Entertainment Robot Toys Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442330 | Date : Feb, 2026 | Pages : 243 | Region : Global | Publisher : MRU

Entertainment Robot Toys Market Size

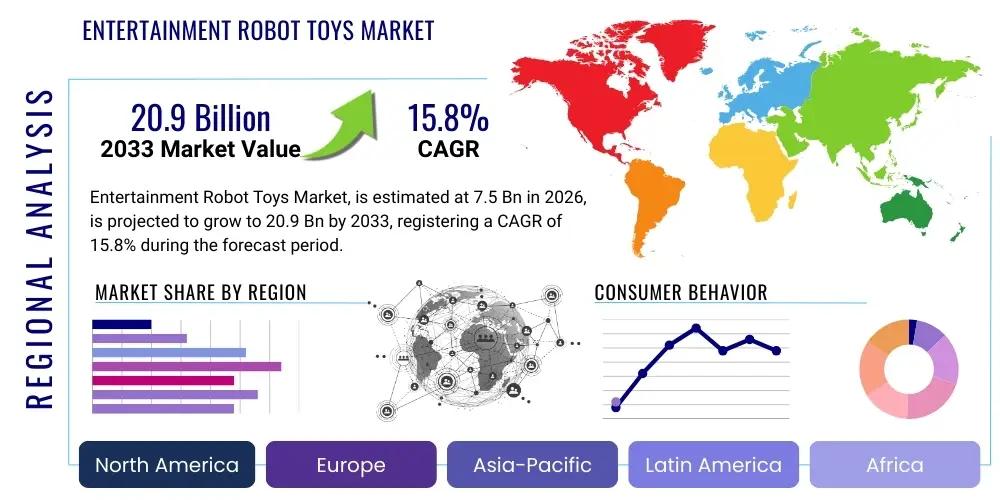

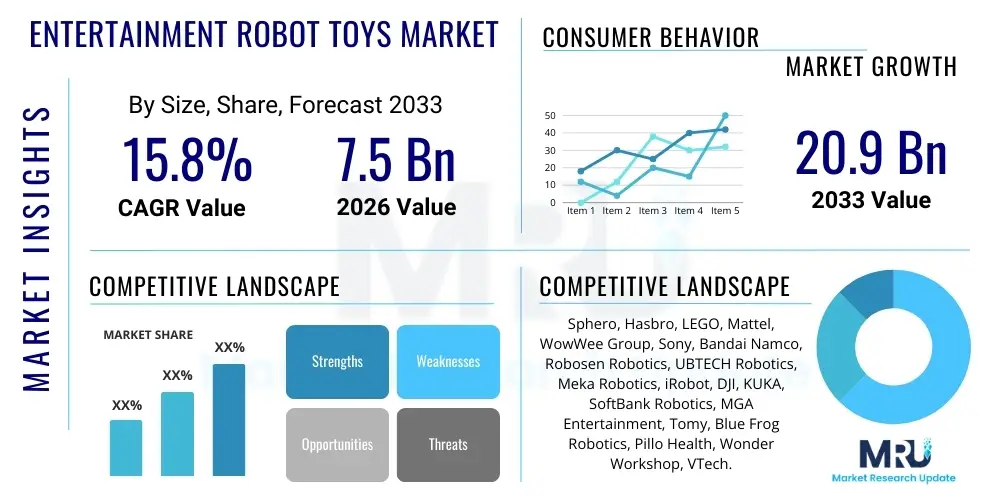

The Entertainment Robot Toys Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 15.8% between 2026 and 2033. The market is estimated at $7.5 Billion in 2026 and is projected to reach $20.9 Billion by the end of the forecast period in 2033.

Entertainment Robot Toys Market introduction

The Entertainment Robot Toys Market encompasses advanced consumer electronics designed primarily for recreational, educational, and companionship purposes. These products integrate complex technologies such as artificial intelligence (AI), advanced sensors, sophisticated motor systems, and cloud connectivity to provide interactive and engaging experiences far beyond traditional static toys. The product range is highly diverse, spanning from programmable humanoid figures and interactive robotic pets to smart vehicle kits and DIY robotics platforms, catering to a broad spectrum of age groups from young children to adult hobbyists and tech enthusiasts. The core appeal lies in the fusion of technology with play, offering dynamic learning and entertainment value that evolves over time.

Major applications for entertainment robots include coding education, companion interaction, competitive gaming, and personalized entertainment experiences. For children, these toys serve as crucial tools for developing Science, Technology, Engineering, and Mathematics (STEM) skills, fostering computational thinking, and providing an early introduction to robotics concepts in a playful manner. For adults, the applications often lean towards collection, advanced programming, robotics experimentation, and sophisticated interactive companionship, particularly with high-fidelity, expressive models. The increasing demand for educational technology and personalized interactive gadgets is consistently driving market expansion, transforming the traditional toy sector into a high-tech consumer segment.

Key benefits derived from these products include enhanced cognitive development, improved problem-solving skills, and sustained engagement through personalization and regular software updates. Driving factors include the continuous reduction in the cost of high-performance components (like microprocessors and sensors), pervasive adoption of smart devices, the proliferation of specialized retail outlets and online platforms dedicated to tech toys, and significant parental investment in educational tools that promise future readiness for their children. Furthermore, technological advancements in battery life, locomotion complexity, and natural language processing (NLP) capabilities are continually expanding the functionality and consumer appeal of entertainment robots, pushing the boundaries of interactive play.

Entertainment Robot Toys Market Executive Summary

The Entertainment Robot Toys Market is experiencing robust growth fueled by several converging business, technological, and consumer trends. Business trends highlight strategic partnerships between traditional toy manufacturers and cutting-edge tech developers, focusing heavily on integrating machine learning and cloud-based services to enhance product lifecycle through continuous feature updates. There is a noticeable shift toward subscription models for content and software updates associated with premium robotic toys, maximizing customer lifetime value. Furthermore, intellectual property licensing, leveraging popular franchises and characters, remains a vital strategy for market penetration and differentiation, driving consumer desire for themed and recognizable robotic companions.

Regional trends indicate North America and Europe retaining dominant market shares due to high disposable income, strong penetration of STEM education initiatives, and a generally higher consumer affinity for advanced technology products. However, the Asia Pacific region, particularly China, Japan, and South Korea, is emerging as the fastest-growing market segment. This acceleration is attributed to rapidly increasing tech literacy, massive manufacturing capabilities lowering production costs, and a cultural embrace of consumer robotics, often fueled by government support for technological innovation in education and consumer goods. Emerging economies in Latin America and the Middle East are also showing increasing adoption, although primarily concentrated in urban centers and high-income demographics.

Segment trends underscore the paramount importance of AI-Enabled robots, which are quickly becoming the standard, driving demand across all price points. Humanoid robots, offering the highest level of interactive complexity and companionship features, command premium pricing and significant interest from adult hobbyists. Educational robots designed for the 6-12 age bracket dominate volume sales, benefiting from institutional adoption in schools and dedicated parental spending. Distribution channels show a clear dominance of online retail, which provides global reach, comprehensive product information, and platform comparisons, although specialized brick-and-mortar stores focusing on hands-on demonstrations remain critical for showcasing complex, high-value robotic systems and fostering community engagement among hobbyists.

AI Impact Analysis on Entertainment Robot Toys Market

User queries regarding AI in the Entertainment Robot Toys Market primarily revolve around the robot's capacity for genuine interaction, learning, and personalization. Consumers frequently ask: "How smart are these robots really?" "Can they remember things about me?" and "Are AI toys safe for my children's privacy?" Key themes emerging from these concerns include the depth of conversational AI (Natural Language Understanding and Generation), the ability of robots to adapt their behavior and personality based on user interaction (machine learning), the integration of sophisticated emotion recognition features, and, crucially, data security and privacy protocols associated with networked, AI-enabled devices. Users expect AI to transcend simple pre-programmed responses, delivering authentic, evolving companionship and complex play scenarios, while maintaining strict adherence to consumer data protection standards like COPPA and GDPR.

The integration of advanced AI algorithms, specifically deep learning and reinforcement learning, fundamentally transforms the utility and perceived value of entertainment robots. These technologies enable robots to process vast amounts of sensory data—visual, auditory, and tactile—to form context-aware decisions, leading to far more realistic and engaging interactions. For example, AI allows robotic pets to develop unique temperaments based on how the user treats them, or permits educational robots to dynamically adjust the difficulty of coding challenges according to the child's demonstrated learning speed. This level of personalized interaction significantly increases consumer retention and justifies the higher price point associated with AI-driven models, positioning AI as the central differentiator in the premium segment of the market.

Furthermore, AI facilitates cloud-based updates, allowing manufacturers to deploy new personalities, game modes, and critical software patches remotely. This capability extends the practical lifespan of the toy, transitioning it from a static purchase to an evolving service platform. The impact of generative AI is beginning to influence content creation, allowing robots to generate novel stories, music, or visual prompts in real-time collaboration with the user, unlocking unprecedented levels of creative play. The sustained growth and technological advancement in this sector are therefore intrinsically linked to continued investment in developing more compact, powerful, and privacy-respecting AI capabilities specifically optimized for consumer-grade hardware and real-time interaction environments.

- AI drives hyper-personalization, enabling robots to evolve personality and behavior based on user data.

- Machine Learning enhances core functionalities such as natural language understanding (NLU), visual recognition, and complex locomotion capabilities.

- Generative AI facilitates dynamic and novel content creation (stories, games) in collaboration with the user, boosting replay value.

- Cloud-based AI infrastructure supports continuous software updates, extending the product lifecycle and adding new features post-purchase.

- Ethical AI frameworks are critical for addressing user concerns related to data privacy, especially for products aimed at children.

- AI optimizes robotics for educational purposes, providing adaptive learning paths and personalized tutoring experiences in STEM subjects.

- Advanced sensor fusion, powered by AI, enables more robust navigation, environmental awareness, and responsive physical interaction.

DRO & Impact Forces Of Entertainment Robot Toys Market

The Entertainment Robot Toys Market is dynamically shaped by a crucial interplay of Drivers, Restraints, and Opportunities (DRO), collectively forming significant Impact Forces that dictate market velocity and strategic direction. A primary Driver is the increasing global emphasis on STEM (Science, Technology, Engineering, and Mathematics) education, prompting parents and educational institutions to invest in interactive, coding-friendly robots as learning tools. Coupled with this is the accelerating pace of technological miniaturization and cost reduction in components like specialized microprocessors, sensors, and actuators, making advanced robotics accessible to a mass consumer market. The rise in disposable income in rapidly developing economies further amplifies this driving force, expanding the consumer base capable of purchasing these relatively premium products.

Conversely, significant Restraints challenge the market's seamless expansion. The high initial cost of premium, AI-enabled robotic systems remains a major barrier to entry for lower-income segments, limiting mass adoption. Furthermore, persistent consumer concerns regarding data privacy and security, especially concerning robots that collect conversational data or visual feeds in domestic environments, create substantial friction. Technological hurdles, such as achieving extended battery life and manufacturing durable, consumer-grade components capable of complex movements, also restrict design freedom and increase production complexity. The rapid obsolescence cycle inherent to consumer electronics demands constant innovation and investment, posing risks to manufacturers.

Despite the Restraints, substantial Opportunities exist, particularly in developing personalized companion robots tailored for specific demographics, such as the elderly or individuals seeking therapeutic interaction. The expansion of 5G and future connectivity standards will unlock highly responsive, cloud-rendered AI processing, enabling cheaper hardware to perform complex tasks previously limited to high-end devices. Furthermore, the burgeoning DIY and hobbyist segments, utilizing open-source platforms and modular robotics kits, present an opportunity for manufacturers to engage an ecosystem of advanced users who contribute to product evolution and community growth. The cumulative Impact Force is one of high disruptive potential, where technological leaps rapidly shift competitive advantage, demanding agile R&D cycles and stringent focus on data ethics to sustain long-term consumer trust and market penetration.

Segmentation Analysis

The Entertainment Robot Toys Market is meticulously segmented based on product type, technology, connectivity, distribution channel, and end-user, reflecting the diverse applications and consumer needs within this sophisticated sector. Understanding these segments is crucial for manufacturers to target marketing strategies, optimize product development pipelines, and forecast regional demand accurately. The market exhibits significant variation in consumer willingness to pay, functionality expectations, and primary use cases across these segmentation axes, driving distinct value propositions for each market niche, from basic, non-AI programmable kits to sophisticated, fully autonomous companion robots.

Analysis by product type reveals a divergence between highly interactive humanoid robots, favored for companionship and advanced interaction, and functional robots, such as robotic vehicles or modular construction kits, which prioritize engineering and coding skills. Technology segmentation highlights the definitive shift towards AI-enabled devices, which command premium pricing but deliver superior, evolving experiences compared to legacy non-AI programmed toys. The distribution segmentation underscores the importance of both efficient online channels for scalability and specialized offline retail for high-touch demonstrations necessary for complex, high-cost robotic products, ensuring consumers fully appreciate the technological capabilities before purchase.

The end-user segmentation is perhaps the most critical, illustrating the vast difference in purchasing drivers between the children’s market (driven by STEM education and parental influence) and the adult/hobbyist market (driven by technical complexity, collection value, and advanced programming capabilities). Manufacturers are increasingly tailoring marketing messages—focusing on educational outcomes for kids and technical specifications and community support for adults—to maximize penetration within these distinct consumer groups, ensuring that the feature set and price point align with the specific needs and technological proficiency of the intended user.

- Product Type: Humanoid Robots, Animal/Pet Robots, Vehicle Robots, Modular Kits/Educational Robots, Others (e.g., Drones, Gaming Peripherals).

- Technology: AI-Enabled Robots (Deep Learning/Cloud Processing), Non-AI Enabled Robots (Pre-programmed/Basic Sensor Interaction).

- Connectivity: Wi-Fi/Bluetooth Enabled, Non-Connected (Standalone Operation).

- Distribution Channel: Online Retail (E-commerce Platforms, Brand Websites), Offline Retail (Specialty Toy Stores, Department Stores, Electronic Retail Chains).

- End-User: Kids (6-12 Years), Teens (13-17 Years), Adults/Hobbyists (18+ Years).

Value Chain Analysis For Entertainment Robot Toys Market

The value chain for the Entertainment Robot Toys Market is complex, involving highly specialized stages from sophisticated component manufacturing to consumer delivery, emphasizing technological input and efficient logistics. Upstream analysis focuses heavily on raw material sourcing and the production of advanced electronic components. This stage is dominated by specialized suppliers of high-precision sensors (LiDAR, ultrasonic, cameras), microcontrollers (optimized for real-time processing and AI inference), high-density batteries, and micro-actuators or servo motors that enable smooth, complex robotic movements. Key strategic dependencies exist on semiconductor manufacturers and specialized mechanical engineering firms, where quality and miniaturization dictate final product performance and cost. The competitive advantage upstream is often secured through economies of scale and control over proprietary intellectual property relating to robotic movement systems.

Midstream activities encompass design, assembly, and software development. Manufacturers invest heavily in industrial design for aesthetic appeal and durability, mechanical engineering for robust chassis and joint construction, and, most critically, software engineering for developing the operating system, AI models, and user interaction protocols. This stage is highly integrated, requiring seamless communication between hardware and software teams to achieve sophisticated functional outcomes, such as natural language understanding and adaptive behavior. Downstream analysis focuses on effective market penetration and consumer relationship management. The primary distribution channels are split between Direct-to-Consumer (DTC) models via brand websites, offering maximum margin control and direct consumer feedback, and Indirect channels, relying on global e-commerce giants and specialized retail partners.

The choice of distribution channel significantly influences market reach and inventory management. Indirect distribution through major retailers provides vast geographical coverage but introduces margin compression and reliance on retailer promotion strategies. Specialty brick-and-mortar stores, which represent a crucial indirect channel, are vital for demonstrating the advanced, interactive features of high-end robots, converting skeptical consumers who require a hands-on experience before committing to a high-value purchase. The efficiency of the entire chain hinges on managing global supply chain risks, ensuring compliance with diverse international safety standards (especially for children’s toys), and optimizing logistics to handle complex, delicate electronic products, ultimately determining the product’s time-to-market and final retail price point.

Entertainment Robot Toys Market Potential Customers

The potential customer base for the Entertainment Robot Toys Market is highly diversified, encompassing three primary end-user segments: children (guided by parental purchasing), educational institutions, and adult hobbyists/tech enthusiasts. Children in the 6-12 age bracket constitute the largest volume market, driven by parental desire to invest in products that promote STEM skills, coding literacy, and future technological readiness. Parents act as the crucial decision-makers, prioritizing safety, educational value, durability, and a positive return on the educational investment, often opting for modular or programmable kits that scale in complexity as the child grows.

Educational institutions, including primary schools, secondary schools, and specialized after-school programs, represent a significant institutional buyer segment. These customers require robust, scalable solutions suitable for classroom use, often favoring bundled packages of educational robots integrated with structured curricula and teacher training resources. Their purchasing criteria focus on institutional budget constraints, ease of integration into existing teaching frameworks, and measurable outcomes in student computational thinking. This segment provides stable, large-volume contracts, contrasting with the volatility of consumer retail.

The adult hobbyist and tech enthusiast segment (18+ years) constitutes the highest value-per-unit customer base. These buyers seek sophisticated, high-fidelity robotic companions, advanced programmable platforms, and robots with unique collection appeal. Their drivers are technological prowess, open-source compatibility for customization, aesthetic design, and the ability to engage in complex programming or competitive robotics. These customers are highly informed, often driving early adoption of cutting-edge features like advanced AI and high-precision kinematics, providing valuable feedback that influences future product generations.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $7.5 Billion |

| Market Forecast in 2033 | $20.9 Billion |

| Growth Rate | 15.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Sphero, Hasbro, LEGO, Mattel, WowWee Group, Sony, Bandai Namco, Robosen Robotics, UBTECH Robotics, Meka Robotics, iRobot, DJI, KUKA, SoftBank Robotics, MGA Entertainment, Tomy, Blue Frog Robotics, Pillo Health, Wonder Workshop, VTech. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Entertainment Robot Toys Market Key Technology Landscape

The technological landscape of the Entertainment Robot Toys Market is characterized by rapid convergence and integration of several sophisticated disciplines, setting it apart from conventional toys. Central to this landscape is the advancement in miniaturized actuators and motor control systems, specifically micro-servo motors and harmonic drives, which allow for high-degree-of-freedom movement in small, consumer-safe packages. This mechanical precision is crucial for humanoid and animal robots to achieve realistic, expressive, and complex locomotion and gestures. Concurrently, the proliferation of specialized System-on-Chips (SoCs) optimized for edge computing is enabling powerful on-board AI processing, reducing reliance on constant cloud connectivity and improving latency for real-time interaction.

Connectivity remains a vital technological pillar. The widespread adoption of Wi-Fi 6 and Bluetooth Low Energy (BLE) facilitates seamless pairing with smart devices, robust Over-The-Air (OTA) firmware updates, and interaction with cloud-based AI services which house the large language models and complex interaction algorithms. Sensor technology is also critical, integrating high-resolution cameras, depth sensors (e.g., structured light or time-of-flight), highly sensitive microphones, and tactile sensors into the robot’s chassis. This sensor suite allows the robot to accurately map its environment, recognize specific voices and faces, and react appropriately to physical touch, significantly enhancing the interactive fidelity and safety of the product.

Furthermore, the software ecosystem surrounding entertainment robots is evolving rapidly, driven by open-source robotics frameworks such as ROS (Robot Operating System) and proprietary platforms developed by major manufacturers. These platforms allow third-party developers and hobbyists to create custom applications, expand functionality, and introduce specialized skills, transforming the robot into a customizable platform rather than a fixed product. The convergence of advanced AI (NLU, computer vision), optimized, robust hardware (actuators, sensors), and high-speed connectivity (5G readiness) defines the current competitive technological edge, driving product innovation towards robots that are not only entertaining but genuinely capable of personalized interaction and learning.

Regional Highlights

The Entertainment Robot Toys Market displays varied growth dynamics and consumer preferences across major global regions, influenced by economic maturity, technological adoption rates, and cultural acceptance of robotics in daily life. North America, encompassing the United States and Canada, currently holds the largest market share in terms of revenue. This dominance is attributed to high consumer spending on advanced electronics, deep-rooted STEM educational focus, and the presence of numerous innovative startups and established technology giants specializing in consumer robotics. The market here is characterized by high demand for premium, AI-enabled companion robots and advanced coding kits.

Europe represents a mature market with significant purchasing power, particularly in Western economies like Germany, the UK, and France. Demand is strongly driven by educational institutions integrating robotics into curricula, coupled with stringent regulatory standards regarding child safety and data protection (GDPR). The European market shows a preference for highly engineered, durable products with clear educational outcomes, often focusing on modular systems that teach engineering principles alongside coding.

Asia Pacific (APAC) is projected to be the fastest-growing region throughout the forecast period. This rapid expansion is spearheaded by countries such as China, Japan, and South Korea, which possess both massive manufacturing capacity and a high cultural affinity for robotics, driven by strong government investment in AI and advanced technology education. China, with its vast consumer base and burgeoning middle class, represents an enormous volume opportunity, while Japan continues to lead in the development and adoption of sophisticated humanoid and companion robots, reflecting a unique societal acceptance of robotic integration into domestic life. This region is characterized by competitive pricing and rapid feature adoption.

Latin America (LATAM) and the Middle East and Africa (MEA) currently hold smaller market shares but offer substantial long-term growth potential. Growth in these regions is concentrated in technologically advanced urban centers where disposable income is higher. In MEA, specifically the UAE and Saudi Arabia, large governmental initiatives focused on diversifying economies and enhancing technology education are driving significant investment in robotics training tools for schools and universities, laying the foundation for future consumer market expansion.

- North America: Market leader by revenue; driven by high consumer spending, strong STEM integration, and demand for premium AI companions.

- Asia Pacific (APAC): Fastest-growing region; fueled by manufacturing capacity, cultural acceptance of robotics, and government support for tech education (China, Japan, South Korea).

- Europe: Stable growth; strong focus on educational robotics and adherence to high safety and data privacy standards (GDPR).

- Latin America and MEA: Emerging markets; growth driven by urbanization and government investments in technological infrastructure and education.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Entertainment Robot Toys Market.- Sphero

- Hasbro

- LEGO

- Mattel

- WowWee Group

- Sony

- Bandai Namco

- Robosen Robotics

- UBTECH Robotics

- Meka Robotics

- iRobot

- DJI

- KUKA

- SoftBank Robotics

- MGA Entertainment

- Tomy

- Blue Frog Robotics

- Pillo Health

- Wonder Workshop

- VTech

Frequently Asked Questions

Analyze common user questions about the Entertainment Robot Toys market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected Compound Annual Growth Rate (CAGR) for the Entertainment Robot Toys Market?

The market is projected to grow at a robust CAGR of 15.8% between the forecast years of 2026 and 2033, driven primarily by advancements in AI technology and increased focus on STEM education globally.

How significantly does AI influence the functionality and value of modern entertainment robots?

AI, particularly machine learning and NLU, is a critical differentiator, enabling hyper-personalization, dynamic interaction, and adaptive learning experiences. AI-enabled robots command premium pricing due to their evolving intelligence and extended utility.

Which geographical region dominates the Entertainment Robot Toys Market in terms of revenue?

North America currently holds the largest market share, characterized by high consumer expenditure on advanced technology products and strong adoption of educational robotics within both household and institutional settings.

What are the main segments of the Entertainment Robot Toys Market based on End-User?

The primary end-user segments are Kids (6-12 years), which is driven by educational demand; Teens (13-17 years); and highly valuable Adults/Hobbyists (18+ years), who focus on technical complexity and programming capabilities.

What are the primary restraints affecting the mass adoption of entertainment robot toys?

Key restraints include the high initial cost of advanced robotic systems, significant consumer concerns regarding data privacy and security (especially concerning devices for children), and the fast pace of technological obsolescence.

What role does the educational robotics segment play in the overall market growth?

The educational robotics segment is a primary growth driver, with modular and programmable robots serving as tools to teach crucial STEM skills and computational thinking. Investment in this area is substantial, supported by both parental and institutional budgets seeking future readiness for students.

How do manufacturers ensure the longevity and continued relevance of entertainment robot products?

Manufacturers leverage cloud connectivity and Over-The-Air (OTA) updates, often facilitated by AI infrastructure, to deliver new features, game modes, software patches, and extended functionality, transforming the product into an evolving service platform and mitigating obsolescence.

Are humanoid robots or vehicle/modular kits leading the market based on product type?

While humanoid robots capture higher-value segments (companionship, advanced interaction), modular kits and educational robots dominate the volume sales, driven by their lower entry price point and explicit link to educational outcomes and learning curricula.

What technological advancements are crucial for the future evolution of entertaining robots?

Crucial advancements include enhanced miniaturized actuators for precise, expressive movement, specialized edge AI processors for low-latency interaction, advanced natural language processing (NLP) for sophisticated conversation, and robust sensor fusion for environmental awareness and safety.

Why is online retail becoming the dominant distribution channel for robot toys?

Online retail offers global reach, competitive pricing, detailed technical specifications for complex products, and the ability for consumers to compare various models and access community reviews, streamlining the purchasing decision for technologically advanced toys.

What regulatory concerns are most prominent for manufacturers in this market?

Manufacturers must strictly adhere to regulations concerning data privacy (such as GDPR in Europe and COPPA in the US, particularly for children’s products) and comply with stringent international standards for product safety, durability, and component quality to ensure consumer trust.

How does the adult hobbyist segment influence product development?

Adult hobbyists drive demand for advanced, highly programmable, and open-source compatible robots. Their technical feedback and willingness to engage with complex features push manufacturers to invest in cutting-edge technology and high-fidelity mechanical systems.

Which components represent the highest value input in the upstream supply chain?

High-value inputs include specialized microcontrollers (SoCs optimized for AI), high-precision micro-actuators and servo motors, advanced sensor arrays (depth and vision), and high-density, long-lasting battery technology essential for maximizing operational time.

What impact do licensed intellectual properties (IP) have on the market?

IP licensing, using popular characters or franchises, significantly boosts market penetration and consumer appeal by creating recognizable and desirable products, often generating initial sales volume and strengthening brand loyalty among targeted consumer groups.

How is the market addressing the need for sustainability in robot toy manufacturing?

Manufacturers are increasingly focusing on modular design for easier repairs and upgrades, utilizing more sustainable, recyclable materials in chassis construction, and optimizing energy efficiency in both operation and charging to address growing consumer demand for environmentally conscious products.

What is the importance of tactile and responsive sensory feedback in companion robots?

Tactile and responsive feedback systems are vital for simulating lifelike interaction and enhancing emotional attachment. These sensors allow the robot to respond realistically to touch, pets, or physical handling, significantly increasing the perceived quality of companionship and emotional engagement.

How do educational robot manufacturers integrate with school curricula?

Leading manufacturers partner with educators to develop specialized curriculum packages, teacher training modules, and structured lesson plans that align the robot's capabilities with national or regional educational standards (e.g., teaching specific block-based or text-based coding languages).

What is the projected market size of the Entertainment Robot Toys Market by 2033?

The market size is projected to reach approximately $20.9 Billion by the end of the forecast period in 2033, driven by sustained high growth rates in APAC and continuous technological innovation globally.

Beyond companionship, what specialized therapeutic applications are emerging for entertainment robots?

Specialized applications include assisting in therapy for children with developmental challenges, providing interactive cognitive stimulation for the elderly, and offering non-judgmental, responsive interaction for individuals dealing with social isolation or mental wellness needs.

What is the difference between Direct and Indirect distribution channels in this market?

Direct distribution (DTC) involves sales through the brand's own website or stores, providing higher margins and direct consumer data. Indirect distribution involves third-party retailers, such as Amazon, specialized electronics stores, or traditional toy shops, offering wider market reach.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager