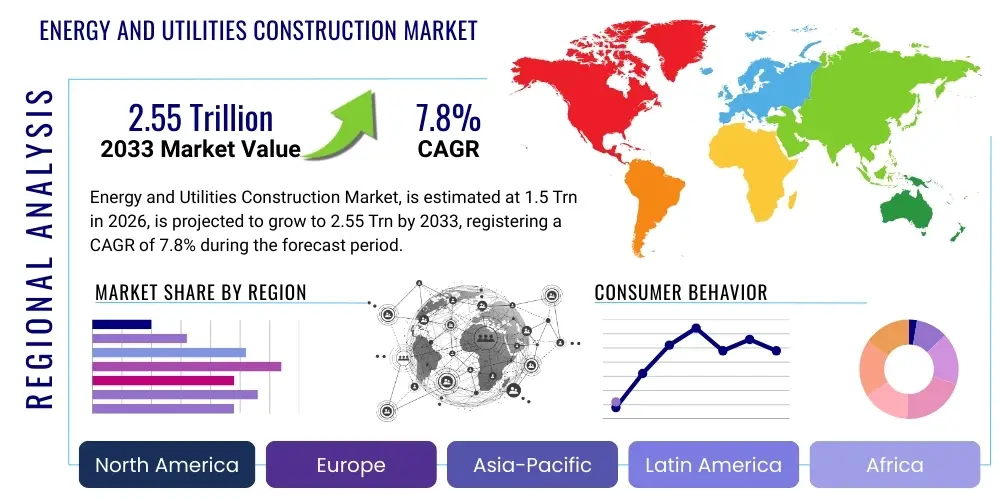

Energy and Utilities Construction Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443181 | Date : Feb, 2026 | Pages : 242 | Region : Global | Publisher : MRU

Energy and Utilities Construction Market Size

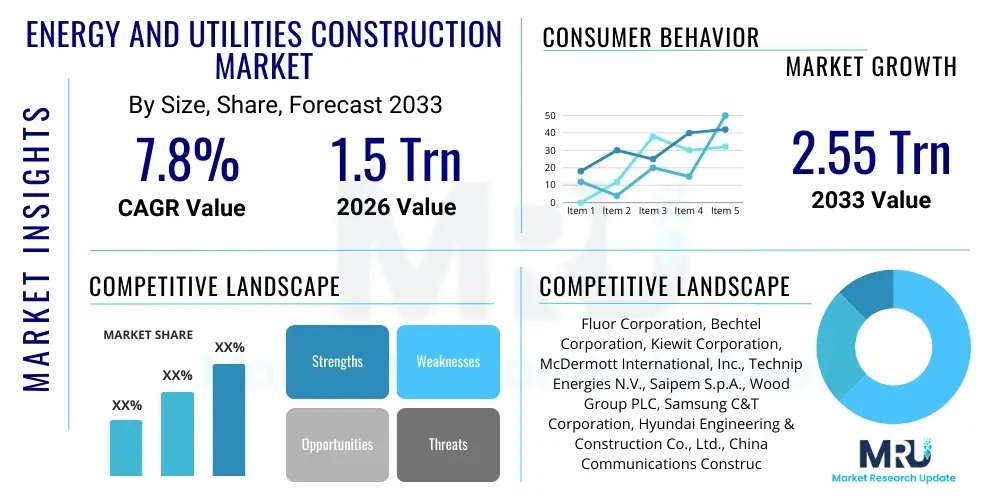

The Energy and Utilities Construction Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 1.5 Trillion in 2026 and is projected to reach USD 2.55 Trillion by the end of the forecast period in 2033.

Energy and Utilities Construction Market introduction

The Energy and Utilities Construction Market encompasses the planning, design, engineering, procurement, and execution of infrastructure projects necessary for generating, transmitting, distributing, and managing energy sources and essential public utilities such as water, sewage, and gas. This sector is fundamentally critical to global economic stability and development, driven by the indispensable need for reliable power and utility services. Key market participants include specialized engineering firms, large-scale EPC contractors, equipment suppliers, and governmental bodies responsible for regulatory oversight and infrastructure investment. The inherent long-term nature and capital intensity of these projects necessitate robust financial planning and adherence to stringent safety and environmental standards, particularly in sensitive areas like offshore wind farms or high-pressure gas pipelines. The scope of construction services ranges from building massive thermal and renewable power plants to installing local distribution networks and upgrading aging grid infrastructure to enhance resilience and efficiency.

The primary applications within this market span across the entire energy value chain. In the power sector, this includes the construction of generation facilities (solar farms, wind parks, hydroelectric dams, natural gas power stations, and nuclear reactors), alongside the development of high-voltage transmission lines, substations, and smart grid components. Utility construction extends to modernizing water treatment plants, expanding desalination capabilities in water-stressed regions, and maintaining complex municipal wastewater systems. Furthermore, the oil and gas segment requires construction for upstream drilling platforms, midstream pipeline networks, storage facilities, and downstream refineries and liquefaction terminals. The benefits derived from construction activities in this domain are manifold, ensuring energy security, enabling the transition to sustainable energy sources, improving public health through better water infrastructure, and supporting industrial growth by providing necessary operational resources.

The growth trajectory of this market is significantly influenced by powerful driving factors. These include unprecedented global commitments toward decarbonization, prompting massive investments in renewable energy infrastructure and associated grid hardening projects. Rapid urbanization and industrialization, particularly in emerging economies across Asia Pacific and Africa, create a sustained demand for new utility infrastructure and expanded power generation capacity. Regulatory shifts, such as stricter emissions standards and mandates for integrating decentralized energy sources, compel utilities to undertake modernization and construction projects. Finally, technological advancements in materials science, digital construction tools, and project management methodologies enhance the efficiency and feasibility of increasingly complex projects, further stimulating market activity across all segments.

Energy and Utilities Construction Market Executive Summary

The Energy and Utilities Construction Market is currently undergoing a transformative period marked by distinct business trends focusing on sustainability and digitalization. Business trends highlight a pronounced shift from conventional thermal power plant construction towards large-scale renewable energy projects, particularly offshore wind and utility-scale solar installations, fueled by corporate Power Purchase Agreements (PPAs) and favorable government subsidies. This transition requires contractors to develop specialized capabilities in complex marine construction and digital integration. Simultaneously, the imperative for grid modernization—to handle intermittent renewable sources and bidirectional power flows—is driving substantial investment in high-voltage direct current (HVDC) systems, advanced metering infrastructure (AMI), and energy storage solutions (ESS) construction. Mergers and acquisitions among specialized EPC firms are increasingly common as companies seek to expand geographical footprint and acquire expertise in niche sustainable technologies or smart utility management systems, aiming to stabilize volatile project pipelines.

Regional trends demonstrate significant divergence in investment priorities. The Asia Pacific (APAC) region stands out as the primary growth engine, driven by the dual needs of expanding baseline capacity to serve massive population growth (especially in India and Southeast Asia) and aggressive national decarbonization targets (notably in China and Japan). North America and Europe are concentrating investments overwhelmingly on infrastructure resilience, grid upgrades, and renewable energy integration, complemented by major federal funding programs targeting clean energy and water infrastructure renewal. Conversely, the Middle East and Africa (MEA) region shows strong construction activity centered around large-scale oil and gas export facilities, alongside significant initial investments in solar and green hydrogen projects, particularly in the Gulf Cooperation Council (GCC) countries where massive solar parks are being developed to support energy transition initiatives.

Segmentation trends reveal that the Power Generation segment, specifically within Renewables, is experiencing the fastest expansion rate, overshadowing traditional segments. Within construction type, Repair, Maintenance, and Upgrades (RM&U) is gaining traction, driven by the need to extend the operational life of existing infrastructure, ranging from aging water pipelines in developed nations to obsolete transmission infrastructure globally. The Oil & Gas segment, while facing long-term headwinds due to energy transition policies, continues to see robust short-term construction in critical midstream infrastructure and LNG export terminals necessary for meeting immediate global energy demands and ensuring supply chain security. This multifaceted growth across segments underscores the market’s responsiveness to both short-term energy security challenges and long-term sustainability mandates.

AI Impact Analysis on Energy and Utilities Construction Market

Common user inquiries regarding the influence of Artificial Intelligence (AI) in the Energy and Utilities Construction Market often center on practical applications for improving project efficiency, mitigating safety risks, and optimizing resource allocation. Users frequently ask how AI can predict construction delays, manage supply chain volatility for complex components (like turbine blades or specialized piping), and automate highly repetitive or dangerous tasks on site. There is also significant curiosity about AI’s role in optimizing the design phase—specifically, using generative design tools and predictive modeling to create optimal infrastructure layouts (e.g., maximizing energy capture in solar or wind farms, or optimizing pipeline routes). Concerns often revolve around the high initial investment in AI platforms, the need for specialized data scientists and engineers, and ensuring data privacy and security when integrating AI across critical infrastructure planning and execution systems. Overall, the collective expectation is that AI will be a core enabler for increasing project certainty, reducing cost overruns, and enhancing the overall sustainability and longevity of constructed assets.

The integration of AI into the construction workflow is fundamentally changing how major projects are managed and executed, moving away from reactive management toward proactive, data-driven decision-making. AI algorithms are increasingly employed for complex risk assessment, identifying potential geological instability, weather-related delays, or equipment failure probabilities before they significantly impact the construction schedule. This predictive capability is particularly valuable in large infrastructure projects, such as cross-country pipelines or high-voltage power lines, where environmental and logistical challenges are immense. Furthermore, AI systems are instrumental in optimizing the utilization of heavy machinery and labor resources on site, minimizing idle time and maximizing productivity through real-time monitoring and algorithmic adjustments to daily work plans, thus driving substantial improvements in cost management and project profitability.

In the context of utility modernization, AI plays a pivotal role in the design and management of smart grids and decentralized energy systems. AI-powered software tools can analyze vast datasets concerning load patterns, weather forecasts, and distributed generation output to optimize the placement and sizing of substations, transmission assets, and energy storage facilities. For water utilities, AI is used to analyze sensor data from existing pipe networks to predict leak locations, prioritizing repair and construction activities where the risk of failure is highest, thereby maximizing infrastructure ROI and minimizing water loss. This strategic application of AI ensures that new construction projects are inherently future-proofed, designed for maximum operational efficiency and reliability, and significantly reducing the lifecycle carbon footprint of utility assets.

- Enhanced Project Scheduling and Risk Prediction: AI algorithms analyze historical data to forecast potential delays (supply chain, weather, labor shortages) with high accuracy.

- Automated Quality Control (QC): Utilizing computer vision and machine learning models to inspect installed components (welds, concrete quality) using drone imagery, ensuring adherence to specifications.

- Generative Design Optimization: AI suggests optimal structural designs and material use for complex assets like wind turbine foundations or substation layouts, reducing material waste.

- Resource and Equipment Allocation: Real-time tracking and optimization of heavy equipment usage and labor distribution across large construction sites to maximize efficiency.

- Predictive Maintenance Planning: AI analyzes operational data from installed utilities (e.g., pipes, transformers) to schedule targeted repair and upgrade construction activities.

- Improved Worker Safety: AI monitoring of construction sites identifies high-risk behavior or unsafe conditions instantly, reducing accidents and insurance liabilities.

DRO & Impact Forces Of Energy and Utilities Construction Market

The dynamics of the Energy and Utilities Construction Market are governed by a robust interplay of Drivers, Restraints, and Opportunities (DRO), collectively constituting powerful Impact Forces that shape investment and execution strategies. The primary drivers revolve around the global momentum of the energy transition, requiring substantial construction of renewable generation facilities, coupled with the critical need for grid modernization to handle decentralized power sources. Simultaneously, the essential nature of utility services (water, sewage, gas) mandates continuous infrastructure renewal and expansion due to population growth and aging asset bases in developed economies. However, these drivers face significant restraints, most notably the complex regulatory approval processes, which often lead to protracted project timelines and escalating costs. Furthermore, the industry grapples with acute shortages of skilled labor capable of managing advanced digital construction technologies and specialized areas like offshore construction, alongside persistent supply chain volatility for essential materials such as steel, copper, and specialized electronic components.

Opportunities within this market are strongly tied to technological innovation and global climate initiatives. The rise of green hydrogen infrastructure construction, involving electrolyzer facilities, dedicated transportation pipelines, and storage solutions, presents a massive, nascent market opportunity for construction firms. Similarly, the necessity of building large-scale Battery Energy Storage Systems (BESS) co-located with renewable power plants provides a stable source of long-term construction contracts. Furthermore, the adoption of advanced construction methodologies, including modular construction, prefabrication, and Building Information Modeling (BIM) coupled with digital twins, offers a pathway for companies to mitigate labor shortages and enhance project efficiency and certainty. Firms that successfully integrate these technologies into their offerings stand to gain a competitive edge by delivering projects faster and within budget, thereby attracting major utility and energy developer clients who prioritize predictable execution and reduced lifecycle costs.

The collective Impact Forces dictate strategic resource allocation and operational focus. Regulatory mandates and global climate goals act as the strongest external force, compelling utilities to prioritize capital expenditure towards sustainable and resilient infrastructure. Financial viability, influenced by fluctuating commodity prices and high interest rates for long-term debt financing, profoundly impacts project initiation. Construction firms must strategically navigate geopolitical risks, particularly those affecting international supply chains and cross-border pipeline/transmission projects. Success in this environment requires proactive risk management, diversification across different utility segments (e.g., balancing volatile oil & gas with steady water or T&D projects), and a strong commitment to sustainable practices to meet increasingly stringent Environmental, Social, and Governance (ESG) criteria set by both investors and regulatory bodies, which now significantly influence contract awards and public perception.

Segmentation Analysis

The Energy and Utilities Construction Market is critically segmented to reflect the diverse operational areas and construction requirements of the energy and infrastructure sectors. The market is primarily divided based on the utility type, construction service scope, and the specific technology utilized. These segmentations are crucial for strategic planning, allowing industry participants to identify high-growth areas, allocate capital effectively, and tailor specialized engineering and construction expertise to specific client needs. The fundamental sectors—Power Generation, T&D, Water & Sewage, and Oil & Gas—each operate under unique regulatory frameworks and technical standards, necessitating distinct procurement and project execution strategies. Analyzing these segments provides a detailed map of the current investment landscape and future development priorities across global utility infrastructure.

- By Sector:

- Power Generation (Thermal, Nuclear, Renewable (Solar, Wind, Hydro))

- Transmission & Distribution (T&D) (HVDC/HVAC lines, Substations, Smart Grid Infrastructure)

- Oil & Gas (Upstream, Midstream (Pipelines, LNG Terminals), Downstream (Refineries))

- Water & Sewage (Water Treatment Plants, Desalination Facilities, Pipeline Networks)

- By Construction Type:

- New Construction (Greenfield Projects)

- Repair, Maintenance, and Overhaul (RM&O)

- Upgrades and Modernization (Brownfield Projects, Smart Grid Integration)

- By Service Type:

- Engineering, Procurement, and Construction (EPC)

- Consulting and Project Management

- Field Services and Commissioning

Value Chain Analysis For Energy and Utilities Construction Market

The value chain for the Energy and Utilities Construction Market is extensive and highly complex, starting with upstream activities involving foundational planning and technological input, moving through the core construction phase, and culminating in downstream deployment and operational handovers. Upstream activities are characterized by critical decision-making, including feasibility studies, detailed engineering design (FEED), securing financing, and complex regulatory approval processes. Key upstream players are technology providers (e.g., turbine manufacturers, specialized water treatment tech vendors), architectural and engineering consultants, and financial institutions that underwrite the massive capital required for infrastructure deployment. The quality and efficiency of the upstream phase directly impact the subsequent construction timeline and cost profile. Robust design and early risk identification are paramount for mitigating delays in the execution phase, especially for projects involving novel technologies like floating offshore wind or hydrogen production facilities.

The core of the value chain is the Construction and Execution phase, dominated by large EPC contractors. This phase involves procurement, construction logistics, site management, installation of equipment, and rigorous quality assurance. Procurement involves securing specialized materials (e.g., high-grade steel, specialized cables, concrete) and proprietary machinery. The primary distribution channel for construction involves direct contracts between the utility owner/developer and the prime EPC contractor. Subcontractors specializing in areas like foundations, electrical wiring, or welding are crucial indirect participants, providing specialized labor and localized expertise. Successful execution requires sophisticated project management software, stringent safety protocols, and effective coordination across a multitude of geographically dispersed vendors and labor forces, ensuring the project adheres to budget and timeline constraints while meeting technical specifications.

Downstream activities focus on commissioning, testing, and operational handover to the utility owner. Post-construction, the constructed assets—be they a new substation or a water purification facility—enter their operational lifespan. Downstream service providers include maintenance contractors, monitoring and diagnostic solution providers, and companies offering asset management software. The feedback loop from the operational phase back to the design and construction segments is increasingly important, driven by data collected from digital twins and smart sensors. This data informs future project planning and drives the Upgrade and Modernization (RM&U) segment. The involvement of indirect distribution channels, such as equipment rental companies and specialized logistics firms, is constant throughout the construction lifecycle, ensuring that the necessary tools and heavy machinery reach often remote or challenging construction sites efficiently.

Energy and Utilities Construction Market Potential Customers

The primary customers and end-users of construction services within the Energy and Utilities sector are entities responsible for delivering essential public services and managing critical infrastructure assets. These customers are broadly categorized into three main groups: publicly owned utilities, privately held independent power producers (IPPs), and major industrial and resource companies. Publicly owned utilities, including municipal water departments, state-owned electricity companies, and regulated gas distributors, represent a stable customer base driven by regulated rate-base expansions and government mandates for infrastructure renewal and service continuity. Their investment cycles are often predictable, tied to long-term government budgets and infrastructure spending bills, making them reliable clients for upgrade and modernization projects.

Independent Power Producers (IPPs) and private renewable energy developers are rapidly growing segments, characterized by their focus on rapid deployment, cost-efficiency, and leveraging private finance, often through project finance structures. These customers are the driving force behind the greenfield construction of utility-scale solar, wind, and battery storage projects. Their procurement processes are highly competitive, prioritizing EPC firms that can demonstrate expertise in novel technologies, speed of execution, and guaranteed performance metrics. Their demand for construction services is directly correlated with energy market prices, PPA availability, and technological maturation in the renewable sector, offering high-growth opportunities but also potential volatility for contractors.

Finally, major resource companies, particularly those involved in Oil & Gas exploration and processing (National Oil Companies and International Oil Companies), and large industrial entities that manage their own captive power and water infrastructure (e.g., mining operations, petrochemical complexes), also form a significant customer base. These customers require specialized, high-specification construction services for complex facilities like LNG liquefaction terminals, offshore platforms, or high-pressure pipelines. Their purchasing decisions are heavily influenced by global commodity prices and strategic capital expenditure aimed at securing long-term supply or optimizing operational efficiency, demanding EPC partners with world-class safety records and deep technical knowledge of hazardous environment construction.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.5 Trillion |

| Market Forecast in 2033 | USD 2.55 Trillion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Fluor Corporation, Bechtel Corporation, Kiewit Corporation, McDermott International, Inc., Technip Energies N.V., Saipem S.p.A., Wood Group PLC, Samsung C&T Corporation, Hyundai Engineering & Construction Co., Ltd., China Communications Construction Company (CCCC), Vinci S.A., Skanska AB, Black & Veatch, PCL Construction, Quanta Services, Inc., SNC-Lavalin Group Inc., Burns & McDonnell, Larsen & Toubro Limited (L&T), Doosan Heavy Industries & Construction, Toshiba Infrastructure Systems & Solutions Corporation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Energy and Utilities Construction Market Key Technology Landscape

The technological landscape of the Energy and Utilities Construction Market is rapidly evolving, driven by the need for greater efficiency, precision, and safety in executing increasingly large and complex infrastructure projects. A foundational technology driving modernization is Building Information Modeling (BIM), which creates a precise, collaborative 3D digital representation of the facility before physical construction begins. BIM is essential for clash detection, quantity takeoffs, and project visualization, significantly reducing rework and material waste. Furthermore, the integration of Digital Twin technology extends BIM's utility into the operational phase, allowing construction data to be used for real-time asset monitoring, predictive maintenance planning, and scenario testing, ensuring that the constructed asset performs optimally throughout its lifespan. These digital tools are critical for complex, long-duration projects like nuclear power plants or offshore drilling platforms, where precision and adherence to regulatory standards are non-negotiable.

Automation and robotics are profoundly changing on-site execution, addressing the persistent challenges of labor scarcity and safety risks. Drone technology equipped with LiDAR and photogrammetry is used for high-accuracy site mapping, progress tracking, and inspection of hard-to-reach or dangerous areas, such as high-voltage transmission towers or pipeline routes in challenging terrain. Advanced robotics are being deployed for repetitive, precision tasks like welding on pipelines or structural assembly, improving quality consistency and speed beyond human capabilities. Furthermore, specialized heavy equipment now incorporates GPS-guided systems and autonomous control features, optimizing earthmoving and material placement tasks, particularly critical for massive solar farm installations or large reservoir construction, thereby maximizing efficiency and reducing human error across the construction lifecycle.

Materials science and modularization represent key technological shifts impacting construction speed and cost. The increasing use of advanced materials, such as high-performance concrete, corrosion-resistant composites, and specialized coatings, extends the durability and operational lifespan of utility infrastructure, particularly in harsh environments (e.g., coastal wind farms, wastewater facilities). Modular construction and prefabrication methodologies involve manufacturing large components or even entire system modules (like skid-mounted substations or packaged water treatment units) off-site under controlled conditions. This approach drastically reduces on-site construction time, minimizes disruption, enhances quality control, and is particularly favored for fast-track projects or those in remote locations, such as new microgrids or remote mining utility installations, providing a significant competitive advantage to firms specializing in advanced fabrication techniques.

Regional Highlights

- Asia Pacific (APAC): APAC is the largest and fastest-growing region in the Energy and Utilities Construction Market, characterized by immense population growth, rapid urbanization, and massive industrial expansion in countries like China, India, and Indonesia. Construction activity is bifurcated, focusing heavily on expanding generation capacity—both coal and gas initially, but with accelerating investment in solar and offshore wind to meet ambitious national targets. Grid infrastructure construction is vital here, necessitated by the integration of large, centralized renewables and the development of cross-country transmission corridors. Significant investments in water security, including the construction of large-scale desalination plants and municipal water distribution networks, further drive market growth.

- North America: The market in North America is defined by regulatory stimuli and the urgent need for infrastructure resilience. Construction is heavily skewed toward grid modernization, including the deployment of smart grid technologies, energy storage systems (BESS), and new HVDC transmission lines to transport renewable power from resource-rich areas (e.g., the Midwest) to demand centers. The passing of major federal legislation focused on infrastructure renewal and clean energy has unlocked substantial capital for construction in both the power sector and for replacing aging water pipes and wastewater treatment facilities across the US and Canada.

- Europe: European construction activity is overwhelmingly dominated by decarbonization efforts, focusing particularly on complex offshore wind farm construction in the North and Baltic Seas, and the supporting transmission interconnectors. There is a strong emphasis on renovating existing natural gas infrastructure for future use with hydrogen and constructing the initial stages of the green hydrogen value chain. Due to high labor costs and environmental restrictions, European projects are leaders in adopting modular construction, prefabrication, and advanced digital technologies to optimize efficiency and minimize site impact.

- Middle East and Africa (MEA): Construction in the MEA region is strongly tied to oil and gas capital expenditures, specifically the development of new LNG export facilities, natural gas pipelines, and refining capacity to secure global market share. Simultaneously, Gulf countries are pioneering massive solar PV parks (e.g., Saudi Arabia, UAE) and are exploring large-scale green hydrogen and ammonia production facilities, representing new, capital-intensive construction opportunities. Africa's market growth is driven by foundational electrification and water infrastructure projects aimed at improving access and reducing energy poverty.

- Latin America: Construction activity in Latin America is primarily concentrated around hydropower expansion, new renewable energy auctions (especially in Brazil and Chile), and the required internal grid reinforcement to manage these new generation sources. While capital constraints can affect project viability, increasing foreign direct investment in renewables and mining-related utility infrastructure drives the market. There is a continued necessity for construction in water and sanitation infrastructure, particularly in fast-growing metropolitan areas needing rapid service expansion.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Energy and Utilities Construction Market.- Fluor Corporation

- Bechtel Corporation

- Kiewit Corporation

- McDermott International, Inc.

- Technip Energies N.V.

- Saipem S.p.A.

- Wood Group PLC

- Samsung C&T Corporation

- Hyundai Engineering & Construction Co., Ltd.

- China Communications Construction Company (CCCC)

- Vinci S.A.

- Skanska AB

- Black & Veatch

- PCL Construction

- Quanta Services, Inc.

- SNC-Lavalin Group Inc.

- Burns & McDonnell

- Larsen & Toubro Limited (L&T)

- Doosan Heavy Industries & Construction

- Toshiba Infrastructure Systems & Solutions Corporation

- GE Vernova (formerly part of GE)

- Siemens Energy AG

- Técnicas Reunidas S.A.

Frequently Asked Questions

Analyze common user questions about the Energy and Utilities Construction market and generate a concise list of summarized FAQs reflecting key topics and concerns.What primary trends are driving the growth of the Energy and Utilities Construction Market?

The primary drivers are the global energy transition mandates accelerating the construction of renewable energy projects (wind, solar), coupled with the critical need for grid modernization (smart grids, T&D upgrades) to ensure system resilience and integrate decentralized power sources. Aging infrastructure replacement in water and sewage systems in developed nations is also a stable growth factor.

How is the oil and gas construction segment adapting to the transition towards renewable energy?

While traditional upstream construction is declining, the oil and gas segment is adapting by focusing on essential midstream infrastructure, particularly LNG export facilities for global gas security, and pivoting expertise toward emerging fields like Carbon Capture and Storage (CCS) and the construction of facilities necessary for green and blue hydrogen production.

What is the role of digital transformation technologies like BIM and AI in utility construction projects?

Digital technologies like Building Information Modeling (BIM) and Artificial Intelligence (AI) are crucial for enhancing project predictability and efficiency. BIM provides accurate digital planning, reducing costly rework, while AI is utilized for sophisticated risk analysis, automated quality control via computer vision, and optimizing complex resource allocation on large-scale infrastructure sites.

Which geographical region offers the most significant growth opportunity for construction firms?

Asia Pacific (APAC) represents the region with the most robust growth opportunities, driven by aggressive infrastructure expansion in developing economies (India, Southeast Asia) and massive renewable energy investments in China. North America also offers strong growth, driven by substantial federal funding for grid resilience and aging asset replacement.

What are the greatest restraints facing the execution of large energy and utilities construction projects?

The most significant restraints include acute shortages of specialized skilled labor, high levels of regulatory complexity leading to prolonged permitting timelines, and persistent volatility in the global supply chain for key materials like high-grade steel, copper, and specialized components required for complex projects such as HVDC transmission lines and offshore platforms.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager