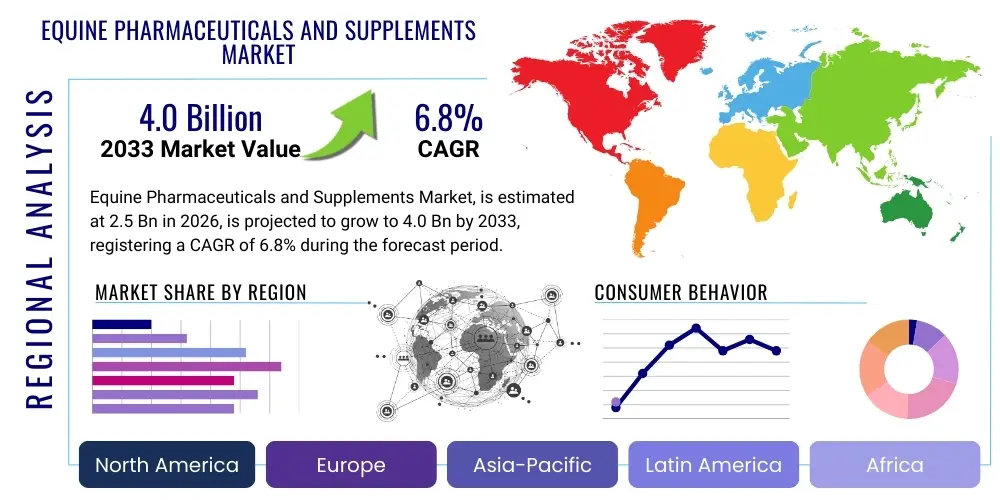

Equine Pharmaceuticals and Supplements Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441730 | Date : Feb, 2026 | Pages : 253 | Region : Global | Publisher : MRU

Equine Pharmaceuticals and Supplements Market Size

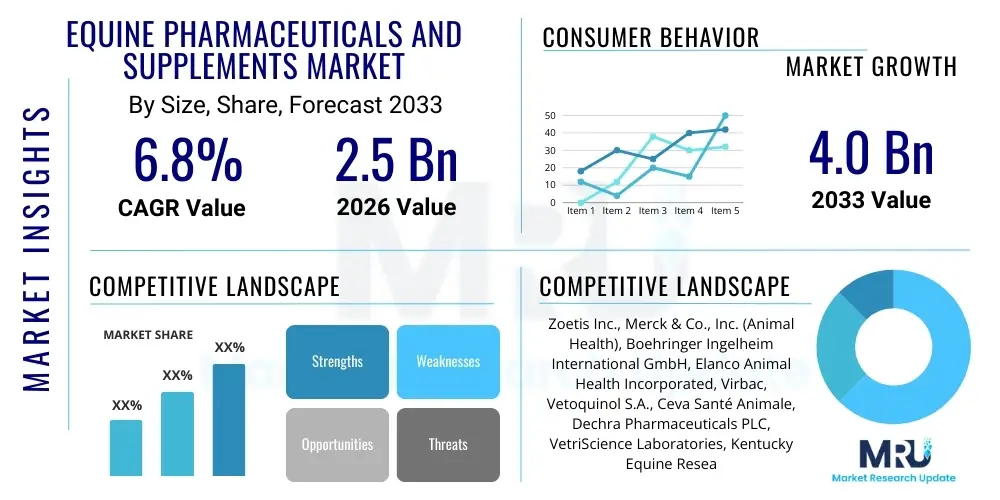

The Equine Pharmaceuticals and Supplements Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 2.5 Billion in 2026 and is projected to reach USD 4.0 Billion by the end of the forecast period in 2033.

Equine Pharmaceuticals and Supplements Market introduction

The Equine Pharmaceuticals and Supplements Market encompasses a broad range of therapeutic agents, preventive medicines, and nutritional additives designed specifically for horses. This market addresses the comprehensive health needs of the global equine population, spanning performance horses (racing, eventing, dressage), pleasure horses, and breeding stock. Products include anti-infectives, analgesics, anti-inflammatories (NSAIDs), vaccines, reproductive hormones, and a burgeoning category of joint, digestive, and coat supplements. The sophistication of equine veterinary medicine has driven demand for highly specific and efficacious treatments, moving beyond general animal health products.

Major applications of these products revolve around disease prevention, management of chronic conditions, optimizing athletic performance, and ensuring reproductive health. Vaccines form a crucial segment for managing endemic diseases such as Equine Influenza and West Nile Virus, while pharmaceuticals are essential for treating lameness, colic, and metabolic disorders like Equine Metabolic Syndrome (EMS). Supplements, often non-prescription, are widely used by horse owners and trainers seeking to maintain joint integrity, balance nutritional deficiencies, and improve recovery times, particularly in high-stress environments like competitive sports.

The market is primarily driven by the increasing global participation in equestrian sports, rising disposable incomes leading to higher spending on equine health, and the growing bond between owners and their horses, necessitating specialized care. Furthermore, advancements in veterinary diagnostics, leading to earlier and more accurate identification of health issues, contribute significantly to the adoption rate of both prescribed pharmaceuticals and proactive nutritional supplements. Regulatory pressures focusing on the safety and efficacy of feed additives and drugs also shape product innovation, pushing manufacturers towards evidence-based formulations and specialized delivery systems.

Equine Pharmaceuticals and Supplements Market Executive Summary

The Equine Pharmaceuticals and Supplements Market is characterized by stable growth driven by specialized veterinary care and heightened owner awareness regarding equine welfare. Current business trends indicate a shift towards biological therapies, including stem cell treatments and sophisticated gene therapies, particularly for debilitating orthopedic conditions that affect performance horses. Furthermore, key market players are focusing heavily on developing palatable, easy-to-administer oral formulations to improve compliance, moving away from complex injectable regimens where possible. Consolidation among major pharmaceutical companies and specialized equine supplement manufacturers is a noticeable trend, aimed at streamlining distribution channels and leveraging synergistic research and development capabilities, especially in emerging fields like nutraceuticals and targeted pain management solutions.

Geographically, North America and Europe remain the largest contributors due to high rates of horse ownership, substantial spending power, and well-established regulatory frameworks supporting advanced veterinary practices. However, the Asia Pacific (APAC) region, specifically countries like China and India, is emerging as a significant growth hotspot. This regional trend is fueled by the rapid commercialization of equestrian activities, the establishment of professional breeding programs, and increasing imports of high-value performance horses, which necessitate specialized pharmaceutical and supplemental intervention. Latin America also presents opportunities, particularly in Brazil and Argentina, which possess large livestock and racing industries, driving demand for preventative medicines and growth promoters.

Segment trends highlight the dominance of the anti-infectives and pain management categories within pharmaceuticals, reflecting the common prevalence of bacterial infections and lameness issues in horses. Within the supplements sector, joint health products (containing glucosamine, chondroitin, and hyaluronic acid) exhibit the highest growth rate, underscoring the priority horse owners place on mobility and athletic longevity. Regulatory convergence and standardization of efficacy testing for supplements are expected to further professionalize this segment, driving out lower-quality offerings and increasing consumer trust in evidence-based formulations.

AI Impact Analysis on Equine Pharmaceuticals and Supplements Market

Users frequently inquire about how Artificial Intelligence (AI) and machine learning (ML) can revolutionize equine diagnostics, treatment efficacy, and drug development timelines. Key concerns center around the implementation cost of sophisticated AI-driven diagnostic tools, the reliability of predictive modeling for disease outbreaks (like Equine Herpesvirus), and the potential for AI to personalize dosing strategies, minimizing adverse drug reactions. There is a high expectation that AI will be integrated into wearable monitoring devices to collect real-time physiological data, which, when analyzed by ML algorithms, could optimize supplement regimens and identify subtle signs of lameness or illness much earlier than traditional methods. Furthermore, users are keenly interested in AI’s role in accelerating the discovery of novel compounds specifically targeting complex equine diseases, thereby shortening the time-to-market for innovative veterinary medicines.

- AI-driven predictive analytics optimize dosing schedules based on individual horse metabolic profiles, minimizing risk and maximizing therapeutic effect.

- Machine learning enhances diagnostics by analyzing complex data from imaging (MRI, X-ray) and gait analysis, leading to earlier detection of musculoskeletal issues.

- AI accelerates the discovery phase of new equine pharmaceuticals by simulating molecular interactions and predicting the efficacy and toxicity of potential drug candidates.

- Wearable technology coupled with AI monitors behavioral and physiological indicators (heart rate variability, stress levels) to personalize supplement requirements for performance optimization.

- Predictive modeling assists veterinarians in managing and anticipating large-scale disease outbreaks across breeding and competition populations.

DRO & Impact Forces Of Equine Pharmaceuticals and Supplements Market

The Equine Pharmaceuticals and Supplements Market is significantly influenced by a dynamic interplay of growth accelerators, regulatory hurdles, and emerging opportunities rooted in technological progress. The primary drivers include the professionalization and commercialization of equestrian sports globally, which mandates higher standards of veterinary care and performance management. This is coupled with growing consumer willingness, particularly in developed economies, to invest heavily in preventative care and supplements for maintaining the quality of life and longevity of their animals. Restraints mainly center around stringent and often complex regulatory approval processes for novel veterinary drugs, which can be costly and time-consuming, delaying market entry. Furthermore, the persistent challenge of antimicrobial resistance in the veterinary field places limitations on the use of certain anti-infectives, spurring a need for expensive alternatives.

Opportunities in this market are vast and primarily reside in the development of targeted therapies and specialty nutraceuticals. There is a significant gap for effective, long-term treatments for chronic conditions such as pituitary pars intermedia dysfunction (PPID) and osteoarthritis. The rise of genomic research in horses presents a fertile ground for developing personalized medicine approaches. Furthermore, the global trend towards organic and natural products extends to equine supplements, creating an opportunity for sustainable, plant-based formulations backed by scientific evidence. Expanding market penetration in emerging economies, where horse populations are large but veterinary infrastructure is developing, represents a long-term strategic opportunity for volume growth.

The key impact forces shaping the market are centered on technological advancements in drug delivery and the influence of regulatory bodies. The move toward biodegradable implants and sustained-release injections improves drug adherence and efficacy, profoundly impacting treatment outcomes. Moreover, the increasing public scrutiny regarding animal welfare standards compels manufacturers to prioritize ethical sourcing and rigorous testing. Economic impact forces, such as fluctuations in disposable income and the rising cost of veterinary services, influence consumer purchasing decisions, particularly affecting the discretionary spending segment dedicated to high-end supplements and non-essential treatments, creating elasticity in demand depending on regional economic stability.

Segmentation Analysis

The Equine Pharmaceuticals and Supplements Market is meticulously segmented based on product type, end-user, and distribution channel, reflecting the varied needs within the global equine industry. Analyzing these segments provides crucial insights into growth pockets and market maturity across different product categories and consumer groups. Pharmaceuticals, typically requiring veterinary prescription, constitute the foundation of disease management, while supplements, often over-the-counter, cater to performance optimization and preventative maintenance. This layered segmentation assists stakeholders in targeting specific therapeutic areas, optimizing supply chain logistics, and tailoring marketing strategies to different professional and recreational horse ownership demographics.

- By Product Type:

- Pharmaceuticals

- Anti-Infectives

- Anti-Inflammatories (NSAIDs)

- Analgesics

- Vaccines

- Reproductive Hormones

- Others (e.g., Sedatives, Parasiticides)

- Supplements

- Joint Supplements

- Digestive & Probiotics

- Vitamins & Minerals

- Coat & Skin Supplements

- Electrolytes & Hydration

- Performance Enhancers

- Pharmaceuticals

- By Indication:

- Pain & Inflammation

- Infectious Diseases

- Musculoskeletal Disorders (Lameness)

- Reproductive Disorders

- Gastrointestinal Disorders (Colic)

- Metabolic & Endocrine Disorders

- Preventive Health

- By Distribution Channel:

- Veterinary Hospitals & Clinics

- Retail Pharmacies (Online and Offline)

- E-commerce Platforms

- Direct Sales (e.g., to Racetracks, Large Stud Farms)

Value Chain Analysis For Equine Pharmaceuticals and Supplements Market

The value chain for equine health products begins with intensive upstream activities focused on research, raw material procurement, and API (Active Pharmaceutical Ingredient) synthesis. The complexity arises from the need for veterinary-specific formulations, requiring specialized toxicological and efficacy testing distinct from human medicine. Upstream suppliers must adhere to rigorous quality standards, especially for high-purity ingredients required in supplements and biological products. Innovation at this stage, particularly in developing sustained-release technologies and bioequivalent generic drugs, dictates cost structures and competitive advantage within the subsequent manufacturing processes.

The core midstream phase involves manufacturing, quality control, and formulation. Pharmaceutical production requires strict adherence to Good Manufacturing Practices (GMP) regulations set by bodies like the FDA and EMA, ensuring product safety and potency. For supplements, manufacturers often integrate blending and packaging facilities, with a growing emphasis on traceability of ingredients from source to finished product. Marketing and regulatory clearance form a critical bottleneck, as products must demonstrate efficacy in equine populations and secure approval for specific indications before moving into distribution. This phase directly influences brand reputation and market entry speed.

Downstream analysis focuses on distribution channels and end-user engagement. Distribution is multifaceted, involving direct channels (sales to major equine organizations, stud farms, and high-volume veterinary clinics) and indirect channels (wholesalers, regional distributors, and retail points, including rapidly expanding specialized veterinary e-commerce platforms). The final stage, reaching the end-user (horse owners, trainers, and veterinarians), heavily relies on veterinary prescription and recommendation for pharmaceuticals, while supplements often utilize consumer marketing and endorsement by equestrian professionals. The efficiency of the distribution network, particularly the cold chain management for vaccines and biologics, is paramount to maintaining product integrity and market access.

Equine Pharmaceuticals and Supplements Market Potential Customers

The primary customers of the Equine Pharmaceuticals and Supplements Market are characterized by their varying levels of professional involvement, financial capacity, and primary use of the animal. Veterinarians serve as critical gatekeepers, influencing the vast majority of pharmaceutical sales and often recommending specific supplement brands based on clinical evidence and trust in the supplier. Large veterinary hospitals and clinics purchase in bulk, prioritizing therapeutic breadth and reliable supply chains, making them pivotal institutional customers. Their purchasing decisions are driven by clinical need, regulatory compliance, and cost-effectiveness for treating diverse equine health issues.

A second major customer segment includes professional equine organizations, such as racing syndicates, competitive barn owners, and large breeding farms (stud farms). These entities manage high-value animals whose performance and reproductive success directly impact substantial financial outcomes. Their demand is highly focused on performance-enhancing supplements, preventative care protocols (vaccinations, deworming), and advanced therapies for injury rehabilitation. Purchasing decisions here are influenced by perceived performance gain, veterinary consultation, and the need for rigorous anti-doping compliance within competitive regulations.

The third, and arguably largest demographic, consists of recreational horse owners and smaller private yards. While they may spend less per horse than professional operations, their sheer numbers constitute a massive market for over-the-counter supplements and basic veterinary care products. These customers are driven by the emotional bond with their animal, seeking products that ensure the horse’s comfort, well-being, and longevity. Purchasing habits in this segment are highly sensitive to brand reputation, peer recommendations, digital marketing visibility, and ease of purchase through online retail platforms.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.5 Billion |

| Market Forecast in 2033 | USD 4.0 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Zoetis Inc., Merck & Co., Inc. (Animal Health), Boehringer Ingelheim International GmbH, Elanco Animal Health Incorporated, Virbac, Vetoquinol S.A., Ceva Santé Animale, Dechra Pharmaceuticals PLC, VetriScience Laboratories, Kentucky Equine Research (KER), Platinum Performance, Farnam Companies, Luitpold Animal Health, Bayer AG (Animal Health, prior to acquisition), Equine Products UK Ltd., Arenus Animal Health, Nutramax Laboratories Veterinary Sciences, Inc., W.F. Young, Inc., Audevard, Bio-Vet, Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Equine Pharmaceuticals and Supplements Market Key Technology Landscape

The technological landscape of the Equine Pharmaceuticals and Supplements Market is rapidly evolving, driven by the push for targeted delivery, improved bioavailability, and reduced systemic side effects. A critical technology involves advanced drug delivery systems, particularly microencapsulation and nanoparticle technology. These methods allow for the controlled and sustained release of active ingredients, essential for long-term treatments like pain management or hormonal regulation, ensuring consistent drug levels in the horse’s system and improving compliance by reducing the frequency of dosing. Furthermore, innovations in oral mucosal delivery and transdermal patches are being explored to offer non-invasive alternatives to traditional injections, enhancing the horse's comfort and minimizing stress during administration.

Biotechnology and regenerative medicine represent another crucial technological area. The increasing use of biological products, including monoclonal antibodies, recombinant vaccines, and stem cell therapies, is revolutionizing the treatment of complex orthopedic injuries and chronic inflammatory conditions that were previously managed inadequately with traditional pharmacological agents. Stem cell research, often utilizing autologous cells harvested from the horse itself, focuses on regenerating damaged tissue like cartilage, tendons, and ligaments. This shift towards biologics is characterized by high R&D investment but promises therapies with high specificity and potentially curative outcomes, moving beyond symptom management.

Finally, the integration of digital health solutions and precision technology is shaping the market for both pharmaceuticals and supplements. Pharmacogenomics, though nascent, is beginning to offer insights into how individual horses metabolize drugs, allowing for personalized dosing to optimize efficacy and safety. In the supplement sector, technology focuses on enhancing the nutrient absorption profile through chelated minerals and highly digestible protein sources. Moreover, sophisticated analytical tools are employed to validate the claims of supplements, providing scientific backing necessary for gaining the trust of discerning veterinarians and professional horse trainers, marking a move towards evidence-based equine nutraceuticals.

Regional Highlights

The global distribution of the Equine Pharmaceuticals and Supplements Market is highly concentrated in regions with robust equestrian economies and strong animal healthcare infrastructure. North America and Europe collectively dominate the market, primarily due to the high density of valuable performance horses, sophisticated regulatory frameworks supporting product innovation, and significant owner investment in preventative and advanced medical care. However, growth rates in emerging markets, particularly APAC, are outpacing mature regions, signaling a strategic shift in global investment focus.

- North America (U.S. and Canada): Market leader characterized by substantial expenditure on performance horses (racing and show disciplines). Demand is driven by advanced diagnostics, high uptake of specialty biologics, and a mature supplement market dominated by joint and performance-enhancing products. The U.S. Federal regulation system (FDA CVM) strongly influences product safety and efficacy standards globally.

- Europe (Germany, UK, France): High penetration of veterinary services and strict animal welfare laws contribute to strong demand. Key focus areas include vaccines for endemic diseases and pharmaceuticals for lameness management. Europe leads in the adoption of phytopharmaceuticals and herbal supplements due to strong consumer preference for natural treatments.

- Asia Pacific (APAC) (Australia, China, Japan): Fastest-growing region, powered by the professionalization of equestrian sports, rising affluence, and the rapid development of racecourses and breeding centers. Australia is a mature sub-market, while China presents massive long-term growth potential for imported high-quality drugs and supplements as veterinary standards improve.

- Latin America (Brazil, Argentina): Significant market for large-animal pharmaceuticals, often driven by the vast livestock and professional racing industries. Demand centers on basic anti-infectives, parasiticides, and feed additives, with an increasing shift towards specialized performance supplements driven by international competition standards.

- Middle East and Africa (MEA): Growth is heavily skewed towards the Middle East (UAE, Saudi Arabia) due to enormous investments in high-stakes racing and endurance sports. This segment shows high demand for top-tier pharmaceuticals, advanced performance supplements, and reproductive technologies for high-value breeding stock.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Equine Pharmaceuticals and Supplements Market.- Zoetis Inc.

- Merck & Co., Inc. (Animal Health)

- Boehringer Ingelheim International GmbH

- Elanco Animal Health Incorporated

- Virbac

- Vetoquinol S.A.

- Ceva Santé Animale

- Dechra Pharmaceuticals PLC

- VetriScience Laboratories

- Kentucky Equine Research (KER)

- Platinum Performance

- Farnam Companies

- Luitpold Animal Health

- Bayer AG (Animal Health, prior to acquisition by Elanco)

- Equine Products UK Ltd.

- Arenus Animal Health

- Nutramax Laboratories Veterinary Sciences, Inc.

- W.F. Young, Inc.

- Audevard

- Bio-Vet, Inc.

Frequently Asked Questions

Analyze common user questions about the Equine Pharmaceuticals and Supplements market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the Equine Pharmaceuticals and Supplements Market?

The central driver is the increasing commercialization and global participation in high-value equestrian sports, coupled with a higher standard of preventative and therapeutic care demanded by owners of performance and leisure horses worldwide. This professionalization necessitates specialized products for injury prevention and performance optimization.

Which product segment holds the largest market share within equine health products?

The Pharmaceuticals segment, specifically driven by anti-infectives, NSAIDs, and vaccines, traditionally commands the largest revenue share due to their necessity in treating acute and chronic diseases. However, the Supplements segment, particularly joint health and digestive aids, is exhibiting the highest CAGR due to increased focus on long-term preventative care.

How do stringent regulatory frameworks impact the equine pharmaceutical development timeline?

Stringent regulations, particularly regarding safety and efficacy for food-producing and performance animals, necessitate extensive clinical trials specific to equine physiology. This significantly lengthens the drug development cycle and increases R&D costs, acting as a crucial barrier to market entry for novel pharmaceutical agents.

What role does e-commerce play in the distribution of equine supplements?

E-commerce platforms are increasingly vital for the distribution of equine supplements, offering convenience, competitive pricing, and direct access to a wide range of specialized products for recreational owners. This channel bypasses traditional veterinary supply chains and is a key growth area for manufacturers seeking direct-to-consumer relationships.

Which geographical region is expected to demonstrate the fastest growth rate in the near future?

The Asia Pacific (APAC) region, led by emerging markets like China and continuing growth in Australia, is projected to show the fastest CAGR. This growth is underpinned by rising disposable incomes, rapid expansion of the organized racing sector, and improving standards in veterinary care infrastructure.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager