Electronic Signature Services Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443195 | Date : Feb, 2026 | Pages : 248 | Region : Global | Publisher : MRU

Electronic Signature Services Market Size

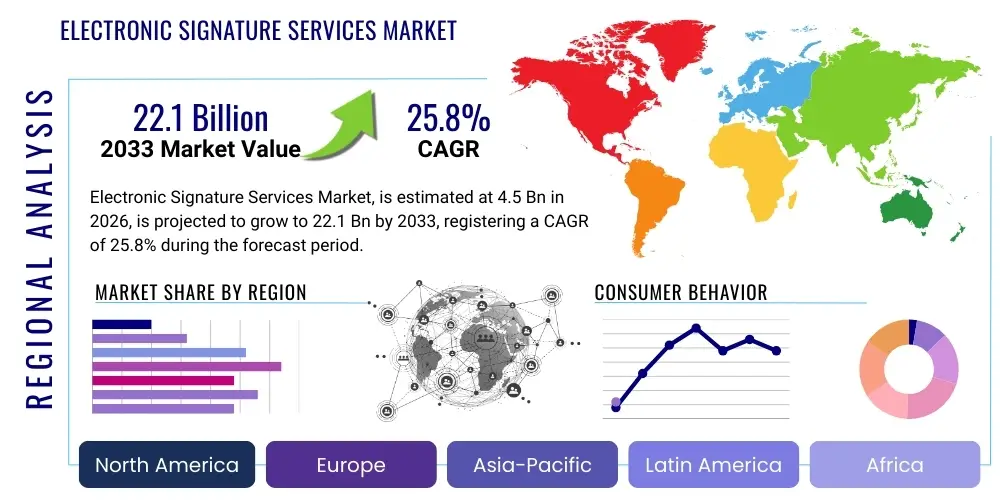

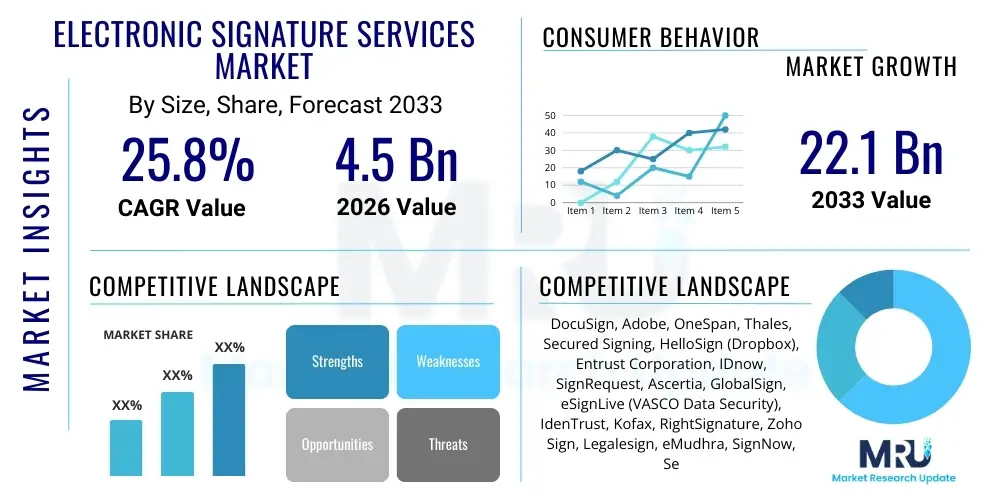

The Electronic Signature Services Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 25.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 22.1 Billion by the end of the forecast period in 2033. This substantial expansion is driven primarily by the escalating demand for streamlined, paperless workflow solutions across highly regulated industries and the global shift towards remote and hybrid work models, which necessitate secure, legally compliant digital transaction methods. The increasing regulatory acceptance of electronic signatures worldwide provides a strong foundation for this trajectory, minimizing legal uncertainty and accelerating enterprise adoption.

Electronic Signature Services Market introduction

The Electronic Signature Services Market encompasses software, platforms, and related services designed to enable users to digitally sign documents with legal validity, replacing traditional wet ink signatures. These services ensure authenticity, non-repudiation, and integrity of digital documents, ranging from simple standard e-signatures to highly secure digital signatures backed by Public Key Infrastructure (PKI). Major applications span financial services (loan agreements, account opening), legal sectors (contracts, filings), healthcare (patient records, prescriptions), and government processes (permitting, licensing). The primary benefits include significant cost reduction associated with printing, mailing, and storage, drastic improvements in turnaround time for documentation, enhanced security compared to paper processes, and superior compliance with global regulatory frameworks such as ESIGN, UETA, and eIDAS. Key driving factors accelerating market growth include mandated digital transformation initiatives across organizations, the heightened need for robust security features in digital transactions, and the seamless integration capabilities of these platforms with existing enterprise resource planning (ERP) and customer relationship management (CRM) systems.

Electronic Signature Services Market Executive Summary

Global business trends indicate a strong enterprise shift toward cloud-based electronic signature solutions, favoring subscription models that offer scalability and flexibility. This migration is fueled by increased regulatory pressure for audit trails and data integrity, making robust digital signatures a necessity rather than a convenience. Regionally, North America maintains market dominance due to early adoption, established regulatory frameworks (like ESIGN and UETA), and the presence of major industry players, though Asia Pacific is emerging as the fastest-growing region, driven by rapid digitalization in emerging economies like India and China, coupled with proactive government initiatives promoting digital identity and paperless operations. Segment trends show that the BFSI sector remains the largest consumer, utilizing e-signatures for high-volume transactions and mandatory compliance documentation, while the healthcare sector is experiencing exponential growth, adopting services to manage patient consent forms and complex regulatory filing processes (e.g., HIPAA compliance). Furthermore, the cloud deployment segment is overwhelmingly favored over on-premise solutions due to lower operational overhead and ease of deployment, significantly influencing vendor product strategies.

AI Impact Analysis on Electronic Signature Services Market

Common user questions regarding AI’s impact on electronic signature services often revolve around the security implications of advanced automation, the role of AI in detecting sophisticated fraud attempts, and how AI can streamline the contract lifecycle management (CLM) process beyond mere signing. Users are keen to understand if AI-powered systems can automatically verify signer intent and identity more reliably than current methods and if generative AI might pose new risks to document authenticity. The core expectation is that AI will transform the e-signature process from a static signing event into an intelligent, end-to-end contractual negotiation and compliance mechanism. This transformation focuses heavily on automating preliminary verification steps, enhancing risk scoring, and ensuring continuous regulatory monitoring across diverse jurisdictions, ultimately aiming for ‘smart’ contracting environments where documents react dynamically to predefined conditions.

The incorporation of Artificial Intelligence and Machine Learning (ML) algorithms is poised to profoundly enhance the security and efficiency of electronic signature workflows. Specifically, AI capabilities are being integrated to analyze behavioral biometrics, such as typing cadence, mouse movements, and signing speed, to confirm the identity of the signer in real-time and detect deviations that might signal fraudulent activity. Furthermore, AI is critical in classifying vast quantities of incoming documents, automatically extracting key clauses, and flagging potential compliance risks or errors before a document is finalized for signature. This predictive analysis significantly reduces manual review time and enhances the overall integrity of the contractual process. By automating data verification against internal and external databases, AI minimizes human error and accelerates the entire transaction cycle, leading to quicker finalization rates and improved user experience. Advanced natural language processing (NLP) is also being utilized to summarize lengthy contracts before signing, ensuring signers are fully aware of their obligations.

- AI enhances fraud detection through behavioral biometrics and anomaly recognition in signing patterns.

- Machine Learning algorithms optimize document routing and workflow automation based on contract type and urgency.

- Natural Language Processing (NLP) enables automatic key clause extraction and contract risk scoring prior to execution.

- AI facilitates the development of self-executing smart contracts by verifying predefined conditions before release.

- Predictive analytics improve regulatory compliance by monitoring and adapting documentation standards across multiple geographies in real-time.

DRO & Impact Forces Of Electronic Signature Services Market

The Electronic Signature Services Market growth is substantially driven by mandatory regulatory compliance requirements, particularly in highly sensitive sectors like BFSI and Healthcare, where digital records and verifiable audit trails are critical. The core drivers include the widespread acceptance of electronic signature legislation globally (e.g., UETA in the US, eIDAS in Europe), the environmental push towards paperless offices, and the inherent efficiencies gained through workflow automation. However, growth faces significant restraints, primarily revolving around user hesitation concerning data security in the cloud, the complexity and cost associated with achieving compliance in fragmented global regulatory landscapes, and challenges related to interoperability between diverse signature platforms and legacy enterprise systems. Opportunities abound in expanding adoption within emerging markets, developing specialized solutions for vertical niches requiring higher levels of assurance (e.g., government digital identity projects), and leveraging blockchain technology for enhanced non-repudiation and tamper-proofing, thus mitigating several current security concerns. The key impact forces are technology obsolescence, shifting regulatory sands, and intensifying competitive pricing pressures.

Segmentation Analysis

The Electronic Signature Services Market is comprehensively segmented based on several critical dimensions, including the component structure (software, services, hardware), the deployment mechanism (on-premise versus cloud-based), the technical type of signature utilized (standard e-signature versus advanced/digital signature), and the diverse end-user applications across industries. This detailed segmentation allows stakeholders to analyze specific market dynamics, identify high-growth niches, and tailor product offerings to meet unique regulatory and operational requirements of different sectors. The increasing preference for cloud-based subscription models has made the 'Deployment Mode' segment a central focus for strategic investment, while the 'End-User' segmentation highlights the escalating demand from sectors undergoing rapid digital transformation, such as legal and real estate, moving beyond the traditional early adopters in banking and finance.

- By Component:

- Software (Platform/Solution)

- Services (Managed Services, Professional Services)

- Hardware (Token, Smart Cards)

- By Type:

- Standard Electronic Signature

- Digital Signature (Advanced and Qualified)

- By Deployment Mode:

- On-Premise

- Cloud (SaaS)

- By End-User:

- Banking, Financial Services, and Insurance (BFSI)

- Government and Public Sector

- Healthcare and Life Sciences

- Legal and Real Estate

- IT and Telecom

- Education

- Others (Retail, Manufacturing)

Value Chain Analysis For Electronic Signature Services Market

The value chain for the Electronic Signature Services Market begins with upstream activities dominated by core technology providers, including encryption specialists, identity verification service vendors, and providers of Public Key Infrastructure (PKI) components necessary for high-assurance digital signatures. These foundational elements ensure the legal and technical validity of the services. Midstream involves the Electronic Signature Service Providers (ESSPs) themselves, who integrate these technologies into user-friendly platforms, managing crucial aspects like identity proofing, document workflow management, and maintaining comprehensive audit trails. This stage is critical for achieving compliance and optimizing the user experience across various devices and interfaces. The downstream phase involves distribution channels and direct engagement with end-users. Distribution relies heavily on indirect channels, such as channel partners, system integrators, and value-added resellers (VARs), who customize solutions and integrate them into complex enterprise IT environments. Direct sales, typically utilized for large enterprise and strategic government accounts, ensure deep customization and dedicated support. The efficiency of the distribution channel is vital for market penetration, particularly in fragmented international markets, linking technological capabilities with specific end-user industry requirements.

Electronic Signature Services Market Potential Customers

The primary customers for Electronic Signature Services span virtually every industry requiring contractual agreements, verification of identity, and retention of auditable records. Within the BFSI sector, customers include large commercial banks, credit unions, and insurance carriers that utilize services for loan origination, policy issuance, and regulatory reporting. Government entities, at federal, state, and local levels, are substantial buyers, implementing e-signatures for internal process approvals, public-facing services, and managing classified documentation requiring strong authentication. In the legal and real estate domains, potential customers are law firms, title companies, and brokerages streamlining client onboarding, closing documentation, and ensuring compliance with property transfer regulations. Enterprise customers in sectors like IT, Telecom, and Manufacturing adopt these services primarily for supply chain management, sales contracts, and internal HR documentation. The common denominator among all potential customers is the need to increase speed, reduce errors associated with manual paperwork, and enhance the legal defensibility of digital transactions while adhering to stringent data protection and privacy laws.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 22.1 Billion |

| Growth Rate | CAGR 25.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | DocuSign, Adobe, OneSpan, Thales, Secured Signing, HelloSign (Dropbox), Entrust Corporation, IDnow, SignRequest, Ascertia, GlobalSign, eSignLive (VASCO Data Security), IdenTrust, Kofax, RightSignature, Zoho Sign, Legalesign, eMudhra, SignNow, Sertifi |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Electronic Signature Services Market Key Technology Landscape

The technological landscape of the Electronic Signature Services Market is defined by the underlying security and verification mechanisms that ensure legal compliance and document integrity. Public Key Infrastructure (PKI) remains the foundational technology, providing the cryptographic keys necessary for issuing and verifying digital certificates, which are essential for high-assurance digital signatures. This ensures non-repudiation and guarantees that the document has not been tampered with since signing. Furthermore, advanced identity verification technologies, including multi-factor authentication (MFA), biometric authentication, and increasingly, AI-driven behavioral biometrics, are integrated to strengthen the initial authentication process of the signer, moving beyond simple password protection to highly secure verification methods required by government and financial institutions.

Modern e-signature platforms are characterized by their deep integration capabilities using Application Programming Interfaces (APIs), allowing seamless embedding into existing enterprise systems such as Salesforce, Microsoft Dynamics, and SAP. This focus on interoperability minimizes disruption for end-users and accelerates enterprise adoption. A significant emerging trend is the utilization of distributed ledger technology (DLT), or blockchain, to provide immutable audit trails and timestamping for signed documents. While not replacing the signing process itself, blockchain significantly enhances the long-term evidentiary value and tamper-proof nature of the records. Compliance with standards such as ISO 32000-1 (PDF) and specific regulatory requirements like the eIDAS regulation in Europe dictates the cryptographic standards and storage protocols adopted by technology providers, ensuring legal standing across diverse global jurisdictions.

The push for mobile accessibility also mandates highly responsive and secure signing environments compatible across various operating systems (iOS, Android), often requiring specialized mobile signature technologies. Server-side signing, where the cryptographic process is secured within a high-security module (HSM) managed by the service provider, is becoming the standard for enterprise-level digital signatures, offering greater control and security compared to client-side signing methods. These technological advancements collectively focus on making the signing process faster, more secure, legally sound, and accessible from any device or location, directly addressing the demands of the modern remote workforce.

Regional Highlights

Regional dynamics play a crucial role in shaping the Electronic Signature Services Market, dictated primarily by variations in regulatory acceptance, digital literacy rates, and sector-specific needs. North America currently dominates the global market, benefiting from mature regulatory frameworks like the U.S. ESIGN Act and UETA, which established the legal validity of electronic records early on. The region is characterized by high adoption across the BFSI, IT, and healthcare sectors, driven by leading technology companies headquartered here and a strong venture capital environment fostering innovation in digital security solutions. The high concentration of large enterprises undergoing intensive digital transformation mandates continuous investment in robust, scalable e-signature infrastructure, ensuring the region remains the largest revenue contributor throughout the forecast period. Furthermore, the emphasis on data sovereignty and stringent compliance requirements, such as HIPAA for healthcare, push for the adoption of highly secure, advanced digital signature solutions.

Europe represents the second-largest market, distinguished by the unified and highly influential eIDAS regulation (Electronic Identification, Authentication and Trust Services). eIDAS provides a tiered structure for electronic signatures (Simple, Advanced, and Qualified), offering the highest legal assurance for Qualified Electronic Signatures (QES), equivalent to a handwritten signature in legal effect across all EU member states. This regulatory clarity fosters widespread adoption, particularly in government services and cross-border transactions. Key growth is concentrated in Western European countries like Germany, the UK, and France, where banks and public administrations are rapidly migrating legacy paper processes to eIDAS-compliant digital workflows. The market is also heavily influenced by the need for compliance with GDPR, which necessitates secure handling and storage of personal data associated with the signing process, favoring established, certified European providers.

Asia Pacific (APAC) is projected to record the highest Compound Annual Growth Rate (CAGR) due to ongoing rapid digital initiatives and increasing mobile penetration in densely populated emerging economies. Governments in countries like India, Singapore, and Australia are actively promoting digital identity initiatives (e.g., Aadhaar in India) and enacting supportive legislation that validates e-signatures. While the market is highly fragmented in terms of regulatory compliance, with each country possessing unique legal requirements, the sheer scale of potential users and the push towards paperless transactions in sectors such as real estate and retail banking provides immense market opportunities. The demand here is often focused on high-volume, low-cost standard e-signature solutions, gradually moving towards more complex digital signature services as regulatory maturity increases, making APAC the key growth engine for the next decade.

- North America: Market leader driven by established ESIGN/UETA legislation and high enterprise digital maturity in BFSI and IT.

- Europe: High growth fueled by the mandated adoption of eIDAS, particularly for cross-border transactions and public sector services.

- Asia Pacific (APAC): Fastest growing region, capitalizing on massive governmental digital identity projects and accelerating mobile-first adoption in emerging markets.

- Latin America: Characterized by increasing investment in digitalization, though hampered by economic volatility and slower legislative harmonization across countries.

- Middle East and Africa (MEA): Emerging market focusing on government and energy sectors adopting digital signing for large-scale infrastructure projects and enhancing transactional security.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Electronic Signature Services Market. These companies are benchmarked based on their portfolio breadth, global footprint, security certifications, technological innovation (including AI integration), and strategic M&A activity that shapes the competitive landscape.- DocuSign

- Adobe Inc. (Adobe Document Cloud)

- OneSpan

- Thales Group

- Entrust Corporation

- GlobalSign

- HelloSign (Dropbox)

- Kofax Inc.

- SignNow (airSlate)

- Secured Signing Ltd.

- eMudhra Ltd.

- Ascertia

- IDnow GmbH

- Zoho Sign (Zoho Corporation)

- Sertifi Inc.

- Legalesign

- RPost (RMail)

- RightSignature (Citrix)

- Icertis

- VASCO Data Security (eSignLive)

Frequently Asked Questions

Analyze common user questions about the Electronic Signature Services market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the legal difference between a standard electronic signature and a digital signature?

A standard electronic signature (e-signature) is typically an image or symbol attached logically to a document, proving intent to sign (e.g., UETA/ESIGN compliance). A digital signature is a specific type of e-signature based on Public Key Infrastructure (PKI) cryptography, requiring a digital certificate for enhanced security and identity verification. Digital signatures (especially Qualified or Advanced) offer higher legal assurance and non-repudiation, particularly in regulated markets like the EU (eIDAS).

Which industries are driving the highest demand for advanced digital signature services?

The highest demand for advanced digital signature services comes from highly regulated sectors such as Banking, Financial Services, and Insurance (BFSI) and the Government and Public Sector. These industries require the highest levels of authentication, auditability, and legal certainty for sensitive transactions, data retention, and compliance with strict KYC (Know Your Customer) and AML (Anti-Money Laundering) regulations.

How does cloud deployment compare to on-premise solutions in this market?

Cloud (SaaS) deployment dominates the market due to its lower initial cost, scalability, rapid implementation, and accessibility, catering largely to SMBs and agile enterprises. On-premise solutions, while offering greater direct control over data and security infrastructure, are typically reserved for large government agencies or enterprises with extremely strict internal data sovereignty policies or highly customized, complex legacy IT environments.

What role does blockchain technology play in the future of electronic signatures?

Blockchain technology is increasingly being explored to provide an immutable, decentralized ledger for timestamping and recording electronic signature events and audit trails. This enhances the security, non-repudiation, and long-term evidentiary value of the signed documents by minimizing the risk of tampering or central point of failure, thereby strengthening trust in the digital contracting process.

What is the primary constraint limiting the market growth of electronic signature services?

The primary constraint is the fragmentation and lack of uniform acceptance of electronic signature legislation across various global jurisdictions, especially concerning cross-border transactions and high-value documents. While major regions have clear laws (eIDAS, ESIGN), ensuring interoperability and compliance across developing nations or regions with stricter data sovereignty laws adds complexity and cost to global deployment strategies, slowing universal adoption.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager