Electrical Contacts And Contacts Materials Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443092 | Date : Feb, 2026 | Pages : 251 | Region : Global | Publisher : MRU

Electrical Contacts And Contacts Materials Market Size

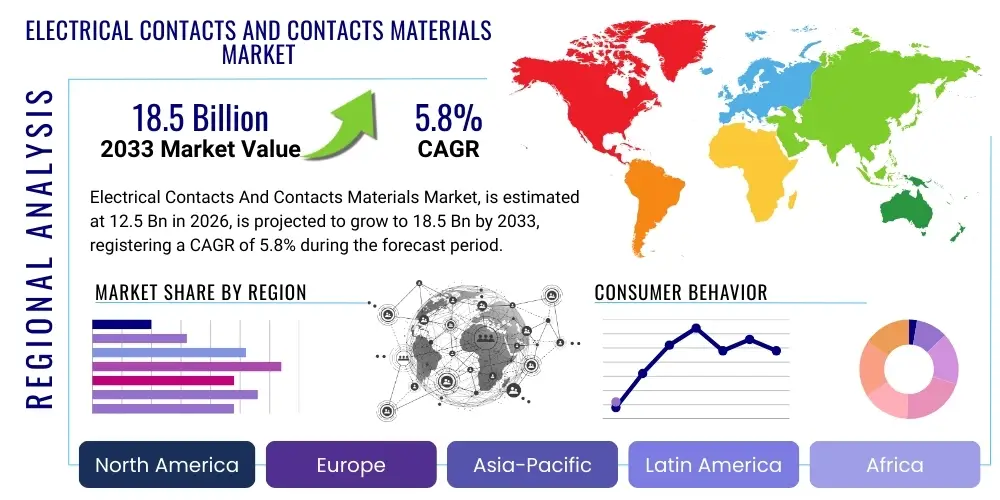

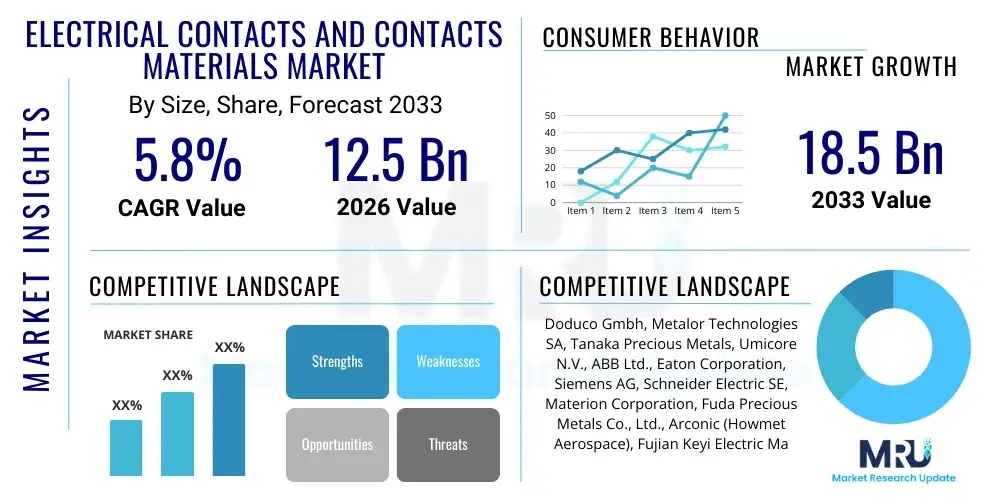

The Electrical Contacts And Contacts Materials Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at $12.5 Billion in 2026 and is projected to reach $18.5 Billion by the end of the forecast period in 2033.

Electrical Contacts And Contacts Materials Market introduction

The Electrical Contacts and Contact Materials Market encompasses specialized metallic and composite components crucial for establishing, interrupting, or changing the path of an electrical circuit. These materials are fundamental to the reliable operation of switches, relays, circuit breakers, and connectors across virtually all sectors of the modern economy. Products range from basic silver-based alloys used in low-current applications to sophisticated refractory metals and composites engineered through powder metallurgy for high-power switching gear, where resistance to arc erosion, welding, and oxidation is paramount. The performance of these contacts directly determines the lifespan, safety, and efficiency of electrical apparatus, making material science innovation a core competitive factor.

Major applications span industrial automation, automotive electronics, renewable energy infrastructure, consumer appliances, and telecommunications equipment. For instance, the rapid global transition toward electric vehicles (EVs) mandates high-performance contact materials capable of managing significant currents and handling frequent, robust switching cycles under demanding thermal conditions. Similarly, the expansion of smart grids and decentralized power generation (solar and wind) requires reliable circuit protection devices utilizing advanced contact materials designed for longevity and resilience against environmental degradation. Key benefits derived from high-quality electrical contacts include maximized conductivity, minimized contact resistance, enhanced operational safety, and extended equipment service life, directly translating into reduced maintenance costs and operational downtime for end-users.

The market is primarily driven by global infrastructure modernization efforts, particularly in developing economies, coupled with stringent regulatory standards favoring energy-efficient and safer electrical systems. Furthermore, the proliferation of Internet of Things (IoT) devices and miniaturization trends necessitate smaller, yet equally reliable, contact solutions. Research and development efforts are concentrated on developing eco-friendly materials (reducing or eliminating cadmium) and optimizing microstructure through advanced manufacturing techniques like spark plasma sintering and additive manufacturing, ensuring contact performance keeps pace with ever-increasing power density requirements across emerging technological landscapes.

Electrical Contacts And Contacts Materials Market Executive Summary

The Electrical Contacts and Contacts Materials Market is poised for substantial growth, characterized by strong business trends centered on technological specialization and sustainability. A key trend involves strategic vertical integration by major manufacturers aiming to control the highly variable costs associated with precious metals like silver, gold, palladium, and platinum, which are critical raw materials. Furthermore, there is an accelerating shift toward advanced composite materials, particularly those based on silver-metal oxides (AgSnO2, AgNi), which offer superior arc resistance and lower environmental impact compared to older, cadmium-containing alloys. M&A activities are focusing on acquiring niche material science expertise, particularly in high-reliability contact solutions for aerospace, medical devices, and high-voltage DC applications necessary for renewable energy storage integration.

Regionally, the market exhibits bifurcation. The Asia Pacific (APAC) region, led by China, India, and Southeast Asia, is projected to be the fastest-growing market due to massive investments in power generation, distribution infrastructure, and the dominant presence of global automotive and electronics manufacturing hubs. North America and Europe, characterized by mature industrial bases, emphasize the replacement and upgrade of aging infrastructure with smart grid components, focusing heavily on materials compliance with strict environmental regulations such as REACH and RoHS. The increasing adoption rate of high-power charging infrastructure for EVs in developed Western markets mandates a supply chain focused on robust, high-current carrying capacity contacts, driving demand for materials like copper-tungsten and specific clad metals.

Segmentation trends indicate a strong move away from traditional materials toward advanced composites. The Silver-based contacts segment continues to dominate due to superior conductivity, but within this category, the shift is marked toward environmentally safer options (AgSnO2 over AgCdO). Application-wise, the automotive segment, especially related to EV components (battery disconnects, relays, charging contactors), is demonstrating exponential growth, requiring specialized arc-quenching capabilities. By product type, contacts manufactured using powder metallurgy techniques are gaining market share, as this method allows for precise control over microstructure and material density, crucial for achieving demanding electrical and mechanical performance parameters simultaneously, particularly in vacuum interrupters and high-performance circuit breakers.

AI Impact Analysis on Electrical Contacts And Contacts Materials Market

User queries regarding the impact of Artificial Intelligence (AI) on the Electrical Contacts and Contacts Materials Market frequently revolve around optimizing complex material compositions, enhancing quality control during manufacturing, and predicting contact failure in operational environments. Users are keen to understand how AI and Machine Learning (ML) can streamline the R&D process, which traditionally relies on exhaustive empirical testing of alloy compositions under various electrical loads and environmental stresses. Key concerns focus on whether AI-driven predictive maintenance (PdM) systems will significantly alter demand cycles by extending component life, potentially reducing replacement frequency, and how AI can ensure defect detection rates approaching 100% in high-volume, precision manufacturing environments. The expectation is that AI will be a transformative force, moving the industry from reactive failure analysis to proactive material design and operational management, particularly in mission-critical applications where contact failure is catastrophic.

AI is being actively implemented to address the inherent complexity in optimizing contact material formulations. ML algorithms can analyze massive datasets encompassing variables like current density, switching frequency, ambient temperature, humidity, and the resulting arc erosion patterns for thousands of material variants. This capability drastically reduces the time and cost associated with developing new alloys by predicting optimal microstructures and elemental ratios, minimizing the reliance on expensive and time-consuming physical prototypes. For instance, neural networks are being trained on spectroscopy data and microscopic images to correlate manufacturing process parameters (e.g., sintering temperature, compression ratio in powder metallurgy) directly with desired performance attributes like hardness, resistance, and welding force, leading to materials designed "in silico" for specific application requirements.

Furthermore, AI-driven computer vision systems are revolutionizing quality inspection by analyzing surface characteristics of finished contacts at high speed, identifying subtle defects such as micro-cracks, contamination, or uneven cladding that human inspectors or traditional automated optical systems might miss. In operational settings, AI is integrated into smart switches and relays to perform real-time diagnostics. By analyzing electrical signatures (voltage, current spikes, and waveform distortions) associated with switching events, ML models can accurately predict the remaining useful life (RUL) of the contacts, enabling maintenance schedules to shift from time-based or cycle-based models to genuine condition-based monitoring. This technological integration enhances equipment reliability, minimizes unscheduled downtime, and drives demand for highly instrumented, AI-ready electrical apparatus, indirectly influencing the specifications and quality requirements for the underlying contact materials.

- AI accelerates material R&D by predicting optimal alloy compositions and microstructures using ML analysis of empirical data.

- Machine Learning algorithms optimize powder metallurgy processes, leading to tighter tolerance control and reduced manufacturing variability.

- Predictive Maintenance (PdM) systems, leveraging AI, forecast contact wear and remaining useful life (RUL) in relays and breakers, shifting maintenance strategies.

- AI-powered computer vision enhances quality control, ensuring near-perfect detection of surface defects and inconsistencies in complex clad contacts.

- Simulation driven by AI allows manufacturers to model arc erosion and thermal stress dynamics accurately before physical prototyping.

- AI-based demand forecasting optimizes supply chain management for precious metal procurement, mitigating price volatility risks.

DRO & Impact Forces Of Electrical Contacts And Contacts Materials Market

The dynamics of the Electrical Contacts and Contacts Materials Market are shaped by a powerful confluence of Drivers, Restraints, and Opportunities, collectively forming the Impact Forces that dictate strategic direction and growth trajectory. Key drivers include the exponential global proliferation of electrification across multiple sectors, most notably the transition to high-voltage DC (HVDC) systems necessitated by renewable energy integration (e.g., utility-scale battery storage and offshore wind) and the rapid global uptake of Electric Vehicles (EVs). These applications require contacts capable of handling significantly higher electrical loads, managing severe arcing during interruption, and maintaining reliability under frequent usage cycles. Additionally, strict global safety and energy efficiency regulations, such as those governing smart grid deployment and industrial machinery, mandate the use of high-performance, durable contact components, thereby sustaining demand for premium-grade materials and complex assemblies.

However, the market faces considerable restraints, primarily centered around the volatility and high cost of raw materials. The dependency on precious metals—silver, gold, and palladium—subjects manufacturers to extreme price fluctuations, impacting profitability and necessitating advanced hedging strategies. Furthermore, the specialized nature of manufacturing processes, particularly powder metallurgy and complex cladding techniques, requires substantial capital investment and highly skilled labor, creating significant barriers to entry for new players. Another restraint is the increasing regulatory pressure globally to eliminate toxic elements, particularly the complete phase-out of cadmium-containing alloys (AgCdO). While this drives innovation towards eco-friendly alternatives (AgSnO2, AgNi), the transition requires extensive re-qualification processes and investment in new material science, temporarily slowing adoption rates in highly regulated industries.

Opportunities within the market are abundant, stemming predominantly from technological advancements and emerging application areas. The miniaturization trend in consumer electronics and industrial controls creates opportunities for micro-contacts requiring highly precise manufacturing techniques like micro-stamping and selective plating of extremely thin layers of precious metals, offering high value per unit. The expansion of 5G infrastructure, data centers, and specialized medical equipment also creates lucrative niches demanding high-reliability, low-contact-resistance connectors and switches. Furthermore, ongoing innovation in powder metallurgy techniques, such as the use of nanoparticles and ceramic reinforcements, promises the development of next-generation composites that can deliver superior anti-welding properties and arc erosion resistance at potentially lower costs than current precious metal-intensive solutions, offering a long-term pathway to mitigate raw material price pressure and secure future growth.

Segmentation Analysis

The Electrical Contacts and Contacts Materials Market is comprehensively segmented based on the material composition, product form, application type, and end-use industry, providing granular insights into market dynamics and growth pockets. Segmentation by material type is crucial as material performance dictates the suitability for specific electrical environments, ranging from low-voltage signaling to high-current power switching. Products are categorized by their complexity, moving from basic solid contacts to advanced clad metals and specialized contact assemblies. Analyzing these segments helps stakeholders understand shifting demand patterns driven by technological obsolescence, regulatory compliance, and sector-specific electrical requirements.

The complexity in material composition is the primary differentiator, with segments reflecting the balance between conductivity, hardness, arc erosion resistance, and cost. While silver remains the undisputed benchmark for conductivity, the integration of oxides, carbides, and refractory metals (e.g., tungsten, molybdenum) creates unique composites designed to withstand the harsh environments of arc interruption. Application segmentation highlights the increasing demand intensity from power transmission, distribution, and automotive sectors, all undergoing radical modernization. This structured view is vital for material suppliers and contact manufacturers to align their R&D investments with high-growth, high-value segments.

- By Material Type:

- Silver-based (Pure Silver, Silver Cadmium Oxide (AgCdO), Silver Nickel (AgNi), Silver Tin Oxide (AgSnO2), Silver Graphite)

- Copper-based (Pure Copper, Copper Tungsten, Copper Chromium)

- Refractory Metals (Tungsten, Molybdenum)

- Precious Metals (Gold, Palladium, Platinum)

- Other Alloys and Composites

- By Product Form:

- Solid Contacts (Rivet Contacts)

- Clad Contacts and Contact Strips

- Contact Assemblies (Welded, Brazed, Staked)

- Powder Metallurgy Contacts

- Contact Tips

- By Application:

- Low Voltage Switches and Relays

- Medium and High Voltage Circuit Breakers

- Contactors and Starters

- Connectors and Terminals

- Slip Rings and Brush Systems

- By End-Use Industry:

- Automotive and Transportation (EV Charging, Internal Components)

- Electrical & Electronics (Consumer Electronics, Industrial Controls)

- Power Generation, Transmission, and Distribution (T&D)

- Industrial Manufacturing and Machinery

- Aerospace and Defense

Value Chain Analysis For Electrical Contacts And Contacts Materials Market

The value chain for the Electrical Contacts and Contacts Materials Market is complex and capital-intensive, starting with the mining and refining of core raw materials, predominantly precious metals like silver, gold, and palladium, as well as industrial metals such as copper and tungsten. The upstream segment is characterized by high price volatility, requiring specialized commodity trading and risk management expertise from both refiners and material processors. This stage dictates the initial cost structure of the final product. Material processors then convert these refined metals into specialized powders, wires, or strips suitable for contact manufacturing through processes such as atomization, mechanical alloying, and compounding, which require highly specialized equipment and precise quality control to ensure metallurgical purity and consistency necessary for electrical performance.

The midstream involves the core manufacturing of the electrical contacts themselves, primarily through sophisticated techniques like powder metallurgy (sintering and infiltration), cladding (where less expensive bulk metal is coated with a precious metal layer), stamping, and cold heading (rivet formation). This stage adds significant value through precision engineering and strict adherence to geometric tolerances and surface finish standards. Companies often specialize here, focusing on specific material compositions (e.g., AgSnO2 composites) or product forms (e.g., high-performance vacuum interrupter contacts). Testing and certification, confirming resistance to arc erosion, mechanical wear, and compliance with IEC/UL standards, form an essential part of the midstream process, differentiating high-quality suppliers.

Downstream distribution channels are bifurcated into direct and indirect routes. Direct distribution is crucial for large-volume customers and Original Equipment Manufacturers (OEMs) in sectors like power infrastructure (circuit breaker manufacturers) and automotive Tier 1 suppliers, facilitating technical collaboration and custom design integration. Indirect distribution, leveraging specialized electrical distributors, industrial component supply houses, and global third-party logistics providers, caters to smaller industrial users, MRO (Maintenance, Repair, and Operations) markets, and the vast consumer electronics assembly base. The choice of channel often depends on the complexity and volume of the contact; specialized assemblies often require direct engagement, while standard rivet contacts may be handled effectively through broad distribution networks, prioritizing speed and regional inventory availability.

Electrical Contacts And Contacts Materials Market Potential Customers

The primary customers for electrical contacts and contact materials are global manufacturers of electrical switching and control apparatus, ranging from massive power infrastructure firms to precision electronics producers. The largest segment of end-users encompasses companies involved in power transmission and distribution (T&D), including manufacturers of high-voltage circuit breakers, disconnect switches, and substation relays. These entities require robust, high-reliability contacts capable of interrupting massive fault currents safely, predominantly utilizing silver-tungsten and copper-chromium materials. The expansion of smart grids globally ensures sustained, long-term demand from this foundational sector, driven by grid modernization mandates.

Another major consumption block is the industrial sector, including manufacturers of industrial control equipment, motor starters, and automation machinery. These customers prioritize long mechanical life, resistance to frequent switching cycles, and protection against welding under overload conditions. The trend toward increased factory automation and the deployment of variable frequency drives (VFDs) necessitate contacts designed for harsh, highly repetitive operations. Furthermore, the automotive sector, specifically the rapidly expanding electric vehicle (EV) segment, represents an extremely high-growth potential customer base. EV manufacturers require advanced contactors for battery disconnect and high-power charging systems (DC fast charging), demanding materials with exceptional thermal management capabilities and superior resistance to welding caused by high DC currents, often favoring AgSnO2 and specific AgNi composites.

Lastly, the consumer electronics and appliance manufacturing industries represent a high-volume market segment. While the complexity and value per contact are lower than in high-power applications, the sheer volume of relays, micro-switches, and connectors required in household appliances, HVAC systems, and communication devices makes this a critical customer group. These applications often rely on lower-cost, highly conductive materials, such as pure silver or selectively plated alloys, prioritizing low contact resistance and cost-effectiveness for mass production. Specialized areas like aerospace, defense, and medical devices constitute niche, high-value customers who demand absolute reliability and utilize ultra-high-grade contacts, often incorporating gold or palladium alloys for corrosion resistance and minimal noise in critical signal applications.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $12.5 Billion |

| Market Forecast in 2033 | $18.5 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Doduco Gmbh, Metalor Technologies SA, Tanaka Precious Metals, Umicore N.V., ABB Ltd., Eaton Corporation, Siemens AG, Schneider Electric SE, Materion Corporation, Fuda Precious Metals Co., Ltd., Arconic (Howmet Aerospace), Fujian Keyi Electric Material, SAXONIA Technical Materials GmbH, Toshiba Corporation, Chugai Electric Industrial Co., Ltd., EMS-ASIMI, DODUCO, Electric Materials Company, Honeywell International Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Electrical Contacts And Contacts Materials Market Key Technology Landscape

The technological landscape of the Electrical Contacts and Contacts Materials Market is fundamentally defined by advancements in metallurgical processing and surface engineering designed to optimize electrical, mechanical, and thermal performance under highly demanding conditions. Powder metallurgy (PM) techniques, including pressing, sintering, and infiltration, remain central to creating composite contacts, especially for high-current interruption applications. Modern PM utilizes finer powders, often at the nano-scale, combined with sophisticated sintering regimes (like Spark Plasma Sintering - SPS) to achieve superior density, homogeneity, and highly controlled microstructures that are essential for maximizing arc erosion resistance and minimizing contact welding in materials like Silver Tin Oxide (AgSnO2) and Copper Tungsten (CuW). The ability to precisely distribute refractory particles within a highly conductive matrix is a key technological differentiator.

Cladding and inlay technologies constitute another critical area, driven by the need to manage material cost while maintaining performance. Cladding involves metallurgically bonding a precious contact material to a less expensive, highly conductive backing material (typically copper or copper alloy). Advances in localized cladding techniques, such as electron beam welding and specialized rolling processes, allow manufacturers to place the expensive contact material only where it is functionally required, thereby significantly reducing material consumption—especially crucial given the high price of silver and gold. Selective plating and tape welding further refine this approach, enabling precise layer thickness control and integration into complex switching mechanisms found in relays and micro-switches, where tolerances are extremely tight and consistency is paramount for long-term reliability.

Furthermore, technology development is heavily focused on materials compliance and environmental responsibility. The push to replace legacy materials like Silver Cadmium Oxide (AgCdO), due to toxicity concerns, has accelerated R&D into high-performance alternatives, predominantly AgSnO2 composites. New processing technologies are required to stabilize the microstructure of these alternatives to prevent segregation and ensure uniform performance. Finally, advanced simulation tools (FEA, CFD) are increasingly used to model arc dynamics, thermal runaway, and mechanical fatigue, allowing engineers to validate contact geometry and material choices virtually before committing to expensive physical tooling. This shift toward predictive engineering ensures that new products meet the rigorous performance standards of emerging applications like high-power DC switching with reduced time-to-market.

Regional Highlights

- Asia Pacific (APAC): APAC is the dominant and fastest-growing region, fueled by massive government spending on infrastructure development, including smart grid deployment and urbanization projects across China, India, and Southeast Asia. The region hosts the vast majority of global consumer electronics, automotive, and industrial equipment manufacturing, driving exceptionally high volume demand for both standard and high-performance contacts. China's rapid adoption of electric vehicles and large-scale renewable energy generation facilities makes it the single largest market for high-current, DC-rated contact materials. Regulatory harmonization efforts across ASEAN countries are encouraging cross-border trade and manufacturing efficiency.

- North America: This region is characterized by high technological maturity and a focus on infrastructure modernization, particularly the replacement of aging power distribution assets. Demand is strong for highly reliable, advanced contact materials driven by stringent safety standards (UL/ANSI). The burgeoning EV sector and the rapid expansion of hyperscale data centers requiring specialized, low-resistance switching solutions are major growth catalysts. Innovation is focused on optimizing materials for high-voltage DC applications related to solar and large-scale battery storage integration into the grid, supporting regional resilience and energy independence initiatives.

- Europe: Growth in Europe is largely dictated by strict environmental directives, such as RoHS and REACH, which necessitate rapid conversion to cadmium-free and halogen-free contact materials. The region is a leader in industrial automation and precision machinery, driving sustained demand for high-reliability, low-voltage contacts and sensors. Significant investments in offshore wind and grid interconnectors across the continent further drive the need for robust, durable contacts suitable for challenging marine and high-stress operational environments, particularly utilizing advanced ceramic-metal composites for enhanced lifespan.

- Latin America (LATAM): LATAM presents considerable opportunity, driven by ongoing efforts to expand and upgrade inefficient national power grids and increase electrification rates. While sensitive to economic volatility, countries like Brazil and Mexico are seeing significant foreign investment in automotive manufacturing and renewable energy projects (hydro and solar), leading to cyclical but strong demand for medium-voltage circuit protection components and industrial contactors. The market tends to be price-sensitive, often favoring efficient copper-based or clad contact solutions.

- Middle East and Africa (MEA): This region is focused on large-scale infrastructural projects, especially in the Gulf Cooperation Council (GCC) countries, supporting massive construction projects, oil and gas processing facilities, and ambitious solar energy parks. Demand is characterized by the requirement for components that can withstand extreme heat and dusty environments. South Africa remains the key industrial manufacturing hub, generating consistent demand for industrial control contacts, while the broader region's power transmission infrastructure expansion drives requirements for robust, large-scale contact assemblies.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Electrical Contacts And Contacts Materials Market.- Doduco Gmbh

- Metalor Technologies SA

- Tanaka Precious Metals

- Umicore N.V.

- ABB Ltd.

- Eaton Corporation

- Siemens AG

- Schneider Electric SE

- Materion Corporation

- Fuda Precious Metals Co., Ltd.

- Arconic (Howmet Aerospace)

- Fujian Keyi Electric Material

- SAXONIA Technical Materials GmbH

- Toshiba Corporation

- Chugai Electric Industrial Co., Ltd.

- EMS-ASIMI

- Electric Materials Company

- Honeywell International Inc.

- Wieland Electric GmbH

- Texas Instruments (Materials Division)

Frequently Asked Questions

Analyze common user questions about the Electrical Contacts And Contacts Materials market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary drivers for the switch from AgCdO to newer contact materials like AgSnO2?

The switch is primarily driven by global environmental regulations, such as the European Union's Restriction of Hazardous Substances (RoHS) directive, mandating the phase-out of cadmium due to its toxicity. AgSnO2 (Silver Tin Oxide) and AgNi (Silver Nickel) serve as high-performance, non-toxic alternatives offering comparable or superior arc erosion resistance and anti-welding properties, crucial for modern circuit protection devices and high-reliability systems.

How does the shift to Electric Vehicles (EVs) impact the demand for electrical contact materials?

The rapid proliferation of EVs drastically increases demand for highly specialized contact materials capable of handling high-voltage DC (HVDC) currents, typically above 400V, required for battery management and charging infrastructure. EV contactors and relays must manage frequent, high-stress switching cycles and prevent catastrophic welding, driving intensive R&D and increased consumption of robust silver-metal oxide composites and copper-tungsten materials within the automotive end-use sector.

What manufacturing technology is critical for producing high-performance electrical contacts?

Powder Metallurgy (PM) is critical, particularly for composite materials like Silver Tin Oxide and Copper Tungsten. PM allows precise control over the microstructure, ensuring uniform dispersion of refractory or oxide particles within the conductive matrix. Advanced PM techniques, such as Spark Plasma Sintering (SPS) and infiltration, are essential for achieving the high density and homogeneity required for superior arc resistance and conductivity in high-power applications like medium-voltage circuit breakers.

Which geographical region exhibits the highest growth potential for electrical contacts?

The Asia Pacific (APAC) region, specifically led by China and India, holds the highest growth potential. This growth is underpinned by massive government investments in power transmission and distribution infrastructure, rapid urbanization, the region's status as a global manufacturing hub for electronics and vehicles, and significant ongoing expansion in renewable energy capacity, all driving overwhelming demand across all contact material segments.

How do manufacturers mitigate the impact of fluctuating precious metal prices on the market?

Manufacturers mitigate price volatility through several strategies: aggressive hedging and forward contracts in commodity markets; technological substitution by developing advanced clad and inlay materials that minimize the volume of precious metals required; and adopting specialized selective plating processes. Furthermore, optimizing internal material recycling processes for high-value metal recovery is a critical component of cost management and sustainability.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager