Endodontic Electric Motor System Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443293 | Date : Feb, 2026 | Pages : 241 | Region : Global | Publisher : MRU

Endodontic Electric Motor System Market Size

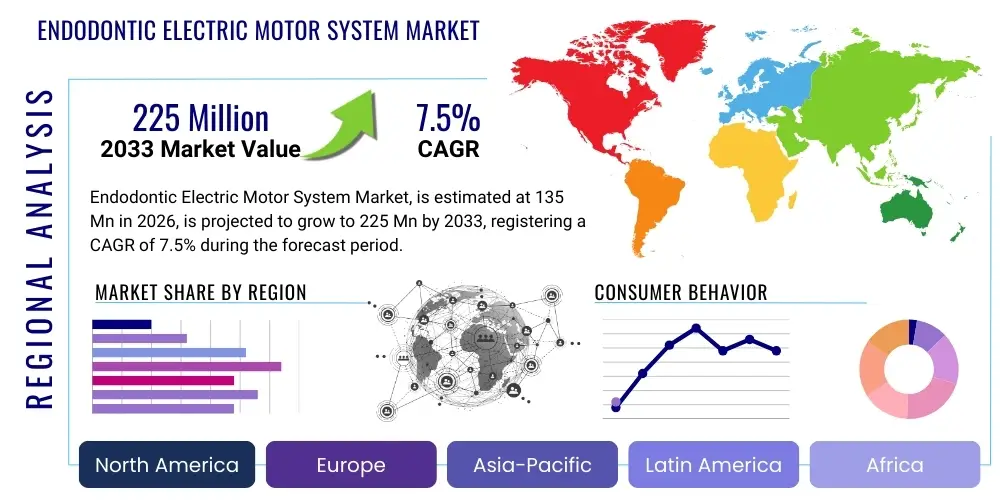

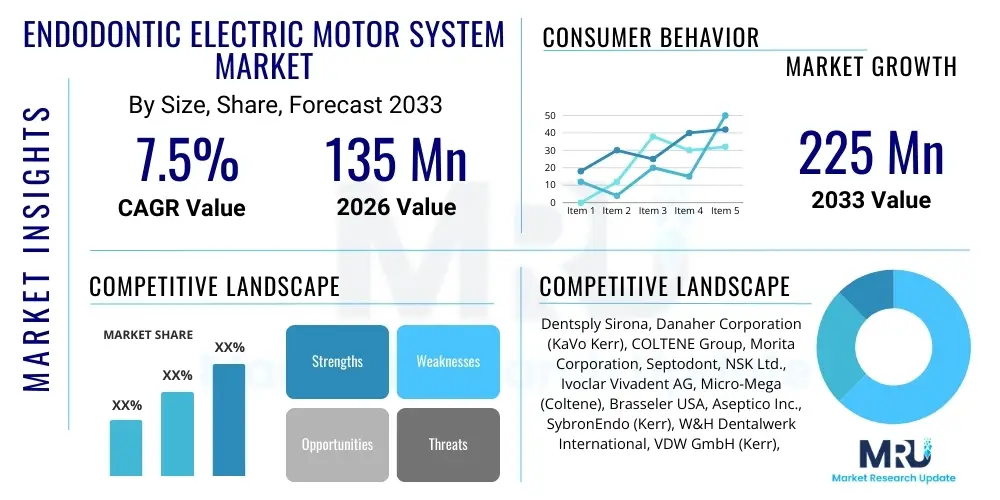

The Endodontic Electric Motor System Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at $135 Million in 2026 and is projected to reach $225 Million by the end of the forecast period in 2033.

Endodontic Electric Motor System Market introduction

The Endodontic Electric Motor System Market encompasses specialized dental devices used for mechanical debridement and shaping of the root canal system during endodontic treatment, commonly known as root canals. These systems utilize electric motors to drive nickel-titanium (NiTi) files, offering precise control over speed, torque, and rotational movement (rotary or reciprocating), which significantly enhances the efficiency and predictability of the procedure compared to traditional manual filing techniques. The adoption of these systems is a direct response to the increasing demand for high-quality, faster, and less invasive dental treatments globally, supported by technological advancements in metallurgy and motor miniaturization.

Key products within this market include standalone electric motors, integrated motor systems often featuring built-in apex locators, contra-angle handpieces, and specialized rechargeable battery units for cordless operation. Major applications primarily involve root canal preparation in dental clinics, hospitals, and specialized endodontic practices. The primary benefit these systems provide is superior cleaning and shaping effectiveness, reducing procedural time, minimizing operator fatigue, and potentially improving long-term clinical outcomes by creating a more optimal shape for obturation (filling).

Market expansion is principally driven by the global rise in dental diseases such as chronic periodontitis and dental caries requiring endodontic interventions. Furthermore, the growing awareness among dental professionals regarding the ergonomic and clinical benefits of mechanized root canal preparation, alongside ongoing product innovations—especially the shift toward lighter, cordless, and smart systems—are key factors propelling market growth across both developed and rapidly developing economies.

Endodontic Electric Motor System Market Executive Summary

The Endodontic Electric Motor System Market is currently undergoing a robust technological transition characterized by the widespread adoption of cordless, integrated systems featuring advanced safety mechanisms. Business trends indicate a strong focus among leading manufacturers on integrating apex location capabilities directly into the motor unit, streamlining the procedural workflow and increasing accuracy. This integration is seen as a crucial differentiator, especially appealing to General Practitioners (GPs) who perform endodontic procedures, broadening the potential customer base beyond specialized endodontists. Furthermore, the development of sophisticated software interfaces allowing for customized file system settings and data logging is gaining traction, positioning these devices as integral components of the modern digital dental practice ecosystem.

Regionally, North America and Europe maintain the largest market shares due to high healthcare expenditure, established dental infrastructure, and early adoption of advanced endodontic technologies. However, the Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR) throughout the forecast period. This rapid growth in APAC is attributable to expanding dental tourism, increasing dental insurance penetration, rising disposable incomes facilitating access to advanced treatments, and a growing pool of trained dental professionals in countries like China and India. Emerging markets are prioritizing cost-effective yet reliable electric motor solutions, leading to increased competition and localized manufacturing efforts.

In terms of segment trends, the cordless segment dominates the market due to enhanced mobility, improved ergonomics, and the elimination of cable management issues, highly valued in busy clinical settings. The key segment driving revenue growth is the integrated systems segment, particularly those compatible with proprietary or specialized NiTi file systems (e.g., controlled memory files). End-user analysis shows that specialized endodontic clinics and large Dental Service Organizations (DSOs) are the primary consumers, investing in multiple units per practice to standardize high-quality care across various locations. The long-term forecast suggests continued emphasis on user-friendly interfaces and enhanced battery life, catering to high-volume clinical demands.

AI Impact Analysis on Endodontic Electric Motor System Market

User queries regarding the intersection of Artificial Intelligence (AI) and endodontic motor systems primarily revolve around automated diagnosis, predictive treatment mapping, and how AI can optimize the actual mechanical preparation process. Common themes include concerns about the level of autonomy AI might bring to root canal treatments, expectations regarding improved clinical predictability, and inquiries into AI’s role in analyzing real-time motor performance data (such as torque fluctuations and speed) to prevent file separation or iatrogenic errors. Users are keen to understand if AI integration will lead to faster learning curves for novice practitioners and standardized, superior outcomes across all levels of expertise. The consensus expectation is that AI will function as a highly sophisticated assistant, enhancing precision rather than fully replacing human judgment.

The core influence of AI on the Endodontic Electric Motor System Market lies in data-driven decision support systems. AI algorithms are increasingly being trained on vast datasets of successful and complicated endodontic cases, enabling them to provide instantaneous recommendations regarding appropriate file selection, optimal speed/torque settings based on Canal anatomy derived from Cone-Beam Computed Tomography (CBCT) scans, and predicted canal complexity. This diagnostic augmentation helps reduce variability in treatment planning. Furthermore, manufacturers are exploring ways to embed machine learning capabilities into the motor systems themselves, allowing the device to dynamically adjust operational parameters (e.g., slight torque modifications) in real-time response to perceived resistance within the canal, optimizing cutting efficiency and significantly mitigating the risk of file breakage, which is a major clinical concern.

Beyond clinical application, AI is poised to revolutionize equipment maintenance and inventory management. Predictive analytics, utilizing the operational data logged by smart electric motors, can forecast potential mechanical failures or required maintenance before they occur, minimizing downtime for clinics. Moreover, AI can optimize the management of specialized disposable NiTi files, tracking usage patterns, and automatically recommending reorder points based on clinical volume and specific procedure types performed. This data integration transforms the electric motor system from a simple mechanical tool into a connected data-generating device critical for operational efficiency and regulatory compliance in modern dental practices.

- Enhanced Diagnostic Accuracy: AI assists in analyzing CBCT data to map complex canal anatomy, influencing motor system settings.

- Predictive Torque Management: Real-time machine learning algorithms adjust motor torque dynamically to prevent file fracture and procedural errors.

- Optimized File Selection: AI suggests specific NiTi file sequences and sizes based on canal geometry and case difficulty.

- Automated Data Logging and Compliance: Motors equipped with AI log all operational parameters, ensuring robust documentation for legal and quality assurance purposes.

- Predictive Maintenance: AI analyzes motor performance metrics to anticipate and schedule required equipment servicing, minimizing clinical disruptions.

DRO & Impact Forces Of Endodontic Electric Motor System Market

The Endodontic Electric Motor System Market is shaped by a powerful confluence of drivers, restraints, and opportunities. The primary driver is the exponentially growing global patient population suffering from dental decay and trauma requiring root canal therapy, combined with a patient preference for shorter, less painful, and more successful treatment outcomes offered by advanced mechanized systems. Restraints predominantly revolve around the high initial capital investment required for these sophisticated motor systems and specialized NiTi files, posing a barrier to entry for smaller, independent practices in developing regions. Opportunities are significant, centered on integrating these motors into larger digital dentistry platforms, leveraging telemedicine for remote consultation on complex cases, and developing more affordable, high-performance battery and motor technologies.

Key drivers include technological proliferation, specifically the refinement of NiTi alloys (such as Controlled Memory and M-Wire technology), which necessitates the use of high-precision electric motors capable of managing specific rotational and reciprocating motions. Furthermore, continuous professional education emphasizing the superior efficacy and safety profile of mechanized endodontics over traditional manual filing is rapidly accelerating adoption rates among younger dental professionals. Regulatory environments, while stringent, are also accelerating innovation by demanding higher safety standards and documentation, naturally favoring the precision and logging capabilities inherent in modern electric motors. These factors collectively exert a significant upward impact force on market demand, establishing mechanized endodontics as the standard of care.

Conversely, significant market restraints include the steep learning curve associated with mastering complex file systems and motor settings, leading to potential practitioner reluctance. The ongoing cost of specialized, often single-use NiTi files, which are essential for proper system function, also contributes to high operational expenses. Market impact forces indicate that pricing pressure, especially from Asian manufacturers offering competitive, feature-rich alternatives, is restraining premium pricing strategies in developed markets. Despite these challenges, the prevailing impact force remains positive, driven by the irreversible trend toward precision dentistry and the clinical imperative to reduce treatment duration and improve patient experience, pushing manufacturers toward developing more intuitive, cost-effective, and fully automated operating modes.

Segmentation Analysis

The Endodontic Electric Motor System Market segmentation provides a detailed insight into product preferences, application scenarios, and end-user demands, facilitating targeted marketing and product development strategies. The market is primarily segmented based on product type (Cordless vs. Corded), movement type (Rotary vs. Reciprocating), and end-user category (Dental Clinics, Hospitals, and Academic & Research Institutions). The strategic importance of segmentation lies in understanding the evolving demands for mobility and integration versus sustained power delivery, and identifying the fastest-growing application areas, which currently favor highly maneuverable, versatile devices suitable for high-throughput clinical settings.

By product type, the shift from bulky corded systems to sleek, high-powered cordless units represents the most pivotal trend. Cordless motors offer unparalleled freedom of movement, reduce clutter in the dental operatory, and utilize advanced battery technology providing sufficient operational time for complex procedures. The movement type segmentation reveals a mature market for continuous rotary motion, but a rapidly expanding preference for reciprocating motion, which is often clinically associated with reduced file stress and minimized risk of procedural accidents. Manufacturers are increasingly developing hybrid systems offering both movement modalities, allowing clinicians to switch seamlessly based on the specific canal morphology encountered.

End-user segmentation clearly indicates that specialized endodontic clinics and large multi-specialty dental chains constitute the largest revenue generating segment, owing to their high procedure volume and ability to invest in premium, high-specification equipment. However, general dental practices, driven by the desire to expand their service offerings and retain patients in-house, represent the fastest-growing customer base for entry-level and mid-range integrated systems. This proliferation among GPs is critical for overall market expansion and necessitates the development of systems with pre-set, simplified programs and robust safety features, lowering the technical skill threshold required for confident adoption.

- By Product Type:

- Cordless Endodontic Motors

- Corded Endodontic Motors

- By Movement Type:

- Continuous Rotary Motors

- Reciprocating Motion Motors

- Hybrid (Rotary and Reciprocating) Systems

- By Application:

- Root Canal Shaping and Cleaning

- Retreatment Procedures

- Apical Prep

- By End-User:

- Dental Clinics (Specialty and General)

- Hospitals and Ambulatory Surgical Centers

- Academic and Research Institutions

Value Chain Analysis For Endodontic Electric Motor System Market

The value chain for the Endodontic Electric Motor System Market begins with the highly specialized procurement of raw materials, primarily focusing on high-precision electronic components, advanced battery cells (lithium-ion), micro-motors, and high-strength engineering plastics for the outer housing. Upstream analysis involves rigorous quality control and sourcing of proprietary components, particularly the specialized micro-motors and gearing mechanisms that define torque accuracy and stability, which are often customized by the manufacturer. The manufacturing stage is complex, involving high-precision assembly in controlled environments, necessitating compliance with stringent medical device manufacturing standards (e.g., ISO 13485) and often integrating software for real-time monitoring and apex location capabilities directly into the hardware.

The downstream component of the value chain is dominated by established and highly specialized distribution channels. Due to the technical nature of the equipment and the regulatory requirements, sales often rely on specialized dental equipment distributors who provide technical support, training, and maintenance services. Direct sales, though less common for small clinics, are increasing for large Dental Service Organizations (DSOs) and teaching hospitals, where manufacturers establish direct contractual relationships to provide integrated solutions and bulk pricing. The regulatory approval process (e.g., FDA clearance in the US, CE marking in Europe) represents a crucial value-adding step, ensuring clinical safety and market access.

Distribution can be categorized as both direct and indirect. Indirect distribution via third-party dental dealers or equipment wholesalers remains the predominant channel, providing necessary logistical reach and localized inventory management across disparate geographical markets. Direct distribution is favored by leading companies to maintain control over branding, pricing, and technical service delivery for high-value contracts. The final stage involves extensive post-sale services, including software updates, technical calibration, repair services, and clinical training, all essential elements that enhance the product's overall value proposition and significantly contribute to customer retention within this technologically driven market.

Endodontic Electric Motor System Market Potential Customers

The primary customers for Endodontic Electric Motor Systems are highly diverse but share a common objective: enhancing clinical efficiency and achieving superior root canal outcomes. Specialized endodontists constitute the core customer segment, demanding premium features such as advanced torque monitoring, integration with multiple file systems, and robust data logging capabilities. These specialists typically require multiple high-specification units to manage high patient volumes and complex referral cases, and they are generally less price-sensitive, prioritizing performance and reliability above all else. Their purchasing decisions are heavily influenced by evidence-based clinical studies and recommendations from key opinion leaders (KOLs) in the field.

The largest growth segment among potential buyers consists of general dentists and non-specialist practitioners who are expanding their scope of practice to include basic and intermediate endodontic procedures. For these practitioners, the key purchasing criteria include ease of use, systems with pre-programmed safety protocols (like auto-reverse functions), integrated apex locators for workflow simplification, and a favorable cost-benefit ratio. Manufacturers are increasingly targeting this demographic by offering simplified, intuitive motor systems bundled with introductory file kits and comprehensive training programs, enabling confident adoption of mechanized techniques without extensive specialized training.

Institutional buyers, encompassing university dental schools, military dental corps, and large public hospitals, represent another critical customer group. These institutions require bulk purchases of durable, standardized equipment for both clinical use and student training. Their purchasing criteria often prioritize longevity, ease of maintenance, compatibility across various clinical settings, and educational features allowing instructors to monitor and record student performance. Dental Service Organizations (DSOs), which manage multiple affiliated practices, are also significant buyers, leveraging their scale to negotiate favorable terms for standardized motor systems across their entire network, emphasizing corporate purchasing efficiency and uniform quality standards.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $135 Million |

| Market Forecast in 2033 | $225 Million |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Dentsply Sirona, Danaher Corporation (KaVo Kerr), COLTENE Group, Morita Corporation, Septodont, NSK Ltd., Ivoclar Vivadent AG, Micro-Mega (Coltene), Brasseler USA, Aseptico Inc., SybronEndo (Kerr), W&H Dentalwerk International, VDW GmbH (Kerr), COXO Dental, Saeshin Precision Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Endodontic Electric Motor System Market Key Technology Landscape

The technology landscape of the Endodontic Electric Motor System Market is characterized by continuous advancements aimed at improving safety, efficacy, and ease of use. A primary technological focus is the evolution of motor control mechanisms, moving beyond simple speed and torque settings to include highly refined software algorithms that manage the delicate interaction between the NiTi file and the canal wall. Modern systems employ advanced electronic feedback loops that constantly monitor resistance and instantly adjust rotation or activate auto-reverse or auto-stop functions, drastically reducing the incidence of file separation—a critical clinical failure point. This sophistication is heavily reliant on miniaturized, high-performance brushless DC motors that offer higher torque at lower speeds and exceptional durability.

A second crucial technological advancement involves the integration of electronic apex locators (EALs) directly into the motor unit. This allows for simultaneous, real-time tracking of the file tip's position within the root canal while the mechanical preparation is underway, eliminating the need for separate devices and streamlining the procedural steps. This integration, often linked via the motor’s handpiece or file clip, provides dynamic feedback and improves the accuracy of working length determination, which is fundamental to successful endodontic outcomes. Furthermore, the motor systems are increasingly designed to be compatible with advanced file material science, particularly Controlled Memory (CM) and other heat-treated NiTi alloys that exhibit superior flexibility and resistance to cyclic fatigue, optimizing the performance envelope of the motor.

Finally, connectivity and ergonomics define the current generation of electric motor systems. Cordless models rely on sophisticated lithium-ion battery technology to provide extended use and rapid charging cycles, meeting the rigorous demands of high-volume clinics. Many premium models now feature Bluetooth or Wi-Fi connectivity, enabling seamless integration with digital patient records (EHRs), facilitating software updates, and allowing for the transfer of treatment data for analytical and educational purposes. The pursuit of superior ergonomics involves lightweight, balanced designs and smaller contra-angle heads, improving visibility and reducing practitioner strain during lengthy procedures, reinforcing the trend toward smarter, more user-centric dental devices.

Regional Highlights

The Endodontic Electric Motor System Market demonstrates distinct characteristics across major geographical regions, driven by varying healthcare infrastructures, reimbursement policies, and adoption rates of advanced dental technology. North America, specifically the United States and Canada, holds the dominant market position, characterized by high patient awareness, robust dental insurance coverage, and immediate adoption of premium, integrated systems. The presence of major market leaders and substantial investment in R&D ensures that this region remains the epicenter for technological innovation and high-specification product launch adoption.

Europe represents a mature market, driven by stringent quality standards and a strong emphasis on evidence-based dentistry. Countries like Germany, France, and the UK are major contributors, exhibiting high penetration rates for both corded and advanced cordless motors. Growth in Europe is steady, supported by continuous professional development and regulatory frameworks that encourage the use of precise, standardized root canal procedures. Manufacturers focus on compliance with CE regulations and ergonomic design tailored to European clinical practice preferences.

The Asia Pacific (APAC) region is forecasted to be the fastest-growing market globally. This expansion is fueled by rising dental healthcare spending, increasing populations, the expansion of modern dental clinics in urban centers, and the growing incidence of lifestyle-related dental diseases. While price sensitivity remains a factor, particularly in developing nations within the region, the demand for cost-effective, durable electric motor systems is escalating rapidly. China and India, with their massive patient bases and burgeoning dental professional communities, are key drivers of volume growth and localized manufacturing innovation.

Latin America (LATAM) and the Middle East & Africa (MEA) present significant opportunities, albeit with market development challenges. LATAM growth is primarily concentrated in urban centers of Brazil and Mexico, driven by private dental practices seeking to offer global standards of care. The MEA region is experiencing growth spurred by healthcare infrastructure investments and medical tourism initiatives, especially in the Gulf Cooperation Council (GCC) countries. These regions are increasingly targeted by manufacturers offering mid-range, reliable systems that provide a balance between advanced features and accessible pricing.

- North America (US & Canada): Market leader, high adoption of premium integrated systems, focus on digital integration and AI readiness.

- Europe (Germany, UK, France): Mature market, steady growth driven by quality standards, strong preference for high-quality, ergonomic devices.

- Asia Pacific (China, India, South Korea): Fastest-growing region, driven by expanding access to care, rapid urbanization, and rising disposable incomes; high demand for cost-competitive yet reliable systems.

- Latin America (Brazil, Mexico): Emerging market segment, growth concentrated in private clinical sector and large metropolitan areas.

- Middle East & Africa (GCC Countries): Infrastructure development and medical tourism fuel demand for modern dental technology.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Endodontic Electric Motor System Market.- Dentsply Sirona

- Danaher Corporation (KaVo Kerr)

- COLTENE Group

- Morita Corporation

- Septodont

- NSK Ltd.

- Ivoclar Vivadent AG

- Micro-Mega (Coltene)

- Brasseler USA

- Aseptico Inc.

- SybronEndo (Kerr)

- W&H Dentalwerk International

- VDW GmbH (Kerr)

- COXO Dental

- Saeshin Precision Co., Ltd.

- Eighteeth Medical

- Foshan Woodpecker Medical Instrument Co., Ltd.

- Techno-Aide

- Shining Smile

- Cerkamed

Frequently Asked Questions

Analyze common user questions about the Endodontic Electric Motor System market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary clinical advantages of using an electric motor system over traditional manual endodontics?

Electric motor systems offer superior clinical efficiency, standardized shaping of the root canal, and precise control over file speed and torque, significantly reducing procedural time and minimizing the risk of procedural errors like canal transportation or ledging compared to manual filing techniques.

How do cordless endodontic motors compare to corded systems in terms of performance and battery life?

Cordless motors generally match the performance of corded systems in terms of torque stability and speed variability, offering superior ergonomics and mobility. Modern lithium-ion battery technology provides sufficient operating time for multiple complex procedures on a single charge, making them the preferred choice for most contemporary dental practices.

What is the significance of an integrated apex locator in modern electric motor systems?

The integrated apex locator (EAL) is crucial for real-time procedural accuracy. It allows the clinician to simultaneously monitor the precise position of the file tip within the root canal while shaping, ensuring accurate working length determination and reducing reliance on multiple radiographic confirmations, thereby simplifying workflow.

What role does the metallurgy of NiTi files play in the functioning of endodontic electric motors?

Advanced NiTi metallurgy, such as Controlled Memory (CM) files, dictates the specific torque and speed settings required for optimal performance. The electric motor system must be compatible with these specific operational parameters to harness the files' flexibility and fatigue resistance, preventing premature file breakage and improving patient safety.

Which end-user segment is driving the highest growth in the Endodontic Electric Motor System Market?

While specialized endodontic clinics remain the largest consumers of high-end equipment, the general dental practice segment is driving the highest market growth rate. General Practitioners are increasingly adopting user-friendly, integrated motor systems to expand their endodontic service offerings and improve practice profitability.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager