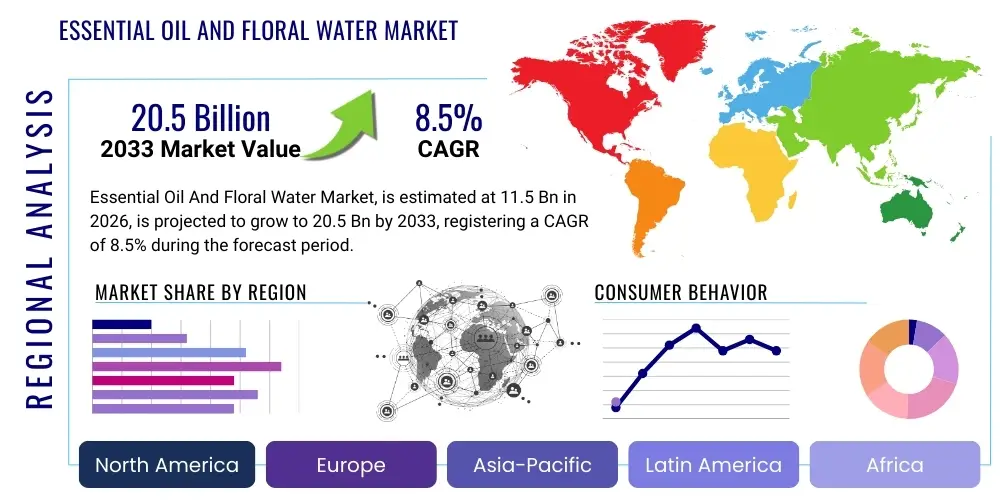

Essential Oil And Floral Water Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442933 | Date : Feb, 2026 | Pages : 248 | Region : Global | Publisher : MRU

Essential Oil And Floral Water Market Size

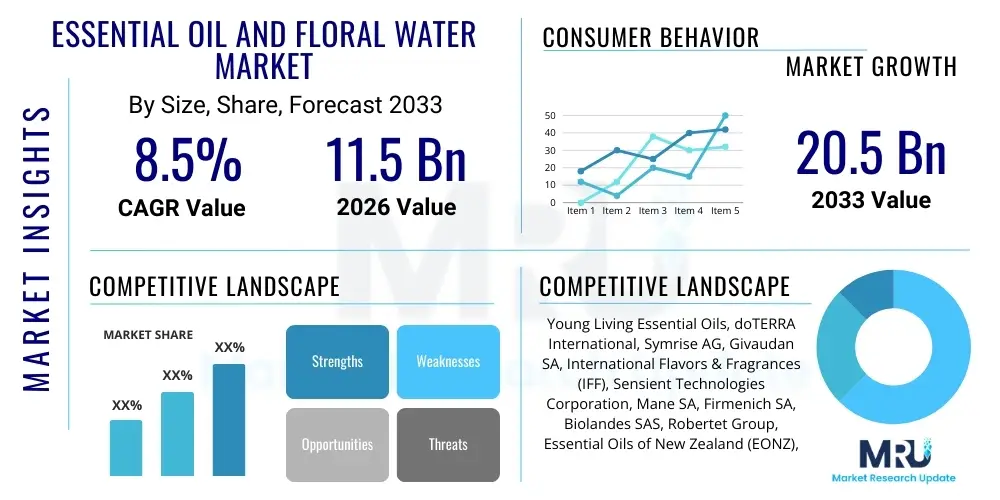

The Essential Oil And Floral Water Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 11.5 Billion in 2026 and is projected to reach USD 20.5 Billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the escalating consumer preference for natural and organic ingredients, particularly within the cosmetic, pharmaceutical, and food and beverage sectors. The high demand for therapeutic and aromatic benefits derived from botanical sources positions these products as crucial components in global wellness trends, fostering robust investment in sustainable sourcing and advanced extraction technologies across major producing regions.

Essential Oil And Floral Water Market introduction

The Essential Oil and Floral Water Market encompasses highly concentrated extracts derived from various plant sources, including flowers, leaves, stems, roots, and fruits, capturing the volatile aroma compounds of the plant. Essential oils, extracted typically through distillation or mechanical pressing, are potent lipophilic liquids utilized primarily for their inherent therapeutic (medicinal), aromatic (fragrance), and flavoring properties. Floral waters, often referred to as hydrosols or hydrolats, are the aqueous byproducts of steam distillation, containing micro-traces of essential oils and water-soluble botanical compounds, making them gentler and highly sought after in skincare and aromatherapy applications where direct use of concentrated oils is undesirable.

Major applications of these botanical extracts span several high-growth industries. In the cosmetics and personal care industry, essential oils serve as natural fragrances, active ingredients (e.g., antimicrobial, anti-inflammatory), and preservatives. The food and beverage sector utilizes specific grades of essential oils for natural flavoring and preservation, replacing synthetic additives. Furthermore, the pharmaceutical and healthcare sectors leverage the proven antimicrobial, antiviral, and soothing properties of certain oils for use in traditional medicines, complementary therapies, and modern drug formulation excipients. This diverse applicability ensures sustained market demand and resilience across economic cycles.

The market growth is primarily propelled by the increasing consumer awareness regarding the potential adverse effects of synthetic chemicals and a consequential shift toward natural, clean-label alternatives. Key driving factors include the rapid expansion of the aromatherapy industry, the integration of essential oils into functional foods and beverages, and the ongoing development of advanced extraction and purification techniques that enhance product quality and consistency, thereby broadening the scope of acceptable applications under stringent regulatory guidelines.

Essential Oil And Floral Water Market Executive Summary

The global Essential Oil and Floral Water Market demonstrates robust growth, characterized by strong consumer trends favoring natural wellness solutions and clean-label products across developed and emerging economies. Business trends are dominated by a push towards vertical integration among major producers to ensure traceability, control quality, and enforce ethical sourcing practices, responding directly to heightened consumer scrutiny regarding sustainability. Strategic partnerships between ingredient suppliers and large-scale cosmetic formulators are increasingly common, aimed at co-developing novel applications and standardizing product quality, especially for highly volatile and sensitive extracts.

Regionally, Asia Pacific (APAC) is emerging as the fastest-growing market, driven by rapid urbanization, increasing disposable income, and the deep cultural acceptance of traditional herbal medicine systems in countries like China and India. Europe remains a significant market, characterized by strict quality standards (e.g., REACH regulations) and high consumer spending on certified organic and premium aromatherapy products. North America, while a mature market, continues to innovate, focusing heavily on product personalization, functional integration (e.g., oils in diffusers, dietary supplements), and the expansion of direct-to-consumer (DTC) distribution channels leveraging e-commerce platforms.

Segment trends highlight the dominance of oils derived from citrus, lavender, and peppermint due to their widespread application and recognized therapeutic profiles. The floral water segment, though smaller, is experiencing accelerated adoption, particularly in the premium skincare segment as alternatives to synthetic toners and facial mists. Furthermore, extraction technology is trending towards sustainable and solvent-free methods, such as supercritical CO2 extraction, which yields high-purity, residue-free products, catering to the increasingly stringent demands of the pharmaceutical and high-end cosmetic industries. This shift towards quality over quantity reinforces premiumization across all segments.

AI Impact Analysis on Essential Oil And Floral Water Market

User inquiries regarding AI's influence in the Essential Oil and Floral Water Market frequently center on three critical areas: optimization of raw material sourcing and yield prediction, automated quality control and adulteration detection, and AI-driven formulation and personalization. Consumers and industry stakeholders are keen to understand how machine learning can predict the optimal harvesting windows based on climate and soil data to maximize essential oil concentration, a key determinant of quality and price. Furthermore, a major concern is ensuring product authenticity; users want to know if AI can be utilized to rapidly analyze complex chromatographic data (GC-MS) to detect synthetic adulterants, thereby protecting market integrity and consumer trust. Finally, there are high expectations for AI tools to assist cosmetic and aromatherapy companies in formulating personalized blend recommendations based on individual genetic, environmental, or psychological profiles.

AI’s influence is rapidly transforming the supply chain efficiency and product innovation within this traditionally manual industry. By deploying predictive analytics models, agricultural producers can optimize irrigation and nutrient delivery, leading to significantly higher yields of aromatic compounds (chemotypes). In manufacturing, AI is streamlining complex extraction processes by monitoring parameters such as temperature, pressure, and flow rates in real-time, ensuring optimal extraction efficiency and chemical consistency batch-to-batch. This precision manufacturing is crucial for products targeting medicinal or therapeutic claims, where minor variations can compromise efficacy and regulatory compliance.

The most profound impact of AI lies in enhancing quality assurance and fostering consumer trust. Machine learning algorithms are being trained on vast databases of chromatographic fingerprints (e.g., GC-MS and HPLC data) of authentic essential oils. When a new batch is tested, the AI system can instantly compare its complex chemical signature against the database, flagging any deviation or the presence of known adulterants with high accuracy and speed. This capability dramatically reduces the time required for quality testing and provides an unprecedented level of transparency and validation, crucial in a market plagued by issues related to mislabeling and synthetic substitution. The integration of AI tools, therefore, acts as a technological gatekeeper, securing the reputation of high-quality essential oil producers globally.

- AI-driven Predictive Agriculture: Optimizing planting, harvesting, and cultivation cycles for maximized volatile oil yield based on environmental data.

- Automated Quality Control (AQC): Utilizing Machine Learning (ML) on GC-MS data for real-time detection of synthetic adulteration and quality inconsistencies.

- Supply Chain Optimization: Employing algorithms to track botanical raw materials from farm to finished product, ensuring traceability and reducing waste.

- Personalized Formulation: AI platforms recommending bespoke essential oil blends for customized aromatherapy and cosmetic applications based on user input.

- Process Efficiency: ML optimizing parameters in advanced extraction techniques (e.g., Supercritical CO2) to enhance purity and reduce processing time.

DRO & Impact Forces Of Essential Oil And Floral Water Market

The Essential Oil and Floral Water Market is significantly influenced by a confluence of accelerating drivers and persistent restraints, balanced by substantial long-term opportunities, which collectively dictate the overall market trajectory. A primary driver is the accelerating consumer migration towards natural health and wellness products, spurred by increased education regarding botanical therapeutics and a generalized mistrust of synthetic pharmaceutical compounds. This trend is amplified by the pervasive integration of aromatherapy into mainstream wellness practices, including spa treatments, mental health support, and domestic environment modification. Furthermore, rigorous regulatory scrutiny in developed markets is inadvertently driving market growth by forcing suppliers to elevate quality standards, thereby differentiating authentic, high-purity essential oils from lower-grade alternatives.

Conversely, the market faces notable restraints that temper expansion. The high cost of raw material cultivation, coupled with volatile climatic conditions, creates inherent supply chain instability and price fluctuations. Many essential oil-yielding plants require specific microclimates, making widespread, low-cost cultivation challenging. Furthermore, the issue of essential oil adulteration—where cheaper synthetic compounds are used to dilute or mimic expensive natural oils—erodes consumer trust and requires significant investment in advanced analytical testing technologies, posing a financial burden primarily on small and medium-sized enterprises. Regulatory heterogeneity across global markets also complicates international trade, particularly regarding labeling requirements and ingredient restrictions in cosmetic and food applications.

The key market opportunity lies in the burgeoning application sectors, particularly functional foods and precision pharmaceuticals. Essential oils are increasingly being studied for their potential as natural preservatives and antimicrobial agents in food processing, providing a clean-label alternative to chemical preservatives. In the pharmaceutical domain, microencapsulation technologies are allowing essential oils to be utilized in targeted drug delivery systems, leveraging their high potency and low toxicity profile. Moreover, the expanding field of sustainable sourcing and certified organic production offers a critical competitive differentiator, allowing premium brands to capture the increasing segment of environmentally conscious consumers willing to pay a premium for ethical and traceable botanical ingredients. These opportunities, centered on technological advancement and new application integration, are poised to mitigate the existing restraints and propel sustained growth.

Segmentation Analysis

The Essential Oil and Floral Water Market is comprehensively segmented based on product type, method of extraction, application, and geography, reflecting the diversity of consumer needs and industrial uses. The dominant segmentation factor remains the product type, differentiating between highly concentrated essential oils and the gentler floral waters (hydrosols). Essential oils are further classified based on their source, such as citrus, spice, floral, and herbaceous oils, each possessing distinct chemical compositions and usage profiles. Segmentation by extraction method is critical as it directly impacts the final product quality and price point; techniques range from traditional steam distillation to sophisticated supercritical CO2 extraction, catering to varying requirements from bulk industrial users to high-purity pharmaceutical applications.

Application segmentation reveals the primary revenue drivers, with the Aromatherapy and Cosmetics & Personal Care sectors commanding the largest shares, capitalizing on the oils’ fragrant and therapeutic qualities. The Food & Beverage segment, while more regulated, is growing rapidly due to the demand for natural flavors and preservatives. Geographically, the market is dissected into major regions—North America, Europe, Asia Pacific, Latin America, and Middle East & Africa—where consumption patterns, regulatory environments, and indigenous raw material availability significantly influence market dynamics and regional dominance, with APAC notably driving volume growth and Europe leading in premium quality standards.

- By Product Type:

- Essential Oils

- Floral Waters (Hydrosols)

- Essential Oil Type:

- Citrus Oils (Orange, Lemon, Grapefruit)

- Spice Oils (Clove, Cinnamon, Ginger)

- Floral Oils (Lavender, Rose, Jasmine)

- Herbaceous Oils (Peppermint, Rosemary, Eucalyptus)

- Wood Oils (Sandalwood, Cedarwood)

- By Method of Extraction:

- Steam Distillation

- Hydrodistillation

- Cold Press Extraction (Expression)

- Supercritical CO2 Extraction

- Solvent Extraction

- By Application:

- Aromatherapy

- Cosmetics and Personal Care (Fragrance, Skincare, Haircare)

- Food and Beverage (Flavoring, Preservatives)

- Pharmaceuticals and Medicinal (Topical, Inhalation)

- Home Care (Cleaning, Air Fresheners)

- By Distribution Channel:

- Direct Sales

- Retail Stores (Supermarkets, Specialty Stores)

- E-commerce

Value Chain Analysis For Essential Oil And Floral Water Market

The value chain for Essential Oil and Floral Water is inherently complex, starting with the highly specialized cultivation and harvesting of aromatic plants, often requiring manual labor and specific geographical knowledge. Upstream activities are dominated by agricultural practices, including seed sourcing, soil preparation, and highly sensitive harvesting methods that maximize the concentration of volatile organic compounds (VOCs) within the plant material. The quality of the final product is critically dependent on these upstream processes, necessitating stringent quality control and often requiring certified organic or wildcrafted sourcing. Farmers and raw material suppliers, therefore, hold significant influence over the initial cost structure and the chemical profile of the end products, driving a trend toward contractual farming to secure stable, high-quality supply.

Midstream processing involves the transformation of raw botanical matter into concentrated essential oils and hydrosols, primarily through various distillation and extraction technologies. This stage is capital-intensive, requiring specialized equipment such as advanced stills for steam distillation or high-pressure vessels for supercritical CO2 extraction. Key stakeholders in this segment include specialized ingredient manufacturers and contract extractors who must adhere to Good Manufacturing Practices (GMP) and possess robust analytical testing capabilities (e.g., GC-MS) to ensure product purity and compliance with industry standards (e.g., ISO, AFNOR). Efficiency in extraction technology directly correlates with cost management and the ecological footprint, pushing investment towards energy-efficient and high-yield methods.

Downstream activities focus on formulation, packaging, marketing, and distribution. Essential oils and floral waters are rarely sold in their concentrated form to the end consumer but are integrated into finished products like lotions, diffusers, supplements, and food flavorings. Distribution channels are highly fragmented, spanning direct sales via dedicated aromatherapy consultants, traditional retail channels (pharmacies, specialty stores, and mass merchants), and rapidly expanding e-commerce platforms. The dominance of direct-to-consumer (DTC) e-commerce allows smaller, niche brands specializing in high-purity, traceable products to bypass traditional intermediaries, offering greater transparency and capturing higher margins by providing detailed product information and usage guidance directly to the educated consumer base. Indirect channels rely heavily on major distributors who service large cosmetic manufacturers and food processors.

Essential Oil And Floral Water Market Potential Customers

The essential oil and floral water market targets a broad spectrum of industrial and retail customers, driven by the versatility of these botanical ingredients across health, beauty, and culinary domains. The largest immediate customers are large-scale corporations within the Cosmetics and Personal Care Industry, including multinational beauty conglomerates and niche organic skincare brands. These entities procure essential oils and floral waters in bulk for use as natural fragrances, active dermatological agents (antimicrobial, antioxidant), and sustainable alternatives to synthetic ingredients in products ranging from anti-aging creams and shampoos to natural deodorants and body washes. The formulation chemists within these companies are constantly seeking unique, high-purity oils to differentiate their product lines and meet clean-label requirements.

Another significant customer segment is the Food and Beverage Industry, which utilizes essential oils classified as Generally Recognized As Safe (GRAS) for flavoring soft drinks, confectioneries, baked goods, and functional beverages. These oils provide intense, natural flavor profiles and often contribute preservative qualities, aligning with the industry's trend towards removing artificial additives. Furthermore, the Pharmaceutical and Traditional Medicine sectors represent high-value customers, purchasing specific chemotypes of essential oils for their scientifically validated therapeutic properties, incorporating them into over-the-counter remedies, specialized wound care products, and excipients in drug formulation, emphasizing requirements for pharmaceutical-grade purity and batch consistency.

Beyond these industrial customers, the market also serves the rapidly growing end-user segment of individual consumers via retail and e-commerce channels. These consumers primarily fall into the categories of aromatherapy enthusiasts, wellness seekers, and do-it-yourself (DIY) cosmetic formulators. They seek detailed information on therapeutic benefits, sourcing, and certified organic status. Other institutional buyers include specialized businesses such as spa and wellness centers, massage therapists, and holistic health practitioners who incorporate essential oils into their service offerings for environmental fragrance, therapeutic treatments, and complementary medicine practices, requiring reliable, certified-pure products in substantial quantities for professional use.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 11.5 Billion |

| Market Forecast in 2033 | USD 20.5 Billion |

| Growth Rate | CAGR 8.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Young Living Essential Oils, doTERRA International, Symrise AG, Givaudan SA, International Flavors & Fragrances (IFF), Sensient Technologies Corporation, Mane SA, Firmenich SA, Biolandes SAS, Robertet Group, Essential Oils of New Zealand (EONZ), Edens Garden, Citrus and Allied Essences Ltd., Now Foods, Takasago International Corporation, Kalsec Inc., Mountain Rose Herbs, Falcon Essential Oils, New Directions Aromatics, Florihana Distillery. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Essential Oil And Floral Water Market Key Technology Landscape

The technological landscape of the Essential Oil and Floral Water Market is rapidly evolving, driven primarily by the need for higher purity, improved yield efficiency, and minimal environmental impact. The standard technique, steam distillation, remains prevalent but is increasingly being challenged by advanced methods. Supercritical Carbon Dioxide (SC-CO2) extraction represents a leading technological advancement, utilizing CO2 in its supercritical state as a solvent. This method is highly favored because it operates at lower temperatures, preserving the thermal stability of sensitive volatile compounds, and, critically, leaves zero residual solvent, resulting in extremely clean, high-quality extracts suitable for pharmaceutical and premium cosmetic applications. The adoption of SC-CO2 is a key indicator of manufacturers targeting the high-end, purity-conscious segments of the market.

Another crucial technological development is the implementation of advanced analytical instrumentation, primarily Gas Chromatography-Mass Spectrometry (GC-MS) and High-Performance Liquid Chromatography (HPLC), for quality assurance. These technologies are indispensable for verifying the chemical composition, identifying specific chemotypes, and detecting the slightest traces of synthetic adulterants or pesticides. Standardization bodies and high-end buyers mandate rigorous GC-MS testing to ensure compliance with purity standards and therapeutic efficacy. Furthermore, the integration of automation and process control systems, particularly in large-scale distillation units, has improved batch consistency, reduced energy consumption, and allowed manufacturers to optimize extraction kinetics in real-time, moving away from manual, inconsistent processes.

Beyond extraction and analysis, technologies focused on shelf life extension and targeted delivery are gaining traction. Microencapsulation and nano-encapsulation techniques are being employed to protect volatile essential oil components from degradation (light, heat, oxidation) and to facilitate controlled, sustained release in finished products, especially in the functional food and pharmaceutical industries. This controlled delivery system enhances the stability and bioavailability of the oils, expanding their utility in complex formulations where volatility or rapid degradation would otherwise be a limitation. Furthermore, advancements in sustainable water management and distillation effluent treatment are becoming key technological investments, addressing environmental concerns associated with large-scale botanical processing operations.

Regional Highlights

Market dynamics for Essential Oil and Floral Water vary significantly across geographies, influenced by local regulatory frameworks, consumption patterns, and indigenous resource availability. North America, comprising the United States and Canada, is characterized by a mature consumer base highly focused on wellness, alternative medicine, and organic certification. The region exhibits high per capita spending on essential oils, primarily driven by the established aromatherapy market and the rapid growth of 'clean beauty' products. Stringent regulations by the FDA regarding claims and safety necessitate high analytical scrutiny for imported and domestic products, favoring suppliers with robust quality assurance protocols. The dominance of large retail chains and robust e-commerce platforms defines the distribution landscape.

Europe represents a highly regulated and quality-driven market, particularly Western European countries like Germany, France, and the UK. The demand here is strongly influenced by the traditional acceptance of herbal medicine and the requirement for certification under the European Medicines Agency (EMA) and COSMOS standards for organic cosmetics. The region is a major producer and consumer of high-value floral oils (e.g., lavender, rose). Regulatory compliance, especially concerning allergen labeling (under REACH), is a critical barrier to entry, simultaneously elevating the value proposition for compliant, high-purity extracts. Germany, in particular, showcases high consumption rates in pharmaceutical and medicinal applications.

The Asia Pacific (APAC) region is projected to be the engine of future market growth, fueled by massive population bases, increasing affluence, and the entrenched use of botanicals in traditional health systems (Ayurveda in India, Traditional Chinese Medicine). Countries like China, India, and Australia are key producers and consumers. While price sensitivity is a factor, the rapid expansion of the middle class is driving demand for premium, imported organic products, especially in urban centers. Furthermore, APAC nations are becoming central to the global supply chain, leveraging diverse climatic conditions to cultivate a wide range of essential oil source plants, though often grappling with standardization and quality control challenges.

Latin America and the Middle East & Africa (MEA) present emerging market opportunities. Latin America, rich in biodiversity (e.g., Brazilian citrus and Amazonian botanicals), is focusing on developing sustainable sourcing initiatives and exporting specialty oils. The MEA region is characterized by steady growth in the personal care sector, particularly in the Gulf Cooperation Council (GCC) countries, where premium fragrance and cosmetic consumption is exceptionally high, leading to increased demand for high-quality imported essential oils and floral waters for use in perfumes, incense, and luxurious spa treatments. Political and economic stability remain crucial factors influencing investment and market expansion across these territories.

- North America (US, Canada): Dominance in aromatherapy and functional wellness applications; high adoption of e-commerce distribution; stringent consumer expectations regarding organic and non-GMO certification.

- Europe (Germany, France, UK): High regulatory requirements (REACH, EMA); leading market for certified organic ingredients; strong demand from the pharmaceutical and high-end cosmetic manufacturing sectors.

- Asia Pacific (China, India, Australia): Fastest growth rate, driven by traditional medicine integration and rising disposable incomes; significant production hub for raw materials; increasing sophistication in processing technology adoption.

- Latin America (Brazil, Mexico): Focus on unique native botanical extracts; development of sustainable sourcing models; internal market growth driven by local personal care manufacturing.

- Middle East & Africa (UAE, Saudi Arabia, South Africa): High demand for fragrance and luxury cosmetic components; reliance on imports for high-grade extracts; burgeoning spa and wellness tourism industry.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Essential Oil And Floral Water Market.- Young Living Essential Oils

- doTERRA International

- Symrise AG

- Givaudan SA

- International Flavors & Fragrances (IFF)

- Sensient Technologies Corporation

- Mane SA

- Firmenich SA

- Biolandes SAS

- Robertet Group

- Essential Oils of New Zealand (EONZ)

- Edens Garden

- Citrus and Allied Essences Ltd.

- Now Foods

- Takasago International Corporation

- Kalsec Inc.

- Mountain Rose Herbs

- Falcon Essential Oils

- New Directions Aromatics

- Florihana Distillery

Frequently Asked Questions

Analyze common user questions about the Essential Oil And Floral Water market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the Essential Oil and Floral Water Market?

The primary factor driving market growth is the global consumer shift towards natural, clean-label ingredients, specifically their incorporation into cosmetics, personal care products, and wellness therapies, displacing synthetic chemical alternatives.

What are the key technical challenges facing essential oil producers regarding quality control?

Key technical challenges include maintaining batch-to-batch consistency in volatile compound profiles due to agricultural variability and preventing and detecting product adulteration, which necessitates substantial investment in advanced analytical tools like GC-MS technology.

Which extraction method yields the highest purity essential oils for high-value applications?

Supercritical Carbon Dioxide (SC-CO2) extraction typically yields the highest purity essential oils. This solvent-free method operates at low temperatures, effectively preserving the delicate therapeutic compounds and ensuring zero solvent residue, making it ideal for pharmaceutical and high-end cosmetic formulations.

How does the application of essential oils in the Food and Beverage industry differ from its use in Cosmetics?

In the Food and Beverage industry, essential oils must meet strict "Generally Recognized As Safe" (GRAS) criteria and are used primarily as natural flavorings and antimicrobial preservatives. In Cosmetics, they function as fragrances, active dermatological ingredients, and natural preservatives, focusing more on topical efficacy and sensory appeal.

Which geographical region is expected to demonstrate the fastest growth rate in the forecast period?

The Asia Pacific (APAC) region is projected to exhibit the fastest Compound Annual Growth Rate (CAGR), driven by increasing disposable incomes, high population density, rapid urbanization, and the deep cultural integration of traditional herbal and botanical remedies in countries such as China and India.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager