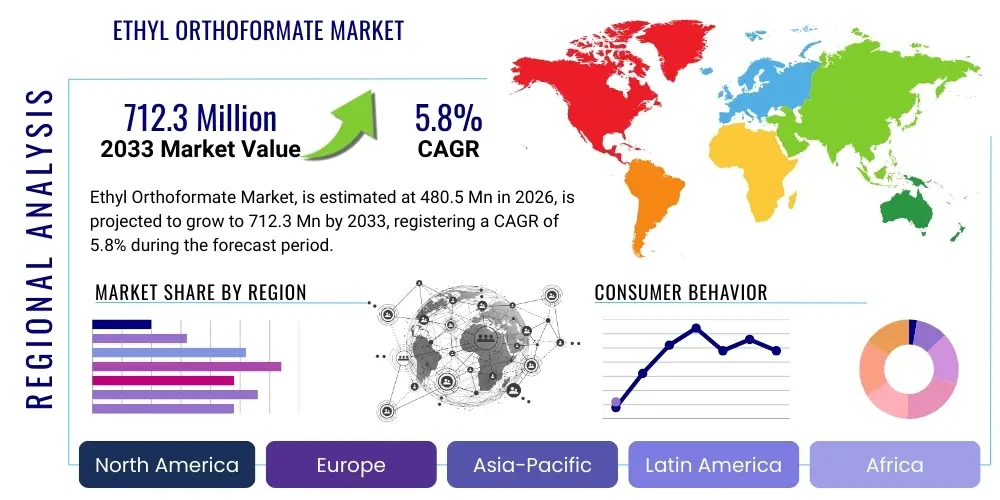

Ethyl Orthoformate Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443217 | Date : Feb, 2026 | Pages : 251 | Region : Global | Publisher : MRU

Ethyl Orthoformate Market Size

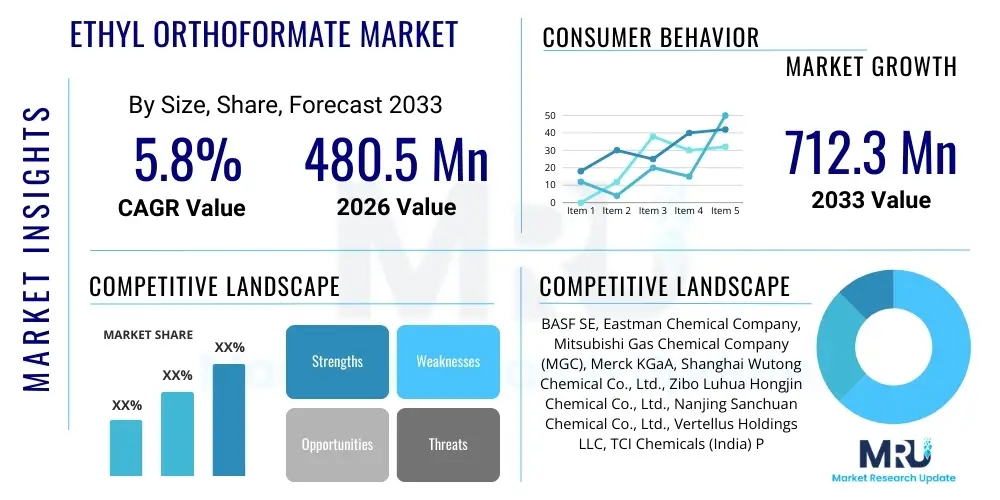

The Ethyl Orthoformate Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at $480.5 Million USD in 2026 and is projected to reach $712.3 Million USD by the end of the forecast period in 2033.

Ethyl Orthoformate Market introduction

Ethyl Orthoformate (EOF), chemically represented as C2H5OCH(OC2H5)2, is a colorless liquid characterized by its distinct ether-like odor and low toxicity. It serves as a crucial intermediate in organic synthesis, playing a vital role in the production of various complex chemical compounds. Historically, EOF has been essential in processes requiring the introduction of formyl groups or the protection of carbonyl functionalities, making it indispensable across several high-value industries. Its high reactivity and efficiency in cyclization reactions further solidify its standing as a foundational chemical building block.

The primary applications of Ethyl Orthoformate span pharmaceuticals, agrochemicals, and the specialty chemical sector, including fragrances and flavoring agents. In the pharmaceutical industry, EOF is key in synthesizing complex ring structures, anti-malarial drugs, and specific vitamins, driven by the stringent purity requirements of cGMP manufacturing. The agrochemical sector utilizes EOF for creating herbicides and fungicides, enhancing crop yield and protection against pests and diseases globally. The demand for higher purity grades of EOF directly correlates with the increasing regulatory scrutiny and the need for precision chemical synthesis in these end-use markets.

Key driving factors propelling the Ethyl Orthoformate market growth include the robust expansion of the global pharmaceutical manufacturing landscape, particularly in emerging economies, and the continuous innovation in the agricultural sector demanding advanced agrochemical solutions. Additionally, the rising consumption of specialty chemicals in textiles and functional materials, where EOF derivatives act as crucial catalysts or intermediates, contributes significantly to market momentum. The versatility and established efficiency of EOF in varied synthetic routes ensure its continued relevance despite emerging alternatives.

Ethyl Orthoformate Market Executive Summary

The Ethyl Orthoformate market exhibits stable expansion driven primarily by accelerated pharmaceutical synthesis and the intensifying global demand for advanced agrochemicals. Business trends indicate a strategic focus on backward integration among major manufacturers to secure stable access to ethanol and carbon monoxide feedstocks, mitigating supply chain volatility. Innovation is centered around developing high-purity (>99.5%) grades tailored for sensitive drug manufacturing applications and exploring greener synthesis pathways to comply with evolving environmental regulations, particularly in Europe and North America. Strategic collaborations between chemical producers and pharmaceutical giants are increasingly defining market dynamics, ensuring tailored product supply and quality assurance.

Regional trends highlight Asia Pacific (APAC) as the fastest-growing market, primarily fueled by the massive expansion of the chemical and pharmaceutical industries in China and India, benefiting from lower production costs and increasing local consumption. North America and Europe maintain significant market shares, characterized by high-value applications, stringent regulatory frameworks, and a focus on R&D for novel drug formulations. The European market, in particular, is navigating the complexities of REACH regulations, pushing manufacturers towards sustainable and safer production methods for EOF.

Segment trends reveal that the Pharmaceutical application segment dominates the market in terms of value, owing to the high price point of clinical-grade EOF and the critical nature of its application in drug synthesis. The purity segment shows a distinct trend favoring the >99.5% grade, reflecting the industry shift toward quality-centric manufacturing practices across all end-user sectors. Furthermore, the textile additives segment, though smaller, is showing steady growth as specialized finishes and dyes increasingly rely on EOF derivatives, suggesting diversification opportunities for chemical suppliers.

AI Impact Analysis on Ethyl Orthoformate Market

User queries regarding the impact of Artificial Intelligence (AI) on the Ethyl Orthoformate market predominantly revolve around optimizing production efficiency, enhancing safety protocols, and accelerating application discovery. Users are keenly interested in how machine learning algorithms can predict optimal reaction conditions, specifically for the synthesis of EOF and its downstream derivatives, leading to reduced waste and higher yield. Furthermore, there is significant interest in AI's role in computational chemistry to rapidly screen for novel drug candidates or agrochemical compounds that utilize EOF as a precursor, thereby potentially increasing the market demand for specific EOF grades. Concerns often center on the initial investment costs associated with implementing AI-driven automation in traditional chemical plants and the need for specialized data infrastructure to support predictive modeling.

- AI-driven optimization of EOF synthesis parameters (temperature, pressure, catalyst concentration) to maximize yield and purity.

- Predictive maintenance analytics applied to chemical reactors and distillation columns, reducing unplanned downtime and enhancing operational safety.

- Machine learning models for feedstock price forecasting, enabling strategic procurement of ethanol and formamide derivatives.

- Accelerated discovery of novel agrochemical and pharmaceutical molecules utilizing EOF through computational chemistry and virtual screening.

- Automation of quality control and purity testing processes using computer vision and analytical data pattern recognition.

- Enhanced supply chain visibility and risk management using AI to track regulatory compliance and transport risks globally.

DRO & Impact Forces Of Ethyl Orthoformate Market

The Ethyl Orthoformate market is characterized by a complex interplay of internal growth drivers, external constraints, and strategic opportunities, shaped by significant impact forces. The primary driver is the burgeoning global demand for specialized pharmaceuticals, where EOF is integral for creating highly potent APIs (Active Pharmaceutical Ingredients) and crucial intermediates. This is synergized by the consistent growth in the agrochemical industry, particularly the need for effective, third-generation herbicides and insecticides that rely on EOF derivatives. Simultaneously, the market faces significant restraints, chiefly regulatory hurdles related to chemical handling and manufacturing environmental standards, especially concerning wastewater and air emissions. Furthermore, the reliance on petroleum-derived raw materials and the resultant price volatility poses a perennial challenge to stable operational planning and cost structure management across the industry.

Strategic opportunities reside primarily in process innovation and geographical expansion. Opportunities for growth include developing bio-based or greener synthesis routes for EOF, reducing reliance on traditional feedstocks and potentially qualifying for environmentally conscious procurement mandates. Geographically, exploring untapped markets in Southeast Asia and Africa, where pharmaceutical and agricultural investments are escalating, presents a viable avenue for sustained market expansion. Leveraging technologies like continuous flow chemistry can also enhance production safety and efficiency, making EOF more competitive against substitute compounds.

Key impact forces shaping the market trajectory involve global macroeconomic shifts and environmental pressures. Supply chain disruptions, exemplified by recent global logistics bottlenecks, directly impact the delivery timeline and cost of raw materials and finished EOF products. Regulatory amendments, such as stricter limits on certain chemical residues in agricultural products, continuously influence the formulation requirements, demanding higher purity and specialized grades of EOF. Furthermore, increasing consumer awareness and preference for sustainable and bio-based ingredients compel manufacturers to invest in environmentally friendly production methods, influencing long-term investment decisions and operational strategies.

Segmentation Analysis

The Ethyl Orthoformate market segmentation provides a granular understanding of the dynamics across different product specifications and end-use sectors, crucial for targeted marketing and strategic investment. The market is typically segmented based on purity level and application, reflecting the heterogeneous demands placed on this chemical intermediate. Purity is a critical differentiator, particularly for the pharmaceutical sector, which mandates stringent quality control and certified grades. The application matrix illustrates the diverse utility of EOF, ranging from high-volume agricultural usage to specialized fine chemical synthesis for high-end fragrance components.

Understanding the interplay between purity and application is vital. For instance, the >99.5% purity segment commands a significant price premium due to its requirement in sensitive pharmaceutical processes where even trace impurities can compromise product integrity or regulatory compliance. Conversely, the standard 99% purity grade serves bulk industrial applications, such as textile finishing agents and general organic synthesis, where cost efficiency often outweighs ultra-high purity requirements. This clear demarcation allows manufacturers to optimize production capabilities and pricing strategies tailored to specific market needs and regulatory frameworks.

The rapid growth of the agrochemicals sector, especially in developing regions, continues to drive volume demand for EOF, while the steady, high-value demand from the pharmaceutical sector ensures stable revenue streams for high-purity suppliers. Furthermore, specialty applications, including its use as a desiccant or as an intermediate in producing high-tech polymers, represent niche but growing opportunities that contribute to the overall resilience and diversification of the Ethyl Orthoformate market structure.

- By Purity:

- 99%

- >99.5%

- By Application:

- Pharmaceuticals

- Agrochemicals

- Fragrances & Flavoring Agents

- Textile Additives

- Others (Desiccants, specialty polymers)

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East and Africa (MEA)

Value Chain Analysis For Ethyl Orthoformate Market

The value chain for Ethyl Orthoformate is characterized by a linear progression starting from basic raw material sourcing to specialized downstream applications. Upstream analysis involves the procurement of key precursors, primarily ethanol (from fermentation or petroleum sources) and carbon monoxide or specialized formamide derivatives. Raw material supply stability and pricing volatility, especially concerning ethanol, significantly influence the final manufacturing costs of EOF. Manufacturers often invest heavily in efficient catalytic processes and reactor design to ensure high conversion rates and minimize feedstock consumption, thereby optimizing the initial stages of the value chain.

Midstream activities encompass the actual synthesis, purification, and quality control of Ethyl Orthoformate. Production typically involves reacting ethanol with carbon monoxide under specific conditions, followed by rigorous distillation and purification steps, especially for high-purity pharmaceutical grades. Key players differentiate themselves through proprietary manufacturing technologies that enhance yield, reduce waste products, and ensure compliance with global quality standards like ISO and cGMP. Logistics and storage are crucial at this stage, as EOF requires careful handling due to its volatile nature.

Downstream analysis focuses on distribution channels and end-user consumption. Direct distribution channels are prevalent for large-volume customers, such as major pharmaceutical companies or large agrochemical manufacturers, often involving long-term supply contracts. Indirect channels utilize specialized chemical distributors and regional agents to reach smaller formulators, R&D labs, and specialty chemical producers. The end-users—pharmaceutical, agrochemical, and fragrance industries—integrate EOF into their complex synthesis processes, confirming the product's role as a critical intermediate, highly sensitive to quality and reliable delivery.

Ethyl Orthoformate Market Potential Customers

The primary customer base for Ethyl Orthoformate resides within industries requiring precision chemical intermediates for synthesis, placing pharmaceutical companies and agrochemical formulators at the forefront. Pharmaceutical manufacturers utilize EOF as a pivotal reagent in the synthesis of diverse drug classes, including antivirals, antifungals, and various heterocyclic compounds essential for therapeutic efficacy. These customers require ultra-high purity (>99.5%) grades, strict batch consistency, and extensive regulatory documentation (e.g., Drug Master Files or DMFs) to ensure their final products meet clinical standards and regulatory approvals. Their purchasing decisions are heavily weighted by supplier reliability, quality assurance certifications, and the ability to scale production rapidly.

Agrochemical companies form the second largest segment of customers, using EOF derivatives like diethyl ethoxymethylenemalonate (DEMM) to synthesize a broad spectrum of herbicides, fungicides, and insecticides. These clients prioritize cost-effectiveness and stability of supply, given the high volumes required for large-scale agricultural production cycles. They seek suppliers who can offer competitive pricing while maintaining sufficient purity levels appropriate for agricultural applications. The procurement needs in this sector are cyclical, often aligning with planting and growing seasons across different geographies.

Additionally, specialty chemical manufacturers, particularly those focusing on fragrances, flavorings, and textile treatments, represent a growing segment of potential customers. In the fragrance industry, EOF is used to create specific acetals and orthoesters that contribute to high-fidelity odor profiles. Textile manufacturers use EOF derivatives as functional monomers or cross-linking agents to impart special properties like enhanced wrinkle resistance or color fastness. These customers often procure smaller, customized batches, valuing supplier flexibility and specific technical support for novel application development.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $480.5 Million USD |

| Market Forecast in 2033 | $712.3 Million USD |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | BASF SE, Eastman Chemical Company, Mitsubishi Gas Chemical Company (MGC), Merck KGaA, Shanghai Wutong Chemical Co., Ltd., Zibo Luhua Hongjin Chemical Co., Ltd., Nanjing Sanchuan Chemical Co., Ltd., Vertellus Holdings LLC, TCI Chemicals (India) Pvt. Ltd., Kanto Chemical Co., Inc., Spectrum Chemical Manufacturing Corp., J&K Scientific Ltd., Alfa Aesar (Thermo Fisher Scientific), Parchem fine & specialty chemicals, Central Drug House (P) Ltd., Finar Chemicals |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Ethyl Orthoformate Market Key Technology Landscape

The manufacturing of Ethyl Orthoformate traditionally relies on classical chemical synthesis involving the reaction of ethanol with carbon monoxide or hydrogen cyanide derivatives under specific conditions, such as the use of an acid catalyst. The primary established process involves the transesterification of methyl orthoformate or the reaction of chloroform with sodium ethoxide. Technological advancements in this traditional landscape focus heavily on process intensification, specifically optimizing catalyst efficiency and reaction conditions (temperature and pressure) to improve selectivity and yield, thereby reducing energy consumption and byproduct formation. The shift towards higher purity requirements necessitates sophisticated distillation techniques, including fractional and reactive distillation, integrated with highly sensitive analytical instruments like Gas Chromatography (GC) to ensure contaminants are below parts per million (ppm) levels.

A critical emerging area in the technology landscape is the exploration of greener and more sustainable synthesis routes. Manufacturers are actively investigating catalytic methodologies that utilize heterogeneous catalysts, which are easier to separate and recycle than traditional homogeneous catalysts, minimizing liquid waste streams. Furthermore, research into continuous flow chemistry is gaining traction. Unlike traditional batch processing, continuous flow reactors allow for precise control over reaction parameters, enhancing safety (especially when dealing with volatile intermediates) and significantly improving productivity per unit volume, aligning with modern operational excellence targets and environmental responsibility.

Another technological thrust involves integrating advanced automation and digitalization into production facilities. This includes utilizing sensors and real-time data monitoring (Internet of Things or IoT) to track process variables and adjust controls dynamically, leading to more consistent product quality and reduced human error. Future technological trajectories also include the development of bio-catalytic routes, although these are currently at an early stage of research, offering the potential to derive EOF precursors from renewable biomass, moving the industry further away from fossil fuel dependence and ensuring long-term sustainability and compliance with global environmental mandates.

Regional Highlights

The global Ethyl Orthoformate market exhibits significant regional disparities in terms of consumption, production capacity, and growth trajectories, primarily influenced by industrial maturity and regulatory environments.

- Asia Pacific (APAC): APAC is the dominant and fastest-growing region, driven by robust domestic demand from India and China. These countries serve as global manufacturing hubs for generic pharmaceuticals and agrochemicals. The low operational costs and expanding domestic agricultural needs fuel massive volume consumption. Regulatory standards are evolving, pushing local manufacturers towards higher quality, particularly in EOF used for export-oriented pharmaceutical production.

- North America: Characterized by high-value, stringent quality requirements, North America focuses on high-purity EOF primarily for advanced research and proprietary drug synthesis. The market growth is stable, driven by continuous innovation in specialty pharmaceuticals and strict adherence to cGMP manufacturing protocols. Investment is focused on integrating efficient, small-scale specialty chemical production methods.

- Europe: Europe maintains a strong market share, heavily influenced by strict environmental policies, notably REACH. European demand is sophisticated, prioritizing sustainable manufacturing and certified product origins. The region is a key consumer for high-purity grades required by established pharmaceutical giants and specialized fine chemical industries.

- Latin America: Growth in Latin America is primarily tied to the expansion of its agricultural sector, demanding increased volumes of agrochemicals. Brazil and Argentina are key markets where EOF is used in synthesizing herbicides and pesticides to enhance crop productivity. Market expansion is dependent on regional economic stability and government support for agricultural modernization.

- Middle East and Africa (MEA): MEA represents an emerging market with potential driven by increasing local investment in pharmaceutical manufacturing, particularly in countries like Saudi Arabia and South Africa. Current market activity is relatively smaller, relying heavily on imports, but planned infrastructure development suggests future growth opportunities in local formulation and chemical distribution.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Ethyl Orthoformate Market.- BASF SE

- Eastman Chemical Company

- Mitsubishi Gas Chemical Company (MGC)

- Merck KGaA

- Shanghai Wutong Chemical Co., Ltd.

- Zibo Luhua Hongjin Chemical Co., Ltd.

- Nanjing Sanchuan Chemical Co., Ltd.

- Vertellus Holdings LLC

- TCI Chemicals (India) Pvt. Ltd.

- Kanto Chemical Co., Inc.

- Spectrum Chemical Manufacturing Corp.

- J&K Scientific Ltd.

- Alfa Aesar (Thermo Fisher Scientific)

- Parchem fine & specialty chemicals

- Central Drug House (P) Ltd.

- Finar Chemicals

Frequently Asked Questions

Analyze common user questions about the Ethyl Orthoformate market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary drivers of Ethyl Orthoformate market growth?

The market is primarily driven by the escalating demand for high-quality chemical intermediates in the global pharmaceutical industry for drug synthesis and the steady growth of the agrochemical sector requiring effective pesticide and herbicide formulations. Expansion in Asia Pacific manufacturing capacity also serves as a major growth catalyst.

Which purity grade of Ethyl Orthoformate holds the highest market value?

The >99.5% purity grade commands the highest market value due to its mandatory use in the sensitive synthesis of Active Pharmaceutical Ingredients (APIs) and specialty fine chemicals, where regulatory compliance and product efficacy depend entirely on minimizing trace impurities.

How do regulatory changes impact the production and trade of Ethyl Orthoformate?

Regulatory changes, such as the European REACH framework and stricter cGMP standards, necessitate significant investment in process safety, environmental controls, and purity testing. This increases operational costs but also raises the barrier to entry, favoring established manufacturers with robust compliance programs.

What is the role of Ethyl Orthoformate in the agrochemical industry?

In the agrochemical industry, Ethyl Orthoformate serves as a key intermediate for synthesizing various complex organic structures, including essential heterocyclic compounds found in advanced herbicides, fungicides, and insecticides, ensuring enhanced crop protection and yield.

Which region is expected to show the fastest growth in the Ethyl Orthoformate market?

The Asia Pacific (APAC) region is projected to exhibit the fastest growth, primarily due to expanding domestic pharmaceutical and agricultural industries in economies like China and India, coupled with increasing investments in large-scale chemical manufacturing infrastructure.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Methyl Orthoformate Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Ethyl Orthoformate Market Statistics 2025 Analysis By Application (Drug, Pesticide), By Type (Hydrocyanic Acid Method, Sodium Metal Method), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Methyl Orthoformate Market Statistics 2025 Analysis By Application (Pesticides, Pharmaceuticals), By Type (Hydrocyanic Acid Method, Sodium Metal Method), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager