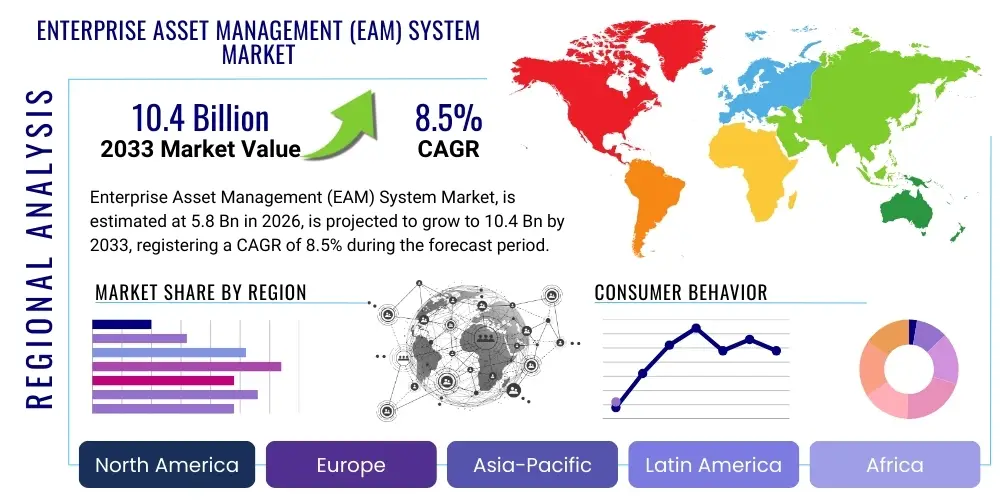

Enterprise Asset Management (EAM) System Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443194 | Date : Feb, 2026 | Pages : 242 | Region : Global | Publisher : MRU

Enterprise Asset Management (EAM) System Market Size

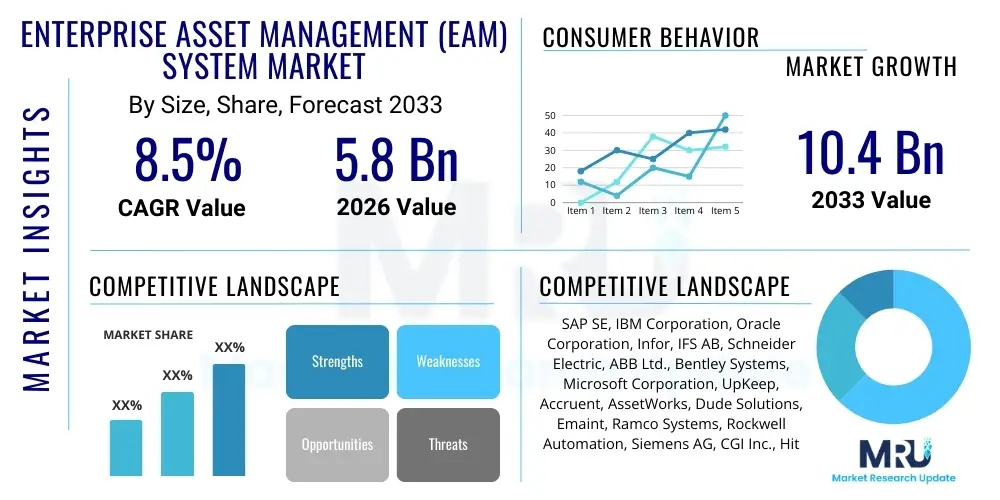

The Enterprise Asset Management (EAM) System Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 5.8 Billion in 2026 and is projected to reach USD 10.4 Billion by the end of the forecast period in 2033.

Enterprise Asset Management (EAM) System Market introduction

The Enterprise Asset Management (EAM) System Market encompasses sophisticated software solutions designed to manage the entire lifecycle of physical assets, maximizing their utility and minimizing operational costs. EAM systems integrate maintenance management, supply chain management, inventory control, and asset tracking capabilities into a centralized platform. This integration is crucial for organizations operating asset-intensive environments, such as manufacturing plants, utilities, oil and gas, and transportation, where asset reliability directly impacts profitability and safety. The primary function of EAM is to transition organizations from reactive maintenance practices to proactive, condition-based, and ultimately predictive maintenance regimes, ensuring optimal asset performance and regulatory compliance across diverse geographical locations.

EAM systems provide substantial benefits, including extended asset lifespan, improved operational uptime, enhanced worker safety, and significant reductions in maintenance expenditures. By centralizing data on asset history, repair schedules, and component inventory, EAM facilitates informed decision-making regarding capital planning and replacement strategies. Modern EAM solutions are increasingly deployed via the cloud, offering scalability, flexibility, and easier integration with other enterprise resource planning (ERP) and operational technology (OT) systems. The shift towards digitalization in industrial operations is accelerating the demand for robust EAM platforms capable of handling complex data streams generated by the Industrial Internet of Things (IIoT).

Major applications of EAM span across critical infrastructure sectors where assets are complex and expensive, including power generation, water treatment, aerospace, and fleet management. Driving factors for market expansion include the global focus on industrial efficiency, stringent regulatory requirements concerning asset integrity and environmental impact, and the imperative to maximize Return on Assets (ROA) in competitive global markets. Furthermore, the convergence of EAM with Artificial Intelligence (AI) and Machine Learning (ML) is fundamentally transforming how maintenance is performed, moving the industry toward truly automated and intelligent asset management.

Enterprise Asset Management (EAM) System Market Executive Summary

The Enterprise Asset Management (EAM) System Market is undergoing rapid transformation, fueled primarily by digital transformation initiatives across asset-intensive industries and the widespread adoption of cloud computing models. Business trends indicate a strong move away from traditional, on-premise solutions towards Software-as-a-Service (SaaS) EAM offerings, favored for their lower total cost of ownership (TCO), faster deployment cycles, and inherent scalability. Key players are aggressively investing in developing capabilities centered around predictive maintenance, leveraging AI and IoT sensor data to forecast equipment failures precisely. Mergers and acquisitions are common, as established ERP vendors seek to incorporate specialized EAM capabilities, while pure-play EAM providers expand their technological portfolios to include cutting-edge features like mobile EAM and geospatial integration.

Regionally, North America maintains its dominance due to high levels of industrial automation, early adoption of advanced technologies like IoT and AI, and the presence of major EAM solution vendors. However, the Asia Pacific (APAC) region is projected to exhibit the highest Compound Annual Growth Rate (CAGR) throughout the forecast period, driven by massive investments in new infrastructure, rapid industrialization, and government mandates promoting smart city and utility initiatives, particularly in countries like China, India, and Southeast Asia. Europe remains a mature market, characterized by strict environmental and safety regulations, which mandates the implementation of advanced EAM for compliance, particularly within the energy and manufacturing sectors.

Segment trends highlight the significant growth of the Cloud deployment segment, which offers unprecedented flexibility for large, geographically dispersed organizations. Furthermore, the application segment focused on Predictive Maintenance is experiencing explosive growth, displacing traditional reactive and time-based maintenance practices. Large enterprises, initially the primary adopters, are being joined by Small and Medium-sized Enterprises (SMEs) that are increasingly realizing the cost benefits and accessibility provided by modular, cloud-based EAM solutions. This comprehensive adoption across enterprise sizes is solidifying the EAM market’s stable and accelerated growth trajectory.

AI Impact Analysis on Enterprise Asset Management (EAM) System Market

Common user questions regarding AI’s influence on the EAM market predominantly revolve around the accuracy and reliability of predictive maintenance algorithms, the practical implementation challenges of integrating AI models with existing operational technology (OT) infrastructure, and the measurable return on investment (ROI) derived from AI-powered asset intelligence. Users frequently question how AI handles 'dirty' or incomplete sensor data, the necessary skill set required for maintenance personnel to interact with machine learning outputs, and the ethical implications concerning data privacy and automated decision-making. The consensus among users is an expectation for AI to deliver truly autonomous asset management, moving beyond simple diagnostics to proactive, self-correcting systems that significantly reduce human intervention and unscheduled downtime. This indicates a high market expectation for mature, explainable AI solutions embedded directly within EAM platforms, driving operational excellence and mitigating complex risk profiles inherent in critical asset operations.

The primary key themes emerging from this analysis center on the democratization of advanced analytics, enabling frontline technicians to utilize complex data insights via user-friendly interfaces, and the urgent need for robust data governance frameworks to support AI-driven EAM. Concerns often address vendor lock-in and the interoperability of various AI models across different asset types and equipment manufacturers. Expectations are high for solutions that not only predict failure but also autonomously trigger the necessary work orders, optimize spare parts inventory based on prediction confidence, and suggest operational adjustments to extend asset life. This integration of intelligence across the EAM lifecycle is perceived as the next indispensable phase of industrial operations, promising unprecedented levels of efficiency and risk mitigation. This heightened scrutiny confirms that AI integration is not merely an enhancement but a fundamental requirement for future EAM systems.

- AI enables highly accurate Predictive Maintenance (PdM) by analyzing complex sensor data patterns.

- Machine Learning (ML) algorithms optimize scheduling and resource allocation, reducing maintenance costs.

- Natural Language Processing (NLP) improves asset history logging and fault diagnostic searches.

- AI drives prescriptive recommendations, suggesting optimal actions rather than just predicting failure.

- Automation of routine EAM tasks (e.g., work order generation, inventory checks) enhances workforce productivity.

- Digital Twin technology, powered by AI, simulates asset performance under various operating conditions.

DRO & Impact Forces Of Enterprise Asset Management (EAM) System Market

The Enterprise Asset Management (EAM) System Market is propelled by a confluence of powerful drivers, tempered by specific restraints, and presenting significant strategic opportunities, all contributing to dynamic impact forces. A primary driver is the accelerating proliferation of the Industrial Internet of Things (IIoT) sensors and connected devices, which provide real-time operational data necessary for condition monitoring and predictive maintenance, thereby necessitating sophisticated EAM platforms for effective data ingestion and analysis. Furthermore, global competitive pressures force organizations to maximize asset utilization and minimize downtime, making the efficiency gains offered by modern EAM systems indispensable. Regulatory mandates, particularly in heavily regulated sectors like energy, utilities, and pharmaceuticals, concerning asset safety, environmental impact, and reporting standards, consistently require comprehensive EAM documentation and performance tracking.

Despite these growth factors, the market faces notable restraints. The initial capital expenditure required for deploying comprehensive EAM solutions, especially traditional on-premise systems, remains a significant barrier for Small and Medium-sized Enterprises (SMEs). Moreover, the complexity involved in integrating EAM systems with disparate legacy Operational Technology (OT) and existing Enterprise Resource Planning (ERP) systems often leads to prolonged implementation cycles and unexpected costs. A critical restraint is the acute shortage of skilled personnel capable of managing and interpreting data generated by advanced EAM systems, particularly those incorporating AI and machine learning components. Data security concerns surrounding cloud deployment and the management of sensitive operational data also pose challenges, requiring substantial investment in cyber-resilient EAM infrastructure.

Opportunities for market growth are abundant, chiefly centered around technological advancements. The development and deployment of Augmented Reality (AR) and Virtual Reality (VR) tools for remote inspection, training, and maintenance procedures offer new avenues for efficiency and safety enhancements. Furthermore, the adoption of 5G networks facilitates seamless, high-volume data transfer from remote assets, unlocking the full potential of real-time monitoring. The expansion into niche applications, such as managing sustainable infrastructure (e.g., solar farms, wind turbines) and smart city assets, presents untapped markets. The collective influence of these forces strongly favors accelerated market expansion, positioning the emphasis on cloud-based, AI-integrated solutions as the primary growth vector, forcing vendors to rapidly innovate to remain competitive and deliver measurable ROI to demanding enterprise customers seeking operational resilience.

Segmentation Analysis

The Enterprise Asset Management (EAM) System market is systematically segmented across various dimensions, including component, deployment type, enterprise size, application, and end-user industry, enabling solution providers to tailor offerings to specific operational needs. The structure of segmentation reflects the diverse technological requirements and deployment preferences of a global customer base, ranging from massive utilities managing distributed networks to single-site manufacturing operations. Analysis of these segments is vital for understanding market dynamics, investment allocation, and targeted marketing strategies. The complexity of modern EAM necessitates granular segmentation, particularly concerning the type of services offered (e.g., consulting, integration, support) versus the core software functionality itself. The migration toward subscription-based models significantly impacts the revenue segmentation profile, favoring recurring revenue streams over one-time software license sales.

The deployment segment remains one of the most transformative areas, with Cloud (SaaS) EAM quickly gaining ground over On-Premise deployments due to its superior agility and reduced infrastructure overheads. Similarly, the segmentation by application highlights the shift from foundational work order management to advanced strategic functions. Predictive maintenance, leveraging big data and analytics, is now the fastest-growing application segment, reflecting the industry's focus on maximizing asset lifespan and minimizing unplanned downtime. Furthermore, segmentation by enterprise size demonstrates that while large enterprises are the largest revenue contributors, the adoption rate among SMEs is rising sharply, driven by cost-effective, scaled-down EAM versions that meet foundational maintenance requirements without the complexity of full-suite ERP integration. This dynamic segmentation underscores the market's maturity and its increasing capability to address diverse operational challenges across the industrial landscape.

- By Component:

- Software

- Services (Professional Services, Managed Services)

- By Deployment Type:

- On-Premise

- Cloud (SaaS)

- By Enterprise Size:

- Small and Medium-sized Enterprises (SMEs)

- Large Enterprises

- By Application:

- Asset Lifecycle Management

- Work Order Management

- Labor Management

- Inventory Management

- Predictive Maintenance

- Supply Chain Management

- By End-User Industry:

- Manufacturing

- Energy and Utilities

- Transportation and Logistics

- Government and Public Sector

- Healthcare

- Oil and Gas

- Mining

Value Chain Analysis For Enterprise Asset Management (EAM) System Market

The EAM system value chain begins with upstream activities centered around core software development, encompassing research and development into advanced functionalities such as AI/ML algorithms, mobile compatibility, and cybersecurity protocols. Key upstream participants include pure-play EAM software vendors, major ERP providers, and specialized technology firms focused on IoT integration platforms and data analytics engines. Strategic alliances between hardware manufacturers (e.g., sensor providers) and software developers are crucial upstream to ensure seamless data flow and compatibility, driving innovation in condition monitoring techniques. The ability of upstream players to quickly integrate emerging technologies, such as blockchain for secure asset tracking and digital twin modeling, dictates their competitive edge and pricing power within the ecosystem. Continuous modular updates and compliance with evolving industry standards are essential upstream deliverables.

Midstream activities primarily focus on the distribution channel, implementation, and integration services. Direct sales channels, where major vendors engage directly with large enterprise clients, remain crucial for high-value contracts requiring extensive customization. However, indirect channels, involving specialized system integrators, value-added resellers (VARs), and implementation partners, dominate the market, particularly for serving SMEs and ensuring successful integration with existing enterprise landscapes (ERP, CRM). These integrators play a vital role in localizing EAM solutions, providing training, and ensuring ongoing technical support. The expertise of these midstream partners in vertical industries is critical, as EAM requirements vary significantly between a utility company and a manufacturing firm.

Downstream activities are dominated by the end-user organizations—the potential customers who utilize the EAM system to manage their physical assets, including monitoring performance, executing maintenance, and optimizing inventory. Effective EAM implementation downstream leads to improved operational efficiency, reduced unexpected downtime, and better regulatory compliance. Feedback from these end-users is channeled back upstream to influence future product development. The distribution channel structure, leveraging both direct expert teams for consultation and indirect networks for implementation reach, ensures that sophisticated EAM technology can be effectively deployed and utilized across geographically diverse and operationally complex environments.

Enterprise Asset Management (EAM) System Market Potential Customers

Potential customers for Enterprise Asset Management (EAM) systems are fundamentally any organization whose core business relies heavily on the performance and longevity of complex, expensive physical assets. This encompasses the entirety of asset-intensive industries where operational failure poses significant financial, safety, or regulatory risks. The largest segment of end-users includes organizations in the Energy and Utilities sector, specifically power generation (including renewables), transmission, and water utilities, where maintaining continuous service delivery and adhering to strict regulatory standards are paramount. These organizations require EAM solutions capable of managing highly distributed networks and critical infrastructure assets over decades.

The Manufacturing industry, covering discrete, process, and heavy manufacturing, represents another massive segment. Customers here prioritize maximizing throughput, reducing equipment failure rates, and optimizing spare parts inventory to maintain tight production schedules. EAM integration with Manufacturing Execution Systems (MES) is a key requirement for these buyers. Furthermore, the Transportation and Logistics sector, including fleet management, aviation, rail, and maritime operations, relies on EAM for scheduled maintenance, condition monitoring of mobile assets, and regulatory compliance related to vehicle safety and emissions. These users often require advanced mobile EAM capabilities for field service technicians.

Emerging and specialized end-users include government and public sector entities managing municipal infrastructure (roads, buildings), healthcare facilities focused on managing expensive medical equipment, and the mining sector, which demands rugged, remote EAM solutions for harsh environments. Essentially, any enterprise seeking to transition from reactive cost-center maintenance to proactive, profit-enabling asset performance management is a prime candidate for modern EAM system adoption, driving broad and continuous demand across the global economic spectrum.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 5.8 Billion |

| Market Forecast in 2033 | USD 10.4 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | SAP SE, IBM Corporation, Oracle Corporation, Infor, IFS AB, Schneider Electric, ABB Ltd., Bentley Systems, Microsoft Corporation, UpKeep, Accruent, AssetWorks, Dude Solutions, Emaint, Ramco Systems, Rockwell Automation, Siemens AG, CGI Inc., Hitachi Ltd., Asset Panda. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Enterprise Asset Management (EAM) System Market Key Technology Landscape

The Enterprise Asset Management (EAM) technology landscape is currently defined by the convergence of several transformative digital technologies, moving EAM solutions far beyond simple computerized maintenance management systems (CMMS). The Internet of Things (IoT) forms the foundational layer, enabling real-time data acquisition from physical assets through sensors, gateways, and edge devices. This constant stream of operational data is critical for condition monitoring and feeding predictive maintenance models. Cloud computing is the prevalent deployment model, offering the necessary elastic scalability and computational power required to process massive volumes of IIoT data effectively. Cloud-native EAM platforms facilitate easier integration with other SaaS enterprise applications and enable continuous feature updates, accelerating the pace of innovation within the market.

Artificial Intelligence (AI) and Machine Learning (ML) represent the intelligence layer, transforming raw data into actionable insights. AI algorithms are employed for fault diagnostics, forecasting Remaining Useful Life (RUL) of assets, optimizing maintenance schedules, and performing anomaly detection. This transition from descriptive and diagnostic analytics to highly accurate predictive and prescriptive analytics is the key technological differentiator for leading EAM vendors. Furthermore, Mobile EAM solutions, utilizing tablets and smartphones, empower field technicians with real-time access to work orders, asset histories, and interactive guides, significantly enhancing productivity and accuracy during maintenance execution, leveraging technologies like geo-location services and offline data synchronization.

Other essential technologies shaping the market include Digital Twins, which create virtual replicas of physical assets, allowing organizations to simulate maintenance scenarios, test operational changes, and predict long-term performance without risk. Blockchain technology is emerging as a critical tool for ensuring secure, immutable records of asset ownership, maintenance history, and supply chain provenance, especially valuable in high-value asset markets like aerospace. Finally, the integration of Geospatial Information Systems (GIS) provides spatial context to asset data, which is indispensable for managing linear assets and distributed infrastructure in sectors like utilities and transportation, allowing for location-aware work planning and regulatory mapping.

Regional Highlights

The global Enterprise Asset Management (EAM) System Market exhibits significant regional variations in maturity, adoption drivers, and growth trajectory. North America currently holds the largest market share, characterized by high technological maturity, substantial industrial automation, and a strong regulatory environment (e.g., NERC in the utility sector) demanding robust asset integrity management. The presence of major EAM solution vendors, alongside large-scale early adoption across critical sectors like oil and gas, manufacturing, and transportation, ensures sustained market dominance. The region is a leader in implementing advanced EAM features, including AI-driven predictive maintenance and cloud-based deployment, due to high IT infrastructure spending and competitive pressure to achieve operational excellence, driving rapid iterative innovation in software capabilities and integration services.

Europe represents the second-largest market, primarily driven by stringent environmental and safety regulations imposed by the European Union, which necessitate comprehensive documentation and life-cycle management of industrial assets. Key sectors contributing to growth include utilities, automotive manufacturing (Industry 4.0 adoption), and renewable energy infrastructure management. While the adoption rate remains high, particularly in Western European nations (Germany, UK, France), the market is relatively mature, with growth focusing on modernization and migration from legacy on-premise systems to contemporary, flexible cloud architectures. Eastern Europe is increasingly investing in EAM solutions as industrial infrastructure undergoes modernization, presenting localized growth pockets focused on efficiency improvements and integration with established EU supply chains.

The Asia Pacific (APAC) region is forecasted to be the fastest-growing market globally, fueled by rapid urbanization, massive infrastructure development, and accelerated industrialization, particularly in emerging economies such as China, India, and Indonesia. Governments in APAC are heavily investing in smart city initiatives and expanding power grids, necessitating sophisticated EAM to manage new assets effectively. While cost constraints sometimes favor on-premise or entry-level EAM solutions, the accelerating push towards digital transformation, driven by foreign investment and global competitive alignment, is increasing demand for advanced, cloud-based, and scalable solutions integrated with mobile technology. This region presents substantial untapped potential, contingent upon improvements in IT infrastructure and increased skilled labor availability to handle complex data environments.

Latin America (LATAM) and the Middle East and Africa (MEA) markets are characterized by selective, high-growth pockets, particularly within natural resource industries (Oil & Gas, Mining) and utilities. In MEA, large-scale, state-led investments in economic diversification, particularly in the Gulf Cooperation Council (GCC) countries, are driving significant EAM adoption for managing new infrastructure projects, power generation facilities, and petrochemical plants. LATAM growth is influenced by foreign direct investment and modernization efforts in manufacturing and logistics, although economic volatility and slower IT adoption rates in some areas can moderate overall market expansion. Both regions show a growing preference for modular, cloud-based solutions that offer scalability without massive upfront capital commitments, often focusing on basic functionalities before transitioning to advanced predictive capabilities as digital maturity increases.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Enterprise Asset Management (EAM) System Market.- SAP SE

- IBM Corporation

- Oracle Corporation

- Infor

- IFS AB

- Schneider Electric

- ABB Ltd.

- Bentley Systems

- Microsoft Corporation

- UpKeep

- Accruent

- AssetWorks

- Dude Solutions

- Emaint

- Ramco Systems

- Rockwell Automation

- Siemens AG

- CGI Inc.

- Hitachi Ltd.

- Asset Panda

Frequently Asked Questions

Analyze common user questions about the Enterprise Asset Management (EAM) System market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between EAM and CMMS?

EAM (Enterprise Asset Management) is comprehensive, focusing on the entire lifecycle of assets—from acquisition and operation to disposal—and includes strategic components like capital planning and supply chain integration. CMMS (Computerized Maintenance Management System) is primarily operational, focusing only on managing day-to-day maintenance activities, work orders, and basic inventory tracking.

Which deployment model is dominating the EAM market?

The Cloud (SaaS) deployment model is currently dominating the EAM market growth trajectory. Cloud-based solutions offer superior flexibility, lower initial capital investment, easier scalability, and faster integration with modern industrial IoT and AI technologies, making them highly attractive to both large enterprises and SMEs seeking agility.

How is AI transforming EAM functionalities?

AI is transforming EAM by enabling highly accurate Predictive Maintenance (PdM) capabilities, moving organizations beyond scheduled or reactive repairs. AI analyzes real-time sensor data to forecast equipment failures, optimize maintenance schedules, and provide prescriptive recommendations for action, thereby maximizing asset uptime and reducing operational costs significantly.

Which industry vertical is the largest consumer of EAM systems?

The Energy and Utilities industry vertical is historically the largest consumer of EAM systems. This sector manages complex, highly distributed, and often mission-critical assets (e.g., power grids, pipelines, generation plants), requiring robust EAM solutions for regulatory compliance, safety, and ensuring continuous service delivery across vast geographical areas.

What are the main market drivers for EAM adoption in the APAC region?

The main market drivers for EAM adoption in the Asia Pacific (APAC) region are rapid industrialization, extensive government investment in new infrastructure projects (smart cities, utilities), and increasing competitive pressure requiring localized manufacturing operations to achieve global operational efficiency and standardization.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager