Elevator Destination Dispatch System Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442801 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Elevator Destination Dispatch System Market Size

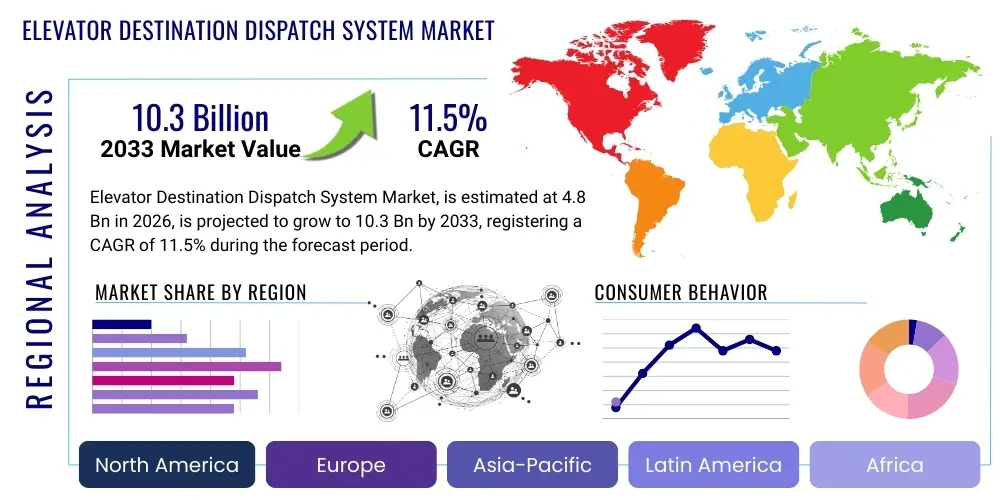

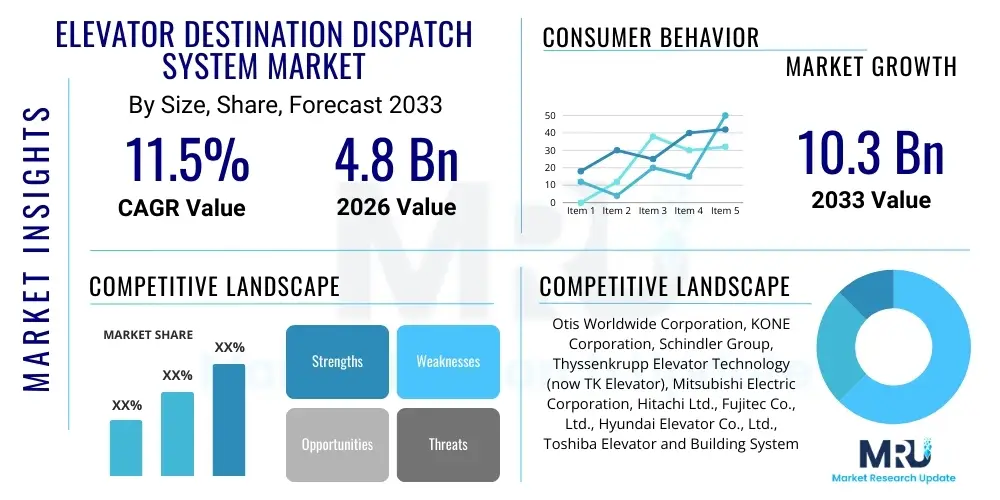

The Elevator Destination Dispatch System Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.5% between 2026 and 2033. The market is estimated at USD 4.8 Billion in 2026 and is projected to reach USD 10.3 Billion by the end of the forecast period in 2033. This substantial growth trajectory is underpinned by increasing global urbanization, the proliferation of high-rise commercial and mixed-use buildings, and a growing emphasis on maximizing vertical transportation efficiency and reducing energy consumption in modern infrastructure projects. The shift from traditional collective control systems to intelligent dispatch algorithms is accelerating adoption across major metropolitan areas worldwide.

Market expansion is further fueled by the integration of advanced technologies such as Artificial Intelligence (AI), Internet of Things (IoT), and sophisticated biometric authentication systems into destination control units. These technological enhancements are transforming elevator operations from passive transport mechanisms into integral, smart components of Building Management Systems (BMS). The demand for seamless and personalized user experiences, coupled with the necessity for optimized traffic flow in densely populated structures, positions destination dispatch systems as a critical investment for developers and building owners seeking competitive advantages in efficiency and sustainability.

Elevator Destination Dispatch System Market introduction

The Elevator Destination Dispatch System (DDS) market comprises technologies designed to optimize elevator traffic flow by grouping passengers heading to the same or nearby floors into the same car, significantly reducing waiting times and maximizing system throughput. Unlike conventional systems where users press the 'up' or 'down' button, DDS requires users to input their destination floor at a lobby terminal, which then assigns a specific elevator car (A, B, C, etc.) to serve that request. This fundamental shift in operational logic allows for predictive traffic management, efficient car assignment algorithms, and overall energy savings due to fewer stops and more direct journeys.

Major applications of DDS are primarily found in high-traffic environments, including corporate headquarters, luxury residential complexes, massive commercial office towers, healthcare facilities, and transportation hubs like airports and train stations. The system is particularly beneficial in buildings exceeding 15 stories, where peak hour congestion significantly impacts occupant satisfaction and productivity. Key benefits driving adoption include a remarkable reduction in passenger waiting times (often by 25-40%), enhanced security through access control integration, improved overall building throughput capacity, and measurable energy efficiency gains resulting from optimized routing and reduced unnecessary travel distance.

Driving factors for this market include the global trend toward "smart buildings" and green construction standards, demanding highly efficient vertical transportation solutions. Furthermore, increasing regulatory focus on building safety and accessibility standards encourages the adoption of technologically advanced systems that can manage complex traffic patterns, including emergency egress scenarios. The continuous development of sophisticated optimization algorithms, capable of adapting to real-time traffic variations and integrating seamlessly with other building systems, ensures the DDS market remains a vital component of modern urban infrastructure development and retrofit projects globally.

Elevator Destination Dispatch System Market Executive Summary

The Elevator Destination Dispatch System Market is characterized by robust growth, driven primarily by favorable business trends focused on smart building technology implementation and high-density urban development. Key business trends include partnerships between traditional elevator manufacturers and specialized software/AI firms to enhance dispatch algorithms, and a rising focus on subscription-based service models for predictive maintenance and software updates. Regional trends highlight significant investment in Asia Pacific, particularly in rapidly urbanizing economies like China and India, where large-scale infrastructure projects require maximum vertical efficiency. North America and Europe maintain strong demand for modernizing existing commercial inventories to meet stringent energy efficiency targets and improve user experience, positioning retrofits as a crucial segment driver.

Segment trends indicate a strong shift towards advanced AI-Integrated Systems, moving beyond basic zone assignment to predictive traffic modeling based on historical data, time of day, and even weather patterns. The Commercial Application segment, especially large corporate and mixed-use towers, remains the dominant revenue generator due to high traffic volumes and high value placed on efficiency and throughput. Component trends emphasize the increasing intelligence of the software layer, including cloud-based management tools that offer real-time performance monitoring and remote diagnostic capabilities, minimizing downtime and optimizing operational parameters continuously. Hardware components are evolving towards sleeker, more intuitive interfaces integrated with access control technologies.

Overall, the market is poised for accelerated innovation, leveraging connectivity and data analytics to transform elevator operations from mechanical necessity to an intelligent mobility service. Strategic imperatives for leading market players involve securing intellectual property rights for next-generation AI dispatch algorithms, expanding service networks to support complex installation and integration, and achieving deep penetration in emerging markets through localized product offerings. The commitment to sustainability and passenger safety remains central to product development, ensuring long-term market relevance and stable growth across all major geographical regions throughout the forecast period.

AI Impact Analysis on Elevator Destination Dispatch System Market

Common user questions regarding AI's impact on Elevator Destination Dispatch Systems often center on improved efficiency metrics, personalization, security concerns related to data privacy, and the potential for true predictive maintenance. Users frequently inquire: "How much faster is an AI-driven system compared to standard DDS?", "Can AI truly learn peak usage patterns and adjust routing dynamically?", and "What are the cybersecurity risks associated with networked, AI-managed elevators?" Based on these inquiries, the key themes revolve around the quantifiable performance improvements delivered by AI (speed, energy saving), the seamless integration of predictive intelligence into daily operations, and the necessary safeguards required to manage the vast data sets generated by these interconnected systems.

The integration of Artificial Intelligence represents a paradigm shift for the DDS market, moving systems from rule-based allocation to sophisticated, learning-based optimization. AI algorithms process massive amounts of real-time data—including passenger input speed, queue lengths, car status, and historical traffic profiles—to make dynamic, non-linear decisions about car assignments that consistently outperform traditional linear programming models. This advanced processing capability allows the system to proactively anticipate surges in demand, redistribute resources optimally during unexpected bottlenecks, and significantly improve average waiting and transit times, especially during complex inter-floor traffic situations, providing a level of responsiveness previously unattainable.

Furthermore, AI significantly enhances the maintenance aspect of the market. By continuously monitoring vibration, motor performance, door operations, and control board diagnostics, AI engines can predict component failure with high accuracy, enabling predictive maintenance schedules rather than relying on time-based checks or reactive repairs. This shift dramatically reduces unexpected downtime, enhances passenger safety, and lowers the operational expenditure for building owners. The next generation of DDS systems utilizes machine learning to personalize the passenger experience, recognizing frequent users and optimizing their transit paths, or integrating with mobile devices for touchless operation, driving market differentiation based on user-centric innovation and operational reliability.

- Enhanced Predictive Traffic Modeling: AI analyzes historical and real-time data to anticipate demand spikes and assign cars optimally, reducing congestion by up to 15%.

- Personalized User Experience: Learning individual user patterns and integrating with personalized access credentials for customized routing and touchless interfaces.

- Predictive Maintenance Implementation: Machine learning models monitor component health, forecasting failures to minimize unexpected elevator downtime and increase safety.

- Dynamic Energy Optimization: Real-time adjustments to car speed and standby modes based on immediate demand, leading to significant reduction in elevator power consumption.

- Seamless BMS Integration: Utilizing AI to communicate and harmonize vertical traffic with other building functions, such as security access and HVAC systems.

- Improved Cybersecurity Protocols: Implementing advanced threat detection algorithms to protect networked control systems from unauthorized access or data breaches.

DRO & Impact Forces Of Elevator Destination Dispatch System Market

The Elevator Destination Dispatch System Market is shaped by a powerful combination of Drivers, Restraints, and Opportunities, which collectively determine the market's trajectory and competitive landscape. Key drivers include the overwhelming global demand for optimized vertical mobility in high-rise structures, driven by population density and urbanization. Restraints often center around the high initial capital investment required for installation and the complexity of retrofitting older buildings with networked infrastructure. Opportunities are abundant, especially in integrating DDS with IoT and AI for true smart building functionality and expanding geographical penetration into rapidly developing urban centers in emerging economies. These forces generate an impact where the technological superiority and efficiency gains of DDS continually push against cost barriers and the inertia of traditional elevator standards.

Major market drivers strongly emphasize efficiency and sustainability. The global regulatory push towards green buildings and certifications (like LEED) mandates energy-efficient infrastructure, favoring DDS due to its reduced travel distance and optimized stops compared to conventional systems. Furthermore, the imperative for building owners to maximize tenant satisfaction and lease rates in premium commercial spaces mandates investment in superior technology that minimizes wait times and improves overall building throughput, thereby increasing the effective functional capacity of the structure without physically increasing the number of shafts. The advancements in sensor technology and edge computing also enable more robust and cost-effective deployment, further accelerating the adoption curve.

Conversely, the primary restraints include the significant upfront cost associated with the proprietary software, specialized hardware, and the required network infrastructure. For existing buildings, the complexity of migrating from a collective control system to a destination dispatch setup often involves substantial architectural changes and extended downtime, posing a deterrent. Another restraint is the potential for passenger confusion or resistance during the initial learning phase, requiring extensive user education and intuitive interface design. Opportunities, however, lie in the rapid reduction in hardware costs, the expansion of cloud-based management solutions reducing local infrastructure burden, and leveraging predictive maintenance services to offer a strong return on investment (ROI) that mitigates the initial capital outlay concerns, particularly for long-term operational efficiency.

Segmentation Analysis

The Elevator Destination Dispatch System market is strategically segmented based on Technology, Application, and Component to provide a clear view of market dynamics and adoption patterns. Segmentation allows stakeholders to identify high-growth areas, target specific end-user needs, and develop focused product strategies, ensuring maximum penetration across diverse building types and modernization requirements. The technological segmentation distinguishes between simpler, standard queue-based dispatch systems and highly advanced, AI-integrated platforms that utilize machine learning for predictive traffic management. Application segmentation provides insights into vertical market demand, with the Commercial sector dominating due to stringent requirements for handling intense peak-hour traffic efficiently, followed closely by the fast-growing Mixed-Use and Institutional segments.

Component segmentation is crucial for understanding the value distribution within the DDS ecosystem. Hardware components, including lobby terminals, advanced car controllers, and sensors, form the foundational physical infrastructure. The Software component, encompassing the dispatch algorithms, networking protocols, user interface operating systems, and integration modules (BMS/Security), represents the intellectual property and continuous innovation driving market value. As systems become more sophisticated, the software segment is experiencing faster growth and higher revenue contributions, largely due to demand for ongoing updates, cloud connectivity, and sophisticated data analytics services that enhance operational performance and longevity.

Analyzing these segments reveals that future growth is concentrated in the realm of software innovation and advanced application scenarios. The institutional segment, particularly hospitals and university campuses, shows high potential due to the need for efficient movement of specialized equipment and personnel during critical times, demanding highly reliable and customized dispatch logic. Furthermore, the integration capabilities of DDS are becoming a major differentiating factor, enabling seamless interaction with physical security systems like turnstiles and biometric access points, ensuring only authorized personnel are granted access and optimizing their entire journey from the lobby to the destination floor, thereby reinforcing the value proposition beyond mere efficiency gains.

- Technology:

- Standard Dispatch Systems (Rule-Based Assignment)

- Advanced AI-Integrated Systems (Machine Learning Optimization)

- Application:

- Residential Buildings (High-end, Luxury)

- Commercial Buildings (Office Towers, Retail Centers)

- Institutional Facilities (Hospitals, Educational Campuses)

- Mixed-Use Buildings (Combining Residential, Commercial, and Retail)

- Component:

- Hardware (Lobby Terminals, Controllers, Sensors)

- Software (Dispatch Algorithms, System Integration Modules, Cloud Platforms)

Value Chain Analysis For Elevator Destination Dispatch System Market

The Value Chain for the Elevator Destination Dispatch System Market is complex, involving specialized intellectual property creation, meticulous manufacturing, integrated installation, and ongoing maintenance services. The upstream analysis focuses heavily on research and development (R&D) for advanced algorithmic software and sensor technology, where major players invest significant capital to create proprietary dispatch logic that offers superior optimization performance. Key upstream suppliers include component manufacturers providing high-resolution touchscreens, specialized microprocessors, network communication modules, and robust security authentication hardware. The intellectual value derived from software engineering and algorithmic development constitutes the highest value-add at this stage, dictating system efficiency and competitive advantage.

The middle segment of the value chain involves the system integrators, manufacturers, and distribution channels. Manufacturing involves assembling the proprietary control panels and lobby interfaces, often adhering to strict global safety and interoperability standards. Distribution channels are typically a combination of direct sales teams employed by multinational elevator corporations (e.g., Otis, Kone, Schindler) who handle large-scale new construction projects directly, and indirect channels relying on authorized dealers and specialized local installers for smaller projects or retrofit opportunities. A crucial aspect here is training and certification for installation teams, as the complexity of networking and integrating DDS with existing building systems requires specialized expertise beyond standard elevator installation.

Downstream analysis is dominated by the installation, commissioning, and long-term maintenance services. Service contracts are a crucial revenue stream, particularly for the software updates, remote diagnostics, and predictive maintenance enabled by cloud connectivity and IoT integration. Direct channels are essential for servicing major contracts, providing 24/7 technical support and ensuring system longevity. The shift towards 'Elevator as a Service' (EaaS) models, where operational data is analyzed continuously for performance optimization, reinforces the downstream importance of recurring revenue streams and specialized maintenance expertise, creating a strong customer lock-in effect based on reliable, high-tech servicing capabilities.

Elevator Destination Dispatch System Market Potential Customers

Potential customers for Elevator Destination Dispatch Systems primarily comprise entities responsible for owning, developing, or managing high-rise and high-traffic commercial, residential, and institutional properties where efficient people flow is critical to operational success and user experience. The immediate primary buyers are commercial real estate developers specializing in Class A office towers, who recognize that DDS is a required feature to attract premium tenants and justify higher lease rates by maximizing the usable floor space and minimizing time spent in transit. These developers seek solutions that demonstrate verifiable gains in throughput capacity and contribute positively to energy efficiency ratings, aligning with modern corporate social responsibility (CSR) goals.

The secondary, but rapidly growing, segment of potential customers includes institutional buyers such as healthcare providers and university system administrators. Hospitals, for instance, require precise and rapid vertical transportation management for critical scenarios, and DDS can prioritize emergency movements while maintaining general traffic flow, offering significant operational benefits. Similarly, large university administrative buildings and science complexes utilize DDS to handle intermittent but intense traffic surges between class changes or administrative hours. These end-users prioritize reliability, integration with existing security and access control systems, and robust maintenance support to ensure continuous operation without interruption.

Finally, a significant customer base exists in the retrofit market, comprising existing building owners and property management firms seeking to modernize aging vertical transportation systems to remain competitive and meet evolving tenant expectations. For these customers, the focus is on systems that minimize installation disruption while delivering maximum performance uplift and extending the operational lifespan of the core elevator infrastructure. Investment decisions in this segment are highly sensitive to the calculated Return on Investment (ROI) derived from energy savings, improved tenant satisfaction, and reduced labor costs associated with faster, more predictive maintenance cycles, making the value proposition of DDS highly compelling for comprehensive property upgrades.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.8 Billion |

| Market Forecast in 2033 | USD 10.3 Billion |

| Growth Rate | 11.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Otis Worldwide Corporation, KONE Corporation, Schindler Group, Thyssenkrupp Elevator Technology (now TK Elevator), Mitsubishi Electric Corporation, Hitachi Ltd., Fujitec Co., Ltd., Hyundai Elevator Co., Ltd., Toshiba Elevator and Building Systems Corporation, Elisha Otis, Dover Corporation, Canny Elevator Co., Ltd., Kleemann Group, Glaro, Imperial Elevator Systems, Delta Elevator, Lift Vision Systems, MAD Elevator Fixtures, Motion Control Engineering, Smart Elevator Technology. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Elevator Destination Dispatch System Market Key Technology Landscape

The technological landscape of the Elevator Destination Dispatch System market is defined by sophisticated algorithmic control, advanced networking infrastructure, and user interface innovation. Central to the DDS functionality is the core dispatch algorithm, which has evolved significantly from simple rule-based grouping to complex, self-learning algorithms leveraging graph theory and optimization models to minimize system-wide travel time, not just individual waiting time. Key technologies utilized include high-speed, secure network protocols (often leveraging proprietary or robust industrial Ethernet standards) to ensure instantaneous communication between lobby input terminals, car controllers, and the central system server. Furthermore, the reliance on high-quality, durable touchscreens and intuitive graphical interfaces at the lobby level ensures efficient user interaction and acceptance of the system's assignments.

The integration of Internet of Things (IoT) technologies and edge computing is critical for the current generation of DDS. IoT sensors embedded within the elevator cars, hoistways, and machine rooms constantly feed operational data (such as vibration, motor temperature, door cycle counts, and passenger load monitoring) back to the central dispatch system and cloud platforms. Edge computing enables local, real-time processing of immediate traffic changes and localized decision-making, ensuring minimal latency and highly responsive car assignment, even if central connectivity is temporarily interrupted. This connectivity supports the increasingly important function of predictive maintenance, allowing service providers to monitor component wear and schedule interventions precisely before mechanical failure occurs, thereby maximizing uptime and operational efficiency for the building owner.

Future technological advancements are heavily focused on leveraging Artificial Intelligence (AI) for true predictive traffic management and enhanced security features. AI models are being trained on years of building traffic data to forecast peaks and adjust car zoning proactively before users even arrive, optimizing the idle positioning of cars. Additionally, the proliferation of biometric authentication (e.g., facial recognition, fingerprint scanning) and seamless integration with building access control systems is transforming the DDS into a personalized security gateway. Passengers who identify themselves at the terminal can be automatically assigned a car that will only travel to floors they are authorized to access, thereby significantly enhancing building security and regulatory compliance while maintaining unparalleled efficiency and convenience in vertical transit management.

Regional Highlights

- North America (USA, Canada): North America represents a mature, high-value market driven primarily by the modernization and retrofitting of existing commercial office inventory in major metropolitan hubs like New York, Chicago, and Toronto. High labor costs and stringent safety regulations necessitate highly efficient, automated solutions like DDS. The region is a rapid adopter of cutting-edge AI-integrated systems and leads in leveraging DDS for seamless integration with sophisticated Building Management Systems (BMS) and advanced access control technologies, ensuring high operational standards and premium tenant services.

- Europe (Germany, UK, France): The European market is characterized by a strong emphasis on energy efficiency, sustainability, and green building certifications (e.g., BREEAM). Demand for DDS is robust, particularly in new, complex commercial developments and mixed-use spaces. Germany and the UK are key players, with a focus on optimizing vertical transportation within historically significant or structurally challenging buildings. European developers are keen on systems offering verifiable energy consumption reductions and enhanced operational transparency through data analytics and cloud-based performance monitoring platforms.

- Asia Pacific (China, India, Japan, South Korea): APAC is the fastest-growing region globally, fueled by unprecedented rates of urbanization and massive investments in high-rise infrastructure, including mega-towers and vast residential complexes. China and India are the dominant growth engines, where the sheer volume of new construction necessitates highly efficient traffic handling solutions to manage dense populations. While price sensitivity exists, the critical need for throughput optimization in dense urban environments overrides cost concerns for large-scale projects, making this region vital for volume sales and rapid market penetration.

- Latin America (Brazil, Mexico): This region demonstrates moderate but accelerating adoption, driven by increasing foreign direct investment in commercial real estate in key business centers such as São Paulo and Mexico City. The market is evolving from traditional systems to advanced DDS as developers seek to align new constructions with international efficiency standards. Key drivers include enhancing building safety and managing complex traffic patterns in mixed-use developments, though economic stability can influence the pace of adoption.

- Middle East and Africa (MEA): The MEA region, particularly the UAE and Saudi Arabia, exhibits extremely high demand for DDS due to iconic, large-scale construction projects (e.g., smart cities and luxury residential towers). These projects mandate the highest possible efficiency and technological sophistication, positioning the region as a primary market for premium, bespoke destination dispatch solutions. Growth in Africa is slower but steady, concentrated in commercial centers requiring modernization and new developments designed for international business standards.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Elevator Destination Dispatch System Market.- Otis Worldwide Corporation

- KONE Corporation

- Schindler Group

- TK Elevator (formerly Thyssenkrupp Elevator Technology)

- Mitsubishi Electric Corporation

- Hitachi Ltd.

- Fujitec Co., Ltd.

- Hyundai Elevator Co., Ltd.

- Toshiba Elevator and Building Systems Corporation

- Canny Elevator Co., Ltd.

- Kleemann Group

- Elisha Otis

- Dover Corporation

- Imperial Elevator Systems

- Delta Elevator

- Lift Vision Systems

- MAD Elevator Fixtures

- Motion Control Engineering

- Smart Elevator Technology

- Glaro

Frequently Asked Questions

Analyze common user questions about the Elevator Destination Dispatch System market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between Destination Dispatch Systems (DDS) and conventional elevator controls?

The primary difference is the point of destination input. Conventional systems use 'up/down' buttons, relying on collective control. DDS requires the passenger to input the specific floor destination at a lobby terminal, allowing the system to use sophisticated algorithms to group passengers efficiently and assign a specific car, resulting in fewer stops and significantly faster travel times.

How much energy saving can a building expect from implementing a Destination Dispatch System?

Buildings implementing DDS typically experience substantial energy savings, often ranging from 15% to 30% compared to traditional systems. This efficiency gain is achieved through optimized routing, reduced unnecessary car movement, fewer intermediate stops, and intelligent standby modes based on anticipated traffic patterns managed by the system's algorithms.

Are Destination Dispatch Systems suitable for retrofitting older commercial buildings?

Yes, DDS is increasingly viable for retrofitting older commercial buildings, although it requires significant investment in new control hardware, lobby terminals, and network infrastructure. While challenging, the retrofit provides substantial benefits by boosting the building's throughput capacity and appeal, making it a key strategy for modernizing aging urban assets and competing with new construction.

How does AI integration improve the performance of a DDS system?

AI integration enhances DDS performance by enabling predictive traffic modeling. AI learns historical patterns and real-time inputs (e.g., passenger density, time of day) to proactively stage cars and optimize assignments dynamically, minimizing waiting times and preventing bottlenecks better than static, rule-based dispatch systems, thus maximizing building efficiency and throughput.

What are the key security benefits of using Destination Dispatch Systems?

Key security benefits include mandatory passenger registration at the terminal and seamless integration with building access control systems (e.g., badge readers, biometrics). This integration ensures that passengers can only be assigned cars that serve floors they are authorized to access, providing an added layer of security and restricted floor access control immediately upon entering the building lobby.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager