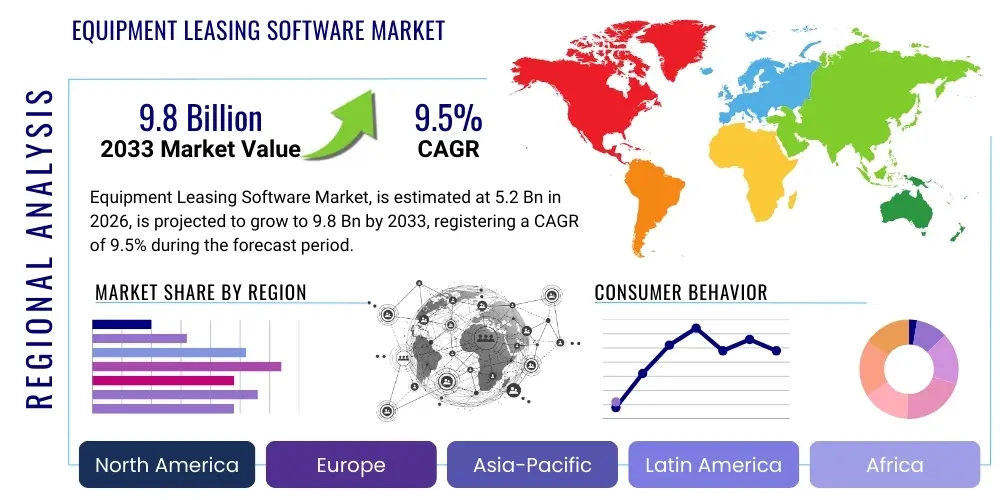

Equipment Leasing Software Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443478 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Equipment Leasing Software Market Size

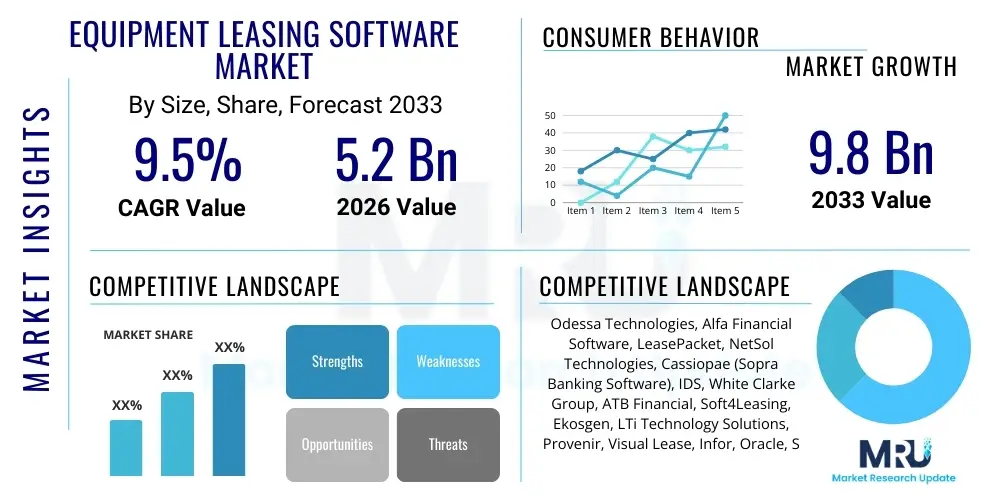

The Equipment Leasing Software Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033. The market is estimated at $5.2 Billion in 2026 and is projected to reach $9.8 Billion by the end of the forecast period in 2033.

Equipment Leasing Software Market introduction

The Equipment Leasing Software Market encompasses specialized technological solutions designed to manage the entire lifecycle of equipment leasing, ranging from initial quotation and credit assessment to contract management, asset tracking, billing, collections, and end-of-lease processing. These sophisticated platforms are crucial for financial institutions, captive finance companies, and independent leasing firms seeking to streamline operations, mitigate financial risk, and ensure rigorous compliance with complex national and international financial regulations, such as IFRS 16 and ASC 842. The product category is extensive, including front-office tools for enhancing customer relationship management and optimizing lease origination pipelines, middle-office functionalities for intricate risk modeling and dynamic pricing adjustments, and back-office solutions critical for general ledger integration, comprehensive portfolio accounting, and streamlined end-of-term processing. The sustained global need for unparalleled scalability, operational efficiency, and rapid adaptability in high-volume, cross-border leasing environments drives the continuous investment and aggressive innovation within this pivotal market space.

Major applications of equipment leasing software span diverse, capital-intensive industries, including banking, financial services, and insurance (BFSI), heavy construction and infrastructure development, global transportation and logistics, precision manufacturing, and the rapidly evolving healthcare sector, where the acquisition of high-value, specialized assets through flexible, non-debt financing mechanisms is increasingly essential. The core strategic benefits derived from utilizing modern, integrated leasing software solutions are multifaceted. They include dramatically faster processing times for complex lease applications, significantly enhanced accuracy in intricate financial reporting required by public bodies, robust, auditable adherence to constantly evolving global accounting standards, and measurably improved portfolio profitability realized through optimized asset performance tracking and superior collections management. Furthermore, the latest generation of these systems facilitates highly personalized and superior customer experiences by enabling sophisticated self-service portals, transparent communication platforms, and the utilization of dynamic, real-time pricing models, definitively moving the industry away from legacy, heavily manual processes toward fully digital, highly integrated, and predictive financial ecosystems.

The global market's expansion is fundamentally driven by several intertwined macroeconomic and technological factors. Principal among these is the increasing worldwide demand for equipment finance as a financially advantageous, flexible alternative to outright capital expenditure and purchase, especially among growing Small and Medium-sized Enterprises (SMEs). This is coupled with the accelerating pace of digital transformation across the financial sector, which demands automated, interconnected systems to maintain competitiveness. Critically, the market growth is underpinned by the necessity for automated compliance management due to the perpetually changing regulatory landscapes that impose severe penalties for misreporting. The pervasive trend toward cloud-based deployment models further accelerates market expansion by offering lower total cost of ownership (TCO), significantly quicker time-to-market for new financial products, and substantially greater operational flexibility compared to capital-intensive, traditional on-premise implementations. The confluence of these strategic and operational drivers necessitates continuous, substantial investment in modern leasing software capable of efficiently handling increasingly complex asset classes, diverse international lease structures, and sophisticated risk management requirements.

Equipment Leasing Software Market Executive Summary

The global Equipment Leasing Software Market is currently characterized by exceptionally robust growth, fundamentally propelled by the mandatory migration of complex leasing operations onto integrated, highly resilient, and typically cloud-native platforms. Key prevailing business trends indicate a decisive and irreversible market shift towards flexible subscription-based service models (SaaS), significantly favoring vendors who offer modular, API-first solutions capable of seamless, rapid integration with existing organizational Enterprise Resource Planning (ERP) systems and sophisticated Customer Relationship Management (CRM) tools. Moreover, market competition is intensifying dramatically, forcing leading vendors to relentlessly prioritize the integration of highly specialized technological capabilities, such such as advanced predictive analytics for instantaneous, accurate credit scoring and highly sophisticated asset lifecycle management modules. These enhancements aim to measurably improve overall portfolio quality, minimize operational friction, and generate superior risk intelligence. The strategic imperative for achieving real-time data visibility across massive, globally distributed leasing portfolios is the defining technological requirement shaping the architecture and functionality of the next generation of product offerings.

A detailed analysis of regional trends highlights North America and Europe as established, mature markets, distinguished by remarkably high technological penetration rates, substantial IT spending capacity, and the necessity to adhere to extremely strict regulatory demands (e.g., rigid compliance with ASC 842 and IFRS 16). These factors collectively drive a continuous and robust demand for compliance-focused, high-security software upgrades and platform modernizations. In sharp contrast, the Asia Pacific (APAC) region is dynamically emerging as the world's fastest-growing market segment, vigorously spurred by rapid, large-scale industrialization, the exponential expansion of key SME sectors, and significantly increased foreign direct investment flows, which together generate an unprecedented volume of equipment financing and leasing activities. Crucially, the technology adoption trajectory in APAC is strongly skewed towards instantly deployable, modern, cloud-first solutions, largely benefiting from the relative absence of deeply entrenched, expensive, and inflexible legacy systems, thereby providing a uniquely fertile ground for agile, innovative FinTech entrants to capture significant market share.

Examination of segmentation trends clearly reveals that the Cloud deployment segment overwhelmingly dominates the market, primarily due to its inherent advantages in cost efficiency, elasticity, and accessibility, making it an especially attractive proposition for Small and Medium-sized Enterprises (SMEs) seeking rapid, non-disruptive implementation and substantially reduced capital expenditure requirements. In terms of primary end-users, the BFSI sector consistently remains the largest consuming segment globally, driven by the sheer volume, exceptional financial complexity, and critical regulatory sensitivity of their diverse leasing portfolios, mandating the use of highly customizable, secure, and robust enterprise solutions. A crucial long-term trend influencing future software development is the ongoing industry movement towards servitization and usage-based leasing models (often termed Equipment-as-a-Service). This structural shift is significantly driving demand for software platforms uniquely capable of tracking, processing, and billing based on dynamic usage data harvested from IoT devices, thus shifting the core operational focus from purely passive financial contract management to comprehensive, proactive asset performance monitoring and utilization optimization.

AI Impact Analysis on Equipment Leasing Software Market

Common user questions regarding the practical and ethical deployment of Artificial Intelligence (AI) in the Equipment Leasing Software Market consistently revolve around its ability to deliver tangible, measurable improvements in financial risk management, the automation efficiency of underwriting processes, and the optimization of the overall customer experience. Users frequently pose complex inquiries about the practical feasibility of deploying sophisticated AI-driven scoring models to partially or wholly replace human credit analysts, the specific integration challenges presented when attempting to introduce complex machine learning algorithms into entrenched existing legacy systems, and the verifiable capacity of AI to accurately and compliantly handle the highly nuanced variables inherent in highly complex or structurally irregular lease agreements. A particularly significant area of focused concern among market participants centers on ensuring robust data privacy safeguards, guaranteeing algorithmic transparency and explainability, and maintaining full regulatory compliance when instantaneous, automated credit or renewal decisions are made by non-human systems. Furthermore, equipment leasing customers are highly interested in how AI can strategically optimize the financial outcomes in the secondary market for leased assets through highly accurate, predictive residual value analysis.

Based on the consistent presence of these key themes and concerns, the overarching industry expectation is that Artificial Intelligence (AI) and Machine Learning (ML) will not merely be incremental additions but will serve as genuinely transformative tools, fundamentally and permanently changing the speed, risk profile, and accuracy of core leasing operations globally. AI is primarily anticipated to provide deep, predictive intelligence across every stage of the leasing lifecycle, effectively automating a wide range of tedious manual and repetitive tasks, and drastically improving the precision and speed of critical financial decision-making processes. The analysis of user sentiment indicates a strong consensus that AI integration will strategically shift the traditional role of leasing professionals—transitioning them from being transactional processors and administrators into strategic decision-makers who leverage data-driven insights generated from vast, complex datasets to proactively tailor hyper-specific financing offers, mitigate portfolio exposure, and manage asset performance risks before they materialize. The overall market outlook regarding AI integration is overwhelmingly positive, provided that vendors successfully address critical concerns related to system integration complexity and establish robust, ethically sound data governance protocols.

The influence of AI extends deeply into achieving essential operational resilience and enabling crucial competitive differentiation for leasing firms. By strategically leveraging AI capabilities for dynamic, instantaneous pricing adjustments based on real-time market liquidity data, highly accurate competitor analysis, and granular customer risk profiles, leasing companies can simultaneously maximize their profit margins while maintaining an aggressive competitive posture in the market. Furthermore, advanced Natural Language Processing (NLP) is increasingly being deployed within these platforms to automate the extraction, verification, and validation of legally binding terms and clauses from complex, often lengthy legal documents. This application drastically reduces the manual time required for crucial contract review, minimizes the probability of costly human error, and accelerates the legal closing process. This sophisticated technological integration is rapidly becoming a non-negotiable prerequisite for software vendors aiming to maintain strategic relevance in a fast-paced market that demands near-instant service delivery, transparent communication, and hyper-personalized financing solutions.

- Enhanced Credit Scoring and Risk Assessment: AI models instantaneously process vast historical financial data and incorporate external macroeconomic factors for highly accurate, accelerated underwriting and instantaneous decision-making processes.

- Automated Lease Origination: Machine learning algorithms streamline and automate core application processing, verify legal documentation authenticity, and handle initial approval workflows, significantly accelerating the total time-to-funding metric.

- Predictive Maintenance Scheduling: IoT sensor data combined with advanced AI analytics anticipates probable equipment failure, thereby optimizing overall asset utilization, minimizing downtime, and ensuring higher realized residual values upon return.

- Optimized Residual Value Forecasting: Sophisticated predictive algorithms analyze complex market trends, historical usage patterns, microeconomic shifts, and asset wear-and-tear data to provide the most precise estimations of future asset value available.

- Hyper-Personalization in Customer Service: AI-powered virtual assistants, sophisticated chatbots, and recommendation engines offer tailored financing options, answer complex queries, and provide immediate, 24/7 customer support, improving satisfaction.

- Fraud Detection and Regulatory Compliance Monitoring: ML systems continuously monitor transactional patterns and behavioral anomalies in real-time to instantly flag suspicious activities, ensuring stringent and continuous adherence to relevant anti-money laundering and regulatory requirements.

DRO & Impact Forces Of Equipment Leasing Software Market

The market dynamics for Equipment Leasing Software are intrinsically shaped by a complex, high-pressure interplay of powerful positive growth stimulants (Drivers), significant practical and logistical operational challenges (Restraints), and future high-potential expansion pathways (Opportunities), which collectively dictate the intensity and direction of the market's Impact Forces. A primary, undeniable Driver is the accelerating global shift towards digitized, end-to-end automated workflow management within the broader financial sector, coupled with the relentless worldwide expansion of equipment leasing as the universally preferred financing method for mission-critical commercial equipment. This confluence necessitates the implementation of robust, highly centralized software systems capable of simultaneously handling multi-jurisdictional compliance, disparate regulatory reporting requirements, and the efficient management of incredibly diverse financial instruments. Conversely, significant Restraints include the extremely high initial capital costs associated with the mandatory migration from deeply entrenched legacy mainframe systems, coupled with the profound technical complexity of integrating new, sophisticated software with the diverse, often fragmented existing enterprise IT architectures of large financial institutions. Furthermore, the persistent and escalating threat of sophisticated cyberattacks specifically targeting highly sensitive financial and customer data elevates the demand for advanced security features, which paradoxically acts as both a powerful driver for significant investment and a substantial operational restraint due to the associated security compliance and governance burden.

Significant, high-potential Opportunities exist predominantly in emerging markets, particularly across high-growth regions in Asia Pacific and Latin America, where rapid industrialization, burgeoning infrastructure projects, and sustained manufacturing growth create substantial latent demand for sophisticated, modern equipment financing solutions. The pervasive global rise of flexible, usage-based leasing models (the servitization of assets) presents a crucial parallel opportunity for software vendors to strategically integrate advanced IoT data ingestion capabilities and sophisticated telemetry analytics directly into their platforms, fundamentally transforming their offerings from being mere financial contract management tools into comprehensive, predictive asset performance and utilization platforms. Additionally, the nascent but strategically important development of Distributed Ledger Technology (DLT), specifically blockchain, offers a revolutionary pathway for creating transparent, immutable, and fully verifiable records of complex asset ownership and contract execution histories. This technology holds the potential to significantly streamline complex syndicated lease structures and cumbersome cross-border transactions, providing a key, defensible differentiator for forward-thinking market vendors who invest early in its integration.

The comprehensive Impact Forces analysis reveals a market environment characterized by a high degree of perpetual technological disruption and aggressive competitive intensity. The bargaining power of buyers remains moderate to high, primarily driven by the increasing availability of highly scalable, subscription-based SaaS solutions and the relatively reduced switching costs associated with migrating between modern cloud platforms compared to replacing proprietary on-premise systems. The threat of new market entrants is substantial, largely fueled by agile FinTech startups specializing in highly specific, high-value technological areas such as AI-driven predictive credit scoring, micro-leasing management, or niche fractional leasing management platforms. Potential substitutes for specialized leasing software (such as generic banking software modules, traditional bank loans, or costly in-house developed IT systems) pose a medium long-term threat, but the sheer complexity, evolving regulatory necessity, and scale requirements of modern equipment leasing mandates that specialized, purpose-built software remains fundamentally indispensable. This overall highly dynamic market landscape strongly emphasizes continuous innovation, guaranteed security posture, regulatory foresight, and strategic channel partnerships as the most critical factors for achieving sustained market success and growth.

Segmentation Analysis

The Equipment Leasing Software Market is meticulously segmented based on several critical dimensions, allowing key vendors, financial analysts, and buyers to precisely target specific technological needs, operational requirements, and strategic market segments. The fundamental segmentation criteria include the deployment model, which explicitly distinguishes the underlying technical architecture used (Cloud, predominantly SaaS, versus traditional On-Premise implementations), the scale of the organization utilizing the software (Small and Medium-sized Enterprises vs. Large Enterprises), and the specific functional component being acquired (Core Software modules vs. critical Implementation and Managed Services). Furthermore, segmentation by end-user industry provides invaluable, detailed insight into the highly vertical-specific customizations required, such as the critical need for specialized meter reading and robust physical asset tracking features for heavy machinery in the construction sector, or the stringent data privacy and regulatory reporting requirements mandated in healthcare leasing.

The Deployment Type remains the single most defining segmentation factor determining adoption rates, with Cloud-based solutions being increasingly and strategically favored across all geographic regions due to their inherent elasticity, significantly quicker deployment cycles, and substantially lower operational overhead (TCO). This aligns perfectly with the overarching digital transformation mandates and cost-efficiency goals of financial institutions globally. Conversely, traditional On-Premise software solutions continue to secure niche traction among extremely large multinational banks, governmental finance entities, and certain organizations operating in highly regulated jurisdictions that mandate absolute, physical control over sensitive, proprietary data, and possess established, robust internal IT infrastructure capabilities to manage complex hosting environments. The segmentation based on Organization Size highlights distinct technological needs: Large Enterprises require highly comprehensive, extremely customized, fully ERP-integrated software suites, whereas SMEs prioritize immediate cost-effectiveness, high-usability, rapid, out-of-the-box functionality, and maximum subscription payment flexibility.

The critical Services segment, which comprehensively encompasses professional consulting, systems integration, physical implementation, complex data migration, and essential ongoing maintenance and support functions, is witnessing the most rapid growth trajectory. This trend is a direct reflection of the substantial technical and logistical complexity inherent in the successful deployment of these mission-critical systems, which frequently involves significant mandatory business process re-engineering, large-scale data cleansing, and meticulous data migration from disparate legacy platforms. Analysis of End-User segmentation overwhelmingly reveals the BFSI sector’s dominant market position due to the immense scale and regulatory necessity of their leasing operations. This is followed closely by the Manufacturing and global Transportation and Logistics sectors, which are heavily reliant on highly efficient fleet, rolling stock, and heavy equipment management tools powered by sophisticated leasing software to ensure optimal asset performance, maximum utilization rates, and absolute regulatory compliance across their asset holdings.

- By Deployment Type:

- Cloud (SaaS)

- On-Premise

- By Component:

- Software (Origination, Servicing, Asset Management, Collections)

- Services (Implementation, Consulting, Support, Managed Services)

- By Organization Size:

- Small and Medium-sized Enterprises (SMEs)

- Large Enterprises

- By End-User:

- Banking, Financial Services, and Insurance (BFSI)

- Manufacturing

- Construction and Industrial

- Transportation and Logistics

- Healthcare

- Others (Retail, Government)

Value Chain Analysis For Equipment Leasing Software Market

The intricate Value Chain for the Equipment Leasing Software Market commences with the Upstream Analysis, which focuses predominantly on the essential core technology providers. These include crucial infrastructure and platform service providers (such as Amazon Web Services, Microsoft Azure, and Google Cloud Platform for robust cloud deployment), specialized database providers (e.g., Oracle, MongoDB), and vendors supplying specialized, high-value software components (such as sophisticated AI/ML module developers, proprietary security protocol suppliers, and advanced API gateway management tools). This initial upstream stage is absolutely crucial as it directly determines the foundational technological capabilities, the architectural scalability, and the mandatory security level of the eventual leasing solution delivered to the client. Key activities executed here involve continuous, large-scale Research and Development (R&D), strategic intellectual property patenting efforts, and securing robust, highly competitive, and scalable global cloud infrastructure contracts, all aimed at ensuring the final software product can reliably handle massive transaction volumes, complex multi-currency data processing requirements, and dynamic regulatory changes efficiently.

The Midstream phase encapsulates the core, value-generating activities of the Equipment Leasing Software vendors themselves. This critical phase involves end-to-end software development, detailed system architecture design, rigorous integration testing, comprehensive quality assurance processes, and the essential, continuous compliance updating (especially vital for frequently revised global accounting standards like IFRS 16). This stage adds the highest proportion of specialized value, successfully transforming generic, foundational technologies into highly specialized, industry-specific, and fully functional leasing solutions. Vendors actively engage in strategic alliances and partnerships with specialized technology consulting firms and regional system integrators to ensure their proprietary products are accurately and successfully deployed within diverse, complex client IT and regulatory environments. Distribution channels utilized are strategically varied, involving both high-value Direct Sales models (typically employed for large, bespoke, global enterprise implementations) and robust Indirect Channels, encompassing partnerships with certified system integrators, geographically focused value-added resellers (VARs), and critical strategic alliances with dominant Enterprise Resource Planning (ERP) providers (such as SAP, Oracle, and Microsoft Dynamics), which often bundle or recommend integrated leasing modules to their substantial client base.

The Downstream Analysis addresses the final crucial activities of implementation execution, comprehensive post-sales support, platform maintenance, and the direct, ongoing engagement with the end-users. This stage meticulously includes mandatory client training, complex data cleansing and secure migration from obsolete legacy systems, highly specific customization of organizational workflows, and the provision of continuous, automated regulatory and feature updates. The verified efficacy, speed, and responsiveness of the vendor's support structure significantly influence customer retention rates, perceived product value, and brand loyalty. Establishing effective, multi-channel feedback loops from potential customers during pre-sales and current users during operation is strategically vital for continuous, rapid product iteration and maintaining long-term competitiveness in a dynamic market. The strategic focus downstream is squarely on maximizing the Customer Lifetime Value (CLV) through highly responsive managed services, continuous platform optimization cycles, and proactive problem resolution, thereby ensuring the Equipment Leasing Software remains an essential strategic asset generating measurable returns for the leasing firm rather than being merely an unavoidable operational expense.

Equipment Leasing Software Market Potential Customers

The highly specialized pool of potential customers in the Equipment Leasing Software Market consists of a diverse range of financial and commercial entities, all fundamentally unified by the critical business need to manage capital-intensive asset financing processes efficiently, compliantly, and with optimal profitability. The single largest and most critical segment consists of large financial institutions, specifically encompassing major commercial banks, national credit unions, and significant global investment firms that operate substantial, complex equipment leasing portfolios across various asset classes. These high-tier institutional buyers require robust, enterprise-grade solutions capable of integrating deeply and securely with their existing core banking systems, accurately managing complex regulatory capital calculations, and providing sophisticated, real-time risk modeling across potentially tens of thousands of simultaneous lease contracts, ranging from heavy construction equipment to specialized IT hardware. Their complex purchasing decisions are heavily influenced by proven vendor stability, verifiable multi-year support guarantees, a strong track record of successful enterprise-scale deployments, and absolute, demonstrable expertise in global regulatory adherence.

The second extremely significant customer group comprises Captive Finance Companies, which function as wholly owned financial subsidiaries of major industrial equipment manufacturers (e.g., global manufacturers of specialized construction machinery, commercial vehicles, or high-precision industrial robotics). These essential customers require leasing software that facilitates seamless sales channel integration across the parent company, supports sophisticated, rapid promotional financing campaigns to drive product sales, and provides comprehensive, granular asset tracking capabilities linked directly back to the manufacturer’s internal product lifecycle management systems. For these captives, the leasing software is a mission-critical tool utilized to directly support core product sales volumes, efficiently manage complex warranty and service agreements, and strategically optimize the critical remarketing and disposition process of returned, end-of-lease assets, thereby establishing and supporting a highly efficient, financially robust circular economy for their equipment brand.

Finally, the growing segment of Independent Leasing and Specialty Finance Firms represents a crucial, highly competitive market segment for specialized software vendors. Often specializing in niche, high-value markets (e.g., sophisticated medical equipment, specialized laboratory instruments, or unique IT hardware financing), these agile firms prioritize maximum platform agility, rapid, low-code customization capabilities, and proven cost-effectiveness to maintain their competitive edge. Cloud-based SaaS providers cater exceptionally well to this dynamic segment, offering flexible subscription models that drastically lower the financial barriers to market entry and technology adoption. These independent firms leverage advanced, feature-rich software capabilities to gain a substantial competitive advantage in pricing, offer superior customer service delivery, and require solutions that allow for the lightning-quick deployment of new, innovative financial products and services without mandating lengthy internal IT development cycles or massive, prohibitive internal infrastructure investments.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $5.2 Billion |

| Market Forecast in 2033 | $9.8 Billion |

| Growth Rate | CAGR 9.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Odessa Technologies, Alfa Financial Software, LeasePacket, NetSol Technologies, Cassiopae (Sopra Banking Software), IDS, White Clarke Group, ATB Financial, Soft4Leasing, Ekosgen, LTi Technology Solutions, Provenir, Visual Lease, Infor, Oracle, SAP, Microsoft Dynamics, Solifi, Frontline Solutions, Acumatica |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Equipment Leasing Software Market Key Technology Landscape

The comprehensive technology landscape of the Equipment Leasing Software Market is currently defined and dominated by the relentless advancements in enterprise-grade cloud computing architecture, specifically the deployment of multi-tenant Software as a Service (SaaS) platforms. These modern architectures provide demonstrably superior scalability, global accessibility, rapid deployment capabilities, and significantly lower long-term infrastructure overhead compared to proprietary, traditional monolithic applications. These leading-edge platforms are architected using modern microservices frameworks, which allows for exceptionally faster deployment of new features and critical security updates, facilitates seamless integration via standardized Application Programming Interfaces (APIs), and ensures superior operational resilience against localized system failures through distributed processing. Furthermore, the strategic adoption of open-source frameworks and development toolsets is increasingly prominent, significantly facilitating rapid client-specific customization and strategically fostering a vibrant, expansive ecosystem of third-party integrators, developers, and specialized FinTech partners around the core vendor solutions.

Crucially, the deep integration of specialized emerging technologies is recognized as fundamentally critical for achieving sustainable competitive advantage and driving innovation. Beyond the widely discussed applications of AI and Machine Learning in areas like predictive credit scoring and immediate fraud detection, vendors are heavily investing significant resources in developing and integrating robust IoT (Internet of Things) connectivity capabilities. This IoT integration allows the leasing software platform to securely and continuously ingest high-volume, real-time usage and precise location data directly from the leased assets in the field. This capability is pivotal for enabling accurate, dynamic usage-based billing models, scheduling proactive, preventative maintenance based on actual wear, and enabling sophisticated, dynamic risk mitigation strategies based on real-time asset performance metrics. This technological infrastructure is absolutely necessary for firms actively transitioning their business models to profitable "Equipment-as-a-Service" frameworks, where the core value proposition is tied directly to the measured utilization and performance of the asset rather than simply managing the financial contract of passive ownership.

Advanced security architecture and mandatory regulatory compliance technology form another non-negotiable cornerstone of the technology landscape. Given the highly sensitive nature of the voluminous financial and proprietary customer data processed by these systems, modern solutions must incorporate and enforce state-of-the-art security protocols, including zero-trust architectures, multi-factor authentication for all access points, robust end-to-end encryption standards (both while data is in transit and when at rest in storage), and immutable, cryptographically secure auditing features to satisfy regulatory bodies. Distributed Ledger Technology (DLT), while still in the early stages of widespread commercial deployment, is actively being explored by innovative leaders for establishing verifiable, tamper-proof digital identities for physical assets and creating secure, shared, permissioned ledgers for executing complex syndicated lease agreements. If successful, this promises to significantly reduce transaction costs, eliminate disputes related to asset ownership transfer, and streamline the authentication of complex legal documentation in high-value, cross-border transactions over the long term.

Regional Highlights

Regional economic and regulatory dynamics significantly influence both the adoption patterns and the technological maturity of the Equipment Leasing Software Market globally. North America, driven by the substantial presence of global financial hubs, exceptionally high technology penetration rates, and sophisticated, strictly enforced regulatory frameworks (especially concerning ASC 842 compliance), currently commands the largest market share globally. The region is characterized by the early and aggressive adoption of cutting-edge features like AI-powered underwriting systems and robust, third-party verified cloud security protocols, with a primary focus on deploying complex, customizable, enterprise-level solutions tailored specifically for large multinational banks and powerful captive finance arms. Continuous innovation spurred by a highly active FinTech ecosystem ensures constant pressure for system modernization.

Europe represents a large, mature, and highly demanding market, where growth is largely mandated by stringent, pan-European compliance requirements, most notably IFRS 16. This regulation necessitates specialized, highly granular software functionality for complex balance sheet accounting treatment and detailed disclosure of lease liabilities. Western European countries exhibit high readiness for strategic cloud migration and show a strong preference for sophisticated vendors who offer multi-lingual, multi-currency, and multi-jurisdictional capabilities to effectively manage complex, cross-border leasing operations efficiently. Key regional demand centers, including the UK, Germany, and France, consistently prioritize solutions offering deep, native integration capabilities with their existing core banking systems and local regulatory reporting platforms.

The Asia Pacific (APAC) region is strategically projected to experience the highest Compound Annual Growth Rate over the forecast period, fueled by accelerating regional economic development, massive state-backed investments in essential infrastructure, and the exponential expansion of the manufacturing sector across key economies such as China, India, and Southeast Asia. Crucially, the region benefits from a relative scarcity of widespread, deeply entrenched legacy systems, enabling a higher rate of direct, leapfrog adoption of modern, cloud-native, and API-first solutions. Market demand in APAC is often concentrated on solutions that can scale rapidly and cost-effectively to support the high volume of new, incoming Small and Medium-sized Enterprise (SME) leasing contracts, prioritizing mobile access, localized features, and rapid, non-disruptive deployment methods.

Latin America (LATAM) and the Middle East & Africa (MEA) are emerging regions offering significant long-term growth potential, albeit from a smaller initial market base. Growth in these regions is strategically driven by aggressive digitalization initiatives within the local banking sectors and the imperative need to professionalize leasing and asset finance operations previously managed manually or inefficiently. LATAM specifically shows rapidly increasing software adoption in commercial vehicle, agricultural, and heavy machinery leasing segments, while the MEA region sees steady, sustainable growth tied directly to major infrastructure development projects, large-scale industrialization efforts, and national economic diversification strategies away from hydrocarbon dependence, necessitating tailored, scalable software solutions capable of operating reliably under varied, and sometimes volatile, regulatory and economic conditions.

- North America: Market leader; driven by strict compliance (ASC 842) and high FinTech investment; focus on enterprise-scale, highly secure, AI-enhanced solutions.

- Europe: Mature market; rapid growth propelled by strict IFRS 16 mandates; strong demand for multi-jurisdictional compliance and robust data security and localization features.

- Asia Pacific (APAC): Fastest growing region; high adoption of cloud solutions by SMEs and new finance firms; growth driven by manufacturing and infrastructure expansion; low presence of restricting legacy systems.

- Latin America (LATAM): Emerging market; increasing demand for commercial vehicle and construction equipment leasing software; substantial government and banking sector digitalization is driving adoption.

- Middle East and Africa (MEA): Growth strongly tied to infrastructure development and national economic diversification plans; increasing adoption of specialized financing software to standardize and professionalize complex leasing operations.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Equipment Leasing Software Market.- Odessa Technologies

- Alfa Financial Software

- LeasePacket

- NetSol Technologies

- Cassiopae (Sopra Banking Software)

- IDS

- White Clarke Group

- ATB Financial

- Soft4Leasing

- Ekosgen

- LTi Technology Solutions

- Provenir

- Visual Lease

- Infor

- Oracle

- SAP

- Microsoft Dynamics

- Solifi

- Frontline Solutions

- Acumatica

Frequently Asked Questions

Analyze common user questions about the Equipment Leasing Software market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary drivers of growth in the Equipment Leasing Software Market?

The market is primarily driven by the mandatory need for accurate compliance with new global accounting standards (IFRS 16, ASC 842), the accelerated digital transformation of financial services, and the rising global business preference for flexible equipment financing over outright capital purchase, necessitating highly automated management systems.

How does cloud deployment compare to on-premise solutions in this market?

Cloud (SaaS) deployment offers superior scalability, significantly lower TCO, and faster implementation, making it the preferred choice for SMEs and institutions seeking high agility. On-premise solutions, while demanding higher initial capital outlay, are still utilized by large multinational enterprises requiring maximum control over sensitive proprietary data and deep integration with proprietary legacy mainframes.

What transformative role does Artificial Intelligence play in modern equipment leasing software?

AI is crucial for dramatically enhancing operational efficiency by enabling instantaneous credit scoring and advanced risk assessment, optimizing accurate residual value forecasting through predictive analytics, and automating routine, time-consuming lease origination tasks, thereby allowing staff to focus on strategic decision support.

Which end-user segment dominates the global adoption of equipment leasing software?

The Banking, Financial Services, and Insurance (BFSI) sector consistently remains the largest consuming end-user segment globally due to the immense scale, financial complexity, and critical regulatory requirements associated with their diverse commercial and industrial equipment leasing portfolios.

What is the current industry outlook on usage-based leasing models and software integration?

The structural shift towards usage-based (servitization) models presents a key growth opportunity. Modern software platforms must integrate seamlessly with IoT sensor devices to securely collect real-time asset utilization data, enabling accurate metered billing, predictive maintenance scheduling, and ensuring profitability is dynamically aligned with actual equipment performance and utilization.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager