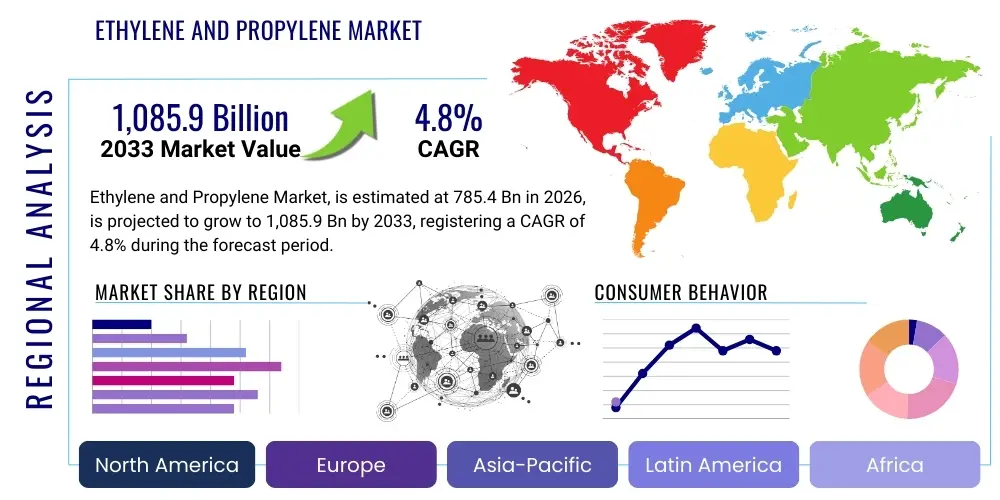

Ethylene and Propylene Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441630 | Date : Feb, 2026 | Pages : 257 | Region : Global | Publisher : MRU

Ethylene and Propylene Market Size

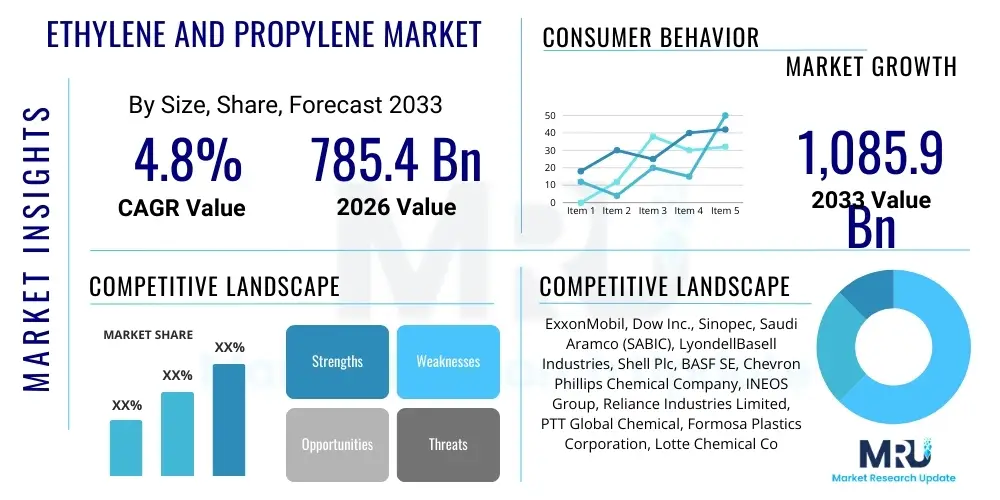

The Ethylene and Propylene Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at $785.4 Billion in 2026 and is projected to reach $1,085.9 Billion by the end of the forecast period in 2033. This robust growth trajectory is underpinned by increasing global demand for plastic derivatives, particularly in emerging economies, coupled with significant investments in refinery and petrochemical complexes aimed at optimizing feedstock utilization. The expansion of downstream industries, including packaging, automotive, and construction, continues to be a primary catalyst for capacity utilization across major producing regions.

Ethylene and propylene are fundamental building blocks of the chemical industry, often referred to as primary petrochemicals. Their market size is directly correlated with global industrial output and consumer spending patterns. While ethylene primarily serves the polyethylene (PE) sector, dominating applications in films and moldings, propylene is essential for polypropylene (PP), which is widely utilized in high-performance engineering plastics, textiles, and automotive components. The integration of advanced manufacturing processes and the shift towards bio-based alternatives present both opportunities and challenges that shape the valuation and volume of this massive commodity market.

The valuation reflects not only the physical volume of production but also the high capital intensity of olefin production facilities, such as steam crackers and dehydrogenation units. Furthermore, the market size calculation incorporates the volatility induced by fluctuating feedstock costs—primarily naphtha, ethane, and propane—which are intrinsically linked to crude oil and natural gas prices. Strategic regional capacity additions, notably in North America (due to shale gas abundance) and the Middle East (due to low-cost associated gas), are continuously reshaping the competitive landscape and contributing to the overall market valuation expansion over the forecast horizon.

Ethylene and Propylene Market introduction

Ethylene and Propylene are the two most crucial base chemicals globally, serving as essential feedstocks for a vast array of downstream petrochemical products that permeate modern industrial and consumer life. Ethylene, the simplest alkene, is primarily produced via the steam cracking of hydrocarbon feedstocks ranging from ethane to naphtha and gas oil, yielding key derivatives such as polyethylene (PE), ethylene oxide (EO), ethylene dichloride (EDC), and vinyl acetate monomer (VAM). Propylene, the second simplest olefin, is obtained mainly as a co-product of steam cracking and refining processes (Fluid Catalytic Cracking - FCC), alongside dedicated on-purpose routes like Propane Dehydrogenation (PDH). The market is characterized by high operational complexity, significant capital expenditure, and strong cyclicality tied to global economic health.

Major applications of these olefins span multiple sectors. Ethylene derivatives are indispensable for flexible and rigid packaging (PE), antifreeze and solvents (EO/MEG), and PVC production (EDC/VCM), making them integral to construction and consumer goods industries. Propylene derivatives, particularly polypropylene (PP), are critical for lightweighting in the automotive industry, durable consumer products, textiles, and medical equipment. Other vital derivatives include propylene oxide (PO), acrylonitrile (ACN), cumene, and oxo-alcohols. The core benefit derived from these chemicals is the ability to mass-produce durable, versatile, and cost-effective materials necessary for manufacturing processes worldwide, driving efficiency and innovation across supply chains.

Key driving factors supporting the sustained market growth include rapid urbanization and industrialization in the Asia-Pacific region, escalating demand for sustainable packaging solutions necessitating continuous innovation in polymer grades, and the expansion of the global middle class leading to increased consumption of durable goods. Furthermore, the shift in feedstock preference, particularly the ongoing utilization of cost-advantaged shale gas-derived ethane in North America, provides a structural cost advantage that encourages capacity expansion and sustained competitive pricing globally. Technological advancements in catalyst development and process intensification, particularly in on-purpose production, also play a significant role in mitigating supply fluctuations and optimizing production economics.

Ethylene and Propylene Market Executive Summary

The Ethylene and Propylene Market is entering a phase of strategic transformation, defined by aggressive capacity additions concentrated in North America and Asia, shifting feedstock economics favoring ethane over heavier liquids, and an accelerating focus on circular economy principles influencing polymer demand. Business trends indicate a continued integration between upstream energy suppliers and downstream chemical producers, aiming to secure long-term, cost-effective feedstock supply, thereby mitigating margin volatility inherent to the steam cracking process. Strategic mergers and acquisitions are observed as major petrochemical players consolidate positions, particularly in high-growth derivative markets like specialty polyolefins and performance polymers. Investment in digitalization and automation of cracking operations is a major theme driving operational excellence and energy efficiency across the installed asset base, optimizing complex product yields based on real-time market signals.

Regional trends highlight the continued dominance of the Asia Pacific (APAC) region, led by China and India, both in terms of consumption and new capacity build-out, driven by massive infrastructure and manufacturing bases. North America maintains a strong position as a global net exporter, leveraged by its structural feedstock cost advantage, resulting in highly competitive ethylene pricing. Europe, while facing constraints due to higher regulatory pressures and feedstock costs (often reliant on naphtha), is prioritizing innovation in specialized derivatives and leading efforts in chemical recycling technologies, focusing on high-value, sustainable solutions rather than sheer volume expansion. The Middle East remains a critical hub for low-cost production and inter-regional trade, strategically connecting Western consumption centers with rapidly growing Asian markets.

Segmentation trends reveal significant divergence in growth drivers across derivatives. The Polypropylene (PP) segment is demonstrating superior growth, bolstered by its utility in lightweight automotive parts and robust performance in injection molding applications, often outstripping the demand growth rate for generic Polyethylene (PE) grades. However, linear low-density polyethylene (LLDPE) and high-density polyethylene (HDPE) continue to show steady expansion, supported by packaging innovation and agricultural applications. A critical trend within the segmentation is the rapid advancement of on-purpose propylene technologies (PDH and MTO), which are fundamentally altering the propylene supply paradigm, decoupling it from the historical constraints of ethylene production and refining output, leading to greater supply stability and strategic independence for propylene derivatives producers.

AI Impact Analysis on Ethylene and Propylene Market

Common user questions regarding AI's impact on the Ethylene and Propylene market frequently revolve around its practical application in optimizing highly complex, energy-intensive processes like steam cracking, improving predictive maintenance regimes for critical rotating equipment (compressors, turbines), and enhancing supply chain resilience through advanced demand forecasting. Users are keenly interested in how Artificial Intelligence and Machine Learning (ML) algorithms can manage the multivariate constraints involved in feedstock selection and switching—a crucial determinant of profitability. Furthermore, there is significant inquiry into AI’s role in developing novel catalysts and screening molecular structures to accelerate the transition towards bio-based or recycled feedstocks, addressing sustainability goals. The overriding expectation is that AI will dramatically reduce operational expenditures (OPEX) and capital expenditures (CAPEX) by minimizing downtime and maximizing asset utilization, while simultaneously improving adherence to increasingly stringent environmental regulations.

The adoption of AI and ML is transitioning from proof-of-concept pilot programs to large-scale deployment across integrated petrochemical complexes. This shift involves implementing digital twins—virtual replicas of physical crackers—that enable real-time simulation and optimization of reaction conditions, thereby maximizing olefin yields (ethylene and propylene) from variable feedstocks such as ethane, propane, or naphtha blends. AI-driven predictive maintenance systems are analyzing sensor data from thousands of points across the plant, anticipating equipment failure days or weeks in advance, drastically reducing unplanned shutdowns and extending the life of high-value assets. This enhanced operational reliability directly translates into more stable global supply and improved investor confidence in the sector's long-term profitability metrics.

Furthermore, AI is instrumental in transforming the commercial aspects of the market. Machine learning models are now used for high-accuracy price forecasting, accounting for complex geopolitical, energy, and macroeconomic factors that influence olefin pricing volatility. In the sustainability domain, AI algorithms are optimizing recycling processes, such as identifying, sorting, and depolymerizing post-consumer plastic waste streams more efficiently, thereby accelerating the development of a viable circular economy for polyethylene and polypropylene. The ability of AI to rapidly process and interpret vast datasets on plant performance, environmental emissions, and market demand positions it as a core enabling technology for future smart chemical manufacturing facilities.

- Advanced process control optimization (APC) using ML to maximize ethylene/propylene yield based on feedstock changes.

- Implementation of predictive maintenance systems to minimize unplanned downtime in high-temperature steam cracking furnaces and compressors.

- AI-driven demand forecasting and inventory management, optimizing logistics and reducing working capital requirements.

- Digital twin technology for real-time simulation and scenario planning for complex chemical reactions and plant operations.

- Accelerated discovery and screening of next-generation catalysts for improved selectivity and lower energy consumption in olefin production.

- Optimization of energy consumption across the plant utility network to lower carbon intensity and improve environmental compliance.

- AI-enabled feedstock sourcing optimization, dynamically selecting the most economical feedstock blend based on real-time commodity pricing.

- Enhanced quality control and anomaly detection in polymer production lines, ensuring consistency in derivative products like PE and PP.

DRO & Impact Forces Of Ethylene and Propylene Market

The Ethylene and Propylene Market is primarily driven by relentless global demand from packaging, automotive, and construction sectors, particularly in rapidly industrializing Asian nations. However, it faces significant restraints, chiefly characterized by the high capital expenditure required for capacity expansion, volatility in feedstock prices (crude oil, natural gas, naphtha), and increasing environmental regulatory scrutiny regarding plastic waste and carbon emissions. Opportunities arise from technological advancements, such as highly efficient on-purpose propylene production (PDH, MTO) and the burgeoning focus on chemical recycling and bio-based polymers, which seek to address sustainability concerns while providing diversified feedstock options. These forces collectively dictate the investment cycles, geographical distribution, and technological roadmap for the global olefin industry.

The key impact forces exerting influence include competitive dynamics among major producing regions—namely the cost advantage held by the Middle East and North America versus traditional producers in Europe and parts of Asia. Regulatory shifts, particularly the EU’s Green Deal and comparable initiatives elsewhere, are accelerating the pivot toward circularity and mandated recycling quotas, fundamentally altering derivative market demand dynamics. Furthermore, innovation in catalysis and process engineering, such as improved furnace design and high-selectivity polymerization catalysts, continually pushes the efficiency frontier, lowering the operational footprint per unit produced. Geopolitical stability and major infrastructure investments also serve as foundational impact forces, determining the reliability of supply chains and the feasibility of large-scale capacity deployment necessary to meet long-term demand growth.

The market faces structural challenges related to the co-product nature of propylene from steam cracking, which creates inherent supply imbalances when ethylene demand dictates cracking rates, leading to price spikes for propylene derivatives. This imbalance has fueled the robust growth of on-purpose technologies, which act as a powerful mitigating force stabilizing propylene supply. Environmental impact forces are increasingly pressing; the industry must rapidly invest in carbon capture and storage (CCS) or transition to low-carbon electricity sources to meet Net Zero commitments, a strategic imperative that requires massive financial outlay but offers long-term sustainability benefits and regulatory compliance assurance.

Segmentation Analysis

The Ethylene and Propylene Market is primarily segmented based on the type of derivative product, end-use application, and the feedstock utilized for production. The derivative segmentation highlights the dominant role of Polyethylene (PE) and Polypropylene (PP), which together consume the vast majority of global olefin output, dictating production scale and market dynamics. The feedstock segmentation—covering Naphtha, Ethane, Propane, and others (e.g., MTO, FCC off-gases)—is critical as it defines regional cost competitiveness and technological complexity. End-use segmentation provides insight into consumer demand drivers, showing significant reliance on packaging, automotive, construction, and textiles, reflecting underlying global economic health and consumer behavior.

Ethylene segmentation is driven predominantly by high-volume applications: HDPE, LDPE, and LLDPE account for the largest volume, followed by key intermediates like Ethylene Oxide (EO), which feeds into MEG (Monoethylene Glycol) production, essential for polyester fibers and antifreeze. Propylene segmentation is heavily dominated by Polypropylene (PP), prized for its versatility and mechanical properties, with secondary derivatives including Propylene Oxide (PO), Acrylonitrile (ACN), and Cumene. The growth rates across these specific derivatives often vary, with LLDPE gaining traction over traditional LDPE in flexible packaging, and specialty PP compounds experiencing above-average growth due to automotive lightweighting mandates.

Analyzing segmentation by production technology further reveals strategic shifts. Ethane-based cracking, prevalent in North America and the Middle East, tends to maximize ethylene yield at the expense of propylene. Conversely, naphtha-based cracking, common in Asia and Europe, produces a more balanced slate of ethylene and propylene, alongside valuable byproducts. The advent of dedicated on-purpose routes, particularly PDH (for propylene), represents a strategic segmentation shift, allowing producers to independently respond to propylene market tightness, decoupling capacity expansion from the traditionally cyclical ethylene market, thereby diversifying supply risks and optimizing regional balances.

- By Derivative:

- Ethylene Derivatives:

- Polyethylene (PE) (HDPE, LDPE, LLDPE)

- Ethylene Oxide (EO)/Ethylene Glycol (EG)

- Ethylene Dichloride (EDC)/Vinyl Chloride Monomer (VCM)

- Styrene Monomer (SM)

- Vinyl Acetate Monomer (VAM)

- Propylene Derivatives:

- Polypropylene (PP)

- Propylene Oxide (PO)

- Acrylonitrile (ACN)

- Cumene

- Acrylic Acid and Esters

- Ethylene Derivatives:

- By Production Process/Feedstock:

- Steam Cracking (Ethane, Propane, Naphtha, Gas Oil)

- Fluid Catalytic Cracking (FCC)

- On-Purpose Technology (Propane Dehydrogenation (PDH), Methanol-to-Olefins (MTO))

- By End-Use Application:

- Packaging (Films, Bottles, Containers)

- Automotive (Interior/Exterior components, Fuel tanks)

- Construction (Pipes, Insulation, Cladding)

- Textiles and Fibers

- Consumer Goods

- Agriculture

Value Chain Analysis For Ethylene and Propylene Market

The Ethylene and Propylene value chain is initiated at the upstream sector, deeply rooted in the extraction and processing of hydrocarbon resources, primarily crude oil and natural gas, which yield the critical feedstocks: naphtha, ethane, and propane. Upstream activities involve intensive exploration, drilling, and fractionation of natural gas liquids (NGLs) to isolate ethane and propane, or refining crude oil into naphtha cuts suitable for cracking. Feedstock selection is the most crucial economic determinant in the chain, directly impacting the variable cost of olefin production. Regions with abundant, low-cost NGLs (e.g., North America, Middle East) possess a structural cost advantage, driving significant regional imbalances and international trade dynamics in both olefins and their downstream derivatives.

The midstream stage centers on the production of ethylene and propylene through highly complex and capital-intensive processes, predominantly steam cracking and, increasingly, on-purpose dehydrogenation. Olefin producers invest heavily in large-scale crackers, integrated refinery units, and separation facilities. Efficiency in this stage is paramount, relying on advanced catalysts, energy recovery systems, and digital optimization tools (like AI/ML) to maximize yield and minimize energy consumption. Once produced, the olefins are typically transported via dedicated pipeline networks, specialized tankers, or refrigerated marine vessels, connecting production hubs to nearby derivative plants or global markets.

The downstream sector encompasses the conversion of ethylene and propylene into finished petrochemical intermediates and polymers. This stage is characterized by high diversity, ranging from large-scale polymerization units (producing PE and PP) to specialized chemical synthesis plants (producing EO/EG, PO, ACN). Distribution channels are highly structured, involving large chemical distributors for bulk sales, specialized traders for global arbitrage, and direct sales relationships with major industrial end-users (e.g., automotive OEMs, large packaging converters). The shift towards the circular economy is adding complexity to the downstream, necessitating investment in chemical and mechanical recycling infrastructure, which acts as a parallel source of monomers or recycled polymers, ultimately influencing the demand for virgin olefins.

Ethylene and Propylene Market Potential Customers

Potential customers for ethylene and propylene are predominantly large industrial entities operating in the downstream petrochemical conversion space, seeking consistent, high-volume, and high-purity supply of monomers to feed their polymerization reactors and chemical synthesis units. The primary buyers are polymer manufacturers, notably producers of Polyethylene (PE) and Polypropylene (PP), who operate integrated plants requiring continuous feedstock supply. These customers dictate market stability and pricing, often engaging in long-term supply contracts with major olefin producers to ensure feedstock security against volatile market conditions. Strategic decisions regarding capacity expansion by these large customers directly translate into future demand for base olefins.

Beyond the major polymer producers, a significant customer base includes specialty chemical manufacturers utilizing olefins as essential building blocks for intermediate chemicals. This segment includes manufacturers of Ethylene Oxide (EO) for conversion into Monoethylene Glycol (MEG) used in polyester fibers and resins; producers of Propylene Oxide (PO) for polyurethanes and surfactants; and chemical companies manufacturing solvents, plastics additives, and synthetic rubber (e.g., EPDM). These customers often require stricter specifications for purity and reliability due to the precise nature of their chemical processes, highlighting the importance of quality control in the olefin supply chain.

The ultimate indirect customers, who drive the underlying demand, are the major end-use industries: the packaging sector (for films, bottles, and food containers), the global automotive industry (relying on lightweight PP compounds for fuel efficiency and interior components), the construction industry (using PVC derived from ethylene for piping and siding), and the textiles sector (utilizing polyester fibers derived from MEG). Therefore, market growth is fundamentally linked to macroeconomic indicators like disposable income, construction spending, and automotive production, which influence the procurement decisions of the direct industrial customers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $785.4 Billion |

| Market Forecast in 2033 | $1,085.9 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ExxonMobil, Dow Inc., Sinopec, Saudi Aramco (SABIC), LyondellBasell Industries, Shell Plc, BASF SE, Chevron Phillips Chemical Company, INEOS Group, Reliance Industries Limited, PTT Global Chemical, Formosa Plastics Corporation, Lotte Chemical Corporation, ENOC Group, Borealis AG, TotalEnergies S.E., China National Petroleum Corporation (CNPC), Braskem S.A., Mitsubishi Chemical Holdings, LG Chem. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Ethylene and Propylene Market Key Technology Landscape

The technology landscape for the Ethylene and Propylene market is dominated by large-scale steam cracking, a highly mature but continuously evolving process requiring ultra-high temperatures to break down saturated hydrocarbons. Recent technological advances focus heavily on improving the selectivity and energy efficiency of these crackers. This includes the implementation of advanced furnace designs, such as high-severity pyrolysis coils and specialized burner technologies, aimed at reducing coke formation, prolonging run lengths, and optimizing the yield mix based on the specific feedstock (e.g., maximizing ethylene from ethane or balancing yields from naphtha). Furthermore, waste heat recovery systems and integration with co-generation units are standard practices aimed at minimizing the massive energy footprint associated with cracking operations, directly addressing cost pressures and environmental mandates.

A major technological shift is observed in propylene production with the widespread adoption of on-purpose technologies, most notably Propane Dehydrogenation (PDH) and Methanol-to-Olefins (MTO). PDH technology converts propane directly into propylene, offering producers the flexibility to expand capacity independently of ethylene demand and traditional refining output. Key innovations in PDH center on catalyst improvements, specifically novel platinum or chromium oxide-based catalysts, that enhance conversion rates, improve selectivity, and extend catalyst life cycles, making the process economically viable even with fluctuating propane prices. MTO technology provides an alternative route, particularly attractive in regions with abundant natural gas or coal resources (like China), where methanol is a competitive feedstock. The efficiency and reliability of MTO catalysts, typically based on zeolites, are subject to continuous R&D to manage complex reaction conditions and byproduct formation.

Looking forward, the technology landscape is being shaped by sustainability requirements, driving innovation in chemical recycling technologies. Depolymerization and pyrolysis techniques are emerging as critical technologies to break down polyethylene and polypropylene waste back into their monomer components or intermediate oils, which can then be fed back into the steam cracker or polymerization units. Catalytic research is also focused on developing sustainable routes, such as using bio-based ethanol (derived from biomass) as a feedstock for ethylene production, although these bio-based technologies currently face economic challenges related to scale and cost compared to fossil-fuel routes. The integration of advanced process control (APC) and machine learning algorithms is another technological pillar, optimizing complex processes like high-density polymerization reactors and reactor controls to ensure consistent product quality and maximize throughput.

Regional Highlights

The global Ethylene and Propylene market exhibits significant regional imbalances in both production capacity and consumption demand, driven by differential feedstock costs and varying speeds of industrial development. Asia Pacific (APAC) stands out as the largest and fastest-growing consumer market, responsible for over half of global demand growth. China is the undeniable powerhouse, investing heavily in integrated petrochemical complexes, often leveraging MTO technology due to abundant coal/methanol resources, alongside traditional naphtha cracking. India and Southeast Asian nations are also increasing their capacity utilization and demand for derivatives to support booming infrastructure, packaging, and manufacturing sectors. The region remains a net importer of olefins and derivatives, absorbing output from the Middle East and North America.

North America (NA) is distinguished by its structural cost advantage derived from the shale gas boom, providing abundant, low-cost ethane and propane. This has led to massive, strategic capacity expansions since 2010, predominantly focused on ethane cracking to maximize ethylene yield. Consequently, North America has transitioned from an importer to a dominant net exporter of ethylene derivatives, particularly polyethylene (PE). The focus here is on maximizing operational efficiency and leveraging digital technologies to maintain a global cost lead, influencing international price benchmarks and driving global trade flows, particularly to Asian and Latin American markets.

Europe represents a mature market characterized by slower demand growth and a heavy reliance on higher-cost naphtha feedstock, often placing its producers at a cost disadvantage compared to the US and MEA. However, Europe leads in high-value specialty chemical production and pioneering the circular economy initiatives. The region’s focus is shifting towards maximizing feedstock flexibility, investing heavily in chemical recycling technologies, and developing advanced, sustainable polymer grades to meet stringent environmental regulations. The Middle East and Africa (MEA), dominated by Saudi Arabia and Qatar, leverage abundant, low-cost associated gas (ethane, propane) for highly cost-efficient production, positioning them as the world’s lowest-cost producers and a critical supplier hub, primarily exporting bulk commodities like PE and PP to global markets, thereby linking major consuming regions.

- Asia Pacific (APAC): Dominates global consumption and capacity expansion, fueled by urbanization, infrastructure development in China and India, and major investments in cracker complexes and on-purpose technologies (MTO/PDH).

- North America (NA): Holds a structural competitive advantage due to cost-effective shale gas-derived feedstocks (ethane/propane), resulting in significant export capacity, primarily of ethylene derivatives, and high asset utilization rates.

- Europe: Characterized by high environmental standards, a focus on specialty chemicals, and significant R&D investment into recycling technologies and bio-based feedstocks, compensating for higher operational costs.

- Middle East & Africa (MEA): A crucial global supply hub, leveraging extremely low-cost feedstock access to maximize cost efficiency and serve as the primary bulk exporter of polyolefins to global demand centers.

- Latin America (LATAM): Exhibits patchy growth, dependent on local economic conditions; dominated by countries like Brazil and Mexico, focusing on optimizing existing domestic capacity and balancing imports, particularly from the US Gulf Coast.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Ethylene and Propylene Market, who are globally recognized for their production capacity, technological leadership, and strategic integration across the value chain.- ExxonMobil

- Dow Inc.

- Sinopec (China Petroleum & Chemical Corporation)

- Saudi Aramco (SABIC)

- LyondellBasell Industries N.V.

- Shell Plc

- BASF SE

- Chevron Phillips Chemical Company LLC

- INEOS Group Holdings S.A.

- Reliance Industries Limited (RIL)

- PTT Global Chemical Public Company Limited

- Formosa Plastics Corporation

- Lotte Chemical Corporation

- ENOC Group

- Borealis AG

- TotalEnergies S.E.

- China National Petroleum Corporation (CNPC)

- Braskem S.A.

- Mitsubishi Chemical Holdings Group

- LG Chem Ltd.

Frequently Asked Questions

Analyze common user questions about the Ethylene and Propylene market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the growth of the Ethylene and Propylene Market?

The market growth is primarily driven by surging global demand for derivative products like Polyethylene (PE) and Polypropylene (PP) across packaging, automotive lightweighting, and construction sectors, coupled with the competitive advantage offered by cost-effective shale gas feedstocks, particularly in North America and the Middle East.

How is the adoption of on-purpose technologies impacting the propylene supply chain?

On-purpose technologies such as Propane Dehydrogenation (PDH) and Methanol-to-Olefins (MTO) are decoupling propylene supply from traditional steam cracking and refining output. This creates a more stable, independent supply source for propylene, mitigating historical price volatility and supporting robust capacity expansion in polypropylene production.

Which regions hold the most significant cost advantage in Ethylene production?

North America and the Middle East hold the most significant cost advantage due to their access to abundant, cheap natural gas liquids (ethane and propane) derived from hydraulic fracturing and associated gas streams, which serve as highly selective and low-cost steam cracking feedstocks.

What role does the circular economy play in the future of polyolefin demand?

The circular economy mandates, driven by regulatory pressure and consumer preference, are requiring increased use of recycled content. This fosters investment in advanced mechanical and chemical recycling technologies, creating a competing supply stream for virgin olefins and shifting focus towards monomer recovery (chemical recycling) for high-quality polymer grades.

What are the key technological challenges currently facing olefin producers?

Key challenges include optimizing feedstock flexibility to manage price volatility, reducing the high energy consumption of steam cracking, and adopting decarbonization strategies (such as Carbon Capture, Utilization, and Storage - CCUS) to meet increasingly strict greenhouse gas emission targets.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager