Electric Vehicle Flat Wire Motor Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442380 | Date : Feb, 2026 | Pages : 253 | Region : Global | Publisher : MRU

Electric Vehicle Flat Wire Motor Market Size

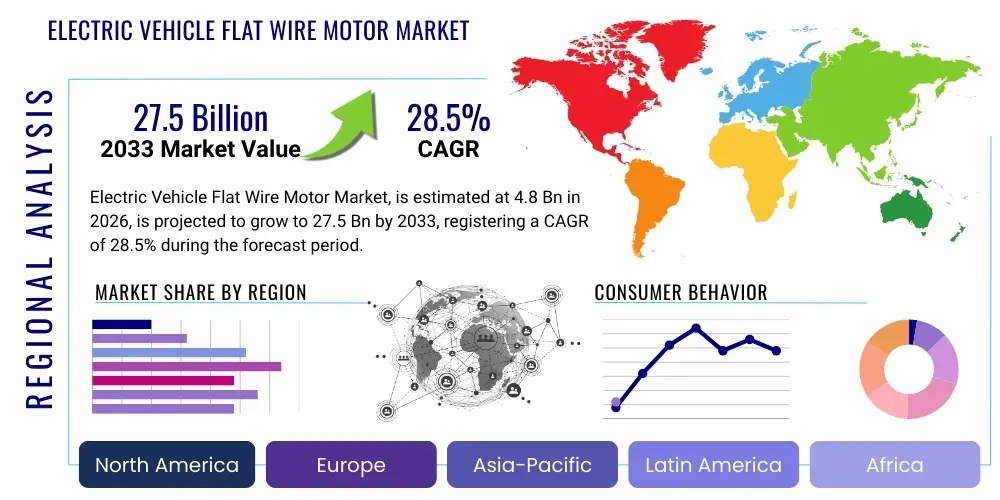

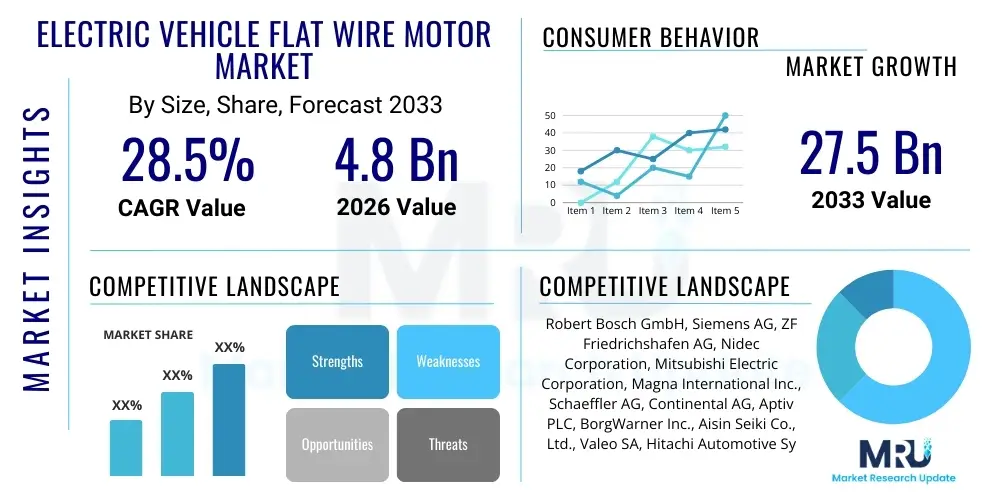

The Electric Vehicle Flat Wire Motor Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 28.5% between 2026 and 2033. The market is estimated at USD 4.8 Billion in 2026 and is projected to reach USD 27.5 Billion by the end of the forecast period in 2033.

Electric Vehicle Flat Wire Motor Market introduction

The Electric Vehicle (EV) Flat Wire Motor Market encompasses advanced traction motor systems utilizing flat, rectangular copper wires (hairpins) instead of traditional round wires in their stator windings. This design, often termed 'Hairpin Winding Technology,' significantly improves volumetric power density, efficiency, and heat dissipation, making these motors highly desirable for high-performance and long-range electric vehicles. These motors are primarily permanent magnet synchronous motors (PMSMs) or induction motors optimized for compactness and sustained high power output.

Major applications of flat wire motors are concentrated across the spectrum of electric mobility, including Battery Electric Vehicles (BEVs), Plug-in Hybrid Electric Vehicles (PHEVs), and high-performance hybrid systems. The core benefits driving adoption include superior fill factor (up to 90% compared to 60-70% for round wire motors), reduced copper losses, enhanced torque characteristics, and a smaller overall package size, which is critical for chassis integration. These characteristics directly address the key demands of EV manufacturers: maximizing range, optimizing thermal management, and reducing system weight.

Key driving factors accelerating market expansion include stringent global emissions regulations pushing rapid EV adoption, continuous advancements in battery energy density necessitating more efficient motor systems, and increasing consumer demand for vehicles with superior acceleration and sustained highway performance. Furthermore, the standardization of flat wire manufacturing processes and economies of scale achieved through dedicated production lines are lowering the unit cost, making this technology accessible to mid-range EV segments, thereby substantially expanding the total addressable market.

Electric Vehicle Flat Wire Motor Market Executive Summary

The Electric Vehicle Flat Wire Motor Market is witnessing unprecedented growth, underpinned by fundamental shifts in automotive manufacturing towards electrification and performance optimization. Business trends indicate a strong move towards vertical integration, where major Tier 1 suppliers and OEMs are investing heavily in in-house hairpin winding capabilities to secure supply chains and maintain competitive technological advantages. Mergers, acquisitions, and strategic partnerships focused on specialized magnet materials (e.g., Neodymium Iron Boron) and advanced cooling solutions are prevalent, signaling intense competition in efficiency gains.

Regionally, the Asia Pacific (APAC) market, spearheaded by China, dominates both production and consumption, driven by massive government subsidies, established supply chain infrastructure, and high consumer adoption rates for NEVs (New Energy Vehicles). Europe follows closely, propelled by strict environmental mandates and strong consumer preference for premium electric models that often utilize high-performance flat wire motors. North America is rapidly accelerating its production footprint, especially with mandates for fleet electrification and the emergence of specialized electric truck and SUV platforms demanding high torque density.

Segment trends highlight the dominance of the Permanent Magnet Synchronous Motor (PMSM) architecture, particularly in Battery Electric Vehicles (BEVs) with power outputs ranging from 150 kW to 250 kW, as manufacturers prioritize energy recuperation and sustained performance. The axial flux flat wire motor segment is gaining traction due to its inherently compact profile and high torque-to-weight ratio, positioning it strongly for integration into wheel hubs and smaller city vehicles. The evolution of insulation materials capable of withstanding higher operating temperatures is also a crucial trend, enhancing the lifespan and reliability of these advanced motor systems.

AI Impact Analysis on Electric Vehicle Flat Wire Motor Market

Common user inquiries regarding the impact of Artificial Intelligence (AI) on the Electric Vehicle Flat Wire Motor Market frequently revolve around optimization, predictive maintenance, and autonomous driving integration. Users are keen to understand how AI algorithms can fine-tune winding patterns and thermal characteristics during the design phase (Generative Design), pushing the theoretical limits of motor performance and efficiency. A significant concern addresses the reliability improvements derived from AI-driven diagnostics, specifically the ability to predict winding insulation failures or demagnetization events before they impact vehicle operation. Furthermore, the role of AI in real-time motor control optimization, especially under rapidly changing load conditions typical of autonomous driving scenarios, is a central theme of user expectation.

The integration of AI tools is fundamentally reshaping the lifecycle management of flat wire motors, from conception to in-field operation. During the design and simulation phase, AI-powered Generative Design can iterate through thousands of complex winding topologies and cooling duct configurations far faster than traditional methods, identifying optimal thermal paths and maximizing the copper fill factor without compromising manufacturability. This drastically reduces R&D cycles and yields motors with inherently superior specific power outputs and reduced thermal stress points.

Operationally, machine learning (ML) models are deployed within the vehicle's Motor Control Unit (MCU) to continuously analyze sensor data related to temperature, current draw, and vibration. These predictive algorithms enable advanced thermal management strategies, ensuring the motor operates within peak efficiency zones under all conditions, thus extending battery life and reducing the risk of catastrophic failure. The data gathered from vast fleets also feeds back into the manufacturing process, allowing for real-time quality control adjustments and preventative maintenance scheduling, significantly boosting the overall reliability and longevity of flat wire motor systems across the EV ecosystem.

- AI-driven Generative Design optimizes complex flat wire winding patterns for maximum efficiency.

- Machine Learning algorithms enable predictive thermal management and failure diagnostics in real-time.

- Optimized manufacturing processes via AI allow for higher throughput and reduced defects in hairpin insertion.

- AI fine-tunes motor control parameters dynamically to match driving conditions and battery state, maximizing energy recuperation.

- Enhanced quality assurance systems use computer vision and AI for detecting microscopic defects in insulation and welding joints.

DRO & Impact Forces Of Electric Vehicle Flat Wire Motor Market

The trajectory of the Electric Vehicle Flat Wire Motor Market is determined by a potent combination of dynamic drivers, technical restraints, and vast market opportunities, which together constitute the primary impact forces. The dominant driver is the pervasive governmental push for reduced carbon emissions, manifesting as aggressive EV adoption mandates across major global economies, which necessitate high-efficiency, reliable traction motors. However, the market faces constraints related to the complex and precise manufacturing requirements of hairpin technology, particularly the high cost and sensitivity of specialized magnet materials like Neodymium.

The primary drivers revolve around the inherent performance advantages of flat wire technology: superior power density and volumetric efficiency. These benefits directly translate into increased EV range and reduced motor package size, critical selling points for both OEMs and consumers. Furthermore, the operational longevity and reduced maintenance profile associated with lower thermal stress are accelerating adoption in commercial EV segments, such as buses and heavy-duty trucks, where total cost of ownership is paramount. Standardization efforts in manufacturing are also reducing barriers to entry.

Restraints are centered on supply chain vulnerabilities and technological maturity hurdles. The global reliance on specific rare-earth minerals for high-performance Permanent Magnet Synchronous Motors (PMSMs) poses geopolitical risks and price volatility. Moreover, the production process for flat wire motors, specifically the high-precision welding and insulation steps required for connecting the hairpins, demands significant capital investment and highly skilled labor, limiting widespread rapid capacity expansion among smaller manufacturers. Opportunities, conversely, lie in material innovation (e.g., developing ferrite-based or non-rare-earth magnet solutions), expanding into high-voltage (>800V) architectures, and capturing the booming market for dedicated EV platforms (skateboard architecture) which are perfectly suited for integrating compact, flat wire motors.

Segmentation Analysis

The Electric Vehicle Flat Wire Motor Market is comprehensively segmented based on motor type, power output, and vehicle application, providing granular insights into market dynamics and technological preferences across different vehicle categories and performance requirements. This segmentation highlights the technological shift favoring Permanent Magnet Synchronous Motors (PMSM) for their superior efficiency and power density, particularly in performance-oriented applications, contrasted with the lower-cost, lower-complexity Induction Motor segment.

Segmentation by power output clearly delineates the market into mainstream passenger vehicles, high-performance sports EVs, and heavy-duty commercial applications. The 100 kW to 250 kW segment currently holds the largest market share, representing the sweet spot for mass-market BEVs balancing performance and cost. Conversely, the above 250 kW segment is characterized by rapid growth, fueled by luxury and performance automakers demanding the highest specific power from compact motor designs, utilizing the flat wire architecture to manage the intense thermal loads associated with extreme output.

Furthermore, segmentation by vehicle type reveals the pervasive integration of flat wire motors across the entire electrified spectrum. While Battery Electric Vehicles (BEVs) are the dominant consumers, Plug-in Hybrid Electric Vehicles (PHEVs) and specific high-end Hybrid Electric Vehicles (HEVs) are increasingly adopting flat wire technology for their propulsion and generator units, seeking marginal gains in efficiency and packaging space. The future growth is heavily concentrated within the BEV segment, correlating directly with global governmental electrification targets and diminishing internal combustion engine dependency.

- By Motor Type:

- Permanent Magnet Synchronous Motors (PMSM)

- Induction Motors (IM)

- Synchronous Reluctance Motors (SynRM)

- By Power Output:

- Less than 100 kW

- 100 kW to 250 kW

- Above 250 kW

- By Vehicle Type:

- Battery Electric Vehicles (BEV)

- Plug-in Hybrid Electric Vehicles (PHEV)

- Hybrid Electric Vehicles (HEV)

Value Chain Analysis For Electric Vehicle Flat Wire Motor Market

The value chain for the Electric Vehicle Flat Wire Motor Market is complex and highly integrated, spanning raw material extraction to final vehicle integration. Upstream activities are dominated by specialized suppliers of high-purity copper and rare-earth magnets (Neodymium, Dysprosium). The manufacturing of the flat wire itself requires stringent quality control and specialized drawing processes. Disruptions or geopolitical shifts affecting rare-earth supply significantly impact the cost and production capacity of the entire market. The increasing focus on minimizing reliance on volatile materials is driving research into alternative magnet compositions and magnet-free motor designs (like synchronous reluctance motors).

Midstream activities involve the core motor component fabrication, including the precision stamping of steel laminations, the automated high-speed winding and insertion of the flat wire coils (hairpin technology), and the complex laser welding processes to connect the coil ends. This stage demands high capital expenditure for specialized machinery and sophisticated quality control systems to ensure the integrity of the insulation and welding points, which are crucial for high-voltage reliability. Tier 1 suppliers like Bosch, Nidec, and specialized component manufacturers dominate this manufacturing phase, often working closely with OEMs to customize specifications.

Downstream activities center on the integration of the motor system (including the motor, inverter, and reduction gearbox) into the vehicle platform. Direct distribution channels, where large automotive OEMs purchase directly from Tier 1 manufacturers, are predominant due to the highly customized nature of traction motor integration. Indirect channels, involving aftermarket suppliers and smaller specialist integrators, exist but hold a minor share, primarily catering to retrofitting and specialized performance tuning. The efficiency and reliability of the distribution network, particularly the logistical management of heavy, high-value components, are crucial for maintaining lean manufacturing schedules within the automotive assembly lines.

Electric Vehicle Flat Wire Motor Market Potential Customers

The primary end-users and buyers of Electric Vehicle Flat Wire Motors are the Original Equipment Manufacturers (OEMs) of electrified vehicles. This segment includes traditional automotive giants undergoing aggressive electrification transitions (e.g., Volkswagen Group, Ford, Toyota) and pure-play EV manufacturers (e.g., Tesla, BYD, Rivian). These customers require high-volume, reliable motor units that maximize performance metrics like torque density and energy efficiency while fitting restrictive packaging envelopes inherent in modern skateboard architectures.

A rapidly expanding customer base includes manufacturers specializing in commercial vehicles, such as electric buses, medium-duty delivery trucks, and heavy-duty transport vehicles. For these applications, the robustness, high torque output at low speeds, and enhanced thermal management capabilities of flat wire motors are critical for sustaining demanding duty cycles and maximizing payload capacity. Companies like Proterra, Daimler Trucks, and specialized last-mile delivery van manufacturers represent key growth areas for flat wire motor suppliers.

Furthermore, specialized segments such as luxury and high-performance sports car manufacturers (e.g., Porsche, Lucid Motors) constitute high-value potential customers. These buyers demand custom-engineered flat wire motors, often utilizing advanced materials and exotic cooling methods, to achieve extreme power and acceleration figures. Military and aerospace sectors, though smaller in volume, also represent strategic customers seeking lightweight, high-power density electric propulsion systems for specialized non-road mobility and auxiliary systems.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.8 Billion |

| Market Forecast in 2033 | USD 27.5 Billion |

| Growth Rate | 28.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Robert Bosch GmbH, Siemens AG, ZF Friedrichshafen AG, Nidec Corporation, Mitsubishi Electric Corporation, Magna International Inc., Schaeffler AG, Continental AG, Aptiv PLC, BorgWarner Inc., Aisin Seiki Co., Ltd., Valeo SA, Hitachi Automotive Systems, Johnson Electric, Tesla (Motor Division), BYD Company Limited, Zhejiang Founder Motor Co., Ltd., Broad-Ocean Motor Co., Ltd., Vitesco Technologies, Remy Power Products. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Electric Vehicle Flat Wire Motor Market Key Technology Landscape

The Electric Vehicle Flat Wire Motor market is defined by several converging technological advancements aimed at maximizing efficiency and minimizing size. The primary technology is the hairpin winding technique itself, characterized by automated insertion and laser welding of rectangular copper conductors into the stator slots. Recent innovations focus heavily on improving the slot fill factor beyond 85-90% and ensuring robust inter-turn insulation, which is critical as EV platforms migrate towards 800V and higher voltage systems. Manufacturers are utilizing advanced insulation materials (e.g., polyamide-imide) capable of operating continuously at higher temperatures, thereby increasing power throughput without compromising motor lifespan.

Another crucial technological frontier involves integrated cooling systems. Due to the higher power density, managing heat generated by flat wire motors is paramount. The current trend involves highly efficient stator cooling jackets, often utilizing specialized oil spray cooling directed at the end windings and the stator core. This shift moves beyond traditional water-glycol cooling to achieve precise thermal management across the motor’s hottest zones, allowing the motor to sustain peak torque levels for extended periods—a vital characteristic for modern EV performance.

Furthermore, significant research is dedicated to refining magnetic circuit design and materials substitution. While Permanent Magnet Synchronous Motors (PMSMs) dominate, efforts are accelerating to develop robust Synchronous Reluctance Motors (SynRMs) and Induction Motors that can meet performance criteria without reliance on expensive or volatile rare-earth magnets. Technological progress in magnetic lamination materials—specifically, using thinner, lower-loss silicon steel sheets—is enhancing efficiency by reducing eddy current losses, contributing further to overall system efficiency gains vital for maximizing vehicle range.

Regional Highlights

- Asia Pacific (APAC): APAC is the global engine for the flat wire motor market, primarily due to the dominant position of China in EV manufacturing and sales. Government policies in China, South Korea, and Japan strongly support the transition to New Energy Vehicles, driving massive production scale. China, in particular, possesses mature supply chains for copper components and magnet manufacturing, leading to competitive pricing and rapid innovation cycles. Furthermore, the high concentration of key motor manufacturers and Tier 1 suppliers ensures continuous R&D investment and expansion of hairpin winding capacity.

- Europe: Europe represents a high-value market segment, driven by stringent environmental regulations (e.g., EU CO2 targets) and strong consumer preference for premium electric vehicles manufactured by OEMs like BMW, Mercedes-Benz, and Volkswagen Group. These manufacturers prioritize flat wire motors for their superior integration capabilities in complex electric drive units and the high-performance metrics demanded by the European consumer base. Germany and France are central manufacturing hubs, focusing on high-voltage (800V) systems and efficiency improvements for long-range travel.

- North America: The North American market is experiencing accelerated growth, fueled by substantial governmental support (e.g., Inflation Reduction Act - IRA) and significant investment by US-based automakers (Ford, GM, Tesla) in dedicated EV platforms. The demand here is concentrated in high-power flat wire motors necessary for large SUVs and electric trucks, requiring exceptional torque and sustained power. Manufacturing capacity is rapidly scaling up, often through joint ventures between domestic auto giants and established Asian technology partners, aiming to localize the complex supply chain.

- Latin America (LATAM) and Middle East & Africa (MEA): These regions currently represent nascent markets for flat wire motor technology, focusing mainly on importing fully assembled EVs. However, growth potential exists, particularly in countries like Brazil and Mexico, due to increasing localized production of standard electric components and a gradual shift towards public transport electrification. In the MEA, high-net-worth markets are seeing increased demand for high-performance luxury EVs, driving niche demand, while broader adoption depends on infrastructure development and local manufacturing investments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Electric Vehicle Flat Wire Motor Market.- Robert Bosch GmbH

- Siemens AG

- ZF Friedrichshafen AG

- Nidec Corporation

- Mitsubishi Electric Corporation

- Magna International Inc.

- Schaeffler AG

- Continental AG

- Aptiv PLC

- BorgWarner Inc.

- Aisin Seiki Co., Ltd.

- Valeo SA

- Hitachi Automotive Systems

- Johnson Electric

- Tesla (Motor Division)

- BYD Company Limited

- Zhejiang Founder Motor Co., Ltd.

- Broad-Ocean Motor Co., Ltd.

- Vitesco Technologies

- Remy Power Products

Frequently Asked Questions

Analyze common user questions about the Electric Vehicle Flat Wire Motor market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is a flat wire motor and how does it differ from traditional EV motors?

A flat wire motor, also known as a hairpin motor, utilizes rectangular copper wires instead of traditional round wires in the stator windings. This design achieves a significantly higher slot fill factor (up to 90%), reducing electrical resistance and copper losses. The key difference lies in the improved power density, superior thermal dissipation capabilities, and smaller physical size, making flat wire motors more efficient and suitable for high-performance EV applications compared to round wire equivalents.

Why are flat wire motors crucial for the adoption of 800V EV architectures?

Flat wire motors are crucial for 800V architectures because they offer enhanced structural integrity and superior thermal management necessary for high-voltage systems. The precision and robustness of the hairpin connections and insulation are better suited to manage the increased electrical stresses and thermal loads generated by 800V systems. Their inherent efficiency also maximizes the range benefit derived from faster charging and reduced energy losses associated with higher operating voltages.

What are the primary manufacturing challenges associated with flat wire motors?

The primary manufacturing challenges involve the high precision required for the automated insertion of the rigid hairpin coils and the subsequent laser welding of the coil ends. Achieving reliable, void-free welding joints and maintaining flawless insulation integrity are complex, high-stakes processes that require significant capital investment in specialized machinery. This complexity raises initial production costs compared to simpler round wire winding methods.

Which segment of the flat wire motor market is expected to exhibit the fastest growth?

The segment categorized by Power Output Above 250 kW is expected to exhibit the fastest growth. This acceleration is driven by the increasing market share of high-performance and luxury BEVs, along with the growing need for powerful motors in electric trucks and commercial vehicles. Flat wire technology is essential in this segment for delivering extreme torque and power density while maintaining thermal stability within restricted vehicle packaging.

How does the reliance on rare-earth magnets impact the flat wire motor market?

The strong reliance on rare-earth magnets, primarily Neodymium, for high-performance Permanent Magnet Synchronous Motors (PMSMs) creates supply chain vulnerability and price volatility. Geopolitical risks associated with sourcing these materials significantly influence long-term planning and cost structures for motor manufacturers. This dependency is driving substantial R&D efforts into advanced magnet-free alternatives, such as Synchronous Reluctance Motors, to mitigate risk and stabilize future costs.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager