Escape Hammer Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443039 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Escape Hammer Market Size

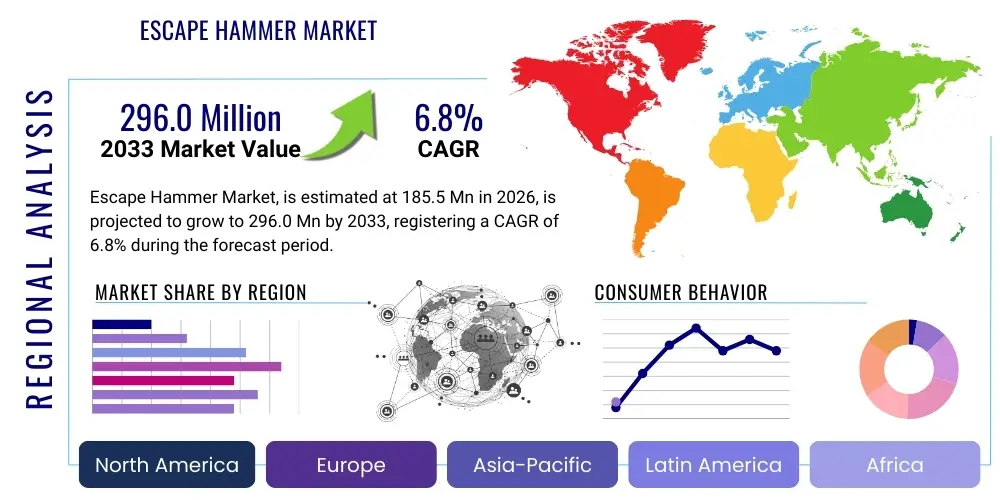

The Escape Hammer Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 185.5 million in 2026 and is projected to reach USD 296.0 million by the end of the forecast period in 2033. This growth trajectory is fueled primarily by increasing global safety regulations, mandatory inclusion in vehicles and public transport systems, and heightened consumer awareness regarding emergency preparedness tools. The valuation reflects the essential nature of these devices in life-saving scenarios, particularly in the automotive and residential sectors where quick egress is critical.

Market expansion is also supported by continuous product innovation, focusing on multi-functionality, durability, and ergonomic design. Manufacturers are integrating features such as seatbelt cutters and LED lights into standard escape hammers, enhancing their utility beyond simple window breaking. Regional market size disparities exist, with North America and Europe currently dominating due to stringent legal requirements for safety equipment in transportation infrastructure, while Asia Pacific demonstrates the highest growth potential driven by rapidly expanding automotive sales and urbanization.

Analyzing the historical data from 2019 to 2024 reveals a steady upward trend, underpinned by global incidents that underscore the necessity of readily accessible escape tools. The market is moderately competitive, characterized by both established safety equipment manufacturers and specialized niche players. Future growth is inextricably linked to regulatory enforcement, particularly in developing economies, ensuring the sustained demand for certified and reliable escape solutions across diverse application areas, including commercial fleets and marine vessels.

Escape Hammer Market introduction

The Escape Hammer Market encompasses the manufacturing, distribution, and sale of specialized safety tools designed to facilitate emergency egress from vehicles, buildings, or other confined spaces. An escape hammer, often referred to as a safety hammer or life hammer, is typically a small, portable tool equipped with a pointed metal head or ceramic tip for shattering tempered glass windows and often includes a recessed blade for cutting seatbelts or other restraints. This duality of function makes it an indispensable component of modern emergency kits, mandated in many jurisdictions for public vehicles and increasingly recommended for private automobiles and residential use.

Major applications of escape hammers span across critical sectors including automotive safety, where they are essential for freeing occupants trapped after accidents; public transport, ensuring rapid evacuation of passengers from buses, trains, and subways; and commercial and residential buildings, particularly in fire escape scenarios where windows might be the only viable exit. The inherent benefit of these devices lies in their ability to provide a non-destructive, rapid means of escape when primary exits are blocked or jammed, significantly reducing entrapment time and improving survival rates. The straightforward mechanical design ensures reliability regardless of power failure or system malfunctions, positioning them as fundamental safety instruments.

The market is primarily driven by three core factors: stringent governmental safety regulations requiring the inclusion of emergency exit tools in new vehicles and public fleets; rising consumer awareness prompted by safety campaigns and media coverage of accidents; and the continuous advancement in material science leading to more compact, effective, and durable hammer designs. These drivers collectively ensure consistent demand, particularly as global vehicle production increases and infrastructural safety standards mature. Furthermore, the simplicity and low cost relative to the potential life-saving value make the escape hammer a high-value safety proposition across the consumer and industrial segments.

Escape Hammer Market Executive Summary

The Escape Hammer Market demonstrates robust resilience driven by non-negotiable safety requirements globally. Key business trends indicate a definitive shift toward multifunctional tools, incorporating features like integrated alarms, LED flashlights, and magnetic bases for secure mounting within vehicles. Strategic emphasis is placed on collaborations between hammer manufacturers and automotive Original Equipment Manufacturers (OEMs) to ensure seamless integration into vehicle interiors, promoting higher adoption rates and standardizing quality. Pricing pressure remains a constant factor in high-volume segments, pushing manufacturers towards optimized supply chains and automation, yet premium products focusing on superior materials and ergonomic design continue to command higher margins, particularly in the aftermarket and luxury vehicle segments.

Regionally, North America and Europe maintain market leadership due to established legislative frameworks, such as regulations governing commercial vehicle safety standards. However, the Asia Pacific (APAC) region is poised for accelerated growth, supported by rapid urbanization, significant infrastructure development, and increasing adoption of international safety norms in fast-growing economies like China and India. The Latin America and Middle East & Africa (MEA) markets, while smaller, are showing incremental increases, largely fueled by governmental initiatives aimed at improving public transport safety and road infrastructure. Regional strategies necessitate localization of product specifications to comply with specific regulatory bodies and consumer preferences regarding mounting options and material specifications.

Segmentation analysis reveals that the Automotive segment remains the dominant application area, followed closely by Public Transport. Based on material, high-strength carbon steel heads dominate due to superior impact durability, although lightweight aluminum alloys are gaining traction in consumer-focused, ergonomic designs. Distribution trends highlight the growing importance of the Online Retail channel, which offers consumers direct access and educational content, complementing traditional Offline Retail and B2B channels vital for fleet procurement. The market structure is poised for steady, regulation-backed expansion, with technological refinements ensuring enhanced efficacy and user experience across all major segments.

AI Impact Analysis on Escape Hammer Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Escape Hammer Market primarily revolve around whether traditional mechanical safety tools will become obsolete due to advanced vehicle safety systems, how AI can optimize the placement or accessibility of these hammers, and if AI-driven diagnostics could predict emergency needs before they occur. Consumers and industry stakeholders are concerned about the integration gap between high-tech vehicle architecture and simple mechanical tools. The analysis indicates that while AI will not replace the fundamental necessity of a mechanical escape device—which operates independently of electrical systems—it will significantly influence peripheral aspects such as inventory management, design optimization, and emergency response infrastructure integration. AI's role is not destructive but complementary, ensuring that the physical tools are optimally deployed and readily accessible when needed.

AI's primary influence will be felt upstream in manufacturing and downstream in logistics and predictive safety assessment. In manufacturing, AI and machine learning algorithms can optimize material composition for impact resistance and durability, simulating stress tests far more rapidly than traditional methods, thereby accelerating the development cycle for new escape hammer designs. Downstream, AI-powered fleet management systems can track the installation status and maintenance schedules of safety equipment within large vehicle fleets, ensuring compliance and immediate replacement of damaged units. Furthermore, Generative Design methodologies, leveraging AI, are being explored to create ergonomic shapes that maximize user grip and impact transmission while minimizing overall tool size, making them safer and more intuitive for emergency use by individuals of varying physical abilities.

While an escape hammer itself remains purely mechanical, its market dynamics are increasingly governed by intelligent systems. AI-driven accident reconstruction and analysis provide valuable data points on entrapment patterns, informing manufacturers on the optimal design features required for the next generation of hammers, such as precise tip geometry to handle specialized laminated safety glass. Moreover, integration with smart vehicle emergency communication systems (like eCall in Europe) can potentially alert first responders to the exact location of the safety hammer within a crashed vehicle, streamlining the rescue process. Thus, AI acts as an invisible hand optimizing the production, placement, and overall efficacy context of the escape hammer, enhancing its life-saving potential.

- AI-driven optimization of escape hammer material composition and tip geometry for enhanced glass shattering efficiency.

- Predictive maintenance analytics using AI in large commercial fleets to monitor safety equipment compliance and functionality.

- Integration of escape hammer location data with vehicle safety protocols and emergency communication systems (eCall integration).

- Leveraging Generative Design (AI) to produce highly ergonomic, space-efficient hammer designs for tight vehicle interiors.

- AI-enhanced supply chain management to ensure timely restocking of fleet safety equipment across global distribution networks.

DRO & Impact Forces Of Escape Hammer Market

The dynamics of the Escape Hammer Market are shaped by a complex interplay of Drivers, Restraints, and Opportunities, which collectively determine the impact forces steering its evolution. Key drivers include stringent governmental mandates for mandatory safety equipment in vehicles and public infrastructure, coupled with growing public awareness campaigns promoting emergency preparedness. The essential nature of the product—offering a crucial, mechanical last resort escape route—insulates it somewhat from economic volatility. However, restraining factors predominantly center around low consumer priority for safety accessories in private vehicles outside regulatory requirements, leading to market saturation in basic segments and intense price competition. Furthermore, the rise of advanced active safety systems in vehicles, while positive overall, sometimes leads consumers to wrongly believe that passive tools like escape hammers are becoming redundant.

Opportunities for growth are vast, particularly through market penetration into developing economies where vehicle ownership is surging but safety regulations are just beginning to mature. There is a substantial opportunity in developing multi-functional, premium tools that integrate seamlessly into modern vehicle aesthetics while offering superior performance against newer glass technologies, such as laminated side windows becoming more common. Expanding applications beyond automotive, specifically into marine, aviation, and residential safety kits, represents a significant avenue for market diversification. The impact forces driving innovation are regulatory compliance and material science advancements, compelling manufacturers to continually refine product durability and user accessibility.

The market is experiencing a significant impact force from global supply chain optimization. Manufacturers are looking to streamline production to meet high-volume demands from automotive OEMs while maintaining strict quality control. The trade-off between affordability (necessary for mass market penetration) and advanced features (required for differentiation and premium positioning) defines competitive behavior. Ultimately, the cyclical demand driven by vehicle production rates and regulatory updates ensures consistent, though sometimes slow, market expansion. The largest positive impact force remains the non-negotiable legal requirement for safety equipment, providing a stable foundation for revenue generation in the forecast period.

Segmentation Analysis

The Escape Hammer Market is segmented based on several key criteria, including the material used for the head, the specific application area, and the primary distribution channel utilized for sales. Analyzing these segments allows stakeholders to pinpoint areas of concentrated demand, identify technological gaps, and tailor marketing strategies to specific end-users, ranging from regulatory bodies and public transit authorities to individual consumers seeking personal safety tools. The segmentation structure reflects the diverse usage environments and performance requirements demanded by different end-user groups, highlighting the critical distinction between high-durability, industrial-grade products and ergonomic, consumer-friendly alternatives.

- By Type (Head Material):

- Stainless Steel Head

- Carbon Steel Head

- Aluminum Alloy Head

- Hardened Plastic/Ceramic Tip

- By Application:

- Automotive (Private Vehicles, Commercial Trucks)

- Public Transport (Buses, Trains, Subways)

- Commercial Buildings & Industrial Facilities

- Residential Use

- Marine & Aviation

- By Distribution Channel:

- Online Retail (E-commerce Platforms)

- Offline Retail (Automotive Supply Stores, General Retail)

- B2B Sales (Direct Sales to OEMs and Fleet Operators)

- Government & Institutional Procurement

Value Chain Analysis For Escape Hammer Market

The value chain of the Escape Hammer Market begins with upstream activities focusing on the procurement and processing of raw materials, primarily high-grade steel (carbon or stainless), robust plastics for handles, and ceramic or specialized hardened alloys for cutting blades and striking tips. Key upstream suppliers include material processing companies and specialized tool component manufacturers. Efficiency in this stage is critical, as the performance and durability of the final product are directly dependent on the quality and purity of the raw materials used. Supply chain stability, especially regarding steel pricing and availability, significantly influences overall production costs. Manufacturers often invest heavily in quality control at this initial stage to ensure compliance with strict international safety standards (e.g., DIN or ISO certifications).

Midstream processes involve manufacturing, assembly, and rigorous testing. Manufacturing includes forging or casting the hammer head, injection molding the handles, and precision assembly of integrated components like seatbelt cutters and mounting brackets. Testing protocols are extensive, focusing on impact strength, tip hardness, cutting effectiveness, and overall ergonomic usability. Distribution channels constitute the crucial downstream element. Direct procurement (B2B) channels are vital for penetrating the OEM and fleet management sectors, ensuring products are installed at the point of vehicle manufacture or fleet commissioning. This channel typically involves large volume contracts and relies on established long-term relationships and high compliance assurance.

Indirect distribution encompasses offline retail (specialty automotive stores, hardware outlets) and rapidly expanding online retail platforms. The online channel offers significant visibility, direct consumer feedback, and often provides detailed product education, driving aftermarket sales. Effective logistics and warehousing are paramount for indirect channels, ensuring products reach consumers efficiently. The value chain culminates in the end-user application and disposal. Given the safety-critical nature of the product, post-sale support, including clear instructions and secure mounting systems, adds tangible value. The continuous cycle of design improvement is often informed by data gathered from the downstream application, ensuring the next iteration addresses real-world constraints faced by end-users.

Escape Hammer Market Potential Customers

Potential customers for escape hammers are broadly categorized into groups driven by regulatory necessity (B2B/Institutional) and those driven by personal safety consciousness (B2C). The primary consumer segment consists of automotive owners, both private individuals purchasing the tool as an aftermarket safety accessory, and commercial fleet operators (taxis, ride-sharing services, logistics companies) who require durable, standardized tools for regulatory compliance and operational safety protocols. Fleet managers prioritize bulk purchasing, certification, and ease of mounting, often seeking integrated solutions that withstand constant use and environmental exposure typical of commercial vehicles.

A second major customer base lies within the Public Transport sector, including municipal transit authorities, railway operators, and aviation service providers. These entities face the strictest safety mandates regarding passenger evacuation equipment, necessitating large-scale, high-quality procurement tailored to specific vehicle designs. Institutional buyers focus intensely on reliability, ease of maintenance checks, and clear instructional labeling. Furthermore, the Building and Infrastructure segment, encompassing commercial property managers, industrial safety officers, and educational institutions, represents a growing customer segment, utilizing escape hammers as part of mandated emergency fire and safety equipment, particularly in areas with limited or secured emergency exits.

Finally, the residential market presents a growing opportunity, driven by increasing consumer desire for comprehensive home emergency kits. Homeowners and landlords purchase these devices for fire safety purposes, ensuring egress through windows when traditional doors are inaccessible. This consumer segment typically values ergonomic design, aesthetic appeal, and multi-functionality (e.g., incorporating alarms or flashlights). Direct sales via e-commerce and collaborations with home safety product retailers are key to accessing this increasingly aware and proactive customer demographic.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 185.5 million |

| Market Forecast in 2033 | USD 296.0 million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ResQMe, LifeHammer, Ztylus, StatGear, Blue Grotto, S.O.S., Tekton, Maycom, Kizer, Swiss+Tech, SE, Gerber Gear, UST, SOG Specialty Knives, CRKT, Victorinox, First Alert, Kidde, Sentinel Safety, Roadside Rescue Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Escape Hammer Market Key Technology Landscape

The technology landscape of the Escape Hammer Market is primarily focused on material science and ergonomic design optimization, rather than complex electronics, ensuring maximum reliability under adverse conditions. A critical technological evolution involves the material composition of the striking tip. Traditional steel tips are being refined with high-density carbon alloys and tungsten carbide inserts to increase hardness and ensure effective performance against modern, multilayered vehicle glass (laminated and acoustic glass), which is inherently tougher than standard tempered glass. This material refinement is crucial as vehicle safety standards drive tougher window construction, demanding higher energy transfer from the escape tool.

Another significant technological advancement is the integration of patented spring-loaded mechanisms, notably used in compact, pen-sized emergency tools. These mechanisms store potential energy and release it upon contact, generating the necessary force to break glass without requiring significant physical strength from the user. This feature dramatically improves accessibility for elderly individuals, children, or those injured during an accident, expanding the potential user base and enhancing the tool's practical efficacy. Furthermore, manufacturing technologies such as precision CNC machining and advanced polymer injection molding are used to create secure, anti-slip handles and robust mounting systems that prevent the hammer from becoming dislodged during vehicular impacts.

Finally, smart integration technology is emerging, although the hammer itself remains mechanical. This involves embedding small RFID tags or NFC chips into the hammer base, allowing fleet managers and institutional buyers to digitally track inventory, verify installation location, and automate compliance checks. While this technology does not affect the core function of the hammer, it drastically improves the operational efficiency and accountability within large organizations. The key technological focus remains the balance between maximizing glass-breaking efficiency and ensuring the seatbelt cutting blade remains safe and easily accessible, typically achieved through recessed or shielded design.

Regional Highlights

- North America: This region is characterized by high consumer awareness and established vehicle safety regulations, particularly in the United States and Canada, where organizations like NHTSA (National Highway Traffic Safety Administration) set rigorous standards for vehicle equipment. The region dominates the aftermarket segment, showing a strong demand for premium, multi-functional escape tools. High vehicle ownership rates and a focus on personal preparedness drive consistent sales. The increasing adoption of escape tools in school buses and commercial trucking fleets further solidifies North America’s leading market share.

- Europe: The European market is highly regulated, primarily driven by EU directives mandating specific safety equipment, especially in public transport (buses, trams) and commercial vehicles (taxis, delivery vans). The eCall system's proliferation, while electronic, reinforces the context for physical emergency tools. European consumers prioritize certified products compliant with EU standards (CE marking) and are increasingly opting for integrated, aesthetically pleasing designs that fit seamlessly into modern vehicle interiors. Germany, the UK, and France are the largest contributing markets due to robust automotive industries and strict regulatory enforcement.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing market, propelled by surging automotive production, rapid urbanization, and rising disposable incomes. Countries like China, India, and Japan are adopting more rigorous vehicle safety norms, shifting from voluntary use to mandatory installation in new public service vehicles. While price sensitivity is higher in certain sub-regions, the sheer volume of vehicle sales and infrastructure projects presents immense untapped potential, leading manufacturers to establish localized production and distribution centers.

- Latin America: This region presents nascent growth opportunities, often tied to governmental investment in public transport infrastructure and safety upgrades. Regulatory enforcement can be inconsistent, but market expansion is evident in large economies like Brazil and Mexico, driven by international safety agreements and the modernization of commercial fleets. Demand often focuses on durable, cost-effective solutions capable of withstanding diverse environmental conditions.

- Middle East and Africa (MEA): Growth in MEA is moderate, concentrated primarily in the Gulf Cooperation Council (GCC) countries where high-end vehicle sales and infrastructural development are strong. Demand is driven by luxurious vehicle standards and, increasingly, by requirements for safety equipment in large public works and transportation systems. African markets are slower to adopt mandatory regulations but show potential in segments related to international aid and commercial logistics fleets operating under global safety standards.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Escape Hammer Market.- ResQMe

- LifeHammer

- Ztylus

- StatGear

- Blue Grotto

- S.O.S.

- Tekton

- Maycom

- Kizer

- Swiss+Tech

- SE

- Gerber Gear

- UST (Ultimate Survival Technologies)

- SOG Specialty Knives

- CRKT (Columbia River Knife & Tool)

- Victorinox

- First Alert

- Kidde

- Sentinel Safety

- Roadside Rescue Inc.

Frequently Asked Questions

Analyze common user questions about the Escape Hammer market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the key differences between various escape hammer head materials?

The primary difference lies in hardness and durability. Carbon steel and tungsten carbide tips offer superior penetration for modern, laminated or treated safety glass, dominating professional and heavy-duty applications. Aluminum alloy or plastic tips are generally used in compact, low-cost consumer models, suitable for standard tempered side windows but potentially less effective against newer, tougher glass.

Is an escape hammer necessary if my vehicle has advanced safety systems like curtain airbags?

Yes, an escape hammer remains critical because it provides a mechanical last resort independent of the vehicle's electrical system, which can fail in a crash or submersion. Advanced safety systems focus on crash mitigation, but the hammer ensures physical egress when doors are jammed or windows are the only exit, particularly useful if the vehicle is inverted or submerged in water.

How often should escape hammers be replaced, and where is the optimal mounting location?

Escape hammers do not typically require replacement unless the material shows signs of degradation, severe wear, or the integrated seatbelt cutter blade is damaged. The optimal mounting location is readily accessible to all occupants, typically secured near the center console, driver's side door pocket, or overhead compartment, ensuring the hammer can be quickly retrieved without fumbling in an emergency.

Are there specific international safety standards or certifications required for escape hammers?

Yes, mandatory compliance often requires adherence to regional safety standards like the European CE marking, various national automotive safety standards (e.g., specific DIN norms in Germany), or testing protocols defined by organizations like TUV or independent testing bodies, particularly for products destined for use in commercial and public transport fleets.

What role does the Online Retail channel play in the growth of the Escape Hammer Market?

Online Retail is crucial for market growth as it facilitates direct consumer education, comparative shopping, and ease of purchase for aftermarket accessories. It expands geographical reach, offers a platform for niche multi-functional tools, and is increasingly becoming the preferred channel for informed private vehicle owners seeking specialized safety equipment.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager