Ethyl Acrylate Ester Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442997 | Date : Feb, 2026 | Pages : 251 | Region : Global | Publisher : MRU

Ethyl Acrylate Ester Market Size

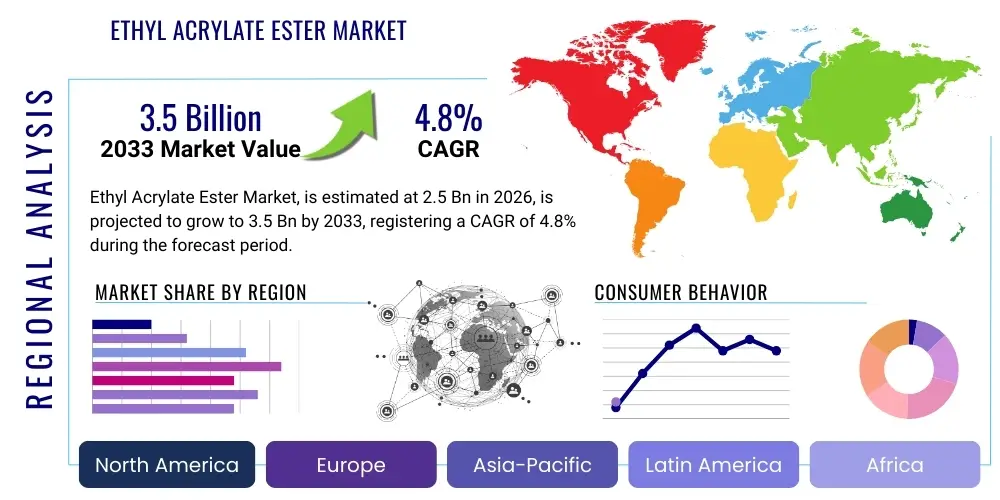

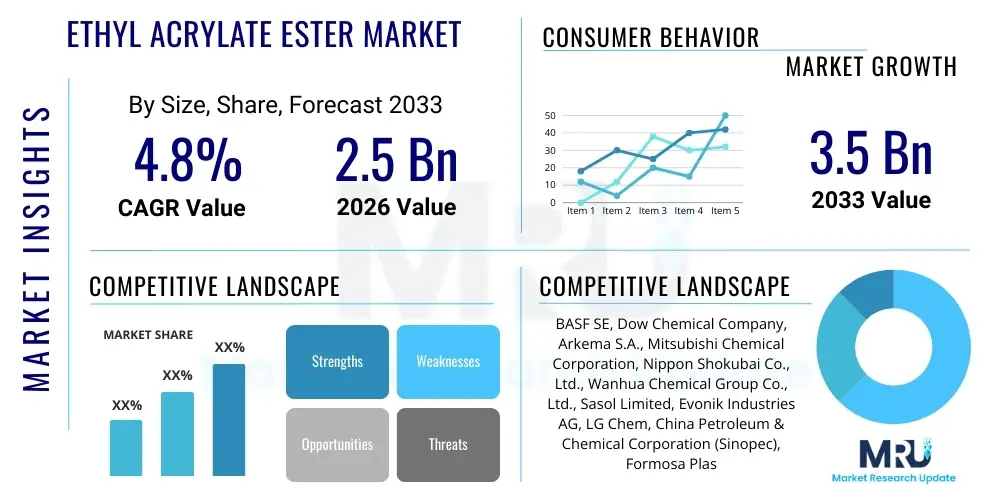

The Ethyl Acrylate Ester Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 2.5 Billion in 2026 and is projected to reach USD 3.5 Billion by the end of the forecast period in 2033.

Ethyl Acrylate Ester Market introduction

Ethyl acrylate ester (EA) is a colorless, volatile organic compound primarily synthesized via the esterification of acrylic acid with ethanol or through the oxidation of propylene. Recognized for its excellent flexibility, weather resistance, and strong adhesive properties, EA serves as a crucial intermediate chemical in the production of various polymers, including polyacrylates, elastomers, and latex emulsions. Its versatility across multiple industries, particularly in coatings and adhesives where performance and durability are paramount, cements its status as a foundational element in modern material science and chemical manufacturing processes. The global demand landscape is heavily influenced by construction spending and automotive production, which are the main consumers of EA-derived materials.

The core application sectors driving market expansion include architectural and industrial coatings, pressure-sensitive adhesives (PSAs), textiles, and plastics. In the coatings industry, EA is valued for enhancing film formation, improving gloss, and providing robust resistance to external environmental factors, making it indispensable for exterior paints and protective finishes. Simultaneously, the expanding use of high-performance adhesives in packaging and assembly applications necessitates a steady supply of EA monomers, driving substantial consumption growth in regions experiencing rapid industrialization and urbanization. Furthermore, the textile industry utilizes EA-based polymers for fabric finishing, enhancing characteristics such as drape, wrinkle resistance, and print quality, thereby widening the market scope beyond traditional chemical synthesis.

Key benefits associated with Ethyl Acrylate Ester include superior low-temperature flexibility, excellent resistance to UV degradation, and compatibility with a wide range of co-monomers, allowing for tailored polymer characteristics. Major driving factors for the market include the stringent regulatory push toward low-VOC (Volatile Organic Compound) and waterborne coatings, for which EA is a critical component, enabling formulators to meet environmental standards without compromising product performance. Additionally, the increasing population and corresponding rise in residential and commercial construction activities, particularly in the Asia Pacific region, contribute significantly to sustained market growth by fueling the demand for paints, sealants, and floor coverings.

Ethyl Acrylate Ester Market Executive Summary

The Ethyl Acrylate Ester Market is characterized by resilient demand fueled by recovery in global construction and automotive sectors post-pandemic, coupled with a notable shift toward sustainable and waterborne formulations in the coatings and adhesives industries. Business trends highlight strategic capacity expansions by major manufacturers in key production hubs, primarily China and the United States, aimed at securing supply chain stability and capitalizing on regional demand spikes. Furthermore, significant investment in research and development is focused on improving process efficiency, reducing production costs, and developing bio-based or renewable sources for feedstocks, aligning with broader corporate sustainability goals and investor mandates for environmentally conscious operations. The competitive landscape remains moderately consolidated, with emphasis on long-term supply agreements and specialized product grades.

Regional trends indicate that the Asia Pacific (APAC) region dominates the global market, driven by massive infrastructure projects, burgeoning manufacturing output, and high growth rates in consumer goods production, particularly in China and India. North America and Europe, while mature markets, demonstrate steady demand, largely supported by strict regulatory frameworks favoring high-performance, environmentally compliant products like waterborne acrylic emulsions derived from EA. These Western markets are also leading innovation in high-end specialty adhesives and sealants for aerospace and medical applications. Latin America and the Middle East & Africa (MEA) present emerging opportunities, characterized by growing industrialization and increasing foreign investment in construction, although market penetration is often constrained by volatile commodity pricing and geopolitical instability.

Segmentation trends reveal that the Coatings segment maintains the largest market share, directly benefiting from the renovation boom and expansion in industrial protective coatings. However, the Adhesives and Sealants segment is projected to exhibit the fastest growth rate, fueled by the rising adoption of pressure-sensitive and structural adhesives in flexible packaging, electronics assembly, and electric vehicle battery manufacturing, where lightweight and strong bonding materials are essential. Analyzing the end-user base, the construction sector remains the primary consumer, but the textiles and plastics industries are demonstrating robust, albeit smaller, incremental demand, driven by performance enhancement requirements in specialized product lines. The shift towards higher purity EA variants is also a notable trend, catering to sensitive applications like medical devices and pharmaceutical packaging.

AI Impact Analysis on Ethyl Acrylate Ester Market

User queries regarding AI's impact on the Ethyl Acrylate Ester market typically revolve around optimizing complex chemical processes, enhancing predictive maintenance capabilities for polymerization reactors, and streamlining supply chain logistics for raw materials like acrylic acid and ethanol. Key concerns include the initial capital investment required for implementing AI-driven control systems, the necessity of specialized data science talent within traditional chemical manufacturing facilities, and the security risks associated with interconnected operational technology (OT) systems. Users also express high expectations that AI could significantly improve reaction yield, reduce energy consumption in separation and purification stages, and accurately forecast fluctuating demand from volatile downstream sectors like automotive and construction, leading to optimized inventory management and minimized waste in highly regulated environments.

AI's primary influence is manifesting in the digitization of plant operations, moving beyond simple automation to prescriptive analytics. Machine learning algorithms are increasingly being deployed to analyze vast datasets pertaining to temperature, pressure, catalyst concentration, and flow rates in EA production. This allows manufacturers to dynamically adjust parameters in real-time, ensuring optimal reaction kinetics and product quality consistency, which is crucial for high-specification products used in aerospace or medical applications. Furthermore, AI-powered quality control systems can identify microscopic defects or impurities faster and more reliably than traditional testing methods, significantly reducing batch failure rates and improving overall operational efficiency.

In the commercial sphere, AI and advanced analytics are transforming market forecasting and strategic planning. By integrating external data (e.g., economic indicators, housing starts, automotive sales figures) with internal production metrics, AI models provide far more accurate predictions of future EA demand across different geographical and application segments. This capability enables companies to make precise decisions regarding feedstock procurement, contract negotiation, and capacity scheduling. The long-term impact is expected to stabilize the historically cyclical nature of commodity chemical pricing for EA, providing a more predictable investment environment and enhancing the competitive advantage of early adopters of these sophisticated analytical tools.

- AI-driven optimization of polymerization processes, leading to increased yield and reduced energy usage.

- Predictive maintenance schedules for EA manufacturing equipment, minimizing unexpected downtime and maximizing asset lifespan.

- Enhanced quality control using computer vision and machine learning for real-time impurity detection in final product streams.

- Optimized supply chain and logistics planning for feedstocks and finished EA products, mitigating raw material price volatility risk.

- Advanced market demand forecasting leveraging external economic data to inform production scheduling and inventory levels.

- Development of novel catalyst materials and formulation improvements through AI-guided combinatorial chemistry research.

DRO & Impact Forces Of Ethyl Acrylate Ester Market

The Ethyl Acrylate Ester market is significantly influenced by a dynamic interplay of Drivers (D), Restraints (R), and Opportunities (O), which collectively define the Impact Forces shaping its trajectory. A primary driver is the accelerating global shift toward eco-friendly, waterborne coatings and adhesives, as EA is a foundational monomer for these low-VOC formulations, mandated by environmental regulations in key regions like Europe and North America. Simultaneously, the restraints are predominantly centered around the volatility of raw material prices—specifically crude oil derivatives, which affect propylene and, subsequently, acrylic acid costs—creating substantial margin pressure for manufacturers. The primary opportunity lies in the rapid expansion of emerging economies, where construction and manufacturing growth exponentially increase the demand for high-performance acrylic polymers. These forces dictate investment decisions in capacity and R&D, focusing on feedstock diversification and process innovation.

The key drivers propelling the market include robust growth in the construction industry across APAC and the revitalization of the global automotive sector, both requiring vast amounts of acrylic coatings and sealants for protection and assembly. The inherent properties of EA, such as its excellent weatherability and flexibility, make it preferred over alternatives in demanding exterior applications. Conversely, the market faces significant restraints from the mature regulatory environment, which, while promoting sustainable products, also imposes strict limits on handling and storage of volatile monomers like EA, increasing operational complexities and compliance costs. Furthermore, the availability and competitive pricing of substitutes, such as vinyl acetate monomers (VAM) or other methacrylate esters, pose a constant constraint, particularly in price-sensitive, lower-performance applications.

The critical opportunities for market participants involve penetrating the burgeoning markets for specialty applications, such particularly in the field of lithium-ion battery components and medical device adhesives, where high purity and specialized physical properties are mandated. Developing sustainable production routes, such as utilizing bio-based ethanol or implementing catalytic conversion processes that minimize energy consumption, represents a significant avenue for competitive differentiation and meeting corporate sustainability goals. The collective impact forces push the industry toward greater efficiency, regulatory compliance, and geographical diversification, ensuring that investment is directed towards high-growth, high-value end-user segments while managing persistent cost and supply chain vulnerabilities inherent to petrochemical derivatives.

Segmentation Analysis

The Ethyl Acrylate Ester market is meticulously segmented based on end-use application, which defines product demand variability, and by regional consumption patterns, which highlight key growth territories and regulatory divergence. Understanding these segments is crucial for strategic resource allocation, product portfolio development, and maximizing market penetration. The primary segmentation criteria involve differentiating between coatings, adhesives and sealants, plastics, and textiles, reflecting the diverse polymerization outcomes achievable with the EA monomer. Each segment exhibits unique growth dynamics influenced by specific industry trends, such as infrastructure investment in coatings or consumer packaging innovation in adhesives. Furthermore, the classification by grade purity helps distinguish standard commodity EA from specialized, high-purity EA required for sensitive pharmaceutical or food contact materials.

- By Application:

- Coatings

- Architectural Coatings (Interior and Exterior)

- Industrial Protective Coatings

- Automotive Coatings (OEM and Refinish)

- Wood Coatings

- Adhesives and Sealants

- Pressure-Sensitive Adhesives (PSAs)

- Structural Adhesives

- Construction Sealants

- Packaging Adhesives

- Plastics and Polymers

- Impact Modifiers

- Elastomers

- Polymer Resins

- Textiles

- Fabric Finishing and Sizing

- Non-woven Binders

- Others (e.g., Medical Devices, Inks, Detergents)

- By Grade:

- Standard Grade

- High Purity Grade

- By Production Process:

- Propylene Oxidation Route (Preferred Industrial Scale)

- Esterification of Acrylic Acid

- By Region:

- North America (U.S., Canada, Mexico)

- Europe (Germany, UK, France, Italy, Spain, Rest of Europe)

- Asia Pacific (China, Japan, India, South Korea, Southeast Asia, Rest of APAC)

- Latin America (Brazil, Argentina, Rest of Latin America)

- Middle East & Africa (Saudi Arabia, UAE, South Africa, Rest of MEA)

Value Chain Analysis For Ethyl Acrylate Ester Market

The value chain for the Ethyl Acrylate Ester market begins with the upstream procurement of crucial petrochemical feedstocks, primarily propylene and ethanol, which are derived from crude oil refining and fermentation/chemical synthesis, respectively. Manufacturing complexity often centers around the conversion of propylene to acrylic acid, followed by the reaction with ethanol to yield Ethyl Acrylate. Key upstream activities involve managing feedstock price volatility, securing long-term supply contracts with petrochemical giants, and optimizing the catalytic processes used in acrylic acid production. The efficiency and cost-effectiveness at this initial stage significantly determine the final pricing and profitability of the downstream EA monomer, placing immense pressure on manufacturers to integrate backward or establish strategic partnerships to ensure competitive feedstock access.

The midstream phase involves the actual polymerization and chemical synthesis of the EA monomer, followed by purification, stabilization, and storage. Manufacturers focus heavily on maintaining high quality and grade purity, especially for specialized applications that require minimal inhibitors or contaminants. Distribution channels link production facilities to diverse downstream end-users. Direct distribution is common for large-volume customers like major multinational coatings producers or integrated polymer manufacturers, utilizing dedicated tanker trucks or rail cars. Indirect distribution, leveraging chemical distributors, regional warehouses, and specialized logistics providers, is crucial for reaching smaller enterprises, specialized formulators, and geographically dispersed markets where demand volumes do not justify direct supply.

The downstream sector represents the consumption points, encompassing end-use industries that formulate EA into finished products such as paints, adhesives, sealants, and textile binders. This phase is highly fragmented and characterized by application-specific innovation. Customers value technical support, customized blending capabilities, and reliable supply of specific monomer grades. The end-use application significantly dictates the required purity and volume, with coatings dominating the volume consumption and adhesives demonstrating high-growth potential. Successful players focus on building strong relationships with major formulators, often engaging in joint development initiatives to tailor polymer properties to meet evolving performance or regulatory requirements in the construction and automotive sectors.

Ethyl Acrylate Ester Market Potential Customers

The primary consumers and end-users of Ethyl Acrylate Ester are large chemical companies and specialized formulators operating within the coatings, adhesives, and polymer manufacturing industries. These customers purchase EA as a core building block chemical, incorporating it into complex polymer chains to impart desired properties like flexibility, adhesion strength, and environmental resistance. Major paint and coatings companies, for instance, utilize EA to create high-quality architectural paints that comply with increasingly strict low-VOC standards, seeking bulk quantities on long-term contracts. Similarly, multinational corporations specializing in adhesive technologies depend on high-purity EA to manufacture pressure-sensitive tapes and structural bonding agents essential for modern packaging and automotive assembly lines, prioritizing supply consistency and technical specifications over marginal price fluctuations.

Beyond these primary manufacturing clients, potential customers include textile treatment specialists who use EA-based emulsions for fabric finishing, enhancing features like durability and hand feel, particularly in technical textiles and non-woven fabrics used in medical and hygiene products. The plastics industry constitutes another significant customer base, utilizing EA as an impact modifier to improve the resilience and strength of rigid polymers, such as PVC. These customers are generally seeking reliable technical partnerships and tailored material specifications to ensure seamless integration into existing production lines, focusing on efficiency and compliance with consumer product safety regulations in diverse geographical markets.

Emerging and niche markets present specialized customer segments that are crucial for future growth. These include manufacturers in the electronics sector, who require specialized sealants for device assembly and display lamination, and the fast-growing electric vehicle (EV) battery manufacturing segment, which needs high-performance, heat-resistant adhesives and sealants. Additionally, pharmaceutical and medical device companies constitute high-value customers, demanding ultra-high purity EA grades for applications like drug-eluting coatings or biocompatible medical adhesives, where regulatory approval and material traceability are non-negotiable prerequisites for long-term supply partnerships.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.5 Billion |

| Market Forecast in 2033 | USD 3.5 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | BASF SE, Dow Chemical Company, Arkema S.A., Mitsubishi Chemical Corporation, Nippon Shokubai Co., Ltd., Wanhua Chemical Group Co., Ltd., Sasol Limited, Evonik Industries AG, LG Chem, China Petroleum & Chemical Corporation (Sinopec), Formosa Plastics Corporation, Dairen Chemical Corporation, Sibur Holding, Hexion Inc., Showa Denko K.K., Hanwha Solutions, Momentive Performance Materials Inc., Lucite International (Mitsubishi Chemical), Jiangsu Jurong Chemical, Guangdong Xinhuayuan Fine Chemical. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Ethyl Acrylate Ester Market Key Technology Landscape

The production of Ethyl Acrylate Ester is predominantly reliant on established catalytic processes, with the most dominant being the propylene oxidation route, often referred to as the integrated route, where propylene is oxidized to acrylic acid, which is then esterified with ethanol. This established technology benefits from economies of scale and high throughput, making it the standard for bulk commodity production. Technological advancements in this area focus primarily on improving catalyst selectivity and longevity to enhance yield, reduce side product formation, and minimize energy consumption during the separation and purification stages. Research efforts are also dedicated to process intensification, utilizing microreactor technology or advanced distillation column designs to achieve continuous, highly efficient production cycles with lower environmental footprints.

A significant area of technological evolution is the increasing focus on sustainable and green chemistry alternatives. This includes the exploration and commercialization of bio-based routes, specifically using bio-ethanol derived from renewable feedstocks (like sugarcane or corn) to react with acrylic acid. While the costs associated with bio-based EA remain generally higher than petrochemical-derived EA, advancements in biocatalysis and fermentation technology are steadily narrowing this gap. Furthermore, innovative research is being conducted into utilizing supercritical fluid technology or membrane separation processes for purification, which promises to drastically reduce the energy required compared to conventional thermal separation methods, thereby contributing to the industry's sustainability goals and reducing operational expenditures.

In the application technology landscape, the key trends involve developing advanced polymerization techniques to create tailored EA co-polymers. Specifically, manufacturers are focusing on controlled radical polymerization (CRP) methods, such as Atom Transfer Radical Polymerization (ATRP) or Reversible Addition-Fragmentation Chain Transfer (RAFT) polymerization. These sophisticated techniques allow for precise control over the polymer architecture, molecular weight distribution, and functionality, leading to superior performance characteristics in end-products, particularly high-solids or solvent-free acrylic dispersions. This technological shift enables the formulation of next-generation coatings and adhesives that offer enhanced durability, faster curing times, and superior adhesion to challenging substrates, thus expanding EA's utility into high-value specialty markets.

Regional Highlights

- Asia Pacific (APAC): Dominates the global Ethyl Acrylate Ester market share, primarily driven by robust growth in construction, infrastructure development, and manufacturing hubs in China, India, and Southeast Asia. The region exhibits a high volume demand for commodity grades used in mass-market architectural coatings and standard packaging adhesives. Future growth is anticipated to be extremely high due to ongoing urbanization and rising disposable incomes driving consumer goods production, necessitating higher quality paints and specialty chemicals.

- North America: Characterized by a mature market with stable, moderate growth, largely focused on high-performance and specialty EA applications. Demand is strongly supported by strict environmental regulations (e.g., EPA mandates) that favor the shift from solvent-borne to waterborne acrylic emulsions. Key consumers include the automotive refinish market and high-end industrial protective coatings for infrastructure and oil & gas facilities. Innovation in sustainable sourcing and advanced polymerization techniques is concentrated here.

- Europe: Exhibits steady, regulated growth, driven by stringent REACH regulations and a strong commitment to circular economy principles, which encourages the adoption of bio-based and low-VOC EA derivatives. Germany, France, and Italy are major consumption centers, primarily serving advanced manufacturing, high-value consumer goods, and sophisticated coatings for aerospace and maritime industries. Manufacturers prioritize efficiency and sustainable sourcing to meet EU mandates and maintain competitiveness against global imports.

- Latin America (LATAM): Represents an emerging market with significant volatility, heavily influenced by economic stability and commodity cycles in Brazil and Mexico. The construction sector remains the largest consumer, benefiting from population growth and government infrastructure spending. Market penetration is often challenging due to logistical complexities, but the long-term potential remains high, particularly as domestic manufacturing capacities increase and foreign direct investment in automotive assembly rises.

- Middle East & Africa (MEA): Currently holds the smallest share but offers niche opportunities driven by large-scale construction projects in the GCC countries (Saudi Arabia, UAE) and industrialization in South Africa. Demand is concentrated in industrial coatings for energy infrastructure and protective paints for harsh desert environments. Market growth is closely tied to oil price stability, which impacts both regional wealth and the cost of petrochemical feedstocks.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Ethyl Acrylate Ester Market.- BASF SE

- Dow Chemical Company

- Arkema S.A.

- Mitsubishi Chemical Corporation

- Nippon Shokubai Co., Ltd.

- Wanhua Chemical Group Co., Ltd.

- Sasol Limited

- Evonik Industries AG

- LG Chem

- China Petroleum & Chemical Corporation (Sinopec)

- Formosa Plastics Corporation

- Dairen Chemical Corporation

- Sibur Holding

- Hexion Inc.

- Showa Denko K.K.

- Hanwha Solutions

- Momentive Performance Materials Inc.

- Lucite International (Mitsubishi Chemical)

- Jiangsu Jurong Chemical

- Guangdong Xinhuayuan Fine Chemical

- Taihe Chemical Industry (China)

- Shanghai Huayi (Group) Company

- TCI Chemicals (India) Pvt. Ltd.

- Fujian Refining and Petrochemical Company

- Sumitomo Chemical Co., Ltd.

- Inneos Solutions (Ineos Group)

- TSRC Corporation

- Kao Corporation

- Perstorp Holding AB

- Reliance Industries Limited (RIL)

- Marubeni Corporation (Trading/Distribution)

- Kuraray Co., Ltd.

- Zhejiang Satellite Petrochemical Co., Ltd.

- Tianjin Beiyang Chemical Group

- Mitsui Chemicals, Inc.

- COVESTRO AG

- SK Global Chemical Co., Ltd.

- Air Products and Chemicals, Inc.

- Nanya Plastics Corporation

- PTT Global Chemical Public Company Limited

- Versalis S.p.A. (Eni Group)

- ExxonMobil Chemical Company

- Bayer MaterialScience (Now Covestro)

- SABIC (Saudi Basic Industries Corporation)

- LyondellBasell Industries N.V.

- Chemours Company

- Solvay S.A.

- Sichuan Lutianhua Co., Ltd.

- Hangzhou Oleochemicals Co., Ltd.

- Jilin Chemical Industrial Co., Ltd.

- Shanxi Sanwei Group Co., Ltd.

- Yankuang Group Co., Ltd.

- Chongqing Jianfeng Chemical Co., Ltd.

- Sino-Science & Technology Co., Ltd.

- Anhui Wotu Chemical Co., Ltd.

- Hebei Jinsui Chemical Co., Ltd.

- Shandong Dongchen Chemical Co., Ltd.

- Zibo Qixiang Tengda Chemical Co., Ltd.

- Jiangsu Changbao Steamed Bread Chemical Co., Ltd.

- Ningbo Juhua Chemical Co., Ltd.

- Yangzhou Chengde Chemical Co., Ltd.

- Suzhou Huayi Chemical Co., Ltd.

- Wuxi Yangshan Chemical Co., Ltd.

- Shanghai Gaoqiao Petrochemical Co., Ltd.

- Jinan Yuansheng Chemical Co., Ltd.

- Qingdao Haiwan Chemical Co., Ltd.

- Zhenjiang Lihua Chemical Co., Ltd.

- Taicang Liyuan Chemical Co., Ltd.

- Guangzhou Li-Feng Chemical Co., Ltd.

- Foshan Huifeng Chemical Co., Ltd.

- Dalian Chemicals Co., Ltd.

- Shijiazhuang Chemical Co., Ltd.

- Tianjin Bohai Chemical Group

- Weifang Yaxing Chemical Co., Ltd.

- Liaoning Huajin Chemical Co., Ltd.

- Hubei Yihua Group Co., Ltd.

- Yunnan Yuntianhua Co., Ltd.

- China National Offshore Oil Corporation (CNOOC)

- China National Chemical Corporation (ChemChina)

- Zhejiang Jinke Chemical Co., Ltd.

- Henan Xinxiang Chemical Co., Ltd.

- Guangxi Beihai Chemical Co., Ltd.

- Inner Mongolia Yitai Group Co., Ltd.

- Jiangxi Copper Corporation

Frequently Asked Questions

Analyze common user questions about the Ethyl Acrylate Ester market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Ethyl Acrylate Ester and its primary uses?

Ethyl Acrylate Ester (EA) is a colorless, volatile chemical monomer primarily used as a foundational building block for synthesizing acrylic polymers. Its main applications are in the formulation of high-performance waterborne coatings, pressure-sensitive adhesives (PSAs), sealants, and textile sizing agents, valued for imparting flexibility and weather resistance to end products.

Which geographical region dominates the consumption of Ethyl Acrylate Ester?

The Asia Pacific (APAC) region, led by China and India, currently dominates the global Ethyl Acrylate Ester market consumption. This dominance is driven by rapid urbanization, massive infrastructure projects, and the large-scale production demands of the regional construction, automotive, and manufacturing sectors.

What are the key drivers impacting the market growth?

The primary drivers are the stringent global regulatory shifts promoting low-VOC (Volatile Organic Compound) and waterborne coatings, for which EA is essential, coupled with strong, sustained growth in global residential and commercial construction activities, increasing demand for durable paints and sealants.

How does raw material volatility affect the price of Ethyl Acrylate Ester?

EA production relies heavily on petrochemical feedstocks, mainly propylene derived from crude oil. Fluctuations in crude oil prices directly influence the cost of acrylic acid, the immediate precursor to EA. This correlation leads to high price volatility for the finished EA monomer, impacting manufacturer margins and requiring robust hedging strategies.

What future technological trends are shaping the production of EA?

Future technological trends focus on sustainability and efficiency, including the commercialization of bio-based Ethyl Acrylate using bio-ethanol feedstocks, and advancements in polymerization techniques like Controlled Radical Polymerization (CRP) to create advanced, tailor-made acrylic co-polymers with superior performance characteristics for specialized industrial applications.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager