Electrodialysis Reversal System Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442795 | Date : Feb, 2026 | Pages : 253 | Region : Global | Publisher : MRU

Electrodialysis Reversal System Market Size

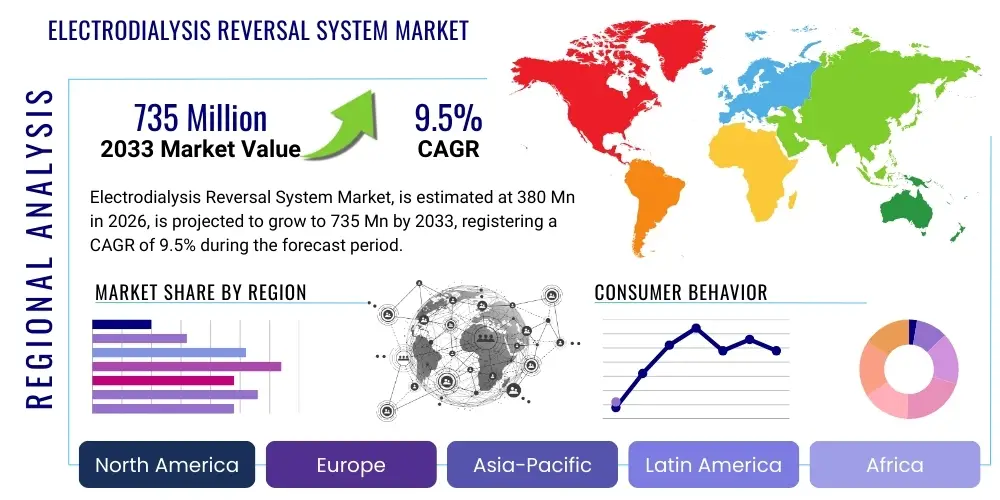

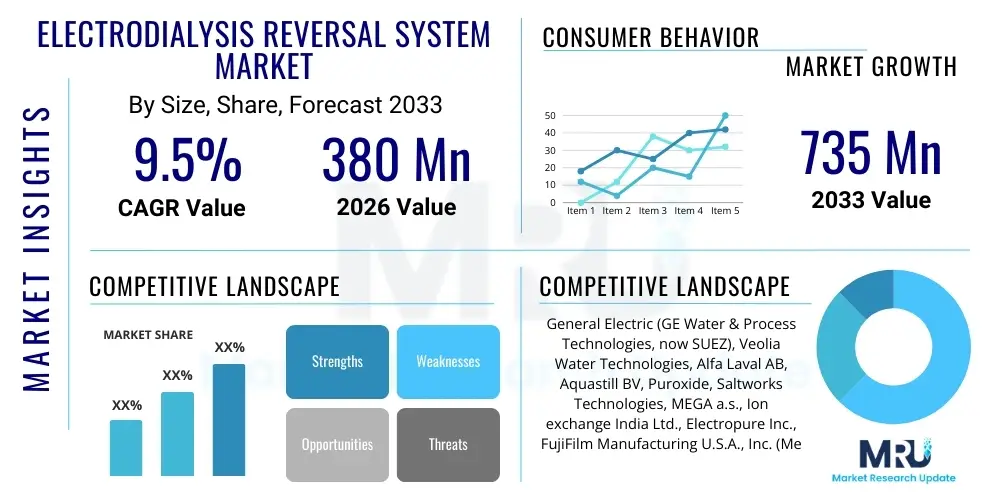

The Electrodialysis Reversal System Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033. The market is estimated at $380 Million in 2026 and is projected to reach $735 Million by the end of the forecast period in 2033.

Electrodialysis Reversal System Market introduction

The Electrodialysis Reversal (EDR) System Market is rapidly expanding, driven primarily by the escalating global demand for high-quality, reusable water resources and stringent environmental regulations concerning industrial discharge. EDR technology represents a significant evolution in electrodialysis, distinguished by its periodic polarity reversal mechanism. This reversal is crucial for mitigating scale formation, fouling, and concentration polarization, thereby maintaining membrane efficiency and extending the system's operational lifespan. EDR systems are fundamentally employed for the removal of dissolved ionized solids, primarily salts, from aqueous streams, offering a highly efficient, chemical-free alternative to traditional methods like reverse osmosis (RO) in specific total dissolved solids (TDS) ranges.

The core product description revolves around a modular stack of alternating anion- and cation-exchange membranes positioned between two electrodes. When a DC electric field is applied, ions migrate across the respective membranes into concentrating streams, leaving behind a purified diluate stream. The periodic reversal of the electric field effectively dislodges accumulated foulants and scales from the membrane surfaces, a feature that makes EDR highly resilient when treating challenging water sources such as brackish groundwater, cooling tower blowdown, and municipal wastewater effluent. Unlike RO, which operates based purely on pressure and size exclusion, EDR relies on the electrical properties of the dissolved solids, making it particularly advantageous for achieving moderate salinity reduction or concentrating specific ionic species.

Major applications for EDR technology span critical sectors including industrial water recycling, wastewater reuse, and the preparation of process water in the food and beverage industry. Key benefits include lower pretreatment requirements compared to pressure-driven membrane systems, reduced chemical usage for cleaning due to the reversal cycle, and the ability to operate effectively with variable feed water quality. The primary driving factors fueling market growth encompass global water scarcity, increasing focus on zero liquid discharge (ZLD) mandates in heavy industries, and the rising adoption of decentralized water treatment solutions, where EDR systems offer operational simplicity and relatively lower energy consumption for mid-range TDS removal.

Electrodialysis Reversal System Market Executive Summary

The Electrodialysis Reversal System Market is experiencing robust growth, underpinned by significant business trends focusing on sustainable water management and resource recovery. A key trend involves the integration of EDR systems into hybrid purification trains, where they often serve as pretreatment for highly sensitive downstream processes or as polishing steps to meet strict regulatory discharge limits. Furthermore, market players are concentrating on developing more resilient and energy-efficient membrane materials, specifically those optimized for higher temperature operation or tolerance to complex organic fouling, driving down the overall lifecycle cost of ownership for end-users. The shift toward modular, containerized EDR units is also prominent, catering to the growing demand for flexible, scalable, and rapidly deployable water treatment infrastructure across diverse geographical and industrial settings.

Regionally, the market dynamics are highly differentiated. North America and Europe are characterized by mature regulatory frameworks emphasizing water reuse, particularly in industrial sectors like power generation and petrochemicals, leading to significant investment in advanced EDR installations. Conversely, the Asia Pacific (APAC) region is poised for the highest growth trajectory, driven by rapid industrialization, burgeoning population centers, and severe water stress, necessitating large-scale desalination and resource recovery projects in countries such as China, India, and Australia. Latin America and the Middle East & Africa (MEA) are emerging markets, primarily focused on utilizing EDR for brackish water desalination in agricultural and remote municipal contexts, benefiting from the technology's lower operational sensitivity compared to RO in specific applications.

Segment trends reveal that the industrial water treatment segment, particularly concerning cooling tower blowdown and process rinse water recovery, maintains market dominance due to high water consumption volumes and strict discharge requirements. Technological advancements are observed predominantly in the membrane material segment, focusing on improved selectivity and fouling resistance, which is enhancing the viability of EDR in challenging environments. Furthermore, the growth of the batch EDR (BEDR) segment is notable in specialized areas requiring highly precise control over ion concentration, such as in the food and beverage industry for demineralization or specific product formulation processes, thereby diversifying the application portfolio of EDR technology beyond conventional desalination.

AI Impact Analysis on Electrodialysis Reversal System Market

Common user questions regarding the impact of AI on the Electrodialysis Reversal System market often revolve around optimizing operational efficiency, predicting maintenance needs, and improving energy consumption. Users frequently inquire about how machine learning algorithms can manage the complex variables involved in the EDR reversal cycle, such as determining the optimal frequency and duration of polarity switching based on real-time feed water quality fluctuations, membrane condition, and desired output purity. There is significant interest in using predictive analytics to preemptively identify membrane scaling or fouling before performance degradation becomes measurable, thereby maximizing uptime and minimizing the need for costly manual interventions or chemical cleaning. Furthermore, end-users are keen to understand the role of AI in creating autonomous EDR systems that can dynamically adjust voltage, flow rates, and concentration levels to minimize specific energy consumption per cubic meter of treated water, a critical factor in the economic viability of the technology.

The application of Artificial Intelligence within the EDR framework is transformative, shifting operations from reactive maintenance schedules to proactive, performance-based management. AI models trained on historical operating data—including parameters such as applied voltage, current density, pressure drop, TDS levels, and reversal cycle timing—can generate highly accurate performance baselines. Deviations from these baselines trigger immediate alerts, allowing operators to diagnose and address issues like subtle membrane damage or the onset of scaling long before they impact effluent quality. This predictive capability translates directly into extended membrane lifespan and sustained high throughput, fundamentally improving the return on investment for EDR installations, particularly those operating in challenging industrial environments with rapidly changing loads or fluctuating feed compositions.

Beyond diagnostics, AI facilitates deep optimization of the EDR process control itself. Traditional EDR systems rely on fixed, time-based reversal cycles. However, AI-driven control systems can implement adaptive reversal strategies, analyzing data streams (e.g., conductivity sensors, pressure transducers) to initiate reversal only when performance metrics indicate the necessity, or adjusting power input in real-time to maintain constant purification rates while minimizing power draw. This intelligent optimization is vital for enhancing the energy efficiency of EDR, making it more competitive against highly energy-intensive alternatives like thermal desalination or processes requiring extensive chemical pretreatment. The ability of AI to model complex electrochemical interactions also accelerates R&D efforts in developing next-generation membranes and stack designs.

- AI optimizes EDR power consumption by dynamically adjusting voltage based on real-time water quality metrics.

- Machine learning algorithms predict membrane fouling and scaling occurrences, enabling predictive maintenance schedules.

- Autonomous EDR control systems utilize AI to optimize polarity reversal frequency, maximizing operational uptime and efficiency.

- AI-driven data analysis enhances system diagnostics, pinpointing subtle performance degradation related to membrane degradation or structural issues.

- Smart sensors integrated with AI facilitate remote monitoring and control, especially crucial for decentralized water treatment facilities.

DRO & Impact Forces Of Electrodialysis Reversal System Market

The Electrodialysis Reversal System Market is primarily driven by powerful macroeconomic and environmental forces centered on water scarcity and legislative compliance. One of the principal drivers is the global need for fresh water, pushing municipalities and industries to adopt advanced water reuse and recycling technologies. EDR offers a cost-effective, energy-efficient solution for reclaiming water from brackish sources and industrial effluents, particularly when the target TDS reduction falls below the economic threshold of Reverse Osmosis. Furthermore, the increasing global emphasis on achieving Zero Liquid Discharge (ZLD) in heavy industries, mandated by increasingly strict regulatory bodies worldwide, compels companies to invest in technologies like EDR that facilitate the concentration of brine streams and minimize wastewater volume requiring ultimate disposal.

Despite significant growth potential, the market faces notable restraints, primarily related to the high initial capital expenditure (CAPEX) associated with EDR installation compared to conventional methods. The cost of specialized ion-exchange membranes, along with the complexity of stack assembly and the required electrical infrastructure, often presents a barrier to entry, particularly for smaller enterprises or emerging economies. Another significant restraint is the performance limitation in treating feed water with exceptionally high levels of suspended solids, oils, or certain complex non-ionized organic matter, which necessitates intensive and costly pretreatment steps. Furthermore, a perceived lack of comprehensive technical expertise among local operators in some regions regarding the sophisticated maintenance and optimization of EDR systems also slows adoption rates.

The market opportunities are substantial, particularly in the synergistic integration of EDR with renewable energy sources and the penetration into new application segments. The low-pressure operation of EDR makes it inherently compatible with solar and wind power, reducing the operational expense (OPEX) and enhancing sustainability, appealing to off-grid or remote installations. The emergence of specialized applications in nutrient recovery (e.g., phosphate or nitrate concentration) from agricultural runoff or wastewater streams presents a significant, untapped opportunity. These opportunities, coupled with the driving factors of regulatory push and water scarcity, exert strong upward pressure on market expansion. The impact forces are thus heavily tilted towards favorable external conditions (regulatory mandates, scarcity) counterbalanced by internal market challenges (high CAPEX, technical complexity).

Segmentation Analysis

The Electrodialysis Reversal System Market is systematically segmented across Type, Application, and End-User, providing a comprehensive view of its diversified usage patterns and technological maturity across various sectors. Analyzing these segments helps stakeholders identify high-growth areas and tailor market strategies accordingly. The Type segmentation distinguishes between Continuous Electrodialysis Reversal (CEDR) and Batch Electrodialysis Reversal (BEDR), reflecting the scale and operational methodology required by different end-users, with CEDR dominating large-scale industrial and municipal operations due to its sustained throughput capabilities. The segmentation by Application highlights the crucial role EDR plays in both general water treatment and specialized chemical processes, demonstrating its versatility.

In terms of Application, the market is broadly divided into Industrial Water Treatment, Wastewater Reuse, Food & Beverage Processing, and Desalination. Industrial Water Treatment consistently holds the largest market share, driven by mandatory compliance for water recycling in sectors like power, electronics, and metals processing, where tight specifications for water quality are paramount. However, the Wastewater Reuse segment is projected to exhibit the fastest growth, fueled by global initiatives to create circular water economies and reduce reliance on finite freshwater resources. EDR is particularly valuable here for producing non-potable reuse water with controlled salinity levels, offering a reliable barrier to microbial contaminants and targeted ion removal.

The End-User segment further delineates market consumption, focusing on key consumer types such as Municipalities, Heavy Industries, and the rapidly growing Pharmaceutical and Biotechnology sector. Heavy Industries (including mining, power generation, and refining) constitute the largest consumer base due to their massive water footprints and complex effluent streams that often contain high concentrations of specific ionic contaminants suitable for EDR removal. Municipalities represent a stable, significant segment, utilizing EDR for potable water desalination in areas with brackish groundwater. The growth in the Food & Beverage sector, relying on EDR for precise demineralization (e.g., juice concentration or dairy product preparation), underscores the technology's move toward higher-value specialized applications.

- Type:

- Continuous Electrodialysis Reversal (CEDR)

- Batch Electrodialysis Reversal (BEDR)

- Application:

- Industrial Water Treatment (Cooling Towers, Boiler Feed Water)

- Wastewater Reuse and Recycling (Tertiary Treatment)

- Desalination (Brackish Water Desalination)

- Food & Beverage Processing (Demineralization, Concentration)

- Chemical Processing and Product Recovery

- End-User:

- Municipalities and Water Utilities

- Heavy Industries (Mining, Oil & Gas, Power Generation)

- Food & Beverage Companies

- Pharmaceutical and Biotechnology

- Electronics and Semiconductors

Value Chain Analysis For Electrodialysis Reversal System Market

The value chain for the Electrodialysis Reversal System Market begins with upstream activities focused heavily on the procurement and manufacturing of specialized components, primarily ion-exchange membranes. The quality and performance of the overall EDR system are critically dependent on the integrity of these membranes, which involves complex polymer chemistry and precision manufacturing. Key upstream players include specialized chemical companies and membrane fabricators, who invest heavily in R&D to enhance membrane selectivity, conductivity, and fouling resistance. This segment is highly concentrated and dictates a significant portion of the final system cost, making supply chain resilience and material pricing critical factors for downstream integrators.

Midstream activities encompass the core integration, assembly, and testing of the EDR stack and associated balance of plant components. System integrators and original equipment manufacturers (OEMs) design the complete skid-mounted systems, incorporating necessary components such as power supplies (rectifiers), piping, pumps, and sophisticated control systems. This stage involves significant engineering expertise to ensure optimal hydraulic and electrical performance, minimizing energy consumption, and customizing the system for specific feed water characteristics and application requirements. Direct distribution channels often involve the OEM selling the customized system directly to large industrial end-users or municipalities, allowing for close technical support and bespoke solutions.

Downstream activities center on deployment, commissioning, operation, and maintenance (O&M) services. Indirect distribution, frequently utilized for smaller, standardized systems or regional penetration, involves channeling products through specialized water technology distributors, engineering, procurement, and construction (EPC) firms, or regional service providers. The long-term profitability of the EDR market relies heavily on the provision of reliable aftermarket services, including membrane replacement, system monitoring, and performance optimization contracts. This ongoing service component, driven by the need to maintain peak efficiency over the system's 15-20 year lifespan, generates substantial recurring revenue for key market players.

Electrodialysis Reversal System Market Potential Customers

Potential customers for Electrodialysis Reversal systems are predominantly large-scale entities facing significant challenges related to water management, high salinity levels, or stringent purity requirements. The primary end-users are municipalities located in arid or semi-arid regions that rely on brackish groundwater sources for potable water supply, where EDR provides a reliable, energy-efficient desalination solution compared to conventional thermal methods. Industrial facilities, particularly those involved in resource extraction, energy generation, and chemical manufacturing, represent another major customer segment. These industries require high volumes of process water and must adhere to strict environmental regulations regarding the discharge of concentrated brine or cooling tower blowdown, making EDR essential for water reuse and minimizing environmental impact.

A rapidly expanding customer base is found within the specialized manufacturing sectors, notably electronics and pharmaceuticals. These industries demand ultra-pure water (UPW) and rely on EDR as an effective pre-treatment step to remove critical ionic species before subsequent polishing stages, ensuring the highest standards of water quality necessary for sensitive processes like semiconductor fabrication or drug production. The need for precise deionization control and reduced chemical footprint makes EDR a superior choice over generalized membrane technologies in these high-value applications. Furthermore, agricultural businesses requiring irrigation water from marginally saline sources also represent a growing customer demographic, especially those focusing on high-value crop cultivation where controlled salinity is crucial for yield optimization.

In essence, the ideal potential customer is characterized by two key factors: a need to treat water with a moderate level of Total Dissolved Solids (TDS, typically 1,000 to 10,000 mg/L) and an operational environment where minimizing chemical usage and maximizing water recovery are economic imperatives. Customers seeking ZLD compliance, those integrating systems with intermittent renewable energy, or entities requiring the selective removal or recovery of valuable ions (e.g., lithium, rare earth elements) from process streams also constitute highly targeted potential customers for advanced EDR solutions. The market is increasingly pivoting towards offering highly customized, modular solutions to address the specific volumetric and purification requirements of this diverse customer landscape.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $380 Million |

| Market Forecast in 2033 | $735 Million |

| Growth Rate | 9.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered |

|

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Electrodialysis Reversal System Market Key Technology Landscape

The core technology landscape of the Electrodialysis Reversal System Market is centered on three interconnected pillars: advanced ion-exchange membranes, optimized system design and stack architecture, and sophisticated power management and control systems. Crucially, membrane technology continues to evolve, with research focused on increasing chemical stability, improving ionic selectivity, and enhancing resistance to biological and organic fouling. Recent innovations include the development of monovalent selective ion-exchange membranes, which allow for the targeted removal of specific ions (e.g., sodium and chloride) while minimizing the passage of valuable divalent ions (e.g., calcium and magnesium), opening up niche applications in food processing and resource recovery. Furthermore, the integration of nanofiltration or ultrafiltration layers onto the base membrane structure is being explored to create hybrid materials that improve durability and expand the range of treatable feed waters.

System design and stack architecture improvements focus on maximizing packing density and ensuring uniform flow distribution across the membrane surfaces to prevent localized fouling and concentration polarization. Modular, compact designs are increasingly prevalent, catering to decentralized water treatment needs and simplifying installation logistics. Innovations in fluid dynamics within the EDR stack, such as optimized spacer geometries and flow path designs, aim to reduce hydraulic pressure drop, consequently lowering the pumping energy required and contributing significantly to the overall reduction in specific energy consumption (SEC). These structural improvements are vital for maintaining the competitive advantage of EDR over pressure-driven membrane processes, especially in large-scale projects where slight efficiency gains translate into massive operational savings.

The third critical technological area involves the power and control systems that manage the polarity reversal cycle. Modern EDR systems utilize high-efficiency DC power supplies and sophisticated software algorithms to precisely control the frequency, duration, and ramp-up/ramp-down timing of the electrical field reversal. This precise control is essential not only for effective fouling mitigation but also for energy optimization. Furthermore, the integration of advanced sensors (conductivity, pH, redox potential) and IoT connectivity allows for real-time monitoring and remote diagnostics. This trend towards digitalization and automation, often utilizing the aforementioned AI capabilities, transforms EDR operations, enabling predictive maintenance, dynamic load balancing, and autonomous operation, thereby minimizing operator intervention and maximizing operational reliability in diverse industrial environments.

Regional Highlights

Regional analysis of the Electrodialysis Reversal System Market reveals distinct adoption patterns influenced by water availability, industrial concentration, and regulatory mandates. North America stands out due to its mature industrial sector, particularly power generation and petrochemicals, which are subject to stringent environmental regulations regarding industrial effluent discharge and water recycling. The market here is characterized by high investment in advanced, large-scale EDR systems for cooling tower blowdown treatment and brackish water remediation in areas experiencing chronic drought. The robust infrastructure and high awareness of sustainable technologies facilitate the rapid adoption of customized, energy-efficient EDR solutions, often integrated into complex ZLD strategies.

Europe demonstrates steady growth, propelled by the European Union’s Water Framework Directive and strong emphasis on circular economy principles. Western European countries, particularly Germany, France, and the Netherlands, utilize EDR primarily for resource recovery (e.g., salt concentration, specific ion removal) and high-quality process water preparation in the food and pharmaceutical industries. The focus in Europe is heavily skewed toward innovative, compact EDR systems that offer minimal chemical usage and maximum water recovery, aligning with high sustainability targets and limited land availability for industrial facilities. Eastern Europe is emerging as a growth pocket, driven by modernization of municipal water infrastructure and increasing industrial compliance requirements.

The Asia Pacific (APAC) region is forecasted to be the engine of market expansion, primarily due to unprecedented industrial growth, rapid urbanization, and severe regional water stress, particularly across China, India, and Southeast Asia. Massive infrastructure projects, coupled with the need for large-scale desalination of brackish groundwater to support rapidly growing populations and manufacturing hubs, create substantial demand for high-throughput EDR systems. While initial cost sensitivity remains a factor, the long-term operational benefits of EDR—specifically its ability to handle variable feed water quality better than some alternatives—are driving adoption. Latin America and the Middle East & Africa (MEA) focus heavily on agricultural and remote municipal desalination projects, where the resilience and lower maintenance complexity of EDR compared to RO in certain high-fouling conditions make it an attractive and viable solution for enhancing water security.

- North America: Market leader in industrial ZLD applications and brackish water treatment; high adoption rate due to stringent environmental regulations and existing robust infrastructure.

- Europe: Focus on resource recovery, advanced municipal wastewater reuse, and high-purity applications in pharmaceuticals and food processing, driven by strong circular economy policies.

- Asia Pacific (APAC): Fastest-growing region, fueled by rapid industrialization, large-scale infrastructure development, and urgent need for brackish water desalination in densely populated areas.

- Middle East & Africa (MEA): Emerging market focused on utilizing EDR for decentralized brackish water desalination and agricultural use, capitalizing on system resilience in harsh climates.

- Latin America: Growing adoption in mining, refining, and specialized agricultural sectors requiring high water recovery rates and effluent volume minimization.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Electrodialysis Reversal System Market.- SUEZ (formerly GE Water & Process Technologies)

- Veolia Water Technologies

- MEGA a.s.

- Saltworks Technologies

- Aquastill BV

- SnowPure, LLC

- Ion exchange India Ltd.

- Electropure Inc.

- FujiFilm Manufacturing U.S.A., Inc. (Membrane Division)

- De Nora

- Xylem (Evoqua Water Technologies)

- Alfa Laval AB

- Wigen Water Technologies

- CST Wastewater Solutions

- Sustech Co., Ltd.

- Puroxide

- Cobetter Filtration Equipment Co., Ltd.

- WGM Group

Frequently Asked Questions

Analyze common user questions about the Electrodialysis Reversal System market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between Electrodialysis Reversal (EDR) and Reverse Osmosis (RO) systems?

EDR systems utilize an electric potential to drive ionic species across selective membranes, primarily separating based on charge, and feature periodic polarity reversal to mitigate fouling. RO systems, conversely, use hydraulic pressure to push water across a semi-permeable membrane, separating based on size exclusion. EDR is generally more energy-efficient and cost-effective for treating brackish water with mid-range TDS (1,000 to 10,000 mg/L) and is superior in handling challenging, high-fouling feed water sources due to the self-cleaning reversal cycle.

In which applications does EDR offer the greatest operational advantage over other water treatment technologies?

EDR offers significant advantages in industrial wastewater treatment, specifically for cooling tower blowdown and process rinse water recycling, where high water recovery rates and tolerance to moderate fouling are essential. It is also preferred in brackish water desalination for municipal supply, and in the food and beverage industry for demineralization or concentration, due to its precise control over ion removal and reduced reliance on chemical cleaning agents, promoting sustainability.

What are the typical capital expenditure requirements for implementing an EDR system compared to traditional treatment methods?

The initial capital expenditure (CAPEX) for EDR systems can be higher than conventional chemical precipitation or basic RO systems of similar capacity, largely due to the high cost of specialized ion-exchange membranes and sophisticated power control units. However, this higher CAPEX is often offset by substantially lower operational expenditures (OPEX) over the system lifecycle, achieved through reduced energy consumption, minimized chemical use, and significantly extended membrane lifespan due to the integrated reversal mechanism.

How is the efficiency of an Electrodialysis Reversal system measured and optimized?

EDR efficiency is primarily measured by specific energy consumption (SEC) in kilowatt-hours per cubic meter (kWh/m³) of treated water, and the overall water recovery rate (ratio of clean water produced to feed water intake). Optimization involves dynamic management of the reversal cycle frequency and duration, adjusting applied voltage based on feed water conductivity, and minimizing pressure drop through optimized stack design. Integration of AI and real-time monitoring sensors is increasingly used to achieve continuous, dynamic optimization for peak performance.

What regulatory factors are currently driving the global demand for Electrodialysis Reversal technology?

The global demand for EDR is significantly driven by tightening regulatory frameworks, especially mandates promoting industrial Zero Liquid Discharge (ZLD) or Minimum Liquid Discharge (MLD) targets in regions like North America, Europe, and parts of Asia. Regulations focused on water recycling quotas, limits on brine disposal volume and salinity, and directives promoting resource recovery from wastewater streams compel industries and municipalities to adopt EDR as a compliant, advanced separation technology.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager