Electric Motor Repair Service Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443306 | Date : Feb, 2026 | Pages : 245 | Region : Global | Publisher : MRU

Electric Motor Repair Service Market Size

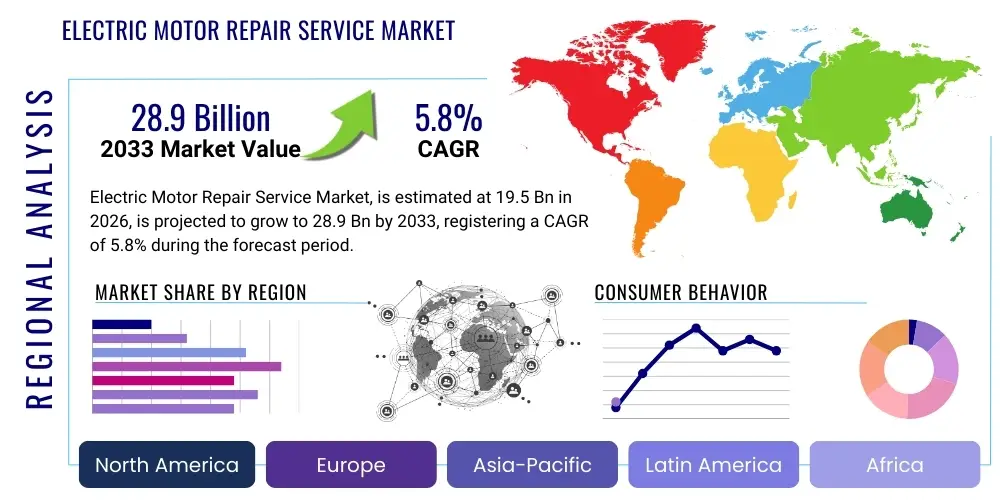

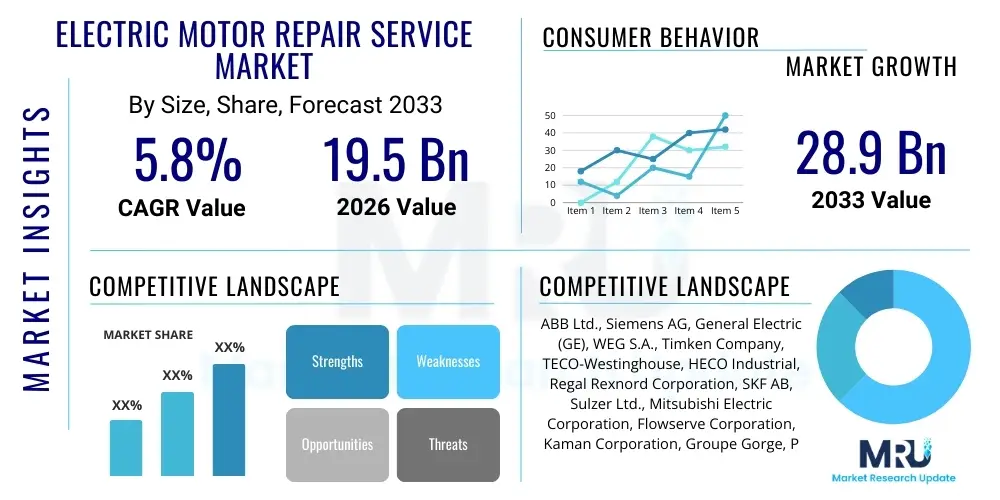

The Electric Motor Repair Service Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 19.5 Billion in 2026 and is projected to reach USD 28.9 Billion by the end of the forecast period in 2033.

Electric Motor Repair Service Market introduction

The Electric Motor Repair Service Market encompasses the specialized activities required to diagnose, restore, and maintain the operational efficiency of various types of electric motors, ranging from small fractional horsepower motors to large industrial high-voltage machines. This essential service ensures continuity of operations across critical industrial sectors, minimizing costly downtime associated with motor failure. The scope of services typically includes comprehensive winding repair, mechanical component refurbishment (bearings, shafts, housing), dynamic balancing, predictive maintenance integration, and overall performance testing to meet or exceed original equipment manufacturer (OEM) specifications. As industrial processes become increasingly automated and reliant on continuous mechanical performance, the demand for timely and high-quality motor repair services acts as a fundamental pillar supporting global manufacturing and infrastructure stability. Furthermore, advancements in repair techniques, particularly those focusing on optimizing energy efficiency post-repair, are enhancing the value proposition of specialized repair providers.

The core applications driving the market demand span across heavy manufacturing, oil and gas, power generation, mining, water and wastewater treatment, and HVAC systems in commercial infrastructure. In manufacturing environments, electric motors are the primary drivers for pumps, compressors, fans, conveyors, and machine tools, making their reliability paramount. The benefits derived from professional repair services are significant, including extending the lifecycle of expensive assets, reducing capital expenditure on replacements, and crucially, improving system reliability. Specialized repair services often integrate preventative measures, such as enhanced insulation systems and superior bearing upgrades, which improve the motor's performance beyond its original specifications, thereby contributing to lower overall operating costs and enhanced energy conservation efforts, aligning with increasing global mandates for sustainability and operational efficiency. The strategic importance of quick turnaround times in repair facilities is also a key competitive factor, especially for mission-critical motors where downtime can incur millions in lost productivity.

Major driving factors influencing the robust growth of this market include the global expansion of the industrial base, particularly in emerging economies, and the extensive installed base of legacy motors that periodically require maintenance and repair. Additionally, stringent regulatory standards, such as those imposed by agencies requiring minimum efficiency standards for motors, often necessitate skilled repair processes that maintain or improve efficiency levels after servicing. The trend toward adopting Industry 4.0 technologies—specifically condition monitoring and predictive maintenance solutions—is revolutionizing the repair landscape, shifting the industry focus from reactive failure response to proactive preventative intervention, thereby ensuring higher asset utilization and reduced risk of catastrophic failure. The rising cost of new, high-efficiency motors also makes refurbishing existing assets an economically compelling choice for many industrial operators globally.

Electric Motor Repair Service Market Executive Summary

The Electric Motor Repair Service Market is characterized by robust resilience driven by the critical necessity of maintaining industrial uptime and the economic viability of repairing high-value assets versus outright replacement. Business trends indicate a significant shift toward sophisticated service offerings, moving beyond simple component replacement to comprehensive asset management programs. Leading repair providers are investing heavily in advanced diagnostic tools, such as thermal imaging, vibration analysis, and laser alignment, ensuring highly accurate repairs and predictive failure analysis. Furthermore, consolidation among smaller regional repair shops and specialized independent service organizations (ISOs) is reshaping the competitive landscape, aiming for economies of scale and broader geographical coverage to service large multinational clients. The demand for repairs specific to higher efficiency motors (e.g., IE3 and IE4 standards) is increasing, requiring technicians to possess specialized knowledge in modern winding techniques and insulation materials. Service customization, including on-site emergency repair and dedicated inventory management for critical spares, represents a primary differentiator among market leaders, reflecting the demand for tailored, high-urgency industrial support.

Regionally, the Asia Pacific (APAC) stands out as the fastest-growing market due to rapid industrialization, extensive infrastructural development, and substantial expansion of the manufacturing and processing sectors, particularly in China, India, and Southeast Asian nations. This growth is accompanied by increased installation of new motors, which eventually enter the repair lifecycle. North America and Europe, characterized by mature industrial bases, exhibit stable demand, focusing primarily on scheduled preventative maintenance, motor efficiency upgrades, and complex repairs of large, aging infrastructure motors used in power generation and petrochemical industries. These developed regions are also early adopters of condition monitoring technologies, fueling demand for repairs informed by real-time operational data. Conversely, market growth in Latin America and the Middle East & Africa (MEA) is accelerating, tied intrinsically to fluctuating investments in the oil and gas sector, mining operations, and burgeoning utilities infrastructure, demanding ruggedized repair solutions suitable for harsh operating environments.

Segment trends highlight the dominance of the AC motor repair segment, reflecting the pervasive use of AC induction motors in industrial applications worldwide. However, the DC motor repair segment, while smaller, maintains importance in specialized fields like transportation, traction, and certain legacy industrial processes. In terms of service type, the predictive maintenance segment is showing the highest growth trajectory, rapidly overtaking purely reactive or time-based preventative schedules. End-user analysis reveals that the manufacturing and process industries (chemicals, metals, pulp & paper) remain the largest consumers of repair services, given their sheer density of motor assets and the critical need for continuous operation. The increasing complexity and cost associated with advanced variable frequency drives (VFDs) and specialized servo motors also contribute to the necessity of skilled repair, positioning these high-tech repair niches as key profitability areas for the industry in the forecast period.

AI Impact Analysis on Electric Motor Repair Service Market

User queries regarding the impact of Artificial Intelligence (AI) on the Electric Motor Repair Service Market predominantly revolve around the automation of diagnostic processes, the reliability of predictive maintenance algorithms, and the potential displacement of skilled human technicians. Users are keen to understand how AI-driven analysis of vibrational, acoustic, and thermal data can pinpoint motor faults before they escalate, thereby optimizing maintenance schedules and minimizing unexpected outages. There is significant interest in AI's role in correlating historical repair records with real-time operational parameters to generate highly accurate Remaining Useful Life (RUL) predictions for critical assets. Concerns frequently surface regarding the initial investment required for sensor installation and data infrastructure, the potential bias in algorithmic fault identification, and the need for specialized training to interpret AI-generated maintenance recommendations. Ultimately, the market anticipates AI will transform the industry from a reactive repair model to a highly efficient, data-driven preventative service, fundamentally altering the skill sets required by technicians toward data literacy and complex system integration.

- AI-driven Predictive Maintenance (PdM) algorithms enhance failure detection accuracy significantly beyond traditional thresholds.

- Automated root cause analysis (RCA) speeds up diagnosis by processing vast datasets from interconnected motor sensors (IoT integration).

- Optimized inventory management for critical spare parts based on forecasted failure probabilities, reducing warehousing costs.

- Introduction of AI-assisted decision support tools for field technicians, offering real-time repair guidance and access to digital repair histories.

- Potential for robotic or automated systems to handle repetitive and dangerous aspects of motor disassembly and cleaning processes.

- Improved quality control post-repair through AI analysis of performance testing data, ensuring compliance with efficiency benchmarks.

- Development of personalized motor health reports and lifecycle assessments powered by machine learning models.

DRO & Impact Forces Of Electric Motor Repair Service Market

The dynamics of the Electric Motor Repair Service Market are fundamentally shaped by a convergence of economic necessities, technological progression, and regulatory mandates, summarized by strong growth drivers offset by specific logistical and financial constraints, presenting substantial opportunities for strategic market players. Key drivers include the massive installed base of electric motors globally, many of which are nearing or past their optimal operational lifespan, necessitating frequent and specialized maintenance to prevent catastrophic industrial failure. Furthermore, the rising global focus on circular economy principles and sustainable industrial practices favors motor repair and refurbishment over replacement, providing a strong environmental and economic impetus for market growth. Technological advancements in diagnostic tools and repair materials, particularly high-performance insulation and high-efficiency bearing systems, allow repair firms to offer services that actually enhance the motor’s performance and energy rating post-service, adding significant value for the end-user. This ability to deliver 'better-than-new' performance in many cases is a powerful driver.

However, the market faces significant restraints. A major challenge is the inherent cost-versus-replacement dilemma, especially for smaller or older motors where the cost of a complex, high-quality repair can approach or sometimes exceed the cost of a new, potentially higher-efficiency replacement motor, leading end-users to opt for new purchases. Another critical restraint is the persistent shortage of highly skilled, certified electro-mechanical technicians capable of handling the intricate repair and precise calibration required for modern, highly engineered motor designs, particularly those integrated with variable speed drives and complex digital controls. Logistical constraints, such as the time required for transportation and repair turnaround—which directly translates into costly downtime for the end-user—also act as a significant barrier. Moreover, the increasing complexity of motor technology requires continuous investment in training and sophisticated equipment, putting smaller, independent repair shops at a competitive disadvantage against larger service networks.

Opportunities for market expansion are centered around the proliferation of Internet of Things (IoT) sensors and connectivity, enabling sophisticated predictive maintenance contracts that guarantee uptime and offer subscription-based service models rather than transactional repair jobs. The massive global push towards decarbonization and industrial energy efficiency mandates creates a specific niche opportunity for repair shops specializing in upgrading standard motors to meet or exceed International Efficiency (IE) ratings during the refurbishment process. Geographically, untapped potential lies in expanding sophisticated repair network coverage in rapidly industrializing regions of Africa and Southeast Asia where local technical capacity often lags behind industrial installation rates. The impact forces acting on the market are high, driven primarily by technological disruption (AI/IoT integration) and economic sensitivity (industrial capital expenditure cycles). The necessity of reducing industrial carbon footprints exerts an indirect but powerful influence, compelling companies to choose repair and efficiency upgrades over disposal, ensuring sustained demand for high-value repair services throughout the forecast period, and transforming repair shops into essential partners for industrial sustainability goals.

Segmentation Analysis

The Electric Motor Repair Service Market is comprehensively segmented based on motor type, service type, and key end-user industry, reflecting the diverse technical requirements and operational demands across the industrial spectrum. Segmentation provides critical insights into high-growth areas, such as the increasing demand for specialized repair of high-voltage and high-efficiency motors, which require precision diagnostics and adherence to stringent quality control standards. The market's segmentation highlights the varying maturity and complexity levels of repairs required across different motor classes, from standard AC induction motors that form the market volume backbone to specialized servo motors critical for high-precision manufacturing. Understanding these segments is crucial for service providers aiming to tailor their technical expertise, investment in specialized equipment, and marketing strategies to capture niche high-value repair contracts, particularly within the lucrative power generation and oil & gas sectors.

- By Motor Type:

- AC Motors (Standard Induction Motors, Synchronous Motors)

- DC Motors (Series Wound, Shunt Wound, Compound Wound)

- Specialty Motors (Servo Motors, Stepper Motors, Explosion-Proof Motors)

- By Service Type:

- Repair and Rewinding

- Maintenance (Preventive, Predictive, Condition Monitoring)

- Overhaul and Refurbishment

- Testing and Inspection (Vibration Analysis, Thermography, Alignment)

- On-Site Services

- By End-User Industry:

- Oil and Gas

- Power Generation

- Mining and Metals

- Manufacturing (Pulp & Paper, Cement, Chemicals)

- Water and Wastewater Treatment

- HVAC and Commercial Infrastructure

- Automotive and Transportation

Value Chain Analysis For Electric Motor Repair Service Market

The value chain of the Electric Motor Repair Service Market is intricate, starting from the upstream supply of specialized components, moving through core service provision, and culminating in the direct deployment and long-term asset management for end-users. The upstream segment is dominated by suppliers of critical components such as high-grade copper wire, specialized insulation materials (e.g., VPI resins, mica tapes), bearings (often customized ceramic or high-speed variants), and sophisticated diagnostic hardware (sensors and analyzers). The quality and availability of these materials directly impact the integrity and longevity of the repair, making strategic supplier relationships vital for repair firms. Maintaining high inventory levels of critical or long-lead-time components is a strategic necessity for service providers to ensure the rapid turnaround times demanded by industrial clients, emphasizing the reliance on a robust and reliable global supply network for specialized electrical and mechanical parts.

The core of the value chain involves the repair and maintenance providers—the electro-mechanical repair shops. These range from large, globally integrated service networks operated by OEMs or major independent service organizations (ISOs) to smaller, highly specialized regional firms. This stage encompasses the technical processes: motor tear-down, detailed inspection and failure analysis, precision machining (shaft repair, housing restoration), specialized winding/rewinding processes, VPI (Vacuum Pressure Impregnation) treatments, reassembly, dynamic balancing, and rigorous no-load and full-load testing. The distribution channel predominantly favors direct service contracts due to the technical nature and criticality of the assets. Larger industrial customers usually engage directly with major repair providers through comprehensive service agreements (CSAs) that cover scheduled maintenance, emergency repairs, and full plant motor inventory management, bypassing traditional third-party distributors for the primary repair service itself.

In the downstream segment, the services culminate at the end-user facilities, where the repaired motors are reintegrated into the operational chain. This stage involves specialized on-site activities such as precision installation, laser alignment, and condition monitoring setup. The role of indirect distribution channels, such as industrial equipment brokers or facility management companies, is limited but exists in coordinating repair logistics for smaller facilities or non-critical assets. The value derived at this final stage is measured by increased asset reliability, extended motor lifespan, and assured compliance with energy efficiency standards. The trend toward incorporating advanced digital services, such as remote monitoring dashboards and AI-powered service reports, further extends the value chain beyond the physical repair, transitioning the service providers into crucial partners in the client's overall operational reliability strategy.

Electric Motor Repair Service Market Potential Customers

The primary consumers and end-users of electric motor repair services are industrial entities operating highly mechanized processes where motor reliability directly impacts production throughput and safety standards. These potential customers possess a large installed base of diverse motors, spanning various sizes, voltage ratings, and environmental specifications (e.g., standard vs. explosion-proof). The manufacturing sector remains the bedrock of demand, encompassing heavy industries like pulp and paper, cement production, steel mills, and chemicals, where motors run continuously under heavy load and harsh conditions, leading to predictable wear and tear that necessitates specialized repair expertise. These clients often seek comprehensive, long-term service agreements that guarantee specific uptime levels and predetermined emergency response times, emphasizing the value of preventative over reactive service models.

Critical infrastructure sectors, including power generation (both conventional thermal and renewable energy), water and wastewater management, and the oil and gas industry (upstream, midstream, and downstream operations), represent another significant customer base. In these environments, motor failure is not only costly in terms of lost production but can also carry severe environmental or public safety risks. For instance, pump motor failures in wastewater plants or critical compressor motor outages in a refinery necessitate rapid, certified, and highly reliable repair solutions, often requiring compliance with sector-specific certifications (e.g., ATEX or API standards for hazardous locations). These customers prioritize quality assurance, traceability of repairs, and the integration of condition monitoring technology to mitigate operational risk associated with mission-critical rotating machinery.

Furthermore, commercial and public service entities, such as large data centers, commercial HVAC operations, and public transportation systems (rail and traction), are increasingly valuable customers. While the individual motor size might be smaller than those in heavy industry, the sheer volume and the essential nature of continuous climate control or transit movement drive steady demand for repair services. The growing trend of modernizing old equipment with higher efficiency motors, particularly in HVAC and industrial cooling systems to meet sustainability goals, creates specific demand for repair providers capable of retrofitting and upgrading older motor designs to meet modern IE3/IE4 standards during refurbishment. These customers value energy efficiency improvements and reliable operation delivered by experienced, certified repair professionals.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 19.5 Billion |

| Market Forecast in 2033 | USD 28.9 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ABB Ltd., Siemens AG, General Electric (GE), WEG S.A., Timken Company, TECO-Westinghouse, HECO Industrial, Regal Rexnord Corporation, SKF AB, Sulzer Ltd., Mitsubishi Electric Corporation, Flowserve Corporation, Kaman Corporation, Groupe Gorge, Precision Electric Motor Repair, Romanoff Electric Motor Repair, Custom Coil & Rotor, Integrated Power Services (IPS), Delba Electrical, Allied Electric. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Electric Motor Repair Service Market Key Technology Landscape

The modern Electric Motor Repair Service Market is increasingly defined by the adoption of advanced diagnostic, repair, and monitoring technologies aimed at enhancing the precision, speed, and long-term reliability of serviced assets. Central to this technological shift is the widespread use of condition monitoring tools, which integrate vibration analysis, infrared thermography, and oil particle counting to diagnose faults non-invasively and proactively. High-precision laser alignment systems are now standard practice, ensuring that coupling and shaft alignment is executed perfectly to prevent premature bearing and coupling failure, a primary cause of motor downtime. Sophisticated winding analysis equipment, such as surge testers and partial discharge analyzers, allows technicians to assess the integrity of insulation systems in high-voltage motors, significantly improving the quality control and longevity of rewound stators. The integration of advanced computer-aided winding machinery further ensures that rewound motors achieve maximum flux density and efficiency, often surpassing hand-winding methods in consistency and quality.

Another pivotal technological development involves the application of digital tools to streamline workflow and improve transparency for the client. The use of Augmented Reality (AR) and Virtual Reality (VR) is emerging, particularly among global service providers, to facilitate remote technical support, allowing senior engineers to guide on-site technicians through complex diagnostic or assembly procedures irrespective of geographical location. Digital job tracking, often integrated through Enterprise Resource Planning (ERP) systems customized for repair processes, allows customers to monitor the repair status of their motor assets in real-time, providing crucial predictability for their operational planning. Furthermore, modern repair shops utilize advanced Vacuum Pressure Impregnation (VPI) systems, which apply specialized high-temperature, high-dielectric resins to winding components under vacuum, drastically improving insulation integrity and resistance to moisture and chemical contamination, a requirement for demanding industrial environments like chemical plants or offshore facilities.

The convergence of repair and data analytics is cementing the role of technology. Specialized dynamic balancing machines, equipped with digital interfaces and high-resolution sensors, ensure repaired rotors run smoothly at operational speed, minimizing mechanical stress. The most impactful technological frontier, however, remains the integration of IoT sensors (accelerometers, temperature probes) directly into critical motor assets, feeding data into AI platforms for continuous health monitoring. This technology transforms the service offering from a physical repair transaction to a data-driven reliability partnership. By leveraging these technologies, repair firms are not just fixing motors; they are managing asset risk, maximizing energy efficiency, and providing actionable insights that help clients optimize their entire industrial footprint. This focus on technological differentiation is essential for maintaining competitive advantage and meeting the rigorous demands of modern, highly automated production facilities.

Regional Highlights

- North America: The North American market is characterized by high operational costs and a strong regulatory focus on energy efficiency (e.g., NEMA Premium standards), driving demand for efficiency-enhancing repair services and high-quality parts. The region benefits from a high adoption rate of predictive maintenance technologies and a mature infrastructure base in sectors like oil and gas, utilities, and large-scale manufacturing. The market here demands rapid response and highly specialized expertise for repairing large, high-voltage motors often found in power generation and petrochemical facilities. The presence of sophisticated service networks and a concentration of key technology innovators sustain the high quality and advanced nature of repair services available across the U.S. and Canada.

- Europe: Europe exhibits a strong commitment to environmental sustainability and circular economy models, significantly boosting the market for motor refurbishment over replacement. Regulatory drivers, particularly those stemming from the European Union (EU) regarding energy performance directives (IE3 and beyond), mandate that repairs must maintain or improve motor efficiency, creating specialized opportunities for repair providers. Germany, the UK, and Italy are key repair hubs, driven by strong automotive, machinery manufacturing, and chemical industries. The market is highly competitive, emphasizing certified quality (ISO standards) and comprehensive service contracts focused on long-term asset management and energy conservation goals.

- Asia Pacific (APAC): APAC represents the highest growth potential globally, fueled by rapid industrialization, massive infrastructure projects, and the expansion of manufacturing capabilities, particularly in China, India, and ASEAN countries. While price sensitivity remains a factor, the sheer volume of newly installed motors quickly entering the repair cycle ensures robust demand. A dual market exists: high-end repair services are required for foreign multinational corporations (MNCs) utilizing advanced machinery, while local industries seek cost-effective, high-volume repair solutions. Investment in local training and certification programs is crucial here to meet the burgeoning demand for qualified technicians.

- Latin America (LATAM): The LATAM market growth is closely tied to commodity markets, especially mining, agriculture, and oil and gas extraction across countries like Brazil, Mexico, and Chile. The demand is often sporadic but critical, focusing on heavy-duty, robust repairs capable of withstanding harsh operating conditions and remote logistics challenges. Economic volatility can sometimes favor repair and refurbishment strongly over capital expenditure on new motors, making the repair market a crucial operational support service. Service providers must address logistical complexities and often maintain mobile repair units to reach distant industrial sites efficiently.

- Middle East and Africa (MEA): The MEA region is dominated by the massive oil and gas and petrochemical sectors, particularly in the GCC countries (Saudi Arabia, UAE). Demand is concentrated around specialized, high-specification motors (e.g., explosion-proof, high-speed turbomachinery drives). Africa's growth is driven by expanding mining and utility infrastructure. Quality and certification are paramount, especially given the hazardous operational environments. The market relies heavily on global service network access and on-site expert deployment, as local technical capacity for complex repairs is often limited compared to established industrial regions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Electric Motor Repair Service Market.- ABB Ltd.

- Siemens AG

- General Electric (GE)

- WEG S.A.

- Timken Company

- TECO-Westinghouse

- HECO Industrial

- Regal Rexnord Corporation

- SKF AB

- Sulzer Ltd.

- Mitsubishi Electric Corporation

- Flowserve Corporation

- Kaman Corporation

- Groupe Gorge

- Precision Electric Motor Repair

- Romanoff Electric Motor Repair

- Custom Coil & Rotor

- Integrated Power Services (IPS)

- Delba Electrical

- Allied Electric

Frequently Asked Questions

Analyze common user questions about the Electric Motor Repair Service market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for specialized electric motor repair services?

The primary driver is the necessity of minimizing industrial downtime, as electric motor failure can halt production, resulting in significant financial losses. Repair and preventative maintenance services ensure operational continuity, maximize asset reliability, and extend the lifespan of high-value industrial equipment more cost-effectively than full replacement.

How are Industry 4.0 technologies impacting motor repair and maintenance practices?

Industry 4.0, primarily through the integration of IoT-enabled sensors and AI-driven platforms, is shifting the industry from reactive repairs to predictive maintenance (PdM). These technologies analyze real-time operational data (vibration, temperature) to accurately forecast motor failure, allowing for scheduled maintenance interventions before critical breakdown occurs, maximizing efficiency.

Is it more cost-effective to repair an industrial motor or replace it with a new, high-efficiency model?

For large, high-voltage, or specialized industrial motors, repair is typically more cost-effective due to the high capital cost of replacement. Furthermore, specialized repair services often involve retrofitting motors with upgraded components and insulation systems, enhancing their efficiency and longevity to match or exceed the performance of new units, thereby delivering superior long-term value.

What are the most common failures addressed by motor repair services?

The most common failures requiring repair include bearing wear (due to lubrication issues or misalignment), electrical winding faults (caused by insulation breakdown or overheating), and mechanical issues such as shaft cracks, rotor bar damage, and housing degradation. Repair services address these through precise mechanical restoration, specialized rewinding, and dynamic balancing procedures.

Which geographical region exhibits the fastest growth potential for the electric motor repair market?

The Asia Pacific (APAC) region is projected to show the fastest growth potential. This accelerated growth is attributed to rapid and extensive industrialization, significant investments in new manufacturing capacity, and large-scale infrastructure development across countries such as China, India, and Southeast Asia, generating a vast installed base requiring scheduled and emergency repair services.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager