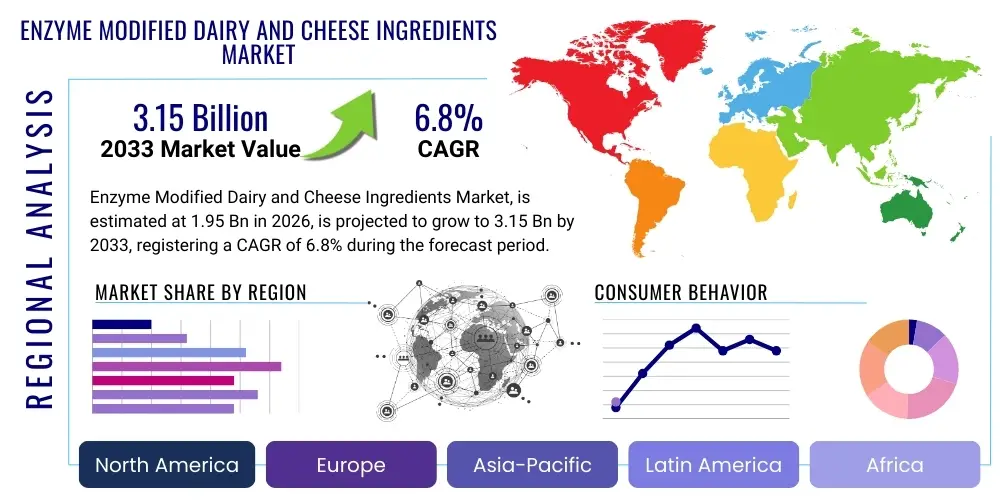

Enzyme Modified Dairy and Cheese Ingredients Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440921 | Date : Feb, 2026 | Pages : 251 | Region : Global | Publisher : MRU

Enzyme Modified Dairy and Cheese Ingredients Market Size

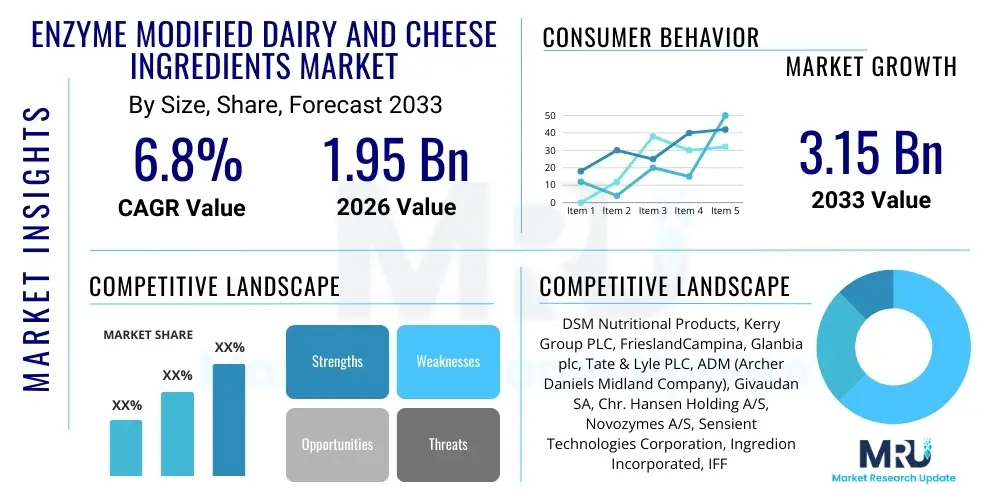

The Enzyme Modified Dairy and Cheese Ingredients Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 1.95 Billion in 2026 and is projected to reach USD 3.15 Billion by the end of the forecast period in 2033.

Enzyme Modified Dairy and Cheese Ingredients Market introduction

The Enzyme Modified Dairy (EMD) and Cheese Ingredients Market encompasses specialized flavor systems and functional components derived from conventional dairy substrates through controlled enzymatic hydrolysis. These specialized ingredients are fundamentally utilized across the global food industry to deliver intense, authentic dairy and cheese flavor profiles, achieving taste characteristics that would otherwise require extensive, time-consuming, and costly traditional aging processes. The primary substrates employed in the modification process include milk fat, cheese curds, whey, and cream, which are meticulously treated with specific blends of food-grade enzymes, predominantly lipases and proteases. The resulting hydrolysates are highly concentrated flavor bases, offering superior performance in a wide range of applications. The inherent efficiency of the enzymatic process is a core value proposition, allowing manufacturers to respond dynamically to market demands for consistent quality and high-volume supply, particularly crucial in the mass production of processed foods where flavor reproducibility is non-negotiable. This rapid flavor generation technology represents a paradigm shift from traditional dairy ingredient sourcing, enabling quicker product development cycles and lower inventory holding costs for food manufacturers seeking reliable flavor consistency.

The product portfolio within this market is diverse, encompassing concentrated Enzyme Modified Cheese (EMC), which provides intense, savory cheese notes ranging from sharp cheddar to creamy mozzarella; Enzyme Modified Butter (EMB), designed to enhance buttery aroma and richness in baked goods and sauces; and Enzyme Modified Cream, often used to improve texture and mouthfeel in high-fat applications. Beyond flavor intensity, these modified ingredients contribute significant functional benefits, including improved emulsification stability, enhanced browning capabilities in bakery items, and the ability to reduce sodium content in formulations without sacrificing perceived flavor intensity. The application spectrum is vast, spanning from savory snacks—where EMD forms the core of high-impact seasoning blends—to processed cheeses, instant soups, sauces, dressings, and specialist confectionery items. Consumer drivers, such as the persistent demand for convenience foods that mimic home-cooked quality and the clean label movement favoring enzyme-derived ingredients over artificial additives, underpin the sustained global adoption of EMD solutions across various food matrices. The careful selection and proprietary blend formulation of enzymes determine the specific flavor profile, making intellectual property surrounding enzyme cocktails a critical competitive factor.

Driving factors for this market are intrinsically linked to macroeconomic trends and consumer lifestyle shifts. Rapid urbanization, particularly in emerging markets across Asia and Latin America, fuels the demand for shelf-stable and easy-to-prepare convenience foods, all of which require reliable, intense flavor components like EMD. Furthermore, the global trend towards healthier eating has paradoxically increased the need for specialized ingredients; EMD enables the development of reduced-fat or reduced-sodium formulations by compensating for flavor loss through flavor concentration, appealing to health-conscious consumers. Regulatory acceptance of food-grade enzymes as processing aids in major global jurisdictions provides a stable foundation for market growth. Technological advancements, including the development of thermotolerant enzymes and precision fermentation techniques, continuously improve the efficiency and cost-effectiveness of EMD production. These innovations facilitate the creation of novel flavor systems tailored to highly specific regional taste preferences, ensuring that the market maintains its trajectory as a dynamic and indispensable segment of the broader food ingredients industry, supporting the global push for flavor innovation and supply chain resilience.

Enzyme Modified Dairy and Cheese Ingredients Market Executive Summary

The Enzyme Modified Dairy and Cheese Ingredients Market landscape is characterized by robust business expansion and strategic consolidation among key industry participants, driven by the imperative to scale production capacity and secure proprietary enzyme technology. Business trends prominently feature a shift toward customized ingredient solutions, where manufacturers partner with food service and industrial clients to develop bespoke flavor systems optimized for specific application temperatures and processing pressures. Significant capital investment is being directed toward optimizing bio-fermentation facilities for enzyme production, ensuring a steady, high-quality supply chain that is resilient to commodity price volatility. Furthermore, major market players are focusing on expanding their technical service capabilities, offering application expertise to help customers seamlessly integrate complex EMD ingredients into their formulations, thereby fostering customer loyalty and driving long-term contractual agreements. The sustained emphasis on transparency and traceability is pushing ingredient suppliers to adopt sophisticated digital tracking systems, confirming the origin and processing history of both dairy substrates and enzyme sources, which is increasingly mandatory for compliance with global food safety standards.

Regional dynamics illustrate a dual market structure: high saturation and intense competition in established markets, juxtaposed with rapid, high-growth potential in emerging regions. North America and Europe, benefiting from mature manufacturing infrastructures and high consumer spending on premium convenience foods, focus on value-added differentiation through specialty flavor profiles, clean-label certification, and sustainable sourcing. Conversely, the Asia Pacific (APAC) market is projected to be the epicenter of demand expansion, driven by population size, accelerating economic growth, and fundamental changes in consumer dietary habits, particularly the increasing penetration of packaged snacks and Western-style dairy products. Local manufacturers in APAC are rapidly adopting EMD technology to compete with global brands, leading to a surge in demand for technical training and localized ingredient formulation expertise. Addressing this regional disparity requires global ingredient companies to establish localized R&D centers to adapt flavor profiles to unique regional palates—such as savory, umami-rich notes popular in Asian cuisine—and navigate highly fragmented local distribution networks effectively. Market penetration strategies in LATAM and MEA focus on leveraging cost-efficiency benefits to replace traditional, higher-cost dairy components.

Segmentation trends highlight the increasing sophistication of end-user demands. The Enzyme Modified Cheese (EMC) segment maintains its dominant position, continually evolving to offer formulations that improve texture in low-fat cheese alternatives or provide stable, intense flavor in high-moisture products. Within the enzyme category, the refinement of protease and lipase combinations is paramount, allowing for precise control over flavor release kinetics and ensuring that the flavor profile remains consistent throughout the product’s shelf life. The application segment growth is particularly pronounced in savory snacks and ready meals, reflecting the consumer shift towards convenient eating occasions. The movement towards plant-based foods presents a significant, albeit challenging, trend; EMD producers are exploring novel enzymatic modifications of non-dairy substrates (e.g., oat, soy, or pea protein) to mimic the complex mouthfeel and flavor depth traditionally provided by dairy, positioning the market for diversification beyond conventional animal-derived products. This diversification strategy is crucial for sustaining long-term growth and addressing the evolving ethical and environmental concerns of modern consumers regarding animal agriculture and dairy production.

AI Impact Analysis on Enzyme Modified Dairy and Cheese Ingredients Market

User engagement concerning the role of Artificial Intelligence (AI) in the Enzyme Modified Dairy and Cheese Ingredients Market strongly focuses on its potential to accelerate the traditionally time-intensive processes of enzyme discovery and flavor replication. The core inquiry revolves around how machine learning (ML) models can analyze vast datasets of microbial genomics and flavor compound profiles (volatiles, non-volatiles) to identify novel enzyme characteristics or optimal reaction pathways that yield desirable flavor precursors more efficiently than conventional microbiology screening. Users frequently ask about the deployment of AI in predicting the sensory impact of ingredient substitutions or process changes, essentially creating a 'digital twin' of the flavor development process. This predictive capability addresses a major industry pain point: maintaining absolute flavor consistency despite natural variations in raw dairy material quality, which is especially critical for mass-market food production where brand reputation hinges on reliable taste. Furthermore, there is significant interest in how AI can optimize the resource allocation within fermentation—controlling temperature, pressure, and nutrient feed rates—to maximize enzyme yield and purity while minimizing operational energy footprints, aligning technological innovation with sustainability objectives.

- AI-driven optimization of enzyme selection and reaction parameters (temperature, pH) to maximize yield and flavor intensity and minimize process time.

- Machine learning algorithms used for predictive quality control, analyzing spectroscopic and chromatographic data of raw materials and intermediates to anticipate and correct flavor outcomes, ensuring batch consistency.

- Enhanced supply chain forecasting and risk management through AI, ensuring timely procurement of specific dairy fractions and predicting price volatility.

- Automated monitoring of large-scale bioreactors and hydrolysis processes using computer vision and sensor data, minimizing human error and ensuring regulatory compliance.

- Accelerated discovery and screening of novel lipase and protease strains for targeted flavor development (e.g., strong Umami notes or specific butyric acid profiles) via genomic analysis.

- Optimization of flavor encapsulation techniques using AI to enhance the stability and controlled release of EMD flavors in the final consumer product, extending shelf life.

- Development of digital flavor twins using predictive modeling to simulate the sensory impact of formulation changes before costly physical trials are undertaken.

DRO & Impact Forces Of Enzyme Modified Dairy and Cheese Ingredients Market

The Enzyme Modified Dairy and Cheese Ingredients Market operates under a complex set of drivers, restraints, and opportunities that collectively exert significant impact forces on strategic decision-making and market trajectory. Primary market drivers include the overwhelming global demand for convenient, processed, and packaged foods, particularly those offering savory, dairy-based flavors, where EMD ingredients provide the essential high-impact flavor component cost-effectively. Further fueling this growth is the increasing consumer and industrial shift towards ingredients derived from natural sources, as EMD products are generally viewed favorably under clean label initiatives compared to synthetic flavorings. The constant pressure on food manufacturers to reduce manufacturing costs and shorten production cycles makes the accelerated flavor development offered by enzymatic modification an indispensable technological advantage, solidifying its role as a key ingredient technology that enhances profitability and responsiveness to volatile market demands across various application sectors.

However, the market faces notable restraints that temper its potential growth rate. The foremost challenge lies in the stringent regulatory requirements imposed by governmental agencies (such as the FDA, EFSA, and regional bodies) concerning the approval and classification of novel food-grade enzymes, which can involve protracted testing and high compliance costs, slowing innovation speed. Another significant restraint is the inherent volatility and lack of consistency in the quality of raw dairy materials; fluctuations in milk composition due to seasonal variations, feed changes, or geographical origin directly impact the enzymatic reaction efficiency and the final flavor profile, necessitating costly standardization processes. Moreover, the initial capital outlay required for establishing advanced bioprocessing facilities, including bioreactors and complex purification systems essential for high-quality EMD production, presents a formidable barrier to entry for small and medium-sized enterprises seeking to capture specialized market niches.

Opportunities for expansion are primarily concentrated in two strategic areas: technological innovation and geographical penetration. The continued refinement of enzymatic technology offers the opportunity to create next-generation, highly specific flavor profiles that can mimic rare or expensive artisanal cheeses, broadening application scope and commanding premium pricing. Secondly, the rapidly expanding plant-based food industry represents a massive untapped opportunity; EMD producers are actively researching and developing enzyme systems to enhance the texture, mouthfeel, and flavor authenticity of non-dairy cheese and butter alternatives, addressing a critical functional gap in this rapidly growing category. These dynamics result in powerful impact forces characterized by fierce competition centered not only on pricing but, more critically, on proprietary enzyme innovation and the ability to deliver robust technical support, forcing continuous R&D investment and accelerating market consolidation as larger players acquire specialized flavor technology firms to integrate unique expertise and secure intellectual property rights.

Segmentation Analysis

The Enzyme Modified Dairy and Cheese Ingredients Market is analyzed through a comprehensive segmentation framework designed to highlight distinct product behaviors, enzyme functionalities, application requirements, and geographical consumption patterns. This detailed breakdown facilitates precise market forecasting and strategic planning for ingredient manufacturers. The segmentation by Product Type, notably Enzyme Modified Cheese (EMC), remains the largest and most dynamic segment, driven by its versatility in savory applications; however, the growth of Enzyme Modified Butter (EMB) and Cream is accelerating due to increased utilization in high-fat bakery and gourmet food sectors, emphasizing textural improvement alongside flavor concentration. Analyzing the market through the lens of Product Type provides critical insights into manufacturing capacity requirements and raw material allocation strategies for processors targeting specific functionality attributes, ensuring optimal product delivery.

Segmentation by Enzyme Type—Lipases, Proteases, and Lactases—reveals the underlying biochemical foundation of flavor creation. Lipases, responsible for the breakdown of milk fats into fatty acids, dominate the market due to their necessity in creating the characteristic creamy and sharp notes associated with aged dairy. Proteases, which hydrolyze proteins, are increasingly important for developing savory, umami-rich, and complex flavor bases often required in high-end processed meats and sauces. The development of proprietary, synergistic enzyme cocktails is blurring the lines between these categories, as manufacturers seek maximum flavor complexity and process efficiency. Understanding this segmentation is vital for biotechnology firms and enzyme suppliers, driving their R&D investments toward novel microbial strains that offer enhanced stability, higher activity, and cost-effective production at industrial scale, crucial for meeting the stringent quality requirements of the food ingredients industry globally.

The Application segmentation—spanning Bakery, Snacks, Sauces, and Ready Meals—directly correlates with consumer consumption patterns and reflects the end-use environment for EMD ingredients. Snack seasonings represent a high-growth, high-volume segment, demanding powdered EMD formats with excellent flowability and flavor adherence. Conversely, the Ready Meals and Soups segment requires EMD solutions optimized for heat stability and flavor integrity during retort processing or freezing cycles. Geographical segmentation is equally crucial, identifying regions like APAC with high growth potential contrasting with mature markets like North America and Europe. Effective market strategy demands localized product adjustment—modifying salt content, flavor intensity, and format (liquid vs. powder) to align with regional food processing capabilities and consumer taste preferences, ensuring maximum market penetration and efficient resource deployment across global territories.

- By Product Type:

- Enzyme Modified Cheese (EMC)

- Enzyme Modified Butter (EMB)

- Enzyme Modified Cream (EMC)

- Other Enzyme Modified Dairy Ingredients (e.g., enzyme-treated whey proteins, customized dairy concentrates)

- By Enzyme Type:

- Lipases (Fungal, Bacterial, Pancreatic sources)

- Proteases (Bacterial, Fungal sources)

- Lactases (Used primarily for lactose reduction in dairy components)

- Other Enzymes (e.g., combination blends and specialized flavor enhancers)

- By Application:

- Bakery and Confectionery (Fillings, batters, flavor inclusion)

- Sauces, Dressings, and Dips (Base flavors for savory products)

- Snack Seasonings and Savory Products (Powdered coatings for chips, nuts, and extruded snacks)

- Ready Meals and Soups (Flavor fortification in frozen or canned goods)

- Dairy and Desserts (Enhanced flavor in ice cream, yogurt, and processed cheese)

- Beverages (e.g., enhanced protein drinks requiring flavor masking and enrichment)

- By Geography:

- North America (U.S., Canada, Mexico)

- Europe (Germany, U.K., France, Italy, Spain, Rest of Europe)

- Asia Pacific (APAC) (China, India, Japan, South Korea, Australia, Rest of APAC)

- Latin America (LATAM) (Brazil, Argentina, Rest of LATAM)

- Middle East and Africa (MEA) (UAE, Saudi Arabia, South Africa, Rest of MEA)

Value Chain Analysis For Enzyme Modified Dairy and Cheese Ingredients Market

The value chain for Enzyme Modified Dairy and Cheese Ingredients is highly sophisticated and begins fundamentally with the rigorous sourcing and preparation of specialized raw materials, forming the cornerstone of the upstream analysis. This stage involves two parallel streams: the procurement of high-quality, standardized dairy intermediates (milk solids, fat, curds, or whey) and the development and production of specific, food-grade enzymes. Enzyme manufacturing, often conducted by global biotechnology leaders, relies on advanced microbial fermentation and rigorous purification to ensure enzyme potency, purity, and freedom from contaminants. Critical upstream activities include genetic engineering or selection of microbial strains (yeast, bacteria, fungi) to optimize enzyme activity and thermal stability, followed by large-scale fermentation and extraction. Supply chain stability at this stage is crucial, as the performance of the final EMD product is directly dependent on the consistent quality and activity of both the dairy substrate and the enzyme cocktail utilized, demanding stringent supply contracts and collaborative quality assurance programs between enzyme suppliers and dairy processors.

The core value addition occurs in the middle segment, which encompasses the proprietary modification process. Dairy substrates are subjected to controlled enzymatic hydrolysis within large-scale bioreactors, where factors like temperature, pH, reaction time, and enzyme concentration are meticulously controlled, often utilizing proprietary equipment and patented process parameters to drive specific flavor outcomes. This step is followed by inactivation of the enzymes (typically via heat treatment) and further concentration through evaporation or ultrafiltration. The resultant liquid hydrolysate is then processed into the final commercial format, predominantly through spray drying or vacuum drying to create highly stable, concentrated powders that possess excellent shelf life and ease of handling for industrial clients. The technological sophistication of this mid-stream manufacturing process—particularly the precision in flavor profiling and standardization—is where ingredient companies differentiate themselves, enabling them to command premium prices for customized, high-performance EMD ingredients that solve complex formulation challenges for their customers.

Downstream activities center on distribution, sales, and technical application support to the ultimate end-users, mainly major food manufacturers. Distribution channels are bifurcated into direct sales, catering to large multinational corporations requiring bespoke, container-load volumes and comprehensive technical collaboration, and indirect channels relying on regional specialty ingredient distributors. The indirect model is essential for market penetration among Small to Medium-sized Enterprises (SMEs) and in emerging markets, where distributors manage localized inventory, provide logistical support, and offer essential application knowledge. Given the complexity of integrating concentrated flavor ingredients, robust technical support—including flavor matching, formulation troubleshooting, and regulatory guidance specific to various global markets—is a critical, non-negotiable component of the downstream value proposition. Successful companies maintain specialized application laboratories to collaborate with customers, ensuring the EMD ingredient performs optimally in the final food product and meets all quality and regulatory benchmarks, thereby maximizing customer satisfaction and securing long-term supply relationships against competitive pressure.

Enzyme Modified Dairy and Cheese Ingredients Market Potential Customers

The core customer base for Enzyme Modified Dairy and Cheese Ingredients comprises the global leaders and regional specialists in the manufacturing of high-volume processed and packaged food products, driven by the need for flavor intensity and cost efficiency. The largest segment of buyers includes manufacturers of savory snack foods, such as potato chips, pretzels, and crackers, who rely heavily on EMD—particularly in concentrated powdered forms—to deliver consistent, authentic cheese and butter flavorings in their seasoning blends. Additionally, multinational companies producing ready-to-eat meals, instant soups, and convenience kits are significant customers, utilizing EMD to create robust flavor bases that withstand thermal processing, extended storage, and freezing/thawing cycles without flavor degradation. These industrial customers prioritize suppliers who can guarantee high batch-to-batch consistency, certified safety standards (e.g., FSSC 22000, GFSI), and scalable supply volumes that can accommodate fluctuations in global production demands, making supply security a key purchasing criterion alongside price and flavor quality.

A rapidly expanding segment of potential customers includes specialized manufacturers focusing on health and wellness products, such as companies developing low-fat, reduced-sodium, or high-protein dairy alternatives and functional foods. In these applications, EMD ingredients are essential for compensating for the flavor and texture loss often associated with the reduction of fat or salt, providing the concentrated flavor necessary to maintain palatability and consumer acceptance. Furthermore, the Quick Service Restaurant (QSR) and Food Service sectors represent substantial potential customers, as they integrate EMD ingredients into proprietary sauce, dip, and topping formulations to ensure standardized flavor profiles across hundreds or thousands of global outlets. These buyers often require highly tailored formulations that integrate seamlessly into their unique operational workflows and strict nutritional labeling requirements, necessitating close collaboration and proprietary product development with ingredient suppliers.

Beyond the direct food processing industry, potential customers extend to contract food manufacturers and private label producers, who require a diverse portfolio of EMD solutions to serve multiple retail clients with varied specifications. These companies value flexible packaging, rapid turnaround times, and the ability of the supplier to develop unique, patentable flavor differentiators for their private label brands. The purchasing decision in this market is heavily weighted towards technical competence and innovation, as buyers increasingly seek suppliers who can proactively provide solutions for emerging trends, such as natural color integration, gluten-free formulations, and specific allergen management. Consequently, ingredient suppliers must maintain comprehensive application labs and a highly skilled technical sales team capable of translating complex biochemical properties into tangible product performance benefits for a highly discerning and diverse customer base across global food production tiers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.95 Billion |

| Market Forecast in 2033 | USD 3.15 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | DSM Nutritional Products, Kerry Group PLC, FrieslandCampina, Glanbia plc, Tate & Lyle PLC, ADM (Archer Daniels Midland Company), Givaudan SA, Chr. Hansen Holding A/S, Novozymes A/S, Sensient Technologies Corporation, Ingredion Incorporated, IFF (International Flavors & Fragrances), Amano Enzyme Inc., Advanced Enzyme Technologies Ltd., Synergy Flavors, Inc., DairiConcepts, CP Ingredients, Carbery Group, Edlong Dairy Technologies, Biocon. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Enzyme Modified Dairy and Cheese Ingredients Market Key Technology Landscape

The critical technology underlying the Enzyme Modified Dairy and Cheese Ingredients market is centered on advanced enzyme engineering and precise bioprocessing control systems, which enable the targeted manipulation of dairy substrates. A primary focus area is the development of next-generation, high-performance enzyme cocktails through techniques such as directed evolution and microbial genomics. These methods allow researchers to select or genetically engineer microbial strains (e.g., specific fungal or bacterial cultures) that produce lipases and proteases with optimized specificity, enabling the creation of unique flavor profiles—ranging from highly acidic, sharp notes to creamy, ripened characteristics—with unprecedented speed and efficiency. The ongoing technological push aims to increase the thermal stability and pH tolerance of these enzymes, allowing them to function optimally under varied industrial processing conditions, thereby maximizing substrate conversion rates and reducing overall production costs while maintaining consistent product quality and ensuring regulatory compliance through clear enzyme provenance.

Another crucial technological pillar involves sophisticated reaction monitoring and process automation systems, moving the production of EMD ingredients towards the principles of Industry 4.0. This includes the use of real-time analytical tools, such as Near-Infrared (NIR) spectroscopy and advanced chromatographic techniques coupled with automated process control, to continuously monitor the hydrolysis reaction kinetics. This enables operators to halt the enzymatic process at the precise moment the optimal flavor concentration and profile are achieved, eliminating variability and ensuring flavor reproducibility across massive production runs. Furthermore, significant investment is channeled into advanced drying and encapsulation technologies, particularly microencapsulation techniques, which are essential for converting liquid, volatile flavor hydrolysates into stable, long-shelf-life powders. Microencapsulation uses protective matrices to shield delicate flavor compounds from oxidation, moisture, and heat during storage and subsequent processing by the end-user, ensuring controlled flavor release only when the final food product is consumed, thereby maximizing flavor impact and consumer sensory perception.

Innovation extends significantly into sustainable manufacturing practices, driven by technology designed to minimize waste and energy usage. Continuous flow reactors, for instance, offer a more energy-efficient alternative to traditional batch processing, improving yield and reducing processing time. Membrane filtration technologies, such as ultrafiltration and nanofiltration, play a vital role in fractionating the modified dairy ingredients, allowing manufacturers to selectively concentrate desirable peptides and fatty acids while recovering and, in some cases, reusing the enzymes or other by-products. The convergence of these processing enhancements with computational chemistry and AI-driven predictive modeling (as previously noted) allows for faster prototyping of customized flavor solutions, ensuring the technological landscape remains responsive to fast-evolving consumer preferences, particularly the demand for clean-label, natural flavor ingredients that deliver both performance and sustainability credentials in highly competitive global ingredient markets.

Regional Highlights

- North America: This region holds a dominant market share, primarily driven by the massive scale of its convenience food and savory snack industries, which are significant consumers of EMD flavor systems. The presence of major global food ingredient headquarters and established R&D centers facilitates continuous innovation in high-value, clean-label EMD solutions. Regulatory clarity and strong consumer purchasing power for premium, flavor-intensive products further solidify its leadership position, with a focus on low-sodium cheese flavorings and functional applications.

- Europe: Characterized by stringent quality standards and a high degree of regulatory focus on enzyme classification, the European market is mature yet highly fragmented. Western Europe (Germany, UK, France) leads consumption, emphasizing natural ingredients, non-GMO sourcing, and customized EMD products tailored for traditional European cheese profiles utilized in ready meals and artisanal bakery fillings. Sustainability and traceability are key competitive differentiators among suppliers in this region.

- Asia Pacific (APAC): Positioned as the highest growth market globally, APAC is experiencing exponential demand expansion driven by rapidly urbanizing populations, rising middle-class incomes, and increased acceptance of Western dietary habits. Countries like China and India are major investment targets due to the explosive growth in packaged snacks and processed dairy products. The focus here is on scalable, cost-efficient EMD solutions that can be adapted quickly to diverse local flavor preferences, such as sharper, spicier, or stronger umami notes.

- Latin America (LATAM): This region exhibits robust, steady growth, primarily fueled by the industrialization of the food sector, particularly in Brazil, Mexico, and Argentina. LATAM markets prioritize EMD ingredients for cost optimization in high-volume production of processed foods, including sauces, savory dips, and local snack variations. Market growth is heavily influenced by foreign investment in local manufacturing capabilities and the need for localized technical support to navigate complex processing environments.

- Middle East and Africa (MEA): Emerging market characterized by significant potential, particularly in the Gulf Cooperation Council (GCC) countries, driven by a wealthy consumer base and heavy reliance on imported food technologies. EMD usage is increasing in processed cheese and savory applications. Challenges include political instability, varied import restrictions, and the necessity to adhere to specific Halal and Kosher certification requirements, necessitating specialized supply chain management and documentation.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Enzyme Modified Dairy and Cheese Ingredients Market.- DSM Nutritional Products

- Kerry Group PLC

- FrieslandCampina

- Glanbia plc

- Tate & Lyle PLC

- ADM (Archer Daniels Midland Company)

- Givaudan SA

- Chr. Hansen Holding A/S

- Novozymes A/S

- Sensient Technologies Corporation

- Ingredion Incorporated

- IFF (International Flavors & Fragrances)

- Amano Enzyme Inc.

- Advanced Enzyme Technologies Ltd.

- Synergy Flavors, Inc.

- DairiConcepts

- CP Ingredients

- Carbery Group

- Edlong Dairy Technologies

- Biocon

- E. I. du Pont de Nemours and Company (Danisco)

- BASF SE

- Associated British Foods plc (ABF)

- Royal Cosun

- Ajinomoto Co., Inc.

Frequently Asked Questions

Analyze common user questions about the Enzyme Modified Dairy and Cheese Ingredients market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary benefit of using Enzyme Modified Cheese (EMC) over traditional cheese?

EMC offers significantly enhanced and concentrated flavor strength, allowing food manufacturers to use less ingredient to achieve the desired intensity, thus reducing overall formulation costs and providing greater flavor consistency across large production batches. It also dramatically shortens the flavor development cycle from years to mere days or weeks.

Are Enzyme Modified Dairy ingredients considered clean label products?

Yes, EMD ingredients often support clean label initiatives. While enzymes are used as processing aids to create the flavor profile, they are typically inactivated or removed, meaning the final food ingredient is usually listed simply as "Enzyme Modified Cheese" or similar derivatives, appealing to consumers seeking fewer synthetic or chemical additives on product labels.

Which enzyme types are most critical in dairy flavor modification and why?

Lipases and Proteases are the most critical enzyme types. Lipases break down milk fat into key fatty acids (contributing to creamy and pungent notes), while Proteases hydrolyze milk proteins into flavor-active peptides and amino acids, creating the savory, sharp, and complex umami characteristics essential for authentic aged cheese flavors.

What are the major applications driving the highest demand growth in the global market?

The highest demand growth globally is currently driven by the expanding savory snack market, specifically powdered seasonings for chips and extruded products, and the Ready Meals sector. Both applications require stable, cost-effective, high-impact dairy flavor solutions that can withstand industrial processing conditions and provide extended shelf stability.

How does technological advancement, such as microencapsulation, benefit EMD ingredients?

Microencapsulation protects the volatile flavor compounds generated during enzymatic hydrolysis from environmental factors like oxygen, heat, and moisture. This technology ensures flavor stability, extends the ingredient’s shelf life, and allows for controlled release of the flavor compounds only when the final food product is consumed, maximizing sensory impact and consistency.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager