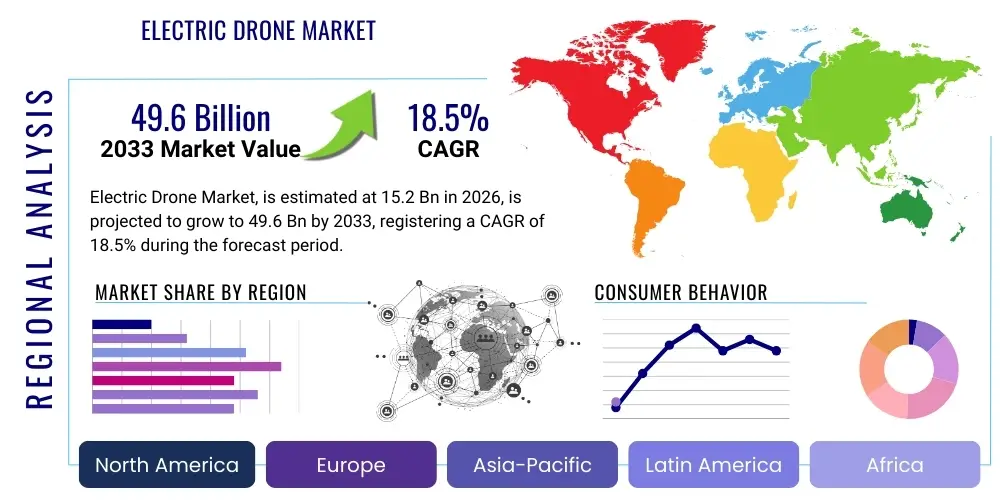

Electric Drone Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441129 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Electric Drone Market Size

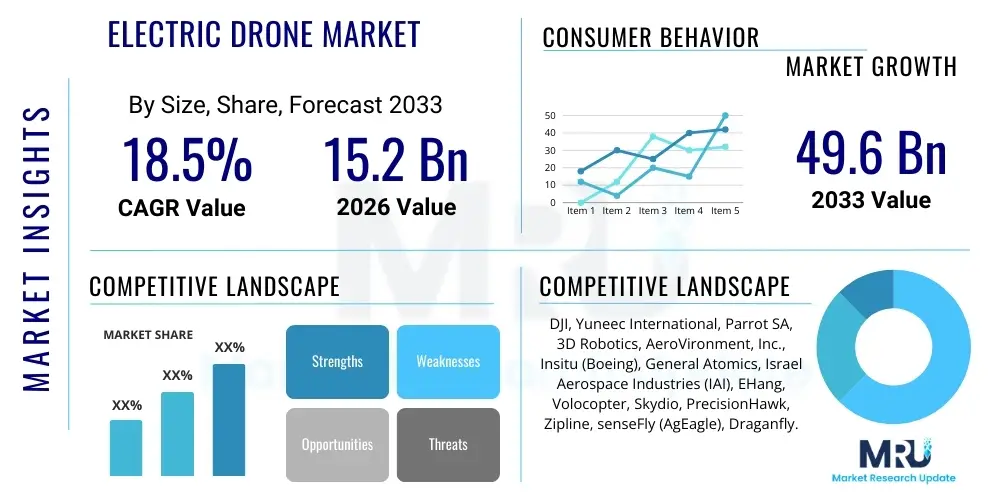

The Electric Drone Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2026 and 2033. The market is estimated at USD 15.2 Billion in 2026 and is projected to reach USD 49.6 Billion by the end of the forecast period in 2033. This robust expansion is fueled by the accelerating integration of electric unmanned aerial vehicles (UAVs) across commercial sectors, including logistics, agriculture, infrastructure inspection, and defense. The shifting regulatory landscape, particularly concerning beyond visual line of sight (BVLOS) operations, is unlocking significant commercial opportunities that necessitate high-performance, battery-powered systems, driving substantial investment in drone technology and manufacturing capabilities worldwide.

The transition towards electric propulsion systems in the drone sector is primarily driven by superior operational efficiency, lower maintenance costs compared to gasoline-powered counterparts, and increasing global mandates for reduced carbon emissions. Electric drones benefit from advancements in battery energy density, which extends flight duration and payload capacity, making them viable for heavy-duty applications such as cargo transport and complex surveying tasks. Furthermore, the proliferation of associated digital infrastructure, including 5G connectivity and sophisticated ground control systems, enables scalable fleet management and complex autonomous missions, significantly enhancing the market's total addressable volume (TAV).

Electric Drone Market introduction

The Electric Drone Market encompasses the design, manufacture, and deployment of unmanned aerial vehicles powered exclusively or primarily by electric batteries. These sophisticated devices, ranging from small multi-rotor systems used for photography and surveillance to large fixed-wing platforms employed for long-range logistics, are transforming industries by providing cost-effective, precise, and environmentally friendly aerial solutions. Key applications span across precision agriculture (crop monitoring and spraying), infrastructure inspection (power lines, bridges, wind turbines), surveying and mapping, and increasingly, last-mile delivery services in urban and suburban environments. The inherent benefits of electric propulsion, such as low acoustic signature, zero direct emissions, and simplified mechanical design, position them as critical tools for modern aerial operations, driving significant technological convergence and market penetration across diverse commercial and governmental segments globally.

Major applications driving market growth include aerial photogrammetry for construction and real estate, rapid response and search and rescue operations conducted by public safety agencies, and the nascent but rapidly expanding field of Urban Air Mobility (UAM), which envisions passenger transport via electric vertical takeoff and landing (eVTOL) aircraft—a closely related segment heavily leveraging electric drone technologies. The primary benefits realized by end-users involve enhanced operational safety by removing personnel from hazardous environments, substantial cost reductions due to automation and reduced fuel dependency, and the acquisition of highly accurate, real-time aerial data. These factors collectively establish electric drones as fundamental assets in the transition towards automated, data-centric industrial ecosystems worldwide, necessitating continuous innovation in power management and navigational intelligence.

Driving factors for the electric drone market include favorable government regulations promoting drone use in commercial airspace, particularly in developed economies, coupled with significant technological breakthroughs in energy storage solutions, miniaturized sensor payloads, and autonomous flight algorithms. The increasing demand for expedited logistics, especially in e-commerce and pharmaceutical delivery, further accelerates the adoption of electric drone fleets. Furthermore, rising defense expenditures focused on integrating autonomous electric UAVs for intelligence, surveillance, and reconnaissance (ISR) missions provide a foundational economic incentive for continued technological maturation, creating robust demand pathways for advanced electric drone systems capable of extended endurance and enhanced operational capabilities in contested environments.

Electric Drone Market Executive Summary

The Electric Drone Market is characterized by intense technological competition and rapid commercialization, positioning it as a dynamic high-growth sector. Business trends indicate a strong move towards specialization, where manufacturers focus on niche applications—such as heavy-lift industrial inspection or ultra-quiet last-mile delivery—rather than generalized platforms. Strategic partnerships between hardware manufacturers, software developers specializing in fleet management and AI-driven data processing, and established aerospace firms are becoming crucial for overcoming complex regulatory hurdles and scaling operations globally. Furthermore, venture capital investment remains robust, primarily targeting startups focusing on long-endurance battery technology and sophisticated counter-drone systems, reflecting the market’s underlying security concerns and persistent demand for improved operational metrics.

Regionally, North America and Asia Pacific are leading the market, driven by differential yet significant factors. North America benefits from clear regulatory frameworks (e.g., FAA initiatives) and a high degree of technological readiness across logistics and energy sectors. Asia Pacific, particularly China and India, exhibits enormous market potential fueled by massive infrastructure projects, burgeoning e-commerce markets demanding faster delivery solutions, and extensive use of drones in agricultural modernization efforts. Europe lags slightly due to complex, fragmented airspace regulations but is poised for significant growth as the European Union Aviation Safety Agency (EASA) harmonizes rules concerning UAM and BVLOS operations, unlocking potential for cross-border drone services and integrated air traffic management systems.

Segment-wise, the commercial segment, particularly logistics and inspection services, dominates revenue share, reflecting immediate utility and return on investment. The multi-rotor configuration continues to hold the largest market share due to its flexibility, vertical takeoff and landing (VTOL) capability, and relative ease of operation in cluttered environments, although the fixed-wing hybrid segment is gaining traction for long-range data collection and surveillance. Battery advancements remain the most critical technological segment, with solid-state and hydrogen fuel cell technologies being heavily researched to address current limitations in flight duration and payload capacity, defining the pace of market expansion and viability in critical high-capacity applications.

AI Impact Analysis on Electric Drone Market

Common user inquiries concerning Artificial Intelligence (AI) in the Electric Drone Market center on operational autonomy, regulatory compliance, and system safety. Users frequently ask how AI can enable true BVLOS flights without human intervention, the role of machine learning in optimizing battery consumption and flight paths, and how computer vision algorithms enhance inspection precision and security applications. A significant theme revolves around the safety implications of highly autonomous systems: specifically, how AI ensures reliable collision avoidance in crowded airspace and defends against cyber threats. Key expectations include personalized drone mission planning, predictive maintenance based on real-time sensor data, and the deployment of self-healing or adaptive navigation systems capable of operating effectively in GPS-denied or dynamic environments.

The integration of AI is fundamentally transforming the operational paradigm of electric drones, moving them from remotely piloted vehicles to fully autonomous decision-making platforms. AI algorithms manage complex sensor fusion, allowing drones to interpret environmental data faster and more accurately than human operators, which is vital for sophisticated tasks like volumetric measurements in mining or identifying subtle structural defects in infrastructure. Furthermore, AI-driven resource management allows drones to dynamically adjust power output based on remaining battery life and mission objectives, significantly extending practical range and optimizing payload deployment strategies across large operational areas, substantially reducing mission downtime and enhancing overall efficiency and data capture quality.

- AI enables highly optimized autonomous navigation and flight path planning, maximizing energy efficiency.

- Machine learning algorithms enhance computer vision for precise object detection, surveillance, and automated inspection.

- Predictive maintenance systems, driven by AI analysis of operational data, improve fleet reliability and reduce unexpected failures.

- AI facilitates robust swarm coordination for large-scale operations like mapping or agricultural spraying.

- Deep learning models improve security by enabling autonomous threat assessment and counter-drone measures.

- AI assists in real-time regulatory compliance and dynamic airspace management within complex UAM frameworks.

DRO & Impact Forces Of Electric Drone Market

The Electric Drone Market is propelled by increasing global military adoption of electric UAVs for ISR, rising demand for autonomous last-mile delivery services driven by e-commerce expansion, and continuous technological advancements in battery performance and sensor miniaturization, collectively acting as potent Drivers (D). Restraints (R) primarily involve stringent and often fragmented global airspace regulations, persistent public safety concerns regarding privacy and potential misuse, and technical limitations related to current battery energy density, which restricts heavy-lift and long-endurance missions. Opportunities (O) abound in the development of integrated air traffic management (UTM) systems, the expansion into specialized industrial services such as offshore wind farm maintenance, and leveraging 5G networks for enhanced command and control capabilities. These factors exert complex Impact Forces, requiring stakeholders to simultaneously invest in regulatory compliance, technological breakthroughs, and public trust initiatives to navigate the market landscape effectively and capitalize on emerging large-scale commercial applications.

Key drivers include the demonstrable cost savings achieved through automated operations compared to traditional methods (e.g., using helicopters for inspection), government investments aimed at modernizing transportation infrastructure through drone logistics corridors, and the growing requirement for high-resolution aerial data across construction, utilities, and emergency services. The environmental benefit—zero operational emissions—also aligns with corporate sustainability goals, making electric drones an increasingly preferred choice for environmentally conscious enterprises and public entities, thereby solidifying their long-term market acceptance and driving substantial increases in procurement volumes globally.

The restraining impact of regulatory complexity, particularly concerning BVLOS and night operations, remains significant, often hindering the rapid scale-up of drone services in densely populated areas. Furthermore, the limited lifespan and recharge cycles of lithium-ion batteries pose operational bottlenecks for missions requiring continuous deployment or substantial payload capacity. Addressing these restraints necessitates collaborative efforts between industry bodies and regulatory agencies to establish standardized safety protocols and sustained investment in next-generation power sources, such as solid-state batteries or compact hydrogen fuel cells, which promise to radically alter the performance envelope of electric UAVs and unlock currently restricted market segments requiring superior energy endurance.

Segmentation Analysis

The Electric Drone Market is analyzed across various critical dimensions including type, payload capacity, application, and end-user. This multi-faceted segmentation provides granular insights into specific high-growth niches and technological preferences shaping demand patterns. By configuration, multi-rotor and hybrid fixed-wing UAVs dominate, reflecting their adaptability to different operational profiles—from precise hovering tasks to long-distance mapping. Application analysis highlights logistics, inspection, and defense as leading segments, each requiring specialized platform characteristics, while end-user segmentation underscores the growing adoption across commercial enterprises (e.g., construction, energy, agriculture) versus governmental and military entities, defining unique sales and support requirements within each category.

- By Type:

- Multi-Rotor

- Fixed-Wing

- Hybrid (VTOL/Fixed-Wing)

- By Payload Capacity:

- Small (Up to 5 kg)

- Medium (5 kg – 25 kg)

- Heavy (Above 25 kg)

- By Application:

- Surveillance and Monitoring

- Mapping and Surveying

- Delivery and Logistics

- Inspection and Maintenance (Infrastructure, Energy)

- Precision Agriculture

- Defense and Security

- By End-User:

- Commercial (E-commerce, Construction, Media)

- Government and Public Safety

- Military and Defense

- By Component:

- Airframe/Hardware

- Software and Services (Flight Control Systems, Data Analytics)

- Power Systems (Batteries, Motors, ESCs)

- Payloads (Cameras, Sensors, LiDAR)

Value Chain Analysis For Electric Drone Market

The Value Chain for the Electric Drone Market begins with Upstream Analysis, focusing on the sourcing and supply of critical raw materials and specialized components. This stage involves manufacturers of advanced composite materials (carbon fiber), high-performance electric motors, sophisticated avionics, and crucially, specialized lithium-ion or solid-state batteries. The competitiveness at this upstream level is heavily influenced by geopolitical stability affecting raw material supply (e.g., lithium, cobalt) and the intellectual property related to proprietary battery chemistries and motor efficiency. Key activities involve research and development into lightweighting materials and optimizing power systems for extended operational efficiency and durability in varying environmental conditions, establishing the foundational cost and performance parameters of the final product.

Midstream activities encompass the core manufacturing, assembly, and integration of the drone platform. This stage involves the integration of flight control systems, navigation hardware (GPS/IMU), and essential communication links, alongside rigorous quality control testing and certification processes necessary for airspace compliance. The distribution channel analysis is critical, covering both Direct and Indirect approaches. Direct channels typically involve high-value, customized military or industrial contracts where manufacturers deal directly with the end-user for specialized deployment and maintenance support. Indirect channels utilize global distributors, value-added resellers (VARs), and e-commerce platforms, especially for prosumer and entry-level commercial drones, requiring robust logistics networks capable of handling sensitive electronics and complying with varied regional import/export regulations concerning dual-use technology.

The Downstream analysis focuses on service delivery and end-user deployment. This includes drone-as-a-service (DaaS) providers, software developers offering specialized data analytics and fleet management solutions, and maintenance, repair, and overhaul (MRO) operations. The value shifts downstream significantly as the market matures, with data derived from drone operations (e.g., 3D maps, inspection reports) often being more valuable than the hardware itself. Therefore, strong partnerships with specialized software firms and cloud computing providers are essential for monetizing aerial data and providing comprehensive, integrated solutions to large enterprise customers, creating long-term recurring revenue streams and bolstering customer retention through specialized analytical insights.

Electric Drone Market Potential Customers

The primary End-Users and Buyers of electric drone technology span a wide spectrum of sectors requiring automated aerial solutions for data collection, asset monitoring, and efficient goods movement. Infrastructure operators, including national utility companies (power transmission, pipelines), telecommunication firms, and transportation authorities (railways, highways), represent major buyers utilizing drones for routine inspection, maintenance planning, and rapid post-disaster assessment, valuing the speed and accuracy of high-definition aerial data. The military and defense sectors constitute a crucial customer base, seeking electric UAVs for silent reconnaissance, target acquisition, and logistical resupply in forward operational areas, prioritizing stealth, reliability, and ease of deployment in challenging environments.

The E-commerce and logistics industry, spearheaded by major retailers and dedicated delivery services, forms a rapidly expanding customer segment, investing heavily in electric drones for last-mile and middle-mile delivery, especially in remote or difficult-to-access locations. These buyers prioritize operational range, payload capacity optimized for package size, and highly reliable, automated flight software integrated with existing logistics management platforms. Furthermore, the agricultural sector represents a massive addressable market, where large farming cooperatives and precision agriculture specialists purchase drones for highly detailed crop monitoring, targeted pesticide application, and soil analysis, focusing on ROI metrics tied to yield improvement and reduced input costs through precise resource management enabled by aerial imaging technology.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 15.2 Billion |

| Market Forecast in 2033 | USD 49.6 Billion |

| Growth Rate | 18.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | DJI, Yuneec International, Parrot SA, 3D Robotics, AeroVironment, Inc., Insitu (Boeing), General Atomics, Israel Aerospace Industries (IAI), EHang, Volocopter, Skydio, PrecisionHawk, Zipline, senseFly (AgEagle), Draganfly. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Electric Drone Market Key Technology Landscape

The technology landscape of the Electric Drone Market is rapidly evolving, driven primarily by advancements in three core areas: propulsion and energy storage, sensor payloads, and autonomous flight intelligence. Energy storage remains paramount, with current research heavily focused on increasing the volumetric and gravimetric energy density of batteries. While lithium-ion dominates, emerging solid-state battery technology promises longer flight times, faster charging capabilities, and improved safety profiles by eliminating flammable liquid electrolytes. Additionally, hybrid systems integrating high-efficiency electric motors with small, lightweight hydrogen fuel cells are being piloted for extended range applications where battery weight is a critical constraint, providing crucial breakthroughs for heavy-lift and long-distance cargo delivery missions that require prolonged operational endurance beyond current battery limitations.

Sensor technology is miniaturizing rapidly while increasing in capability, enabling drones to carry sophisticated payloads without compromising flight duration. Key technologies include high-resolution LiDAR systems for precise 3D mapping and infrastructure modeling, advanced thermal and multispectral cameras critical for precision agriculture and inspection, and sophisticated real-time kinematic (RTK) GPS for highly accurate positioning essential for autonomous landings and complex maneuvers in challenging environments. The integration of 5G connectivity is also pivotal, enabling low-latency, high-bandwidth data transmission necessary for real-time video streaming, robust command and control links over large distances, and seamless communication between drone fleets and centralized UTM systems, significantly enhancing operational reliability and data throughput capabilities across diverse applications.

Crucially, the development of sophisticated onboard processing and AI-driven flight management systems defines the next generation of electric drones. Edge computing capabilities allow drones to process complex sensor data instantly for autonomous decision-making (e.g., dynamic obstacle avoidance and payload adjustments) without relying solely on cloud connectivity, which is vital for operations in remote or contested regions. Technologies such as neural networks for enhancing object recognition, adaptive flight algorithms that compensate for component failure, and integrated cybersecurity measures protecting against signal jamming and data interception are standardizing across high-end commercial and military platforms, ensuring operational resilience and security in increasingly complex airspace environments, thereby mitigating risks associated with autonomous deployment.

Regional Highlights

- North America: Leading the market due to substantial governmental support, particularly from the US Department of Defense and the FAA, which is actively working on integrating drones into national airspace. High adoption rates across energy, construction, and specialized logistics sectors, alongside a robust ecosystem of technology providers and venture capital funding, solidify its market dominance.

- Europe: Characterized by stringent but unifying regulatory efforts by EASA, particularly concerning UAM and safety standards. Key growth is concentrated in infrastructure inspection, environmental monitoring, and initial deployment of passenger eVTOL concepts, focusing heavily on sustainability and quiet operation in urban environments.

- Asia Pacific (APAC): Fastest growing region, driven by massive utilization in logistics (China, Japan), agriculture (India, Southeast Asia), and expansive government investments in surveillance and security technologies. China holds a dominant position in manufacturing and internal market adoption, influencing global supply chain dynamics.

- Latin America: Emerging market with increasing adoption in mining, large-scale agriculture (e.g., Brazil, Argentina), and surveying activities. Growth is constrained by economic volatility and slower regulatory development but offers significant untapped potential in resource management applications.

- Middle East and Africa (MEA): Primarily driven by defense and security applications, coupled with growing interest in infrastructure projects and oil & gas pipeline inspection. High investment from Gulf Cooperation Council (GCC) countries in smart city initiatives and UAM infrastructure fuels localized growth.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Electric Drone Market.- DJI (Dajiang Innovation)

- Yuneec International

- Parrot SA

- AeroVironment, Inc.

- Insitu (Boeing)

- General Atomics Aeronautical Systems

- Israel Aerospace Industries (IAI)

- EHang Holdings Limited

- Volocopter GmbH

- Skydio

- PrecisionHawk

- Zipline

- senseFly (AgEagle Aerial Systems)

- Draganfly Inc.

- Kespry

- Autel Robotics

- Textron Systems (through Aerosonde)

- Elbit Systems

- Lockheed Martin Corporation

- Microdrones GmbH

Frequently Asked Questions

Analyze common user questions about the Electric Drone market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor limiting the flight time and payload capacity of electric drones?

The primary limitation is the current energy density of commercial lithium-ion batteries. Enhancing battery technology, including the adoption of solid-state or hydrogen fuel cells, is critical to achieving longer endurance and increasing viable payload capacity for heavy-lift applications, which currently restricts the use of electric drones in long-distance logistics operations.

How is regulatory policy evolving to support the commercial deployment of electric drones, particularly BVLOS operations?

Regulatory bodies like the FAA and EASA are progressively establishing specific frameworks for beyond visual line of sight (BVLOS) operations and integrated airspace management (UTM). This evolution involves establishing strict safety standards, performance requirements for autonomous systems, and dedicated drone corridors, which are essential steps for scaling commercial drone delivery and inspection services safely.

Which application segment is expected to drive the highest market growth in the near future?

The Delivery and Logistics segment is projected to exhibit the highest growth rate. Driven by global e-commerce demands and the need for efficient, rapid last-mile delivery, significant investment is flowing into large fleet deployment and specialized drone hub infrastructure, positioning logistics as a critical revenue generator in the electric drone market over the forecast period.

What role does Artificial Intelligence (AI) play in improving electric drone safety and operational efficiency?

AI is crucial for enabling autonomous operations, enhancing safety through advanced collision avoidance algorithms, and optimizing operational efficiency by managing power consumption and dynamic flight path planning. AI-driven computer vision also improves data capture quality for precision applications like detailed infrastructure inspection and agricultural monitoring.

What is the difference in operational suitability between multi-rotor and hybrid fixed-wing electric drones?

Multi-rotor drones offer superior maneuverability and hover capability, making them ideal for precise inspection, surveillance, and short-range delivery in congested areas. Hybrid fixed-wing drones offer significantly greater range and speed, making them more suitable for long-distance mapping, large-area surveying, and middle-mile cargo transport, blending fixed-wing efficiency with VTOL flexibility.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager