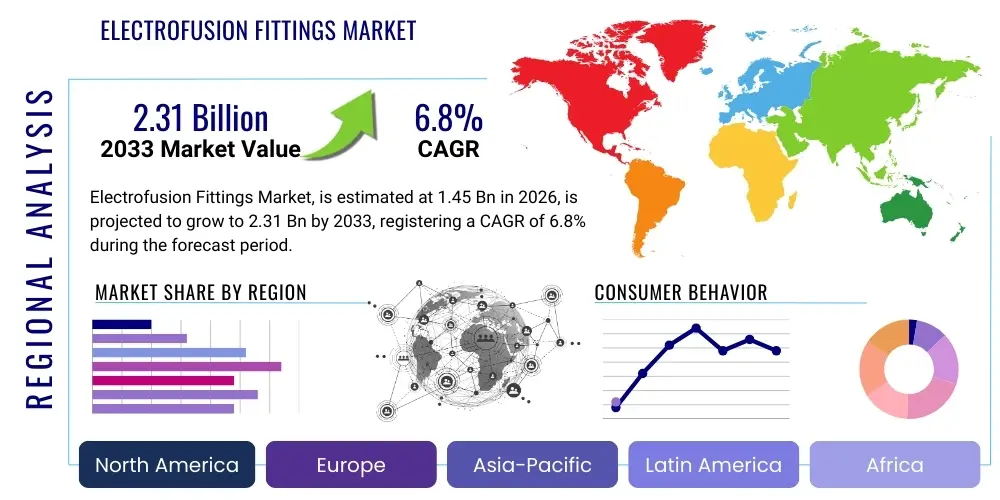

Electrofusion Fittings Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441111 | Date : Feb, 2026 | Pages : 243 | Region : Global | Publisher : MRU

Electrofusion Fittings Market Size

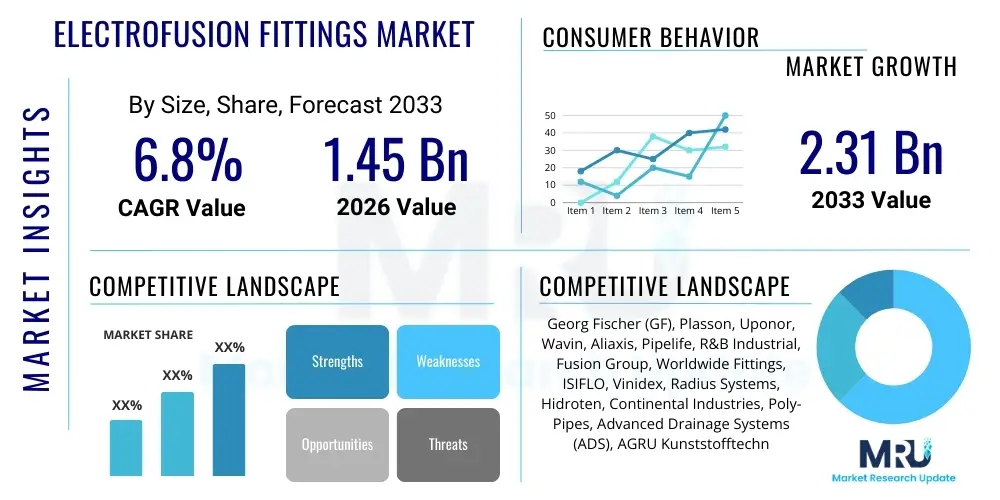

The Electrofusion Fittings Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $1.45 Billion in 2026 and is projected to reach $2.31 Billion by the end of the forecast period in 2033.

Electrofusion Fittings Market introduction

The Electrofusion Fittings Market encompasses the manufacturing and distribution of specialized components used to join polyethylene (PE) and polypropylene (PP) pipes securely and permanently, primarily within critical infrastructure networks. These fittings utilize an electrical resistance heating process, where integrated heating coils melt the plastic surfaces of both the fitting and the pipe, creating a homogenous, robust, and leak-proof joint. This technology is crucial for maintaining the integrity and safety of fluid and gas distribution systems, offering significant advantages over traditional mechanical joining methods or butt fusion in confined spaces or complex installations. The inherent material properties of polyethylene, such as high resistance to corrosion, chemical inertness, and exceptional longevity, combined with the reliability of the electrofusion process, have positioned these fittings as the standard solution for modern utility infrastructure globally.

Electrofusion fittings are indispensable across a broad spectrum of applications, most notably in the transmission and distribution of potable water and natural gas, where joint reliability is paramount for public safety and operational efficiency. The product portfolio includes a variety of forms such as couplers, tees, elbows, reducers, and saddle fittings, designed to meet diverse network configurations and pipe diameter requirements. Furthermore, the market benefits from increasing regulatory scrutiny regarding pipeline leakage, particularly in aging infrastructure across developed economies, compelling utility providers to invest in superior joining technologies. The ease of installation, coupled with the automated nature of the welding process which minimizes installer error, significantly drives their adoption.

The principal benefits driving market expansion include the superior long-term performance and reduced maintenance costs associated with PE pipelines. Unlike metallic systems susceptible to rust and chemical degradation, PE systems joined via electrofusion maintain structural integrity for decades, even in aggressive soil conditions. Key driving factors are rapid urbanization leading to extensive new utility installation projects, the mandated replacement of obsolete metallic pipes to curb massive water and gas losses, and technological advancements enabling faster, more accurate fusion processes. These factors collectively solidify the market's trajectory towards sustained growth throughout the forecast period.

Electrofusion Fittings Market Executive Summary

The global Electrofusion Fittings Market is characterized by a stable but accelerating growth trajectory, driven fundamentally by robust infrastructural development and the global imperative to minimize resource leakage in utility networks. Key business trends indicate a strong focus on automation and traceability, with leading manufacturers integrating advanced data logging capabilities and barcoding standards into their fittings to ensure complete quality assurance throughout the installation lifecycle. The shift toward higher density polyethylene (HDPE) materials and larger diameter fittings for long-distance transmission lines represents a significant commercial focus. Additionally, consolidation among smaller regional players by large multinational corporations is shaping the competitive landscape, aiming for enhanced production capacities and wider global distribution networks, particularly targeting high-growth emerging economies in Asia Pacific.

Regionally, the market dynamics are heavily influenced by the pace of infrastructure modernization. North America and Europe maintain a mature market status, where growth is primarily derived from repair, rehabilitation, and regulatory-driven pipeline replacement programs aimed at reducing non-revenue water and mitigating environmental risks associated with natural gas leaks. Conversely, the Asia Pacific region, led by rapidly industrializing nations such as China and India, presents the highest growth potential due to massive greenfield infrastructure projects, including new urban water supply schemes and expansion of nascent natural gas grids. Latin America and MEA are seeing strong, localized growth tied to resource management improvement projects and investment in mining and industrial applications, although political instability and inconsistent regulatory frameworks pose localized challenges to market penetration.

Segment trends highlight the dominance of coupler fittings due to their high volume requirement in straight pipe runs, yet the fastest growth is observed in specialized segments like branch saddles and tapping tees, driven by increasing complexity in urban pipeline branching and service line connections. Furthermore, the application segment shows Gas Distribution maintaining a stable, high-value share due to stringent safety standards requiring impeccable joint integrity, while Water Utilities continue to be the largest volume consumer. The industry is also witnessing an evolution in material science, with a focus on fittings designed for specialized fluids and extreme pressure applications, thus broadening the addressable market beyond traditional municipal utilities and into heavy industrial sectors.

AI Impact Analysis on Electrofusion Fittings Market

User queries regarding the impact of Artificial Intelligence (AI) on the Electrofusion Fittings Market overwhelmingly center on how technology can enhance quality control, optimize manufacturing efficiency, and facilitate predictive maintenance in field applications. Users are concerned with eliminating human error during the welding process and ensuring data-driven verification of joint integrity post-fusion. Key themes also include the potential for AI algorithms to manage complex supply chain logistics for millions of small, essential fittings and the integration of AI-powered analytics into specialized welding units to proactively flag potential issues based on real-time environmental and electrical input data. Expectations are high that AI will transform quality assurance from a manual checking process into an automated, self-regulating system, significantly reducing failure rates and long-term operating costs for utility providers.

- AI-driven Quality Assurance (QA): Implementation of computer vision systems to inspect the interior and exterior surface finish of fittings during production, identifying microscopic flaws or dimensional inaccuracies far exceeding human capability.

- Predictive Maintenance of Welding Equipment: AI algorithms analyze historical performance data from electrofusion machines (voltage, time, ambient temperature) to predict imminent component failures, maximizing uptime for installers.

- Optimized Manufacturing Processes: Utilization of machine learning to fine-tune injection molding parameters, reducing material waste, lowering energy consumption, and achieving tighter dimensional tolerances in high-volume production runs.

- Smart Inventory and Supply Chain Management: AI tools forecasting demand patterns regionally and product-specifically, minimizing overstocking while ensuring timely delivery of critical fittings to construction sites.

- Automated Welding Protocol Validation: AI integrated into fusion boxes to instantly cross-reference environmental conditions and pipe specifications against optimal fusion parameters, preventing substandard joints before the process begins.

- Simulation and Design Optimization: Use of generative design AI to optimize the internal coil winding patterns and body geometry of fittings, enhancing thermal uniformity during the fusion cycle for stronger, more reliable joints.

DRO & Impact Forces Of Electrofusion Fittings Market

The market's dynamics are dictated by a compelling set of Drivers, Restraints, and Opportunities (DRO), which collectively form the Impact Forces shaping its competitive and technological evolution. A major driver is the accelerating requirement for reliable, maintenance-free piping systems, particularly as global infrastructure faces immense pressure from aging and climate change-related stresses. The superior long-term performance of electrofusion joints—offering zero leakage potential when installed correctly—makes them essential for preserving scarce resources like water and reducing hazardous emissions in gas networks. Conversely, a significant restraint lies in the relatively high initial capital expenditure required for specialized electrofusion welding units and the need for certified, specialized training for installers, which acts as a barrier to entry in regions with underdeveloped technical labor pools. The complexity and cost of maintaining a fleet of specialized equipment can sometimes deter smaller contractors.

A key opportunity invigorating market growth is the emerging market for new energy transmission infrastructure. The preparation for hydrogen and biogas distribution networks, which require extremely robust and leak-proof joints due to the physical properties of these gases, presents a substantial growth avenue for high-performance PE fittings. Furthermore, the integration of ‘smart’ capabilities into fittings—such as embedded RFID chips or data logging—to enhance traceability and lifecycle management aligns perfectly with global digitalization trends in utility management. The primary impact force driving innovation is the regulatory environment, where ever-tightening standards for leakage control (e.g., Non-Revenue Water reduction targets) and pipeline safety mandates force utility companies to adopt best-available technologies like electrofusion, accelerating replacement cycles.

The inherent dependency of electrofusion technology on the stability of raw material pricing, specifically polyethylene resins, introduces a moderate restraining force. Fluctuations in crude oil prices directly affect production costs, making long-term pricing stability challenging for manufacturers and potentially influencing procurement decisions by risk-averse utility companies. However, this is largely counterbalanced by the powerful driver represented by the durability quotient; the total cost of ownership (TCO) for electrofusion-joined PE systems is overwhelmingly favorable compared to frequent repairs or replacements required by traditional pipe materials. These powerful economic and regulatory impact forces ensure continued investment in R&D aimed at automating installation and improving fitting robustness, securing the market's positive outlook.

Segmentation Analysis

The Electrofusion Fittings Market is comprehensively segmented based on product type, pipe diameter, primary application, and material used, reflecting the diverse requirements of the global infrastructure sector. Analyzing these segments provides a clear understanding of market penetration, demand hotspots, and technological priorities. The segmentation by product type is crucial as different fittings address unique functions within a network—from straight-line connections (couplers) to complex branching (saddles). Application segmentation highlights the critical difference in regulatory environments and quality demands between gas distribution and water utilities, influencing segment valuation. Material-wise, the market is overwhelmingly dominated by high-performance polyethylene grades, but advancements in modified materials are opening specialized niches.

- By Type

- Couplers (Sleeves)

- Elbows (Bends)

- Tees (Equal and Reducing)

- Reducers

- End Caps

- Branch Saddles (Tapping Saddles)

- By Pipe Diameter

- Small Diameter (Below 63mm)

- Medium Diameter (63mm to 250mm)

- Large Diameter (Above 250mm)

- By Application

- Water Utilities (Potable Water, Wastewater)

- Gas Distribution Networks (Natural Gas, Biogas)

- Chemical and Industrial Processing

- Mining and Slurry Transport

- Sewage Treatment and Effluent Disposal

- By Material

- High-Density Polyethylene (HDPE)

- Medium-Density Polyethylene (MDPE)

- Polypropylene (PP)

Value Chain Analysis For Electrofusion Fittings Market

The value chain for the Electrofusion Fittings Market begins upstream with the polymerization and supply of specialized polyethylene resins (HDPE and MDPE). This stage is highly critical as the quality and stability of the raw material directly dictate the performance and longevity of the final product. Key suppliers are major petrochemical companies, and manufacturers of fittings must maintain robust relationships and quality control over these inputs, often requiring customized material formulations optimized for injection molding and consistent thermal expansion properties. Following material procurement, the manufacturing phase involves complex processes, including high-precision injection molding of the fitting body and the automated insertion and precise winding of resistance heating coils. This stage requires significant capital investment in specialized machinery and adherence to strict international standards (e.g., ISO 12176).

Midstream activities are centered on the distribution channel, which is often bifurcated into direct sales and indirect distribution. Large infrastructure projects, especially those led by national gas or major water utility companies, frequently involve direct negotiation and supply from the manufacturer to ensure technical consistency and logistical control. Conversely, smaller projects, maintenance work, and supplies to regional contractors are managed via specialized indirect distribution networks, including authorized dealers, wholesalers, and technical sales representatives who also often provide essential technical support and certified training services. The effectiveness of the indirect channel hinges on maintaining a comprehensive inventory of diverse fitting types and sizes, ensuring rapid deployment to construction sites.

Downstream analysis focuses on the end-user (utility companies, civil engineering contractors) and the crucial installation phase. The final quality of the joint is highly dependent on proper surface preparation, equipment calibration, and adherence to manufacturer instructions. Due to this complexity, after-sales support, including technical assistance and certification training, forms a critical component of the value chain, directly influencing customer satisfaction and brand loyalty. Optimization of this value chain emphasizes traceability from raw material batch numbers through to the final fusion data logged by the welding unit, offering end-users unparalleled assurance regarding the lifetime performance of the installed infrastructure.

Electrofusion Fittings Market Potential Customers

The primary customer base for Electrofusion Fittings centers heavily on large-scale governmental and private utility operators responsible for managing extensive municipal and industrial networks. These customers prioritize product quality, longevity, and adherence to national and international safety standards, given the high cost and disruption associated with pipeline failure. Key buyers include regional and municipal water supply companies seeking to reduce Non-Revenue Water (NRW) losses, which are often caused by faulty joints in aging systems. Additionally, major natural gas distributors represent a high-value customer segment, driven by stringent regulatory requirements mandating zero-tolerance for leaks due to environmental and safety hazards.

Beyond municipal services, significant consumption originates from industrial sectors, particularly mining, chemical processing plants, and major construction enterprises involved in large civil infrastructure projects. Mining operations frequently require durable piping systems for slurry transport and process water, where the corrosion resistance of PE fittings proves invaluable in harsh, chemically aggressive environments. Chemical and industrial plants utilize electrofusion to ensure secure containment of various fluids, where the chemical compatibility of the material is a deciding factor. These customers often procure specialized, larger-diameter fittings and require tailored technical specifications regarding pressure ratings and material grades.

Finally, EPC (Engineering, Procurement, and Construction) contractors act as pivotal purchasing intermediaries. These firms execute large-scale projects on behalf of utility owners and are responsible for product specification, procurement, and installation. Their purchasing decisions are influenced by project timelines, cost efficiency, ease of installation, and proven reliability. Manufacturers therefore focus significant marketing efforts on educating and providing technical support directly to these contractor teams, recognizing them as key decision-makers in the procurement cycle, often favoring established brands known for reliable fusion consistency and comprehensive product lines.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.45 Billion |

| Market Forecast in 2033 | $2.31 Billion |

| Growth Rate | CAGR 6.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Georg Fischer (GF), Plasson, Uponor, Wavin, Aliaxis, Pipelife, R&B Industrial, Fusion Group, Worldwide Fittings, ISIFLO, Vinidex, Radius Systems, Hidroten, Continental Industries, Poly-Pipes, Advanced Drainage Systems (ADS), AGRU Kunststofftechnik, WL Plastics, Frialen (part of Aliaxis), McElroy Manufacturing. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Electrofusion Fittings Market Key Technology Landscape

The technological landscape of the Electrofusion Fittings Market is rapidly evolving, driven by the dual goals of maximizing joint reliability and minimizing installation complexity. Central to this evolution is the standardization of automated fusion processes via high-tech welding control boxes. These modern units utilize advanced microprocessors to read data instantly from the fitting, typically through embedded barcodes, ensuring that the precise fusion parameters (voltage, time, cooling duration) specific to that fitting’s material and size are applied automatically, eliminating the risk of manual input errors. This level of automation ensures consistency across multiple installations and is crucial for meeting rigorous utility performance specifications, representing a fundamental shift from installer-dependent quality to technology-dependent quality assurance.

Another significant technological development focuses on the fittings themselves, specifically the design and manufacturing precision of the internal resistance coils. Innovations include optimized coil winding geometry and variations in wire gauge to ensure uniform heat distribution across the entire fusion area, minimizing cold spots which are potential failure points. Furthermore, the material science segment is advancing, with manufacturers focusing on developing next-generation PE compounds that offer enhanced resistance to slow crack growth and higher pressure tolerance, widening the applicability of electrofusion beyond standard low-pressure distribution systems into high-pressure transmission lines. Traceability technology, such as integrated radio-frequency identification (RFID) or Near Field Communication (NFC) tags, is increasingly common, allowing utilities to track the fitting's journey from production batch to the exact GPS location and time of installation, creating a verifiable digital record for every joint.

The integration of digital logging and telemetry in the field is also a pivotal trend. Modern fusion machines record every fusion cycle, storing detailed operational data, including ambient temperature, required energy input, and successful completion status. This data is often transferable via Bluetooth or cloud connectivity to utility management systems, facilitating centralized project oversight and rapid auditing. This technological framework supports the growth of "smart" utility infrastructure by providing verifiable, data-backed proof of joint integrity, reducing liability and simplifying compliance reporting. The continuous drive toward higher pressure ratings and larger diameter fittings also mandates concurrent improvements in the fusion machine capacity and control algorithms to manage the significantly increased energy required for reliable fusion on massive pipe sections.

Regional Highlights

- North America: This region represents a mature yet robust market, largely driven by comprehensive municipal programs focused on the replacement and rehabilitation of extensive, aging metallic gas and water infrastructure. Strict safety regulations, particularly concerning natural gas leakage reduction, mandate the use of highly reliable joining methods, positioning electrofusion as the preferred choice for new installations and maintenance operations. High labor costs also incentivize the adoption of automated, error-reducing electrofusion technology. The United States market is the largest contributor, with significant investment in water resilience projects and continued expansion of suburban gas grids, demanding medium to large-diameter couplers and saddle fittings. Regulatory mandates related to lead service line replacement further accelerate demand.

- Europe: Europe exhibits strong market penetration, characterized by high standards for environmental protection and resource management. Countries like Germany, the UK, and Scandinavian nations have stringent Non-Revenue Water (NRW) targets, fueling consistent demand for leak-proof PE systems. The market here is highly competitive, dominated by well-established local and international manufacturers known for precision engineering and advanced material technology. A unique growth factor in Europe is the proactive preparation for specialized networks, including district heating and cooling systems, and early-stage infrastructure for hydrogen gas distribution, which requires the highest possible joint integrity achievable through electrofusion. Innovation is focused on system integration and digital traceability.

- Asia Pacific (APAC): APAC is the fastest-growing region globally, propelled by unprecedented rates of urbanization and massive government investment in utility infrastructure expansion, especially in China, India, and Southeast Asia. The demand here is dual: extensive greenfield projects require huge volumes of fittings for new gas and water grids, while simultaneous efforts are underway to modernize existing, inefficient systems in major metropolitan areas. While price sensitivity remains a factor in certain sub-regions, the long-term need for reliable, maintenance-free systems is driving the adoption of high-quality electrofusion technology. Infrastructure projects associated with energy security and water accessibility are the primary consumption drivers across the region.

- Latin America: The market in Latin America is characterized by high levels of investment volatility but significant underlying potential, primarily driven by urgent needs to improve water management and sanitation standards. Brazil and Mexico are key markets, where efforts to formalize and expand utility coverage into developing urban areas necessitate reliable piping solutions. Adoption rates are sometimes slowed by economic instability or difficulties in accessing specialized training and high-quality equipment. However, the superior resistance of PE fittings to seismic activity and corrosive soils, common in many parts of the region, strongly supports their long-term market growth and adoption over conventional materials.

- Middle East and Africa (MEA): Growth in the MEA region is highly dependent on large-scale infrastructure projects associated with oil, gas, and major desalination plants. The Middle East segment, with its large capital reserves, demands high-quality, corrosion-resistant fittings essential for transporting highly saline or aggressive process water and expanding national gas grids. The African market, while segmented, shows significant growth potential in urban centers where international aid and national development programs prioritize clean water supply and sanitation projects. The harsh environmental conditions, including extreme temperatures, necessitate robust, high-performance fittings, making electrofusion a key enabling technology.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Electrofusion Fittings Market.- Georg Fischer (GF)

- Plasson

- Uponor

- Wavin (Part of Orbia)

- Aliaxis Group

- Pipelife (Part of Wienerberger)

- Fusion Group

- R&B Industrial Supply

- Worldwide Fittings

- ISIFLO AS

- Vinidex Pty Ltd

- Radius Systems Ltd

- Hidroten S.A.

- Continental Industries, Inc.

- Poly-Pipes

- Advanced Drainage Systems (ADS)

- AGRU Kunststofftechnik GmbH

- WL Plastics

- Frialen (Part of Aliaxis)

- McElroy Manufacturing

Frequently Asked Questions

Analyze common user questions about the Electrofusion Fittings market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary technical advantage of electrofusion over butt fusion for pipeline joining?

Electrofusion offers superior reliability in complex installations and confined spaces, as it requires less pipe movement and surface area preparation compared to butt fusion. It creates a robust, homogeneous joint using pre-embedded heating elements, ensuring high consistency and traceability via automated welding machines, which significantly minimizes installer dependency and error rates in critical infrastructure joints.

Which application segment holds the largest market share for electrofusion fittings?

The Water Utilities application segment consistently holds the largest volume market share. This is driven by massive global efforts to replace leak-prone, aging metallic water mains and service lines with corrosion-resistant polyethylene pipes, requiring a vast number of reliable, maintenance-free electrofusion joints for municipal potable water and wastewater distribution networks.

How do regulatory changes influence the market growth of electrofusion fittings?

Stringent regulatory mandates regarding pipeline safety, environmental protection, and leakage reduction (e.g., Non-Revenue Water targets in water systems and methane emission standards in gas systems) are the primary market drivers. These regulations compel utility operators to upgrade to certified, high-reliability joining technologies like electrofusion, thereby accelerating adoption and infrastructure replacement cycles globally.

What role does barcoding play in the quality assurance process of electrofusion?

Barcoding is essential for modern electrofusion QA. Each fitting is embedded with a barcode containing specific fusion parameters (time, voltage). The electrofusion control box automatically scans this code, ensuring the exact, manufacturer-specified energy input is delivered, eliminating manual data entry errors and providing complete, verifiable traceability of the joint quality post-installation.

Which geographical region is forecast to exhibit the fastest growth in the electrofusion fittings market?

The Asia Pacific (APAC) region is forecast to experience the fastest growth. This acceleration is attributed to massive ongoing infrastructure development projects, rapid urbanization, and significant government spending in countries like China and India aimed at expanding and modernizing municipal gas and water distribution networks to meet burgeoning urban demand.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager