Encryption Management Solutions Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442826 | Date : Feb, 2026 | Pages : 255 | Region : Global | Publisher : MRU

Encryption Management Solutions Market Size

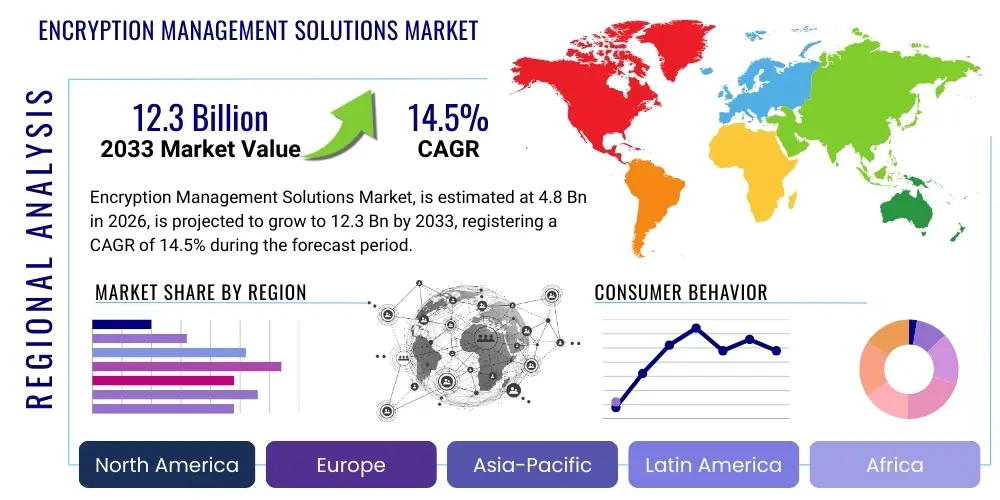

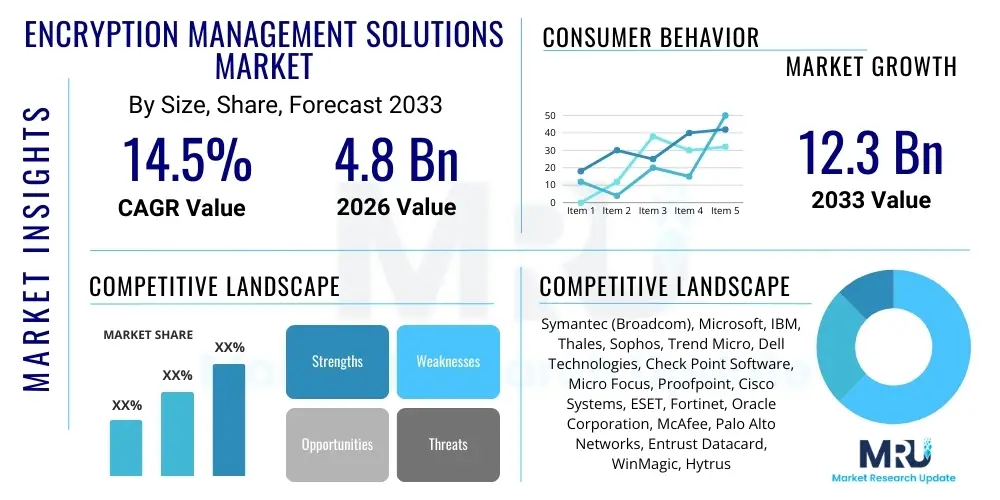

The Encryption Management Solutions Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 14.5% between 2026 and 2033. The market is estimated at USD 4.8 Billion in 2026 and is projected to reach USD 12.3 Billion by the end of the forecast period in 2033.

Encryption Management Solutions Market introduction

The Encryption Management Solutions Market encompasses software and services designed to centrally manage cryptographic keys, policies, and encrypted data across an enterprise’s entire infrastructure—from endpoints and applications to databases and cloud environments. These solutions are crucial in an era dominated by stringent data privacy regulations such as GDPR, HIPAA, and CCPA, where organizations face immense pressure to protect sensitive information from breaches and unauthorized access. Effective encryption management ensures compliance, maintains data integrity, and simplifies complex key lifecycle management, providing the necessary operational foundation for robust cybersecurity postures in hybrid IT environments. The escalating volume of data generated and transmitted daily, coupled with the rising sophistication of cyber threats, has made centralized encryption control a non-negotiable component of modern security architecture, thereby driving significant market growth globally.

Key applications of these solutions span across full disk encryption, database encryption, email encryption, and securing virtualized and cloud workloads. The underlying product capabilities include key generation, distribution, rotation, revocation, and secure storage via hardware security modules (HSMs) or virtual appliances. Benefits derived from deploying advanced encryption management platforms include enhanced compliance validation, reduced operational overhead associated with decentralized encryption schemes, and improved organizational agility in adopting new technologies like multi-cloud infrastructure while maintaining consistent security policies. Furthermore, these systems provide audit trails and reporting necessary for governance and regulatory scrutiny.

The primary driving factors fueling this market expansion are the persistent threat landscape, mandatory governmental and industry-specific data protection regulations, and the rapid migration of critical business processes and sensitive data to public cloud platforms. As organizations embrace digital transformation, the perimeterless nature of modern enterprises necessitates encryption solutions that can manage keys uniformly across disparate systems. The demand for solutions that offer robust, scalable, and automated encryption key management is particularly strong in highly regulated sectors such as BFSI, Healthcare, and Government, positioning these solutions as fundamental components of zero-trust security frameworks.

Encryption Management Solutions Market Executive Summary

The Encryption Management Solutions Market is characterized by vigorous growth driven primarily by escalating data breach costs and increasingly rigorous regulatory demands across all major geographies. Business trends highlight a pronounced shift towards unified, cloud-agnostic key management services (KMS), leveraging platforms that integrate seamlessly with hyperscalers like AWS, Azure, and Google Cloud, moving away from disparate, siloed encryption tools. Enterprises are prioritizing solutions offering cryptographic agility, enabling them to quickly switch algorithms or key lengths in response to quantum computing threats or specific regulatory mandates. Furthermore, the convergence of encryption management with identity and access management (IAM) solutions is a critical emerging trend, ensuring that encryption policies are directly tied to user roles and contextual access, significantly enhancing security posture and streamlining administration.

Regionally, North America maintains the dominant market share, attributed to the presence of large technology companies, early adoption of advanced cybersecurity practices, and the stringent compliance requirements imposed by federal and state regulations. However, the Asia Pacific (APAC) region is projected to exhibit the highest Compound Annual Growth Rate (CAGR), fueled by aggressive digital transformation initiatives in countries like China, India, and Japan, coupled with new data localization and privacy laws being implemented across the region. Europe also represents a mature and highly regulated market, where the General Data Protection Regulation (GDPR) acts as a persistent catalyst for enterprise investment in centralized encryption controls to avoid substantial non-compliance penalties.

In terms of segments, the Services component segment, which includes professional services for deployment, integration, and managed security services (MSS), is growing faster than the solutions segment, indicating that organizations require specialized expertise to implement and maintain complex key management systems effectively, particularly in hybrid environments. Deployment trends confirm a strong preference for Cloud-based solutions due to their scalability and reduced infrastructure overhead, although On-Premise deployment remains vital for highly sensitive government and financial data that must adhere to strict internal data residency policies. The BFSI and Healthcare end-user segments continue to be the largest consumers of encryption management, driven by the need to secure highly sensitive financial records and protected health information (PHI).

AI Impact Analysis on Encryption Management Solutions Market

Common user questions regarding AI's influence on encryption management typically revolve around two core themes: enhancing existing security processes and mitigating new AI-driven threats. Users frequently inquire if AI can automate the complex lifecycle management of millions of keys, asking questions such as "Can AI predict key compromise?" or "How does machine learning improve key rotation scheduling?". The primary concern, however, is the dual-edged sword of AI; while it can enhance detection capabilities, users are equally concerned about AI being weaponized by attackers to crack cryptographic algorithms or rapidly identify weak points in key management infrastructure. Key expectations center on using AI for anomaly detection in key usage, optimizing resource allocation for cryptographic operations, and ensuring quantum-safe transitions.

The integration of Artificial Intelligence (AI) and Machine Learning (ML) is fundamentally altering the landscape of encryption management, transforming it from a static, rule-based system into a dynamic, adaptive security layer. AI algorithms are increasingly being used to analyze vast datasets related to key access patterns, encryption policy enforcement, and operational metrics. This capability allows systems to establish baselines of normal behavior, thereby detecting subtle anomalies that might indicate an internal threat, a key misuse attempt, or unauthorized access far more effectively than traditional SIEM or logging tools. For instance, if a key typically used only during nightly backups is accessed during business hours from an unusual geographic location, AI can immediately flag this activity, triggering automated policy responses like key revocation or granular access restrictions, significantly reducing response time to potential breaches.

Furthermore, AI plays a crucial role in optimizing the efficiency and cryptographic agility of encryption management systems. ML models can predict the optimal time and frequency for key rotation based on threat intelligence, regulatory changes, and usage load, ensuring that keys are not overused or unnecessarily complicated to manage. This predictive maintenance extends the lifespan of cryptographic hardware (like HSMs) and streamlines compliance reporting by automatically generating reports on key lineage and adherence to rotation schedules. This enhancement in automation and predictive capability addresses a major pain point for security teams: the administrative burden and high operational costs associated with manual key management, making AI an indispensable tool for scalability in hyper-growth data environments.

- AI-driven anomaly detection in key usage and access patterns.

- Predictive key rotation scheduling and optimization based on threat models.

- Automated policy enforcement and immediate revocation based on contextual risk scoring.

- Enhanced integration with threat intelligence platforms for real-time risk assessment.

- Development of quantum-resistant algorithms managed via ML-optimized platforms.

- Simplification of complex multi-cloud key synchronization through intelligent automation.

- ML-powered optimization of cryptographic processing resources and performance.

DRO & Impact Forces Of Encryption Management Solutions Market

The market dynamics of Encryption Management Solutions are shaped by a strong combination of mandatory regulatory drivers and persistent cyber risks, counterbalanced by complex deployment challenges and the persistent skill gap in cryptography expertise. The overarching impact forces are heavily weighted toward factors necessitating robust data security, particularly the exponential rise in remote work environments and the subsequent expansion of the corporate attack surface. While strict global compliance mandates (Drivers) provide a consistent impetus for adoption, the inherent complexity and high cost associated with deploying enterprise-grade hardware security modules (Restraints) often slow down implementation, particularly among Small and Medium-sized Enterprises (SMEs). However, the massive ongoing shift toward cloud-native and serverless architectures creates substantial opportunities for providers offering scalable, pay-as-you-go Key Management as a Service (KMaaS) solutions, fundamentally redefining the market structure and accessibility.

Drivers: The fundamental drivers include the critical need for regulatory compliance, such as GDPR, HIPAA, and PCI DSS, which impose severe financial penalties for data mismanagement, making encryption a legal necessity rather than just a security preference. Secondly, the increasing volume and sensitivity of data stored in the cloud necessitates secure, centralized key management that is independent of the cloud provider, addressing vendor lock-in concerns. Thirdly, the pervasive growth of sophisticated ransomware attacks, which often target backup systems and encrypted data, has amplified the enterprise focus on granular encryption controls and robust key recovery capabilities. Finally, the realization of the "Zero Trust" security model heavily relies on encrypting data both in transit and at rest, mandating holistic key management integration.

Restraints: Significant restraints impede market velocity, chiefly the complexity of integrating diverse encryption solutions across heterogeneous IT landscapes, which often involve legacy systems, disparate cloud environments, and multiple operating systems. This complexity leads to deployment hurdles and high initial integration costs. Another major restraint is the scarcity of highly skilled cryptographic engineers and security professionals capable of designing, implementing, and managing sophisticated encryption ecosystems, leading to reliance on third-party managed services. Furthermore, performance overhead associated with strong encryption, particularly in high-transaction environments, can deter adoption unless solutions are highly optimized for speed and efficiency.

Opportunities: Key opportunities lie in the migration to post-quantum cryptography (PQC) solutions, positioning early innovators to capture significant future market share as organizations prepare for cryptographically relevant quantum computers. The rapid expansion of Internet of Things (IoT) and Operational Technology (OT) sectors presents a massive, untapped market for embedded, lightweight encryption management solutions required to secure trillions of endpoints. Furthermore, the growing acceptance of confidential computing—where data remains encrypted even while being processed in memory—opens avenues for specialized key management services tailored to securing enclaves and trusted execution environments, presenting high-value growth potential for solution providers.

Impact Forces: The high impact forces currently shaping the market include the geopolitical landscape driving data sovereignty and localization demands, compelling multinational firms to deploy geographically segmented key management. The second high impact force is the continuing evolution of quantum computing threats, which drives urgent R&D into quantum-resistant key exchange and management protocols. Finally, the growing shift toward "data access governance" means that encryption key access is being tightly integrated with data governance platforms, making key management not just a security function but a core element of organizational data control and compliance strategy.

Segmentation Analysis

The Encryption Management Solutions Market is extensively segmented based on the components offered, the deployment models utilized, the specific applications being secured, and the diverse range of end-user industries served. Understanding these segments is crucial as it reveals underlying purchasing patterns and technological preferences. The structure of the market reflects the varied operational environments of global enterprises, from highly centralized on-premise infrastructure requirements to the decentralized, scalable needs of cloud-native organizations. Solution providers often specialize in catering to specific segment needs, such as providing hardware-based key protection for financial institutions (BFSI) or scalable virtual key vaults for cloud applications in the IT & Telecom sector.

Analysis of the Component segment shows that while the Solutions component (which includes software platforms and hardware appliances like HSMs) constitutes the larger market share, the Services component (including consulting, integration, maintenance, and managed services) is growing at a faster rate. This accelerated growth in services underscores the complexity inherent in deploying and managing these systems, leading organizations to outsource expertise. The Application segmentation highlights the persistent need for securing sensitive data at rest, making Database Encryption and Full Disk Encryption foundational components, although cloud workload encryption is rapidly gaining traction as enterprises prioritize securing multi-cloud assets.

Geographically and by End-Use, highly regulated industries drive the most significant investment. The BFSI sector remains the largest consumer due to the volume of financial transactions and stringent regulatory oversight (e.g., PCI DSS). Conversely, the deployment segmentation indicates a strong market shift, with Cloud-based key management solutions experiencing exponential adoption. This shift is driven by the desire for operational flexibility, scalability, and integration with modern cloud security stacks, signaling a long-term trend away from purely on-premise infrastructure for all but the most highly restricted environments.

- By Component:

- Solution (Software Platforms, HSMs, Key Vaults)

- Services (Consulting, Integration, Managed Security Services)

- By Deployment Type:

- On-Premise

- Cloud-Based

- Hybrid

- By Application:

- Disk Encryption (Full Disk Encryption, Partition Encryption)

- File/Folder Encryption

- Database Encryption

- Communication and Email Encryption

- Cloud Workload Encryption

- By Enterprise Size:

- Large Enterprises

- Small and Medium-sized Enterprises (SMEs)

- By End-Use Industry:

- Banking, Financial Services, and Insurance (BFSI)

- Healthcare and Life Sciences

- IT and Telecom

- Government and Public Sector

- Retail and E-commerce

- Manufacturing

Value Chain Analysis For Encryption Management Solutions Market

The value chain for Encryption Management Solutions is intricate, beginning with specialized component suppliers and culminating in complex, integrated deployment and post-sales support. The chain commences with upstream suppliers, primarily manufacturers of cryptographic hardware components such as FIPS-certified Hardware Security Modules (HSMs) and specialized semiconductor chips that provide the root of trust and secure key storage capabilities. These suppliers ensure the fundamental security integrity and performance necessary for enterprise-grade solutions. Key management platform vendors then acquire these specialized components to build proprietary software platforms, integrating features like policy management, centralized auditing, and key lifecycle automation. These vendors form the core of the market, defining the functional capabilities and interoperability standards for the industry.

Moving downstream, the distribution channel plays a critical role in taking the highly technical solutions to end-users. This involves a mix of direct sales engagement for large, strategic accounts, particularly in the government and BFSI sectors where customized deployment is common. However, the majority of market volume is channeled through indirect distribution, involving value-added resellers (VARs), system integrators (SIs), and managed security service providers (MSSPs). MSSPs are becoming increasingly important, as they bundle the encryption management platform with deployment expertise, ongoing monitoring, and incident response services, making these solutions accessible and manageable for organizations lacking internal cryptographic expertise.

The final stage involves implementation and ongoing support, which are critical for the successful adoption of encryption management. Implementation services often require deep integration into existing IT infrastructures, involving network configurations, identity management systems, and cloud environments. Post-sales support and continuous managed services—often categorized under the Services segment—represent a significant revenue stream and a vital component of the value proposition. This downstream activity ensures compliance adherence, rapid key recovery in disaster scenarios, and continuous adaptation to evolving threats and regulatory updates, cementing the long-term relationship between providers and their end-user base.

Encryption Management Solutions Market Potential Customers

Potential customers for Encryption Management Solutions are organizations across virtually every industry vertical that handle sensitive, regulated, or proprietary data, where the loss or compromise of such data could result in significant financial, legal, or reputational damage. The primary buyers are Chief Information Security Officers (CISOs), Chief Compliance Officers, and IT infrastructure managers responsible for data governance and protection strategies. These stakeholders are primarily driven by two imperatives: mandatory adherence to regulatory frameworks (e.g., PCI DSS compliance for payment card data) and the institutional necessity of protecting intellectual property and customer trust in a high-threat environment. Organizations that operate in multi-cloud or hybrid IT environments, requiring consistent security policies across different infrastructure types, represent the most immediate and high-value potential customers.

Specific end-user/buyer groups are heavily concentrated in highly regulated sectors. The Banking, Financial Services, and Insurance (BFSI) sector, including global banks, insurance carriers, and fintech companies, are perpetual buyers due to the high volume of Personally Identifiable Information (PII) and monetary transaction data they manage. Similarly, the Healthcare sector, encompassing hospitals, pharmaceutical companies, and health insurance providers, must rigorously encrypt Protected Health Information (PHI) to comply with regulations like HIPAA. These sectors typically seek robust, high-assurance solutions, often requiring FIPS 140-2 Level 3 certified HSMs for key storage, demonstrating a willingness to invest heavily in premium, validated security architecture.

Beyond these traditional high-security sectors, the IT & Telecom industry, particularly cloud service providers (CSPs) and large software companies, are significant consumers, deploying internal key management systems to offer encryption services to their own clientele and secure their development and operational environments. Furthermore, large multinational retailers and e-commerce platforms represent a growing segment, driven by the need to secure high volumes of customer payment data and maintain consumer confidence against frequent data breach attempts. The common thread among all these potential customers is the scale of sensitive data they manage and the resulting complexity of meeting global data residency and compliance requirements.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.8 Billion |

| Market Forecast in 2033 | USD 12.3 Billion |

| Growth Rate | 14.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Symantec (Broadcom), Microsoft, IBM, Thales, Sophos, Trend Micro, Dell Technologies, Check Point Software, Micro Focus, Proofpoint, Cisco Systems, ESET, Fortinet, Oracle Corporation, McAfee, Palo Alto Networks, Entrust Datacard, WinMagic, Hytrust (VMware), SealPath. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Encryption Management Solutions Market Key Technology Landscape

The technology landscape of the Encryption Management Solutions Market is rapidly evolving, driven by the demand for greater automation, cloud compatibility, and resistance to emerging threats like quantum computing. Central to this landscape is the widespread adoption of Hardware Security Modules (HSMs), which serve as the indispensable, tamper-resistant environment for generating, storing, and managing cryptographic keys. These devices, increasingly offered in both physical appliance and cloud-based virtual formats, adhere strictly to security standards such as FIPS 140-2, ensuring that the critical key material is never exposed to less secure general-purpose computing environments. Furthermore, interoperability standards like the Key Management Interoperability Protocol (KMIP) are foundational, enabling encryption management platforms to communicate securely and efficiently with diverse encryption clients, including applications, databases, and operating systems from multiple vendors, crucial for maintaining cryptographic agility across heterogeneous IT environments.

A major technological advancement is the rise of Key Management as a Service (KMaaS) offerings, provided both by specialized security vendors and major cloud hyperscalers (e.g., AWS KMS, Azure Key Vault). KMaaS solutions simplify deployment and scaling by abstracting the operational complexity of the underlying HSM infrastructure, offering highly resilient and geographically redundant key storage options. This shift has democratized access to enterprise-grade key management, particularly benefiting SMEs and cloud-native organizations. Alongside KMaaS, cryptographic agility—the ability to easily switch between algorithms (e.g., AES-256, RSA, ECC) and key lengths without disrupting operations—is now a mandatory feature, driven by the impending shift toward post-quantum cryptographic (PQC) algorithms. Platforms must be built to support hybrid encryption modes, where PQC algorithms can be tested and integrated alongside existing, classical cryptography.

Finally, the technological evolution is heavily focused on integration with broader security ecosystems. Advanced platforms seamlessly integrate with Identity and Access Management (IAM) systems to link key access rights to user identity and role, enforcing a principle of least privilege. They also utilize blockchain technology in niche applications to create immutable logs of key usage and policy changes, enhancing auditability and trust, though this is still nascent. Looking forward, the application of homomorphic encryption techniques and confidential computing requires highly specialized key management capabilities tailored to securing data in computation, paving the way for the next generation of data protection frameworks where keys must be managed in highly dynamic and restricted execution environments.

Regional Highlights

The global Encryption Management Solutions market demonstrates diverse adoption patterns dictated by regional regulatory frameworks, digital infrastructure maturity, and cyber threat prevalence.

- North America: Dominates the global market share due to stringent compliance mandates (e.g., CCPA, HIPAA) and the presence of numerous large technology companies and financial institutions that are early adopters of advanced cybersecurity technologies. The region benefits from a highly mature security ecosystem and high investment in cloud-based KMaaS solutions.

- Europe: A significant market driven almost entirely by the General Data Protection Regulation (GDPR). GDPR mandates strong data protection measures, including encryption, which has spurred widespread enterprise investment in centralized encryption and key lifecycle management to ensure legal compliance and avoid severe financial penalties. Germany, the UK, and France are core contributors.

- Asia Pacific (APAC): Expected to record the highest CAGR during the forecast period. This rapid growth is fueled by aggressive governmental and corporate digitalization efforts, increased internet penetration, and the introduction of new data localization and privacy laws across key economies like China, India, and Australia. The growing volume of sensitive data hosted in public clouds is a primary catalyst.

- Latin America (LATAM): Exhibits steady growth, driven by regional banking reforms and increasing regulatory scrutiny over cross-border data transfers. Key markets like Brazil and Mexico are witnessing higher adoption rates as financial institutions modernize their security frameworks to combat rising cybercrime rates.

- Middle East and Africa (MEA): Growth is primarily concentrated in the Gulf Cooperation Council (GCC) countries, driven by large-scale government infrastructure projects, smart city initiatives, and the need to secure critical national infrastructure, often requiring high-assurance, on-premise solutions. South Africa also serves as a regional cybersecurity hub.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Encryption Management Solutions Market.- Symantec (Broadcom)

- Microsoft Corporation

- IBM Corporation

- Thales Group

- Sophos Group plc

- Trend Micro Incorporated

- Dell Technologies Inc.

- Check Point Software Technologies Ltd.

- Micro Focus (OpenText)

- Proofpoint, Inc.

- Cisco Systems, Inc.

- ESET, spol. s r.o.

- Fortinet, Inc.

- Oracle Corporation

- McAfee, LLC

- Palo Alto Networks, Inc.

- Entrust Datacard Corporation

- WinMagic Corp.

- Hytrust (now part of VMware)

- SealPath

Frequently Asked Questions

Analyze common user questions about the Encryption Management Solutions market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary role of an Encryption Management Solution (EMS)?

The primary role of an EMS is to centralize and automate the entire lifecycle of cryptographic keys—including generation, storage, distribution, rotation, and revocation—ensuring consistent policy enforcement and enhanced compliance across disparate data environments (on-premise, cloud, and hybrid).

How does the shift to cloud computing affect key management adoption?

The cloud shift increases demand for Key Management as a Service (KMaaS) solutions and hybrid platforms that can manage keys residing in cloud providers' Key Management Services (KMS) while maintaining organizational control, preventing vendor lock-in, and ensuring data residency compliance.

What is the most critical compliance regulation driving market growth?

The General Data Protection Regulation (GDPR) in Europe is arguably the most critical driver, as it mandates specific technical and organizational measures, including encryption, to protect EU citizens’ data, applying pressure globally to adopt robust management practices.

Are Hardware Security Modules (HSMs) still necessary with cloud key management?

Yes, HSMs remain vital. Even in cloud environments, they serve as the "root of trust." Cloud providers often use HSMs to back their KMS offerings, and enterprises often deploy their own dedicated HSMs to retain physical or virtual control over master keys for enhanced security and regulatory compliance (e.g., FIPS 140-2 validation).

How is AI influencing the future of encryption management?

AI is being integrated to enhance security operations by automating policy enforcement, predicting optimal key rotation schedules, and providing rapid anomaly detection in key usage patterns, thereby improving cryptographic agility and reducing the administrative burden on security teams.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager