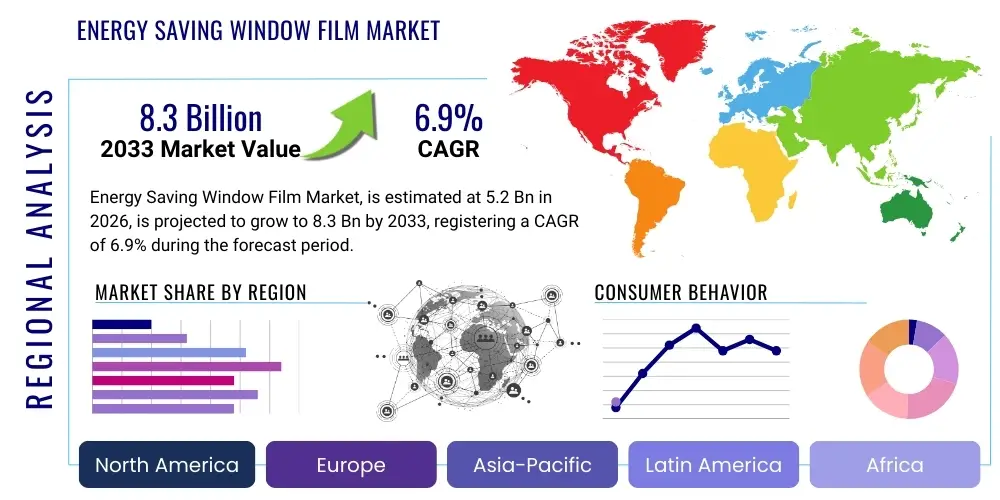

Energy Saving Window Film Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443091 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Energy Saving Window Film Market Size

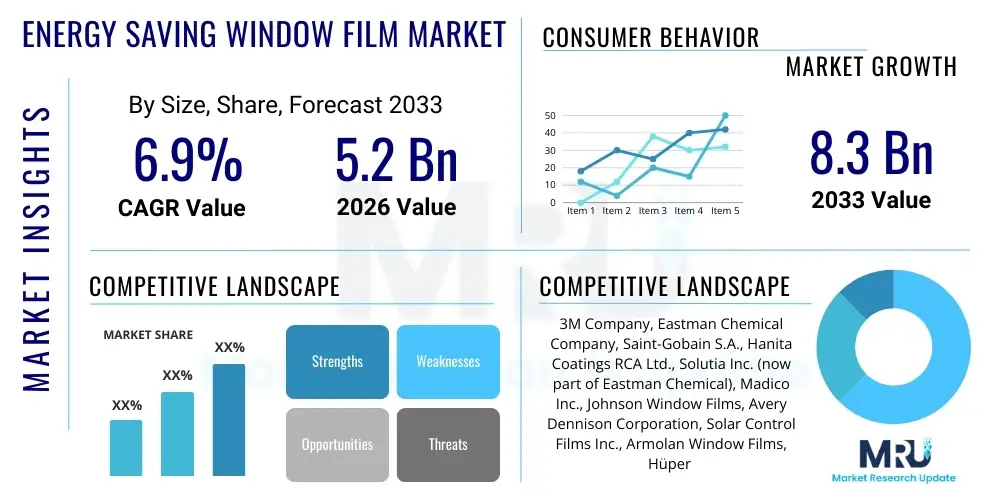

The Energy Saving Window Film Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.85% between 2026 and 2033. The market is estimated at USD 5.2 Billion in 2026 and is projected to reach USD 8.3 Billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by global imperatives concerning energy conservation, coupled with increasing regulatory pressures on commercial and residential building sectors to enhance thermal performance and reduce carbon footprints. The growing acceptance of high-performance materials, such as spectrally selective and low-emissivity (Low-E) films, is a core catalyst supporting this robust financial trajectory, positioning the market as a vital component in the transition toward sustainable architecture and smart infrastructure worldwide.

Energy Saving Window Film Market introduction

The Energy Saving Window Film Market encompasses specialized, multi-layered polymer sheets applied to existing glass surfaces to improve thermal efficiency, solar control, and safety performance of windows. These films primarily function by managing solar radiation, specifically reflecting, absorbing, or transmitting portions of the visible light, infrared, and ultraviolet (UV) spectrums. Key product types include spectrally selective films, which allow high visible light transmission while rejecting significant heat-generating infrared rays, and Low-E films, which minimize heat transfer between interior and exterior environments, crucial for both cold and warm climates. Major applications span commercial real estate (offices, retail, hospitality), residential buildings, and the automotive sector, where they contribute directly to reduced reliance on Heating, Ventilation, and Air Conditioning (HVAC) systems. The fundamental benefit is substantial energy cost savings, improved occupant comfort, glare reduction, and protection against harmful UV degradation of interiors.

The proliferation of stringent building codes, particularly in developed economies, mandating better insulation and efficiency metrics, acts as a pivotal driving force for market uptake. Furthermore, rapidly escalating global energy prices compel building owners and facility managers to seek cost-effective, retrofit solutions that offer quick returns on investment (ROI). Energy saving films provide a significantly cheaper and less disruptive alternative to full window replacement, accelerating their adoption in the vast existing building stock. The continuous technological advancements in film manufacturing, involving sophisticated deposition techniques like sputtering and vacuum coating to integrate metallic oxides and nanoparticles, enhance the films' overall performance metrics, specifically the Solar Heat Gain Coefficient (SHGC) and Visible Light Transmission (VLT). This technological evolution ensures that modern films meet the dual requirements of aesthetic appeal and high functional efficiency.

Beyond energy cost reduction, these products significantly contribute to environmental sustainability goals. By lowering HVAC demand, they indirectly decrease carbon dioxide emissions associated with fossil fuel-based electricity generation. The market is characterized by robust innovation focusing on durability, ease of application, and integration with smart building management systems. Driving factors include governmental subsidies and tax credits promoting energy-efficient upgrades, increasing consumer awareness regarding sustainable living, and the global trend toward green building certifications such as LEED and BREEAM. The commercial sector remains the dominant application segment due to the larger glass surface area and the substantial operational cost benefits derived from improved thermal envelopes.

Energy Saving Window Film Market Executive Summary

The Energy Saving Window Film Market is poised for significant expansion, driven by converging macro-economic trends and technological breakthroughs. Business trends indicate a strong pivot toward retrofit solutions, particularly in mature economies facing aging infrastructure and high energy costs. Strategic partnerships between film manufacturers and large-scale facility management companies are increasingly common, aimed at providing turnkey energy audit and installation services. Furthermore, there is a distinct trend in product innovation focusing on 'smart' films capable of dynamic light regulation or integration into Internet of Things (IoT) ecosystems, enhancing their value proposition beyond static solar control. Regional trends show Asia Pacific (APAC) emerging as the fastest-growing market, primarily fueled by rapid infrastructural development, increasing awareness of climate control necessity in densely populated urban centers, and governmental support for sustainable construction practices. North America and Europe, while mature, exhibit steady demand driven by strict regulatory mandates pertaining to building performance and substantial investments in green building initiatives.

Segment trends reveal that the Spectrally Selective film segment is capturing significant market share due to its superior ability to block heat (infrared) while maximizing natural daylight (VLT), appealing heavily to commercial building aesthetics and occupant well-being. The application segment analysis highlights that the retrofit market significantly outweighs the new construction segment, underlining the importance of addressing the massive existing inventory of inefficient buildings globally. Conversely, the residential segment is showing accelerated growth, supported by direct-to-consumer marketing strategies and an increasing focus on home energy management. Material advancements, specifically the use of advanced ceramic and metal oxide coatings for enhanced durability and performance uniformity, characterize the competitive landscape, pushing manufacturers to continuously improve Solar Heat Gain Coefficient (SHGC) ratings while maintaining high visible light transmission (VLT).

The competitive landscape is moderately fragmented, featuring large multinational chemical and material companies alongside specialized film producers. Key strategic maneuvers include mergers and acquisitions aimed at consolidating specialized coating technologies, aggressive expansion into emerging markets, and heavy investment in R&D to develop films with superior longevity and ease of installation. Sustainability reporting and compliance with global ESG (Environmental, Social, and Governance) standards are becoming critical differentiators for major market players. The overarching market narrative is defined by the transition from simple reflective films to sophisticated, multi-layered products that offer complex solar spectrum management, positioning energy saving films not just as an accessory, but as an integral component of modern, high-performance building envelopes.

AI Impact Analysis on Energy Saving Window Film Market

Common user questions regarding AI's impact on the Energy Saving Window Film Market frequently center on predictive analytics for energy optimization, AI-driven manufacturing efficiencies, and personalized product recommendations. Users are keenly interested in how Artificial Intelligence can move the industry beyond static film application toward dynamic, adaptive solutions. Key themes emerging from these inquiries include the potential for AI algorithms to correlate complex datasets—such as regional climate patterns, building orientation, specific window sizes, internal heat loads, and historical energy consumption—to determine the optimal film type and thickness for maximum return on investment. Furthermore, concerns are raised about how AI can optimize the manufacturing process itself, ensuring quality control, reducing material waste, and customizing production runs based on highly specific market demands and performance specifications. Expectations are high that AI will facilitate the integration of these films into wider smart building ecosystems, allowing for real-time performance adjustments and seamless monitoring.

AI is already beginning to revolutionize the research and development phase by simulating real-world solar performance and material interactions. Generative AI models can rapidly prototype new chemical compositions for films, predicting how changes in nano-coating thickness or material blend will affect crucial metrics like SHGC, VLT, and UV rejection without the need for extensive physical testing. This drastically accelerates the innovation cycle, leading to the faster introduction of next-generation spectrally selective and dynamic films. For end-users, sophisticated AI-powered diagnostic tools are being deployed by installation companies. These tools use high-resolution imaging and environmental sensor data to map a building’s solar exposure profile, identifying 'hot spots' and calculating the precise energy savings potential of various film options. This data-driven approach instills greater confidence in the product’s efficacy and justifies the investment cost, overcoming a historical barrier to adoption.

In manufacturing, machine learning algorithms are optimizing the intricate sputtering and laminating processes. By monitoring thousands of data points from sensors on the production line—including temperature, pressure, and deposition rate—AI systems can detect minute deviations in quality in real time, ensuring uniformity and adherence to strict performance tolerances. This is particularly vital for spectrally selective films that rely on ultra-thin, precise metallic layers. Moreover, AI-powered inventory and supply chain management systems are improving logistics by predicting regional demand fluctuations, thereby minimizing lead times and reducing storage costs. Overall, AI transforms energy saving window film from a passive material solution into an active, data-optimized component of energy efficiency infrastructure, fundamentally shifting market positioning and enhancing competitive advantage for companies adopting these technologies.

- Predictive modeling of thermal performance and energy savings based on real-time climate and building data.

- Optimization of R&D through Generative AI to design novel nano-coating materials with enhanced spectral properties.

- AI-driven personalized recommendation engines for commercial clients, ensuring optimal film selection tailored to specific architectural and geographical requirements.

- Enhanced manufacturing quality control using Machine Learning (ML) to monitor coating uniformity and minimize defects during high-precision deposition processes.

- Integration facilitation with smart building management systems (BMS) for dynamic energy response and monitoring of film efficacy post-installation.

DRO & Impact Forces Of Energy Saving Window Film Market

The market dynamics of the Energy Saving Window Film sector are shaped by a complex interplay of positive catalysts (Drivers), necessary limitations (Restraints), and future growth areas (Opportunities), which collectively constitute the Impact Forces influencing strategic decision-making and market penetration. The primary drivers revolve around the macroeconomic push for decarbonization and energy independence, translating into stringent government regulations like updated energy performance certificates and mandatory efficiency standards for both new and existing commercial properties. The continuous and unpredictable volatility of global energy costs makes the compelling return on investment offered by these films a critical factor for building owners looking to mitigate operational expenditures, reinforcing demand across residential and commercial applications. The non-disruptive, cost-effective nature of retrofitting existing windows compared to full replacement is a massive market opportunity in itself, driving high adoption rates.

However, the market faces significant headwinds, acting as restraints that limit its exponential growth potential. One major restraint is the relatively high upfront installation cost compared to standard, non-performance window treatments, which can deter budget-conscious consumers or small businesses, especially when combined with a lack of standardized consumer education regarding the long-term savings. Furthermore, concerns surrounding the actual durability, lifespan, and warranty claims related to delamination, bubbling, or discoloration present a perception challenge that requires persistent manufacturer assurance and improved product quality. The technical complexity involved in specialized film application also restricts the market, requiring trained professionals and thereby hindering widespread adoption in DIY-centric sectors. Misinformation or skepticism about the actual validated energy savings achieved in various climates also contributes to market inertia in certain regions.

Despite these restraints, substantial growth opportunities exist through technological breakthroughs and strategic market expansion. The development and commercialization of next-generation smart window films, including electrochromic and thermochromic variants that dynamically adjust solar heat gain based on external conditions, represent a major untapped market segment offering premium performance and integration with smart home technology. Furthermore, geographical expansion into rapidly industrializing and urbanizing areas of Southeast Asia and Africa, where cooling costs are becoming prohibitive and regulatory frameworks are evolving, presents lucrative avenues for market penetration. The increased focus on health and wellness, emphasizing improved indoor air quality and daylighting while rejecting harmful UV radiation, also provides a strong non-energy related value proposition, particularly within healthcare and educational facilities. The synergistic effect of these drivers and opportunities substantially outweighs the current restraints, projecting sustained positive momentum for the energy saving window film market over the forecast period.

Segmentation Analysis

The Energy Saving Window Film Market is primarily segmented based on Film Type, Application, and End-User. Analyzing these segments provides a detailed understanding of market dynamics, consumer preferences, and technological adoption trends. The categorization by Film Type—which includes Low-E (Low-Emissivity), Spectrally Selective, and Traditional/Reflective films—is crucial as it distinguishes performance capabilities and suitability for different climatic conditions and architectural requirements. Spectrally selective films dominate the high-performance commercial segment due to their optimal balance of light transmission and heat rejection. Application segmentation (Residential, Commercial, Automotive) reflects the diverse end-use requirements, with commercial buildings representing the largest volume and value segment due to the vast surface area of glass facades and critical need for operational cost reduction. End-User segmentation, distinguishing between new construction and retrofit projects, highlights the dominance of the retrofit market as facility managers seek non-disruptive, quick-to-implement efficiency upgrades for aging infrastructure globally.

The differentiation in segments is vital for strategic planning. For instance, the Low-E film segment sees greater adoption in regions experiencing significant seasonal temperature variations, as their primary function is to minimize heat transfer in both directions—keeping heat in during winter and out during summer. Conversely, highly reflective films, while sometimes less aesthetically preferred for certain commercial applications, remain cost-effective solutions for maximizing solar heat rejection in perpetually hot climates. The automotive segment, driven by regulations concerning fuel efficiency and interior comfort, increasingly adopts specialized films designed for curvature and long-term exposure to road debris and cleaning chemicals. Understanding these granular segment behaviors allows manufacturers to tailor marketing campaigns, allocate R&D resources effectively toward high-growth product types, and establish efficient distribution channels appropriate for each target consumer group, be it large commercial integrators or individual residential consumers.

Furthermore, the interplay between these segments defines competitive strategies. Companies focusing heavily on the Spectrally Selective category must invest in advanced vacuum deposition machinery and supply chain security for specialized materials like silver and proprietary alloys. Meanwhile, companies targeting the residential retrofit market often prioritize ease of installation and comprehensive warranties accessible through retail distribution networks. The trend towards integrating window films with emerging smart glass technologies is starting to blur the lines between traditional static films and dynamic glass solutions, offering new hybrid products that may bridge performance gaps and create entirely new premium segments within the broader energy efficiency market. The robust growth observed across all major segments confirms the films’ fundamental role in achieving global sustainability and energy efficiency goals.

- By Film Type:

- Low-E (Low-Emissivity) Film

- Spectrally Selective Film

- Reflective/Traditional Film

- Ceramic Film

- By Application:

- Residential

- Commercial (Office Buildings, Retail, Hospitality, Government)

- Automotive

- By End-User:

- New Construction

- Retrofit/Renovation

Value Chain Analysis For Energy Saving Window Film Market

The value chain for the Energy Saving Window Film Market is complex, beginning with the highly specialized upstream production of raw materials and extending through sophisticated manufacturing processes, rigorous distribution channels, and professional application services. Upstream analysis focuses on the procurement of base materials, primarily high-grade polyethylene terephthalate (PET) film, which must possess superior clarity, dimensional stability, and resistance to thermal degradation. Critical specialized materials include proprietary chemical coatings, nano-particles (such as titanium dioxide or tungsten oxide for ceramic films), and high-purity metals (like silver, gold, and nickel-chromium alloys) required for the multi-layer, spectrally selective deposition process. The quality and consistent supply of these raw materials directly dictate the performance characteristics (SHGC, VLT) and overall cost structure of the final product, making supplier relationships and material science expertise a major competitive factor in the initial stage of the value chain.

The midstream involves the core manufacturing process, where base PET film is treated via highly technical methods such as sputtering, vacuum deposition, and laminating to embed the energy-saving properties. Manufacturers often operate highly controlled, clean-room environments due to the need for ultra-thin and uniform coating layers. Downstream analysis focuses on bringing the finished product to the end-user. Distribution channels are varied, involving both direct sales to major commercial construction and retrofit integrators, and indirect sales through specialized film distributors, authorized dealers, and franchised installers who handle the cutting, preparation, and expert application of the film. Furthermore, some lower-performance or DIY films are sold through large big-box retailers and e-commerce platforms, though professional installation remains crucial for high-performance commercial-grade products to ensure warranty validity and optimal results. The dominance of the professional installation segment underscores the importance of training and certification in the downstream value chain.

The efficiency of the value chain is increasingly determined by logistical optimization and close collaboration between manufacturers and certified installers. Direct channels are preferred for high-volume commercial projects as they allow for better project management and customization. Indirect channels, particularly the certified dealer networks, are essential for penetrating the highly fragmented residential and small commercial markets, relying on localized expertise and fast service delivery. Profit margins tend to be highest at the specialized raw material supply and the professional installation stages, reflecting the high barriers to entry in material science and the technical skill required for flawless application. Maintaining strict quality control across the entire chain—from material purity to final installation adhesion—is paramount to preserving the film's intended energy performance characteristics and protecting the brand reputation in this highly technical market.

Energy Saving Window Film Market Potential Customers

The potential customers and primary buyers in the Energy Saving Window Film Market span a wide range of institutional, corporate, and residential entities motivated by either cost reduction, regulatory compliance, aesthetic enhancement, or occupant comfort. The largest segment comprises commercial building owners, facility managers, and real estate investment trusts (REITs) responsible for operating and maintaining large portfolios of office buildings, shopping centers, hotels, and industrial complexes. These customers are driven by the need to significantly lower recurring operational costs associated with HVAC usage, achieve green building certifications (like LEED or Green Globes), and comply with increasingly stringent municipal or federal energy performance standards. For these high-volume buyers, the product is valued for its proven ROI, long lifespan, and minimal disruption during installation, making it a critical tool in asset management and ESG reporting.

The second major group includes government and public sector entities, encompassing buyers for schools, universities, hospitals, and municipal administration buildings. These institutions are often under public scrutiny to demonstrate fiscal responsibility and environmental stewardship. Their buying decisions are frequently influenced by federal and local mandates supporting energy-efficient upgrades, alongside the need to improve indoor learning or healing environments by regulating temperature and reducing glare. The third significant customer base is the residential sector, comprising homeowners and multi-family property managers. While often sensitive to upfront costs, this group is motivated by increased personal comfort, protection of expensive interior furnishings from UV damage, and a desire to reduce their monthly utility bills. The residential market shows high potential in regions experiencing extreme heat or cold, emphasizing the dual function of solar rejection and thermal insulation.

Furthermore, specialized industrial buyers, such as those in the aerospace, defense, and niche manufacturing sectors, require energy control and safety films for sensitive environments where temperature stability is critical. The automotive industry represents a focused customer group, primarily large original equipment manufacturers (OEMs) and after-market service providers, seeking films that comply with stringent visibility laws while maximizing cabin cooling efficiency and passenger UV protection. For all potential customers, the decision to purchase is heavily reliant on verifiable performance data, comprehensive warranties, and the availability of highly skilled, certified installers who can guarantee the film's longevity and performance specifications. Therefore, manufacturers often focus on developing robust case studies and partnering with reputable third-party certification bodies to provide the necessary purchasing confidence to this diverse customer base.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 5.2 Billion |

| Market Forecast in 2033 | USD 8.3 Billion |

| Growth Rate | CAGR 6.85% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | 3M Company, Eastman Chemical Company, Saint-Gobain S.A., Hanita Coatings RCA Ltd., Solutia Inc. (now part of Eastman Chemical), Madico Inc., Johnson Window Films, Avery Dennison Corporation, Solar Control Films Inc., Armolan Window Films, Hüper Optik USA, Global Window Films, V-KOOL International Pte Ltd, ASWF (American Standard Window Film), Reflectiv S.A. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Energy Saving Window Film Market Key Technology Landscape

The technological landscape of the Energy Saving Window Film Market is characterized by material science advancements and sophisticated manufacturing processes aimed at controlling the solar spectrum with increasing precision. The core technology involves the precise application of ultra-thin layers of material onto the base PET substrate. Sputtering technology remains a cornerstone, utilizing a vacuum chamber to bombard a target material (like proprietary metal alloys or ceramic oxides) with ions, causing the target atoms to deposit onto the film surface in layers often measured in nanometers. This process allows manufacturers to create spectrally selective films that finely tune the solar rejection characteristics, rejecting infrared radiation effectively while maximizing visible light transmission (VLT), which is crucial for maintaining natural daylighting and occupant health.

A critical trend is the integration of nanotechnology, particularly in ceramic films. These films use ceramic particles, such as tungsten oxide or titanium nitride, which are non-conductive, non-corrosive, and highly efficient at blocking heat and UV rays without interfering with electronic signals (like GPS or cell service), a common issue with older metallic films. Furthermore, these ceramic materials offer superior durability and color stability compared to dyed or traditional metalized films. The development of multi-layer optical film (MLOF) technologies further pushes performance boundaries. MLOFs involve stacking numerous layers (sometimes over 200) of different materials with varying refractive indices to selectively reflect specific wavelengths of light, offering unparalleled control over the solar spectrum and achieving extremely low Solar Heat Gain Coefficients (SHGC) necessary for achieving net-zero energy building standards.

Looking ahead, the market is witnessing significant investment in chromogenic technologies, which represent the cutting edge of dynamic solar control. These include electrochromic, thermochromic, and photochromic films. Electrochromic films, while highly complex, allow users or building management systems to instantly and reversibly adjust the tint and transparency of the window using a low-voltage electrical charge, dynamically responding to changing solar conditions. Though currently more expensive than static films, these smart technologies promise ultimate energy optimization by providing adaptive control, minimizing both cooling and heating loads based on real-time needs. The future of the energy saving window film market lies in these dynamic materials, integration into IoT platforms, and continuous refinement of sputtering and coating techniques to bring down manufacturing costs while improving both longevity and energy performance metrics across the entire product portfolio.

Regional Highlights

The global Energy Saving Window Film Market exhibits distinct regional consumption patterns and growth trajectories, heavily influenced by local climate conditions, regulatory environments, and construction activity levels.

- North America: This region is characterized by high adoption rates, particularly in the commercial retrofit segment. The demand is driven by high energy costs, federal tax incentives (like those related to energy efficiency improvements), and stringent municipal building codes in major metropolitan areas requiring improved window performance. The U.S. market, specifically, shows robust demand for spectrally selective and Low-E films due to the diverse climatic zones, necessitating solutions that manage both extreme heat gain in the South and thermal loss in the North.

- Europe: Europe is a mature market focusing heavily on sustainability and compliance with the European Union's Energy Performance of Buildings Directive (EPBD). The region emphasizes passive energy strategies, and window films are integral to achieving low-carbon goals. Central and Western European countries exhibit strong demand for Low-E products to enhance insulation against cold climates, while Southern Europe focuses on solar control. The market is highly regulated, favoring products with verified performance certifications.

- Asia Pacific (APAC): APAC is the fastest-growing region, fueled by rapid urbanization, massive infrastructure development, and a surge in new commercial and residential construction, especially in China, India, and Southeast Asian nations. High cooling demands in tropical and subtropical climates, coupled with increasing disposable incomes and awareness of energy conservation, are catapulting the demand for high-performance solar control films. Government initiatives promoting energy-efficient building standards are key accelerators in this market, particularly in urban megacities battling severe heat island effects.

- Latin America (LATAM): The LATAM market is emerging, with growth concentrated in rapidly developing economies like Brazil and Mexico. The primary driver is the need for affordable cooling solutions in hot climates. While adoption rates are lower than in APAC or North America, increasing electricity prices and improving consumer awareness are expected to boost the retrofit segment, particularly utilizing traditional reflective and cost-effective solar control films.

- Middle East and Africa (MEA): This region is dominated by extreme heat conditions, making solar heat rejection a paramount requirement for energy efficiency, especially in the GCC countries. Massive investments in commercial infrastructure and hospitality sectors require specialized, high-performance films with extremely low SHGC ratings to manage high solar loads. The market is primarily focused on the commercial sector, with government mandates often driving large-scale adoption in public and corporate buildings to conserve vast amounts of energy currently used for cooling.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Energy Saving Window Film Market.- 3M Company

- Eastman Chemical Company

- Saint-Gobain S.A.

- Hanita Coatings RCA Ltd.

- Solutia Inc. (now part of Eastman Chemical)

- Madico Inc.

- Johnson Window Films

- Avery Dennison Corporation

- Solar Control Films Inc.

- Armolan Window Films

- Hüper Optik USA

- Global Window Films

- V-KOOL International Pte Ltd

- ASWF (American Standard Window Film)

- Reflectiv S.A.

- Lexen Window Film

- Garware Hi-Tech Films Limited

- Lintec Corporation

- SunTek Films (part of Eastman Chemical)

- Purlfrost Ltd.

Frequently Asked Questions

Analyze common user questions about the Energy Saving Window Film market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the typical return on investment (ROI) period for installing energy saving window film in commercial buildings?

The ROI period for commercial energy saving window film typically ranges from 2 to 5 years. This rapid payback is achieved through significant reductions in peak HVAC electricity demand, minimizing cooling costs, and improving equipment lifespan. The exact timeframe depends on local climate, pre-existing window performance, and regional electricity rates.

How do Spectrally Selective films differ from traditional Reflective films in terms of performance?

Spectrally Selective films utilize advanced nano-coatings to block high amounts of infrared (heat) radiation while allowing 40-70% of natural visible light transmission (VLT). Traditional Reflective films block heat primarily by reflecting a large portion of the entire solar spectrum, often resulting in lower VLT and a highly mirrored or darkened appearance, which can be less aesthetically desirable.

Are energy saving window films compliant with strict green building standards like LEED certification?

Yes, high-performance energy saving window films significantly contribute to LEED certification (Leadership in Energy and Environmental Design) and other green building standards. They specifically earn credits under categories related to Energy and Atmosphere (EAp2 and EAc1), Materials and Resources, and Indoor Environmental Quality by reducing energy consumption and improving daylighting performance.

What is the average lifespan of professionally installed commercial-grade energy saving window film?

Professionally installed commercial-grade energy saving window films typically have a lifespan ranging from 10 to 15 years, often backed by manufacturer warranties covering defects such as peeling, cracking, or severe discoloration. Durability depends on film type, exposure conditions, and adherence to proper application protocols.

Can window films be integrated with smart building management systems (BMS) for enhanced energy efficiency?

While static films provide passive energy control, advanced dynamic films, particularly those utilizing electrochromic technology, are designed for direct integration with BMS. This allows the building system to automatically adjust the tint level in real-time based on solar intensity, internal temperature, and occupancy data, optimizing energy use and occupant comfort dynamically.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager