Electromagnetic Vibration Test Systems Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442574 | Date : Feb, 2026 | Pages : 245 | Region : Global | Publisher : MRU

Electromagnetic Vibration Test Systems Market Size

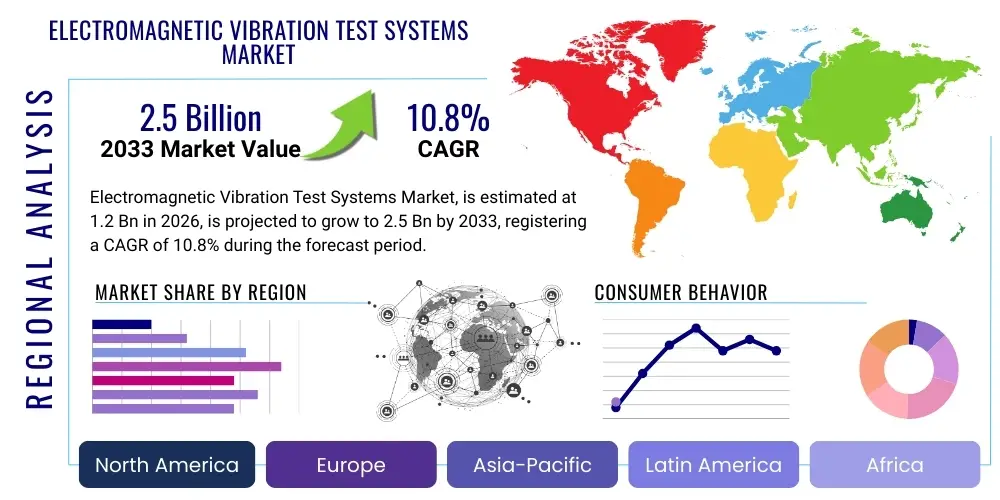

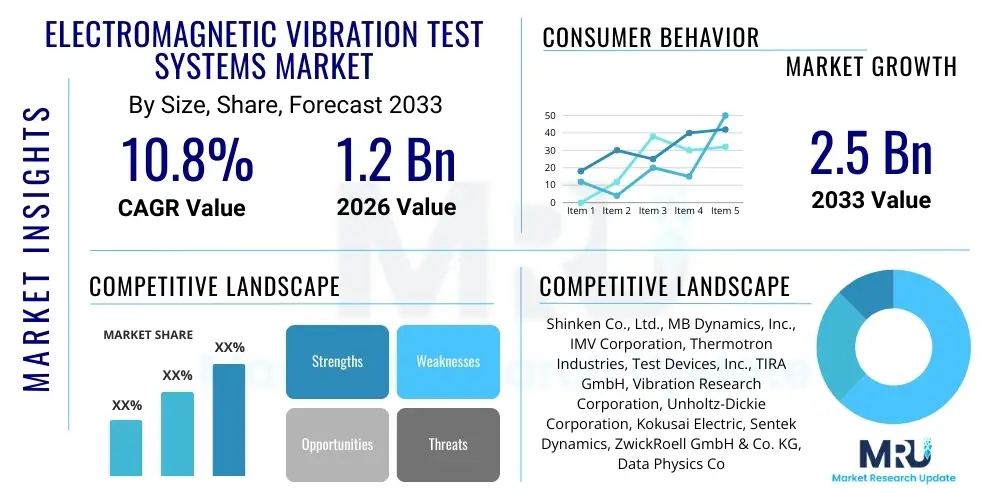

The Electromagnetic Vibration Test Systems Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 10.8% between 2026 and 2033. The market is estimated at $1.2 Billion in 2026 and is projected to reach $2.5 Billion by the end of the forecast period in 2033.

Electromagnetic Vibration Test Systems Market introduction

The Electromagnetic Vibration Test Systems Market encompasses highly sophisticated equipment designed to simulate real-world vibration and shock environments for testing the durability, reliability, and structural integrity of products and components. These systems, fundamentally utilizing electrodynamic shakers, are indispensable tools across industries where component failure due to mechanical stress is a critical concern, such as automotive, aerospace, defense, and consumer electronics. The core objective of deploying these test systems is to accelerate product qualification cycles, identify potential failure points early in the design phase, and ensure compliance with stringent international standards like MIL-STD, ISO, and ASTM. The increasing complexity of modern systems, especially in electric vehicles and satellite technology, drives the demand for high-performance shakers capable of generating wide frequency ranges and high force levels.

Product descriptions within this domain include a range of shakers differentiated by their cooling mechanism (air-cooled, water-cooled, oil-cooled) and their maximum force output, ranging from small lab-scale shakers used for micro-electronics to massive industrial systems employed for full-scale vehicle components or satellite modules. Auxiliary equipment, such as slip tables, head expanders, and advanced vibration controllers, are integral parts of a complete test setup, enabling multi-axis testing and precise control over complex test profiles like Random, Sine, and Shock. The ability of these systems to accurately replicate operational stresses, often combined with environmental chambers for simulating temperature and humidity simultaneously, provides manufacturers with comprehensive data necessary for product validation.

Major applications span quality assurance, accelerated life testing, and validation of mission-critical systems. For instance, in the automotive sector, these systems are crucial for testing battery packs, engine components, and internal electronic control units (ECUs). In aerospace, they validate the structural integrity of fuselage components, avionics, and rocket payloads against launch and operational vibrations. Key benefits derived from the adoption of EVTS include reduced product recalls, improved operational safety, significant cost savings by minimizing late-stage design changes, and accelerated time-to-market. Driving factors include the global shift towards electrification, the expansion of commercial space exploration, and increasing regulatory pressure demanding higher reliability standards across all transportation and defense sectors.

Electromagnetic Vibration Test Systems Market Executive Summary

The Electromagnetic Vibration Test Systems market is experiencing robust growth fueled by intensifying requirements for product reliability, particularly within the automotive and aerospace industries. Business trends indicate a strong focus on developing integrated test solutions that combine vibration, thermal, and humidity testing into unified, software-driven platforms, enhancing test efficiency and data correlation. Key manufacturers are investing heavily in advanced power amplifiers and controller software capable of handling high-frequency, complex non-linear vibration profiles associated with modern product designs, such as high-density electronic boards and large EV battery modules. Furthermore, the market is characterized by consolidation among providers seeking to offer comprehensive service packages encompassing installation, calibration, and long-term maintenance, moving beyond merely selling hardware.

Regional trends reveal the Asia Pacific (APAC) region as the fastest-growing market, primarily driven by massive investments in manufacturing infrastructure, especially in China, Japan, and South Korea, which are global hubs for automotive and consumer electronics production. North America maintains a strong position due to substantial defense spending and the dominance of the aerospace and satellite manufacturing sectors, which require highly specialized, high-force vibration testing capabilities. Europe’s market growth is supported by rigorous environmental and safety regulations, particularly concerning vehicle crash safety testing and compliance with CE certification standards, promoting the consistent adoption of cutting-edge EVTS technology. Investment in research and development centers across these regions further propels the demand for advanced, flexible testing solutions.

Segment trends highlight the dominance of the air-cooled shaker segment due to its versatility, lower capital cost, and ease of maintenance, making it suitable for standard laboratory and quality control applications. However, the water-cooled and oil-cooled segments, characterized by higher force capacity and continuous operational stability, are witnessing accelerated growth, driven by the need to test heavy components like EV battery packs and large aerospace structures which demand sustained high-acceleration testing. Application-wise, the electric vehicle (EV) sector is emerging as a primary growth driver, demanding specialized vibration testing for motors, inverters, and sophisticated battery management systems (BMS) to ensure safety and longevity under real-world road conditions. Simulation services and outsourced testing are also growing segments, preferred by smaller companies lacking the extensive capital required for in-house equipment investment.

AI Impact Analysis on Electromagnetic Vibration Test Systems Market

User queries regarding AI integration in EVTS largely center on how artificial intelligence can transform traditional, time-consuming testing methodologies into predictive and optimized processes. Common questions revolve around the use of machine learning (ML) for failure prediction, the automation of complex test sequences, and the optimization of resource usage within testing labs. Users are keenly interested in determining if AI can accurately translate lab test results into real-world performance indicators and reduce the number of physical prototypes required. Key themes summarize the expectation that AI will move EVTS from being a mere validation tool to a powerful diagnostic and design optimization platform, primarily through enhanced data processing capabilities and reduced human intervention in routine testing processes. There is a general consensus that AI integration is crucial for maintaining competitive advantage in sectors dealing with highly complex, interconnected systems, such as autonomous vehicles and next-generation satellite constellations.

The application of AI in EVTS focuses heavily on improving the efficiency and accuracy of vibration control software. Traditional vibration controllers rely on fixed algorithms; however, AI allows for dynamic adjustment of test parameters in real-time based on monitoring thousands of data points related to component resonance and structural response. This ML-driven approach minimizes potential damage to the test specimen while ensuring the test closely mirrors defined environmental specifications. Furthermore, AI algorithms are being deployed to analyze massive datasets generated during non-destructive testing (NDT), identifying subtle anomalies or degradation patterns that human operators might overlook, thereby increasing the reliability of the pass/fail determination.

A significant area of AI integration is in accelerating the design-to-validation cycle. By integrating test data with digital twin models, AI can perform high-fidelity simulations that predict component lifespan and vulnerability under various stress conditions without extensive physical testing. This capability drastically reduces the operational costs associated with running high-force shakers for extended periods and shortens the overall product development timeline. The increasing adoption of sensors and IoT devices attached to the tested components generates the necessary input data stream that AI and ML models require to refine their predictive accuracy, thereby creating a closed-loop system for continuous design improvement and test optimization. This paradigm shift makes testing a strategic input rather than a final gate.

- AI-driven Predictive Maintenance: Optimizing shaker health and scheduling component replacements based on real-time performance data analysis.

- Automated Test Sequence Generation: ML algorithms autonomously adjust vibration profiles (e.g., frequency sweeps, random noise distribution) to maximize stress exposure based on component material properties.

- Digital Twin Integration: Using AI to correlate physical test data with virtual simulation results, enhancing model accuracy and reducing reliance on costly hardware prototypes.

- Enhanced Data Diagnostics: Machine learning analyzing sensor data (strain, temperature, acceleration) during testing to instantly identify and classify subtle failure modes.

- Optimized Resource Allocation: AI scheduling and load balancing across multiple test systems in large validation laboratories to maximize throughput and energy efficiency.

DRO & Impact Forces Of Electromagnetic Vibration Test Systems Market

The Electromagnetic Vibration Test Systems Market is predominantly driven by increasing regulatory mandates for product reliability and safety across mission-critical industries like aerospace, defense, and automotive, particularly with the proliferation of complex electronic control units and safety-critical mechanical components. Simultaneously, the global push towards electrification necessitates rigorous testing of complex and heavy battery modules against mechanical shock and vibration inherent to vehicle operation, demanding high-force, high-efficiency shakers. However, the market faces significant restraints, primarily the exceptionally high capital expenditure required for purchasing and installing these sophisticated systems, coupled with substantial ongoing maintenance and calibration costs, which limit adoption among smaller enterprises or emerging R&D centers. The technical complexity requiring specialized operator training also acts as a barrier to entry.

Opportunities for market expansion are centered around emerging applications such as the development and qualification of components for the burgeoning commercial space sector and the expansion of 5G infrastructure, where robust testing of telecommunication equipment against environmental stress is mandatory. Furthermore, the rising demand for comprehensive environmental simulation, integrating vibration testing with extreme temperature, humidity, and vacuum capabilities within a single chamber, presents lucrative opportunities for system integrators. Technological advancements, particularly in energy-efficient power amplification systems (e.g., switching amplifiers) and sophisticated multi-axis control software, are also creating avenues for market players to offer differentiated, high-performance products that address unique industrial needs.

The market is profoundly influenced by various impact forces. Political and regulatory impact forces mandate stringent testing protocols, forcing manufacturers globally to invest in certified EVTS equipment to achieve compliance and certification (e.g., ECE R100 for EVs). Economic forces, specifically fluctuating material costs (e.g., rare earth magnets used in shakers) and global supply chain volatility, affect the production costs and lead times of these complex systems. Competitive intensity remains high, driven by technological innovation and the need for precision. The threat of substitutes, particularly advanced simulation software, while not entirely replacing physical testing, impacts the market dynamics by reducing the total number of repetitive validation tests required, pushing EVTS manufacturers to focus on unique boundary condition verification where simulation models lack fidelity.

Segmentation Analysis

The Electromagnetic Vibration Test Systems market is systematically segmented based on Shaker Type, Component Type, Application, and End-User, reflecting the diverse requirements of the industrial landscape. The segmentation by shaker type (air-cooled, water-cooled, oil-cooled) is crucial as it dictates the maximum continuous force, operational stability, and overall size of the system, directly influencing its suitability for testing light electronics versus heavy machinery components. Component Type segmentation includes electrodynamic shakers, power amplifiers, vibration controllers, and slip tables, representing the integral hardware and software elements required for a functional test rig. Understanding these segments helps tailor solutions to specific customer needs, such as high-frequency testing (requiring precision controllers) or high-force endurance testing (requiring robust water-cooled shakers).

The application segmentation is critical for market focus, detailing the systems’ usage across key verticals such as Automotive, Aerospace & Defense, Electronics, Civil Engineering, and Consumer Goods. The automotive sector, especially EV battery testing, is a dominant segment due to the inherent complexity and safety requirements associated with high-voltage systems. Conversely, the aerospace segment demands extremely high reliability and compliance with specialized testing standards for satellite components and launch vehicle systems. These application-specific requirements often drive the demand for customized fixtures and specialized control software capable of replicating unique mission profiles.

End-User segmentation distinguishes between Original Equipment Manufacturers (OEMs), Test Laboratories/Service Providers, and Research & Development (R&D) Institutions. OEMs utilize these systems for in-house quality control and production line verification, driving demand for robust, high-throughput systems. Test laboratories, which offer third-party compliance and verification services, require versatile systems capable of handling a broad range of customer specifications. R&D institutions often utilize the most advanced, customizable systems for material science research and developing next-generation structural designs, often pushing the boundaries of current test capabilities regarding frequency and acceleration limits, thereby driving technological innovation in the market.

- Shaker Type

- Air-Cooled Shakers

- Water-Cooled Shakers

- Oil-Cooled Shakers

- Component Type

- Electrodynamic Shakers

- Power Amplifiers

- Vibration Controllers

- Slip Tables and Fixtures

- Application

- Automotive (EV Batteries, ECUs, Powertrain)

- Aerospace & Defense (Avionics, Satellite Components)

- Electronics (Consumer Devices, Industrial Controls)

- Civil Engineering

- Others (Medical Devices, Energy)

- End-User

- Original Equipment Manufacturers (OEMs)

- R&D Institutes

- Test & Measurement Service Providers

Value Chain Analysis For Electromagnetic Vibration Test Systems Market

The value chain for Electromagnetic Vibration Test Systems begins with upstream activities focused on the procurement of specialized raw materials and high-precision components. Key upstream inputs include rare-earth magnets (primarily Neodymium), advanced electronic components for power amplifiers (IGBTs, MOSFETs), high-strength alloys for armature and table construction, and highly sophisticated digital signal processing (DSP) hardware for vibration controllers. Critical suppliers in this stage are specialized magnet manufacturers and leading semiconductor companies. The quality and stable supply of these components are paramount, as they directly influence the maximum force, frequency range, and reliability of the final vibration system. Manufacturers often maintain strategic partnerships with these critical suppliers to mitigate geopolitical risks associated with material sourcing, ensuring a continuous and high-quality production pipeline.

Midstream operations involve the core manufacturing processes: precision machining of shaker components, meticulous assembly of the electrodynamic system (coil and armature), integration of high-power amplification systems, and development of proprietary control software. This stage is characterized by high technological complexity and proprietary intellectual property, particularly concerning control algorithms that ensure stable, accurate, and non-destructive testing. System integrators play a vital role here, combining shakers, amplifiers, controllers, and environmental chambers into a single, cohesive test solution tailored to specific customer application requirements, such as acoustic noise testing combined with vibration simulation. Rigorous quality control and comprehensive system calibration are essential before the product moves downstream.

Downstream activities focus on distribution, installation, service, and maintenance. Distribution channels are typically a mix of direct sales forces (especially for high-value, complex systems requiring specialized technical support) and authorized third-party distributors or agents who handle sales and initial installation in specific geographic regions. Direct channels are preferred for major OEM and defense contracts due to the need for continuous technical consultation and customization. Post-sales service is a high-margin component, including routine calibration services mandated by international standards (e.g., ISO 17025) and provision of replacement parts, particularly power amplifier modules and slip table components. Customer training is also a critical downstream service, ensuring safe and effective operation of the complex test equipment.

Electromagnetic Vibration Test Systems Market Potential Customers

Potential customers and end-users of Electromagnetic Vibration Test Systems are organizations with critical needs for product validation, structural integrity assessment, and compliance verification against harsh operational environments. The primary end-users are concentrated within highly regulated and technologically demanding industries. This includes Tier 1 and Tier 2 automotive suppliers who must rigorously test vehicle components (braking systems, suspension elements, exhaust systems) and, crucially, the rapidly expanding sector of electric vehicle battery manufacturers and component developers. These customers require high-force, long-stroke shakers to simulate the long-term stress experienced by heavy battery packs and power electronics over the vehicle's lifespan.

Another major buyer segment is the Aerospace and Defense industry, comprising aircraft manufacturers, missile developers, and satellite builders, along with government-run defense laboratories. These customers demand systems capable of extreme performance, simulating high-g forces and complex vibration profiles encountered during rocket launches, aerial maneuvering, and deep-space operation. Their purchases often involve customized, multi-axis hydraulic or electrodynamic systems designed to meet rigorous military specifications (e.g., MIL-STD-810H). The reliability of these products is non-negotiable, driving continuous investment in the most accurate and powerful testing equipment available, often forming strategic, long-term relationships with key system providers.

Furthermore, consumer electronics manufacturers, telecommunications providers, and independent commercial test laboratories constitute significant potential customer bases. Electronics companies rely on these systems to test the durability of mobile devices, servers, and industrial control panels against shipping vibrations and typical operational shocks, ensuring product longevity and minimizing warranty claims. Independent test laboratories serve as crucial outsourcing partners for smaller OEMs and startups, offering accredited testing and certification services, thus requiring a broad portfolio of versatile vibration systems to cater to varied client needs. Academic and material science research institutions are also regular buyers, utilizing high-precision systems for fundamental research on structural dynamics and fatigue analysis of new materials.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.2 Billion |

| Market Forecast in 2033 | $2.5 Billion |

| Growth Rate | 10.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Shinken Co., Ltd., MB Dynamics, Inc., IMV Corporation, Thermotron Industries, Test Devices, Inc., TIRA GmbH, Vibration Research Corporation, Unholtz-Dickie Corporation, Kokusai Electric, Sentek Dynamics, ZwickRoell GmbH & Co. KG, Data Physics Corporation, ETS Solutions, Labworks Inc., NVT Group, Spektra GmbH, Econ Technologies, L.A.B. Equipment Inc., Vibration Control & Engineering, MTI Instruments. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Electromagnetic Vibration Test Systems Market Key Technology Landscape

The technological landscape of the Electromagnetic Vibration Test Systems market is continually evolving, driven primarily by the need for higher fidelity, wider frequency ranges, and greater energy efficiency. A pivotal advancement lies in the development of sophisticated power amplification systems, moving away from older linear amplifiers towards highly efficient digital switching amplifiers (Class D). These modern amplifiers significantly reduce power consumption and heat generation while delivering precise, high-current outputs necessary to drive large electrodynamic shakers. Furthermore, technological focus is placed on enhancing the durability and performance of the shaker armature (the moving coil assembly), often through the use of lightweight, high-stiffness materials like carbon fiber reinforced polymers (CFRPs) and specialized magnetic circuit designs to maximize force-to-mass ratios and extend the usable frequency range up to 5,000 Hz or higher.

Another crucial area of innovation is in the Vibration Controller and associated software. Modern controllers utilize multi-core Digital Signal Processors (DSPs) to handle complex test profiles, including Multi-Sine, Sine-on-Random, and advanced Shock Response Spectrum (SRS) testing, with exceptionally low latency. The software component incorporates features like automated test report generation, predictive control algorithms, and remote diagnostic capabilities, aligning with Industry 4.0 principles. The integration of advanced sensor technologies, such as micro-electro-mechanical systems (MEMS) accelerometers and high-precision laser vibrometers, ensures real-time measurement accuracy and provides the necessary feedback loop for closed-loop control, which is essential for safely testing delicate or resonant structures.

The development of customized testing fixtures and head expanders also forms a vital part of the technological landscape. Manufacturers are increasingly utilizing additive manufacturing (3D printing) technologies to create lightweight, highly stiff, and geometrically complex fixtures tailored precisely to the product under test, minimizing mass loading effects and ensuring accurate energy transmission from the shaker to the specimen. This capability is paramount when testing components with unusual geometries, such as complex manifolds or integrated sensor packages. The ability to integrate the vibration test setup seamlessly with adjacent environmental simulation chambers (thermal, humidity, altitude) using standardized communication protocols (e.g., Ethernet/IP) is also a significant market differentiator, providing customers with comprehensive Environmental Stress Screening (ESS) solutions under a unified control interface.

Regional Highlights

- North America: This region commands a significant share of the global EVTS market, driven primarily by the robust aerospace and defense sectors, which demand high-end, custom-engineered vibration systems for mission-critical applications. The presence of major technology hubs and large R&D investments in autonomous vehicles and commercial space exploration fuels continuous demand. Stringent military specifications (MIL-STD) and FAA regulations ensure consistent capital expenditure on advanced testing infrastructure, particularly in high-force, tri-axial testing capabilities. The region benefits from key players and pioneers in vibration testing technology, maintaining a competitive edge in software development and system integration services.

- Europe: Europe is characterized by strict environmental and safety standards, particularly within the automotive sector, driving the need for sophisticated EVTS for vehicle safety testing, noise, vibration, and harshness (NVH) analysis, and battery performance validation. Germany, France, and the UK are key contributors, hosting major automotive OEMs and aerospace entities (like Airbus and ESA projects). Growth is supported by substantial government and private investment in sustainable transport solutions (EVs and high-speed rail), requiring equipment capable of long-duration, high-reliability stress testing. The focus here is often on high precision and meeting specific EU regulatory compliance mandates.

- Asia Pacific (APAC): APAC represents the fastest-growing market, propelled by massive and accelerating manufacturing output, particularly in China, Japan, South Korea, and India. This region is a global manufacturing center for consumer electronics, industrial machinery, and a rapidly expanding EV market. The influx of foreign direct investment in manufacturing facilities requires concomitant investment in quality assurance and reliability testing equipment. Price sensitivity is higher in certain sub-regions, driving demand for cost-effective, high-throughput air-cooled systems, although high-force water-cooled systems are increasingly adopted by major automotive and high-tech electronics manufacturers seeking competitive advantage through certified reliability.

- Latin America (LATAM): The LATAM market is emerging, with growth concentrated in industrial centers of Brazil and Mexico, driven by foreign automotive manufacturing and local infrastructure development projects. Market penetration is moderate, often relying on imported technology and localized service support from global vendors. Demand is slowly stabilizing as local industries increasingly adopt international quality standards, specifically for export-oriented manufacturing.

- Middle East and Africa (MEA): Growth in MEA is primarily linked to defense modernization programs, oil and gas infrastructure validation (testing resilience to extreme environmental conditions), and burgeoning aerospace initiatives in countries like the UAE. While smaller in overall volume, the demand is highly specialized, focusing on ruggedized systems for testing equipment resilience in desert climates and offshore environments, often requiring integration with specialized climatic chambers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Electromagnetic Vibration Test Systems Market.- Shinken Co., Ltd.

- MB Dynamics, Inc.

- IMV Corporation

- Thermotron Industries

- Test Devices, Inc.

- TIRA GmbH

- Vibration Research Corporation

- Unholtz-Dickie Corporation

- Kokusai Electric

- Sentek Dynamics

- ZwickRoell GmbH & Co. KG

- Data Physics Corporation

- ETS Solutions

- Labworks Inc.

- NVT Group

- Spektra GmbH

- Econ Technologies

- L.A.B. Equipment Inc.

- Vibration Control & Engineering

- MTI Instruments

Frequently Asked Questions

Analyze common user questions about the Electromagnetic Vibration Test Systems market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the high cost of Electromagnetic Vibration Test Systems?

The high cost is primarily driven by the sophisticated engineering of high-force electrodynamic shakers, which require rare-earth magnets, precision-machined components, and expensive, high-power digital switching amplifiers, alongside advanced proprietary control software and DSP hardware for achieving accurate closed-loop control.

How does the integration of AI specifically improve vibration testing efficiency?

AI improves efficiency by enabling predictive diagnostics of the shaker system, optimizing complex test profiles in real-time based on component response, and automating the analysis of high-volume test data to identify subtle failure modes faster than traditional methods, thereby reducing test cycle time.

What is the difference between air-cooled and water-cooled shakers in practical application?

Air-cooled shakers are generally smaller, lower in force output, and suitable for high-frequency testing of lighter objects (electronics, small components). Water-cooled shakers, conversely, provide significantly higher continuous force output and better thermal management, making them essential for testing large, heavy components like EV battery packs or aerospace structures over extended periods.

Which industrial sector currently represents the largest growth opportunity for EVTS manufacturers?

The electric vehicle (EV) sector, encompassing battery pack testing (vibration, shock, and combined environmental stress testing), power electronics validation, and robust motor component qualification, represents the largest and most immediate growth opportunity due to massive global investment and stringent safety standards.

Are vibration test systems capable of multi-axis testing, and why is this capability important?

Yes, while core electrodynamic shakers typically test in a single vertical axis, multi-axis testing (e.g., three degrees of freedom) is achieved by integrating multiple shakers or specialized mechanical systems like slip tables. This capability is crucial because real-world stresses, such as road vibration or launch shock, involve simultaneous forces in multiple directions, requiring high-fidelity simulation for accurate product validation.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager