Electric Self Balancing Scooter Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442165 | Date : Feb, 2026 | Pages : 251 | Region : Global | Publisher : MRU

Electric Self Balancing Scooter Market Size

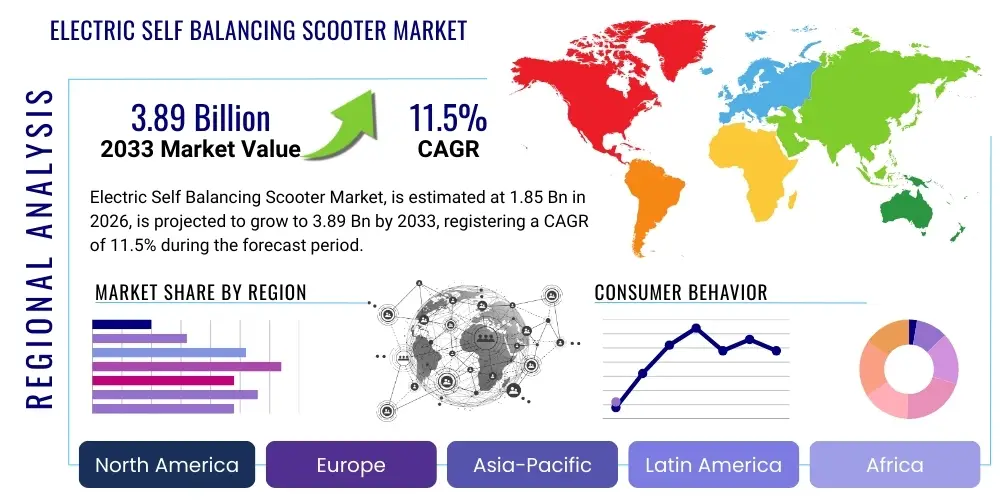

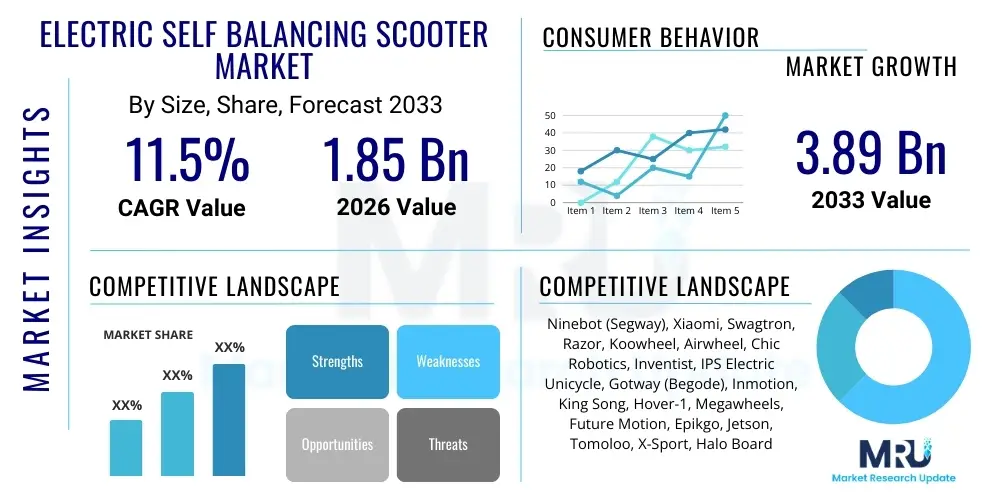

The Electric Self Balancing Scooter Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.5% between 2026 and 2033. The market is estimated at $1.85 Billion in 2026 and is projected to reach $3.89 Billion by the end of the forecast period in 2033.

Electric Self Balancing Scooter Market introduction

The Electric Self Balancing Scooter Market, encompassing devices such as hoverboards, unicycles, and specialized mobility aids, is a dynamic sub-segment of the broader personal electric vehicle (PEV) and micromobility landscape. These devices offer a sustainable, convenient, and entertaining mode of short-distance transportation, primarily catering to urban commuters, recreational users, and individuals seeking last-mile connectivity solutions. The core technology relies on advanced gyroscopic sensors, high-efficiency brushless motors, and sophisticated battery management systems (BMS) to maintain stability, offering hands-free operation and intuitive control to the rider.

Major applications for electric self-balancing scooters span recreational use in parks and leisure areas, personal transportation within large corporate or university campuses, and integration into urban commuting chains, particularly bridging the gap between public transport hubs and final destinations. The inherent benefits, including zero local emissions, reduced traffic congestion contribution, and compact storage capabilities, significantly bolster their appeal in increasingly crowded metropolitan environments. Moreover, the ease of learning and the low operational costs compared to traditional motorized vehicles further drive consumer adoption across various demographic groups.

The market's expansion is fundamentally driven by accelerating urbanization trends globally, coupled with a rising consumer preference for eco-friendly transportation alternatives. Supportive government policies promoting electric mobility, substantial investments in smart city infrastructure facilitating micromobility, and continuous technological advancements improving battery range, safety features, and overall device reliability are key factors propelling the market forward. Furthermore, the strong presence of rental and sharing schemes in major cities has introduced these products to a wider audience, transforming perception from novelty items to viable transport solutions.

Electric Self Balancing Scooter Market Executive Summary

The Electric Self Balancing Scooter Market is characterized by intense competition, rapid technological evolution, and significant expansion fueled by the global shift towards sustainable urban mobility. Key business trends include the consolidation of safety features, such as enhanced fire-resistant battery casings and robust software limitations on speed, driven largely by regulatory pressures and consumer demand for reliability. Furthermore, strategic alliances between scooter manufacturers and urban planning departments are accelerating the integration of these devices into smart city ecosystems, promoting dedicated micromobility lanes and infrastructure improvements. The market sees a distinct segmentation focus, with premium models offering extended range and connectivity targeting professional commuters, while entry-level models prioritize affordability and ease of use for recreational buyers, leading to differentiated product portfolios among major players.

Regionally, Asia Pacific (APAC) currently dominates the market, primarily due to high population density, established manufacturing hubs, and early adoption of micromobility solutions, particularly in China and Southeast Asian nations. North America and Europe, however, exhibit the fastest growth rates, driven by favorable regulatory frameworks supporting shared mobility services and a high disposable income enabling consumers to invest in personal ownership of premium models. Regulatory harmonization across the European Union concerning safety standards and speed limits is expected to streamline market entry for international players. Latin America and the Middle East & Africa (MEA) are emerging markets, showing increasing adoption linked to tourism and improving urban infrastructure investments.

Segment trends highlight the dominance of the Hoverboard segment historically, although Electric Unicycles (EUCs) are gaining momentum due to their superior portability, speed, and range, appealing to experienced riders. In terms of application, the Personal Commute segment is growing exponentially, overtaking Recreational Use as cities prioritize last-mile solutions. The ongoing trend involves the integration of advanced sensors and connectivity (IoT), transforming these scooters from simple transportation tools into smart devices capable of navigation assistance, real-time diagnostics, and theft prevention, thereby increasing the average selling price and segment value across the board.

AI Impact Analysis on Electric Self Balancing Scooter Market

User queries regarding the impact of Artificial Intelligence (AI) on the Electric Self Balancing Scooter Market predominantly center around three key themes: safety enhancement, optimized ride performance, and the integration of autonomous or semi-autonomous features. Users frequently ask how AI can prevent accidents, specifically querying technologies that detect obstacles, manage uneven terrain, and adjust balance dynamically in real-time. Another major area of interest is predictive maintenance—how AI diagnostics can monitor battery health and component wear to prevent catastrophic failure or performance degradation. Furthermore, consumers and operators of shared fleets are keen on understanding how AI-driven routing and traffic analysis can improve efficiency and reduce operational costs.

AI's influence is transforming self-balancing scooters from rudimentary vehicles into intelligent personal mobility platforms. Sophisticated machine learning algorithms are being utilized to analyze vast amounts of sensor data collected during rides (including gyroscope data, motor temperature, and speed profiles). This analysis allows the scooter’s onboard computer to predict rider movements and environmental changes with greater accuracy than traditional control systems, enabling proactive adjustments to motor torque and stability control. This dynamic stabilization not only enhances safety for novice riders but also significantly improves performance when navigating complex urban environments or undertaking sharp turns.

For fleet management and shared mobility, AI provides critical operational efficiencies. Deep learning models analyze historical usage patterns and real-time geographical data to optimize scooter deployment, ensuring units are available where demand is highest and minimizing idle time. Furthermore, computer vision systems, often incorporating edge AI processing, are being trialed to monitor compliance with local regulations, such as detecting sidewalk riding versus designated lanes, or identifying improper parking behavior. This level of intelligent oversight is essential for securing partnerships with municipal governments and ensuring the long-term viability of shared electric self-balancing scooter programs, solidifying AI as a foundational technology for future market growth.

- Enhanced Dynamic Stability Control: AI algorithms predict rider movement and environment for instantaneous balance adjustment, minimizing falls.

- Predictive Maintenance: Machine learning diagnoses battery degradation, motor issues, and component wear, scheduling maintenance before failure occurs.

- Optimized Fleet Rebalancing: AI analyzes usage data and urban mapping to efficiently redistribute shared scooters to high-demand zones.

- Autonomous Navigation Assistance: Semi-autonomous features guide riders away from restricted zones or high-traffic areas through haptic feedback.

- Advanced Obstacle Detection: Integration of computer vision and sensor fusion for real-time hazard identification and speed mitigation.

DRO & Impact Forces Of Electric Self Balancing Scooter Market

The Electric Self Balancing Scooter Market is primarily propelled by the increasing consumer demand for sustainable and convenient last-mile transportation solutions in densely populated cities, supported by favorable regulatory policies across North America and Europe promoting micromobility infrastructure. However, the market faces significant restraints, chiefly concerning safety issues related to lithium-ion battery fires and the lack of standardized, uniform international regulations regarding usage parameters (speed limits, designated riding areas), which often leads to municipal bans or restrictions, hindering mass market acceptance and uniform product development. Opportunities for growth are abundant in emerging economies and through technological advancements focusing on solid-state battery technology for enhanced safety and range, alongside deeper integration into multimodal transit systems and smart city platforms.

The key driver accelerating adoption is the escalating traffic congestion in urban centers globally, pushing commuters towards smaller, agile, and time-saving modes of transport. This is compounded by the rising environmental consciousness among consumers and corporate entities, favoring zero-emission vehicles. Furthermore, the continuous reduction in the cost of high-density lithium-ion batteries and improvements in motor efficiency are driving down the final product cost, making self-balancing scooters more accessible to a broader consumer base. The high visibility and popularity generated by rental services also serve as a powerful marketing driver, acclimatizing users to the technology and encouraging personal ownership.

Restraints are dominated by persistent safety perceptions. High-profile incidents involving thermal runaway (battery fires) in early models necessitated stringent quality control measures, increasing production costs and regulatory scrutiny. Furthermore, inconsistent road safety laws and the ambiguity regarding whether these devices should be classified as pedestrian aids or motorized vehicles create legal hurdles for riders and manufacturers. The primary opportunity lies in expanding product diversification, introducing specialized models for diverse terrains or niche markets like industrial warehousing or large-scale retail logistics. The growing trend of connectivity (IoT integration) and the development of safer battery chemistries represent critical impact forces poised to reshape the competitive landscape and mitigate major restraints, ultimately determining the long-term market trajectory.

Segmentation Analysis

The Electric Self Balancing Scooter Market is extensively segmented based on Product Type, Application, and Distribution Channel, allowing for detailed analysis of consumer behavior and market penetration across various sectors. Product type segmentation distinguishes between highly maneuverable and portable devices like hoverboards, the utility-focused unicycles (EUCs), and more specialized segments such as Segway-style personal transporters. Analyzing these segments reveals shifting consumer preferences, where hoverboards maintain high visibility among recreational users, while the superior performance specifications of EUCs increasingly appeal to dedicated commuters seeking extended range and higher speeds. This diversification ensures that manufacturers can target specific demographic needs, from children's recreational use to high-end professional transportation.

Segmentation by application clearly delineates the market’s utility, contrasting the dominant Personal Commute sector against Recreational Use, Fleet/Shared Mobility services, and niche Commercial Applications. The rapid expansion of shared mobility services has profoundly impacted market dynamics, acting as both a gateway to product adoption and a robust commercial end-user base. Understanding the distribution channel breakdown—Online Retail versus Offline Retail (physical stores, specialty dealers)—is crucial for market entry strategies, as online platforms offer greater visibility and competitive pricing, while offline channels provide necessary hands-on product demonstration and crucial after-sales support, especially pertinent given the product’s safety considerations and technical complexity.

- By Product Type:

- Hoverboards (Two-Wheel Scooters)

- Electric Unicycles (EUCs)

- Personal Transporters (e.g., Segway-style)

- By Application:

- Personal Commute

- Recreational Use

- Fleet/Shared Mobility Services

- Commercial Use (Industrial, Warehouse)

- By Distribution Channel:

- Online Retail

- Offline Retail (Specialty Stores, Department Stores)

Value Chain Analysis For Electric Self Balancing Scooter Market

The value chain for the Electric Self Balancing Scooter Market begins with the Upstream activities centered around the procurement and manufacturing of key components, most critically the lithium-ion batteries, motors (typically brushless DC motors), microprocessors, and high-quality gyroscopic sensors. Component sourcing is often globally distributed, with Asia Pacific nations dominating battery cell production and motor manufacturing. Strategic partnerships and long-term contracts with battery suppliers are paramount, given the stringent safety standards and performance demands placed on power packs. Manufacturers focus heavily on rigorous quality control during the assembly phase to ensure reliability and adherence to safety certifications like UL standards, directly impacting brand reputation and market access.

The Downstream segment of the value chain involves assembly, distribution, marketing, and post-sale services. Distribution is primarily managed through two channels: Direct channels, where large established brands utilize their own e-commerce platforms or flagship stores for direct consumer interaction and higher margin retention; and Indirect channels, relying on a network of authorized distributors, large mass-market retailers, and specialized sporting goods stores. Shared mobility providers also represent a significant downstream consumption point, often negotiating large-volume, customized supply contracts directly with manufacturers, bypassing traditional retail channels entirely.

Effective management of the distribution channel is critical to maximizing market penetration. Online retail dominates global sales due to convenience, lower overheads, and the ability to rapidly update product specifications and pricing. However, physical retailers remain essential for high-end products, providing customers the opportunity to test ride the scooters and receive personalized maintenance advice, which is vital for complex products like Electric Unicycles. After-sales support, encompassing warranty services, repairs, and spare parts supply, completes the value chain, playing an increasingly influential role in consumer choice given the inherent durability concerns associated with mobile electronics used in harsh urban environments.

Electric Self Balancing Scooter Market Potential Customers

The primary target demographic for Electric Self Balancing Scooters includes tech-savvy urban professionals and students aged 18 to 35 who require efficient, cost-effective last-mile transportation alternatives integrated seamlessly with public transit systems. These buyers prioritize portability, speed, and connectivity features, often opting for higher-end hoverboards or Electric Unicycles for daily commutes. A secondary, yet rapidly expanding, customer base comprises recreational users, including families and teenagers, who utilize these devices for leisure activities in designated safe zones, parks, or private properties, generally favoring more affordable, robust hoverboard models designed for ease of control and durability rather than extended range.

Another crucial customer segment consists of fleet operators and shared mobility service providers. These B2B customers demand commercial-grade durability, advanced telematics integration (GPS, IoT connectivity), and ease of maintenance to minimize downtime and maximize return on investment (ROI) across vast city-wide networks. Their purchasing decisions are driven by total cost of ownership (TCO), lifespan, and integration capabilities with proprietary software platforms for tracking and billing. These professional customers require highly customized hardware tailored for heavy, shared usage and demanding charging cycles.

Finally, niche industrial and commercial sectors, such as large warehouse logistics centers, corporate campuses, and security patrols, represent specialized end-users. In these environments, the scooters are utilized to improve internal mobility efficiency, reducing time spent traversing large facilities. These commercial buyers value reliability, long shift endurance (battery life), and specific regulatory compliance tailored to industrial safety standards, representing a high-margin opportunity for specialized, robust product variants.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.85 Billion |

| Market Forecast in 2033 | $3.89 Billion |

| Growth Rate | 11.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Ninebot (Segway), Xiaomi, Swagtron, Razor, Koowheel, Airwheel, Chic Robotics, Inventist, IPS Electric Unicycle, Gotway (Begode), Inmotion, King Song, Hover-1, Megawheels, Future Motion, Epikgo, Jetson, Tomoloo, X-Sport, Halo Board |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Electric Self Balancing Scooter Market Key Technology Landscape

The technological evolution within the Electric Self Balancing Scooter Market is primarily driven by three critical areas: power source optimization, sophisticated stabilization systems, and enhanced connectivity features. The transition towards safer, higher-energy density battery packs is ongoing, with significant research directed towards solid-state and improved lithium-ion chemistries that mitigate the risks associated with thermal runaway, which historically plagued the market. Advances in Battery Management Systems (BMS) are crucial, focusing on more precise cell balancing, temperature regulation, and state-of-charge algorithms to extend both lifespan and operational range, directly addressing key consumer pain points regarding device endurance.

Stabilization technology relies heavily on advanced sensor fusion. Modern scooters integrate high-precision MEMS (Micro-Electro-Mechanical Systems) gyroscopes and accelerometers with high-speed microprocessors. These systems employ sophisticated PID (Proportional-Integral-Derivative) control loops, often incorporating AI/ML enhancements, to process real-time input from the rider and the environment instantaneously. This rapid calculation allows for sub-millisecond motor adjustments, ensuring stable balance even when navigating bumps, slopes, or sudden stops. The sophistication of these control systems directly differentiates high-performance commuting devices from basic recreational models.

Furthermore, IoT and connectivity features are becoming standard, moving beyond simple Bluetooth pairing for monitoring. Integration of GPS tracking is mandatory for shared mobility fleets and beneficial for anti-theft measures in personal units. Advanced telematics allow for remote diagnostics, over-the-air (OTA) software updates, and seamless integration with smartphone applications for personalized speed limits, ride tracking, and community features. The adoption of robust, purpose-built electric hub motors—often designed for high torque and efficiency at low speeds—further contributes to reliable, quiet, and maintenance-light operation, collectively defining the cutting edge of the current technology landscape.

Regional Highlights

The regional dynamics of the Electric Self Balancing Scooter Market illustrate a strong bifurcation between established manufacturing and adoption hubs in Asia Pacific and high-growth consumer markets in North America and Europe. Asia Pacific, spearheaded by China, maintains its dominant position largely due to unparalleled manufacturing capabilities, economies of scale in component production (especially batteries and motors), and a massive consumer base that has rapidly embraced micromobility solutions for daily commuting. While regulatory pressures exist, the sheer volume of production and local consumption ensures APAC's market leadership. Furthermore, developing economies within Southeast Asia are witnessing explosive growth in shared mobility deployments.

North America is characterized by robust consumer spending and significant venture capital investment in shared scooter platforms. The market here is driven less by personal ownership in the urban core (due to stricter city regulations) and more by widespread fleet deployment. Safety standards, notably the implementation of UL 2272 certification for electrical and fire safety, have significantly stabilized consumer confidence. Key regional growth is concentrated in metropolitan areas across the US and Canada where urban sprawl necessitates last-mile solutions, positioning North America as a high-value market focused on premium, certified products.

Europe represents a highly fragmented yet rapidly maturing market, influenced heavily by varying national regulations on speed, road access, and helmet requirements. Countries like Germany, France, and Spain have established specific legal frameworks that have, despite initial friction, provided clarity and boosted market predictability. The high adoption of electric vehicles generally, coupled with significant public investment in cycling and micromobility infrastructure, fosters a strong growth environment. The demand is strong for both personal ownership and shared services, though manufacturers must navigate complex certification and homologation processes across different EU member states. Latin America and MEA are emerging markets where adoption is currently concentrated in tourist centers and affluent urban areas, with future growth closely tied to governmental infrastructure projects and the expansion of modern retail distribution networks.

- Asia Pacific (APAC): Dominates due to massive manufacturing base, low production costs, and high internal adoption rates in urban centers like Shenzhen and Seoul. Focus on volume and rapid technology iteration.

- North America: Driven by high consumer purchasing power and the proliferation of large-scale shared mobility operators. Strong emphasis on safety standards (UL certification) and advanced telematics integration.

- Europe: Rapidly growing market supported by favorable public policies promoting green transport and significant investment in micromobility infrastructure (e.g., dedicated lanes). Growth is sensitive to complex, region-specific road regulations.

- Latin America & MEA: Emerging markets with growth tied to tourism, young demographic adoption, and improving urban infrastructure investments. High potential for shared services expansion.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Electric Self Balancing Scooter Market.- Ninebot (Segway)

- Xiaomi

- Swagtron

- Razor

- Koowheel

- Airwheel

- Chic Robotics

- Inventist

- IPS Electric Unicycle

- Gotway (Begode)

- Inmotion

- King Song

- Hover-1

- Megawheels

- Future Motion

- Epikgo

- Jetson

- Tomoloo

- X-Sport

- Halo Board

Frequently Asked Questions

Analyze common user questions about the Electric Self Balancing Scooter market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth rate (CAGR) of the Electric Self Balancing Scooter Market?

The Electric Self Balancing Scooter Market is forecasted to experience a Compound Annual Growth Rate (CAGR) of 11.5% between the forecast period of 2026 and 2033, driven by sustained demand for efficient last-mile commuting solutions and technological safety improvements.

Which product type currently holds the largest market share in the self-balancing scooter segment?

The Hoverboard segment (two-wheel scooters) traditionally holds the largest volume share due to its lower cost and accessibility for recreational users. However, Electric Unicycles (EUCs) are rapidly growing in revenue share, appealing to serious commuters due to superior range and speed capabilities.

What is the most significant restraint affecting the growth of the electric self-balancing scooter market?

The most significant restraint is regulatory inconsistency and lack of standardization across various municipalities and countries concerning where these devices can be ridden (e.g., roads, bike paths, sidewalks), coupled with persistent consumer safety concerns related to battery integrity and device reliability.

How is Artificial Intelligence (AI) impacting the future development of these scooters?

AI is critically important for enhancing safety through dynamic stability control and real-time environment recognition. Furthermore, AI-driven predictive maintenance and optimized routing are crucial for improving operational efficiency, particularly within shared mobility fleet management.

Which geographical region is expected to demonstrate the fastest growth rate for self-balancing scooters?

While APAC dominates in market size, North America and Europe are projected to exhibit the fastest revenue growth, attributed to high disposable incomes, strong investment in shared mobility services, and the establishment of clearer, supportive regulatory frameworks.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager