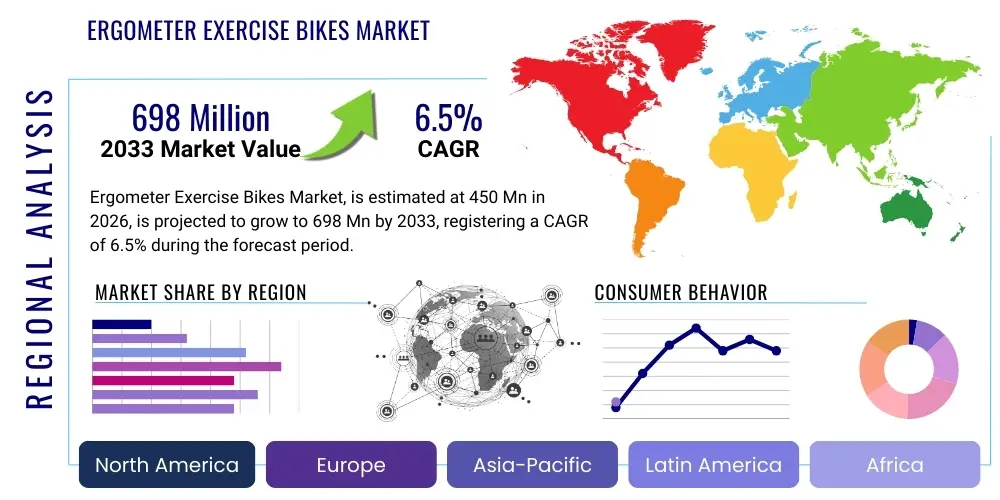

Ergometer Exercise Bikes Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441966 | Date : Feb, 2026 | Pages : 241 | Region : Global | Publisher : MRU

Ergometer Exercise Bikes Market Size

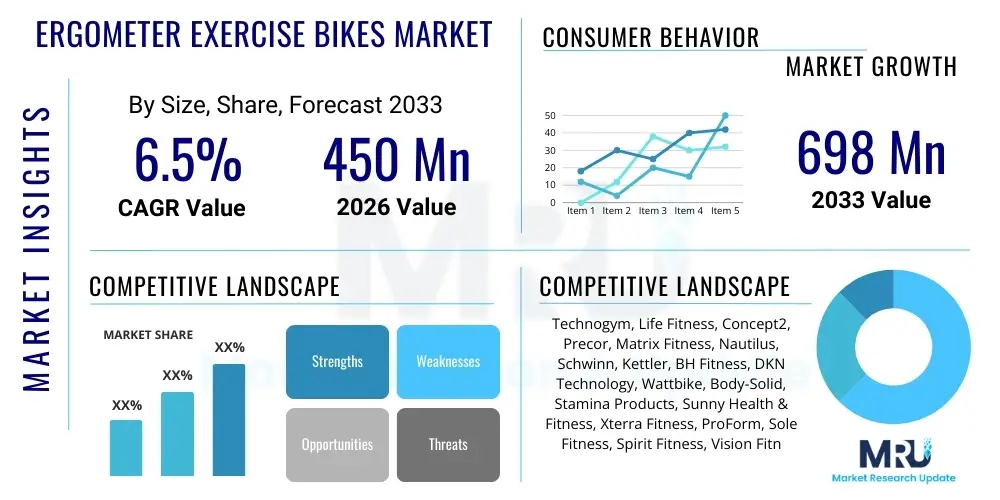

The Ergometer Exercise Bikes Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 698 Million by the end of the forecast period in 2033.

Ergometer Exercise Bikes Market introduction

The Ergometer Exercise Bikes Market encompasses specialized stationary bicycles equipped with precision monitoring systems that accurately measure power output, typically in watts. Unlike standard exercise bikes that rely on estimated calorie burn, ergometers provide clinical-grade feedback regarding workload and physiological effort, making them indispensable tools in medical rehabilitation, elite athletic training, and structured fitness programs. The core product offering ranges from high-end indoor cycling models designed for commercial gyms and specialized studios to advanced home-use units that integrate smart technology for personalized training.

Major applications of these devices span professional sports, physical therapy clinics, hospitals for cardiac and pulmonary rehabilitation, and increasingly, high-end residential fitness settings driven by the rising consumer focus on data-driven health metrics. The defining benefits of ergometers include unparalleled accuracy in workload replication, the ability to conduct standardized fitness tests (like the maximal aerobic power test), and seamless integration with external performance tracking platforms. This precision allows users and trainers to implement highly specific training zones, optimizing physiological adaptations and ensuring efficient, measurable progress toward fitness or recovery goals.

Driving factors for market growth include the global surge in health consciousness, particularly post-pandemic, leading to increased investment in quality home fitness equipment. Furthermore, advancements in sensor technology and connectivity, enabling ergometers to integrate virtual reality environments and gamified workout experiences, significantly enhance user engagement. The regulatory emphasis on evidence-based rehabilitation protocols also ensures sustained demand from the medical and clinical sectors, solidifying the ergometer’s position as a crucial piece of quantifiable fitness apparatus.

Ergometer Exercise Bikes Market Executive Summary

The global Ergometer Exercise Bikes Market is characterized by robust growth, primarily fueled by the convergence of technological advancements and changing consumer behavior favoring personalized, quantifiable fitness routines. Business trends highlight a strong shift towards connected fitness models, where manufacturers are competing less on mechanical design and more on digital ecosystem offerings, including subscription services, live coaching platforms, and integration with third-party wearables. Strategic alliances between hardware providers and software developers, particularly those specializing in AI-driven personalized training, are redefining market leadership and consumer expectations regarding user experience and performance feedback accuracy. Furthermore, sustainability in manufacturing and the modular design of high-end equipment are emerging as key differentiation factors in procurement decisions for major commercial clients.

Regionally, North America and Europe maintain dominance, driven by high disposable incomes, mature sports and fitness industries, and substantial regulatory requirements in clinical settings that mandate calibrated equipment. However, the Asia Pacific region is demonstrating the highest growth trajectory, spurred by rapid urbanization, increasing penetration of global fitness chain franchises, and rising awareness of preventative health measures among middle-class populations in China, India, and Southeast Asia. Latin America and the Middle East and Africa represent nascent but important markets, primarily focused on commercial and governmental health initiatives, with slower but steady adoption in premium residential segments.

Segment trends indicate that the Commercial Application segment, encompassing gyms, studios, and hospitals, currently holds the largest market share due to the high capital investment required for professional-grade, multi-user machines. Conversely, the Residential segment is experiencing the fastest growth rate, propelled by the work-from-home culture and consumer demand for premium, space-efficient fitness solutions. Recumbent ergometers are growing significantly within the rehabilitation segment, offering ergonomic benefits for users with limited mobility or specific joint issues, while upright ergometers continue to dominate general fitness and high-intensity training applications.

AI Impact Analysis on Ergometer Exercise Bikes Market

Common user inquiries regarding the impact of Artificial Intelligence (AI) on the Ergometer Exercise Bikes Market primarily revolve around the enhancement of personalized training, the safety implications of automated adjustments, and the integration of predictive maintenance. Users frequently ask: "How accurately can AI adjust resistance based on real-time physiological response?", "Will AI coaching replace human trainers?", and "Can AI predict equipment failure before it occurs, ensuring consistent training availability?" These questions highlight a consumer desire for ultra-personalized, dynamic workouts that maximize efficiency while simultaneously ensuring equipment reliability and minimizing the need for manual programming or intervention.

The integration of AI algorithms is fundamentally transforming the ergometer experience by moving beyond static programming. AI leverages the high accuracy of ergometer power measurement to create closed-loop feedback systems. This allows the bike to dynamically alter resistance (watts) based on monitoring the user’s heart rate variability, perceived exertion metrics, lactate threshold estimates, and historical performance data, ensuring the user remains precisely within their specified training zone for optimal results. This technology effectively democratizes elite training methodology, making sophisticated physiological stress management accessible to the average home user and dramatically increasing workout efficacy and safety by preventing overtraining.

Beyond training personalization, AI is proving critical in the operational management of large fleets of ergometers in commercial environments. Predictive analytics, utilizing machine learning on sensor data (such as bearing temperatures, belt tension consistency, and electronic component performance), allows operators to anticipate mechanical issues days or weeks before catastrophic failure. This proactive maintenance capability significantly reduces downtime, lowers operational costs, and extends the service life of expensive commercial equipment, thus providing substantial value proposition to gym owners and rehabilitation facility managers.

- Enables dynamic, real-time workload adjustment based on physiological data (e.g., heart rate, power output stability).

- Facilitates personalized training regimen generation and optimization, adapting goals based on recovery metrics.

- Powers advanced virtual coaching interfaces, providing biometric feedback and form analysis.

- Implements predictive maintenance analytics for commercial fleet management, minimizing equipment downtime.

- Enhances user safety by monitoring fatigue indicators and adjusting intensity to prevent injury or overexertion.

DRO & Impact Forces Of Ergometer Exercise Bikes Market

The Ergometer Exercise Bikes Market is primarily driven by the escalating demand for data-driven, quantifiable fitness solutions across medical, athletic, and consumer segments. Restraints center mainly on the high initial capital investment required for clinically accurate ergometers compared to standard stationary bikes, alongside complex calibration needs. Opportunities lie within integrating advanced immersive technologies, such as Virtual Reality (VR) and sophisticated biofeedback mechanisms, to enhance user engagement. These factors collectively create significant impact forces, pushing market players toward innovation in both hardware precision and software intelligence to maintain competitive advantage.

Drivers: A primary driver is the widespread global recognition of the importance of cardiovascular rehabilitation following major health events, coupled with stricter clinical guidelines mandating the use of calibrated equipment for accurate patient monitoring and outcome assessment. Secondly, the professional sports industry's relentless pursuit of marginal gains ensures continuous investment in high-precision ergometers for athlete load management, performance testing, and recovery protocols. Finally, the growing segment of affluent consumers adopting premium home fitness equipment who prioritize objective performance data over generalized workout metrics is substantially expanding the residential market segment, demanding commercial-grade quality in smaller footprints.

Restraints: The most significant restraint is the elevated cost structure of ergometer bikes. Their reliance on certified electronic braking systems and calibrated sensors raises the entry price point considerably above basic stationary bikes, limiting mass-market adoption in lower-income demographics or budget-conscious fitness centers. Furthermore, the complexity inherent in maintaining calibration and servicing sophisticated electronic components requires specialized technical knowledge, which can be a logistical challenge for smaller commercial operators or individual home users. Market saturation in developed urban centers, where many established competitors are already dominant, also presents a challenge for new market entrants.

Opportunities: A substantial opportunity exists in leveraging connectivity and the Internet of Things (IoT) to establish comprehensive digital ecosystems. This includes developing subscription-based services that offer live coaching, specialized workout content tailored by AI, and seamless data transfer to health records or fitness apps. Moreover, exploring new market penetration strategies in emerging economies, perhaps through rental or leasing models to mitigate the high upfront cost, offers untapped potential. Technological advancement in magnetic resistance systems, making them more affordable and easier to maintain while retaining high accuracy, is another key area for innovation and expansion.

Segmentation Analysis

The Ergometer Exercise Bikes Market is systematically segmented based on application, product type, and distribution channel, providing a clear framework for analyzing market dynamics and strategic focus areas. The Application segmentation (Commercial vs. Residential) reveals the distinct purchasing criteria and volume dynamics between high-utilization environments requiring durability and calibration integrity, and individual home users prioritizing connectivity and aesthetics. Product Type segmentation (Upright vs. Recumbent) reflects different user needs related to biomechanics, comfort, and rehabilitation requirements. Analyzing these segments is critical for manufacturers to tailor product specifications, pricing strategies, and marketing narratives effectively to their target audience.

The dominance of the Commercial segment stems from the institutional necessity for certified, heavy-duty equipment that can withstand continuous use in gyms, physical therapy centers, and clinical settings. These buyers focus on Mean Time Between Failure (MTBF), warranty coverage, and network compatibility for class setups. Conversely, the rapid expansion of the Residential segment is driven by the desire for high-quality, professional-grade fitness outcomes within the home environment, often fueled by immersive digital experiences and subscription content bundles. The blurring lines between professional and home equipment standards necessitate continuous innovation to maintain competitive separation in both spheres, particularly concerning digital integration and footprint optimization.

Furthermore, distribution channel analysis highlights the increasing role of online retail, especially for residential units, capitalizing on direct-to-consumer models that bypass traditional retail markups and provide extensive pre-purchase information. However, specialized dealers and institutional sales teams remain crucial for the Commercial segment due to the need for installation, integration services, and complex procurement processes typical of clinical and large fitness center operations. Understanding these segmentation nuances allows companies to optimize inventory, streamline supply chains, and dedicate resources to high-growth areas, ensuring strategic alignment with evolving consumer and institutional demands.

- By Application:

- Commercial (Gyms, Fitness Centers, Rehabilitation Clinics, Hospitals)

- Residential (Home Users)

- By Type:

- Upright Ergometer Bikes

- Recumbent Ergometer Bikes

- Spin Bike Ergometers

- By Distribution Channel:

- Online Retail (E-commerce Platforms, Company Websites)

- Offline Retail (Specialty Stores, Sporting Goods Stores, Direct Institutional Sales)

Value Chain Analysis For Ergometer Exercise Bikes Market

The value chain for the Ergometer Exercise Bikes Market begins with upstream suppliers, primarily focusing on advanced materials and high-precision electronic components. This stage involves the sourcing of specialized magnetic resistance systems, calibrated sensors (such as strain gauges for power measurement), microprocessors, and high-quality industrial steel and plastics. The reliance on accurate, certified electronic components means that supplier selection is rigorous, often favoring those who meet stringent international standards for measurement accuracy and durability. Strategic relationships with these component suppliers are vital as they directly influence the final ergometer’s clinical credibility and manufacturing cost.

The midstream phase involves manufacturing, assembly, and quality control, where sophisticated calibration processes ensure the power output readings are accurate across the entire resistance range. This often requires complex testing protocols and software integration. Downstream activities involve distribution, sales, and aftermarket services. Distribution channels are bifurcated: direct institutional sales or specialized dealers handle the commercial segment, providing necessary installation and maintenance contracts. The residential segment increasingly utilizes online direct-to-consumer models, facilitated by robust e-commerce logistics and fulfillment networks that manage high-volume, individualized deliveries.

Direct distribution, particularly via institutional sales teams, is crucial for securing large contracts with hospital groups and national gym chains, where negotiation, customization, and comprehensive service agreements are key differentiators. Indirect distribution, leveraging specialty sports retailers and major online marketplaces, serves the individual residential consumer, focusing on brand visibility, competitive pricing, and efficient last-mile delivery. Effective management of this complex, two-tiered distribution system is essential for minimizing inventory costs while ensuring rapid deployment to commercial customers who often require time-sensitive setup and integration into existing facility infrastructure.

Ergometer Exercise Bikes Market Potential Customers

The core customer base for Ergometer Exercise Bikes is diverse, spanning institutional purchasers focused on high-traffic durability and clinical accuracy, and high-net-worth individuals prioritizing personalized, data-driven fitness experiences. End-users are generally categorized into three major groups: healthcare facilities (hospitals, rehabilitation centers, physiotherapy clinics), professional sports organizations (elite training centers, athletic teams), and the increasingly sophisticated residential consumer segment. These buyers seek certified accuracy in power measurement, connectivity with medical or training software, and reliability under heavy-duty conditions, distinguishing them from buyers of conventional stationary cycling equipment.

Healthcare facilities are primary institutional buyers, utilizing ergometers for precise measurement during cardiac stress testing, pulmonary rehabilitation, and post-injury recovery, where accurate workload quantification is non-negotiable for insurance reimbursement and patient safety. Professional sports teams and university athletic departments represent another significant customer segment, relying on ergometers for sophisticated physiological testing, monitoring athlete fatigue levels, and implementing highly specific interval training based on wattage targets. These customers require robust networking capabilities for large-scale data collection and analysis.

The rapidly growing segment of affluent home consumers constitutes a key potential customer base in the residential market. These buyers are typically tech-savvy individuals committed to maximizing fitness efficiency and willing to invest substantial amounts in equipment that replicates the functionality of a professional lab or high-end commercial gym. They are heavily influenced by seamless application integration, on-demand content availability, and the perceived status associated with owning high-precision, clinically accurate fitness technology, driving demand for aesthetically pleasing designs coupled with maximal performance metrics.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 698 Million |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Technogym, Life Fitness, Concept2, Precor, Matrix Fitness, Nautilus, Schwinn, Kettler, BH Fitness, DKN Technology, Wattbike, Body-Solid, Stamina Products, Sunny Health & Fitness, Xterra Fitness, ProForm, Sole Fitness, Spirit Fitness, Vision Fitness, WaterRower, Keiser. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Ergometer Exercise Bikes Market Key Technology Landscape

The technological landscape of the Ergometer Exercise Bikes Market is defined by the critical need for precise power measurement and seamless digital integration. The core technology centers around the braking system, with high-end ergometers primarily utilizing Eddy current or electro-magnetic resistance mechanisms, which are preferred for their ability to provide smooth, silent, and, most importantly, precisely controlled resistance independent of cycling speed. These systems, coupled with calibrated strain gauge sensors embedded near the crank or flywheel, ensure that the displayed wattage is clinically accurate, which is the foundational requirement distinguishing an ergometer from a standard bike. Continued refinement focuses on minimizing the mechanical friction and improving the response time of resistance changes for dynamic interval training protocols.

Beyond mechanical precision, the most dynamic technological shifts involve connectivity and software. Modern ergometers utilize Bluetooth, ANT+, and Wi-Fi to integrate with a myriad of devices and platforms, supporting applications for training analysis, virtual racing (e.g., Zwift), and telemedicine monitoring. The shift toward subscription-based software ecosystems is paramount, incorporating high-definition displays, embedded microprocessors, and sophisticated operating systems tailored for streaming live and on-demand fitness classes. These digital ecosystems leverage cloud computing for storing vast amounts of user performance data, enabling comparative analytics and personalized feedback loops.

Furthermore, innovations in biofeedback and AI integration are rapidly becoming standard for premium models. This includes specialized sensors for measuring heart rate variability (HRV), skin conductance, and even rudimentary muscle oxygen saturation (SmO2) estimates, providing deeper insights into physiological stress and recovery status. The convergence of these precision sensors with robust computing power enables truly adaptive training programs, offering a compelling technological edge for manufacturers who can effectively merge clinical accuracy with engaging, intelligent user interfaces.

Regional Highlights

The Ergometer Exercise Bikes Market exhibits significant regional disparities in adoption, growth rates, and primary end-user profiles, reflecting differences in economic maturity, healthcare systems, and prevailing fitness culture. North America and Europe, as highly mature markets, lead in terms of market value and technological adoption, while Asia Pacific demonstrates the most vigorous growth potential due to demographic shifts and increasing disposable incomes.

- North America: This region is characterized by robust consumer spending on premium fitness equipment and a highly evolved healthcare system that heavily utilizes ergometers for cardiac rehabilitation and clinical research. The U.S. and Canada benefit from a strong culture of competitive cycling and professional sports training, driving demand for high-end, connected ergometer models. The market here is defined by intense competition among established global brands and a strong preference for subscription-based content platforms, cementing its position as the largest revenue contributor.

- Europe: Europe represents a sophisticated market with strong demand across both the medical and performance segments, particularly in countries like Germany, the UK, and Scandinavia. The European market places a high value on engineering quality, durability, and compliance with strict European quality standards (CE marking). Germany, in particular, exhibits high adoption rates in rehabilitation centers and elderly care facilities due to its demographic structure and strong focus on health insurance-funded physical therapy.

Unlike North America, where digital content drives selection, European buyers often prioritize the mechanical reliability and long-term serviceability of the ergometers. However, the connectivity trend is rapidly accelerating, especially in Western European urban centers, where boutique fitness and high-tech home gyms are popular. Government initiatives supporting physical activity and public health contribute to consistent institutional procurement of fitness equipment for schools and public recreation centers.

Eastern European nations are emerging as strong growth areas, though typically favoring more cost-effective models. The market is also heavily influenced by established European manufacturers known for their clinical heritage and long-standing reputation for measurement accuracy. The blend of robust clinical demand and growing consumer appetite for performance tracking ensures steady, sustainable growth across the continent.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, driven by rapid economic development, increasing urbanization, and the expansion of the fitness club industry, particularly in China, Japan, and India. Rising disposable incomes are allowing middle-class populations to transition from basic fitness equipment to premium, data-driven solutions like ergometers. The cultural shift towards adopting Western fitness models and increasing awareness of obesity and diabetes management are major catalysts.

While the commercial sector (new gym openings) drives initial high-volume demand, the residential segment is quickly catching up, particularly in technologically advanced nations like South Korea and Singapore. Manufacturers must adapt to a highly fragmented market, often requiring localized marketing strategies and products tailored to smaller living spaces, emphasizing compact and foldable designs with advanced features.

The regulatory environment for clinical use is still developing in many APAC countries, meaning that the market is currently more consumer-driven than clinically driven compared to North America and Europe. However, government investment in public healthcare infrastructure, especially in countries like China, promises significant future demand from the institutional segment as clinical standards harmonize with global benchmarks.

- Latin America (LATAM), Middle East, and Africa (MEA): These regions are emerging markets with growth concentrated in high-income urban centers and government-funded health and sports initiatives. In LATAM, growth is often tied to the expansion of international fitness franchises and the small but growing base of affluent consumers demanding premium home fitness. Brazil and Mexico are key markets due to their large populations and economic scale.

The MEA region, particularly the Gulf Cooperation Council (GCC) countries, shows strong demand, primarily driven by high government investment in sports facilities, luxury hotels, and private wellness centers. These regions often import high-end, fully featured models, prioritizing brand prestige and advanced technological specifications. However, the market remains highly sensitive to economic fluctuations and political stability, posing a higher degree of risk compared to mature markets.

Penetration in the broader African and smaller LATAM nations remains low due to cost constraints and logistical challenges related to distribution and maintenance. Opportunities lie in establishing strategic partnerships with regional distributors who can provide robust localized service support necessary for high-value electronic equipment like ergometers.

The high prevalence of chronic lifestyle diseases and the subsequent focus on preventative health strategies further solidifies the demand from clinical and corporate wellness programs. The average price point for residential units is notably higher here than in other regions, indicating a strong willingness to pay for certified accuracy and advanced digital features. Regulatory standards, especially those related to medical device certification for use in clinical settings, also ensure a baseline level of quality and precision in the equipment procured.

Key to the North American market growth is the continued success of integrated cycling platforms that require accurate power metrics, such as Zwift and TrainerRoad. This software integration drives hardware adoption, creating a symbiotic relationship between content providers and ergometer manufacturers. Furthermore, commercial gyms and boutique cycling studios consistently upgrade their equipment to offer the latest connected experiences, ensuring a stable replacement cycle for high-volume orders.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Ergometer Exercise Bikes Market.- Technogym

- Life Fitness

- Concept2

- Precor

- Matrix Fitness

- Nautilus

- Schwinn

- Kettler

- BH Fitness

- DKN Technology

- Wattbike

- Body-Solid

- Stamina Products

- Sunny Health & Fitness

- Xterra Fitness

- ProForm

- Sole Fitness

- Spirit Fitness

- Vision Fitness

- WaterRower

- Keiser

Frequently Asked Questions

Analyze common user questions about the Ergometer Exercise Bikes market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the key difference between an ergometer bike and a standard stationary bike?

The critical difference is measurement accuracy. Ergometer bikes use calibrated electronic braking systems and sensors to accurately measure and display power output (watts) with high precision, making them suitable for clinical testing and structured, quantifiable training. Standard bikes provide only estimated metrics like distance or generalized calorie burn.

How is AI transforming the ergometer training experience?

AI utilizes the ergometer's accurate power data to create dynamic, real-time adaptive workouts. It automatically adjusts resistance based on the user's instantaneous physiological metrics (like heart rate or power consistency), ensuring training stimulus is optimized for efficiency, safety, and personalized fitness goals.

Which market segment is showing the fastest growth rate?

The Residential segment is currently exhibiting the fastest growth rate. This acceleration is driven by the increasing consumer desire for premium, connected home fitness equipment that provides the clinical accuracy and structured workout programming previously exclusive to commercial facilities.

What are the primary factors restraining market adoption globally?

The main restraints are the high initial purchase price of clinically certified ergometers compared to conventional exercise bikes, and the specialized technical requirements needed for ongoing calibration and complex maintenance of precision electronic components.

In what clinical settings are ergometer exercise bikes most commonly used?

Ergometers are most frequently used in cardiovascular and pulmonary rehabilitation centers, physiotherapy clinics, and hospital settings for stress testing. Their certified accuracy is essential for monitoring patient recovery progress and adherence to strict medical rehabilitation protocols.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager