Employee Recognition Software Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443228 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Employee Recognition Software Market Size

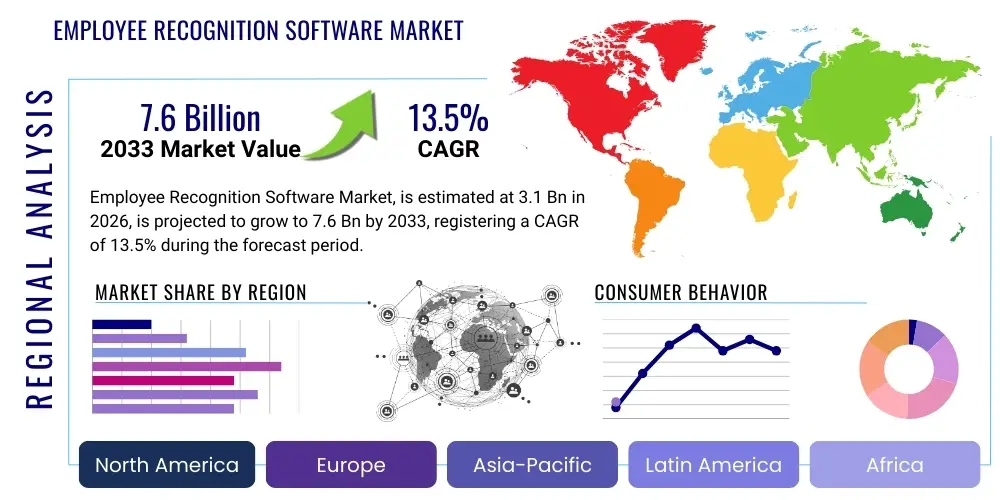

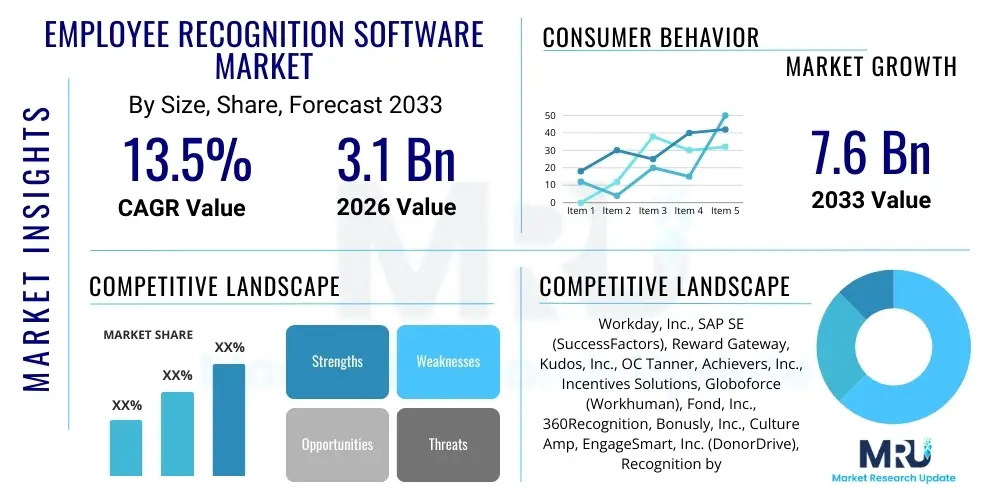

The Employee Recognition Software Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 13.5% between 2026 and 2033. The market is estimated at USD 3.1 Billion in 2026 and is projected to reach USD 7.6 Billion by the end of the forecast period in 2033.

Employee Recognition Software Market introduction

The Employee Recognition Software Market encompasses specialized technological platforms designed to automate, manage, and scale formal and informal recognition programs within organizations. These platforms facilitate critical human resource functions such as peer-to-peer appreciation, automated milestone celebrations, service awards, and performance-based rewards, effectively moving organizations beyond traditional, sporadic acknowledgment methods. The core objective of these sophisticated software solutions is to strategically enhance employee engagement, significantly boost retention rates, and proactively shape overall organizational culture by ensuring that recognition is transparent, timely, and directly aligned with core company values and strategic objectives. The shift in organizational priorities, emphasizing psychological safety and employee well-being, has cemented these tools as essential components of modern HR infrastructure.

Major applications of Employee Recognition Software span across various critical HR functions, serving as foundational elements for performance management frameworks, sophisticated talent retention strategies, continuous culture building efforts, and internal communications optimization. Specific functionality includes the automation of personalized birthday and work anniversary acknowledgments, the operation of point-based reward systems that allow employees global flexibility in redeeming gifts or experiential rewards, and the facilitation of social recognition feeds that boost visibility, equity, and morale across distributed teams. The dramatic global proliferation of hybrid and remote work models, accelerated significantly post-2020, has fundamentally amplified the demand for these digital tools, as companies seek effective, measurable ways to maintain connectivity, foster camaraderie, and ensure that excellent work receives visible and equitable acknowledgment, irrespective of the employee's geographical location or specific work setting.

The primary driving factors fueling the relentless market expansion include the statistically documented link between standardized, timely recognition and tangible increases in employee productivity, the intense global organizational focus on improving the holistic employee experience (EX), and severe competition for scarce, skilled talent, positioning retention as a top-tier corporate strategic priority. Furthermore, the increasing sophistication of embedded data analytics and Business Intelligence (BI) capabilities within these platforms allows HR departments to meticulously measure the specific Return on Investment (ROI) of their recognition initiatives, providing quantifiable justification for continued substantial financial investment. End-users benefit significantly through documented outcomes such as higher job satisfaction scores, demonstrably reduced employee turnover rates, improved cross-functional team collaboration, and the unique ability for management to gain critical, real-time insights into organizational health and underlying employee sentiment, thereby transforming recognition from a rudimentary administrative task into a powerful, strategic business function that rigorously supports long-term growth and organizational stability.

Employee Recognition Software Market Executive Summary

Current business trends within the Employee Recognition Software Market indicate a decisive movement toward embedding recognition functionality directly into existing daily workflows and standard communication platforms, such as Microsoft Teams and Slack, a strategy aimed at minimizing friction and maximizing pervasive user adoption rates organization-wide. Leading organizations are increasingly demanding highly customizable, flexible, and immensely scalable solutions capable of adapting to globally diverse workforces, thereby necessitating that market vendors offer robust multi-language support, compliance modules tailored to complex regional labor laws, and culturally sensitive, geographically relevant reward catalogs. A pivotal shift is observed away from purely monetary rewards toward more personalized and experiential recognition elements, often leveraging non-monetary elements like public acknowledgments, bespoke career development opportunities, and increased professional autonomy, reflecting a profound maturation of contemporary employee expectations regarding psychological support and holistic organizational value alignment.

From a regional perspective, North America unequivocally maintains the dominant market share, a leadership position driven by the region's pioneering early adoption of cutting-edge cloud-based Human Resources technology, a fiercely competitive regional labor market that demands superior and comprehensive employee benefits packages, and consistently high corporate spending on specialized HR technology innovation and digital transformation initiatives. Conversely, the Asia Pacific (APAC) region is currently demonstrating the most accelerated and robust growth trajectory, propelled by sweeping regional digital transformation mandates, a rapidly increasing awareness among local enterprises regarding the profound strategic value derived from systematic employee engagement, and the large-scale expansion of numerous multinational corporations into economically dynamic countries like India, China, and Southeast Asia, mandating the establishment of standardized, globally integrated recognition systems. Europe displays sustained, steady growth, primarily influenced by strong, protective regulatory frameworks that prioritize holistic employee well-being and a deeply ingrained cultural emphasis on achieving work-life balance, stimulating consistent demand for advanced recognition tools that support a more comprehensive and humane employee experience.

Analysis of segment trends clearly reveals that the Software as a Service (SaaS) deployment model remains overwhelmingly dominant due to its inherent advantages in flexibility, significantly lower total cost of ownership (TCO) stemming from reduced upfront capital expenditures, and the superior ease of scaling and maintenance, a factor particularly attractive to dynamic Small and Medium-sized Enterprises (SMEs). While Large Enterprises increasingly adopt SaaS, their requirements often necessitate far more complex customization and deeper technical integration capabilities. Among the various recognition methods, peer-to-peer recognition is witnessing exponential growth, having been widely acknowledged for its efficacy in fostering a profoundly positive workplace culture and effectively distributing the critical responsibility of recognition across the entire employee population, thereby alleviating the sole burden from traditional management structures. Industry-wise, the Information Technology (IT) & Telecommunications and Banking, Financial Services, and Insurance (BFSI) sectors remain the largest and most intensive adopters, given their characteristically high employee churn rates and deep reliance on specialized intellectual capital, although accelerated adoption rates are now prominently observed within the Healthcare and Retail sectors as they focus intensely on the essential motivation and long-term retention of large populations of frontline workers.

AI Impact Analysis on Employee Recognition Software Market

Users frequently raise probing questions regarding the core potential of Artificial Intelligence (AI) to fundamentally personalize recognition experiences, automate highly contextual behavioral nudges, and definitively ensure demonstrable fairness and equity in the allocation of rewards and acknowledgments. Key thematic concerns consistently revolve around the philosophical question of whether sophisticated AI algorithms can authentically and genuinely replicate necessary human empathy within the recognition process, practical concerns regarding stringent data privacy compliance stemming from necessary deep behavioral tracking, and the pervasive expectation that integrated AI capabilities must evolve beyond rudimentary automation to deliver truly proactive, predictive insights into latent employee disengagement risks. The collective user anticipation is that deep AI integration will fundamentally revolutionize how crucial recognition moments are systematically identified, triggered, and executed, driving a definitive shift from reactive acknowledgments toward sophisticated, data-driven, and timely interventions aimed at optimizing long-term engagement levels and proactively mitigating measurable turnover risks long before they manifest as critical organizational issues. The persistent and central concern within the market remains the delicate and necessary balance between achieving algorithmic efficiency and rigorously maintaining genuine, human-centric connection and profound authenticity within the highly sensitive recognition process.

- AI-driven behavioral analysis identifies and predicts the precise optimal timing for recognition delivery based on integrated workflow activity, communication patterns, and project milestones.

- Personalized recognition recommendations are rigorously generated by advanced AI, suggesting specific, culturally meaningful, and non-monetary rewards meticulously tailored to observed individual employee preferences and documented past behavioral patterns.

- Automated anomaly detection systems instantaneously flag any potential patterns of unconscious bias or inequity in recognition distribution across diverse demographic or functional groups, actively promoting and enforcing demonstrably equitable reward systems.

- Integrated sentiment analysis tools continuously monitor internal communication channels (where permissible and integrated) to accurately gauge fluctuating employee morale and systematically identify 'hidden heroes' or critical contributions whose efforts might otherwise go entirely unnoticed by standard managerial oversight.

- Predictive modeling algorithms forecast granular employee turnover risk probabilities based on quantitative analysis of recognition frequency, value, and network patterns, thereby enabling targeted and proactive managerial intervention strategies.

- Intuitive chatbot interfaces leverage advanced Natural Language Processing (NLP) capabilities to facilitate easy, immediate recognition submissions and complex reward inquiries across ubiquitous mobile platforms, maximizing accessibility.

- Optimized budget allocation and rigorous Return on Investment (ROI) measurement are efficiently achieved through complex AI algorithms that analyze the direct correlation between recognition financial spend and key organizational performance metrics, ensuring strategic alignment.

- Intelligent nudges and automated reminders proactively prompt managers and peers to provide specific recognition for observed achievements based on predefined project milestones or critical behavioral metrics, fundamentally preventing detrimental recognition oversight.

DRO & Impact Forces Of Employee Recognition Software Market

The operational dynamics of the Employee Recognition Software market are inherently governed by a sophisticated and complex interplay of powerful growth stimulants, structural and technological limitations, and emerging high-potential opportunities, all of which are amplified by significant macro-level impact forces actively reshaping the fundamental structure of the modern global workplace. Drivers overwhelmingly center on the undeniable, empirically supported evidence linking the implementation of robust and consistent recognition practices directly to quantifiable, tangible business benefits, including markedly enhanced workforce productivity, measurable decreases in employee absenteeism rates, and critically important reductions in the total cost associated with employee turnover. The strategic imperative for managing globally dispersed remote and hybrid teams to successfully maintain a cohesive and positive organizational culture necessitates the adoption of sophisticated digital solutions that can bridge geographical and communication gaps effectively and immediately. Furthermore, the strong organizational push for transparency and widespread social recognition mechanisms, particularly those highly favored by the influential Millennial and Generation Z employee cohorts, compels organizations to rapidly decommission outdated, manual, or sporadic recognition systems in favor of modern, highly integrated, and socially optimized platforms.

Restraints, conversely, introduce substantial complexity and limitations to widespread market adoption and the effectiveness of comprehensive implementation strategies. A particularly significant hurdle remains the inherent initial complexity of system integration and the often prohibitively high capital costs associated with migrating established legacy HR systems to modern, cloud-native recognition platforms, a challenge most acutely faced by large, established, and often risk-averse enterprises. Enduring organizational resistance to fundamental cultural or technological change, frequently coupled with the persistent lack of clear, universally accepted metrics for definitively defining and measuring the financial Return on Investment (ROI) of critical cultural initiatives, often results in significant delays or outright blockage of necessary budget approvals. Moreover, legitimate and pervasive concerns regarding stringent data privacy compliance, overall platform security vulnerabilities, and the inherent potential for recognition platforms to be misused, or, critically, to be perceived by the workforce as fundamentally insincere or performative if not implemented with profound authenticity, collectively generate friction in both user adoption and the system’s ultimate cultural efficacy, mandating extremely careful, expert change management execution and transparent, continuous communication strategies.

Opportunities for decisive and accelerated market growth are abundant and strategically compelling, particularly within emerging economic geographies where digital infrastructure adoption rates are soaring and corporate focus on intensive human capital optimization is rapidly increasing. A massive latent potential lies specifically in the strategic integration of recognition programs with broader, holistic employee well-being initiatives, including critical components like comprehensive mental health support services and personalized financial wellness tools, offering a far more compelling and comprehensive organizational value proposition to employees. The continued development and refinement of micro-recognition features fully embedded directly into daily collaboration tools, alongside the creative application of advanced gamification techniques to render recognition processes highly interactive and intrinsically engaging, represent key, high-growth avenues for technological differentiation. The irreversible, pervasive strategic shift toward highly personalized, proactive AI-driven recognition workflows that meticulously cater to documented individual employee preferences and specific professional career development paths will be the defining characteristic of future market leaders and will inevitably serve to catalyze relentless innovation across the highly competitive vendor landscape. These intrinsic market forces, in synergistic combination with the overwhelming macro-economic shifts favoring sustainable talent retention over expensive acquisition, collectively constitute the profound, enduring impact shaping the fundamental trajectory and future structure of the global Employee Recognition Software Market.

Segmentation Analysis

The Employee Recognition Software Market is meticulously analyzed through segmentation based on several critical dimensions, including the method of deployment, the organization's size, the core component structure, the nature of the recognition provided, and the specific industry vertical, thereby enabling a necessary granular analysis of nuanced market demand and specialized vendor offerings. The rigorous analysis of these foundational segments is strategically critical for comprehensively understanding diverse consumer purchasing behaviors and effectively tailoring sophisticated product offerings to meet the highly varied operational and cultural needs of organizations, ranging from small, agile startups prioritizing deployment speed and affordability to large multinational corporations that demand complex integration capabilities and stringent global compliance features. The component segmentation, which clearly delineates between foundational software platforms/solutions and associated expert services (including crucial consulting, integration & implementation support, and ongoing maintenance), highlights the indispensable reliance on expert professional support for effective system deployment and the successful management of necessary organizational cultural change.

The Deployment Type segmentation consistently bifurcates the market into Cloud (SaaS) and On-Premise models, with the Cloud paradigm decisively dominating the market due to its superior benefits in scalability, universal accessibility, minimized infrastructural burden, and subscription-based financial model flexibility. Organization Size segmentation strategically distinguishes between Large Enterprises, which consistently demand robust, highly integrated, and deeply customized software solutions capable of handling massive employee pools, and Small and Medium-sized Enterprises (SMEs), which typically favor ready-to-use, standardized, and subscription-based models for rapid deployment. The critical differentiation in Recognition Types—between Monetary (e.g., formal gifts, bonuses, redeemable points) and Non-Monetary (e.g., virtual badges, public praise, flexible time off)—accurately reflects continuously evolving cultural preferences, specific budgetary constraints, and organizational recognition philosophies across the diverse spectrum of industry verticals, vigorously driving continuous platform innovation to facilitate both recognition modalities seamlessly.

Industry Vertical segmentation provides crucial insights, revealing highly concentrated demand within specific sectors that are heavily reliant on specialized skilled labor and simultaneously face exceptionally high employee attrition rates, notably the Information Technology and Telecommunications sector, and the Banking, Financial Services, and Insurance (BFSI) sector. However, a significant and measurable acceleration in adoption is now prominently observed in historically non-IT centric sectors, including Healthcare (driven by acute needs for clinical and administrative staff retention), Retail chains (focused on pervasive frontline worker motivation), and the Manufacturing industry, propelled by the urgent necessity to enhance operational efficiency and maintain consistently high levels of employee engagement across geographically distributed physical locations. This comprehensive segmentation map offers indispensable strategic clarity for all market participants seeking to optimize their targeted go-to-market strategies, refine their product positioning, and structure their specialized feature development roadmaps for maximum impact.

- By Component:

- Software (Platform/Solution)

- Services (Consulting, Integration & Implementation, Support & Maintenance)

- By Deployment Type:

- Cloud (SaaS)

- On-Premise

- By Organization Size:

- Small and Medium-sized Enterprises (SMEs)

- Large Enterprises

- By Recognition Type:

- Monetary Recognition

- Non-Monetary Recognition

- By Industry Vertical:

- IT and Telecommunication

- BFSI (Banking, Financial Services, and Insurance)

- Retail and E-commerce

- Healthcare

- Manufacturing

- Education

- Others (Government, Media & Entertainment)

Value Chain Analysis For Employee Recognition Software Market

The rigorous value chain analysis for the Employee Recognition Software Market commences with crucial upstream activities, which are fundamentally focused on core platform development and the technical provisioning of necessary foundational infrastructure. This initial stage includes strategically securing robust underlying cloud infrastructure partnerships (with major IaaS providers like AWS or Microsoft Azure), engineering sophisticated proprietary analytics engines, and meticulously designing highly intuitive, accessible user interfaces that maximize adoption. Key upstream providers are typically specialized software development firms, advanced Artificial Intelligence (AI) and Machine Learning (ML) module vendors, and expert data security consultants whose primary role is ensuring proactive and continuous compliance with complex global data privacy regulations (e.g., GDPR, CCPA). Innovation at this critical foundational stage is non-negotiable, intensely focusing on achieving flawless, seamless integration capabilities with all leading Human Resource Information Systems (HRIS) and Enterprise Resource Planning (ERP) systems, thereby establishing the robust, scalable technical bedrock for the entire recognition solution.

Mid-stream activities are decisively dominated by the core platform vendors themselves, who are responsible for product packaging, extensive client-specific customization, complex system integration services, and the crucial management of diverse licensing and subscription models (which are typically based on recurring SaaS subscriptions). This central stage necessitates extensive strategic content development, including the continuous curation and management of vast, globally relevant reward catalogs, the establishment of intricate contractual relationships with efficient global fulfillment partners for both physical goods and digital rewards, and the provision of highly tailored implementation consulting to ensure the platform's core functionality is optimally matched with the client's explicit cultural objectives and strategic workforce requirements. The quantifiable quality and technical depth of the integration process, coupled with the responsiveness of the customer support provided immediately following system rollout, are the primary determinants of the platform's perceived value and its long-term cultural success within the end-user organization.

Downstream analysis critically focuses on the various distribution channels and the ultimate deployment mechanisms utilized by the end-users. Direct sales channels, where established vendors leverage dedicated enterprise sales teams to sell large, complex subscriptions directly to multinational corporations, remain a deeply embedded and prevalent distribution strategy, especially for installations requiring high degrees of customization. However, indirect distribution is rapidly gaining market share, heavily relying on strategic partnerships with reputable HR consulting firms, major System Integrators (SIs), and Value-Added Resellers (VARs) who proficiently bundle recognition software subscriptions with their broader, comprehensive HR transformation service offerings. End-users—comprising HR managers, functional department heads, and influential C-suite executives—are the ultimate consumers who strategically utilize the software to achieve measurable increases in employee engagement. Consequently, the demonstrable efficiency and effectiveness of the chosen distribution channel, augmented by robust employee training programs and specialized change management support, determines the velocity of adoption and the full maximization of the recognition software’s profound strategic impact within the final corporate environment.

Employee Recognition Software Market Potential Customers

The definitive primary consumers and institutional buyers of sophisticated Employee Recognition Software are fundamentally organizations of all scales and across the entire spectrum of global industries that strategically recognize and consistently treat human capital as an indispensable asset requiring continuous, significant investment and proactive engagement. Within these diverse organizational structures, the key decision-makers, budget holders, and internal system sponsors typically reside within the core Human Resources (HR) departments. This includes high-level roles such as Chief Human Resources Officers (CHROs), Executive Vice Presidents of HR Strategy, and specialized dedicated Total Rewards or Employee Experience specialists who are fundamentally accountable for delivering measurable results in talent retention, cultural efficacy, and overall employee well-being initiatives. Increasingly, due to the complex integration requirements, major procurement decisions routinely involve collaboration with the Information Technology (IT) department leadership, and often require final sign-off from C-suite executives (including CEOs and CFOs) due to the software's direct, measurable linkage to optimizing operational efficiency and strategically controlling labor-related costs.

Potential customers are strategically segmented based primarily on their specific operational and cultural needs. Large multinational corporations (MNCs) constitute a critically important segment, characterized by their high demands for globally compliant, immensely scalable recognition systems capable of managing tens of thousands of employees across diverse legal, cultural, and geographic jurisdictions, thereby requiring complex single-sign-on (SSO) security protocols and deep, native enterprise system integration. Conversely, Small and Medium-sized Enterprises (SMEs) also represent a high-potential, rapidly growing customer segment, typically seeking robust yet affordable, quick-to-deploy solutions that promise immediate, tangible cultural impact without requiring extensive dedicated internal IT support, consequently driving high demand for simplified pure SaaS models featuring highly intuitive administrative dashboards and self-service configuration.

Furthermore, the target market is expanding substantially into critical sectors experiencing acute challenges related to high burnout, operational stress, and significant frontline worker volatility, specifically including the sprawling Healthcare industry (e.g., large hospital systems and specialized clinics), expansive Retail chains, and large-scale Manufacturing facilities. These organizations represent accelerated growth demand for highly accessible, mobile-first, and high-visibility recognition tools that can reliably reach employees who do not have consistent, daily access to traditional desktop computers, thereby ensuring equitable and pervasive recognition access for all deskless workers. Fundamentally, any organization that places paramount strategic importance on reducing employee attrition, is actively seeking to institutionalize and visibly reinforce its core corporate values, or is currently struggling to maintain cultural continuity, alignment, and high morale within a pervasive remote or hybrid operational setting, constitutes a prime, high-value candidate for the immediate and long-term adoption of Employee Recognition Software solutions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.1 Billion |

| Market Forecast in 2033 | USD 7.6 Billion |

| Growth Rate | 13.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Workday, Inc., SAP SE (SuccessFactors), Reward Gateway, Kudos, Inc., OC Tanner, Achievers, Inc., Incentives Solutions, Globoforce (Workhuman), Fond, Inc., 360Recognition, Bonusly, Inc., Culture Amp, EngageSmart, Inc. (DonorDrive), Recognition by Design, Nectar HR, Gifted, Vantage Circle, Guusto, Inc., Core Strengths, Kazoo. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Employee Recognition Software Market Key Technology Landscape

The current technological landscape underpinning the Employee Recognition Software market is fundamentally characterized by an intense strategic focus on seamlessly integrating sophisticated software components designed to dramatically enhance the overall user experience, rigorously automate complex processes, and effectively derive actionable strategic insights from organizational data. Cloud computing infrastructure, predominantly delivered via the Software as a Service (SaaS) model, constitutes the non-negotiable foundational infrastructure, enabling instant, widespread rapid deployment, universal accessibility across all devices, and the provision of seamless, real-time feature updates without client intervention. This overwhelming reliance on scalable cloud environments minimizes the recurring maintenance overhead for client organizations while simultaneously guaranteeing exceptionally high system availability, robust security, and the necessary scalability to efficiently accommodate dynamically fluctuating employee populations and aggressive global expansion requirements.

A mission-critical technological component is the highly developed integration capability layer, which meticulously ensures that the recognition platform can communicate flawlessly and exchange data efficiently with existing core enterprise Human Resources and diverse business systems. These essential integrations include comprehensive compatibility with leading HRIS platforms (such as Workday, Oracle, and SAP SuccessFactors), centralized payroll processing systems, and standard internal communication and collaboration platforms (like Slack, Microsoft Teams, and Workplace from Meta). This deep, bidirectional technical integration is paramount, guaranteeing absolute data accuracy, substantially reducing repetitive administrative burdens, and ensuring that recognition practices are inherently embedded into the daily workflow rather than existing as an isolated, rarely utilized, peripheral tool. Furthermore, the pervasive application of sophisticated data analytics, machine learning algorithms, and advanced business intelligence (BI) tools is absolutely essential for providing quantifiable, empirical proof of program Return on Investment (ROI), empowering HR professionals to track real-time recognition usage patterns against critical organizational metrics, including employee performance scores, tenure progression, and measurable turnover rates, thereby expertly transforming qualitative anecdotal evidence into actionable, strategic data for executive management decision-making.

Emerging and genuinely cutting-edge technologies are rapidly increasing their influence across the recognition software domain, most notably the advanced application of Artificial Intelligence (AI) and Machine Learning (ML). AI is being systematically employed for granular, deep-level personalization, highly accurate predictive analytics (specifically forecasting attrition likelihood based on subtle shifts in recognition activity and sentiment), and rigorously ensuring equitable reward distribution by instantly flagging potential patterns of inherent bias through sophisticated behavioral auditing. Although still in nascent stages, distributed ledger technologies, such as Blockchain, offer profound potential for securely managing digital reward currencies and ensuring robust transparency, security, and immutability in complex, multi-jurisdictional global reward systems. Additionally, the increasing adherence to open Application Programming Interfaces (APIs) and flexible microservices architecture is strategically empowering recognition vendors to offer highly modular, decoupled, and flexible solutions, fundamentally allowing end-user customers to precisely select only the specialized features they require and seamlessly integrate them into their existing, often heterogeneous, organizational tech stack environments.

Regional Highlights

A detailed regional analysis reveals substantial variation in the strategic maturity and primary adoption drivers characterizing the Employee Recognition Software Market, although the powerful forces of globalization and the imperative for standardized corporate HR practices are increasingly leading toward regional market convergence. North America, unequivocally, maintains its dominant position in both overall market size and rapid technological innovation, largely driven by an exceptionally competitive and fluid labor market, a mature and deeply entrenched ecosystem of advanced cloud technology providers, and the consistent, high corporate readiness to invest substantially and strategically in comprehensive employee retention and engagement initiatives. The United States, in particular, exhibits market-leading high adoption rates across both massive large-scale enterprises and the burgeoning, dynamic tech startup ecosystem, often strategically integrating recognition platforms as an inherent, fundamental component of their defined organizational culture from their very inception, treating it as a competitive differentiator.

Europe represents a substantial, highly sophisticated, and steadily growing market segment, primarily characterized by exceptionally strong regulatory compliance requirements (particularly surrounding stringent data privacy regulations like GDPR) and a deep cultural emphasis on the holistic well-being of employees and core corporate social responsibility. Western European nations, including the economically powerful UK, Germany, and France, lead the regional adoption curve, often demonstrating a preference for platforms that prioritize non-monetary recognition types and those that proficiently support comprehensive, integrated employee experience programs. Vendor success across the highly fragmented European market is intrinsically tied to their ability to provide platforms that are fully multilingual, easily auditable for compliance purposes, and capable of seamlessly integrating culturally nuanced, locally relevant reward options that strictly align with diverse local labor laws and prevailing societal values and expectations.

The Asia Pacific (APAC) region is strategically forecasted to achieve the highest Compound Annual Growth Rate (CAGR) globally, largely attributable to accelerating regional industrialization, the rapid economic expansion across pivotal nations like India, China, and Indonesia, and the swift assimilation of global HR best practices among indigenous local businesses. While initial adoption was historically slower, often driven solely by large-scale multinational companies, domestic enterprises are now aggressively committing significant resources to digital HR tools to efficiently manage rapidly expanding and highly mobile workforces, and to directly address the characteristically high attrition rates common within the regional BPO and dynamic IT services sectors. Latin America (LATAM) and the Middle East and Africa (MEA) currently remain categorized as high-potential emerging markets, smaller in immediate scale, yet offering substantial long-term growth prospects fueled by consistently increasing foreign direct investment and major digital transformation mandates across key regional industries such as financial services, energy, and government modernization programs.

- North America (Dominant Market Share): Characterized by high SaaS adoption rates, immense corporate investment in AI-driven HR technology solutions, and intense focus on mitigating high employee turnover in critical technology and financial services sectors. Key markets include the United States and Canada.

- Europe (Steady Growth and Regulatory Focus): Driven strategically by the strong organizational emphasis on employee welfare, rigorous GDPR compliance requirements, and widespread adoption observed across the manufacturing and professional services industries. Key markets include the UK, Germany, France, and the Nordic countries.

- Asia Pacific (Fastest Growth Trajectory): Fuelled profoundly by rapid regional digital transformation initiatives, acute workforce scalability challenges, and the aggressive expansion of multinational corporate operations into dynamic nations like India, Australia, Singapore, and China.

- Latin America (Emerging Potential): Increasing strategic corporate focus on optimizing productivity levels and effectively retaining key talent in highly competitive regional markets such as Brazil, Mexico, and Argentina, consequently leading to rapidly rising demand for localized and culturally adapted recognition platforms.

- Middle East & Africa (Niche Growth): Exhibiting growing adoption rates concentrated within the government, energy, and financial sectors, primarily driven by regional economic diversification goals, large-scale technological modernization programs, and the influx of global corporate headquarters, particularly in the UAE and Saudi Arabia.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Employee Recognition Software Market.- Workday, Inc.

- SAP SE (SuccessFactors)

- Globoforce (Workhuman)

- OC Tanner

- Achievers, Inc.

- Reward Gateway

- Kudos, Inc.

- Bonusly, Inc.

- Fond, Inc.

- Culture Amp

- Nectar HR

- Vantage Circle

- Incentives Solutions

- Gifted

- Guusto, Inc.

- Recognition by Design

- Core Strengths

- 360Recognition

- EngageSmart, Inc.

- Kazoo

Frequently Asked Questions

Analyze common user questions about the Employee Recognition Software market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected Compound Annual Growth Rate (CAGR) for the Employee Recognition Software Market?

The Employee Recognition Software Market is projected to exhibit a robust Compound Annual Growth Rate (CAGR) of 13.5% between 2026 and 2033, driven primarily by the global strategic shift towards fluid hybrid work models and necessary increased corporate investment in comprehensive talent retention and employee experience initiatives.

Which deployment model strategically dominates the Employee Recognition Software sector, and why?

The Cloud (SaaS) deployment model significantly dominates the market landscape. This overwhelming preference stems from the inherent operational benefits of SaaS, including substantially lower initial capital expenditure, near-instantaneous deployment capabilities, superior operational scalability, and highly simplified integration with the vast ecosystem of modern HR platforms.

How is Artificial Intelligence (AI) fundamentally impacting the development and functionality of recognition software solutions?

AI is strategically transforming recognition software by enabling advanced, real-time personalization of reward types, actively utilizing predictive analytics algorithms to accurately identify specific employees at elevated risk of attrition, and automating equitable reward distribution through the application of sophisticated behavioral analysis and continuous sentiment monitoring tools.

Which geographical region currently holds the largest market share for Employee Recognition Software solutions?

North America consistently commands the largest global market share, a leadership position directly attributable to its high technological maturity, accelerated platform adoption rates across intensely competitive industries like Tech and BFSI, and a strong cultural imperative for strategically prioritizing and quantifying all investments related to the overall employee experience.

What are the primary strategic challenges currently restraining overall market growth and widespread organizational adoption?

Key structural restraints include the inherent complexity and significant total cost associated with technically integrating modern recognition platforms with archaic existing legacy HR systems, persistent organizational resistance to adopting new culture-focused technologies, and prevailing ethical concerns regarding rigorous data security compliance and necessary employee privacy during pervasive behavioral tracking and analysis.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager