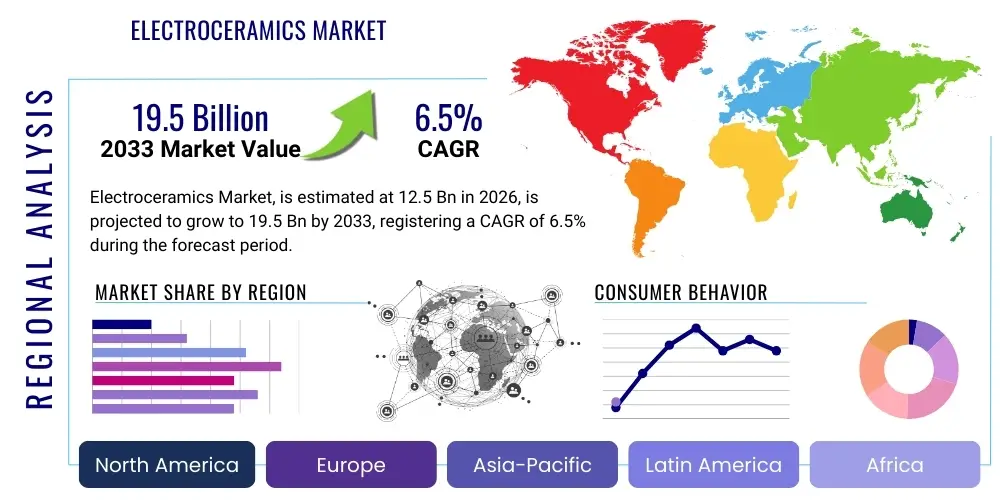

Electroceramics Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442824 | Date : Feb, 2026 | Pages : 245 | Region : Global | Publisher : MRU

Electroceramics Market Size

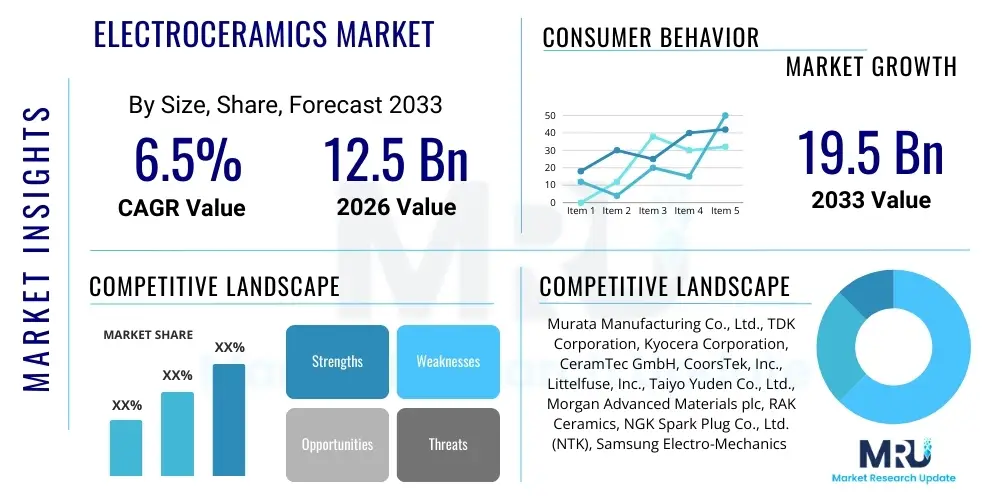

The Electroceramics Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 12.5 billion in 2026 and is projected to reach USD 19.5 billion by the end of the forecast period in 2033.

Electroceramics Market introduction

Electroceramics are specialized ceramic materials characterized by their unique electrical and electronic properties, playing a critical role in modern electronic systems. These materials are intrinsically inorganic, non-metallic, and often crystalline, designed specifically to function as insulators, semiconductors, ionic conductors, or dielectrics. The intrinsic stability, high-temperature resistance, and excellent electrical performance of electroceramics make them indispensable components across high-reliability and high-frequency applications. Key product types include titanates (like Barium Titanate), alumina, zirconia, and piezoelectric ceramics (like Lead Zirconate Titanate or PZT), each offering tailored characteristics for specific electronic functions.

Major applications of electroceramics span across passive components such as multilayer ceramic capacitors (MLCCs), resistors, and inductors, and active components like sensors, actuators, and transducers. The rapid expansion of 5G infrastructure, electric vehicles (EVs), and advanced medical imaging technologies necessitates materials capable of handling high power densities and operating efficiently under demanding environmental conditions, requirements perfectly met by advanced electroceramic formulations. Furthermore, the miniaturization trend in consumer electronics and the increasing complexity of integrated circuits (ICs) drive the continuous demand for higher performance, smaller footprint electroceramic components.

The primary driving factors sustaining the market momentum include the burgeoning global electronics industry, increasing penetration of IoT devices requiring reliable sensing technologies, and significant investments in smart grid development. The inherent benefits of these materials, such as high dielectric constant, excellent mechanical strength, chemical inertness, and stability under harsh operating conditions, solidify their position as essential materials for future technological advancements. Market growth is further catalyzed by technological breakthroughs in ceramic processing techniques, enabling finer particle sizes and improved homogeneity, thereby enhancing overall device performance and reliability, especially in high-frequency signal processing and energy storage applications.

Electroceramics Market Executive Summary

The Electroceramics Market is experiencing robust growth fueled by transformative business trends, including the paradigm shift towards electrification in the automotive sector and the widespread global rollout of advanced wireless communication networks, particularly 5G and nascent 6G technologies. Strategic investments are heavily concentrated on developing advanced functional ceramics tailored for extreme operating environments, emphasizing materials that offer enhanced piezoelectric coefficients, improved insulation capabilities, and higher thermal conductivity. Major industry players are focusing on vertical integration and strategic partnerships to secure raw material supply chains and accelerate the introduction of novel electroceramic formulations compatible with increasingly sophisticated microelectronic manufacturing processes, thereby addressing the high-volume demand from the capacitor and sensor markets.

Geographically, the Asia Pacific region dominates the electroceramics landscape, primarily due to the established and rapidly expanding electronics manufacturing hubs in countries such as China, South Korea, Japan, and Taiwan. This regional stronghold is supported by significant governmental backing for technological innovation and the presence of leading global OEMs and ODMs heavily relying on electroceramic components for their finished products. North America and Europe, while possessing mature markets, are experiencing specialized growth driven by high-reliability applications in aerospace, defense, and advanced healthcare, coupled with the accelerating transition toward electric mobility and industrial automation, demanding superior sensor and power electronics ceramics.

Segment trends indicate that the piezoelectric ceramics sub-segment is poised for substantial expansion, directly correlated with the rising adoption of sophisticated sensors and actuators in automotive safety systems and industrial robotics. Concurrently, the multilayer ceramic capacitor (MLCC) application segment remains the volume leader, continually pushed by the miniaturization demands of consumer electronics and the necessity for robust energy storage solutions in complex circuitry. Material-wise, Barium Titanate remains crucial for dielectric applications, while specialized alumina and zirconia formulations see increased usage in high-strength insulating and structural components, reflecting the market’s dual requirement for both high functionality and mechanical resilience.

AI Impact Analysis on Electroceramics Market

User inquiries regarding AI's impact on the Electroceramics Market frequently center on its role in materials discovery, optimization of manufacturing processes, and predictive maintenance of high-volume production lines. Users are keenly interested in understanding how AI-driven simulations can shorten the R&D cycle for new ceramic compositions with specific dielectric or piezoelectric properties, thereby addressing the persistent challenge of finding optimal material recipes faster than traditional trial-and-error methods. A significant thematic concern is whether AI integration will lead to a consolidation of manufacturing expertise, favoring firms that can effectively deploy machine learning for quality control and yield maximization. Expectations are high that AI will revolutionize quality assurance by detecting microscopic defects in sintered components, an area where human inspection or standard automated visual systems often fall short.

The adoption of Artificial Intelligence, specifically machine learning and deep learning algorithms, is fundamentally transforming the electroceramics value chain, moving beyond simple automation into complex data analysis for decision support. In raw material processing, AI can optimize powder mixing ratios and sintering temperature profiles to achieve superior crystalline structures and material homogeneity, critical factors determining the final electrical performance. Furthermore, predictive modeling powered by AI is being deployed to anticipate equipment failures in kilns and presses, ensuring continuous operation and reducing costly downtime associated with high-throughput ceramic component production. This shift signifies a transition towards 'Smart Manufacturing' or Industry 4.0 principles within the typically traditional ceramics sector.

AI's influence extends significantly into the design phase of new electroceramic components. By leveraging computational materials science and generative design models, researchers can simulate millions of potential material compositions and structural arrangements under varying operational stresses (thermal, mechanical, electrical). This capability drastically accelerates the identification of optimal materials for emerging applications, such as high-temperature superconductors or ultra-high capacitance density MLCCs. The integration of AI tools, therefore, positions market leaders to maintain a competitive edge by achieving faster time-to-market for specialized, high-performance ceramic products required in next-generation electronic devices and high-frequency communication systems.

- AI accelerates new electroceramic material discovery and formulation optimization.

- Machine learning enhances precision quality control and defect detection in high-volume production.

- Predictive maintenance minimizes operational downtime of high-temperature processing equipment (kilns).

- AI-driven simulation optimizes sintering profiles, leading to improved material properties (e.g., higher dielectric constants).

- Generative design aids in developing complex 3D ceramic structures for advanced sensors and actuators.

- AI integration supports the goal of achieving zero-defect manufacturing in electronic ceramic components.

DRO & Impact Forces Of Electroceramics Market

The dynamics of the Electroceramics Market are shaped by a complex interplay of Drivers, Restraints, and Opportunities (DRO), which collectively exert significant Impact Forces on market trajectories. A primary driver is the accelerating global demand for advanced electronic devices, particularly the proliferation of 5G/6G communication systems, which mandate specialized dielectric ceramics capable of ultra-high frequency operation with minimal signal loss. Additionally, the mandated shift towards electric vehicles (EVs) creates massive demand for power electronics ceramics (insulators, heat sinks) and high-density capacitors necessary for efficient battery management systems and power conversion units, fundamentally transforming the market's sectoral consumption profile.

However, the market faces considerable restraints, primarily stemming from the inherent complexities and high energy costs associated with ceramic processing, notably the extremely high temperatures required for sintering, which impacts manufacturing sustainability and overheads. Furthermore, dependence on specific, often geopolitically sensitive, raw materials like rare earth elements and certain metal oxides (e.g., lead compounds in PZT) introduces supply chain volatility and regulatory compliance challenges, particularly concerning environmental regulations like RoHS, pushing R&D towards lead-free alternatives. The demanding specifications required for high-reliability applications also necessitate stringent quality control, adding complexity and cost to the final product.

Opportunities for expansion are predominantly found in the continuous emergence of next-generation technologies. The rise of flexible electronics, wearable devices, and implantable medical technologies requires innovative thin-film and low-temperature co-fired ceramic (LTCC) solutions, offering new avenues for specialized electroceramic applications. Moreover, ongoing research into non-conventional ceramic types, such as solid-state electrolytes for next-generation batteries, presents a potentially transformative opportunity, shifting electroceramics from components to foundational energy storage elements. The ability of manufacturers to innovate successfully in sustainable and cost-effective production methods will determine their long-term growth and market competitiveness in addressing these emerging opportunities.

Segmentation Analysis

The Electroceramics Market is comprehensively segmented based on material type, product application, and end-user industry, providing a granular view of demand distribution and technological focus areas. The segmentation reflects the diverse functional roles these materials play, ranging from fundamental passive electronic components to highly specialized active devices. Analysis across these segments reveals distinct growth patterns, driven by unique technological needs in sectors like high-frequency telecommunications and high-power density energy applications, requiring tailored ceramic formulations. The performance requirements imposed by end-user industries, such as durability in aerospace or biocompatibility in medical devices, dictate the selection and optimization of specific electroceramic materials.

Material-based segmentation is critical as the composition directly determines the electrical and mechanical properties, with major categories including alumina, zirconia, and various titanates (e.g., Barium Titanate). Alumina dominates the structural and insulator segments due to its high strength and low cost, while advanced ferroelectrics like PZT lead the sensor and actuator markets. Application segmentation highlights the volume dominance of capacitors, essential for almost all electronic circuitry, contrasted by the high-value, high-precision niche of piezoelectric sensors and transducers. This diversity necessitates specialized manufacturing capabilities across the market.

The end-user segmentation clearly indicates the primary consumption drivers, with Electronics and Electrical equipment representing the largest sector, underpinned by continuous consumer demand and infrastructural spending on grid modernization and ICT. The Automotive sector is the fastest-growing segment, propelled by the global shift towards Electric Vehicles (EVs) and autonomous driving systems, which require a multitude of high-reliability sensors and power electronics. Strategic focus for market players involves developing high-thermal-conductivity ceramics to manage heat in dense automotive and data center electronics, ensuring market relevance across all high-growth industrial verticals.

- By Material Type:

- Alumina Ceramics

- Zirconia Ceramics

- Titanate Ceramics (e.g., Barium Titanate)

- Piezoelectric Ceramics (e.g., PZT, Lead-free ceramics)

- Silica Ceramics

- Other Advanced Oxide and Non-Oxide Ceramics

- By Product Application:

- Capacitors (MLCCs, High-voltage capacitors)

- Actuators and Transducers

- Sensors (Pressure, Temperature, Flow, Level)

- Insulators and Substrates

- Dielectric Devices

- Filters and Resonators

- By End-User Industry:

- Electronics & Electrical

- Automotive (EVs, ADAS)

- Healthcare & Medical Devices

- Aerospace & Defense

- Telecommunications

- Industrial Equipment & Automation

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East and Africa (MEA)

Value Chain Analysis For Electroceramics Market

The value chain for the Electroceramics Market begins with the upstream sourcing and processing of highly purified raw materials, primarily specialized metal oxides such as Barium Carbonate, Titanium Dioxide, Zirconia, and high-purity Alumina. This initial stage is crucial as the purity and particle size distribution of the powders directly determine the final electrical properties and yield of the sintered ceramic components. Key activities in the upstream segment involve mining, chemical synthesis, calcination, and fine milling processes, often requiring specialized chemical suppliers and materials processing experts. Efficiency and cost optimization at this stage are critical, especially given the rising prices and supply volatility of strategic minerals.

The core manufacturing process, or midstream analysis, involves formulation, mixing, shaping (via pressing, casting, or extrusion), and the critical high-temperature sintering stage, followed by machining, metallization, and packaging. This segment is highly technology-intensive, relying on proprietary manufacturing techniques like Low-Temperature Co-fired Ceramics (LTCC) or sophisticated tape casting for multilayer devices. Downstream activities involve integrating these components into complex electronic assemblies or systems. Key downstream buyers include Electronics Manufacturing Service (EMS) providers, automotive tier-one suppliers, and specialized aerospace assemblers who integrate the ceramic components into finished products such as engine control units, sensors, or power supplies. The value added in the downstream segment is substantial, focused on assembly, testing, and system integration.

Distribution channels for electroceramics are varied, utilizing both direct and indirect routes based on component specialization and volume. High-volume, standardized components like MLCCs are often distributed indirectly through global electronic component distributors (e.g., Arrow, Avnet) and regional resellers, ensuring widespread availability for mass-market electronics manufacturers. Conversely, highly customized or specialized components, such as sophisticated piezoelectric actuators for aerospace or custom substrates for high-power modules, are typically supplied directly by the electroceramic manufacturer to the OEM or Tier 1 supplier, fostering close technical collaboration and intellectual property protection. The direct channel is vital for maintaining technical specification fidelity and ensuring integration success for performance-critical applications.

Electroceramics Market Potential Customers

The primary end-users and buyers of electroceramic components are concentrated within industrial sectors that prioritize performance, reliability, and miniaturization in their electronic systems. The largest customer base resides within the Electronics & Electrical industry, encompassing global manufacturers of consumer electronics (smartphones, laptops), data center equipment, and infrastructure developers involved in building smart grids and advanced metering infrastructure. These customers require massive volumes of capacitors, resistors, and insulators that must operate flawlessly under continuous loads and escalating heat constraints.

Another rapidly expanding segment of potential customers is the Automotive industry, particularly Original Equipment Manufacturers (OEMs) and their Tier 1 suppliers engaged in the design and production of Electric Vehicles (EVs) and Advanced Driver-Assistance Systems (ADAS). These customers purchase high-reliability sensors (pressure, oxygen, strain), complex substrates for power modules (e.g., IGBT modules), and thermal management ceramics critical for battery and motor performance. The automotive sector demands zero-defect components capable of long operational lifespans under extreme temperature variations and mechanical stress.

Furthermore, specialized industries like Aerospace & Defense and Healthcare represent high-value potential customers. Aerospace customers seek ultra-reliable, lightweight insulators and high-frequency components for satellite communication and avionics systems, where failure is unacceptable. Healthcare buyers require highly sensitive piezoelectric ceramics for ultrasonic imaging (e.g., ultrasound transducers), flow sensors, and components used in minimally invasive surgical devices. These end-users typically require custom material formulations and stringent compliance with industry-specific quality and regulatory standards, creating opportunities for manufacturers capable of niche specialization and superior technical support.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 12.5 billion |

| Market Forecast in 2033 | USD 19.5 billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Murata Manufacturing Co., Ltd., TDK Corporation, Kyocera Corporation, CeramTec GmbH, CoorsTek, Inc., Littelfuse, Inc., Taiyo Yuden Co., Ltd., Morgan Advanced Materials plc, RAK Ceramics, NGK Spark Plug Co., Ltd. (NTK), Samsung Electro-Mechanics Co., Ltd., Vishay Intertechnology, Inc., CTS Corporation, Maruwa Co., Ltd., PI Ceramic GmbH, Fuji Titanium Industry Co., Ltd., Guandong Fenghua Advanced Technology Holding Co., Ltd., HEFEI ZHONGRUI CERAMIC TECHNOLOGY CO., LTD., APC International, Ltd., Skyworks Solutions, Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Electroceramics Market Key Technology Landscape

The technological landscape of the Electroceramics Market is rapidly evolving, driven primarily by the need for enhanced functionality, higher performance density, and reduced manufacturing complexity. A core enabling technology is Low-Temperature Co-fired Ceramic (LTCC) technology, which allows for the integration of passive components (resistors, capacitors, inductors) and complex electrical circuits into a single, compact, multilayer ceramic substrate. LTCC is vital for miniaturization in wireless modules and high-frequency communication applications (like 5G/6G modules) due to its superior high-frequency performance and dimensional stability. Furthermore, advancements in thick film and thin film deposition techniques are crucial for developing specialized ceramic substrates and integrated passive devices (IPDs), particularly for sophisticated sensor applications and high-density packaging.

Significant innovation is also occurring in the synthesis and processing of functional ceramic powders. Techniques like hydrothermal synthesis and sol-gel processing are being perfected to achieve ultra-fine, highly pure, and uniformly sized nanoparticles (nanoceramics), which dramatically enhance dielectric constants, piezoelectric coefficients, and mechanical strength when sintered. This focus on nano-scale engineering is critical for improving the energy storage capability of MLCCs and boosting the sensitivity of piezoelectric sensors. Concurrently, the industry is heavily invested in developing reliable, high-performance lead-free piezoelectric ceramics to replace traditional PZT, driven by increasing regulatory scrutiny, demanding complex substitutions and phase engineering to match the performance of lead-based materials.

Furthermore, technologies aimed at process sustainability and efficiency, such as advanced energy-efficient sintering methods (e.g., microwave sintering or spark plasma sintering), are gaining traction, although conventional furnace sintering remains dominant for volume production. Digitalization, particularly the implementation of Industry 4.0 concepts and AI-driven quality control, represents another critical technological trend. These advanced monitoring systems utilize machine vision and real-time data analytics to identify micro-structural flaws during or immediately after the sintering process, ensuring maximum yield and quality consistency, which is paramount for high-reliability components used in mission-critical applications like autonomous vehicles and medical implants.

Regional Highlights

The geographical distribution of the Electroceramics Market reveals distinct patterns of consumption and manufacturing capability, with Asia Pacific (APAC) maintaining a dominant, high-growth position.

- Asia Pacific (APAC): This region is the undisputed leader in both production and consumption, primarily driven by the massive electronics manufacturing base situated in China, South Korea, Japan, and Taiwan. The region benefits from lower manufacturing costs, established supply chains for electronic components, and strong domestic demand from consumer electronics and automotive electrification projects. Japan and South Korea remain global hubs for advanced material R&D, specializing in high-end ceramic capacitor and piezoelectric sensor production. Continuous investment in 5G infrastructure and data centers across China and India fuels exceptionally high component demand.

- North America: Characterized by a focus on high-reliability, high-specification applications, North America represents a significant market, particularly in Aerospace & Defense, high-end medical devices, and advanced automotive technology (ADAS, EVs). The demand is driven by rapid adoption of IoT and industrial automation, necessitating specialized sensor and insulator ceramics. Innovation in this region often centers on new material science and advanced manufacturing techniques, including 3D printing of ceramic parts.

- Europe: Europe holds a strong position in the industrial and automotive sectors. Germany, France, and the UK are key markets, driven by stringent environmental regulations accelerating the transition to EVs and robust investments in industrial automation (Industry 4.0). Demand is high for power electronics ceramics, complex piezoelectric transducers for non-destructive testing, and specialized substrates for renewable energy technologies. The region places a heavy emphasis on sustainability and the development of lead-free components.

- Latin America (LATAM) and Middle East & Africa (MEA): These regions are emerging markets with growth spurred by ongoing infrastructure development, increasing urbanization, and expanding telecommunications networks. While smaller in size, localized demand for basic insulators, energy sector components, and increasing penetration of imported consumer electronics components ensures steady growth. Investments in localized assembly operations and renewable energy projects provide clear, albeit targeted, growth opportunities.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Electroceramics Market, covering their product offerings, strategic initiatives, and financial overview.- Murata Manufacturing Co., Ltd.

- TDK Corporation

- Kyocera Corporation

- CeramTec GmbH

- CoorsTek, Inc.

- Littelfuse, Inc.

- Taiyo Yuden Co., Ltd.

- Morgan Advanced Materials plc

- NGK Spark Plug Co., Ltd. (NTK)

- Samsung Electro-Mechanics Co., Ltd.

- Vishay Intertechnology, Inc.

- CTS Corporation

- Maruwa Co., Ltd.

- PI Ceramic GmbH

- Fuji Titanium Industry Co., Ltd.

- Guandong Fenghua Advanced Technology Holding Co., Ltd.

- HEFEI ZHONGRUI CERAMIC TECHNOLOGY CO., LTD.

- APC International, Ltd.

- Skyworks Solutions, Inc.

- 3M Company

Frequently Asked Questions

Analyze common user questions about the Electroceramics market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the current growth of the Electroceramics Market?

The most significant driver is the global transition toward Electric Vehicles (EVs) and the widespread deployment of advanced wireless infrastructure (5G/6G). These applications require high volumes of specialized electroceramic components, such as high-density MLCCs and robust power electronics substrates, capable of handling high power and frequency demands.

Which material segment holds the largest share in the Electroceramics Market?

The Titanate Ceramics segment, particularly Barium Titanate, maintains the largest market share due to its critical role in the manufacturing of Multilayer Ceramic Capacitors (MLCCs). MLCCs are essential components in nearly all modern electronic devices, ensuring the Titanate segment’s volume leadership.

How is the market addressing the regulatory concerns surrounding lead-based materials like PZT?

The market is intensively focused on research and commercialization of high-performance lead-free piezoelectric ceramics. Manufacturers are developing alternatives based on compounds like Bismuth Sodium Titanate (BNT) and Potassium Sodium Niobate (KNN) to comply with environmental directives such as RoHS, ensuring sustained performance while minimizing toxicity.

What role does the Automotive industry play in electroceramics demand?

The Automotive industry is the fastest-growing end-user due to electrification and automation trends. Electroceramics are crucial for power electronics (inverters, converters), battery management systems, and a multitude of high-reliability sensors (e.g., ultrasonic, pressure, fuel level) essential for EV performance and ADAS safety systems.

What technological advancement is key to miniaturization in electroceramics?

Low-Temperature Co-fired Ceramic (LTCC) technology is pivotal for miniaturization. LTCC allows multiple passive components and complex circuitry to be integrated into a single, compact, multilayer ceramic module, enabling higher density packaging required for smartphones, wearable devices, and 5G base stations.

This report has been rigorously prepared to provide a comprehensive, detailed, and analytically sound perspective on the global Electroceramics Market, ensuring alignment with professional market research standards and optimization for modern information retrieval systems.

The increasing complexity of electronic devices, coupled with the relentless pursuit of energy efficiency and smaller form factors, guarantees the continued strategic importance of electroceramic materials. Future market expansion is anticipated to be heavily influenced by breakthroughs in solid-state battery technology, where specialized ceramic electrolytes will be fundamental, potentially opening up entirely new multi-billion dollar segments for electroceramic manufacturers worldwide. Geopolitical stability concerning raw material sourcing remains a critical strategic risk that needs continuous monitoring by stakeholders across the value chain. Manufacturers are diversifying sourcing and investing in advanced recycling technologies to mitigate reliance on geographically concentrated oxide supplies, securing long-term operational resilience and competitive positioning.

Furthermore, the high barrier to entry due to significant capital investment required for fabrication facilities (especially clean rooms and high-temperature kilns) favors established players who can continually reinvest in R&D to maintain technological leadership. Intellectual property surrounding proprietary formulations and unique sintering processes provides a strong competitive advantage. Successful firms are those that can effectively manage the delicate balance between high volume production of standardized components (like MLCCs) and the high-margin, bespoke production of specialized functional ceramics (like high-sensitivity medical sensors), catering to the bifurcated market demand structure and achieving operational efficiencies through process optimization and advanced automation.

The pervasive trend towards high-frequency operation in communication systems and radar applications further accentuates the need for ultra-low loss dielectric materials. Electroceramic researchers are continually exploring new compound systems with optimized permittivity and low dissipation factors at gigahertz frequencies. This technological race is particularly intense in the telecommunications and defense sectors, where component performance directly translates to system capability and operational superiority. Collaborative efforts between material scientists, electronic engineers, and application specialists are accelerating the development cycle, ensuring that electroceramic component specifications meet or exceed the rigorous demands set by next-generation communication standards and high-power military hardware requirements.

Regional investment patterns show a distinct correlation between government-backed initiatives in clean energy and market growth for related electroceramics. For instance, countries actively promoting solar and wind energy infrastructure creation are simultaneously boosting demand for ceramic insulators, high-voltage ceramic components, and specialized sensors used in energy conversion and grid stability management systems. This synergy between national energy policy and industrial material requirement provides a stable, long-term growth foundation for manufacturers operating in these strategic regions. The competitive landscape is characterized by constant innovation in material formulation, advanced quality control methodologies, and the optimization of supply chain logistics to ensure timely delivery of millions of components daily to global assembly lines.

The medical device segment, though smaller in volume compared to electronics, represents a critical area for high-precision electroceramics. Devices such as advanced surgical tools, diagnostic imaging equipment (MRI, ultrasound), and implantable devices require bio-compatible and highly stable piezoelectric or dielectric ceramics. The rigorous regulatory pathway and prolonged R&D cycle in healthcare necessitate long-term commitment and impeccable quality assurance from suppliers. Key innovation here includes developing materials suitable for miniature, high-resolution transducers and ceramic feedthroughs for reliable implantable electronics, ensuring patient safety and device longevity in physiological environments. This niche focuses heavily on specialization rather than sheer volume, commanding premium pricing and demanding highly customized manufacturing outputs.

Looking ahead, emerging applications such as quantum computing and neuromorphic hardware are expected to introduce entirely new, extremely demanding requirements for electroceramic properties, potentially requiring materials stable at cryogenic temperatures or exhibiting highly non-linear electrical behaviors. While these fields are nascent, successful development of supporting ceramic materials could define the next wave of disruptive innovation in the electroceramics sector, prompting significant R&D investment today. The market’s future vitality hinges on continuous innovation across material science and manufacturing engineering disciplines to keep pace with the accelerating demands of the global technology landscape.

Furthermore, the convergence of additive manufacturing (3D printing) technologies with electroceramic materials promises to revolutionize component design flexibility, particularly for complex geometries required in specific sensor housing or specialized antenna components. While still maturing, ceramic 3D printing techniques allow for rapid prototyping and production of customized, structurally optimized parts that are difficult or impossible to produce using traditional pressing and sintering methods. This approach is highly valuable in low-volume, high-value applications such as aerospace and advanced defense systems, offering reduced lead times and material waste. Companies successfully integrating 3D printing into their production matrix are strategically positioning themselves for future customized market demands.

The impact of economic volatility, while generally affecting capital expenditure across end-user industries, has proven relatively resilient in critical electroceramics applications, such as data storage and medical devices. This resilience stems from the non-discretionary nature of modern digital infrastructure and essential healthcare requirements. However, the consumer electronics segment remains sensitive to macroeconomic shifts, influencing the quarterly demand for high-volume passive components. Market leaders must strategically manage inventory and production capacity to buffer against these sectoral fluctuations while maintaining robust investment in high-growth, stable areas like power electronics and specialized sensing technologies for industrial automation. The long-term growth trajectory remains robust, underpinned by global technological shifts.

A key challenge facing the industry is the talent gap—the requirement for highly skilled chemical engineers, material scientists, and process automation specialists capable of managing and optimizing complex ceramic fabrication processes. The integration of AI and Industry 4.0 systems requires a workforce capable of advanced data analysis and predictive modeling, moving beyond traditional manufacturing skillsets. Companies are addressing this through partnerships with academic institutions and investing heavily in internal training programs to ensure the workforce possesses the requisite multidisciplinary expertise needed to manage increasingly sophisticated production lines and R&D activities, thereby securing the human capital necessary for competitive advantage.

Finally, sustainability considerations are increasingly impacting purchasing decisions, especially in Europe and North America. Customers are demanding eco-friendly manufacturing processes and components with reduced environmental footprints. This includes not only the development of lead-free materials but also the optimization of sintering processes to drastically reduce energy consumption and greenhouse gas emissions. Electroceramic manufacturers demonstrating clear commitments to sustainable practices, transparent supply chains, and adherence to circular economy principles are likely to gain preference among environmentally conscious OEMs, adding a non-price competitive dimension to the market strategy.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager