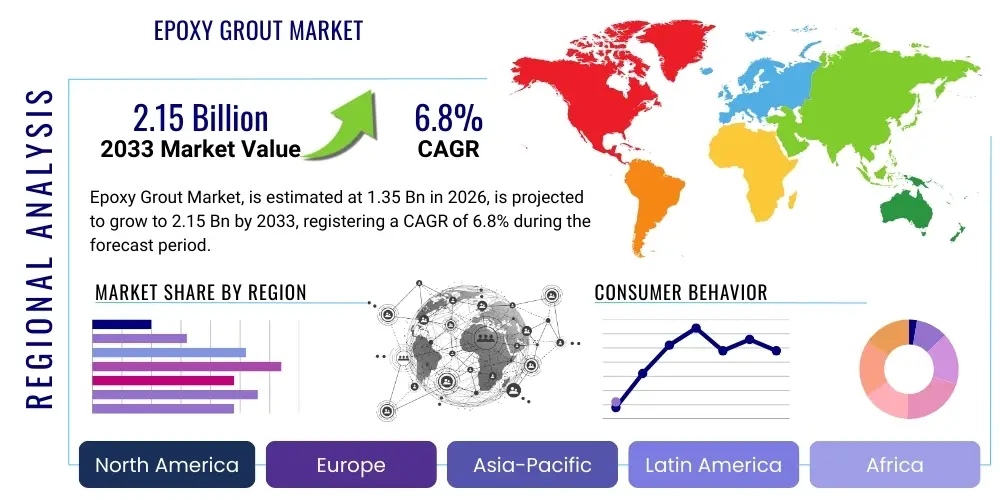

Epoxy Grout Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443573 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Epoxy Grout Market Size

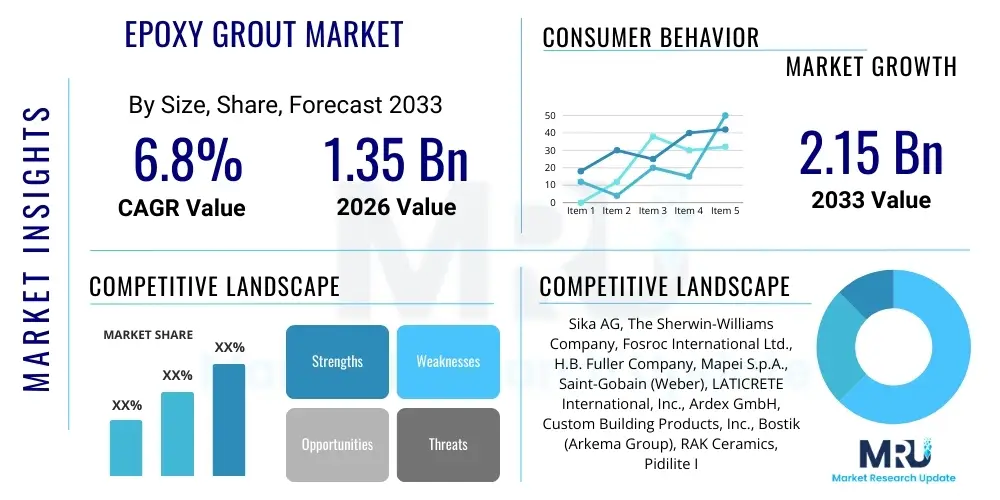

The Epoxy Grout Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 1.35 Billion in 2026 and is projected to reach USD 2.15 Billion by the end of the forecast period in 2033. This growth trajectory is fundamentally driven by escalating demand in high-performance construction environments, particularly industrial flooring, chemical processing facilities, and high-traffic commercial spaces where conventional cementitious grouts fail to provide adequate durability and chemical resistance. Furthermore, increasing infrastructure investment globally, coupled with stringent regulatory standards for hygiene and structural integrity in sectors like food and beverage and pharmaceuticals, heavily favors the adoption of two-component epoxy systems.

Epoxy Grout Market introduction

The Epoxy Grout Market encompasses the manufacturing, distribution, and application of specialized polymer-based grouting materials, primarily composed of an epoxy resin and a hardener. This sophisticated construction material is employed to fill joints and gaps, offering superior performance characteristics compared to traditional Portland cement grouts. Key benefits include exceptional chemical resistance, high compressive and flexural strength, minimal shrinkage, and impermeability to water and microbial growth, making them indispensable in demanding environments. The primary applications span across commercial flooring installations, intricate tile settings, structural anchorages in heavy industries, and critical infrastructure repair projects requiring long-term durability and resistance to harsh environmental factors.

Product description highlights the two-part nature of epoxy grout, requiring on-site mixing of the resin and catalyst before application, which results in a thermosetting plastic highly resistant to degradation. Major applications center around industrial settings such as chemical plants, food processing facilities, and automotive manufacturing floors, alongside high-end residential and commercial areas like swimming pools, hospitals, and shopping centers where aesthetic longevity and hygiene are paramount. The inherent strength and chemical stability of epoxy resins allow these grouts to withstand severe abrasive wear and exposure to acids, alkalis, and solvents, positioning them as the premium choice for performance-critical installations.

Driving factors for market expansion include the global boom in residential and non-residential construction, particularly in developing economies, and the sustained refurbishment of aging infrastructure in mature markets. Additionally, heightened awareness regarding the maintenance costs associated with low-quality grouting materials is pushing contractors and end-users toward high-performance epoxy alternatives. Regulatory shifts emphasizing safer, cleaner, and more durable building materials further accelerate market penetration, confirming epoxy grout's role as a cornerstone material in modern, resilient construction practices.

Epoxy Grout Market Executive Summary

The Epoxy Grout Market exhibits robust growth, underpinned by fundamental shifts toward performance-oriented construction materials globally. Key business trends show increasing consolidation among major chemical and construction material manufacturers, alongside significant investment in R&D aimed at developing faster-curing, low-VOC (Volatile Organic Compound), and environmentally sustainable epoxy formulations. The competitive landscape is characterized by intense focus on application-specific solutions, such as specialized chemical-resistant grouts for laboratories and heavy-duty industrial anchoring systems, driving innovation and premium pricing within specialized segments. Furthermore, supply chain optimization and localized production are crucial strategic initiatives being pursued by market leaders to mitigate geopolitical risks and fluctuating raw material costs, specifically related to bisphenol A (BPA) and various curing agents.

Regional trends indicate that the Asia Pacific (APAC) region remains the fastest-growing market, primarily fueled by massive infrastructure projects in countries like China, India, and Southeast Asian nations, alongside rapid urbanization and the subsequent surge in commercial and residential development requiring durable flooring solutions. North America and Europe, while mature, maintain substantial market shares due to stringent regulatory frameworks mandating high-performance materials in healthcare, food processing, and industrial maintenance sectors, coupled with significant ongoing renovation and repair activities. These developed markets show a strong preference for high-end, premium-priced epoxy systems offering superior longevity and aesthetic value, particularly within the commercial tile and stone segment.

Segmentation trends highlight the dominance of the Industrial Application segment, driven by essential requirements for structural integrity and chemical protection in facilities handling corrosive substances. However, the Residential segment is demonstrating accelerated adoption, particularly for high-value areas like kitchens, bathrooms, and outdoor spaces, reflecting rising consumer incomes and increased focus on maintenance-free, aesthetically pleasing finishes. Regarding product type, standard epoxy grouts continue to hold the largest volume share, but high-performance epoxy systems, engineered for extreme thermal cycling or seismic resistance, are experiencing faster revenue growth due to their essential function in critical infrastructure and specialized manufacturing environments.

AI Impact Analysis on Epoxy Grout Market

Analysis of common user questions reveals strong interest in how AI and automation can enhance quality control, optimize formulation, and streamline application processes within the epoxy grout industry. Users frequently inquire about AI's role in predicting material performance under specific environmental stresses, optimizing mixing ratios to minimize waste and ensure consistency, and leveraging machine vision for automated inspection of grout joints. Key concerns revolve around the capital investment required for adopting AI-driven systems, the availability of skilled labor to manage advanced predictive maintenance platforms, and the ethical implications of data privacy related to project site monitoring. Expectations focus heavily on AI reducing material failure rates, shortening cure times through real-time environmental adjustments, and improving supply chain resilience through predictive demand forecasting for raw epoxy components.

AI's influence is expected to dramatically redefine R&D cycles by accelerating material discovery. Machine learning algorithms can analyze vast datasets of chemical properties, curing dynamics, and stress test results, identifying novel resin-hardener combinations that offer improved characteristics such as faster setting, enhanced flexibility, or superior chemical resistance, far quicker than traditional laboratory experimentation. This capability not only reduces the time-to-market for innovative epoxy products but also allows manufacturers to rapidly tailor solutions to highly niche application requirements, such as anti-microbial grouts for medical facilities or thermally stable grouts for cryogenic applications.

Furthermore, the integration of AI in construction management, particularly through Building Information Modeling (BIM) platforms, allows for precise calculation of required material volumes, minimizing construction waste and improving project scheduling. On the factory floor, AI-powered quality control systems use high-resolution cameras and sensors to monitor the manufacturing process of packaged epoxy components, ensuring exact volumetric consistency and purity, thus guaranteeing consistent performance upon installation. This integration of digital intelligence across the value chain promises significant gains in operational efficiency and reliability, appealing directly to large industrial contractors focused on risk mitigation and standardized project execution.

- Enhanced quality control through real-time monitoring of batch consistency and purity during manufacturing.

- Optimization of chemical formulations using machine learning to predict performance outcomes and reduce R&D timelines.

- Predictive maintenance analytics for construction equipment, minimizing downtime on large-scale grouting projects.

- Supply chain risk mitigation by forecasting raw material volatility and optimizing procurement strategies.

- Automated inspection of finished grout installations using drone-mounted or handheld AI vision systems for defect detection.

- Improved sustainability by optimizing mixing instructions and material use, reducing construction site waste.

DRO & Impact Forces Of Epoxy Grout Market

The Epoxy Grout Market is principally driven by expanding infrastructure investment, especially in highly corrosive industrial environments, and the increasing global adoption of premium flooring solutions that mandate superior durability and aesthetic longevity. Restraints include the higher upfront cost of epoxy grout materials compared to traditional cementitious products, the specialized training required for proper application, and volatility in the pricing and supply of petrochemical-derived raw materials, particularly epoxy resins and curing agents. Opportunities are vast, focused on developing low-VOC and bio-based epoxy alternatives to meet stringent environmental regulations, capitalizing on the growing demand for specialized anti-microbial variants in healthcare and food processing, and penetrating the large, untapped market of infrastructure repair and rehabilitation projects. These forces collectively shape the market's trajectory, demanding a strategic balance between cost management, innovation, and compliance with performance standards.

The primary driving force remains the superior functional characteristics of epoxy grout. Unlike conventional materials, epoxy offers exceptional resistance to thermal shock, heavy impact, and a broad spectrum of chemicals, making it essential for sectors such as pharmaceuticals, commercial kitchens, and heavy manufacturing. As construction standards worldwide become more stringent regarding longevity and structural resilience, the total lifecycle cost advantage of epoxy grouts, despite their higher initial price point, becomes increasingly compelling for large-scale commercial and industrial users. Furthermore, the rapid growth in renovation and retrofitting activities across North America and Europe necessitates materials capable of quick curing and high bond strength for repairs, accelerating the uptake of high-performance epoxy systems.

However, the market faces significant headwinds, particularly related to application complexity and environmental concerns. Epoxy grouts require precise mixing and rapid application within a limited pot life, which demands skilled labor, a constraint in many developing markets. Economically, the market remains sensitive to fluctuations in crude oil prices, which directly impact the cost of petrochemical feedstock used in resin production. The major impact forces influencing the market trajectory include globalization of manufacturing leading to standardized quality requirements across regions, technological advancements that improve application ease and longevity, and increasing consumer and regulatory pressure toward sustainable building chemistry, pushing manufacturers toward solvent-free and water-based epoxy solutions.

Segmentation Analysis

The Epoxy Grout Market is extensively segmented based on Type, Application, and End-Use, reflecting the diverse performance requirements across various construction sectors. The Type segmentation distinguishes between Standard Epoxy Grout, which serves general-purpose commercial and residential tiling needs, and High-Performance Epoxy Grout, formulated for extreme conditions requiring enhanced chemical, thermal, or structural resistance, such as industrial equipment baseplates or chemical containment areas. Application segmentation categorizes usage across Residential, Commercial, Industrial, and Infrastructure sectors, with industrial and infrastructure typically driving higher volume and value due to the demanding nature of the projects. Finally, End-Use segmentation specifies the primary function, encompassing Tile & Stone setting, Industrial Flooring, Structural Repair, and specialized Chemical Containment, allowing manufacturers to target specific functional needs with tailored product lines.

The dominance of the industrial application segment is attributed to the critical need for materials that can withstand aggressive cleaning regimes, heavy machinery traffic, and continuous exposure to corrosive agents. In industrial flooring, epoxy grouts are not merely joint fillers but integral components of the floor system, providing structural continuity and chemical barrier properties essential for operational safety and compliance. Simultaneously, the burgeoning demand in the structural repair segment, particularly for infrastructure like bridges, dams, and marine structures, underscores the material's role in long-term maintenance and seismic retrofitting, utilizing specialized non-shrink and high-strength epoxy formulas for critical load-bearing applications.

Further segment analysis reveals that High-Performance Epoxy Grout is projected to record the highest CAGR, largely due to its increasing adoption in food and beverage processing facilities and pharmaceutical manufacturing. These sectors are subject to strict hygiene standards, making the non-porous and easy-to-clean nature of high-performance epoxy indispensable. Geographical segmentation remains crucial, with regions like Asia Pacific and the Middle East offering substantial opportunities driven by massive new construction activities, while North America and Europe emphasize premiumization and sustainable product offerings, focusing on low-VOC and fast-curing chemistries across all end-use applications, ensuring sustained market diversification and resilience against economic fluctuations.

- Type:

- Standard Epoxy Grout

- High-Performance Epoxy Grout (Chemical Resistant, Thermal Resistant, Flexible)

- Application:

- Residential Construction

- Commercial Building (Retail, Office, Hospitality)

- Industrial Facilities (Manufacturing, Warehousing, Processing)

- Infrastructure Projects (Bridges, Tunnels, Marine Structures)

- End-Use:

- Tile & Stone Installation

- Industrial Flooring Systems

- Structural Repair and Anchoring

- Chemical Containment Areas

Value Chain Analysis For Epoxy Grout Market

The value chain for the Epoxy Grout Market is complex, starting with the upstream sourcing of raw petrochemical materials. This upstream analysis focuses on the extraction and refining of crude oil components, leading to the production of key precursors such as Bisphenol A (BPA) and Epichlorohydrin, which are essential for manufacturing epoxy resins, alongside various amines and polyamides used as hardeners. Raw material supply is dominated by large, integrated chemical companies, whose pricing and production capacity significantly influence the manufacturing costs of epoxy grout producers. Strategic agreements and backward integration by major grout manufacturers into resin production are key strategies to mitigate cost volatility and secure consistent high-quality feedstock, making this upstream segment highly critical and capital-intensive.

Midstream activities involve the formulation and compounding of the two-part epoxy system by specialized chemical companies and construction material manufacturers. This stage is characterized by intensive R&D to optimize mixing ratios, modify rheological properties (viscosity and flow), and incorporate performance enhancers such as specialized fillers, pigments, and anti-microbial additives. Quality control is paramount during formulation to ensure consistent pot life, curing time, and ultimate material performance. The finished product then enters the downstream distribution channel, primarily leveraging a mix of direct sales to large industrial contractors and indirect distribution through specialized construction supply houses, major retail home improvement chains, and authorized distributors, depending on the target end-use sector.

The distribution network is crucial for market access, with direct channels favored for complex industrial or infrastructure projects where technical support and customized formulations are required. Indirect channels, including regional dealers and large retailers, efficiently service the high-volume residential and smaller commercial tiling segments. Effective logistics and inventory management are vital due to the relatively limited shelf life of some epoxy components and the need for prompt delivery to construction sites. Therefore, strong relationships with both large chemical suppliers (upstream) and established distribution networks (downstream) are central to achieving competitive advantage and maximizing market penetration in the highly fragmented end-user landscape.

Epoxy Grout Market Potential Customers

Potential customers for the Epoxy Grout Market span a wide array of commercial entities and governmental organizations, unified by the requirement for extremely durable, chemically resistant, and low-maintenance joint-filling solutions. The primary end-users are professional contractors and specialized applicators operating within industrial, commercial, and public infrastructure sectors. Large industrial buyers, such as food and beverage processing companies, chemical plants, pharmaceutical manufacturers, and automotive assembly facilities, represent the most critical customer segment due to their stringent performance requirements concerning hygiene, structural integrity, and resistance to aggressive cleaning agents and chemical spills. These customers often purchase high-performance, specialized formulations directly from manufacturers or through specialized industrial distributors.

A secondary, yet rapidly expanding, segment of potential customers includes large commercial developers, hospital administrators, educational institution management, and hospitality groups. These entities prioritize materials that offer aesthetic longevity, minimize maintenance downtime, and meet high standards for hygiene and safety in public spaces. In these commercial settings, epoxy grout is favored for high-traffic areas, swimming pools, commercial kitchens, and restrooms, ensuring durable joints that resist staining and microbial growth. Purchasing decisions here are heavily influenced by specification requirements set by architects, engineers, and interior designers who mandate premium construction materials for long-term value.

Furthermore, governmental agencies and public works departments constitute a significant customer base, particularly within the infrastructure and structural repair segments. Departments responsible for maintaining bridges, tunnels, water treatment facilities, and military installations rely on high-strength, non-shrink epoxy grouts for anchoring heavy equipment, repairing deteriorated concrete, and ensuring structural resilience against environmental degradation. The purchasing process in this segment is typically tender-based, demanding certified products that comply with national and international infrastructure and construction standards, emphasizing product technical data and proven long-term field performance over immediate cost savings.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.35 Billion |

| Market Forecast in 2033 | USD 2.15 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Sika AG, The Sherwin-Williams Company, Fosroc International Ltd., H.B. Fuller Company, Mapei S.p.A., Saint-Gobain (Weber), LATICRETE International, Inc., Ardex GmbH, Custom Building Products, Inc., Bostik (Arkema Group), RAK Ceramics, Pidilite Industries Ltd., W. R. Meadows, Inc., Cera-Chem Private Limited, Five Star Products Inc., Garon Products Inc., BASF SE, Master Builders Solutions (MBCC Group), Ronacrete Ltd., ITW Performance Polymers |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Epoxy Grout Market Key Technology Landscape

The technology landscape within the Epoxy Grout Market is continually evolving, focusing on enhancing user-friendliness, sustainability, and specialized performance. A primary area of technological advancement involves the development of low-VOC (Volatile Organic Compound) and solvent-free epoxy systems. These new formulations utilize advanced polymer chemistry to achieve desired curing properties and strength without the use of harsh solvents, directly addressing increasing regulatory scrutiny and contractor demands for healthier and safer working environments. Water-based epoxy grouts represent a significant leap in this direction, offering easier clean-up and reduced odor while maintaining acceptable durability for residential and light commercial applications, expanding the addressable market beyond traditional industrial uses.

Another crucial technological focus is on improving the application process through novel packaging and rheology modification. Pre-measured, pre-dosed dual-cartridge systems minimize on-site mixing errors and reduce material waste, catering to the residential and smaller commercial segments where skilled labor may be less abundant. Furthermore, manufacturers are investing in specialized lightweight fillers and thixotropic agents to control the flow and consistency of the grout. This ensures that the material is easily workable during application (allowing for deep penetration into joints) yet resists sagging or slumping immediately after placement, which is critical for vertical and overhead structural repairs, enhancing the versatility of the product line across diverse construction challenges.

Specialized functional technologies also dominate the high-performance segment. This includes the integration of anti-microbial additives, typically silver-ion based, directly into the epoxy matrix to inhibit the growth of bacteria, mold, and mildew, which is mandatory for applications in hospitals, cleanrooms, and food preparation areas. Simultaneously, the market is seeing advancements in quick-setting and high-early-strength epoxy formulas, essential for time-critical industrial repair projects where minimizing downtime is paramount. These technological innovations are highly valued by end-users as they directly translate into improved hygiene standards, faster project completion, and enhanced longevity of the finished installation, driving premium pricing and competitive differentiation among market players.

Regional Highlights

- Asia Pacific (APAC): APAC is projected to be the engine of growth for the Epoxy Grout Market, exhibiting the highest CAGR during the forecast period. This rapid expansion is primarily attributable to extensive urbanization and government-backed infrastructure spending, particularly in rapidly developing economies such as China, India, and Southeast Asian nations (Indonesia, Vietnam). The massive scale of new construction—including commercial complexes, high-rise residential buildings, and industrial parks—creates enormous demand for cost-effective yet durable construction materials. While price sensitivity is higher in this region, the simultaneous influx of foreign investment and multinational manufacturing operations necessitates adherence to international quality standards, driving the adoption of high-performance epoxy grouts for precision industrial flooring and structural applications.

- North America: North America holds a significant revenue share, characterized by a mature market heavily focused on renovation, repair, and premium construction. Market growth is driven less by volume of new construction and more by the adoption of advanced, specialty epoxy formulations. The presence of stringent regulations, particularly concerning hygiene in food processing (USDA) and safety standards in chemical manufacturing, mandates the use of highly chemical-resistant and low-VOC epoxy grouts. The region also shows a strong consumer preference for aesthetically superior, maintenance-free epoxy grouts in residential and high-end commercial tile installations, sustained by robust economic conditions and high consumer purchasing power focused on premium home improvements.

- Europe: Europe represents a stable and high-value market, distinguished by early adoption of sustainability standards and strict environmental regulations, such as REACH. This drives the demand for low-emission, solvent-free, and bio-based epoxy grout solutions. Key drivers include sustained investment in maintaining and upgrading aging public infrastructure, especially rail and road networks, alongside continuous renovation in the hospitality and healthcare sectors. Countries like Germany, the UK, and France show strong demand for specialized structural epoxy formulations used in industrial machinery baseplates and precision anchoring, adhering to rigorous engineering specifications and longevity requirements inherent to European construction practice.

- Latin America (LATAM): The LATAM market is experiencing moderate growth, spurred by increasing government investment in public infrastructure and the expansion of the manufacturing sector, particularly in Brazil and Mexico. Although penetration rates for epoxy grout are lower compared to developed regions, awareness of the lifecycle benefits of high-performance grouting materials is rising, substituting traditional cementitious products in critical applications. Economic stability and foreign direct investment are key determinants of market acceleration, focusing initially on industrial warehousing and commercial developments that require robust flooring systems to support logistical and manufacturing operations.

- Middle East and Africa (MEA): MEA presents substantial opportunities driven by mega-project investments in the Gulf Cooperation Council (GCC) countries, focusing on urban development, tourism infrastructure (hotels, airports), and petrochemical facilities. The harsh environmental conditions, including high temperatures and chemical exposure in industrial hubs, necessitate materials with exceptional durability and thermal resistance, favoring premium epoxy systems. Africa’s growth, while nascent, is concentrated in industrializing nations benefiting from foreign construction aid and local resource development projects, requiring significant structural anchoring and repair solutions that can withstand challenging installation conditions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Epoxy Grout Market.- Sika AG

- The Sherwin-Williams Company

- Fosroc International Ltd.

- H.B. Fuller Company

- Mapei S.p.A.

- Saint-Gobain (Weber)

- LATICRETE International, Inc.

- Ardex GmbH

- Custom Building Products, Inc.

- Bostik (Arkema Group)

- RAK Ceramics

- Pidilite Industries Ltd.

- W. R. Meadows, Inc.

- Cera-Chem Private Limited

- Five Star Products Inc.

- Garon Products Inc.

- BASF SE

- Master Builders Solutions (MBCC Group)

- Ronacrete Ltd.

- ITW Performance Polymers

Frequently Asked Questions

Analyze common user questions about the Epoxy Grout market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of epoxy grout over traditional cementitious grout?

Epoxy grout offers superior performance characteristics, including non-porous impermeability, exceptional chemical resistance (acids, solvents, alkalis), minimal shrinkage, and significantly higher compressive and flexural strength. These properties make epoxy ideal for hygiene-sensitive areas and heavy-duty industrial environments where cementitious grouts would quickly degrade.

Is epoxy grout considered safe for use in food processing facilities and commercial kitchens?

Yes, epoxy grout is highly recommended for food processing, commercial kitchens, and healthcare facilities. Its non-porous nature prevents the absorption of liquids and microbial growth, facilitating compliance with stringent regulatory standards for hygiene and sanitation, often surpassing the capabilities of standard building materials.

What is the typical shelf life and pot life of standard two-part epoxy grout systems?

The shelf life of unmixed components (resin and hardener) typically ranges from 12 to 24 months when stored correctly in cool, dry conditions. However, once the two parts are mixed (pot life), the material must be applied immediately, as cure times often range from 30 minutes to 60 minutes, requiring careful planning during installation.

How does the cost of epoxy grout compare to other grouting materials, and is the investment justifiable?

Epoxy grout has a significantly higher initial material cost compared to standard cementitious or acrylic grouts. However, the investment is justified by the lower long-term maintenance costs, superior durability, and resistance to staining and chemical damage, resulting in a significantly lower total lifecycle cost, particularly in high-traffic commercial and industrial settings.

What key factors are driving the demand for low-VOC and sustainable epoxy grout formulations?

Demand is primarily driven by escalating environmental regulations (especially in North America and Europe) aimed at improving indoor air quality and worker safety. Consumers and contractors increasingly prefer low-VOC and solvent-free formulations to comply with green building standards and reduce health risks associated with volatile organic compounds during application and curing.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager