battery Electric Vehicles (BEVs), Plug-in Hybrid Electric Vehicles (PHEVs), and specialized electric commercial vehicles, supporting both front-wheel drive (FWD), rear-wheel drive (RWD), and all-wheel drive (AWD) configurations through the deployment of multiple E-Axle units.

The primary benefits driving the rapid adoption of E-Axles include enhanced energy efficiency, superior power density, reduced vehicle weight, and optimized cost of ownership over the vehicle lifecycle. The compact nature of these systems allows OEMs greater freedom in designing 'skateboard' platforms, maximizing passenger and cargo space, which is a critical selling point for modern EVs. Furthermore, integrated systems offer better control over torque vectoring and traction management, leading to improved dynamic performance and safety. The primary driving factors are the global push for decarbonization, mandated by governmental policies across major economies (Europe, China, and North America), coupled with technological advancements, such as the miniaturization of power modules and the introduction of advanced thermal management solutions that ensure system longevity and reliability under diverse operating conditions.

The market faces dynamic evolution, characterized by intense competition among traditional Tier 1 automotive suppliers and specialized EV technology startups, all striving to achieve higher levels of integration and modularity. Key considerations for market participants include achieving optimal Noise, Vibration, and Harshness (NVH) characteristics, enhancing system robustness against varying battery voltages, and establishing robust, localized supply chains to mitigate geopolitical risks and tariff implications. The shift towards 800V architectures in high-performance EVs is also forcing manufacturers to redesign E-Axle components, particularly inverters and motor windings, to handle higher voltages efficiently, paving the way for ultra-fast charging capabilities and further differentiation within the competitive landscape.

Electric Axle Drive Systems Market Executive Summary

The Electric Axle Drive Systems Market is undergoing a transformational growth phase, primarily fueled by global mandates targeting zero-emission vehicles and the widespread adoption of dedicated electric vehicle platforms. Business trends indicate a clear shift towards modular, scalable E-Axle platforms (3-in-1 systems), where suppliers are investing heavily in vertical integration of key components, particularly focusing on optimizing inverter design using SiC technology for increased efficiency and driving range. Strategic partnerships between traditional automotive suppliers and EV disruptors are becoming commonplace, aimed at accelerating product development cycles and securing large-volume contracts. Pricing models are evolving rapidly, moving from high-cost, specialized components to standardized, mass-produced systems, essential for achieving cost parity with ICE vehicles, while addressing complexities associated with diverse OEM performance requirements and battery architectures.

Regionally, Asia Pacific, particularly China, maintains the dominant market share due to substantial government subsidies, a mature EV manufacturing ecosystem, and high consumer acceptance of electric mobility, especially in urban areas. Europe follows closely, driven by stringent Euro 7 emission standards and robust R&D investment, positioning it as a leader in high-performance and premium E-Axle applications. North America is experiencing accelerated growth, largely driven by major investments announced by legacy Detroit automakers in electrifying their truck and SUV lineups, necessitating the deployment of robust and efficient E-Axle systems designed for heavier loads and higher performance metrics. The market structure across these regions is consolidating, with larger suppliers leveraging their existing relationships and production scale to secure long-term contracts, emphasizing localization strategies to navigate trade barriers and logistics challenges.

Segment trends highlight the dominance of the 100 kW to 200 kW power output segment, catering primarily to the volume passenger car market. However, the high-power segment (above 200 kW) is witnessing the highest growth rate, propelled by the demand for performance EVs and the electrification of heavy-duty commercial vehicles, which require multi-speed E-Axle transmissions to manage high torque demands efficiently. By architecture, the three-in-one integrated E-Axle system is rapidly displacing segregated systems, reflecting the industry's focus on maximizing energy density and simplifying vehicle assembly processes. The ongoing evolution within the commercial vehicle segment is pivotal, where specialized E-Axles for buses and medium-duty trucks are driving demand, emphasizing durability and regenerative braking capabilities crucial for maximizing urban operational efficiency and fleet management metrics.

AI Impact Analysis on Electric Axle Drive Systems Market

Common user inquiries regarding the impact of Artificial Intelligence (AI) on the Electric Axle Drive Systems Market predominantly revolve around optimizing energy management, predictive maintenance, and enhancing the overall system efficiency and control. Users frequently question how AI algorithms can maximize range by intelligently managing torque distribution and regenerative braking under real-time driving conditions. There is significant interest in using machine learning (ML) for predictive failure analysis, leveraging sensor data (temperature, vibration, current draw) within the E-Axle to anticipate component wear, thereby minimizing unexpected downtime and reducing warranty costs for OEMs. Furthermore, users are keen to understand AI's role in the design phase, particularly for topology optimization and material selection, aiming for lighter, more efficient, and quieter E-Axle units.

AI is transforming the development and operational phases of Electric Axle Drive Systems by enabling unprecedented levels of performance optimization and system health monitoring. During operation, AI-powered control units utilize deep learning models to analyze vast amounts of vehicle data, driver behavior, and environmental conditions, dynamically adjusting motor control parameters (like torque vectoring and field weakening) to ensure peak energy conversion efficiency across the entire speed and load range, a factor critical for maximizing vehicle range. This intelligent control surpasses traditional static control maps, leading to measurable gains in overall powertrain efficiency and a smoother driving experience. The integration of edge computing capabilities within the power electronics unit allows for immediate, low-latency decision-making, which is vital for safe and responsive traction control.

In manufacturing and supply chain management, AI applications are focused on quality control and process optimization. Vision systems powered by machine learning algorithms are deployed on assembly lines to detect microscopic defects in winding insulation, gear teeth, and bearing surfaces, ensuring higher quality standards than achievable through manual inspection. Furthermore, predictive modeling in the supply chain uses AI to forecast demand fluctuations for complex subcomponents, such as rare-earth magnets and custom heat sinks, enabling manufacturers to optimize inventory levels, reduce lead times, and mitigate the risk associated with material scarcity or sudden market shifts, ultimately lowering the total production cost of the E-Axle system.

- AI optimizes E-Axle thermal management systems by predicting hot spots and adjusting cooling flows in real-time.

- Machine Learning enhances regenerative braking efficiency, maximizing energy recapture and extending vehicle range dynamically.

- Predictive maintenance algorithms analyze NVH (Noise, Vibration, Harshness) data to anticipate gearbox or bearing failures.

- AI-driven control software enables highly precise torque vectoring for improved vehicle stability and handling.

- Generative Design algorithms accelerate the development of optimized, lightweight E-Axle housing structures.

- AI improves manufacturing yield by automating quality inspection of complex internal components like rotor assemblies.

DRO & Impact Forces Of Electric Axle Drive Systems Market

The Electric Axle Drive Systems market is primarily driven by the intense regulatory push for vehicle electrification globally, particularly in major automotive markets, coupled with significant technological advancements leading to highly integrated, efficient, and cost-effective E-Axle designs. Restraints include the persistent high initial cost of battery electric vehicles compared to their ICE counterparts, which indirectly affects E-Axle pricing sensitivity, along with volatility and potential shortages in the supply chain for critical materials like lithium, copper, and specialized rare-earth magnets used in permanent magnet motors. Opportunities abound in the burgeoning electrification of heavy-duty commercial transport and off-highway vehicles, which demand highly robust, multi-speed E-Axle configurations. Furthermore, the development of localized manufacturing capabilities in emerging economies presents a substantial opportunity for market expansion and resilience against geopolitical trade pressures, ensuring the availability of components.

The impact forces influencing this market are multi-faceted. Economic forces include increasing government incentives (tax credits, subsidies) aimed at accelerating EV adoption, thereby boosting E-Axle demand volume, offset by the risk of economic downturns affecting consumer discretionary spending on new vehicles. Technological impact is profound, characterized by the shift to 800V architectures and the integration of SiC inverters, which are fundamentally changing E-Axle design requirements towards higher performance and faster charging capabilities. Regulatory forces, such as mandated fleet average emission reductions and outright bans on new ICE vehicle sales in certain jurisdictions (e.g., California, EU member states), create a non-negotiable demand floor for E-Axle production. Socially, the increasing consumer awareness regarding climate change and the strong preference among tech-savvy buyers for high-performance EVs equipped with advanced AWD systems further solidifies market growth momentum, compelling OEMs to prioritize E-Axle integration.

The competitive landscape acts as a significant force, driving continuous innovation in component miniaturization, weight reduction, and efficiency optimization. Tier 1 suppliers are engaged in fierce rivalry to offer complete modular platforms adaptable to various vehicle segments, focusing heavily on reducing the Noise, Vibration, and Harshness (NVH) characteristics of the integrated units, a common consumer complaint in early EV models. Furthermore, the market faces disruptive force from new entrants, particularly specialized EV startups that are pioneering novel component arrangements and manufacturing techniques, pushing established players to accelerate their innovation cycles. Successful navigation of these dynamic forces—balancing cost reduction, performance enhancement, and supply chain security—will determine the long-term competitive advantage for players in the Electric Axle Drive Systems market.

Segmentation Analysis

The Electric Axle Drive Systems Market is comprehensively segmented based on three critical parameters: the degree of integration (Design Type), the level of power output (Power Output), and the end-use application (Vehicle Type). The Design Type segmentation distinguishes between integrated (3-in-1, or 4-in-1 systems including DC/DC converter or battery management system) and segregated E-Axles, reflecting the industry's trend toward compact, modular designs that simplify vehicle assembly and optimize packaging. Power Output segments cater to the diverse requirements ranging from low-power city cars to high-performance sports vehicles and heavy commercial transport, with the mid-power band representing the largest volume segment. Vehicle Type analysis separates the passenger vehicle segment (BEVs, PHEVs) from the rapidly expanding commercial vehicle segment (buses, trucks), each demanding distinct performance specifications and durability standards from the E-Axle unit.

- By Design Type

- Integrated E-Axle (3-in-1 Systems)

- Segregated E-Axle (Motor, Gearbox, Inverter separate)

- By Power Output

- Less than 100 kW

- 100 kW to 200 kW

- More than 200 kW

- By Vehicle Type

- Passenger Vehicles (BEV, PHEV)

- Commercial Vehicles (Buses, Trucks, Vans)

- By Drivetrain

- Front-Wheel Drive (FWD)

- Rear-Wheel Drive (RWD)

- All-Wheel Drive (AWD)

Value Chain Analysis For Electric Axle Drive Systems Market

The value chain for Electric Axle Drive Systems is complex, starting with upstream activities involving the sourcing of highly specialized raw materials and components, extending through sophisticated manufacturing and assembly processes, and concluding with downstream activities centered on vehicle integration, distribution, and aftermarket service. Upstream analysis focuses heavily on securing critical materials such as specialized steel alloys for gears and shafts, high-grade copper for motor windings, rare earth elements (like Neodymium) for Permanent Magnet Synchronous Motors (PMSMs), and advanced semiconductors (Silicon Carbide – SiC) for inverters. Stability in this upstream supply chain is paramount, as geopolitical risks or material price volatility can significantly impact the final product cost and manufacturing lead times. Manufacturers often vertically integrate or establish long-term strategic partnerships with material suppliers to ensure continuity and quality control for these highly specific inputs.

The manufacturing phase represents the core of value addition, involving precision machining of mechanical components (gears, housing), complex motor assembly (winding, insulation, rotor balancing), and the high-tech assembly of power electronics. Distribution channels vary significantly: Direct distribution is dominant, where Tier 1 suppliers (like ZF, Bosch) engage directly with Original Equipment Manufacturers (OEMs) under long-term supply agreements, ensuring just-in-time delivery and customized component specifications tailored to specific vehicle platforms. Indirect channels primarily involve the aftermarket, where authorized distributors and service centers handle replacement units and spare parts, a segment expected to grow as the global EV fleet ages. The complexity of E-Axle systems requires specialized diagnostic tools and training for service technicians, adding significant value to the downstream service providers.

Crucially, the power electronics segment (inverter) holds disproportionate intellectual property and value within the E-Axle. The shift to higher-voltage SiC semiconductors necessitates specialized design expertise and dedicated manufacturing facilities, often making the inverter the most expensive sub-component. Downstream activities are increasingly focused on software integration; E-Axle suppliers must collaborate closely with vehicle manufacturers to ensure seamless communication with the Vehicle Control Unit (VCU) and Battery Management System (BMS). This co-development approach ensures optimal performance mapping, thermal management coordination, and safe operation under fault conditions, solidifying the long-term relationship between the supplier and the OEM and establishing barriers to entry for new competitors who lack comprehensive system integration expertise.

Electric Axle Drive Systems Market Potential Customers

The primary end-users and buyers of Electric Axle Drive Systems are global Original Equipment Manufacturers (OEMs) across both the traditional automotive sector and the rapidly emerging electric vehicle (EV) startup ecosystem. These customers are categorized mainly into passenger vehicle manufacturers (e.g., Volkswagen Group, General Motors, Tesla) and commercial vehicle manufacturers (e.g., Daimler Truck, Volvo Group, BYD). Passenger vehicle OEMs, being the largest volume buyers, prioritize lightweight, high-efficiency, and highly integrated 3-in-1 E-Axles suitable for skateboard platforms, focusing on maximizing driving range and meeting demanding NVH specifications. Their purchasing decisions are driven by cost per unit at high volumes and the supplier's capability to deliver systems compatible with 400V and 800V architectures.

Commercial vehicle manufacturers represent a high-growth segment, demanding E-Axles with exceptional torque density, robust thermal management capabilities, and often, multi-speed gearing to handle heavy payloads and sustained high-speed operation, particularly for long-haul trucks and city buses. Fleet operators, while not direct component buyers, heavily influence OEM procurement decisions by demanding systems that offer maximum durability, minimal downtime, and superior energy regeneration capabilities to reduce operational costs. Furthermore, smaller, specialized manufacturers focusing on niche markets, such as high-performance sports cars, agricultural machinery, or defense applications, seek highly customized, high-power E-Axles tailored for extreme performance and rugged durability in off-highway environments, representing a smaller but high-value customer group.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 8.5 Billion |

| Market Forecast in 2033 | USD 35.8 Billion |

| Growth Rate | 22.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ZF Friedrichshafen AG, Robert Bosch GmbH, Continental AG, Magna International Inc., BorgWarner Inc., GKN Automotive (Melrose PLC), Vitesco Technologies, Schaeffler AG, Aisin Seiki Co., Ltd., Hyundai Mobis, Nidec Corporation, JTEKT Corporation, AVL List GmbH, EATON Corporation, American Axle & Manufacturing Holdings (AAM), Cummins Inc., Dana Incorporated, Shanghai Automotive Electric Drive (SAED). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Electric Axle Drive Systems Market Key Technology Landscape

The technological evolution within the Electric Axle Drive Systems market is centered on achieving higher integration density, improved thermal efficiency, and enhanced modularity. A pivotal technology is the widespread adoption of Silicon Carbide (SiC) MOSFETs in the inverter component. SiC offers superior switching performance and thermal characteristics compared to traditional Silicon IGBTs, enabling the E-Axle system to operate at higher voltages (800V platforms), reduce losses, and tolerate higher operating temperatures, significantly contributing to lighter and smaller power electronic units and ultimately extending the vehicle’s driving range. Furthermore, optimizing the electric motor design is crucial, with Permanent Magnet Synchronous Motors (PMSMs) currently dominating due to their high power density, though there is increasing research into magnet-less motors (like Induction Motors or Switched Reluctance Motors) to mitigate reliance on volatile rare-earth element supply chains.

Integration technology, particularly the shift toward 3-in-1 integrated units (motor, gearbox, inverter), is another key area. Advanced packaging techniques are used to minimize the overall footprint and weight of the system while effectively managing the intense heat generated by the motor and inverter simultaneously. This involves sophisticated cooling mechanisms, including direct oil cooling for the stator windings and high-performance cold plates for the SiC modules. Noise, Vibration, and Harshness (NVH) mitigation is also a critical technological challenge; suppliers are investing in advanced gear geometry, passive damping materials, and active noise cancellation algorithms embedded within the inverter control unit to ensure the E-Axle operates quietly, a necessary feature given the quiet operation of EVs compared to ICE vehicles.

The future technology landscape is moving towards highly flexible, multi-functional E-Axles. This includes incorporating integrated charging functionality (e.g., bi-directional charging capability allowing the EV to act as a power source), and integrating sensor systems for condition monitoring and advanced vehicle dynamics control. The increasing complexity of software-defined components necessitates over-the-air (OTA) update capabilities for the E-Axle’s control unit, allowing manufacturers to improve performance, fix bugs, and enhance efficiency post-sale. The development of specialized two-speed or multi-speed gearboxes is also gaining traction, particularly for heavy-duty commercial vehicles and high-performance passenger cars, as single-speed reductions often compromise between high-speed cruising efficiency and low-speed launch torque, demonstrating the market’s focus on application-specific optimization.

Regional Highlights

Regional dynamics play a crucial role in shaping the Electric Axle Drive Systems Market, reflecting differences in regulatory environments, manufacturing capabilities, and consumer adoption rates. Each region presents unique opportunities and challenges for E-Axle suppliers, influencing investment strategies and production localization efforts.

- Asia Pacific (APAC): Dominates the market, driven overwhelmingly by China's aggressive EV targets, substantial government subsidies, and the presence of high-volume local EV manufacturers (e.g., BYD, Geely). South Korea and Japan are strong hubs for technology development, particularly in power electronics (SiC) and battery integration. The region’s focus is on cost-effective, highly scalable E-Axle solutions for mass-market passenger cars and light commercial vehicles.

- Europe: Characterized by stringent emission standards (Euro 7) and clear timelines for phasing out ICE vehicles, making it a high-growth region. Europe leads in the adoption of premium and high-performance E-Axles, often utilizing 800V architectures. Germany, France, and the UK are major manufacturing and R&D centers, with a strong emphasis on integration, efficiency, and NVH reduction for sophisticated vehicle platforms.

- North America: Experiencing rapid acceleration, particularly in the electrification of large SUVs and pickup trucks, which necessitates robust, high-torque E-Axles (often dual E-Axle setups for AWD). Government policy, notably the Inflation Reduction Act (IRA), is driving significant localization of manufacturing capacity, creating strong demand for domestic E-Axle production and supply chain security.

- Latin America (LATAM), Middle East, and Africa (MEA): Currently smaller markets, primarily driven by pilot projects and fleet electrification initiatives in large cities. Growth is slower due to infrastructure limitations, but significant future potential exists in fleet conversions (buses, taxis) and industrial applications, demanding resilient and low-maintenance E-Axle systems tailored for challenging operational environments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Electric Axle Drive Systems Market.- ZF Friedrichshafen AG

- Robert Bosch GmbH

- Continental AG

- Magna International Inc.

- BorgWarner Inc.

- GKN Automotive (Melrose PLC)

- Vitesco Technologies

- Schaeffler AG

- Aisin Seiki Co., Ltd.

- Hyundai Mobis

- Nidec Corporation

- JTEKT Corporation

- AVL List GmbH

- EATON Corporation

- American Axle & Manufacturing Holdings (AAM)

- Cummins Inc.

- Dana Incorporated

- Shanghai Automotive Electric Drive (SAED)

- Hitachi Astemo, Ltd.

- Keboda Technology Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Electric Axle Drive Systems market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary technical advantage of an integrated Electric Axle (E-Axle)?

The primary technical advantage is the high degree of integration (motor, gearbox, inverter in one unit), which significantly improves energy efficiency, reduces weight and volume, simplifies vehicle assembly complexity, and facilitates optimized chassis design, particularly for 'skateboard' EV platforms.

How is Silicon Carbide (SiC) impacting E-Axle performance?

SiC semiconductors are critical for next-generation E-Axles, enabling inverters to operate at higher voltages (800V systems) with lower power losses, superior thermal stability, and reduced size. This directly translates to improved system efficiency, faster charging capability, and increased vehicle range.

Which geographic region currently leads the Electric Axle Drive Systems market?

The Asia Pacific region, led primarily by China, holds the largest market share due to immense EV production volumes, robust local manufacturing capacity, and consistent governmental support through electrification mandates and subsidies for both passenger and commercial vehicles.

What are the biggest restraints on the growth of the E-Axle market?

Key restraints include high initial manufacturing costs related to complex components (rare earth magnets, high-performance semiconductors), along with challenges associated with securing and stabilizing the supply chain for critical raw materials, which is highly susceptible to geopolitical and logistical volatility.

Are E-Axles being adopted primarily by passenger or commercial vehicles?

While passenger vehicles currently account for the largest volume in E-Axle adoption, the commercial vehicle segment (especially buses and heavy-duty trucks) is projected to exhibit the highest growth rate during the forecast period due to stringent fleet emission standards and the demand for robust, high-torque electrification solutions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager