Employee Onboarding Software Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441094 | Date : Feb, 2026 | Pages : 241 | Region : Global | Publisher : MRU

Employee Onboarding Software Market Size

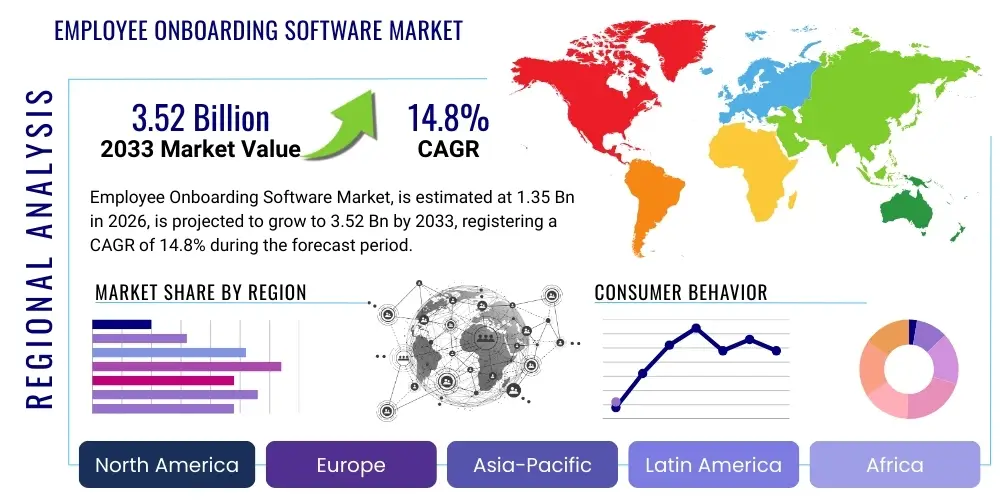

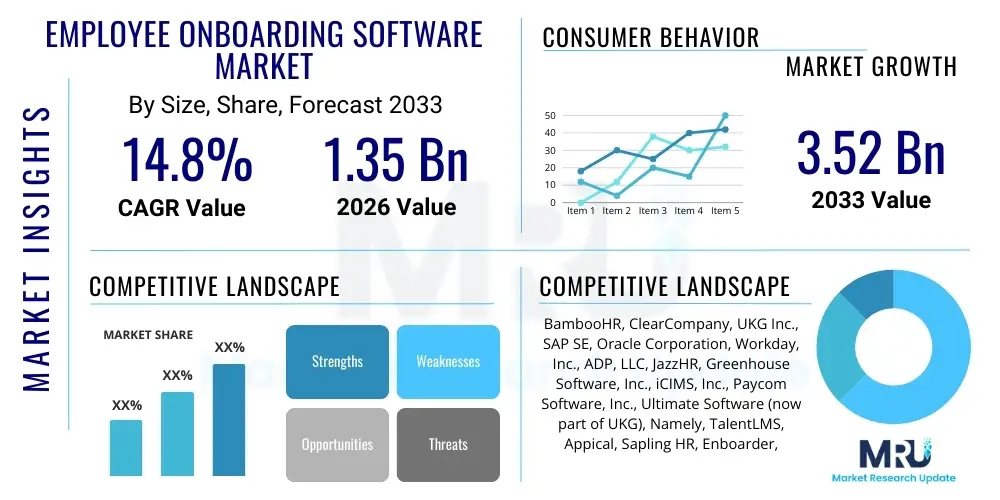

The Employee Onboarding Software Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 14.8% between 2026 and 2033. The market is estimated at USD 1.35 Billion in 2026 and is projected to reach USD 3.52 Billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the increasing recognition among global enterprises of the critical link between efficient onboarding processes and sustained employee retention and productivity. As organizations increasingly adopt hybrid and remote work models, the necessity for robust, automated, and standardized digital onboarding solutions becomes paramount, fueling significant investment across small, medium, and large enterprises seeking to optimize the initial employee experience.

Employee Onboarding Software Market introduction

The Employee Onboarding Software Market encompasses specialized digital solutions designed to automate, streamline, and standardize the integration of new hires into an organization. This software facilitates the necessary administrative tasks, legal compliance checks, cultural assimilation, and technical setup required when a new employee joins. Key functionalities often include digital forms completion, training module assignment, policy acknowledgment tracking, and seamless integration with existing Human Resources Information Systems (HRIS). The primary objective of these platforms is to transform what historically was a disjointed and paper-heavy process into an engaging, consistent, and efficient digital experience, reducing time-to-productivity for new employees and minimizing administrative burdens on HR staff.

Major applications of employee onboarding software span across diverse sectors, including IT and Telecom, Banking, Financial Services, and Insurance (BFSI), Healthcare, Manufacturing, and Retail. Within these applications, the software serves several critical purposes, such as compliance management—ensuring all local and international regulatory requirements regarding employment documentation are met—and enhancing employee engagement from day one. By providing a personalized, structured introduction to the company culture and roles, these platforms significantly improve the likelihood of long-term employee commitment. The core benefits realized by organizations utilizing these solutions include marked reductions in new hire turnover, substantial time savings for HR departments, improved data accuracy, and a demonstrably stronger employer brand reputation, particularly in competitive labor markets where the initial employee experience dictates perceived organizational quality.

Driving factors underpinning the market growth are multifaceted, anchored primarily by the accelerating digital transformation within the HR function globally. The shift towards remote and hybrid work necessitates digital solutions that can facilitate onboarding without physical presence, making software indispensable. Furthermore, heightened scrutiny on corporate compliance and stricter data privacy regulations compel businesses to adopt automated systems that securely manage sensitive employee data and documentation. The push for improved talent acquisition outcomes, recognizing that a positive onboarding experience is crucial for retention, acts as a continuous impetus for organizations to invest in sophisticated, user-friendly onboarding platforms that deliver immediate value to both the employee and the business. This strategic investment in human capital management technologies is a non-negotiable step for modern, scaling enterprises.

Employee Onboarding Software Market Executive Summary

The Employee Onboarding Software Market is characterized by robust growth, driven by enterprise demands for digital efficiency and superior employee experience in a globalized, often remote, work environment. Business trends indicate a strong move toward platform consolidation, where onboarding capabilities are increasingly integrated within broader Human Capital Management (HCM) suites, though specialized, best-of-breed solutions still capture significant market share, particularly among mid-sized companies seeking deep customization. Regional trends reveal North America and Europe as leading adopters due to established regulatory frameworks and high labor costs necessitating efficiency gains, while the Asia Pacific (APAC) region is demonstrating the fastest growth owing to rapid digitalization and burgeoning enterprise populations. Segmentation trends highlight the cloud-based deployment model dominating the landscape due to its scalability and low implementation cost, coupled with a rising emphasis on AI-driven personalization and automation within the functional features of the software, signifying a market shift from simple compliance tools to strategic engagement platforms. The market remains competitive, with vendors continually innovating features focused on pre-boarding engagement and post-onboarding follow-up to ensure continuity in the employee journey.

AI Impact Analysis on Employee Onboarding Software Market

User inquiries regarding Artificial Intelligence (AI) in employee onboarding software center predominantly on its capacity to personalize the new hire experience, automate complex workflow decisions, and predict potential early attrition risk. Common user questions probe the effectiveness of AI-driven chatbots for instant Q&A, the use of machine learning algorithms to tailor training paths based on individual background and role requirements, and the integration of predictive analytics to flag new hires who might be struggling or disengaging during the initial phase. Users seek clarity on how AI can move onboarding beyond a mere transactional process into a genuinely personalized and supportive experience. Based on this analysis, the key themes are efficiency gains through intelligent automation, enhancing employee support via immediate AI interaction, and leveraging predictive insights to increase retention rates. The general expectation is that AI will transform onboarding from static paperwork management into a dynamic, adaptive, and highly effective talent assimilation strategy, though concerns remain regarding data privacy and the ethical implications of using AI for performance and retention prediction.

- AI-powered workflow automation minimizes administrative overhead by intelligently routing documents and approvals.

- Predictive analytics identifies new hires at risk of early departure, allowing HR to implement targeted intervention strategies proactively.

- Conversational AI and chatbots provide 24/7 instant support for common procedural questions, enhancing perceived responsiveness.

- Machine learning algorithms personalize training content and task sequencing based on individual learning pace and previous professional history.

- AI-driven sentiment analysis monitors engagement levels during the initial weeks, offering real-time feedback loops to management.

DRO & Impact Forces Of Employee Onboarding Software Market

The market dynamics are fundamentally shaped by a confluence of influential factors: Drivers (D) emphasize the necessity of efficiency and engagement, Restraints (R) pertain largely to implementation hurdles and data complexity, Opportunities (O) focus on integration capabilities and specialized features, and Impact Forces summarize the overall pressure points governing investment decisions. The overarching narrative is that while the imperative to digitize HR processes is strong—driven by remote work normalization and the war for talent—organizational inertia, high initial capital expenditure for comprehensive systems, and challenges related to integrating disparate legacy HR systems present meaningful obstacles. Nevertheless, the growing sophistication of cloud technology and AI integration offers significant avenues for market expansion, particularly in developing economies and specialized vertical markets demanding compliance rigor.

Major market drivers include the global expansion of remote and hybrid working models, which renders paper-based or manual processes obsolete, necessitating cloud-based automation for distributed teams. Furthermore, intense competition for skilled talent across all industries compels organizations to prioritize an outstanding employee experience (EX) starting immediately with pre-boarding, as positive early experiences correlate directly with higher retention rates. Regulatory compliance complexity, particularly regarding cross-border employment and data handling (e.g., GDPR, CCPA), also forces companies toward standardized software solutions that can track and verify adherence automatically. These factors collectively push companies toward adopting advanced onboarding systems that are scalable, compliant, and highly engaging for modern workforces, cementing the market’s trajectory of accelerated adoption and continuous feature enhancement over the forecast period. The pressure to reduce time-to-productivity for new hires is an economic driver that cannot be ignored.

Conversely, the market faces significant restraints. High implementation costs and the substantial time commitment required for customization and integrating new software with existing legacy HR ecosystems (like payroll and core HRIS) deter smaller organizations or those with budget constraints. Data security and privacy concerns also act as a constraint, especially given the sensitive nature of employee personal and financial information handled during onboarding; companies often hesitate to move this data to third-party cloud solutions without robust assurances. Opportunities, however, abound, centered around the development of niche solutions for specific high-regulation industries (e.g., finance and healthcare) and the further refinement of mobile-first onboarding experiences, catering to deskless workers and younger generations entering the workforce. The convergence of onboarding, learning management systems (LMS), and performance management modules into seamless platforms represents a compelling opportunity for comprehensive vendors, driving higher average contract values and broader organizational adoption. These impact forces necessitate strategic positioning by vendors, focusing equally on robust security protocols and demonstrable return on investment (ROI) via retention improvements.

Segmentation Analysis

The Employee Onboarding Software Market is structurally segmented based on crucial attributes including deployment type, enterprise size, component, and end-use industry. This segmentation provides a granular view of market dynamics, revealing varying adoption rates and feature preferences across different organizational profiles. Deployment type, primarily split between cloud and on-premise solutions, reflects the overarching trend of cloud migration within enterprise software, driven by demands for scalability and accessibility. Segmentation by enterprise size (SMEs vs. Large Enterprises) highlights differing budgetary allocations and feature requirements, with SMEs often prioritizing cost-effectiveness and ease of use, while large enterprises demand sophisticated integrations, deep customization, and global compliance capabilities. Analyzing these segments is critical for vendors aiming to target specific customer demographics with tailored product offerings and marketing strategies, ensuring solution alignment with operational needs and infrastructure capabilities.

- By Deployment Type:

- Cloud-based

- On-premise

- By Component:

- Software/Platform

- Services (Implementation, Training, Support, Consulting)

- By Enterprise Size:

- Small and Medium Enterprises (SMEs)

- Large Enterprises

- By End-Use Industry:

- IT and Telecommunication

- BFSI (Banking, Financial Services, and Insurance)

- Healthcare

- Manufacturing

- Retail and Consumer Goods

- Government and Public Sector

- Others (Education, Energy)

Value Chain Analysis For Employee Onboarding Software Market

The value chain for the Employee Onboarding Software market begins with core software developers and technology providers (upstream), moves through integration and implementation services, and culminates with the end-user organizations (downstream). Upstream analysis centers on the development of highly specialized features, including AI integration for personalization, robust security architecture, and seamless API development to ensure compatibility with existing HR technology stacks (HRIS, payroll, LMS). The competitiveness at this stage is dictated by technological superiority and the speed of innovation, specifically in incorporating emerging technologies like blockchain for secure credential management or advanced analytics for predictive modeling. Successful upstream participants invest heavily in R&D to maintain a feature advantage and enhance user experience (UX).

Downstream activities involve the successful implementation and utilization of the software by client organizations. This phase is heavily dependent on professional services—including system customization, data migration, user training, and ongoing technical support—often provided either directly by the software vendor or through certified third-party implementation partners. The distribution channel analysis is critical here: Direct sales channels are frequently used for large enterprise clients requiring complex, custom solutions and dedicated account management, ensuring closer vendor-client collaboration. Conversely, indirect channels, primarily through HR technology consultancies, system integrators, and channel partners (resellers), are vital for reaching the broad SME market and ensuring regional accessibility and localized support capabilities. The effectiveness of the distribution network determines market reach and the scalability of the vendor's operations.

The successful delivery of value relies on minimizing friction during integration and maximizing user adoption among both HR professionals and new hires. Direct distribution ensures greater control over the implementation quality and brand experience, which is crucial for maintaining high customer retention rates, particularly in the subscription-based Software as a Service (SaaS) model prevalent in this market. Indirect distribution expands the geographical footprint rapidly and leverages partners' expertise in vertical integration, making specialized solutions more accessible. Regardless of the channel, comprehensive support services are non-negotiable, as the sensitivity of onboarding data and processes demands continuous reliability and quick resolution of technical issues, emphasizing the service component's high value within the overall software package.

Employee Onboarding Software Market Potential Customers

The primary potential customers and end-users of Employee Onboarding Software span every industry that experiences significant employee turnover, rapid growth, or operates across geographically dispersed locations. Large enterprises are major buyers due to the sheer volume of new hires and the complexity of managing multinational compliance requirements, often necessitating high-end, fully integrated HCM suites that include advanced onboarding modules. However, Small and Medium Enterprises (SMEs) represent a rapidly growing segment of potential buyers; while they might lack the extensive budgets of large corporations, they possess an equally urgent need to streamline HR operations and professionalize their image to compete for talent. SMEs are particularly attracted to cloud-based, subscription (SaaS) solutions that offer rapid deployment and lower initial capital outlay, focusing on core functionalities like digital documentation and basic compliance checks.

From an industry perspective, sectors with highly regulated environments, such as BFSI and Healthcare, are critical end-users. These industries mandate meticulous documentation, stringent background checks, and rapid completion of specialized training modules, making automated software an essential tool for audit readiness and risk mitigation. The IT and Telecommunication sector, characterized by high growth and an extreme shortage of specialized talent, heavily invests in superior onboarding experiences to reduce early attrition in highly competitive technical roles. Furthermore, any organization shifting rapidly toward a fully remote or hybrid model post-pandemic is an immediate, high-priority customer, as manual processes become entirely impractical without digital systems capable of handling remote identity verification and equipment distribution logistics. The market is thus defined by the intersection of compliance needs, geographical dispersion, and competitive labor market pressures.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.35 Billion |

| Market Forecast in 2033 | USD 3.52 Billion |

| Growth Rate | 14.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | BambooHR, ClearCompany, UKG Inc., SAP SE, Oracle Corporation, Workday, Inc., ADP, LLC, JazzHR, Greenhouse Software, Inc., iCIMS, Inc., Paycom Software, Inc., Ultimate Software (now part of UKG), Namely, TalentLMS, Appical, Sapling HR, Enboarder, GoCo, Gusto, Lessonly (now part of Seismic) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Employee Onboarding Software Market Key Technology Landscape

The technological landscape of the Employee Onboarding Software market is rapidly evolving, moving beyond simple document management towards integrated, intelligent platforms leveraging cutting-edge advancements. The predominant technology backbone is Software as a Service (SaaS), delivered primarily via cloud infrastructure, which enables easy scaling, rapid updates, and high accessibility across global teams. Crucially, API integration capabilities are fundamental; modern onboarding solutions must communicate seamlessly with existing enterprise systems like payroll, HRIS (e.g., SAP, Oracle), and identity management tools (e.g., Active Directory). The emphasis is on creating a frictionless flow of data without requiring manual entry, significantly reducing data redundancy and potential errors inherent in traditional processes. This reliance on robust API architecture dictates vendor selection and determines the overall longevity and utility of the software within a complex IT ecosystem.

Artificial Intelligence (AI) and Machine Learning (ML) represent the most significant technological advancements currently reshaping the market. AI is utilized to automate decision-making processes, such as intelligent task assignment based on job role or location, and to power conversational interfaces (chatbots) that provide immediate, personalized support to new hires regarding policies or procedures, drastically improving the perceived efficiency of the HR department. Furthermore, the use of sophisticated predictive analytics, often driven by ML algorithms analyzing historical employee data, helps HR teams forecast early turnover risk. Blockchain technology, although still nascent in widespread adoption, is being explored for secure and immutable storage of sensitive credentials, certifications, and compliance documentation, offering enhanced security and simplified verification processes, particularly relevant in highly regulated sectors.

Mobile technology is also indispensable, as new hires increasingly expect to complete tasks and consume introductory content via their personal devices. Employee Onboarding Software vendors must ensure full mobile responsiveness and, ideally, dedicated mobile applications that support functions like document signing (leveraging e-signature technologies), video introductions, and scheduling of initial meetings. The push toward gamification—integrating badge systems, progress bars, and interactive quizzes—utilizes psychological drivers to increase engagement and ensure necessary training modules are completed effectively. The convergence of cloud architecture, AI, mobile accessibility, and robust integration protocols defines the competitive technological edge in this market, pushing solutions providers to deliver platforms that are not just functional but genuinely transformative in the context of human capital management strategy.

Regional Highlights

The global Employee Onboarding Software market exhibits distinct growth patterns and adoption maturity across key geographical regions—North America, Europe, Asia Pacific (APAC), Latin America, and the Middle East and Africa (MEA)—each driven by unique economic and regulatory factors. North America stands as the dominant market, characterized by early adoption of cloud-based HR technology, a high concentration of market leaders and innovative startups, and a culture prioritizing employee experience as a strategic differentiator. The stringent regulatory landscape in the US and Canada regarding employment documentation and data privacy further necessitates the use of automated, compliant software solutions. The strong presence of multinational corporations, coupled with high labor costs, places significant pressure on companies in this region to maximize efficiency through sophisticated HR automation tools.

Europe represents the second-largest market, primarily driven by complex, fragmented compliance requirements across the European Union nations (e.g., GDPR mandates concerning data handling), making standardized onboarding software critical for companies operating across multiple EU borders. Countries like the UK, Germany, and France show high maturity levels, focusing on solutions that integrate well with existing national social security and payroll systems. The emphasis in Europe is often placed on robust data security and localized language support within the onboarding journey. The demand is particularly strong within the banking, pharmaceutical, and manufacturing sectors which face intense regulatory scrutiny, thereby fueling steady, consistent growth in the adoption of enterprise-grade onboarding platforms that guarantee audit trails and legal adherence.

The Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR) during the forecast period. This rapid expansion is attributed to the fast-paced economic development, increased foreign direct investment, and the growing workforce digitalization across major economies like India, China, and Southeast Asian nations. Companies in APAC are moving swiftly from manual, paper-based processes directly to advanced cloud-based systems to manage large, diverse, and often rapid hiring cycles. The challenge in APAC lies in catering to diverse languages and localized labor laws; consequently, market success hinges on vendor flexibility and the ability to customize platforms quickly for various regional nuances. Meanwhile, Latin America (LATAM) and the Middle East and Africa (MEA) are emerging markets, showing gradual adoption centered initially on large oil, gas, and governmental entities, with future growth dependent on improved internet infrastructure and greater penetration of SME digitalization initiatives.

- North America: Market leader; driven by advanced cloud adoption, intense focus on employee experience (EX), and high compliance needs (e.g., I-9 documentation). Key adoption centers include the US and Canada, supporting a large volume of remote and tech-focused employment.

- Europe: Second largest market; growth spurred by the necessity to navigate complex, cross-border regulatory compliance (GDPR, localized labor laws). Strong adoption in the UK and DACH regions (Germany, Austria, Switzerland) in finance and manufacturing.

- Asia Pacific (APAC): Fastest-growing region; rapid digitalization across large economies (India, China) and necessity for scalable solutions to handle large, distributed workforces. Focus on multi-language support and regional customization.

- Latin America (LATAM): Emerging market; increasing adoption spurred by foreign investment and the modernization of public sector HR systems. Adoption concentrated in major economies like Brazil and Mexico.

- Middle East and Africa (MEA): Nascent growth; driven by large enterprise and governmental entities focusing on digital transformation initiatives, particularly within the Gulf Cooperation Council (GCC) countries where expatriate onboarding is complex.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Employee Onboarding Software Market.- UKG Inc. (Ultimate Software Group, Inc.)

- SAP SE

- Oracle Corporation

- Workday, Inc.

- ADP, LLC

- BambooHR

- ClearCompany

- JazzHR

- Greenhouse Software, Inc.

- iCIMS, Inc.

- Paycom Software, Inc.

- Namely

- TalentLMS

- Appical

- Sapling HR (now part of Kallidus)

- Enboarder

- GoCo

- Gusto

- Lessonly (now part of Seismic)

- Cornerstone OnDemand

Frequently Asked Questions

Analyze common user questions about the Employee Onboarding Software market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth rate (CAGR) for the Employee Onboarding Software Market?

The Employee Onboarding Software Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 14.8% between 2026 and 2033. This robust growth is fueled by global corporate digitalization and the shift toward remote and hybrid work models, necessitating automated HR functions.

How does AI impact the effectiveness of employee onboarding solutions?

AI significantly impacts onboarding effectiveness by enabling high degrees of personalization through tailored training paths, automating complex procedural workflows, and leveraging predictive analytics to identify and mitigate early attrition risks, transforming transactional processes into strategic engagement opportunities.

Which deployment type currently dominates the Employee Onboarding Software market?

The cloud-based (SaaS) deployment model dominates the market. Cloud solutions offer superior scalability, accessibility for distributed workforces, rapid implementation, and continuous updates, making them the preferred choice for both SMEs and large global enterprises seeking efficiency.

What are the primary restraints preventing faster market adoption?

Primary restraints include the high initial cost of enterprise systems, significant complexity involved in integrating new onboarding software with established legacy HR systems (HRIS, payroll), and ongoing organizational concerns regarding data security and privacy compliance during migration.

Which geographical region exhibits the fastest growth potential in this market?

The Asia Pacific (APAC) region is expected to demonstrate the highest growth rate, driven by rapid economic digitalization, massive workforce expansion, and the need for scalable, cloud-based systems to manage large, geographically diverse employee bases across key developing economies.

What distinguishes specialized onboarding software from general HRIS modules?

Specialized onboarding software focuses deeply on the end-to-end new hire experience, often including advanced pre-boarding engagement tools, dedicated compliance workflows, personalized training integration, and robust feedback loops, whereas general HRIS modules typically handle only the core administrative data entry aspect.

How important is mobile accessibility in modern onboarding platforms?

Mobile accessibility is critically important, serving as a key driver of engagement and compliance, especially for deskless workers or Gen Z hires. Modern platforms must offer dedicated mobile apps or highly responsive designs to facilitate form completion, e-signing, and initial training consumption conveniently.

In which industries is regulatory compliance the main driver for adoption?

Industries subject to stringent regulatory oversight, most notably Banking, Financial Services, and Insurance (BFSI) and Healthcare, are primary drivers. These sectors rely on automated onboarding software to maintain detailed audit trails, conduct mandatory background checks, and ensure adherence to complex legal and professional standards.

What is the average time-to-value realized by implementing robust onboarding software?

Organizations typically realize value within 6 to 12 months, stemming from measurable reductions in HR administrative time, decreased costs associated with manual errors, and most significantly, improved new hire retention rates and faster time-to-productivity, leading to tangible ROI.

Beyond administration, what strategic function does modern onboarding software fulfill?

Strategically, modern onboarding software acts as a key component of talent management, reinforcing employer branding, ensuring cultural assimilation, and providing the crucial initial support needed to transform a new hire into a long-term, productive employee, directly influencing overall organizational stability and performance.

What role do chatbots play in enhancing the new hire experience?

Chatbots, powered by conversational AI, offer immediate, 24/7 answers to common procedural and policy questions, significantly reducing the burden on HR staff and ensuring new employees feel supported and informed instantly, thus dramatically improving the overall user experience.

Why are SMEs increasingly adopting Employee Onboarding Software?

SMEs are adopting these solutions to professionalize their hiring process, improve competitive standing against larger firms for talent, and utilize cost-effective SaaS solutions to manage growth without disproportionately increasing administrative headcount. Ease of use and rapid deployment are key attractors for this segment.

How does the value chain distinguish between upstream and downstream market activities?

Upstream activities focus on core technology R&D, feature innovation (like AI integration), and platform development by vendors. Downstream activities involve system implementation, consulting services, training, and the actual utilization of the software by end-user organizations, often involving third-party integrators.

What is the current trend regarding integration with Learning Management Systems (LMS)?

There is a strong trend toward seamless, deep integration between onboarding platforms and LMS. This convergence ensures that initial compliance training, role-specific learning modules, and continuous development pathways are automatically assigned and tracked from the employee's very first day, maximizing efficiency.

What is the estimated market value for the Employee Onboarding Software market in 2033?

The market is projected to reach an estimated value of USD 3.52 Billion by the end of the forecast period in 2033, reflecting substantial investment growth driven by the strategic importance of employee retention and digital workflow automation globally.

How do global regulatory shifts, such as GDPR, influence market demand?

Global regulatory shifts like GDPR heavily influence demand by increasing the administrative and legal complexity of managing employee data, compelling companies to adopt automated software solutions that provide robust, auditable data handling and consent tracking mechanisms across various jurisdictions.

What characteristics define a "best-of-breed" onboarding solution versus an HCM suite module?

A "best-of-breed" solution focuses solely on deep onboarding functionality, offering specialized features, superior user experience, and flexible integration options. In contrast, an HCM suite module offers integrated, broader functionality across HR domains but may lack the specialized depth and customization capabilities of a dedicated system.

Why is the reduction of time-to-productivity a crucial economic driver?

Reducing time-to-productivity is vital because it minimizes the period during which a new employee generates costs without fully contributing to output. Efficient onboarding software accelerates this transition by providing necessary resources, training, and tools quickly, maximizing return on labor investment.

What role does gamification play in modern employee onboarding?

Gamification techniques, such as progress tracking, interactive challenges, and reward systems, are used to increase engagement, motivate new hires to complete mandatory documentation and training modules promptly, and reinforce early learning in a dynamic, non-intimidating manner.

Which geographical segment is the market leader in terms of current market share?

North America currently holds the largest market share, attributed to its early technological maturity, high adoption rates among large enterprises, and a mature ecosystem of vendors offering comprehensive, integrated human capital management solutions.

How does onboarding software specifically address the challenges of remote hiring?

Onboarding software addresses remote hiring challenges by facilitating remote identity verification, digitally distributing necessary documents and equipment checklists, providing virtual tours and introductions, and enabling standardized training completion regardless of the employee's physical location.

What impact does negative initial employee experience have on business outcomes?

A negative initial employee experience significantly increases early turnover rates, harms employer brand reputation, lowers team morale, and increases the financial costs associated with repeated recruitment and training efforts, underscoring the necessity of investing in high-quality onboarding tools.

What is the primary differentiation strategy employed by vendors in this highly competitive market?

The primary differentiation strategy involves specializing in vertical industries (e.g., healthcare compliance), offering superior user experience and mobile functionality, and integrating advanced AI capabilities for deep personalization and predictive retention modeling to stand out from generic HR solutions.

How do vendors ensure data security and compliance within their SaaS offerings?

Vendors ensure security through rigorous encryption protocols, adhering to international standards (ISO, SOC 2 compliance), offering multi-factor authentication, and ensuring data residency options to meet specific regional requirements like those mandated by GDPR and CCPA.

What emerging technology is being explored for secure credential management during onboarding?

Blockchain technology is being explored for secure credential management, offering an immutable, decentralized ledger for verifying professional certifications, educational records, and identity documents, enhancing trust and efficiency in background verification processes.

How does the segmentation by enterprise size influence feature preference?

SMEs prioritize cost-effectiveness, rapid implementation, and core compliance features, typically choosing off-the-shelf SaaS. Large enterprises demand complex API integrations, global compliance matrices, deep customization, and advanced AI-driven analytical reporting capabilities.

Why is API integration capability considered a fundamental requirement for modern onboarding software?

API integration is fundamental because onboarding processes rely heavily on data exchange with existing core enterprise systems (HRIS, payroll, CRM). Robust APIs ensure seamless data synchronization, eliminate manual input errors, and allow the onboarding system to function as a crucial hub within the broader HCM ecosystem.

What are the key components of the services segment in this market?

The services component includes crucial elements such as initial implementation support, system customization, data migration from legacy platforms, specialized user training for HR teams and managers, and comprehensive, ongoing technical support and consulting services for optimization.

How do competitive labor markets drive investment in onboarding software?

In competitive labor markets, the quality of the onboarding experience serves as a powerful differentiator and a tool for early retention. Companies invest heavily in sophisticated software to project a modern, organized, and caring employer brand, thereby maximizing the likelihood of retaining high-demand talent.

What is the role of continuous feedback mechanisms post-onboarding?

Post-onboarding feedback mechanisms are essential for continuous improvement. They allow HR to gather real-time data on the employee experience, identify bottlenecks or deficiencies in the assimilation process, and provide data-driven insights to managers for proactive intervention and refinement of future onboarding cycles.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager