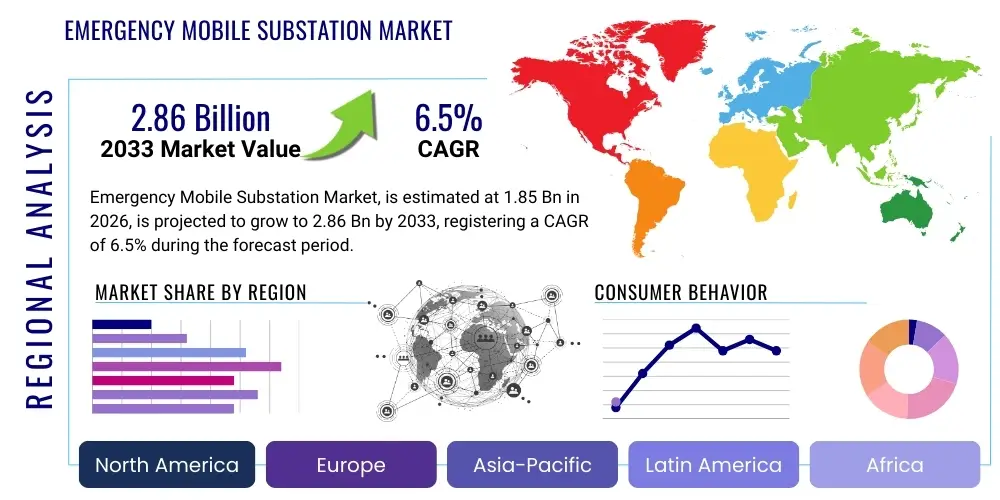

Emergency Mobile Substation Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442870 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Emergency Mobile Substation Market Size

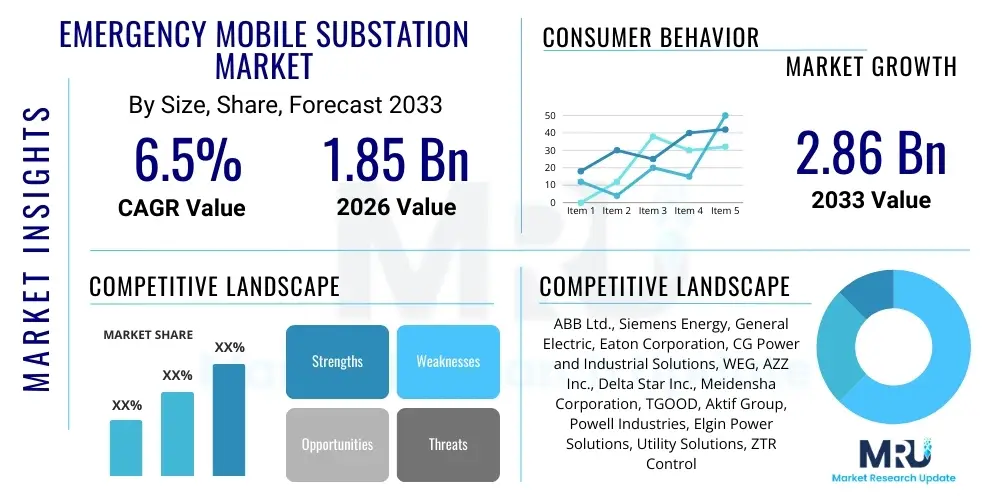

The Emergency Mobile Substation Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 1.85 Billion in 2026 and is projected to reach USD 2.86 Billion by the end of the forecast period in 2033.

Emergency Mobile Substation Market introduction

The Emergency Mobile Substation Market encompasses specialized, compact, and fully assembled power distribution and transmission equipment mounted on trailers or containerized platforms, designed for rapid deployment and connection to existing electrical grids. These mobile units serve as critical temporary replacements for permanent substations that fail due to natural disasters, operational failures, or planned maintenance activities. The core product includes major components such as power transformers, switchgear, circuit breakers, and control and protection systems, all integrated into a high-mobility solution capable of operating across various voltage levels, typically ranging from 69 kV up to 400 kV in specialized applications.

Major applications of emergency mobile substations span utility backup and restoration, large-scale industrial projects requiring temporary power augmentation, and integration support for intermittent renewable energy sources during grid upgrades. These substations offer substantial benefits, including minimized power outage duration, improved grid resiliency against unforeseen events, and enhanced flexibility in managing load spikes or construction phases. Their ability to restore service within hours, rather than the months required for permanent substation repairs or construction, makes them indispensable assets for critical infrastructure management globally.

The market is predominantly driven by the increasing frequency and intensity of extreme weather events, which necessitate robust contingency planning by utility providers, alongside the global trend of aging electrical infrastructure requiring continuous maintenance and refurbishment. Furthermore, the rising need for flexible grid solutions to accommodate decentralized renewable energy sources and the stringent regulatory mandates emphasizing grid reliability across developed economies are accelerating the adoption of these rapid deployment power solutions.

Emergency Mobile Substation Market Executive Summary

The Emergency Mobile Substation Market is witnessing robust expansion, primarily fueled by infrastructural vulnerabilities and the accelerating demands of modernizing power grids. Business trends indicate a shift towards higher voltage capacity mobile units, catering to bulk power transmission requirements, and a strong focus on modular, standardized designs that enhance deployment speed and minimize customization costs. Key market players are increasingly investing in sophisticated control and monitoring systems, incorporating digital technologies to facilitate seamless integration with smart grid architectures. The competitive landscape is characterized by established electrical equipment manufacturers leveraging their expertise in power transformers and switchgear to offer complete, turnkey mobile solutions, often through long-term leasing agreements or immediate deployment contracts with national utilities.

Regionally, North America and Europe dominate the market, largely due to mature regulatory frameworks mandating high levels of grid reliability and significant investments in aging infrastructure replacement programs. These regions exhibit high demand for containerized solutions optimized for extreme environmental conditions. The Asia Pacific (APAC) region, however, is projected to demonstrate the fastest growth rate, driven by rapid urbanization, massive infrastructure development projects, and increasing electrification rates in developing economies like India and Southeast Asia. This growth is centered on establishing new substations quickly, often using mobile units as a preliminary step before permanent structures are finalized, and addressing increasing industrial load requirements.

Segment trends reveal that the high voltage (HV) and extra-high voltage (EHV) segments, specifically above 220 kV, are gaining prominence as transmission systems become the focal point of resilience efforts. Application-wise, utility and transmission & distribution (T&D) companies remain the principal end-users, but the industrial sector, particularly mining, oil and gas, and large manufacturing complexes, is emerging as a significant market segment due to the critical nature of continuous power supply for their operations. Technology trends emphasize the integration of eco-friendly dielectric fluids and vacuum switchgear to minimize environmental footprint and maintenance requirements, aligning with global sustainability initiatives.

AI Impact Analysis on Emergency Mobile Substation Market

User inquiries regarding AI's influence on the Emergency Mobile Substation Market frequently center on predictive maintenance capabilities, optimal deployment logistics, and the role of AI in real-time load balancing during emergency situations. Key themes revolve around how machine learning can analyze vast streams of grid data (weather patterns, asset health, load profiles) to predict potential substation failures, thereby allowing utilities to preposition mobile substations preemptively rather than reactively. Concerns often touch upon the cybersecurity implications of integrating sophisticated AI platforms into critical mobile infrastructure and the standardization challenges of ensuring interoperability between diverse manufacturer systems. Expectations are high regarding AI's ability to automate the complex switching and protection settings required when connecting a mobile substation to a damaged grid section, significantly reducing manual configuration time and human error during high-stress deployments.

AI algorithms are fundamentally transforming how emergency power solutions are managed and utilized. By processing historical failure data, current operating conditions, and external variables, AI can generate highly accurate probability assessments of equipment failure within the fixed grid infrastructure. This shifts the operational paradigm from emergency response to predictive resilience, enabling utilities to strategically deploy mobile assets before an outage occurs, ensuring continuous supply. Furthermore, during an actual deployment, AI-powered control systems can rapidly diagnose the fault condition in the affected section and automatically configure the mobile substation's protective relays and power flow parameters, vastly accelerating the synchronization and connection process.

Beyond predictive scheduling and rapid configuration, AI is also crucial for optimizing the internal performance of the mobile substation components themselves. Machine learning models analyze vibration, temperature, and partial discharge data from the mobile transformer and switchgear, providing real-time health monitoring. This proactive internal diagnostics capability ensures that the mobile substation, which is itself a critical asset, remains in peak operational readiness. The adoption of AI-driven Geographic Information Systems (GIS) assists in calculating the most efficient deployment routes, accounting for traffic, road restrictions, and site accessibility, thereby guaranteeing the fastest possible time-to-service.

- Enhanced Predictive Maintenance: AI models predict fixed substation failures, enabling preemptive mobilization of emergency units.

- Optimized Deployment Logistics: AI utilizes GIS and real-time data to determine the fastest, most feasible deployment routes and site preparations.

- Automated Configuration and Synchronization: Machine learning algorithms rapidly configure protection settings and synchronize the mobile substation with the existing, often unstable, grid segment.

- Real-Time Load Management: AI dynamically adjusts the mobile substation’s output to balance load fluctuations during the emergency restoration phase.

- Asset Health Monitoring: Internal AI systems monitor the condition of mobile substation components (transformers, switchgear) to ensure high readiness.

- Simulation and Training: AI-driven simulators are used to train personnel on complex mobile substation deployment scenarios and fault handling.

DRO & Impact Forces Of Emergency Mobile Substation Market

The Emergency Mobile Substation Market is primarily driven by the escalating vulnerability of aging transmission and distribution (T&D) infrastructure worldwide and the necessity for robust contingency planning against increasingly common severe weather events and climate change impacts. These factors compel governments and utility operators to invest in flexible, rapid-response power solutions. Restraints include the high initial capital investment required for purchasing and maintaining these sophisticated, high-capacity mobile units, coupled with the complex regulatory hurdles and standardization issues related to interconnecting mobile assets across diverse grid architectures and differing national safety specifications. Opportunities abound in the integration of mobile substations with renewable energy projects, where they can provide essential temporary power during construction phases or serve as crucial backup during transient generation periods, especially in decentralized microgrids.

A key driver is the global trend of grid modernization, where older, inefficient substations are being decommissioned or upgraded. Mobile substations bridge the power gap during these extensive maintenance periods, ensuring continued electricity supply to consumers and industrial facilities. Furthermore, the regulatory environment in many developed nations imposes strict penalties for prolonged power outages, creating a financial imperative for utilities to possess rapid recovery assets like mobile substations. The increasing complexity of cyber threats targeting critical infrastructure also drives demand, as mobile substations can isolate and provide power to uncompromised sections of the grid, facilitating resilience and security.

However, the sheer size and weight of high-voltage mobile substations pose logistical challenges related to transportation permits and infrastructure capacity (bridges, roads), particularly in densely populated or remote areas. Additionally, the limited number of specialized personnel trained to operate, connect, and troubleshoot these highly customized mobile systems acts as a soft restraint. The major impact forces influencing market growth are the unpredictable rise in natural catastrophes (earthquakes, hurricanes, wildfires), global shifts toward decentralized power generation requiring flexible connection points, and advancements in power electronics that are making mobile solutions more compact and efficient.

- Drivers: Aging fixed infrastructure; increasing frequency of natural disasters; strict grid reliability mandates; rising global electricity demand requiring flexible backup.

- Restraints: High initial procurement cost and maintenance expenses; complex logistical planning and transportation restrictions; regulatory inconsistencies across regions.

- Opportunity: Expansion into developing economies; integration with decentralized renewable energy and microgrids; deployment in rapidly growing industrial areas (e.g., data centers).

- Impact Forces: Climate change severity accelerating grid vulnerability; technological advancements enhancing mobility and voltage capacity; regulatory pressure on utilities to minimize outage times.

Segmentation Analysis

The Emergency Mobile Substation Market is fundamentally segmented based on critical technical specifications and deployment scenarios, primarily focusing on voltage level, configuration type, and end-user application. Analyzing these segments provides nuanced insight into the varied needs of global utilities and industrial consumers. The voltage segmentation is crucial as it dictates the complexity and size of the mobile unit, ranging from medium voltage (MV) used for localized distribution to ultra-high voltage (UHV) for main transmission grid contingencies. Configuration segmentation differentiates between highly robust containerized solutions, favored for long-term storage and extreme environmental protection, and trailer-mounted solutions, optimized for rapid travel and accessibility.

Application analysis highlights the primary purchasing power and operational use cases. The utility segment remains the dominant consumer, utilizing these assets for planned maintenance and unplanned emergency restoration of T&D networks. Conversely, the industrial segment, including heavy manufacturing and mining, relies on mobile substations to prevent catastrophic financial losses associated with production halts, often requiring specialized designs tailored to harsh operating environments. Understanding these segments is vital for manufacturers, who must align their product development—such as modular designs and increased power density—with the evolving requirements for faster deployment and higher voltage resilience across different operational settings.

Further granularity exists within the component segment, where the market is segmented by the primary hardware included, such as transformers, switchgear, and control systems. The trend here is toward smaller, lighter, and more durable components, driven by advances in insulation materials and protection technology. The shift toward eco-friendly components, such as transformers utilizing natural ester fluids rather than traditional mineral oil, is becoming a key differentiator, particularly in environmentally sensitive deployment locations, influencing overall market share distribution.

- By Voltage Level:

- Medium Voltage (MV) (Up to 69 kV)

- High Voltage (HV) (69 kV to 230 kV)

- Extra High Voltage (EHV) (Above 230 kV)

- By Configuration:

- Trailer-Mounted (Skid-Mounted)

- Containerized (ISO Containerized)

- By Application:

- Utility (T&D Network Maintenance and Restoration)

- Industrial (Mining, Oil & Gas, Manufacturing, Data Centers)

- Commercial (Large Campuses, Temporary Events)

- By Component:

- Power Transformers

- Switchgear and Circuit Breakers

- Control and Protection Systems

- Auxiliary Equipment

Value Chain Analysis For Emergency Mobile Substation Market

The value chain for the Emergency Mobile Substation Market is highly structured, beginning with specialized upstream suppliers providing critical raw materials and highly technical components. This upstream segment involves manufacturers of high-grade electrical steel, sophisticated insulating materials, high-purity copper, and core components like high-voltage bushings and tap changers. The quality and availability of these materials directly impact the final product's efficiency, longevity, and overall mobility. Downstream activities involve the complex integration of these components into a functioning mobile unit, followed by specialized deployment and maintenance services provided directly to the end-users, ensuring that operational readiness is maintained at all times.

The manufacturing stage is centralized among key original equipment manufacturers (OEMs) who possess the necessary engineering expertise to design compact, high-performance systems that adhere to stringent transportation limits and electrical standards. This stage involves complex mechanical engineering for trailer or container integration, rigorous electrical testing, and standardization for rapid interchangeability. The distribution channel is predominantly direct, especially for large-scale utility contracts, due to the customized nature and high value of the asset. Sales often involve detailed specification negotiations, long lead times, and comprehensive post-sales service agreements, bypassing traditional intermediary distributors.

While large utilities often purchase directly from OEMs, indirect channels sometimes involve engineering, procurement, and construction (EPC) firms, particularly for new infrastructure projects or specialized industrial applications. EPC firms act as intermediaries, integrating the mobile substation into a broader project plan. The high-level technical expertise required for installation and commissioning necessitates that OEMs or their certified partners provide deployment support. This ensures safety and optimal performance during the critical connection phase, solidifying the importance of service contracts and technical training throughout the downstream value flow.

Emergency Mobile Substation Market Potential Customers

The primary end-users and potential buyers for Emergency Mobile Substations are electricity transmission and distribution (T&D) utilities, encompassing both private and state-owned enterprises across the globe. These organizations are critically responsible for maintaining grid stability and minimizing System Average Interruption Duration Index (SAIDI) scores. Mobile substations are essential assets for their reliability portfolio, enabling seamless maintenance activities and swift recovery from unexpected grid failures caused by equipment malfunctions or external forces, ensuring that continuous supply is maintained for residential and commercial customers.

Beyond the core utility sector, the industrial segment represents a significant and growing customer base. Potential buyers include large-scale operations in mining, where remote locations and harsh conditions necessitate reliable, deployable power; the oil and gas sector, which requires temporary power for drilling sites or pipeline operations; and increasingly, the booming data center industry, where uninterrupted power supply is paramount for continuous data processing and storage. These industrial users value the mobile substation’s ability to prevent economically catastrophic downtime, often justifying the premium cost associated with rapid, high-capacity temporary power solutions.

Furthermore, specialized segments such as large construction and engineering firms, especially those involved in major infrastructure projects (e.g., high-speed rail, large municipal developments), constitute potential customers requiring temporary, high-capacity power solutions during various construction phases. Emergency response agencies and military installations also represent niche buyers, leveraging the rapid deployment capabilities of mobile substations to restore critical communications and operations following large-scale regional emergencies or conflicts. The common thread across all these potential customers is the high cost associated with downtime and the critical need for power flexibility.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.85 Billion |

| Market Forecast in 2033 | USD 2.86 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ABB Ltd., Siemens Energy, General Electric, Eaton Corporation, CG Power and Industrial Solutions, WEG, AZZ Inc., Delta Star Inc., Meidensha Corporation, TGOOD, Aktif Group, Powell Industries, Elgin Power Solutions, Utility Solutions, ZTR Control Systems, Alstom (now GE Power), Lucy Electric, Hyundai Electric, Toshiba Energy Systems, Prolec GE. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Emergency Mobile Substation Market Key Technology Landscape

The technological evolution within the Emergency Mobile Substation market is focused on enhancing power density, reducing physical footprint, and integrating advanced smart grid functionalities. A critical trend is the adoption of vacuum technology in switchgear, replacing traditional SF6 gas insulation in medium-voltage applications, driven by environmental concerns regarding SF6 as a potent greenhouse gas. This technological shift improves safety and reduces maintenance complexity. Furthermore, manufacturers are increasingly incorporating modern power electronics, such as voltage source converters (VSCs) and advanced semiconductor devices, enabling more compact and efficient mobile high-voltage direct current (HVDC) solutions, which are becoming crucial for long-distance power transmission and grid interconnection flexibility.

Another pivotal technological development involves the integration of sophisticated digital control and protection systems within mobile units. These systems leverage fiber optics and microprocessor-based relays, facilitating seamless interoperability with modern utility Supervisory Control and Data Acquisition (SCADA) systems and ensuring rapid, intelligent fault isolation. The deployment of smart sensors (IoT devices) throughout the mobile substation allows for continuous, remote monitoring of critical operational parameters like winding temperature, oil quality, and mechanical vibrations, enabling condition-based maintenance and ensuring the asset's readiness for immediate deployment. This digital integration is key to achieving the sub-hour restoration times demanded by utilities.

Material science innovation also plays a significant role, particularly in reducing the overall weight of the mobile unit while maintaining high reliability. The use of advanced composite materials for enclosure construction and lighter core components, coupled with high-efficiency transformer designs utilizing amorphous metal cores, minimizes the gross vehicle weight. This weight reduction is crucial for overcoming stringent road transportation limits and improving the accessibility of deployment sites, especially in regions with underdeveloped infrastructure. Future advancements are expected in solid-state circuit breakers (SSCBs) and battery energy storage integration, enabling mobile substations to act as dynamic grid stabilization assets rather than just static power bypass solutions.

Regional Highlights

- North America: This region holds a commanding share of the market, driven primarily by the critical need to replace and refurbish vast stretches of aging transmission infrastructure, much of which exceeds its intended operational lifespan. The high incidence of severe weather events, including hurricanes in the Southeast and wildfires in the West, necessitates substantial investment in emergency preparedness, strongly supported by federal and state regulatory bodies. Utilities like those in the US and Canada maintain large fleets of mobile substations, often procured through long-term contracts with major global OEMs, focusing heavily on robust, EHV trailer-mounted units capable of supporting high-capacity transmission lines. Demand is particularly strong for digitally integrated solutions compatible with evolving smart grid standards and cybersecurity protocols.

- Europe: The European market is characterized by stringent environmental regulations and a focus on renewable energy integration. Demand for mobile substations here is fueled by grid fragmentation due to high penetration of wind and solar energy, requiring flexible connection points. Utilities in Western Europe, especially Germany, France, and the UK, prioritize containerized mobile solutions that meet strict noise reduction requirements and utilize eco-friendly insulation like natural esters. The focus is less on disaster recovery and more on planned maintenance, substation upgrades, and enabling cross-border power exchange flexibility, driven by the European Union’s energy harmonization goals.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing market, driven by unparalleled infrastructure development and rapid industrialization in countries like China, India, and Indonesia. The need for mobile substations arises from the urgent requirement to extend electricity access to rapidly growing urban centers and remote industrial clusters, often where permanent substation construction faces bureaucratic or topographical delays. The market is highly price-sensitive, demanding cost-effective, durable solutions. Furthermore, increasing investment in smart cities and massive renewable energy projects (e.g., solar farms) across the region is generating significant demand for both temporary power during construction and emergency backup for critical new assets.

- Latin America (LATAM): This market is experiencing steady growth, largely spurred by the need for grid stabilization and recovery from regional climate variations and natural disasters. Investment in mobile units is concentrated in countries like Brazil and Mexico, where power supply interruptions can severely impact vital sectors such as mining and utilities often struggle with infrastructure maintenance due to limited capital. The market emphasizes rugged, medium-to-high voltage solutions suitable for deployment across challenging terrain and locations with varying levels of infrastructure quality.

- Middle East and Africa (MEA): Growth in the MEA region is segmented. The Middle East segment, particularly the GCC nations, shows demand driven by massive utility expansion projects, new smart city developments (like NEOM), and high industrial energy consumption (e.g., desalination plants). They require high-capacity, specialized mobile substations optimized for extreme heat. The African market, conversely, is driven by electrification projects and the establishment of decentralized power systems, where mobile substations are utilized as flexible, interim power hubs for expanding national grids into underserved areas.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Emergency Mobile Substation Market.- ABB Ltd.

- Siemens Energy

- General Electric

- Eaton Corporation

- CG Power and Industrial Solutions

- WEG

- AZZ Inc.

- Delta Star Inc.

- Meidensha Corporation

- TGOOD

- Aktif Group

- Powell Industries

- Elgin Power Solutions

- Utility Solutions

- ZTR Control Systems

- Alstom (now GE Power)

- Lucy Electric

- Hyundai Electric

- Toshiba Energy Systems

- Prolec GE

Frequently Asked Questions

Analyze common user questions about the Emergency Mobile Substation market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of an Emergency Mobile Substation?

The primary function is to provide rapid, temporary electrical power transmission and distribution services to an electrical grid segment when a permanent substation fails due to maintenance, equipment fault, or catastrophic events, thereby minimizing outage duration and ensuring grid continuity.

What voltage levels do mobile substations typically support?

Mobile substations are highly adaptable, commonly supporting voltage levels from Medium Voltage (MV, 15 kV to 69 kV) up through Extra High Voltage (EHV, up to 400 kV or higher), depending on the specific application requirements of the transmission or distribution utility.

What factors are driving the growth of the Mobile Substation Market?

Market growth is largely driven by the increasing vulnerability of aging global T&D infrastructure, the rise in severe weather events necessitating robust emergency planning, and the regulatory pressure on utilities to achieve high grid reliability metrics and minimize power outage penalties.

Are mobile substations compatible with smart grid systems?

Yes, modern emergency mobile substations are increasingly equipped with advanced digital control and protection systems, enabling seamless integration with existing smart grid architectures, SCADA systems, and remote monitoring platforms for intelligent operation.

What is the typical deployment time for a mobile substation during an emergency?

While transit time varies, the electrical connection and commissioning (time-to-service) for a well-prepared mobile substation can typically range from several hours (4 to 8 hours) to under a day, significantly faster than the months required to repair or replace a fixed substation.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager