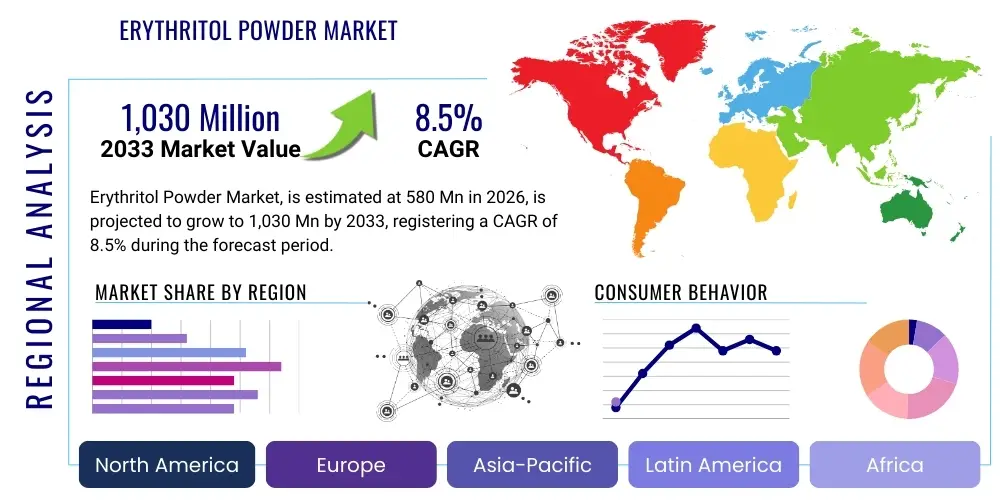

Erythritol Powder Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442086 | Date : Feb, 2026 | Pages : 242 | Region : Global | Publisher : MRU

Erythritol Powder Market Size

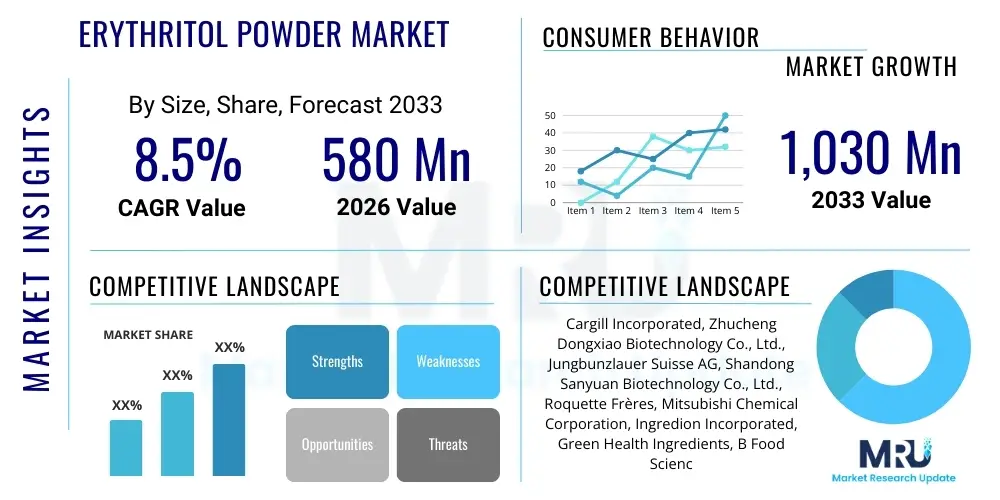

The Erythritol Powder Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 580 Million in 2026 and is projected to reach USD 1,030 Million by the end of the forecast period in 2033.

Erythritol Powder Market introduction

Erythritol powder is a zero-calorie sugar alcohol widely utilized in the food and beverage industry as a high-bulk, low-glycemic index sweetener. Derived primarily through the fermentation of glucose or starch substrates by yeast, it exhibits approximately 60-80% of the sweetness of sucrose but offers superior digestive tolerance compared to other polyols. Its non-cariogenic properties and high stability under various processing conditions make it an invaluable ingredient for health-conscious food formulations targeting sugar reduction mandates across global markets.

The core application areas of erythritol powder span across dietary foods, functional beverages, confectionery, and pharmaceutical excipients. Its ability to provide bulk and texture without contributing significantly to caloric content positions it as a preferred alternative to artificial sweeteners, appealing to consumers focused on weight management, diabetes control, and low-carbohydrate diets (such as Keto). Major driving factors include escalating global obesity rates, stringent regulatory focus on minimizing added sugars, and robust research confirming its safety and health benefits over synthetic options.

Furthermore, the superior sensory profile of erythritol, often described as having a clean, mild sweetness with minimal aftertaste, distinguishes it from competitors like stevia or monk fruit when used alone or in synergistic blends. The increased industrial capacity, particularly in Asia Pacific, coupled with advancements in fermentation technology, is leading to enhanced cost-efficiency and supply reliability, further fueling its adoption in mainstream packaged goods and baking mixes worldwide.

Erythritol Powder Market Executive Summary

The Erythritol Powder Market is experiencing robust acceleration driven primarily by structural shifts in global dietary patterns emphasizing reduced sugar intake and the rise of functional health ingredients. Business trends indicate a strong move toward high-purity, non-GMO, and organic erythritol variants, necessitating greater transparency and traceability throughout the supply chain. Key market players are engaging in strategic vertical integration—securing raw material sources like corn or tapioca starch—to mitigate volatility and ensure consistent supply for demanding food and pharmaceutical sectors. Innovation is concentrated on co-crystallization and blending technologies to optimize texture and mouthfeel in finished products, especially in dairy alternatives and baked goods.

Regional trends reveal Asia Pacific (APAC) maintaining dominance in production capacity, owing to low operating costs and abundant raw material access, although North America and Europe remain the principal consumption hubs due to high consumer awareness and advanced regulatory frameworks promoting sugar alternatives. European markets show a particularly strong preference for naturally sourced polyols, reinforced by initiatives like the UK's soft drink sugar levy. Meanwhile, emerging economies in Latin America and the Middle East & Africa are demonstrating significant potential, paralleling rising disposable incomes and increasing exposure to Western dietary trends and health-conscious packaging labels.

Segmentation trends highlight the pharmaceutical and nutraceutical segment as the fastest-growing application area, leveraging erythritol's role as an inert bulking agent and sweetening component in sugar-free medications and dietary supplements. By form, the granulated and powder segments dominate the market, but the fine mesh powder sub-segment is seeing accelerated growth for applications requiring high solubility and seamless dispersion in liquid formulations. Demand derived from specialty diets, particularly the keto and paleo communities, is also amplifying the importance of certified, high-grade erythritol, forcing manufacturers to meet stringent quality standards related to fermentation processes and final product purity.

AI Impact Analysis on Erythritol Powder Market

User queries regarding the impact of Artificial Intelligence (AI) on the Erythritol Powder Market largely revolve around optimizing fermentation yields, enhancing quality control consistency, and predicting commodity price fluctuations for raw materials. Key concerns center on whether AI-driven predictive maintenance can reduce downtime in capital-intensive production facilities and if advanced algorithms can accelerate the discovery and validation of novel, high-efficiency microbial strains for bio-production. Expectations include AI standardizing the sensory profile of erythritol blends, thereby addressing one of the major commercial hurdles related to taste variability when mixing polyols with high-intensity sweeteners. Furthermore, stakeholders are keenly interested in how machine learning can analyze vast consumer data sets to forecast specific ingredient demand spikes driven by emerging diet fads or regulatory changes, optimizing inventory and reducing waste across the supply chain.

- AI optimizes fermentation bioreactor parameters (temperature, pH, nutrient feed rate) to maximize erythritol yield and purity, reducing operational costs.

- Predictive maintenance schedules in manufacturing facilities, enabled by AI, minimize unexpected equipment failure and ensure continuous production of high-grade powder.

- Machine learning algorithms analyze consumer preference data and flavor chemistry to design optimal erythritol blends that minimize cooling effect and aftertaste.

- AI-driven supply chain transparency and traceability systems enhance regulatory compliance and assure customers of non-GMO and organic sourcing.

- Automated quality assurance systems utilize image recognition and spectral analysis to instantaneously detect contaminants or deviations in crystal structure.

DRO & Impact Forces Of Erythritol Powder Market

The Erythritol Powder Market dynamics are dictated by a compelling confluence of health consciousness, regulatory pressure, and technological advancements. The primary drivers include aggressive consumer efforts to reduce sugar consumption globally, supported by mandatory food labeling requirements and government taxation on sugary products. However, restraints emerge from the high production costs associated with fermentation compared to synthesized sweeteners, coupled with persistent, albeit scientifically unfounded, consumer skepticism regarding the long-term metabolic effects of sugar alcohols. Opportunities are abundant in the functional beverage sector and in developing synergistic sweetener blends that leverage erythritol’s bulking properties while addressing its cooling sensation drawback.

Driving forces center on the escalating prevalence of diabetes and obesity worldwide, compelling consumers to seek natural, zero-calorie alternatives. The non-glycemic and tooth-friendly nature of erythritol provides a substantial competitive advantage over sucrose. Additionally, market growth is significantly bolstered by its rising inclusion in niche market formulations, such as keto-friendly snacks and athletic nutrition products, where calorie and carbohydrate control are paramount. The commitment of major food manufacturers (CPG companies) to reformulate legacy products to meet wellness targets further solidifies this growth trajectory.

Conversely, the impact of high raw material input costs, especially corn or tapioca starch, can significantly restrain profitability, particularly when global agricultural markets experience instability. Furthermore, intense competition from alternative high-intensity natural sweeteners (e.g., allulose, monk fruit) that offer zero-calorie properties but potentially better solubility or taste profiles presents a continuous market challenge. The critical impact forces that shape the market are the speed of technological innovation in cost-efficient fermentation processes and the rate at which major regulatory bodies confirm and communicate the safety profile of erythritol to the general public, thereby mitigating consumer concerns.

- Drivers: Global initiatives for sugar reduction; increasing prevalence of lifestyle diseases (diabetes, obesity); non-cariogenic properties; consumer demand for natural sweeteners.

- Restraints: Relatively high production cost compared to synthetic sweeteners; large quantity required for equivalence to sucrose sweetness (bulk factor); occasional reports of mild digestive issues in high doses.

- Opportunities: Expansion into functional food and beverage markets; development of proprietary sweetener blends; increased application in pharmaceutical excipients; growing demand in keto and low-carb food segments.

- Impact Forces: Raw material price volatility (corn/tapioca starch); regulatory approvals (e.g., Generally Recognized As Safe status); technological breakthroughs in fermentation efficiency; consumer perception and education regarding polyols.

Segmentation Analysis

The Erythritol Powder Market is intricately segmented based on its source, form, application, and geographical region, reflecting diverse end-user requirements and production methodologies. Analyzing these segments provides critical insights into market penetration strategies and areas of highest growth potential. The fundamental differentiation based on source—Non-GMO/Conventional versus Organic/Natural—is becoming increasingly important, driven by stringent consumer preferences in developed economies seeking products free from genetically modified ingredients. This segmentation influences pricing dynamics significantly, with natural and organic variants commanding a substantial premium.

Segmentation by form, encompassing granules, powder, and liquid concentrates, directly correlates with end-use application. Granular erythritol, due to its texture and bulk, is heavily used in baking and tabletop sweeteners, mimicking the behavior of crystalline sugar. Fine powders, however, are critical for achieving seamless integration and solubility in sensitive food matrices, such as smooth drinks, dairy products, and coating applications, requiring high dispersion characteristics. The shift towards convenience and ready-to-use ingredients is driving accelerated innovation in powdered and pre-mixed blends designed for industrial efficiency.

The application segmentation reveals the broad utility of erythritol across various industries. While Food & Beverage remains the largest revenue generator, fueled by confectionery (especially chewing gum and hard candy), bakery goods, and specialized dairy products, the fastest anticipated growth is within the Nutraceuticals and Pharmaceuticals sectors. Here, erythritol is prized for its low glycemic load and chemical inertness, making it an ideal carrier or excipient in vitamin supplements, medicinal syrups, and sugar-free over-the-counter drugs. Understanding the specific quality requirements (e.g., microbiological purity, particle size distribution) for each application is paramount for market leaders.

- By Source: Non-GMO/Conventional, Organic/Natural

- By Form: Powder/Granules, Liquid

- By Application: Food & Beverage (Confectionery, Bakery, Dairy, Beverages, Others), Pharmaceuticals, Nutraceuticals, Personal Care

- By Region: North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Value Chain Analysis For Erythritol Powder Market

The value chain for the Erythritol Powder Market begins with upstream activities focused on the procurement and processing of raw materials, primarily corn or tapioca starch, which serve as the glucose feedstock. Major considerations at this stage involve optimizing fermentation media costs, securing consistent supply quality, and managing global commodity market risks. Producers often establish close ties with agricultural suppliers to ensure Non-GMO certification or organic compliance, which directly impacts the premium pricing potential of the final product. Efficiency in starch hydrolysis and purification processes is crucial for maximizing yield before the specialized fermentation phase begins.

The midstream stage centers on the core manufacturing processes: fermentation, separation, purification, crystallization, and drying. This stage is capital and technology-intensive, dominated by specialized biotechnological firms. Fermentation processes must be rigorously controlled using specific yeast strains (like Moniliella megachiliensis) to efficiently convert glucose into erythritol. Downstream activities involve converting the purified crystalline erythritol into specific commercial forms (fine powder, coarse granules) and packaging. Quality control, particularly concerning particle size distribution, moisture content, and heavy metal testing, is vital before distribution.

Distribution channels are multifaceted, utilizing both direct and indirect routes. Large industrial buyers (major CPG companies, beverage manufacturers) typically engage in direct bulk procurement contracts with major manufacturers to ensure supply consistency and benefit from economies of scale. Indirect channels involve specialized ingredient distributors and brokers who serve smaller bakeries, regional food processing units, and pharmaceutical formulation companies, offering smaller batch sizes and technical support. The effectiveness of the channel relies heavily on robust logistics capable of handling global trade flows, particularly between high-volume Asian production centers and key consumption markets in the West.

Erythritol Powder Market Potential Customers

The primary end-users and buyers of erythritol powder are expansive, reflecting its versatility as both a sweetener and a bulking agent. Food and beverage manufacturers constitute the largest customer base, constantly seeking sugar reduction solutions without compromising sensory attributes. This includes producers of 'diet' or 'light' soft drinks, energy bars, breakfast cereals, sugar-free chocolate, and chewing gum manufacturers who require a non-cariogenic and stable polyol substitute. Their purchasing decisions are highly sensitive to price, purity, and certification (e.g., kosher, halal, non-GMO).

A rapidly expanding customer segment includes nutraceutical and dietary supplement producers. These buyers use erythritol in protein powders, meal replacement shakes, vitamin chewables, and specialized medical nutrition products due to its non-caloric and low-impact metabolic profile, which aligns perfectly with health claims focusing on blood sugar management. For these customers, purity and pharmaceutical-grade quality are non-negotiable requirements, often demanding Certificates of Analysis (CoA) confirming the absence of microbial contaminants and heavy metals.

Furthermore, smaller artisan bakeries, keto-focused food startups, and direct-to-consumer bulk ingredient retailers form a significant portion of the potential customer landscape, particularly in digitally mature markets. These consumers prioritize easy-to-use bulk packaging and specialized blends optimized for home baking or small-scale commercial production. This segment often relies on ingredient distributors for quick access and competitive pricing, driven by direct consumer pull from popular low-carb diets.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 580 Million |

| Market Forecast in 2033 | USD 1,030 Million |

| Growth Rate | CAGR 8.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Cargill Incorporated, Zhucheng Dongxiao Biotechnology Co., Ltd., Jungbunzlauer Suisse AG, Shandong Sanyuan Biotechnology Co., Ltd., Roquette Frères, Mitsubishi Chemical Corporation, Ingredion Incorporated, Green Health Ingredients, B Food Science Co., Ltd., Baolingbao Biology Co., Ltd., GLG Life Tech Corporation, Tate & Lyle PLC, Wuhu Huahai Biology Engineering Co., Ltd., H&H Group (Swisse Wellness), Zhejiang Huakang Pharmaceutical Co., Ltd., Fubon Biochemical Co., Ltd., Futaste Co., Ltd., ADM (Archer Daniels Midland Company), Sanxinyuan Food Industry Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Erythritol Powder Market Key Technology Landscape

The technological landscape of the Erythritol Powder Market is fundamentally anchored in advanced bio-fermentation processes. Traditional production involved using osmotic-tolerant yeast strains, but recent innovations focus on enhancing the efficiency of microbial conversion of glucose into erythritol, often utilizing specific strains of yeast like Yarrowia lipolytica or Moniliella. Key advancements include continuous fermentation systems, which offer higher throughput and lower labor costs compared to traditional batch processes. Optimization efforts are concentrated on improving the fermentation broth composition, managing oxygen transfer rates, and precisely controlling pH and temperature to maximize the specific production rate and minimize by-product formation.

Post-fermentation technology, particularly in purification and crystallization, is critical for achieving the high-purity powder demanded by premium end-users. Techniques such as multi-stage ion exchange and activated carbon filtration are utilized to remove impurities, color compounds, and residual fermentation components. The crystallization process, which dictates the final powder's particle size and flow characteristics (granules versus fine powder), utilizes sophisticated vacuum evaporators and cooling technologies to produce uniform, high-quality crystals essential for industrial handling and specific formulation requirements like dusting and caking resistance.

Furthermore, technology related to blending and co-processing is gaining traction. Since pure erythritol often exhibits a noticeable cooling effect, manufacturers are investing in proprietary blending technologies that combine erythritol with high-intensity natural sweeteners (e.g., stevia derivatives or monk fruit extracts). These advanced blending methods ensure homogenous distribution and synergistic sweetness profiles, masking undesirable sensory attributes while maintaining the low-calorie status. Encapsulation techniques are also being explored to potentially mitigate the cooling sensation and improve stability in high-moisture environments, broadening the ingredient's applicability in challenging food matrices.

Regional Highlights

Regional dynamics heavily influence the Erythritol Powder Market, reflecting varying regulatory environments, consumer health trends, and production capacities.

- Asia Pacific (APAC): Dominates the global production landscape due to the availability of cost-effective starch raw materials (corn and tapioca) and large-scale manufacturing infrastructure, particularly in China. While a major exporter, consumption in APAC is also rapidly growing, fueled by urbanization and increasing awareness of sugar-related health issues in countries like India and Southeast Asian nations.

- North America: Represents the largest consumption market, driven by high consumer adoption of low-carb and keto diets and widespread industrial reformulation efforts by major food and beverage corporations. Favorable regulatory status (GRAS approval by the FDA) and strong health supplement markets underpin consistent high demand for non-GMO and organic erythritol variants.

- Europe: Characterized by stringent food regulations and high consumer demand for natural and clean-label ingredients. The European market exhibits strong growth, supported by national initiatives targeting sugar reduction (e.g., sugar taxes). Manufacturers often prioritize supply chains certified for sustainability and ethical sourcing to meet sophisticated European consumer expectations.

- Latin America (LATAM): Showing accelerated adoption, spurred by rising rates of non-communicable diseases and increasing penetration of international food brands. Brazil and Mexico are emerging as key regional markets, though price sensitivity remains a more significant factor than in North America or Europe.

- Middle East & Africa (MEA): Currently the smallest market but poised for future expansion. Growth is concentrated in the Gulf Cooperation Council (GCC) countries, where high rates of diabetes and increasing Westernization of dietary habits are driving demand for functional, sugar-free alternatives in confectionery and beverages.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Erythritol Powder Market.- Cargill Incorporated

- Zhucheng Dongxiao Biotechnology Co., Ltd.

- Jungbunzlauer Suisse AG

- Shandong Sanyuan Biotechnology Co., Ltd.

- Roquette Frères

- Mitsubishi Chemical Corporation

- Ingredion Incorporated

- Green Health Ingredients

- B Food Science Co., Ltd.

- Baolingbao Biology Co., Ltd.

- GLG Life Tech Corporation

- Tate & Lyle PLC

- Wuhu Huahai Biology Engineering Co., Ltd.

- H&H Group (Swisse Wellness)

- Zhejiang Huakang Pharmaceutical Co., Ltd.

- Fubon Biochemical Co., Ltd.

- Futaste Co., Ltd.

- ADM (Archer Daniels Midland Company)

- Sanxinyuan Food Industry Co., Ltd.

- PureCircle (a subsidiary of Ingredion)

Frequently Asked Questions

Analyze common user questions about the Erythritol Powder market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the Erythritol Powder Market?

The primary driver is the global effort to reduce sugar consumption, catalyzed by rising obesity and diabetes rates, and supported by regulatory mandates like sugar taxes and stricter nutritional labeling requiring low or zero-calorie alternatives.

Is erythritol considered a natural or artificial sweetener?

Erythritol is classified as a sugar alcohol (polyol). Though chemically synthesized in some cases, commercially available erythritol is predominantly produced through the natural fermentation of glucose derived from corn or tapioca starch, leading many brands to market it as a naturally derived zero-calorie sweetener.

Which application segment holds the largest share of the Erythritol Powder Market?

The Food and Beverage segment, particularly in confectionery (sugar-free gums and candies), bakery products, and functional beverages, consistently holds the largest market share due to the ingredient's effective bulking properties and non-glycemic characteristics.

What is the main challenge facing erythritol manufacturers?

The main challenge is maintaining cost competitiveness. Fermentation-based production methods are generally more expensive than synthetic sweetener synthesis, leading to higher final product costs that restrict broader adoption in highly price-sensitive industrial applications.

How does erythritol compare to other popular sugar substitutes like Xylitol and Stevia?

Erythritol has zero calories and the highest digestive tolerance among sugar alcohols (less likely to cause gastrointestinal distress than Xylitol). Compared to Stevia, erythritol offers superior bulk and minimal aftertaste, making it ideal for formulations where texture and volume are required.

Market Dynamics Deep Dive: Regulatory and Health Landscape

The regulatory environment plays a pivotal, dual-edged role in shaping the trajectory of the Erythritol Powder Market. In developed regions such as North America and Europe, clear regulatory approval—such as the FDA’s Generally Recognized As Safe (GRAS) status and European Union endorsement—has provided market certainty, enabling manufacturers to confidently invest in scaling production and formulation development. Conversely, evolving legislation regarding front-of-pack labeling and marketing claims necessitates continuous adaptation by ingredient suppliers. For instance, the distinction between "natural" and "naturally derived" sweeteners is under constant scrutiny, impacting how erythritol is positioned against competitors like high-intensity artificial alternatives.

Consumer perception, heavily influenced by media reports and health trends, is another critical dynamic. While erythritol benefits significantly from the anti-sugar movement and the popularity of low-carb diets (e.g., Ketogenic), it occasionally faces scrutiny alongside other sugar alcohols regarding potential digestive side effects or long-term health implications. Market leaders are proactively countering misinformation through rigorous scientific communication and investment in clinical studies confirming its safety profile and non-impact on blood glucose levels. The ability to achieve certifications like Non-GMO Project Verified and organic status has become a vital strategic tool for maintaining consumer trust and capturing premium market segments.

Furthermore, global trade policies and intellectual property rights related to bio-fermentation technology impose significant constraints and opportunities. Producers in Asia, particularly China, benefit from economies of scale, often exerting downward pressure on global pricing. However, companies based in Europe and North America often maintain a competitive edge through patented processes, highly specialized purification methods, and strong quality control systems tailored to meet the stringent demands of pharmaceutical and premium food manufacturers. The continued harmonization of international food standards, such as those set by Codex Alimentarius, will facilitate cross-border trade and increase market accessibility for high-purity erythritol powder.

Competitive Landscape and Strategic Positioning

The competitive landscape of the Erythritol Powder Market is moderately fragmented, featuring a mix of large, diversified ingredient giants and specialized bio-technology companies, predominantly based in Asia. Market competition revolves around three primary factors: manufacturing cost efficiency (yield optimization), product purity and consistency, and strategic vertical integration. Companies with established access to high-quality, non-GMO starch feedstock and proprietary fermentation strains hold a distinct cost advantage, allowing them to compete aggressively on price in bulk industrial contracts.

Leading players like Cargill, Roquette, and Jungbunzlauer leverage their global distribution networks and extensive ingredient portfolios to offer erythritol as part of comprehensive sugar reduction solutions, integrating it seamlessly with their portfolios of stevia, soluble fibers, and other specialty starches. This strategy promotes 'solution selling' rather than commodity trading, strengthening their position with major global CPG manufacturers who prefer sourcing complex ingredient systems from a single, reliable supplier. Innovation strategies often focus on developing patented co-processed blends that mitigate the inherent cooling effect of erythritol, enhancing its organoleptic performance in beverages and dairy products.

Conversely, specialized Chinese manufacturers, such as Zhucheng Dongxiao and Shandong Sanyuan, focus heavily on maximizing output and optimizing manufacturing efficiency. Their strategic focus is often on achieving the highest purity (99.5%+) and securing key export markets through aggressive pricing. Key competitive actions observed include capacity expansion projects, obtaining international quality certifications (e.g., FSSC 22000, ISO), and forming strategic alliances to gain technical expertise in downstream processing. Future competitive success is expected to be dictated by the speed of adopting AI-driven process control and the ability to consistently supply certified organic and sustainable erythritol options, meeting the rising ethical demands of Western buyers.

Future Market Outlook and Trend Forecasting

The long-term outlook for the Erythritol Powder Market remains highly positive, driven by persistent global health crises related to metabolic disorders and an unwavering consumer shift toward preventative nutrition. The market is forecasted to transcend its traditional niche status and become a staple industrial sweetener ingredient, comparable in ubiquity to HFCS or sucralose, particularly as production costs decrease due to technological maturation and economies of scale. One major trend forecasted is the substantial growth in the use of erythritol in fermented foods and beverages, such as functional yogurts and kombucha, leveraging its stability and low impact on bacterial cultures.

Another significant trend involves the premiumization of the product via origin and certification. While cost-driven conventional erythritol will remain dominant in bulk applications, high-value markets (North America, Europe) will increasingly demand erythritol sourced from non-GMO tapioca or specialized organic substrates, commanding significantly higher prices. This bifurcation necessitates specialized supply chains and targeted marketing efforts by manufacturers. Furthermore, customized particle size distribution (PSD) will become a key competitive parameter, with formulators requiring ultra-fine powders for specialized applications like aerosolized food sprays or complex pharmaceutical encapsulations.

In terms of geographical expansion, while APAC will maintain its manufacturing dominance, consumption growth rates in emerging economies—particularly Southeast Asia and the Middle East—will begin to challenge the established dominance of North America. This is largely attributed to rising consumer education, increasing discretionary spending on packaged goods, and the adoption of global health standards. The synergistic use of erythritol with emerging next-generation sweeteners, such as Allulose, will define the next wave of product innovation, optimizing flavor profiles while maintaining desirable functional properties. This collaborative formulation approach promises to unlock new application frontiers, particularly in confectionery and bakery where current taste limitations persist.

Product Innovation Insights and Research Focus

Product innovation within the Erythritol Powder Market is highly concentrated on enhancing sensory characteristics and improving functionality in complex food matrices. A key research focus is minimizing the cooling effect, a major sensory hurdle for erythritol, through techniques such as co-crystallization with other ingredients or specific particle coating. Manufacturers are investing heavily in food science research to develop customized blends that offer a complete sweetness profile without the characteristic temperature drop perceived when consumed.

Another area of intense R&D is developing more sustainable and environmentally friendly fermentation processes. Research institutions and market leaders are exploring novel microbial strains and utilizing waste streams (e.g., from agricultural processing) as feedstock, aiming to reduce the environmental footprint and decrease reliance on energy-intensive purification steps. Success in this area will not only lower production costs but also provide valuable sustainability credentials, crucial for marketing to environmentally conscious CPG partners.

Finally, packaging and delivery formats are undergoing innovation. This includes developing moisture-resistant packaging to prevent caking and improve shelf life, particularly in humid climates. For the pharmaceutical sector, innovation focuses on ultra-pure, standardized micro-particle erythritol formulations optimized for direct compression tableting and use in advanced drug delivery systems. The convergence of ingredient science with material science is creating new possibilities for erythritol to move beyond simple sweetening and function as a sophisticated excipient or stabilizing agent in medical applications.

Sustainability and ESG in Erythritol Production

Environmental, Social, and Governance (ESG) criteria are increasingly influencing procurement decisions in the Erythritol Powder Market, particularly among major food and beverage corporations in Europe and North America. Sustainability concerns focus primarily on the raw material source (corn/tapioca cultivation), energy consumption during fermentation and crystallization, and waste management. Companies demonstrating a commitment to ESG principles are gaining a competitive advantage, often securing long-term contracts with buyers prioritizing ethical sourcing and reduced carbon footprints.

Manufacturers are responding by implementing sophisticated energy management systems to reduce the substantial power required for heating and cooling in bioreactors and evaporators. Furthermore, utilizing agricultural by-products or waste streams as fermentation feedstock represents a significant step toward circular economy principles, lowering both raw material costs and environmental impact. Transparency in sourcing, particularly regarding water usage and ethical labor practices in agricultural supply chains, is becoming mandatory for maintaining supplier relationships in high-value segments.

The social component of ESG involves ensuring fair labor practices across the complex global supply chain and investing in local communities where manufacturing facilities are located. Governance relates to supply chain traceability, anti-corruption policies, and product quality assurance. As regulatory bodies globally begin to mandate standardized ESG reporting, companies that have preemptively embedded these practices into their core operations, especially concerning non-GMO and organic certifications, are best positioned to capture market share and establish long-term brand equity.

Pricing Analysis and Cost Drivers

The pricing structure of the Erythritol Powder Market is dictated by a complex interplay of input costs, manufacturing efficiency, and regional demand dynamics. The single largest cost component remains the raw material—glucose derived from corn starch or tapioca—which is susceptible to global agricultural commodity price fluctuations, impacting manufacturer profitability and end-user procurement budgets. Significant energy costs associated with the highly controlled fermentation and subsequent energy-intensive purification and crystallization processes also contribute substantially to the final pricing.

Pricing variance is stark across segments. Bulk industrial-grade erythritol, often produced in high volumes in Asian facilities, trades at the lowest price points, where cost efficiency is paramount. Conversely, specialized products—such as certified organic, Non-GMO Project Verified, or fine-mesh powder used in nutraceuticals—command a substantial premium (sometimes 50-100% higher) due to stricter quality control, certification costs, and lower production yields associated with specialized processes.

Regional pricing also plays a role, with Western markets typically exhibiting higher spot prices compared to Asian markets, partly due to logistics, import tariffs, and the higher preference for premium, certified products. Manufacturers leverage hedging strategies and long-term procurement contracts to stabilize input costs, while simultaneously investing in fermentation strain optimization (utilizing technology to increase output per unit of feedstock) to mitigate margin compression caused by intense competition in the bulk segment.

COVID-19 Pandemic Impact and Recovery

The COVID-19 pandemic exerted a mixed impact on the Erythritol Powder Market. Initially, disruptions in global logistics and production shutdowns in Asia hampered supply chains, leading to temporary price volatility and inventory shortages in destination markets like North America and Europe. However, this temporary restraint was quickly overshadowed by a robust surge in consumer interest in health and wellness. The pandemic dramatically accelerated the trend toward reduced sugar intake, driving increased consumer demand for zero-calorie, clean-label ingredients like erythritol for use in home baking and dietary supplement consumption.

The recovery phase has been characterized by aggressive capacity expansion and technological investment by leading manufacturers to meet sustained high demand. Food manufacturers shifted production focus toward shelf-stable, immunity-boosting, and low-sugar products, which favored the inclusion of erythritol. Furthermore, the reliance on digital retail channels increased, making specialized ingredients more accessible to home users and small-scale producers, thereby broadening the consumer base beyond large industrial users.

Long-term implications of the pandemic include a reinforced focus on supply chain resilience, leading companies to diversify sourcing geographically and invest in local or regional warehousing to mitigate future disruption risks. The public health crisis cemented the consumer trend of seeking functional ingredients that support metabolic health, securing erythritol's position as a key component in the post-pandemic health-conscious packaged food industry, ensuring stable growth well into the forecast period.

Distribution Channels Analysis

The effective distribution of Erythritol Powder relies on a combination of direct and indirect channels tailored to the customer profile and volume requirements. Direct distribution, involving sales teams engaging directly with major multinational CPG companies, is crucial for securing large volume, long-term contracts. This channel emphasizes technical support, customized formulation solutions, and strict adherence to specific quality specifications, offering manufacturers maximum margin control and direct feedback integration.

Indirect channels, primarily facilitated by specialty ingredient distributors and regional brokers, cater to smaller and medium-sized enterprises (SMEs), regional food processors, and the growing nutraceutical formulation market. Distributors provide essential value-added services such as local warehousing, small-batch packaging, just-in-time delivery, and credit facilities, reducing the capital expenditure burden on end-users. These intermediaries must maintain robust technical knowledge of erythritol’s application nuances to effectively service diverse clientele.

The emergence of e-commerce platforms and specialized B2B marketplaces has created a third, rapidly expanding channel, particularly for branded retail packs and niche bulk orders serving the home-use and artisan segments (e.g., keto baking suppliers). This channel demands efficiency in last-mile logistics and relies on strong digital marketing strategies to reach fragmented consumer bases, representing a key area of investment for forward-looking manufacturers seeking to build brand recognition outside traditional industrial circles.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager