Entity Management Software Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443345 | Date : Feb, 2026 | Pages : 248 | Region : Global | Publisher : MRU

Entity Management Software Market Size

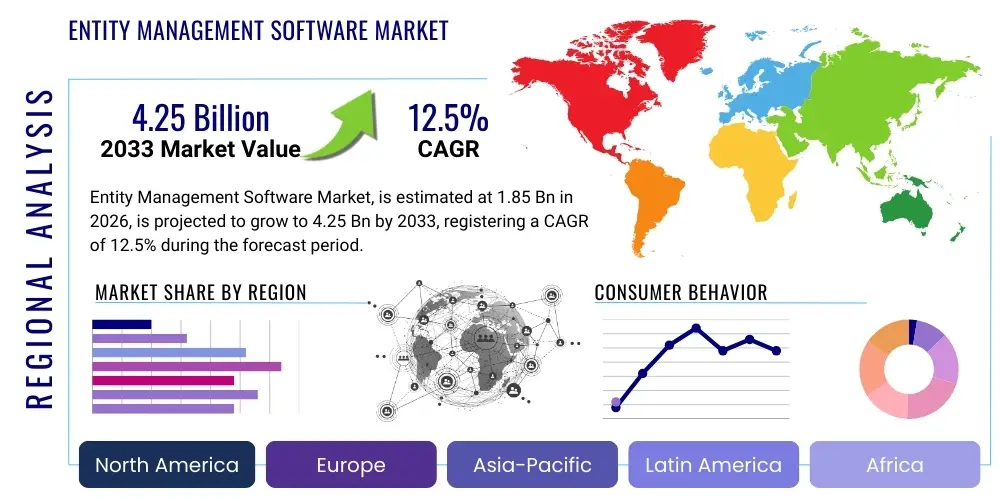

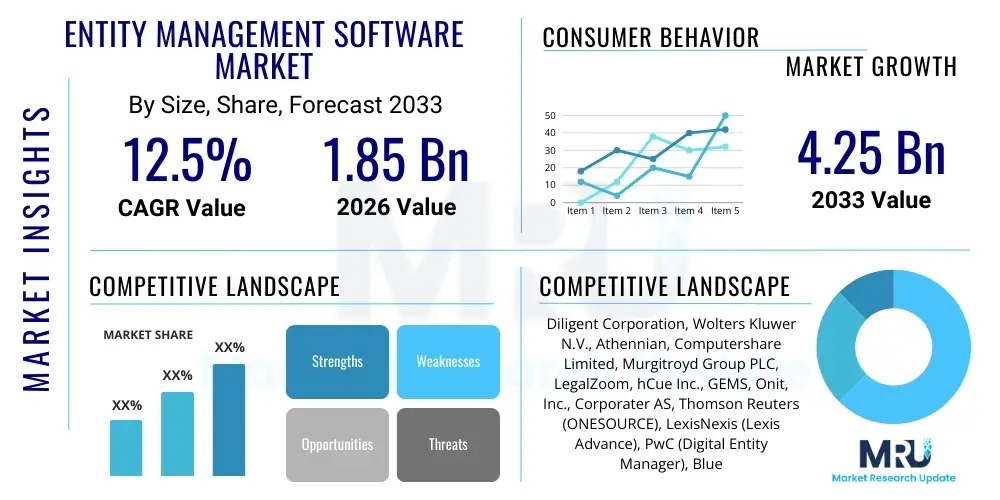

The Entity Management Software Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2026 and 2033. The market is estimated at $1.85 Billion USD in 2026 and is projected to reach $4.25 Billion USD by the end of the forecast period in 2033.

Entity Management Software Market introduction

The Entity Management Software Market encompasses technological solutions designed to help organizations centrally manage, organize, and maintain corporate compliance records, legal entities, ownership structures, and regulatory filings across multiple jurisdictions. These platforms provide critical support for corporate secretarial functions, ensuring transparency, minimizing governance risk, and streamlining complex reporting obligations associated with global operations. The software digitizes paper-based processes, creating a single source of truth for all entity-related data, which is crucial for internal audits, regulatory submissions, and proactive risk management.

Major applications of entity management software span legal compliance, corporate governance, treasury management, and tax optimization. Key benefits include enhanced data accuracy, reduced manual error rates, improved visibility into organizational structure, and significant time savings associated with mandatory regulatory filing deadlines. These systems often integrate modules for board management, statutory registers, and document management, making them indispensable tools for multinational corporations seeking robust governance frameworks.

Driving factors for market growth include the increasing complexity of global regulatory environments, particularly stringent requirements like GDPR, escalating demand for transparency in corporate ownership structures (e.g., beneficial ownership rules), and the widespread digital transformation initiatives across legal and finance departments. Furthermore, the rise in cross-border M&A activity necessitates efficient management of newly acquired entities, further propelling the adoption of centralized entity management platforms.

Entity Management Software Market Executive Summary

The Entity Management Software Market is experiencing robust growth driven primarily by escalating regulatory pressures and the imperative for standardized corporate governance globally. Business trends highlight a strong shift toward cloud-based deployment models, favored for their scalability, accessibility, and lower upfront capital expenditure, particularly among Small and Medium Enterprises (SMEs). Large enterprises, while initially utilizing on-premise solutions, are increasingly migrating to hybrid or fully cloud environments to facilitate real-time data synchronization across disparate geographic locations. Key vendors are focusing heavily on integrating Artificial Intelligence (AI) and Machine Learning (ML) capabilities to enhance predictive compliance monitoring and automate routine data entry tasks, thereby delivering greater efficiency to corporate legal departments.

Regionally, North America maintains the dominant market share, characterized by high adoption rates due to stringent regulatory regimes (SEC, IRS) and the presence of numerous global headquarters. However, the Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR) during the forecast period. This accelerated growth is fueled by rapid economic development, increasing foreign direct investment, and emerging governance mandates in countries like China, India, and Australia, pushing local businesses to professionalize their entity maintenance processes. Europe is also a significant contributor, driven by complex, overlapping EU directives requiring meticulous cross-border legal structure management.

Segment trends reveal that the Services component (including implementation, consulting, and maintenance services) is growing faster than the Software component itself, reflecting the specialized expertise required for setting up and integrating these sophisticated compliance systems into existing enterprise resource planning (ERP) and financial systems. By end-user, the Banking, Financial Services, and Insurance (BFSI) sector, along with the corporate legal departments in large enterprises, remain the primary adopters, given their critical need for watertight corporate legal entity data to mitigate financial and reputational risks associated with non-compliance.

AI Impact Analysis on Entity Management Software Market

User queries regarding the integration of AI in Entity Management Software frequently center on themes of automation accuracy, the potential for predictive regulatory monitoring, and data privacy concerns associated with feeding sensitive governance documents into learning models. Users are keenly interested in how AI can move the function beyond simple record-keeping toward proactive risk identification and strategic decision support. Key concerns revolve around ensuring AI algorithms accurately interpret complex, nuanced statutory requirements across varying jurisdictions, and how these tools handle beneficial ownership disclosure obligations without introducing new compliance vulnerabilities. Expectations are high regarding AI’s ability to automate the generation of compliance reports and identify potential governance gaps before they result in penalties.

The core influence of AI integration is shifting the entity management function from reactive compliance reporting to a highly proactive, intelligent risk mitigation system. AI/ML algorithms analyze vast databases of regulatory changes, statutory deadlines, and corporate documents in real time. This capability allows the software to provide immediate alerts on upcoming filing obligations based on entity domicile and type, drastically reducing the risk of accidental non-compliance. Furthermore, AI is utilized in natural language processing (NLP) capabilities to scan and summarize legal documents, such as board resolutions and minutes, automating the extraction of key operational data needed for entity profiles.

This technological evolution necessitates a corresponding upskilling of corporate governance professionals, who will transition from manual data handlers to strategic oversight managers utilizing AI-generated insights. The development cycle in this market segment is now heavily focused on integrating robust audit trails and explainable AI (XAI) features to ensure transparency in automated compliance decisions, addressing the underlying user skepticism regarding black-box compliance tools. Successful adoption hinges on the platform's ability to seamlessly merge human oversight with algorithmic efficiency, ensuring that highly sensitive corporate legal data remains secure and accurately managed.

- Enhanced Data Verification and Validation: AI algorithms automatically cross-reference data inputs against multiple internal and external sources (e.g., government registries) to ensure the integrity and accuracy of entity records, minimizing human error.

- Predictive Compliance Monitoring: Machine Learning models forecast potential regulatory breaches or upcoming deadlines based on jurisdictional changes, providing proactive alerts to governance teams.

- Automated Document Generation: NLP facilitates the automatic drafting of standardized compliance documentation, such as annual returns, director changes, and standard resolutions, significantly accelerating administrative workflows.

- Intelligent Risk Scoring: AI assigns dynamic risk scores to individual entities based on governance structures, geographic exposure, and regulatory history, allowing managers to prioritize audits and compliance efforts.

- Streamlined Due Diligence: During M&A activities, AI rapidly processes and categorizes large volumes of legal documentation for newly acquired entities, accelerating the integration and harmonization of governance structures.

DRO & Impact Forces Of Entity Management Software Market

The Entity Management Software market dynamics are shaped by a complex interplay of Drivers, Restraints, and Opportunities, which collectively form the Impact Forces dictating adoption rates and technological investment. The primary drivers include the stringent global regulatory landscape, notably the acceleration of beneficial ownership registration requirements across major economies, and the growing corporate liability associated with weak governance structures. These external pressures compel organizations, particularly those operating across multiple jurisdictions, to invest in robust, centralized systems to avoid massive financial penalties and reputational damage. Simultaneously, the internal push for digital transformation within corporate secretarial and legal functions emphasizes efficiency gains, moving away from archaic, decentralized systems based on spreadsheets and physical files toward integrated digital platforms.

Despite these strong drivers, the market faces significant restraints. High initial implementation costs, particularly for large-scale enterprise deployments requiring extensive customization and integration with legacy ERP systems, often deter adoption, especially among mid-sized companies. Furthermore, the complexity inherent in data migration—transferring decades of historical corporate records accurately into a new system—poses a substantial technical and logistical challenge. Resistance to change within traditionally conservative corporate legal departments also acts as a subtle but pervasive restraint, requiring substantial change management efforts from vendors.

Opportunities for market expansion are centered around embedding advanced regulatory technology (RegTech) features, utilizing blockchain for secure, immutable record-keeping of legal entities, and targeting underserved markets such as developing nations where governance frameworks are rapidly maturing. The growing demand for specialized software catering specifically to Private Equity (PE) firms and fund managers managing complex, temporary entity structures also presents a fertile growth area. The ultimate impact force is the undeniable trend toward compulsory global transparency, making entity management software not just a useful tool, but a mandatory infrastructure component for any organization seeking operational legitimacy and resilience in the 21st century global economy.

Segmentation Analysis

The Entity Management Software market is segmented based on deployment model, component, end-user industry, and organization size. This segmentation provides a granular view of market dynamics, revealing varying adoption rates and technological preferences across different corporate structures and geographical areas. The market analysis reveals that while software licenses form the foundation, the complementary services segment, including consulting and implementation, is becoming increasingly vital due to the customization and expertise required to deploy these complex RegTech systems successfully. Understanding these segments is critical for vendors designing product strategies that align with specific buyer needs, such as the preference for cloud solutions among SMEs versus the hybrid demands of large, heavily regulated institutions.

Deployment model segregation is perhaps the most dynamic area, with the rapid ascent of SaaS (Software as a Service) overtaking traditional on-premise solutions. SaaS offers flexibility and lower total cost of ownership (TCO), appealing broadly to organizations of all sizes. The component segmentation differentiates between the core software platform (focused on databases and functionality) and the critical services (training, integration, support) necessary for successful implementation and continuous regulatory updates. End-user classification demonstrates the deep reliance of highly regulated industries, such as BFSI and Healthcare, on these tools for navigating stringent sectoral compliance demands.

- Deployment Model:

- Cloud-Based

- On-Premise

- Component:

- Software

- Services (Consulting, Implementation, Training & Support)

- Organization Size:

- Small and Medium Enterprises (SMEs)

- Large Enterprises

- End-User Industry:

- Banking, Financial Services, and Insurance (BFSI)

- Legal and Corporate Secretarial Firms

- Healthcare and Pharmaceuticals

- Information Technology (IT) and Telecom

- Retail and Consumer Goods

- Government and Public Sector

- Functionality:

- Compliance and Regulatory Filing

- Corporate Governance Management

- Organizational Structure Management

- Board and Shareholder Management

Value Chain Analysis For Entity Management Software Market

The value chain for the Entity Management Software market begins with upstream activities focused on core R&D and technological infrastructure development. Upstream vendors include specialized software developers, data providers specializing in global regulatory intelligence, and cloud infrastructure providers (e.g., AWS, Azure) that offer the scalability and security required for hosting sensitive legal data. This phase is characterized by significant investment in cybersecurity protocols, AI/ML model development for predictive compliance, and continuous monitoring of legislative changes to ensure the software remains current and effective across diverse jurisdictions. The quality and breadth of regulatory data sourced at this stage are critical determinants of the downstream product's reliability and competitive edge.

Midstream activities involve the core software development, customization, and integration. Software providers transform regulatory intelligence and technological capabilities into deployable products, often requiring specialized services for complex enterprise integrations. Distribution channels play a crucial role here, primarily consisting of direct sales teams focused on large enterprise contracts and indirect channels leveraging partnerships with specialized legal technology consultants, system integrators, and value-added resellers (VARs). These indirect channels are particularly effective in reaching SMEs and regional markets where localized implementation expertise is necessary to navigate country-specific compliance nuances and language requirements.

Downstream activities center on deployment, maintenance, and end-user support. The market relies heavily on high-quality post-sales services, including continuous regulatory updates, dedicated technical support, and user training. Direct distribution allows vendors to maintain greater control over service quality and client relationships, particularly for customized, highly complex installations. Indirect channels, through specialized legal consulting firms, often handle the continuous monitoring of client-specific regulatory changes and provide the essential human layer of expertise needed to interpret automated compliance warnings, ensuring clients derive maximum value and mitigating the risk associated with relying solely on software-driven outputs.

Entity Management Software Market Potential Customers

Potential customers for Entity Management Software are primarily organizations characterized by complexity, highly regulated operations, and multinational presence, requiring meticulous oversight of multiple legal entities. The core buyers are Chief Legal Officers (CLOs), General Counsels, Corporate Secretaries, and Compliance Officers within large multinational corporations (MNCs) who bear the ultimate responsibility for ensuring statutory compliance and governance integrity across all operational territories. Financial institutions, including global banks, insurance carriers, and investment firms, constitute a significant segment due to the overwhelming volume of anti-money laundering (AML), Know Your Customer (KYC), and financial reporting regulations requiring verifiable entity structures.

Beyond traditional enterprises, the market is rapidly expanding to include professional services firms, such as large international law firms and accounting practices, which utilize entity management software to manage the corporate secretarial needs of their own client base. Furthermore, organizations undergoing significant corporate restructuring, such as those involved in frequent mergers, acquisitions, or divestitures, are critical buyers, as the software provides the necessary infrastructure to manage transitional entities and harmonize disparate governance standards quickly and accurately. The imperative to manage beneficial ownership registries and tax transparency requirements has also made the Chief Financial Officer (CFO) and tax departments increasingly influential stakeholders in the purchasing decision, driving demand for solutions that integrate legal and financial entity data seamlessly.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.85 Billion USD |

| Market Forecast in 2033 | $4.25 Billion USD |

| Growth Rate | CAGR 12.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Diligent Corporation, Wolters Kluwer N.V., Athennian, Computershare Limited, Murgitroyd Group PLC, LegalZoom, hCue Inc., GEMS, Onit, Inc., Corporater AS, Thomson Reuters (ONESOURCE), LexisNexis (Lexis Advance), PwC (Digital Entity Manager), Blueprint OneWorld, Secretarial Software Ltd., CSC Global, BoardEffect (A Diligent Brand), Loomion, EnGlobe, and Legal Nodes. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Entity Management Software Market Key Technology Landscape

The technology landscape of the Entity Management Software market is rapidly evolving, moving beyond simple record-keeping databases to integrated RegTech platforms. The foundational shift involves the transition to API-first, microservices architectures. This approach allows entity management systems to communicate seamlessly and securely with other critical enterprise systems, such as ERP platforms (SAP, Oracle), CRM software, and financial reporting tools, ensuring data consistency across legal, financial, and operational silos. The use of robust, modern database technologies capable of handling complex, multi-jurisdictional data structures is non-negotiable, requiring scalability and high availability typically provided by specialized cloud infrastructure providers that comply with stringent data residency and security standards.

Furthermore, the incorporation of advanced technologies such as Artificial Intelligence (AI) and Machine Learning (ML) is transforming core functionalities. AI-powered tools are deployed for Natural Language Processing (NLP) to read and categorize legal documents, automatically extract key metadata (e.g., directors, share capital, filing dates), and ensure standardized data entry. ML algorithms are increasingly used for predictive modeling, analyzing historical compliance patterns and regulatory trends to anticipate future governance risks or changes in reporting requirements. This integration of intelligence significantly enhances the software’s value proposition, positioning it as a proactive compliance engine rather than a passive repository.

Another emerging technology gaining traction is blockchain, particularly for maintaining immutable records of corporate ownership and statutory filings. While still in nascent stages of adoption within commercial entity management solutions, blockchain technology offers a secure, transparent, and auditable ledger for critical governance data, which could potentially revolutionize how beneficial ownership is tracked globally, significantly reducing the administrative burden and potential for fraud. Cybersecurity remains paramount, with sophisticated encryption methods, multi-factor authentication, and specialized compliance modules (like ISO 27001 and SOC 2 certifications) defining the competitive minimum standard for enterprise-grade entity management platforms, especially those handling highly confidential intellectual property and governance documents.

Regional Highlights

- North America: Dominant Market Presence and Regulatory Sophistication

North America currently holds the largest share of the Entity Management Software market, driven by the sheer volume of multinational corporations headquartered in the US and Canada, coupled with highly complex and punitive regulatory environments. Regulations enforced by the SEC, IRS, and increasingly stringent state-level corporate reporting requirements necessitate sophisticated, automated solutions. The region is characterized by early adoption of cloud-based solutions and high technological maturity, leading to a strong demand for AI-integrated features focused on automating complex tax compliance (e.g., FATCA, BEPS) and beneficial ownership tracking (e.g., FinCEN’s Corporate Transparency Act). The competitive landscape here is mature, featuring both global legacy providers and agile RegTech startups pushing innovation in predictive analytics.

The United States, in particular, drives market demand due to its diverse state-level statutory requirements and the constant flow of M&A activity which creates a continuous need for entity consolidation and harmonization. Enterprise adoption is deep, and vendors often compete on the breadth of integration capabilities with existing major corporate IT infrastructure. Canada also contributes significantly, driven by similar governance pressures and cross-border operational complexity, demanding platforms that can handle compliance across both U.S. and Canadian legal frameworks seamlessly. The robust venture capital ecosystem further accelerates innovation, supporting smaller firms that specialize in vertical solutions within niche areas like private equity governance.

- Europe: Focus on Harmonization and Data Residency

Europe represents the second-largest market, characterized by fragmentation due to numerous independent national legal systems but unified by overarching European Union directives. The adoption of Entity Management Software is intensely focused on achieving compliance with EU mandates, particularly GDPR concerning data protection, and various anti-tax avoidance directives. The key regional differentiator is the strong emphasis on data residency requirements, which often necessitates vendor solutions capable of providing customized hosting options or guaranteeing data localization within specific EU member states to meet legal obligations.

Growth is fueled by the need for meticulous management of cross-border governance following Brexit, which introduced new complexities for UK-EU entity structures, and the rigorous implementation of the Fifth Anti-Money Laundering Directive (5AMLD), which mandates increased transparency in ultimate beneficial ownership. Germany, France, and the UK are primary hubs for adoption, especially within the financial services and industrial sectors. The market sees a strong preference for modular solutions that can be easily adapted to specific national company law requirements, promoting localized vendor expertise alongside global platforms.

- Asia Pacific (APAC): Fastest Growing Market due to Regulatory Maturation

The APAC region is projected to exhibit the highest CAGR during the forecast period. This accelerated growth stems from rapid economic globalization, increased foreign direct investment (FDI), and the maturation of corporate governance and anti-corruption frameworks in key markets like China, India, Singapore, and Australia. Organizations in APAC are transitioning quickly from rudimentary, manual compliance methods to modern digital platforms to attract international investment and meet export requirements.

Singapore and Australia show high maturity, driven by stringent corporate registries and sophisticated financial markets, mirroring Western adoption patterns. However, high growth potential lies in markets like India and China, where large domestic corporations are professionalizing their entity structures and local governments are pushing for greater corporate transparency. Challenges in this region include language diversity, varied legal interpretations, and infrastructure disparities, requiring vendors to provide flexible, highly localized, and scalable cloud solutions capable of operating effectively across disparate regulatory environments while ensuring robust regional support services.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Entity Management Software Market.- Diligent Corporation

- Wolters Kluwer N.V.

- Athennian

- Computershare Limited

- Murgitroyd Group PLC

- CSC Global

- LegalZoom

- GEMS

- Onit, Inc.

- Corporater AS

- Thomson Reuters (ONESOURCE)

- LexisNexis (Lexis Advance)

- PwC (Digital Entity Manager)

- Blueprint OneWorld

- Secretarial Software Ltd.

- BoardEffect (A Diligent Brand)

- Loomion

- EnGlobe

- Legal Nodes

- Fenergo (Entity Data Management)

Frequently Asked Questions

Analyze common user questions about the Entity Management Software market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary drivers for adopting Entity Management Software?

The core drivers are the exponential growth in global regulatory complexity, specifically around beneficial ownership transparency and anti-money laundering (AML) mandates, coupled with the internal corporate demand for digital transformation, efficiency gains, and centralized risk mitigation in corporate governance.

How does Entity Management Software support global compliance and regulatory filing?

The software centralizes all legal entity data, deadlines, and documentation in a single source of truth. It tracks jurisdictional requirements automatically, provides deadline alerts for filings (e.g., annual returns, director changes), and often generates mandated statutory forms, ensuring timely and accurate compliance across all operating regions.

What is the current trend regarding deployment models in the Entity Management Software Market?

The market shows a strong, ongoing transition toward Cloud-Based (SaaS) deployment models. SaaS solutions offer superior scalability, lower infrastructure investment, and facilitate real-time data access and synchronization, which is essential for multinational corporations managing legal entities across diverse global teams.

What is the role of AI in next-generation Entity Management Software platforms?

AI is crucial for moving beyond passive data storage; it enables predictive compliance, automating the extraction of key data from legal documents using NLP, and providing intelligent risk scoring for entities based on governance structures and regulatory exposure, thereby enhancing proactive strategic oversight.

Which geographical region is expected to demonstrate the highest growth rate and why?

The Asia Pacific (APAC) region is projected to show the highest CAGR. This growth is attributable to rapid economic expansion, increasing foreign investment, and the recent implementation of more stringent, professionalized corporate governance and transparency regulations across major developing economies in the region.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager