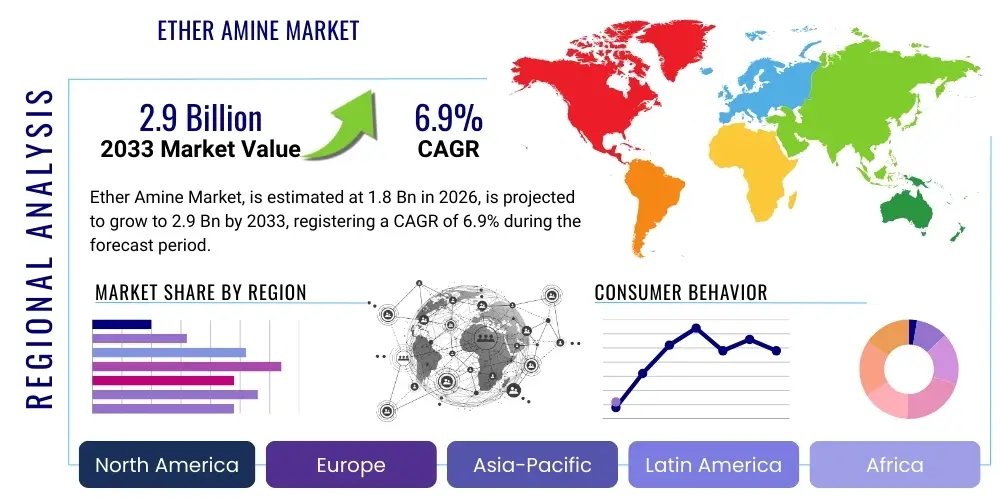

Ether Amine Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443251 | Date : Feb, 2026 | Pages : 241 | Region : Global | Publisher : MRU

Ether Amine Market Size

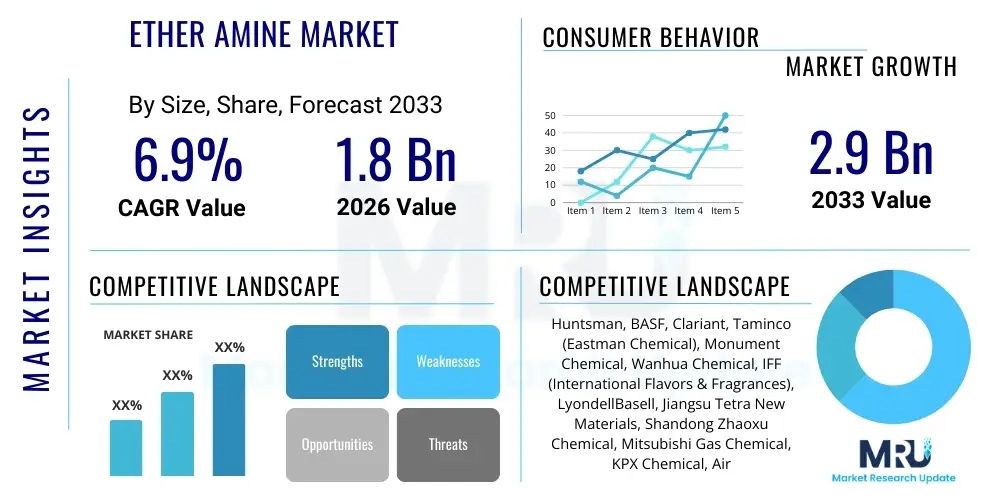

The Ether Amine Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.9% between 2026 and 2033. The market is estimated at USD 1.8 Billion in 2026 and is projected to reach USD 2.9 Billion by the end of the forecast period in 2033.

Ether Amine Market introduction

Ether amines are a specialized class of organic compounds characterized by the presence of both an ether linkage and an amino functional group. These compounds bridge the properties of polyethers (offering flexibility and hydrophilicity) and amines (providing reactivity for cross-linking and basicity), making them highly versatile intermediates in chemical synthesis. Their unique structure allows them to be used as curing agents, dispersants, emulsifiers, and corrosion inhibitors across a wide spectrum of industrial applications. The core chemical structure typically features a polyether backbone, derived from propylene oxide or ethylene oxide, which is subsequently functionalized with primary, secondary, or tertiary amino groups through reactions like reductive amination. The structural variation, particularly the molecular weight and the number of amine functionalities, determines the end-use properties, such as viscosity, reactivity, and compatibility with various polymer matrices. The global market is witnessing robust growth primarily driven by the expanding construction and automotive industries, which heavily rely on advanced coatings, durable adhesives, and high-performance polyurethane systems formulated with ether amines.

The primary applications of ether amines span high-performance coatings, where they function as effective curing agents for epoxy resins, imparting enhanced mechanical strength, chemical resistance, and faster cure times. In polyurethane chemistry, they serve as crucial chain extenders and cross-linkers, particularly in Reaction Injection Molding (RIM) applications and foam production, yielding products with superior resilience and thermal stability. Furthermore, the oil and gas sector utilizes ether amines extensively as corrosion inhibitors, scale control agents, and demulsifiers due to their amphiphilic nature and ability to interact strongly with metal surfaces and stabilize emulsions. The agricultural industry employs these chemicals in the formulation of high-efficacy agrochemicals, acting as surfactants and adjuvants that improve the dispersion and penetration of active ingredients. The continuous innovation in synthesis methods focusing on bio-based feedstocks and cleaner production processes is shaping the competitive landscape, pushing manufacturers towards developing products with reduced environmental footprints, thereby meeting stringent global regulatory requirements.

Key driving factors propelling the ether amine market include the accelerating demand for epoxy-based structural adhesives in aerospace and automotive light-weighting initiatives, the rapid infrastructural development in emerging economies necessitating advanced protective coatings, and the increasing global consumption of specialized agrochemical formulations. The inherent benefits of ether amines, such as their ability to lower viscosity in resin systems, leading to easier handling and application, and their capacity to enhance the overall durability and lifecycle of end products, cement their irreplaceable role across diverse industries. Ongoing research into new derivative structures, particularly those utilizing renewable polyether segments derived from biomass, is expected to unlock novel applications in high-value areas like specialty solvents, personal care products, and specialized lubricant formulations, further solidifying the market's trajectory over the forecast period. The increasing focus on waterborne coatings and low-VOC (Volatile Organic Compound) formulations mandates the use of highly efficient, low-odor curing agents, positioning ether amines favorably within the sustainability paradigm.

Ether Amine Market Executive Summary

The global Ether Amine market is characterized by moderate consolidation among large international chemical producers but exhibits high regional competition, particularly in Asia Pacific where capacity expansion is rapid. Current business trends indicate a significant shift towards specialized monoether and diether amine variants, preferred for high-end applications such as wind turbine blade manufacture and electric vehicle battery encapsulation, requiring enhanced thermal stability and dielectric properties. Market growth is heavily influenced by feedstock price volatility, particularly fluctuations in propylene oxide and ammonia costs, compelling manufacturers to focus intensively on supply chain resilience and backward integration to stabilize profit margins. The industry is also seeing an accelerated pace of mergers and acquisitions aimed at consolidating regional market shares and acquiring specialized patented synthesis technologies, particularly those related to higher molecular weight ether amines optimized for high-solids and 100% solids coatings systems, aligning with global sustainability goals.

Regionally, Asia Pacific dominates the market, driven by massive investments in infrastructure (roads, bridges, ports) and the booming automotive manufacturing sector, particularly in China and India. The demand for epoxy curing agents and specialty polyurethane foams is exceptionally high in these economies. North America and Europe, while being mature markets, are leading in the adoption of advanced, low-toxicity ether amines for environmentally sensitive applications such as marine coatings and potable water contact materials, strictly regulated by bodies like the EPA and REACH. These regions are prioritizing R&D into bio-based and sustainable ether amine alternatives, driven by stringent environmental mandates and consumer preference for green chemistry. Furthermore, the Middle East and Africa (MEA) are emerging as significant growth pockets due to expanding oil and gas exploration activities, which require large volumes of corrosion inhibitors and specialized drilling fluid additives based on ether amines.

In terms of segmentation trends, the application segment dominated by Polyurethanes maintains its lead, primarily due to the ubiquitous use of PU foams in construction insulation and furniture, alongside the growing use of PU elastomers in footwear and automotive components. However, the fastest growth is anticipated in the Agrochemicals segment, where enhanced surfactant properties of ether amines are being leveraged to create highly effective, stable pesticide formulations that reduce application rates and environmental runoff. The monoether amine segment, due to its versatility and lower molecular weight, remains the most consumed product type, but the Diether Amine segment is projected to show accelerated growth, favored in formulations requiring increased flexibility and reduced brittleness, such as high-solids epoxy flooring and protective linings. End-user industries, specifically Construction and Automotive, are responsible for the bulk of demand, consistently pushing for tailored products that meet evolving performance requirements, such as improved UV resistance and rapid curing characteristics.

AI Impact Analysis on Ether Amine Market

User queries regarding AI’s impact on the Ether Amine market frequently center on optimizing complex, multi-step synthesis pathways, predicting product performance under varying environmental conditions, and streamlining volatile raw material procurement. The primary concerns revolve around how machine learning can enhance reaction yield, minimize expensive side-product formation, and facilitate the discovery of novel ether amine structures with targeted properties, especially for sustainable or bio-based feedstocks. Users are keen on understanding AI's role in predictive maintenance for large-scale reactors and optimizing energy consumption in high-temperature hydrogenation and amination processes, leading to significant operational expenditure savings and adherence to energy efficiency regulations. Furthermore, there is substantial interest in leveraging AI for supply chain visibility, forecasting demand fluctuations for key derivatives in niche markets (e.g., wind energy or 3D printing resins), and managing the complex logistics involved in transporting hazardous chemical intermediates globally, addressing resilience and regulatory compliance challenges effectively.

AI and Machine Learning (ML) algorithms are increasingly deployed in Research and Development (R&D) to accelerate the design and screening of new ether amine structures. High-throughput experimentation combined with ML models allows researchers to predict the optimal backbone structure (e.g., EO/PO ratio) and amination conditions required to achieve specific functional parameters like viscosity, pKa values, and cure kinetics with epoxy or isocyanate resins. This computational approach drastically reduces the time and cost associated with traditional trial-and-error chemistry, leading to a faster time-to-market for specialized additives. Moreover, AI-driven process control systems are being integrated into manufacturing plants to maintain tight control over critical process parameters (CPPs) such as temperature, pressure, and catalyst loading during the reductive amination step, thereby ensuring consistent product quality, minimizing batch variations, and maximizing overall operational efficiency in complex chemical processes.

Beyond synthesis, AI is transforming market analysis and supply chain management for ether amines. Predictive analytics models utilize real-time data on feedstock prices (e.g., propylene oxide, ethylene oxide, ammonia), global shipping costs, and geopolitical factors to forecast future procurement costs, enabling chemical companies to implement proactive hedging strategies and optimize inventory levels. In the application space, AI algorithms are being used by large end-users (e.g., construction and automotive firms) to predict the lifetime performance and degradation rates of ether amine-cured polymers under real-world stress conditions, such as high moisture or extreme temperatures. This level of predictive capability is invaluable for certifying product durability and meeting stringent industry standards, driving specification adoption for high-performance ether amine derivatives over conventional curing agents. The implementation of digital twins of production facilities, driven by AI, further enhances efficiency by simulating process changes before physical implementation, significantly de-risking capital investments.

- AI optimizes synthesis routes, improving reaction yields and purity by modeling complex chemical kinetics.

- Machine Learning predicts raw material cost fluctuations, enhancing procurement and inventory management strategies.

- Predictive maintenance schedules for reactor vessels and auxiliary equipment reduce unplanned downtime in production facilities.

- AI algorithms accelerate the discovery of novel bio-based and sustainable ether amine structures for green chemistry initiatives.

- Computational chemistry driven by AI is used to simulate and predict the curing performance and long-term durability of polymer systems.

- Automated quality control systems using computer vision ensure consistent physical and chemical properties of the final product batches.

DRO & Impact Forces Of Ether Amine Market

The Ether Amine Market is profoundly influenced by dynamic forces encompassing robust demand drivers, persistent operational restraints, and compelling future opportunities, all acting simultaneously to shape market progression. Key drivers include the escalating global demand for high-performance epoxy systems in industrial flooring, protective linings, and wind energy applications, alongside the indispensable role of ether amines as essential components in the production of high-resilience polyurethane foams critical for the construction and furniture sectors. Furthermore, the increasing complexity and scale of global oil and gas infrastructure necessitate specialized corrosion inhibitors and functional fluid components, maintaining a steady and high-value demand for tailored ether amine derivatives. Conversely, the market faces significant restraints, primarily stemming from the volatile pricing of key petrochemical feedstocks, such as propylene oxide and ethylene oxide, which introduces considerable uncertainty into manufacturing costs and profit forecasting. Stringent environmental regulations, particularly regarding the handling and transportation of potentially corrosive chemical intermediates and the mandatory reduction of VOCs in coatings formulations, impose substantial compliance burdens and elevate R&D investment requirements for low-toxicity alternatives, slowing down market access for certain conventional products.

Opportunities within the market largely reside in technological innovation and geographical expansion. The growing global commitment to renewable energy infrastructure, specifically the surging production of wind turbines and advanced solar panel mounting systems that utilize structural adhesives and specialized coatings, presents a major high-growth opportunity for specialized, durable ether amines. Development of bio-based ether amines, utilizing feedstocks derived from vegetable oils or sugars, represents a disruptive opportunity that addresses sustainability concerns and potentially mitigates reliance on volatile petroleum-based inputs, offering a competitive edge in regulated markets like Europe. Moreover, market penetration into emerging application areas, such as advanced 3D printing resins, where controlled curing kinetics and excellent mechanical properties are paramount, and the integration of ether amines into specialized electronic encapsulation compounds, provides new, high-margin revenue streams. Strategic geographical expansion into rapidly industrializing regions of Southeast Asia and Africa, coupled with localized production capabilities to reduce logistics costs, further unlocks untapped market potential and addresses regional supply chain vulnerabilities.

The cumulative impact forces reveal a strong positive momentum driven by sustained growth in end-use sectors, particularly infrastructure and automotive lightweighting, which outweighs the cost volatility inherent in petrochemical supply chains. The necessity for high-performance materials that offer superior durability and chemical resistance in harsh environments (e.g., marine, oil refineries) ensures continued specification of ether amine derivatives over cheaper, less effective alternatives. The underlying trend of functional material sophistication dictates that, despite regulatory hurdles, manufacturers who successfully innovate towards sustainable, high-purity, and high-performance products will capture disproportionate market share. The collective influence of infrastructure spending, technological advancement in material science, and the critical global need for corrosion protection establishes a moderately high impact force scenario, favoring structured, long-term market expansion focused on specialized, value-added products, enabling overall market resilience against short-term economic fluctuations and geopolitical risks.

Segmentation Analysis

The Ether Amine market is comprehensively segmented based on Type, Application, and End-Use Industry, providing a nuanced understanding of demand dynamics and consumption patterns across various sectors. The segmentation by Type, including Monoether Amine, Diether Amine, and Triether Amine, directly correlates with the required end-product functionality; Monoether amines are widely used as intermediates, while di- and triether amines function primarily as curing agents and cross-linkers offering varied flexibility and reactivity. This product diversity allows manufacturers to precisely tailor formulations to meet specific performance characteristics, such as cure speed in coatings or flexibility in polyurethane elastomers. The application segmentation, encompassing Polyurethanes, Epoxy Curing Agents, Fuel Additives, and Agrochemicals, highlights the chemical's versatile utility, with the largest volume consumed in polymer synthesis due to its cross-linking efficiency and ability to modify polymer morphology, driving substantial R&D focus in these high-volume areas.

The End-Use Industry segmentation, covering Construction, Automotive, Agriculture, and Oil & Gas, clearly identifies the major economic drivers for demand. The Construction industry remains the largest consumer, fueled by the global requirement for protective coatings, industrial flooring, and insulation materials (PU foam), especially in rapidly urbanizing regions. The Automotive segment is growing rapidly, driven by the shift towards Electric Vehicles (EVs) which utilize advanced adhesives, sealants, and lightweight composite components often cured using ether amines. Understanding these segment dynamics is critical for market stakeholders to prioritize capacity expansion and targeted marketing efforts, ensuring optimal alignment between product offerings and high-growth industrial demands. The increasing regulatory pressure across these industries, particularly concerning environmental impact, necessitates continuous product innovation, favoring suppliers capable of providing certified, high-purity products meeting stringent international performance standards for critical infrastructure applications and consumer safety.

Within the Agrochemicals segment, ether amines are integral to creating stable emulsion concentrates and effective suspension formulations, improving the biological efficacy of herbicides and pesticides by optimizing droplet size and surface coverage. This application area is experiencing notable growth, linked to global efforts to enhance crop yields and adopt precision agriculture techniques, requiring sophisticated chemical adjuvants. Furthermore, the segmentation reveals the critical role of ether amines in niche high-value sectors, such as personal care (as emulsifiers or stabilizers) and specialized lubricant additives, demonstrating the chemical's broad economic footprint beyond the traditional polymer markets. The distinct performance requirements of each segment—such as low color and high purity for electronics, versus robust chemical resistance for marine coatings—dictate specialized manufacturing protocols and quality assurance checks, differentiating the competitive strategies adopted by market leaders specializing in specific ether amine derivatives and their corresponding applications.

- By Type:

- Monoether Amine

- Diether Amine

- Triether Amine

- By Application:

- Polyurethanes (Chain Extenders, Cross-linkers)

- Epoxy Curing Agents

- Fuel Additives (Detergents, Corrosion Inhibitors)

- Lubricant Additives

- Adhesives and Sealants

- Agrochemicals (Surfactants, Emulsifiers)

- Surfactants and Detergents

- Others (Personal Care, Specialty Solvents)

- By End-Use Industry:

- Construction and Infrastructure

- Automotive and Transportation

- Oil & Gas (Corrosion Inhibition, Drilling Fluids)

- Agriculture

- Coatings and Paints

- Mining and Quarrying

- Personal Care and Cosmetics

Value Chain Analysis For Ether Amine Market

The Value Chain for the Ether Amine market begins with the procurement of critical upstream raw materials, predominantly derived from the petrochemical industry. Key inputs include propylene oxide (PO), ethylene oxide (EO), and ammonia (NH3) or other amines, which are essential for forming the polyether backbone and the amine functionality, respectively. Upstream activities are dominated by major integrated chemical manufacturers that often produce their own PO and EO, conferring a significant cost advantage and greater supply chain stability. The synthesis process itself involves specialized catalytic reactions, such as alcohol amination or reductive amination, which require high energy input and specialized equipment, placing a premium on operational efficiency and proprietary catalyst technology to minimize costs and maximize product purity. Therefore, effective management of raw material pricing volatility and optimization of synthesis yields are critical determinants of profitability at this initial stage of the value chain, highly influencing the final product cost structure and competitive positioning in the global market.

Midstream activities encompass the core manufacturing, purification, and functionalization of various ether amine types (mono-, di-, tri-). This stage involves complex chemical engineering processes aimed at customizing the molecular weight and functional group placement to meet specific application requirements, such as low viscosity for high-solids coatings or specific reactivity profiles for high-speed polyurethane reactions. Manufacturers focus heavily on quality control, ensuring the purity and low color requirements critical for high-end applications like electronics encapsulation and clear protective coatings. Distribution channels form the next crucial link, often leveraging a mix of direct sales to large, strategic end-users (e.g., major coatings companies or PU producers) and indirect sales through specialized chemical distributors who provide local stock, technical support, and smaller batch sizes to regional formulators and smaller enterprises. The choice between direct and indirect distribution hinges on regional regulatory requirements, the volume of consumption, and the level of technical specialization required by the customer base, ensuring efficient and compliant delivery of these regulated chemical products.

Downstream activities involve the final formulation and application of products utilizing ether amines, primarily driven by end-user industries such as construction, automotive, and agriculture. Direct buyers, often global chemical formulators, incorporate ether amines into epoxy curing agents, specialized polyurethanes, fuel and lubricant additives, or agrochemical adjuvants. The final value added at this stage comes from the performance benefits—suchg as improved durability, faster curing, or enhanced corrosion resistance—that ether amines impart to the end product. For instance, a coating manufacturer utilizes a specialized ether amine to develop an industrial floor coating with superior abrasion resistance, allowing them to command a premium price in the market. Feedback loops between downstream users and midstream producers are essential for innovation, driving the development of next-generation ether amines that address emerging market needs, such as non-yellowing characteristics or improved handling safety, thereby continuously reinforcing the market's high-value proposition and ensuring sustained demand growth through technical superiority and application effectiveness.

Ether Amine Market Potential Customers

Potential customers for the Ether Amine market are highly diversified, encompassing large multinational corporations involved in polymer production and specialty chemical formulation, as well as specialized regional manufacturers focused on niche applications. Major end-users primarily include manufacturers in the construction sector, particularly those producing industrial flooring systems, concrete repair materials, and protective coatings for structural steel and marine environments, relying on ether amines as essential epoxy curing agents that offer rapid turnaround times and superior mechanical properties. The automotive and aerospace industries represent another high-value customer segment, utilizing ether amines in advanced composite manufacturing, structural adhesives for vehicle lightweighting (e.g., bonding dissimilar materials), and specialized polyurethane components for seating and interior applications, driven by continuous efforts to enhance fuel efficiency and meet stringent safety standards.

Furthermore, the petrochemical and oil & gas sectors are substantial, recurring customers, utilizing ether amines in high volumes as corrosion inhibitors, particularly in pipeline and refinery operations, and as demulsifiers in crude oil processing to separate water and oil efficiently under harsh operating conditions. This segment demands high-purity, thermally stable ether amine derivatives capable of performing reliably in extreme pressure and temperature environments. Agricultural chemical companies are increasingly important buyers, incorporating ether amines as highly effective surfactants and dispersants in pesticide and herbicide formulations. These customers seek products that enhance the biological activity of the active ingredient, ensuring stable shelf life and improved application efficacy, thereby maximizing crop yields and minimizing environmental impact through optimized dosing.

The versatility of ether amines also attracts customers in niche markets, including specialty electronics manufacturers requiring low-outgassing encapsulation materials, personal care product formulators using them as mild emulsifiers or conditioning agents, and specialized lubricant companies incorporating them as anti-wear or dispersant additives in high-performance synthetic fluids. These diverse customer bases highlight the market's resilience, as demand is not overly dependent on a single industry. For suppliers, maintaining a broad portfolio of ether amine derivatives, coupled with strong technical support, is crucial to effectively serve the varied and demanding requirements of these potential customers, ranging from bulk commodity buyers to highly specialized consumers seeking custom-synthesized, high-value molecular structures tailored for cutting-edge technological applications.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.8 Billion |

| Market Forecast in 2033 | USD 2.9 Billion |

| Growth Rate | 6.9% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Huntsman, BASF, Clariant, Taminco (Eastman Chemical), Monument Chemical, Wanhua Chemical, IFF (International Flavors & Fragrances), LyondellBasell, Jiangsu Tetra New Materials, Shandong Zhaoxu Chemical, Mitsubishi Gas Chemical, KPX Chemical, Air Products and Chemicals, Cargill, Dow, Recochem, Sinopec, Zhejiang Jianli Chemical, Shanghai Fine Chemical, Henan Xinxiang Chemical. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Ether Amine Market Key Technology Landscape

The technology landscape governing the production of ether amines is focused primarily on optimizing the chemical synthesis pathways to achieve higher purity, better yield, and lower energy consumption, while simultaneously exploring sustainable feedstock alternatives. The predominant manufacturing technology involves the reductive amination of polyether alcohols (polyols), where a polyol is reacted with ammonia or a primary/secondary amine in the presence of a heterogeneous catalyst, typically based on nickel or cobalt, under high temperature and pressure conditions. Recent technological advancements are centered on developing highly selective, long-life heterogeneous catalysts that minimize side product formation and allow for continuous process operation, thereby significantly reducing purification costs and waste generation. Furthermore, process intensification techniques, such as microreactor technology, are being explored by leading manufacturers to enhance reaction control, improve heat transfer efficiency, and ensure intrinsically safer operation when dealing with volatile reactants and exothermic reactions, leading to smaller operational footprints and capital expenditure savings in new plants.

A crucial technological trend involves the customization of the polyether backbone composition, moving beyond simple polyethylene glycol (PEG) or polypropylene glycol (PPG) derivatives to specialty copolymers tailored for specific applications. For example, specific ether amines are engineered with mixed EO/PO backbones to fine-tune the hydrophilicity and hydrophobicity balance, which is vital for performance in surfactant and corrosion inhibitor applications in aqueous or hydrocarbon systems. Advanced purification technologies, including specialized distillation, solvent extraction, and membrane separation, are critical for achieving the high-purity, low-color products demanded by the electronics, personal care, and high-performance coatings sectors where trace impurities can severely impair performance characteristics, such as electrical insulation properties or UV stability. Continuous improvement in these purification steps is necessary for compliance with stringent regulatory requirements concerning residual solvent levels and volatile organic impurities in the final chemical product.

The emerging technological frontier focuses on sustainability, encompassing the integration of bio-based feedstocks derived from renewable sources like glycerol, starch, or cellulosic materials into the polyether backbone synthesis. Utilizing these green sources not only aligns with corporate sustainability mandates but also potentially stabilizes supply chains against fossil fuel price volatility. Additionally, enzymatic synthesis and biocatalysis are under investigation as greener alternatives to traditional thermal amination, offering the potential for milder reaction conditions, reduced energy input, and highly specific product formation, minimizing the need for extensive downstream separation. Digitalization, through the implementation of advanced process control (APC) systems and real-time analytical tools, further enhances the technology landscape by allowing manufacturers to predict process deviations and optimize reaction parameters autonomously, maximizing throughput and ensuring consistently high-quality ether amine production across various grades and chemistries, ultimately bolstering the competitiveness of the global manufacturing base.

Regional Highlights

- Asia Pacific (APAC): APAC is the dominant market for ether amines, characterized by the highest consumption volume and fastest growth rate, primarily driven by massive infrastructure and construction activities in emerging economies such as China, India, and ASEAN nations. The region's booming automotive production, coupled with extensive manufacturing capacity for epoxy resins and polyurethane foams, fuels the high demand for both commodity and specialized ether amine derivatives. Government initiatives supporting manufacturing, combined with lower labor and operational costs compared to Western counterparts, encourage major global producers to establish large-scale manufacturing hubs in this region. Furthermore, the rapid expansion of the oil and gas sector, particularly in Southeast Asia, contributes significantly to the demand for corrosion inhibitors and drilling fluid additives.

- North America: North America represents a mature, high-value market focused heavily on specialized, high-performance ether amine grades that comply with strict environmental and health regulations imposed by bodies like the EPA. Demand is strong in the oil and gas sector for enhanced oil recovery (EOR) chemicals and in advanced coatings for aerospace and defense applications. The region exhibits high adoption rates for innovative, low-VOC, and bio-based ether amines, reflecting a market trend prioritizing sustainability and technical superiority. Investments are concentrated in R&D and digitalizing existing production facilities to maximize efficiency and responsiveness to niche, high-specification customer demands.

- Europe: Europe is characterized by stringent regulatory environments (REACH), which significantly influence product development, pushing the market toward non-toxic, sustainable, and high-efficacy ether amines, particularly for marine, construction, and water-contact applications. The region is a leader in incorporating ether amines into advanced composite materials for the growing wind energy sector. While industrial growth is moderate compared to APAC, the emphasis on high-quality, durable, and certified materials ensures premium pricing and stable demand for specialized mono- and diether amines used in high-performance polyurethane and epoxy systems across Western Europe.

- Latin America (LATAM): LATAM is an emerging market with moderate growth potential, heavily influenced by cyclical economic stability in key countries like Brazil and Mexico. Demand is predominantly driven by the agriculture sector, where ether amines are used extensively as agrochemical adjuvants to improve crop protection effectiveness. The recovering construction sector and expanding automotive manufacturing base also contribute to steady demand for coatings and polyurethane components, although local production capacity remains limited, leading to high reliance on imports from North America and Asia.

- Middle East and Africa (MEA): The MEA region is a rapidly growing consumer, fundamentally driven by the enormous scale of oil, gas, and petrochemical operations across the Arabian Peninsula and North Africa. Ether amines are crucial for corrosion mitigation in pipelines and processing facilities. Significant investments in major construction and urbanization projects, particularly in the UAE and Saudi Arabia, further boost demand for protective coatings and industrial adhesives, making this region a key focus area for specialized chemical suppliers seeking robust, project-driven market expansion.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Ether Amine Market.- Huntsman Corporation

- BASF SE

- Clariant AG

- Eastman Chemical Company (Taminco)

- Monument Chemical

- Wanhua Chemical Group Co., Ltd.

- International Flavors & Fragrances (IFF)

- LyondellBasell Industries N.V.

- Jiangsu Tetra New Materials Co., Ltd.

- Shandong Zhaoxu Chemical Co., Ltd.

- Mitsubishi Gas Chemical Company, Inc.

- KPX Chemical Co., Ltd.

- Air Products and Chemicals, Inc.

- Cargill, Incorporated

- The Dow Chemical Company

- Recochem Corporation

- China Petrochemical Corporation (Sinopec)

- Zhejiang Jianli Chemical Co., Ltd.

- Shanghai Fine Chemical Co., Ltd.

- Henan Xinxiang Chemical Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Ether Amine market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary functions of ether amines in industrial applications?

Ether amines primarily function as versatile chemical intermediates, serving as high-performance curing agents for epoxy resins, essential chain extenders and cross-linkers in polyurethane systems, effective corrosion inhibitors in the oil and gas sector, and specialized surfactants/adjuvants in agrochemical formulations, leveraging their unique ether-amine structure for enhanced performance and durability.

Which end-use industry contributes the most to the Ether Amine market demand?

The Construction and Infrastructure sector is the largest contributor to ether amine demand globally. This is driven by the extensive use of these chemicals in high-solids protective coatings, industrial floor coatings, and the manufacturing of high-resilience polyurethane foams vital for insulation and structural integrity in modern building projects.

How is market volatility managed given the reliance on petrochemical feedstocks?

Market volatility, primarily stemming from fluctuating prices of propylene oxide (PO) and ethylene oxide (EO), is managed through strategic backward integration by major producers, long-term procurement contracts, and increasing investment in research focusing on cost-effective, sustainable, bio-based feedstock alternatives to mitigate dependence on conventional petrochemical inputs and stabilize production costs.

What technological advancements are driving product innovation in ether amines?

Key technological advancements include the development of highly selective, proprietary heterogeneous catalysts to improve reaction yields and purity, the customization of polyether backbones (EO/PO ratios) to fine-tune end-product performance, and the exploration of enzymatic synthesis methods for greener, lower-energy production of specialized, high-purity ether amine derivatives.

Which geographical region exhibits the fastest growth potential for the Ether Amine market?

The Asia Pacific (APAC) region demonstrates the fastest growth potential, driven by rapid urbanization, massive government investment in infrastructure development, booming industrial and automotive manufacturing sectors, and expanding regional production capacity for core chemical intermediates, particularly in China and India.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Ether Amine Market Size Report By Type (Poly Ether Amine MW 230, Poly Ether Amine MW 2000, Poly Ether Amine MW 400, Other), By Application (Epoxy Coating, Polyurea, Adhesives & Sealants, Fuel Additives), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Ether Amine Market Statistics 2025 Analysis By Application (Epoxy Coating, Polyurea, Adhesives & Sealants, Fuel Additives), By Type (Poly Ether Amine MW 230, Poly Ether Amine MW 2000, Poly Ether Amine MW 400, Other), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager