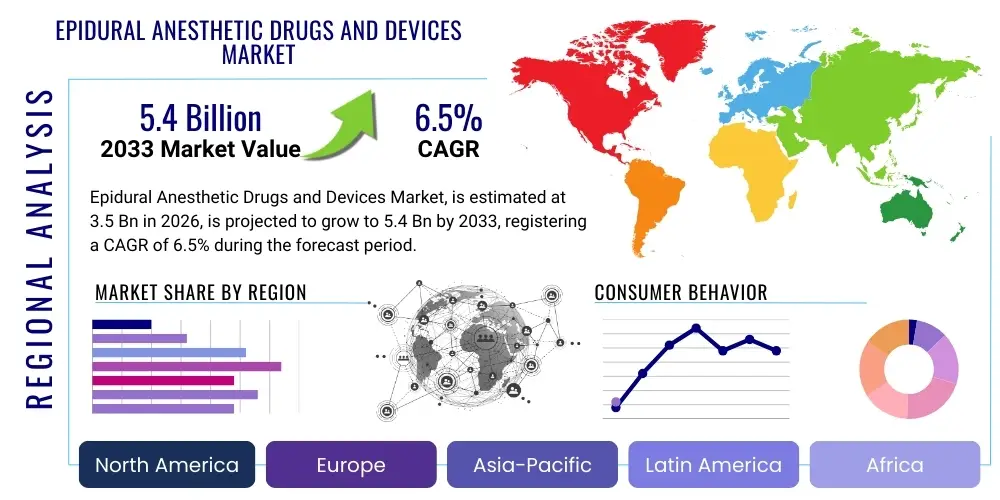

Epidural Anesthetic Drugs and Devices Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443027 | Date : Feb, 2026 | Pages : 249 | Region : Global | Publisher : MRU

Epidural Anesthetic Drugs and Devices Market Size

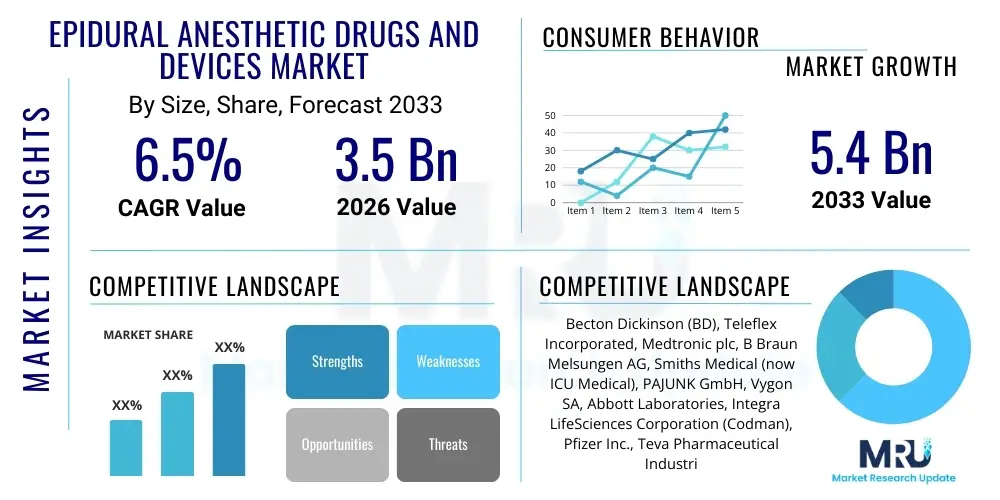

The Epidural Anesthetic Drugs and Devices Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 3.5 Billion in 2026 and is projected to reach USD 5.4 Billion by the end of the forecast period in 2033.

Epidural Anesthetic Drugs and Devices Market introduction

The Epidural Anesthetic Drugs and Devices Market encompasses the specialized pharmaceuticals and medical equipment used for administering regional anesthesia in the epidural space, primarily targeting pain management during surgical procedures, labor and delivery, and chronic pain conditions. The product description spans a range of local anesthetic agents such as Bupivacaine, Ropivacaine, and Lidocaine, often combined with adjunct drugs like opioids, alongside sophisticated delivery systems including epidural catheters, specialized needles (Tuohy needles), infusion pumps, and comprehensive procedural kits. Major applications are concentrated in obstetrics, offering superior pain relief during childbirth, and in post-operative pain management (POPM) where continuous epidural infusion minimizes systemic opioid requirements and enhances patient recovery outcomes. The inherent benefits include highly localized pain control, reduced risk of systemic side effects associated with general anesthesia, and improved patient mobility and early rehabilitation.

The primary driving factor sustaining this market's growth is the escalating volume of surgical procedures worldwide, particularly orthopedic, abdominal, and thoracic surgeries, where effective regional anesthesia is crucial for better outcomes and shorter hospital stays. Furthermore, the rising awareness and adoption of minimally invasive pain management techniques, moving away from high-dose systemic opioids, significantly boost the demand for precise epidural delivery devices. Technological advancements, particularly in smart infusion pumps that offer programmed dosing schedules and enhanced safety features like anti-free-flow mechanisms and electronic records, are further stimulating market penetration. The inherent reliability of epidural analgesia for complex pain scenarios, including cancer pain and trauma, solidifies its indispensable role in modern healthcare.

Regulatory approval pathways emphasizing enhanced drug safety profiles and device usability are also contributing to market maturation. While drugs form the core therapeutic component, the device segment, encompassing highly engineered catheter designs (e.g., multi-orifice and wire-reinforced) and robust kit configurations, dictates the safety and efficiency of administration. The convergence of highly efficacious drugs with precision delivery technologies underscores the sophisticated nature of this medical domain, poised for stable growth driven by global demographic shifts toward an aging population susceptible to chronic pain requiring advanced management solutions and increased access to sophisticated medical care in emerging economies.

Epidural Anesthetic Drugs and Devices Market Executive Summary

The Epidural Anesthetic Drugs and Devices Market demonstrates robust growth, propelled primarily by significant technological advancements in drug delivery systems and an increasing focus on improved patient comfort and accelerated recovery times globally. Current business trends indicate a strong move toward integrated procedural kits that combine drugs, specialized needles, and catheters, offering convenience and reducing procedural variability for clinicians. Strategic collaborations between pharmaceutical companies specializing in anesthetic agents and medical device manufacturers focusing on precise, user-friendly pump technologies are defining the competitive landscape. Key regional trends show North America and Europe retaining dominant market shares due to advanced healthcare infrastructure and high surgical throughput, while the Asia Pacific region is emerging as the fastest-growing area, driven by rapidly expanding hospital infrastructure, increasing healthcare expenditure, and growing medical tourism, particularly for complex orthopedic and obstetrical procedures.

Segment trends reveal that the devices segment, particularly single-use disposable kits and programmable elastomeric and electronic infusion pumps, is experiencing accelerated adoption over the drug segment, driven by infection control mandates and the continuous need for innovative safety features. Within the application segment, labor and delivery continues to be a foundational driver, though the rising prevalence of chronic pain conditions and the resulting demand for long-term epidural pain relief strategies represent the most dynamic growth sub-segment. Hospitals remain the principal end-users, but the growing shift towards Ambulatory Surgical Centers (ASCs) for routine procedures is opening up new channels for device distribution, demanding smaller, more cost-effective equipment suitable for outpatient settings. This transition necessitates manufacturers to focus on scalability and portability without compromising precision or safety.

The overarching strategic objective for market leaders revolves around securing regulatory approvals for new drug formulations (e.g., sustained-release formulations) and optimizing catheter and pump interfaces to minimize complications such as dural punctures and catheter migration. The market’s resilience is also being tested by pricing pressures from generic drug manufacturers and the need for rigorous training programs to ensure the safe and effective use of advanced devices. Overall, the market remains fundamentally strong, underpinned by indispensable clinical utility across multiple surgical and pain management disciplines, with future growth heavily dependent on innovations that enhance procedural safety and reduce overall healthcare costs associated with pain management.

AI Impact Analysis on Epidural Anesthetic Drugs and Devices Market

Common user questions regarding AI’s influence on the Epidural Anesthetic Drugs and Devices Market frequently center on its role in improving administration precision, predicting optimal dosing, and minimizing potential complications associated with epidural insertion. Key themes revolve around whether AI algorithms can enhance the success rate of the first-pass needle placement by analyzing real-time ultrasound or fluoroscopic imaging, thereby reducing patient discomfort and procedure time. Users are also highly interested in how AI might integrate with smart infusion pumps to create closed-loop drug delivery systems, automatically adjusting anesthetic concentrations based on physiological feedback (e.g., heart rate variability, pain scores) to ensure continuous, optimal analgesia. Concerns typically involve data privacy, regulatory hurdles for AI-driven medical devices, and the necessary specialized training required for anesthesiologists to effectively utilize these advanced decision support tools, ensuring that human expertise remains central to patient care while leveraging computational power for enhanced safety and efficacy.

The primary expectation is that AI will revolutionize safety protocols, particularly by improving the identification of anatomical variations or risk factors pre-procedure, using predictive analytics on patient electronic health records (EHRs). This foresight could significantly reduce the incidence of catastrophic complications such as epidural hematomas or nerve injury. Furthermore, AI-powered diagnostic support systems are expected to streamline the post-procedure monitoring process, flagging subtle changes in patient status that might indicate complication development much earlier than traditional manual monitoring protocols. This shift toward proactive risk management, facilitated by machine learning algorithms, promises to elevate the standard of care in regional anesthesia, making epidural procedures safer and more predictable across diverse patient populations, ranging from routine obstetric cases to complex chronic pain interventions.

The integration of AI into manufacturing and logistics is also a growing area of interest, concerning optimizing the supply chain for sterile epidural kits and forecasting demand for specific local anesthetic drugs based on anticipated surgical volumes and seasonal health trends. For devices, AI could accelerate the design validation process by simulating real-world usage scenarios and identifying potential failure points in catheter or pump mechanisms before mass production. This comprehensive application of AI—from pre-procedural planning and real-time administration to logistical optimization—underscores a future where data-driven insights enhance both clinical outcomes and operational efficiencies within the epidural anesthetic market ecosystem, ultimately benefiting patients through enhanced safety and personalized pain management.

- AI-driven real-time image guidance for precision needle placement, improving first-attempt success rates.

- Predictive modeling using patient data to optimize anesthetic drug type and dosage, minimizing side effects.

- Integration into smart infusion pumps for closed-loop, adaptive drug delivery based on continuous physiological feedback.

- Automated identification and early warning systems for monitoring potential post-epidural complications (e.g., hypotension, infection).

- Supply chain optimization and demand forecasting for epidural drugs and disposable kits.

- Enhanced simulation and training tools for anesthesiologists using virtual reality and AI feedback.

DRO & Impact Forces Of Epidural Anesthetic Drugs and Devices Market

The market's trajectory is primarily governed by a dynamic interplay of Drivers (D), Restraints (R), and Opportunities (O), which collectively shape the Impact Forces. Major drivers include the increasing global adoption of epidural anesthesia for labor and delivery due to its superior efficacy compared to systemic analgesia, coupled with the rapid growth in the geriatric population requiring complex surgeries necessitating effective post-operative pain management (POPM). Furthermore, clinical guidelines promoting regional anesthesia over general anesthesia where possible, particularly in high-risk patients, exert significant positive force on market demand. The continuous evolution of device technology, such as anti-microbial coated catheters and miniaturized, highly accurate electronic pumps, ensures better patient outcomes and procedural safety, further driving clinical adoption across various therapeutic areas, including trauma and cancer care, thereby widening the application scope beyond traditional settings.

Conversely, significant restraints hinder optimal market penetration and adoption. The most critical restraint is the inherent risk of complications associated with the epidural procedure, including dural puncture, nerve damage, epidural hematoma, and infection, which necessitate high levels of specialized training and procedural vigilance, sometimes limiting adoption in settings with resource constraints. Moreover, stringent regulatory requirements, particularly concerning the approval of new drug combinations and complex delivery devices, often lead to lengthy and costly product development cycles. Furthermore, price sensitivity and reimbursement challenges, particularly in developing economies, often push hospitals toward lower-cost generic drugs and basic device kits, impacting the profitability of premium device manufacturers specializing in advanced safety features. Public perception regarding the procedure, often fueled by misinformation, also occasionally poses an adoption barrier.

Opportunities for expansion lie predominantly in geographical market penetration into underserved regions, particularly in Latin America and the Middle East, where healthcare infrastructure is rapidly developing and patient populations are growing. Product innovation focusing on reducing complications, such as integrating real-time imaging (ultrasound or AI-assisted) guidance into standard practice, represents a major avenue for market growth and competitive differentiation. The increasing trend toward home healthcare and ambulatory pain clinics creates an opportunity for portable, user-friendly, and cost-effective devices designed for continuous outpatient pain management. The drive to curb the opioid epidemic globally also presents a major opportunity, positioning epidural and regional anesthesia techniques as preferred, non-addictive alternatives for robust pain control, fostering investment into new drug delivery systems that prolong the duration of action of local anesthetics.

Segmentation Analysis

The Epidural Anesthetic Drugs and Devices Market is meticulously segmented based on product type, application, and end-user, reflecting the diverse clinical needs and technological components involved in regional anesthesia. The product segmentation is foundational, distinctly separating the pharmacological agents (drugs) from the mechanical delivery systems (devices), each requiring separate R&D and regulatory oversight. Device segmentation further breaks down into single-use disposables (catheters, needles, kits) and capital equipment (infusion pumps), recognizing the cyclical purchase patterns of consumables versus long-term investments in capital equipment. This granular segmentation allows market participants to tailor their strategies toward high-growth niches, such as chronic pain management devices, which demand specific features like high durability and precise flow control suitable for long-term administration, distinct from the needs of acute, short-term post-operative pain relief.

Application analysis highlights the primary therapeutic areas driving demand. While obstetrics remains a stable and high-volume segment globally, the growth in surgical applications, particularly the recovery phase, is crucial. Post-operative pain management (POPM) is becoming increasingly sophisticated, demanding continuous infusion capabilities and multimodal approaches that integrate epidural delivery. Furthermore, the rising incidence and improved diagnosis of chronic pain conditions, spanning neuropathic pain, low back pain, and complex regional pain syndromes, are creating a significant, specialized market for targeted epidural therapies, often utilizing image-guided techniques and requiring specialized drug combinations to manage debilitating symptoms effectively. Understanding these varying clinical requirements helps manufacturers design application-specific products, such as specialized kits optimized for labor and delivery, which prioritize speed and ease of insertion.

End-user segmentation clearly defines the primary consumption points. Hospitals, due to the critical nature of surgical and obstetrical procedures, constitute the largest segment. However, the rapidly growing adoption of less invasive procedures and the focus on cost containment are driving robust expansion in Ambulatory Surgical Centers (ASCs) and specialized pain clinics, offering streamlined care and often faster patient turnaround times. This shift requires suppliers to adapt their distribution strategies, offering smaller, more flexible inventory management solutions suitable for outpatient settings. Analyzing these segments ensures that companies can accurately forecast demand across different healthcare settings and develop appropriate pricing models that align with the purchasing power and operational scale of each end-user type, maximizing market reach and profitability across the entire healthcare ecosystem.

- Product Type:

- Drugs (Local Anesthetics, Opioids, Adjuncts)

- Devices

- Epidural Catheters

- Epidural Needles (Tuohy, Crawford)

- Infusion Pumps (Electronic, Elastomeric, Syringe)

- Epidural Kits/Trays

- Application:

- Labor and Delivery (Obstetrics)

- Surgical Procedures (Orthopedic, General, Thoracic)

- Chronic Pain Management

- Acute Post-Operative Pain Management (POPM)

- End-User:

- Hospitals

- Ambulatory Surgical Centers (ASCs)

- Pain Clinics

Value Chain Analysis For Epidural Anesthetic Drugs and Devices Market

The value chain for the Epidural Anesthetic Drugs and Devices Market begins with upstream activities involving the sourcing and refinement of raw materials, which include pharmaceutical active ingredients (APIs) for local anesthetics, specialized polymers, and medical-grade metals for device manufacturing. Upstream analysis focuses intensely on quality control and supply stability, particularly for APIs which are subject to stringent regulatory guidelines and global supply fluctuations. Device manufacturers rely on high-precision machining and sterilization processes to produce components like catheters and needles, where material integrity and bio-compatibility are paramount. Key strategic considerations at this stage involve establishing robust supplier contracts and investing heavily in advanced manufacturing technologies, such as micro-extrusion for catheters, to ensure high yield, tight tolerance control, and compliance with global safety standards, thereby managing input costs and maintaining product reliability under high-volume demand.

The midstream of the value chain is characterized by the core processes of manufacturing, assembly, and rigorous quality assurance. For drugs, this involves compounding, sterile filling, and packaging, while for devices, it includes assembling complex kits, integrating electronic components for infusion pumps, and final sterilization. This stage is crucial for ensuring product performance and safety, demanding compliance with Current Good Manufacturing Practices (cGMP) and ISO standards. Once products are finalized, the downstream segment begins, focusing on distribution channels. This segment is highly intricate, leveraging both direct sales forces, particularly for high-value capital equipment like electronic infusion pumps, and extensive indirect networks, including wholesalers, distributors, and Group Purchasing Organizations (GPOs) that handle high volumes of disposable kits and pharmaceutical agents to penetrate diverse institutional settings globally.

Distribution channels for the epidural market are segmented based on product type and end-user location. Direct sales allow manufacturers to maintain strong relationships with key hospital accounts and provide specialized technical support and training for complex devices. Indirect channels are essential for achieving broad market reach, particularly in supplying standardized kits and drugs to decentralized healthcare points, including smaller hospitals and pain clinics. Effective inventory management within this channel is vital, given the short shelf-life of some pharmaceutical components and the need for just-in-time delivery to hospitals facing high procedural volumes. The final phase involves post-sales support, technical servicing for pumps, and pharmacovigilance for drug agents, reinforcing brand reputation and ensuring long-term customer loyalty, completing the comprehensive market value chain from raw material sourcing to end-user application and maintenance.

Epidural Anesthetic Drugs and Devices Market Potential Customers

The primary potential customers and end-users of epidural anesthetic drugs and devices are institutions and medical professionals who require precise regional anesthesia for pain management, spanning across surgical, obstetrical, and chronic care environments. Hospitals, particularly those with high-volume surgery departments, dedicated obstetrics wings, and comprehensive pain management programs, represent the largest and most frequent buyers. They procure substantial quantities of both disposable kits and local anesthetic drugs, alongside investing in advanced electronic infusion pumps that offer continuous epidural analgesia (CEA) capabilities for post-operative recovery. The purchasing decisions within hospitals are typically driven by centralized procurement departments influenced heavily by clinical preference, product safety data, and established GPO contracts, making long-term clinical evidence a critical factor for successful market penetration among this dominant customer segment.

A rapidly expanding segment of potential customers includes Ambulatory Surgical Centers (ASCs) and specialized pain clinics. ASCs, focusing on same-day surgical procedures such as orthopedic, cosmetic, or minor gynecological interventions, are increasingly adopting regional anesthesia techniques to accelerate patient discharge and improve cost-efficiency. While their procedural volume may be lower than large tertiary hospitals, their rapid proliferation and focus on streamlined, standardized procedures make them key targets for efficient, easy-to-use epidural kits. Pain clinics, specializing in chronic conditions like sciatica, herniated discs, and failed back surgery syndrome, utilize epidural devices for targeted injections (e.g., epidural steroid injections) and require specialized, high-resolution imaging adjuncts and specific needle designs for accuracy under fluoroscopic or ultrasound guidance, thus demanding highly specialized product offerings.

Government procurement agencies and public health organizations in developing economies also represent significant potential customers, often driven by tenders focused on cost-effectiveness and volume supply, prioritizing essential generic local anesthetics and basic, reliable disposable kits. Furthermore, independent anesthesiologists, obstetricians, and chronic pain specialists exert substantial influence as indirect customers; while they do not purchase the products directly, their clinical preference and recommendations heavily dictate which brands and technologies are stocked and utilized by their affiliated hospitals or clinics. Targeting these key opinion leaders (KOLs) through clinical trials, educational outreach, and specialized training programs is crucial for manufacturers seeking to establish sustained product adoption across all potential customer segments globally.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 5.4 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Becton Dickinson (BD), Teleflex Incorporated, Medtronic plc, B Braun Melsungen AG, Smiths Medical (now ICU Medical), PAJUNK GmbH, Vygon SA, Abbott Laboratories, Integra LifeSciences Corporation (Codman), Pfizer Inc., Teva Pharmaceutical Industries Ltd., Hikma Pharmaceuticals PLC, Fresenius Kabi AG, Drägerwerk AG & Co. KGaA, Cook Medical Inc., GE Healthcare, Mindray Medical International Limited, SunMed LLC, Westmed Inc., Halyard Health. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Epidural Anesthetic Drugs and Devices Market Key Technology Landscape

The technological landscape of the Epidural Anesthetic Drugs and Devices Market is undergoing continuous refinement, primarily focused on enhancing safety, precision, and ease of use. A major thrust of innovation is centered on improved catheter design, moving beyond basic single-orifice tips to multi-orifice, wire-reinforced, and anti-kinking catheters that aim to prevent catheter migration, occlusion, and reduce the risk of accidental intravascular injection. Furthermore, the integration of radio-opaque materials facilitates accurate visualization under X-ray or fluoroscopy, crucial for long-term placement in chronic pain management. These advancements directly address common procedural complications, significantly improving the reliability and therapeutic efficacy of continuous epidural techniques, which are becoming the standard of care for complex post-operative pain protocols, demanding catheters capable of extended, stable placement.

Infusion pump technology represents another critical area of technological advancement. Modern electronic pumps are highly sophisticated, featuring programmable dosing profiles, Patient-Controlled Epidural Analgesia (PCEA) capabilities, and built-in drug libraries designed to prevent medication errors, fulfilling the need for enhanced safety measures in dynamic hospital environments. The incorporation of smart technology, including wireless connectivity and electronic health record (EHR) integration, allows for real-time monitoring of infusion status and patient response, enabling clinicians to make data-driven adjustments quickly and remotely. Furthermore, the development of smaller, more robust elastomeric pumps for ambulatory and home care settings is expanding the market reach, offering patients continuous pain relief outside the hospital walls, thereby reducing overall healthcare costs associated with extended inpatient stays while maintaining high levels of analgesic efficacy.

Imaging guidance technologies are fundamentally changing the insertion phase of the epidural procedure. While traditional insertion relies heavily on anatomical landmarks and the "loss-of-resistance" technique, the increasing use of ultrasound guidance, both pre-procedurally for identifying anatomy and inter-procedurally for real-time needle tracking, significantly improves the precision of needle placement, especially in patients with challenging anatomies (e.g., obese or elderly patients). Advanced technological integration involves the development of specialized epidural needles (e.g., Tuohy needles) with enhanced tactile feedback and safety features, such as depth markers and wing designs for secure handling. Future innovations are expected to merge real-time imaging with AI-driven predictive algorithms, creating semi-automated systems that guide practitioners to the optimal injection site, minimizing the risk of complications and further standardizing procedural success rates across varying levels of clinician expertise.

Regional Highlights

- North America: North America, particularly the United States, holds the dominant share in the Epidural Anesthetic Drugs and Devices Market. This dominance is attributed to sophisticated healthcare infrastructure, high patient awareness regarding pain management options, and the pervasive adoption of advanced, high-cost devices like smart electronic infusion pumps. The region benefits from high expenditure on healthcare, robust reimbursement policies for regional anesthesia procedures, and the strong presence of major market players focused on continuous product innovation and safety features. The growing emphasis on reducing opioid prescription rates has further bolstered the use of epidural techniques in post-operative care, driving demand for specialized drug-sparing regimens and PCEA devices.

- Europe: Europe represents a mature and technologically advanced market, following North America closely in adoption rates. Key markets such as Germany, the UK, and France show high utilization of epidural anesthesia in both obstetrics and orthopedic surgery. The market is characterized by stringent regulatory environments (e.g., MDR compliance), which favors high-quality, clinically proven devices and drugs. Strategic growth is driven by increasing public health focus on patient safety and the standardization of POPM protocols, leading to steady demand for standardized epidural kits and advanced drug formulations that offer enhanced stability and prolonged pain relief profiles.

- Asia Pacific (APAC): The Asia Pacific region is projected to be the fastest-growing market during the forecast period. This accelerated growth is primarily fueled by rapid economic development, substantial improvements in healthcare access, and the expansion of hospital infrastructure in populous countries like China, India, and South Korea. While historically reliant on basic kits, increasing medical tourism and rising disposable incomes are driving the adoption of premium devices and advanced local anesthetic agents. Regulatory harmonization efforts and growing investments by multinational companies to establish local manufacturing and distribution hubs are key factors enabling deeper market penetration across diverse regional markets.

- Latin America (LATAM): The LATAM market is characterized by moderate growth, driven by increasing institutional investment in public and private healthcare facilities, particularly in Brazil and Mexico. Price sensitivity remains a significant barrier, leading to a preference for basic, cost-effective kits and generic local anesthetics. However, rising surgical procedure volumes and efforts to standardize medical practices according to international guidelines offer substantial long-term growth potential, particularly if regulatory environments streamline the approval of essential, safe epidural devices.

- Middle East and Africa (MEA): The MEA region exhibits heterogeneous market growth. Countries within the Gulf Cooperation Council (GCC) show high purchasing power and rapid adoption of high-end Western technologies due to government investments in specialized healthcare centers. Conversely, the African continent presents a challenging environment due to infrastructural and economic limitations, restricting usage primarily to major urban tertiary care centers. Future growth will be dependent on increasing healthcare expenditure, expanding access to skilled personnel, and targeted aid programs focused on essential medical supplies for labor and delivery services.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Epidural Anesthetic Drugs and Devices Market.- Becton Dickinson (BD)

- Teleflex Incorporated

- Medtronic plc

- B Braun Melsungen AG

- ICU Medical, Inc. (following acquisition of Smiths Medical)

- PAJUNK GmbH

- Vygon SA

- Abbott Laboratories

- Integra LifeSciences Corporation (Codman)

- Pfizer Inc.

- Teva Pharmaceutical Industries Ltd.

- Hikma Pharmaceuticals PLC

- Fresenius Kabi AG

- Drägerwerk AG & Co. KGaA

- Cook Medical Inc.

- GE Healthcare

- Mindray Medical International Limited

- SunMed LLC

- Westmed Inc.

- Halyard Health

Frequently Asked Questions

Analyze common user questions about the Epidural Anesthetic Drugs and Devices market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the Epidural Anesthetic Devices segment?

The primary factor driving the growth of the device segment is the increasing demand for enhanced patient safety, leading to innovations in smart infusion pumps with PCEA capabilities and integrated drug libraries, alongside advanced catheter designs that minimize migration and procedural complications during continuous pain management.

Which application area holds the largest market share for epidural products globally?

Labor and Delivery (Obstetrics) currently holds the largest volume share for epidural anesthesia usage globally, driven by widespread adoption of neuraxial techniques for pain relief during childbirth in developed and rapidly developing economies.

How is the adoption of AI impacting the safety and efficacy of epidural procedures?

AI is improving safety and efficacy by integrating with imaging systems (ultrasound/fluoroscopy) to provide real-time guidance for needle placement, optimizing dosing predictions based on patient physiological data, and automating complication monitoring through predictive analytics, thereby enhancing procedural precision.

What are the key technological advancements concerning epidural catheters?

Key technological advancements include the development of specialized multi-orifice, wire-reinforced, and anti-microbial coated catheters designed to improve flow distribution, prevent kinking or migration post-insertion, and reduce the risk of infection, especially in long-term chronic pain applications.

Which geographical region is expected to demonstrate the fastest growth rate in this market?

The Asia Pacific (APAC) region is forecasted to exhibit the fastest Compound Annual Growth Rate (CAGR), driven by massive governmental and private sector investments in expanding hospital infrastructure, increasing surgical volumes, and rising awareness regarding advanced pain management therapies.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager