Emergency Power Generators Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443634 | Date : Feb, 2026 | Pages : 257 | Region : Global | Publisher : MRU

Emergency Power Generators Market Size

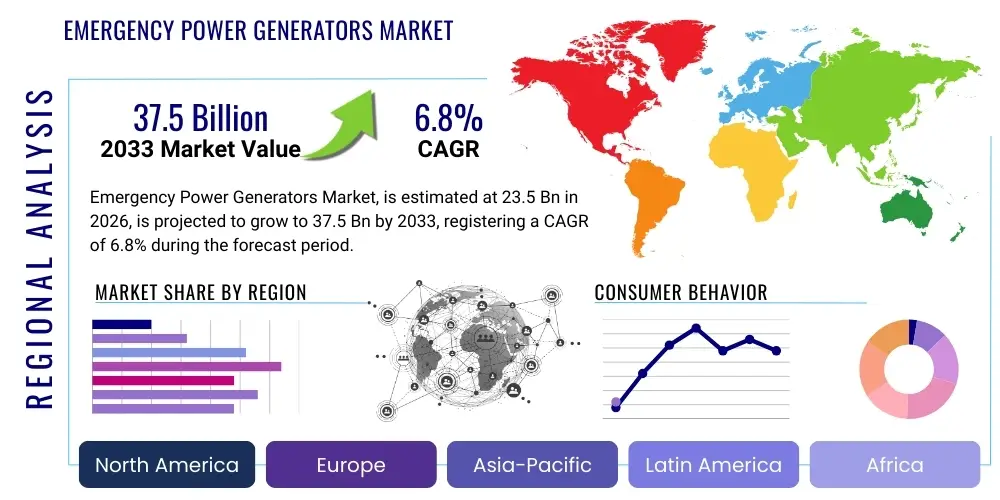

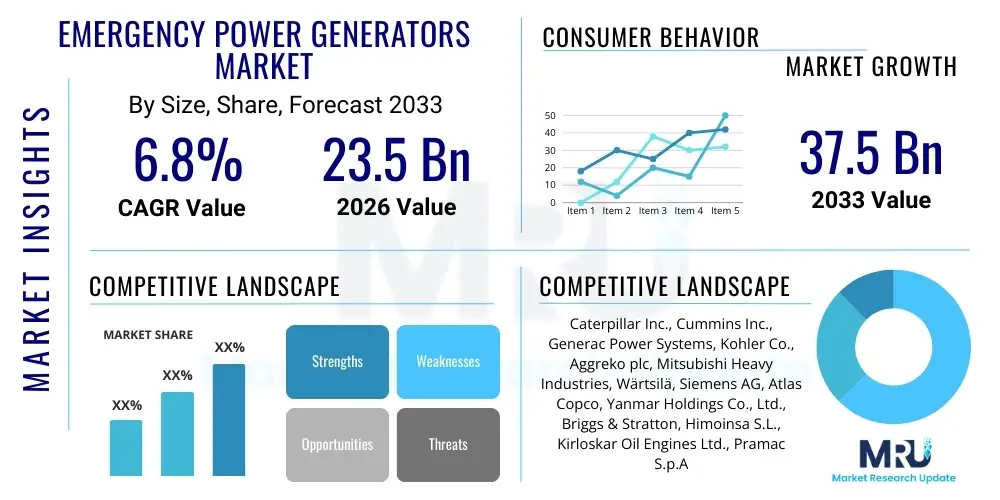

The Emergency Power Generators Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 23.5 Billion in 2026 and is projected to reach USD 37.5 Billion by the end of the forecast period in 2033.

Emergency Power Generators Market introduction

The Emergency Power Generators Market encompasses the production, distribution, and utilization of systems designed to provide electrical power during outages, utility disruptions, or in areas where grid connectivity is unreliable or non-existent. These generators are critical infrastructure components across numerous sectors, ensuring continuity of operations, safety, and mission-critical functionality. The product range is highly diverse, including diesel, natural gas, propane, and increasingly, hybrid and renewable-source generators, spanning capacities from small portable units for residential use to massive industrial systems capable of powering data centers, hospitals, and entire manufacturing facilities. The primary function of an emergency generator is rapid and reliable activation upon loss of primary power, often utilizing automated transfer switch (ATS) technology to seamlessly bridge the gap until grid power is restored or until manual shutdown. Market expansion is intrinsically linked to rising urbanization, the increasing frequency of extreme weather events, and stringent regulatory requirements for operational resilience in critical infrastructure.

Major applications of emergency power generators are predominantly found in sectors requiring zero downtime, such as healthcare facilities (hospitals, clinics), telecommunications (cell towers, data centers), and utility infrastructure (water treatment plants, pumping stations). Furthermore, commercial enterprises, including large retail outlets, banking institutions, and manufacturing plants, rely heavily on these systems to prevent significant economic losses associated with production halts or data corruption. The benefit profile of these generators centers on minimizing financial risk, safeguarding life and health, and ensuring compliance with disaster recovery protocols. Modern generators are also becoming more efficient, quieter, and cleaner, integrating advanced monitoring systems for proactive maintenance and performance optimization, thereby enhancing their overall value proposition across sophisticated industrial landscapes.

The driving factors for market growth are multifaceted. Rapid growth in the construction of hyperscale data centers globally, particularly in the Asia Pacific and North American regions, represents a colossal demand driver, as these facilities require redundant, multi-megawatt backup systems. Similarly, global instabilities, geopolitical risks, and the consequential fragility of power grids necessitate enhanced resilience planning across developed and developing economies. Government mandates related to essential services, coupled with consumer expectations for uninterrupted connectivity and services, further solidify the foundational demand for robust and reliable emergency power solutions, propelling continuous innovation in fuel efficiency and low-emission technologies within the market sphere.

Emergency Power Generators Market Executive Summary

The Emergency Power Generators Market exhibits robust growth, driven by escalating digitalization and increasing vulnerability of centralized power grids to climatic events and cyber threats. Key business trends indicate a definitive shift toward cleaner fuel sources, notably natural gas generators, which offer lower operational costs and reduced emissions compared to traditional diesel variants. Furthermore, the market is experiencing significant technological innovation characterized by advanced remote monitoring capabilities (IoT integration), predictive maintenance protocols, and modular power solutions that allow for scalable deployment. Strategic partnerships focused on integrated energy solutions, combining generators with battery storage (hybrid systems), are becoming a core competitive strategy for major players aiming to address demands for greater energy efficiency and environmental sustainability compliance, particularly in regulated markets across Europe and North America.

Regionally, the Asia Pacific (APAC) stands out as the fastest-growing market, primarily fueled by massive infrastructure development in countries like China and India, coupled with chronic power deficits and unreliable grid infrastructure across Southeast Asian nations. North America and Europe, while mature markets, maintain high demand due to stringent regulatory frameworks governing critical infrastructure resilience and the high penetration rate of data centers and telecommunication hubs. The regional trend is characterized by a strong focus on compliance with emission standards in developed economies, forcing manufacturers to invest heavily in Tier 4 compliant diesel engines and cleaner alternatives. Meanwhile, the Middle East and Africa (MEA) continue to provide substantial opportunities, particularly in oil and gas exploration sites and regions experiencing rapid urbanization without corresponding improvements in utility services.

Segmentation trends reveal strong growth in the medium to high capacity range (above 300 kVA), primarily attributable to rising demand from industrial sectors, large commercial complexes, and data centers. By fuel type, the natural gas segment is projected to gain significant market share, challenging diesel’s traditional dominance due to favorable pricing, superior environmental performance, and enhanced logistics compared to liquid fuels. End-user segmentation shows that the Industrial segment, encompassing manufacturing, utilities, and mining, remains the largest consumer, but the Telecommunications and IT sector is exhibiting the highest growth rate, reflecting the global dependency on continuous digital connectivity and the concurrent construction boom in cloud infrastructure.

AI Impact Analysis on Emergency Power Generators Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Emergency Power Generators Market commonly revolve around themes of predictive failure analysis, optimization of generator deployment and cycling, integration with smart grid technologies, and the role of machine learning in enhancing fuel efficiency. Users are keenly interested in how AI can transition maintenance from reactive to truly predictive, minimizing costly downtime. Concerns also surface regarding the cybersecurity implications of integrating AI-driven systems and the requisite standardization for data exchange between generator systems, Automated Transfer Switches (ATS), and central energy management platforms. Key expectations center on AI’s ability to dynamically manage hybrid power sources (generators, solar, battery storage) to ensure maximum reliability and cost-effectiveness during power events, leading to a smarter, more autonomous emergency power ecosystem.

AI's primary influence is manifesting in operational efficiency and reliability. Machine learning algorithms are now processing vast amounts of operational data—including load fluctuations, engine diagnostics, temperature variations, and environmental inputs—to predict component failures with high accuracy before they occur. This paradigm shift toward predictive maintenance drastically reduces unplanned outages, extending the operational life of the equipment and lowering overall total cost of ownership (TCO). Furthermore, AI is crucial for optimizing the complex interplay within hybrid power systems. It intelligently decides when to use stored battery power, when to cycle the generator for optimal efficiency, and when to sell excess power back to the grid (if applicable), maximizing resilience while minimizing fuel consumption and carbon footprint, particularly in microgrid applications.

Beyond diagnostics, AI is also enhancing the deployment and design phase. AI algorithms can analyze complex site data, including historical outage patterns, maximum load requirements, and physical constraints, to recommend optimal generator sizing and placement, ensuring resilience targets are met without over-specifying equipment. This sophistication in system design, coupled with real-time optimization during active operation, positions AI not just as a monitoring tool, but as a critical component that enhances the fundamental value proposition of emergency power generation: guaranteed power assurance. The future direction involves integrating AI directly into ATS systems, enabling decisions on load shedding or prioritization based on real-time operational necessity and established business rules, thereby creating truly 'smart' backup systems.

- AI-driven Predictive Maintenance: Utilizing ML algorithms to forecast component failure, drastically reducing unplanned downtime and optimizing service schedules.

- Dynamic Load Management: Real-time adjustment of generator output and load distribution based on immediate operational needs and consumption patterns.

- Hybrid System Optimization: Intelligent management of combined power sources (generator, battery, solar) for enhanced fuel efficiency and emissions reduction.

- Cybersecurity and Monitoring: AI enhances the security of remote monitoring systems by detecting anomalous behavior indicative of cyber threats.

- Optimal Sizing and Deployment: Use of historical data analysis to recommend highly accurate generator capacity and placement during the planning phase.

DRO & Impact Forces Of Emergency Power Generators Market

The market dynamics of emergency power generators are shaped by a complex interplay of Drivers (D), Restraints (R), and Opportunities (O), which dictate investment decisions and technological focus across the industry. The primary drivers revolve around the non-negotiable need for business continuity and societal stability, particularly in critical sectors. Restraints often center on environmental concerns associated with fossil fuels, high initial capital expenditure, and the logistical challenges of managing large, complex machinery. Opportunities are emerging mainly through digitalization, the energy transition, and the adoption of decentralized power generation models, collectively defining the market's growth trajectory and influencing the strategic direction of key manufacturers.

Key drivers include the global expansion of digital infrastructure, requiring uninterruptible power for data centers, 5G networks, and cloud computing services. Simultaneously, the accelerating impact of climate change—manifested through increased frequency and intensity of natural disasters like hurricanes, wildfires, and floods—exposes grid vulnerabilities, making decentralized emergency backup power essential. Regulatory requirements in developed economies also act as a powerful driver, mandating standby power provision in public health, safety, and financial services sectors. These drivers exert substantial positive pressure on market growth, encouraging both volume sales and technological advancements in resilience features.

However, growth is moderated by significant restraints. High operating costs associated with rising fuel prices (for diesel/gas), coupled with stringent emission regulations (e.g., EU Stage V, US EPA Tier 4), increase the complexity and cost of compliance for manufacturers and end-users alike. The market faces a restraint in the form of substantial initial investment required for high-capacity industrial generators, which can be prohibitive for smaller enterprises. Despite these hurdles, lucrative opportunities exist in hybrid power integration (generator + battery storage), the burgeoning microgrid market, and the transition toward hydrogen and biofuel-powered generators, which promise sustainable, long-term solutions, providing pathways to overcome environmental restraints and capture high-growth segments focused on sustainability.

Impact Forces Summary:

- Drivers: Rapid growth in data center construction; increasing frequency of grid-disrupting natural disasters; stricter regulatory requirements for critical infrastructure uptime; global expansion of 5G and telecommunication networks.

- Restraints: High capital investment and maintenance costs; volatility of fossil fuel prices; increasing stringency of global and regional emission standards (e.g., NOx, particulate matter); land use and noise restrictions in urban settings.

- Opportunities: Development of hybrid generator-battery storage systems; technological advancements in cleaner fuels (hydrogen, biofuels, natural gas); expansion of decentralized microgrid infrastructure; integration of IoT and AI for predictive maintenance and remote monitoring.

Segmentation Analysis

The Emergency Power Generators Market is rigorously segmented based on Capacity (kVA), Fuel Type, Application (End-User), and Phase (Single/Three). This comprehensive segmentation allows stakeholders to analyze specific demand patterns, track technological shifts, and target high-growth niches effectively. The dominance of segments varies significantly by geography; for instance, high-capacity, three-phase generators dominate the industrial landscape, while residential and small commercial sectors rely more heavily on lower capacity, often single-phase, gasoline, or propane-fueled units. Understanding the nuances within each segment, especially the transition from traditional diesel dominance to hybrid and natural gas solutions, is crucial for market positioning and competitive advantage, driven fundamentally by operational cost efficiencies and environmental compliance.

- By Fuel Type: Diesel, Natural Gas, Gasoline, Propane, Others (Hydrogen, Biofuel)

- By Capacity: Below 75 kVA, 75 kVA – 375 kVA, 375 kVA – 750 kVA, Above 750 kVA

- By Phase: Single Phase, Three Phase

- By Application (End-User): Residential, Commercial (Retail, Offices, Hospitality), Industrial (Manufacturing, Oil & Gas, Mining), Telecommunications & IT (Data Centers), Healthcare, Utilities

Value Chain Analysis For Emergency Power Generators Market

The value chain for emergency power generators is intricate, commencing with the upstream sourcing of raw materials, particularly specialized metals and components for engine manufacturing, alternator winding, and advanced control systems. Key upstream activities involve R&D focused on engine efficiency, emissions reduction, and integration technologies. Suppliers include engine manufacturers (e.g., Cummins, Caterpillar), alternator producers, and component specialists providing enclosures and cooling systems. The quality and availability of these specialized components directly impact the final product's reliability and cost. Strong strategic relationships with reputable engine suppliers are paramount for maintaining product quality and meeting regulatory certifications, especially regarding emissions standards (Tier 4/Stage V).

Midstream activities involve core manufacturing, assembly, system integration, and rigorous testing. This is where the generator set (genset) is constructed, integrating the engine, alternator, base frame, cooling system, and control panel. OEMs invest heavily in manufacturing precision and automated testing facilities to ensure generator performance under varying load conditions. A critical midstream step is the integration of sophisticated control electronics and transfer switches, often involving partnerships with specialized electronic component providers to facilitate features like remote monitoring, parallel operation, and seamless utility synchronization, which are essential for high-capacity industrial applications.

Downstream analysis focuses on distribution channels and after-sales service. Distribution often utilizes a dual approach: direct sales for large industrial projects (ensuring high customization and technical support) and indirect channels through authorized dealers, distributors, and rental fleets for smaller commercial and residential units. After-sales service, including preventative maintenance, parts supply, and repair, represents a significant revenue stream and a core competitive differentiator. Effective service networks ensure maximum uptime, which is the primary metric of success for emergency power solutions. The market highly values service contracts and the efficiency of the supply chain for replacement parts, thereby influencing customer loyalty and repeat business.

Emergency Power Generators Market Potential Customers

Potential customers for the Emergency Power Generators Market span the entire economic spectrum, dictated by their operational requirements for continuous power supply. The primary segment comprises large institutions and industries where power outages translate directly into immediate danger, catastrophic financial loss, or major regulatory non-compliance. Healthcare providers, such as hospitals and surgical centers, represent a crucial segment, as mandated by law to maintain redundant power systems for life support and critical functions. Financial institutions and data centers are also high-value customers, requiring complex, multi-megawatt configurations to safeguard transactional integrity and maintain 24/7 data access, often utilizing N+1 or 2N redundancy strategies.

Another significant pool of buyers resides within the essential services and infrastructure sector, including public utilities (water and sewage treatment, communication masts), government facilities (emergency services, defense installations), and transportation hubs (airports, railway control centers). These entities prioritize long-run time, robust construction, and compliance with stringent public safety standards. The growing trend toward decentralized power solutions also expands the customer base to include developers of community microgrids and remote energy infrastructure projects, particularly in developing regions or areas isolated from the main utility grid, driving demand for innovative, smaller-scale, often containerized solutions.

Finally, the commercial and residential sectors constitute a steadily growing customer base. Commercial customers, including large retail chains, hotels, and manufacturing plants, purchase generators to protect inventory, maintain security systems, and avoid operational stoppages during peak business hours. Residential demand, particularly in regions prone to severe weather or unreliable grids, is focused on smaller, affordable, often gas or propane-fueled generators, driven by increasing consumer awareness of personal comfort and security during extended outages. These varied customer profiles necessitate a highly customized product offering from manufacturers across capacity, fuel type, and price point.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 23.5 Billion |

| Market Forecast in 2033 | USD 37.5 Billion |

| Growth Rate | CAGR 6.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Caterpillar Inc., Cummins Inc., Generac Power Systems, Kohler Co., Aggreko plc, Mitsubishi Heavy Industries, Wärtsilä, Siemens AG, Atlas Copco, Yanmar Holdings Co., Ltd., Briggs & Stratton, Himoinsa S.L., Kirloskar Oil Engines Ltd., Pramac S.p.A., Broadcrown (Puma Power), MTU Onsite Energy (Rolls-Royce), Multiquip Inc., JCB Power Products, General Electric (GE), Teksan Generator |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Emergency Power Generators Market Key Technology Landscape

The technology landscape of the emergency power generator market is rapidly evolving, moving beyond simple combustion engines toward sophisticated, intelligent power management systems. One of the most critical technological advancements is the shift to high-efficiency, low-emission engines, driven by global mandates like Tier 4 Final in the US and Stage V in the EU. This involves complex exhaust after-treatment systems, including Diesel Particulate Filters (DPF) and Selective Catalytic Reduction (SCR) technology, significantly increasing the complexity and cost but ensuring environmental compliance, which is a major purchasing criterion in developed markets. Simultaneously, advancements in natural gas engine technology are improving power density and reducing maintenance cycles, making them a viable alternative to diesel in various standby applications, particularly where continuous refueling is challenging.

Another pivotal technological trend is the integration of Internet of Things (IoT) and cloud-based monitoring solutions. Modern generator control panels are equipped with sensors and communication modules that allow operators to remotely monitor performance metrics—such as fuel level, oil pressure, battery voltage, and load output—from anywhere in the world. This remote diagnostic capability facilitates true predictive maintenance, allowing service technicians to address potential issues proactively, often via firmware updates or targeted maintenance interventions, thereby maximizing the generator's uptime and reliability, a critical factor for sectors like data centers. Furthermore, these smart systems enable remote start/stop functionality and precise data logging for compliance and optimization purposes.

The market is also witnessing significant technological focus on hybridization and integration into microgrids. This involves developing advanced power electronics and control systems that seamlessly integrate the generator with battery energy storage systems (BESS), solar photovoltaics (PV), and sophisticated Automated Transfer Switches (ATS). The resulting hybrid solution allows the generator to run fewer hours, often at higher efficiency points, while the battery handles short-duration outages or peak shaving, leading to fuel savings, reduced noise pollution, and extended generator lifespan. Technology innovation is currently centered on optimizing the communication protocols and energy management algorithms necessary for these complex, multi-source power systems to operate cohesively and autonomously during grid disruptions, further strengthening resilience against increasingly volatile grid conditions.

Regional Highlights

Geographical analysis reveals stark differences in market maturity, regulatory environment, and primary demand drivers across continents, leading to distinct regional growth trajectories and competitive landscapes.

- North America: This region is characterized by high demand for sophisticated, high-capacity generators, primarily driven by the colossal expansion of data centers, telecommunications infrastructure, and stringent regulatory requirements for healthcare and utilities resilience. The market here is mature but experiences high replacement demand. Key drivers include extreme weather events (hurricanes, ice storms) and the need for Tier 4 compliant, low-emission diesel and natural gas units. Adoption of hybrid solutions (generator + battery storage) is growing rapidly, particularly in urban areas prioritizing sustainability and noise reduction.

- Europe: The European market is highly regulated, prioritizing low emissions (Stage V standards) and energy efficiency. Demand is stable, centered on securing industrial manufacturing facilities and critical public services. There is a notable trend towards natural gas and gas-powered cogeneration (CHP/Cogen) solutions due to environmental policies and favorable infrastructure. Geopolitical concerns regarding energy security and grid stability in Eastern Europe also contribute to steady market demand for standby power.

- Asia Pacific (APAC): APAC is the epicenter of growth due to rapid industrialization, massive infrastructure investment, and persistently unreliable or insufficient utility grids in major developing nations (India, Indonesia, Vietnam). Demand spans all capacities, from small residential units addressing daily load shedding to multi-megawatt installations for mega-factories and new city developments. Low-cost diesel remains dominant in many sub-regions, but large, multinational operations are increasingly demanding cleaner, natural gas, or dual-fuel solutions.

- Latin America (LATAM): Market demand is highly correlated with economic stability and investment in key sectors like mining, oil and gas, and telecommunications. Grid instability across several large economies (e.g., Brazil, Mexico) fuels strong demand for reliable backup power for commercial continuity. The region shows a preference for robust, reliable diesel generators capable of handling harsh operating environments and fluctuating fuel quality, although urbanization is beginning to spur interest in cleaner alternatives.

- Middle East and Africa (MEA): This region is crucial for off-grid power generation, especially in remote oil and gas fields and rapidly expanding urban areas where infrastructure struggles to keep pace. High-temperature operation and fuel logistics are key considerations. The Middle East maintains strong demand driven by government projects and high-load industrial applications, while Africa presents opportunities in decentralized power solutions, telecom towers, and mining operations, often requiring rugged, high-reliability diesel generators capable of long-term independent operation.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Emergency Power Generators Market.- Caterpillar Inc.

- Cummins Inc.

- Generac Power Systems

- Kohler Co.

- Aggreko plc

- Mitsubishi Heavy Industries

- Wärtsilä

- Siemens AG

- Atlas Copco

- Yanmar Holdings Co., Ltd.

- Briggs & Stratton

- Himoinsa S.L.

- Kirloskar Oil Engines Ltd.

- Pramac S.p.A.

- Broadcrown (Puma Power)

- MTU Onsite Energy (Rolls-Royce)

- Multiquip Inc.

- JCB Power Products

- General Electric (GE)

- Teksan Generator

Frequently Asked Questions

Analyze common user questions about the Emergency Power Generators market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth rate (CAGR) for the Emergency Power Generators Market through 2033?

The Emergency Power Generators Market is projected to exhibit a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033, driven primarily by increasing grid instability and the global proliferation of data centers.

Which fuel type is expected to gain the most market share in the coming years?

Natural gas generators are projected to gain significant market share, surpassing gasoline and challenging diesel, due to their lower environmental impact, reduced operational costs, and increasing integration into modern hybrid power solutions.

How is AI impacting the maintenance and operational efficiency of emergency generators?

AI is fundamentally transforming maintenance through predictive diagnostics, utilizing machine learning algorithms to anticipate component failures and optimize generator cycling, thus maximizing uptime and reducing unplanned service interventions.

Which application segment holds the largest share in the Emergency Power Generators Market?

The Industrial segment, which includes manufacturing, utilities, and large infrastructure projects, historically holds the largest market share, though the Telecommunications and IT sector exhibits the fastest growth due to hyperscale data center expansion.

What are the primary restraints hindering the growth of this market?

Key restraints include the high initial capital expenditure required for large-scale systems, the volatility of fossil fuel prices, and the increasing stringency of global environmental regulations requiring complex and costly emissions control technologies.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager