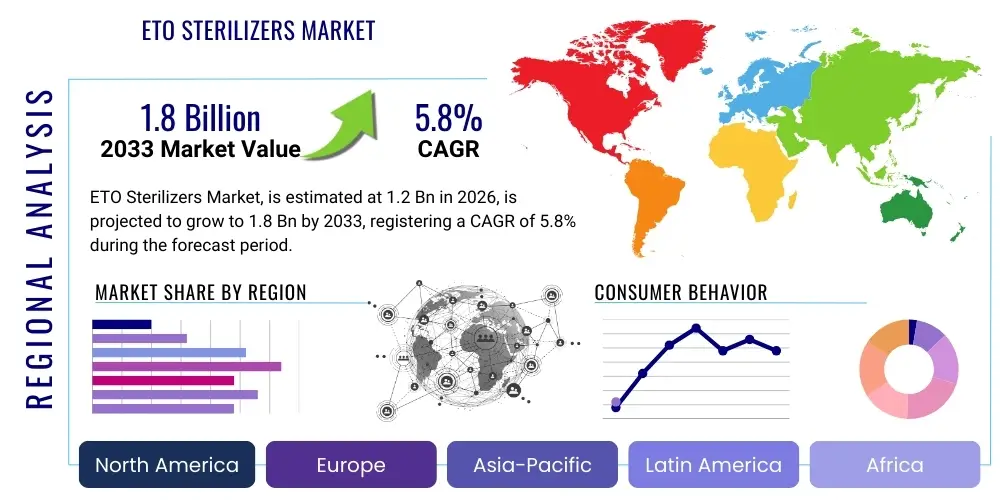

ETO Sterilizers Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441087 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

ETO Sterilizers Market Size

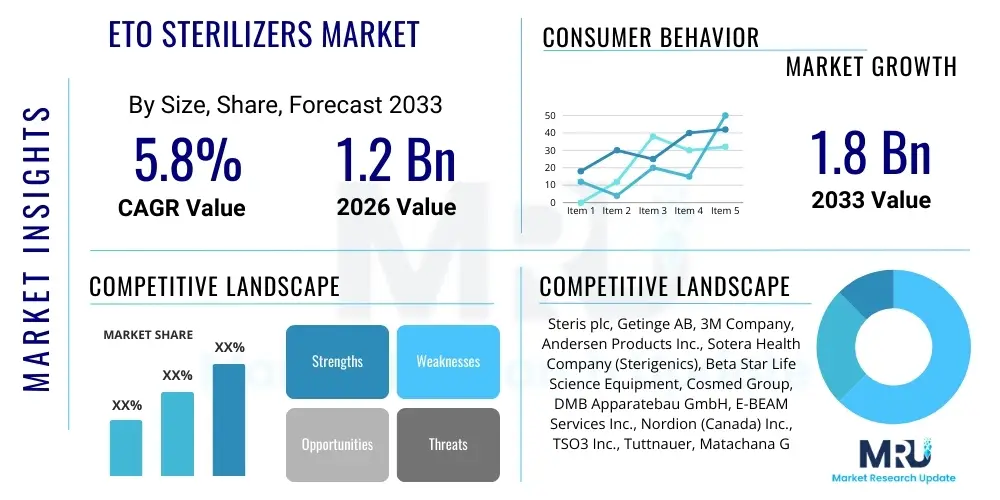

The ETO Sterilizers Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 1.2 Billion in 2026 and is projected to reach USD 1.8 Billion by the end of the forecast period in 2033.

ETO Sterilizers Market introduction

The Ethylene Oxide (ETO) Sterilizers Market encompasses equipment utilized primarily within the medical device and pharmaceutical industries for low-temperature sterilization of heat- and moisture-sensitive products. ETO sterilization is a crucial process, recognized globally for its effectiveness in penetrating complex device geometries without causing material degradation, making it indispensable for instruments that cannot withstand high-temperature steam sterilization. These systems operate by exposing devices to ETO gas under controlled conditions of temperature, vacuum, and humidity. The complexity of modern medical instruments, including specialized surgical kits, implantable devices, and disposable plastics, directly drives the demand for reliable ETO sterilization solutions, ensuring patient safety and regulatory compliance.

Product categories within this market range from large-scale industrial sterilizers used by contract sterilization providers and original equipment manufacturers (OEMs) to smaller, modular units suitable for use in hospital settings or smaller clinical laboratories. Key applications include the sterilization of catheters, syringes, complex electronic medical devices, and custom procedure trays. The inherent antimicrobial efficacy of ETO, capable of eliminating spores, bacteria, and viruses, positions it as a vital technology despite evolving regulatory scrutiny aimed at minimizing ETO emissions and worker exposure. Market growth is structurally supported by the continuous expansion of the global healthcare sector, particularly in emerging economies where healthcare infrastructure investment is accelerating.

Major benefits of utilizing ETO sterilization systems include their high material compatibility, deep penetrating power, and proven efficacy against a wide spectrum of microbial contaminants. Driving factors for market expansion are manifold: the rising prevalence of Hospital-Acquired Infections (HAIs) necessitating rigorous sterilization protocols, the continuous innovation in complex, disposable medical devices requiring specialized sterilization methods, and the increasing volume of surgical procedures worldwide. Furthermore, advancements in control systems and monitoring technologies are improving the safety and efficiency of ETO processes, helping manufacturers meet stringent environmental and occupational safety standards imposed by regulatory bodies like the FDA and EPA.

ETO Sterilizers Market Executive Summary

The ETO Sterilizers Market is characterized by robust business trends centered on automation, enhanced cycle control, and mitigating environmental impact. Key market players are investing heavily in advanced gas conditioning systems and residue removal technologies to optimize operational efficiency and adhere to increasingly strict governmental regulations regarding ETO residue limits and atmospheric emissions. There is a noticeable trend towards the adoption of hybrid sterilization methods and smaller, highly automated ETO units designed for quick turnaround times in specialized contract sterilization centers. Furthermore, strategic mergers and acquisitions among major sterilization service providers are consolidating market share and enabling providers to offer integrated supply chain solutions to large medical device manufacturers, thereby streamlining the sterilization logistics chain globally.

Regionally, North America and Europe currently dominate the market due to the presence of established medical device manufacturing hubs and advanced healthcare infrastructure, coupled with rigorous regulatory mandates that necessitate certified sterilization methods. However, the Asia Pacific (APAC) region is projected to exhibit the highest growth rate, fueled by massive investments in healthcare infrastructure, the burgeoning medical tourism sector, and the rapid expansion of local medical device manufacturing capabilities, particularly in China and India. These developing regions are adopting modern sterilization technologies quickly to align with global quality standards, creating substantial demand for industrial and institutional ETO sterilization systems. Latin America and MEA are also showing steady growth, driven by increasing access to modern medical treatments.

Segment trends indicate strong growth in the medium-capacity industrial sterilizers segment, balancing efficiency and cost-effectiveness for contract sterilization organizations. By application, the sterilization of single-use disposable medical devices remains the largest contributor to market revenue, reflecting the global trend toward minimizing cross-contamination risks in clinical settings. Furthermore, technology trends reveal a shift toward lower ETO concentrations and enhanced aeration cycles, driven by the need to accelerate product release timelines while maintaining safety parameters. The regulatory environment acts as a critical constraint, driving manufacturers to innovate in areas such as ETO capture and destruction technologies, transforming compliance into a competitive differentiator.

AI Impact Analysis on ETO Sterilizers Market

Common user questions regarding the impact of Artificial Intelligence (AI) on the ETO Sterilizers Market often revolve around operational efficiency, predictive maintenance, and regulatory compliance assurance. Users frequently inquire whether AI can optimize sterilization cycle parameters in real-time to reduce ETO exposure times and residual levels, thereby accelerating product throughput. Concerns also focus on how AI can integrate vast datasets—including gas concentration, temperature, humidity, and biological indicator results—to provide predictive analytics for equipment failure or potential compliance deviations before they occur. The expectation is that AI-driven solutions will lead to a 'smart sterilization' ecosystem, minimizing human error, enhancing energy consumption efficiency, and providing irrefutable, auditable data trails necessary for stringent regulatory submissions and quality control verification in an increasingly complex manufacturing environment.

AI's primary influence is expected to be centered on optimizing the highly technical and controlled sterilization cycle. By leveraging machine learning algorithms to analyze historical process data, AI can dynamically adjust preconditioning phases, gas injection rates, and post-sterilization aeration periods based on factors like batch size, product density, and even ambient environmental conditions. This optimization minimizes unnecessary cycle duration, substantially reduces overall ETO usage, and critically, ensures that residual ETO levels on finished products are consistently below regulatory thresholds, a factor that is challenging to achieve consistently using static, predetermined cycles. The move toward data-driven, adaptive sterilization is foundational to future quality management systems in this sector.

Moreover, AI integration will revolutionize maintenance and inventory management within contract sterilization facilities and large hospitals. Predictive maintenance capabilities use sensor data to identify anomalies indicative of imminent equipment failure, such as subtle pressure drops or temperature fluctuations, allowing for preventative intervention rather than costly reactive repairs. In logistics, AI algorithms can optimize the scheduling of batches based on demand and required aeration times, significantly improving facility capacity utilization. This transition towards digitally enhanced operations minimizes downtime, reduces operational costs, and ensures a more reliable supply chain for sterilized medical devices, addressing major bottlenecks currently faced by high-volume service providers.

- AI-driven optimization of sterilization cycle parameters to reduce ETO exposure and residual levels.

- Implementation of predictive maintenance protocols based on real-time sensor data analysis, minimizing unplanned downtime.

- Enhanced quality assurance through machine learning models that correlate process variables with biological indicator efficacy results.

- Automated generation of comprehensive, audit-ready compliance reports, streamlining regulatory submission processes.

- Improved supply chain logistics and batch scheduling optimization using adaptive algorithms based on production forecasts.

- Development of AI-powered process control systems that ensure greater consistency and repeatability across diverse product lines.

DRO & Impact Forces Of ETO Sterilizers Market

The ETO Sterilizers Market is shaped by a critical interplay of potent Drivers (D), significant Restraints (R), and compelling Opportunities (O), which collectively dictate market trajectory and intensity of competition. The primary driver is the pervasive demand for sterile, single-use medical devices globally, coupled with the lack of viable, universally applicable sterilization alternatives for sensitive materials like polymers and electronics. Opportunities mainly stem from technological advancements in ETO mitigation and emission control systems, allowing operators to meet environmental standards while maintaining sterilization efficacy. However, the market faces severe restraints, chiefly the toxicity of ETO gas itself, leading to extremely tight regulatory oversight, public health concerns, and substantial capital investment required for compliant infrastructure and sophisticated abatement technologies. These forces collectively compel continuous innovation in process safety and environmental responsibility.

Drivers primarily center on healthcare expansion and technological necessities. The global rise in chronic diseases necessitates more surgical interventions, driving demand for disposable kits and implantable devices that often require ETO sterilization due to material constraints. Furthermore, the emphasis on infection prevention in hospitals, accelerated by pandemic preparedness and increasing awareness of antimicrobial resistance, reinforces the critical nature of effective sterilization. This demand pushes manufacturers toward higher capacity and more efficient systems capable of handling large volumes consistently. Innovations in medical technology, introducing ever more complex instruments sensitive to traditional heat sterilization, solidify ETO's irreplaceable role in the sterilization portfolio.

Restraints fundamentally challenge market expansion and impose high entry barriers. The established carcinogenicity and flammability of Ethylene Oxide mandate rigorous facility design, stringent operational protocols, and mandatory continuous monitoring, significantly increasing operational costs. The regulatory crackdown, particularly in regions like North America and Europe, focusing on reducing occupational exposure and stack emissions, forces considerable investment in air pollution control devices (APCDs). This regulatory pressure often pushes smaller players out of the market and encourages larger medical device OEMs to outsource sterilization services to specialized contract service organizations (CSOs) that can absorb the high compliance costs, thereby limiting the direct purchase of ETO equipment by end-users.

Opportunities for growth are concentrated in geographic expansion and technological refinement. Emerging markets in APAC and Latin America represent vast underserved areas where healthcare modernization drives demand for industrial sterilizers. Technologically, opportunities exist in developing advanced ETO substitutes (like Vaporized Hydrogen Peroxide, though limited in material compatibility), enhancing ETO-based technologies through supercritical ETO processes, and integrating advanced automation and data analytics (AI/ML) to optimize cycle times and improve validation processes. The integration of end-to-end supply chain traceability systems that document every aspect of the sterilization cycle also presents a significant competitive advantage and opportunity for value-added services.

Segmentation Analysis

The ETO Sterilizers Market is segmented based on critical parameters including Product Type (equipment vs. consumables), Capacity (small, medium, large/industrial), End-User (Hospitals, Medical Device Manufacturers, Contract Sterilization Service Providers), and Technology (100% ETO vs. ETO mixture). This detailed segmentation helps in understanding the varying demands across different operational settings and regulatory requirements. Product type segmentation distinguishes between the capital expenditure associated with purchasing the sterilization chamber and the ongoing operational expenditure related to ETO cartridges, aeration filters, and biological indicators. The capacity segmentation is crucial as it reflects the primary customer base: hospitals typically utilize small to medium units, while large medical device manufacturers and CSOs require high-throughput industrial systems.

The End-User segment provides crucial insights into purchasing power and regulatory adherence. Contract Sterilization Service Providers (CSSPs) constitute the largest and fastest-growing segment, driven by the increasing tendency of medical device OEMs to outsource complex sterilization tasks to specialized third parties to manage compliance risk and optimize capital expenditure. CSSPs typically require industrial-capacity, highly automated ETO sterilizers. Conversely, hospitals, while using smaller ETO units for reprocessing heat-sensitive instruments, are often constrained by safety concerns and facility limitations, sometimes leading them to adopt alternative, safer low-temperature methods like hydrogen peroxide plasma, limiting the growth of hospital-based ETO unit adoption.

Technology segmentation highlights the shift from pure ETO cylinders to mixed gas forms (e.g., ETO mixed with CO2 or inert gases), which are often safer and easier to handle, though sometimes requiring specialized equipment modifications. While 100% ETO systems offer maximum efficacy and faster cycle times, regulatory mandates focused on safety and residue limits are driving the adoption of advanced ETO mixture systems and improved gas diffusion techniques. Overall, the structural complexity of these segments reflects the highly regulated, application-specific nature of the sterilization industry, where device material compatibility and process validation are paramount.

- Product Type:

- Equipment (Chambers, Aerators, Vacuum Pumps)

- Consumables (ETO Cartridges, Biological Indicators, Chemical Indicators)

- Capacity:

- Small Capacity (Under 100 Liters)

- Medium Capacity (100 to 500 Liters)

- Large/Industrial Capacity (Above 500 Liters)

- End-User:

- Hospitals and Clinics

- Medical Device Manufacturers (OEMs)

- Contract Sterilization Service Providers (CSSPs)

- Pharmaceutical Companies

- Technology:

- 100% ETO Systems

- ETO Mixture Systems (e.g., ETO/CO2)

Value Chain Analysis For ETO Sterilizers Market

The ETO Sterilizers market value chain begins with upstream suppliers providing critical raw materials and components, including specialized metals for chamber construction (stainless steel), high-integrity sealing materials, complex vacuum pump systems, and the essential input, Ethylene Oxide gas itself, sourced from specialized chemical manufacturers. The upstream phase is characterized by stringent quality control requirements, as the durability and inertness of the sterilization chamber components are paramount to safety and efficacy. Key integration points here involve long-term supply agreements between equipment manufacturers and specialized chemical or component suppliers to ensure reliable, compliant sourcing of high-purity ETO gas and proprietary sterilization accessories.

The midstream phase involves the core activity: design, engineering, and manufacturing of the ETO sterilization equipment. Equipment manufacturers invest heavily in R&D to develop systems that offer greater automation, reduced cycle times, enhanced gas removal and aeration capabilities, and sophisticated environmental control systems (e.g., catalytic converters for ETO abatement). Downstream activities encompass the distribution, installation, validation, and comprehensive post-sales service, including periodic re-validation and calibration. Distribution channels are typically a mix of direct sales teams for large industrial projects and specialized third-party distributors or integrators who handle installation and local support, especially in geographically dispersed markets or those requiring complex regulatory navigation.

The indirect channel plays a significant role through contract sterilization service providers (CSSPs). These entities act as indirect customers for the ETO sterilizer manufacturers but as direct service providers for medical device OEMs. The CSSPs offer centralized, validated, and high-volume sterilization services, effectively offloading the substantial compliance and operational burden from the OEM. This indirect model is increasingly prevalent, driving demand for industrial-scale equipment and sophisticated process control software from the original equipment manufacturers. Ensuring the integrity and traceability across this complex value chain, particularly concerning ETO residue testing and regulatory documentation, is critical for all stakeholders.

ETO Sterilizers Market Potential Customers

Potential customers for ETO sterilization equipment and related consumables are heavily concentrated within the medical and pharmaceutical sectors, driven by the necessity to sterilize products that are sensitive to high heat or moisture. The primary and most significant customer segment consists of Contract Sterilization Service Providers (CSSPs). These companies, such as Sterigenics (part of Sotera Health), Steris AST, and others, require robust, industrial-scale ETO sterilizers to service multiple medical device manufacturers (MDMs) simultaneously, providing outsourced sterilization solutions to manage high volume and strict regulatory oversight. As MDMs continue to focus on core manufacturing competencies, the reliance on these specialized service providers grows, making them key purchasers of high-capacity equipment.

The second major group includes large Medical Device Manufacturers (OEMs) who opt for in-house sterilization facilities. Companies producing high-volume, highly complex, or proprietary devices (e.g., certain implantable cardiac devices, specialized surgical kits) often maintain their own sterilization centers to exert greater control over the process, manage intellectual property, and expedite supply chain logistics. These captive facilities necessitate the purchase of custom-engineered, large-volume ETO sterilizers, along with the full suite of monitoring and abatement technologies required for full regulatory compliance and process validation.

Finally, hospitals and integrated delivery networks (IDNs) represent a segment, though generally smaller and declining in terms of industrial ETO usage. Hospitals primarily utilize small to medium-capacity ETO sterilizers for the terminal sterilization or high-level disinfection of specialized, reusable, heat-sensitive instruments that are difficult to process via other methods. However, due to increasing occupational safety concerns and the availability of safer, faster, low-temperature alternatives (like VHP), hospital purchasing decisions are often shifting towards non-ETO methods, thus limiting the growth potential in this specific end-user category compared to the industrial segments.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.2 Billion |

| Market Forecast in 2033 | USD 1.8 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Steris plc, Getinge AB, 3M Company, Andersen Products Inc., Sotera Health Company (Sterigenics), Beta Star Life Science Equipment, Cosmed Group, DMB Apparatebau GmbH, E-BEAM Services Inc., Nordion (Canada) Inc., TSO3 Inc., Tuttnauer, Matachana Group, Boekel Scientific, PMS Instrumente GmbH, Quallion LLC, BMT Medical Technology, Sakura Finetek, Melag Medizintechnik. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

ETO Sterilizers Market Key Technology Landscape

The ETO Sterilizers Market is constantly evolving technologically, primarily driven by the imperative to improve process safety, enhance efficiency, and minimize environmental impact. A central technological focus involves developing highly automated control systems utilizing Programmable Logic Controllers (PLCs) and Supervisory Control and Data Acquisition (SCADA) systems. These advanced control systems ensure precise monitoring and regulation of critical parameters—such as pre-vacuum levels, gas concentration, temperature uniformity, and humidity—throughout the complex ETO cycle. Modern systems feature sophisticated sensor technology capable of real-time monitoring of ETO leaks and residues, critical for both occupational safety and process validation, ensuring consistent compliance with ISO and FDA standards. Furthermore, the push towards integrated digital record-keeping systems eliminates manual documentation, providing seamless, auditable data trails essential for regulatory submissions.

A second critical area of innovation lies in Ethylene Oxide abatement and emission control technologies. The increasing regulatory pressure from environmental agencies globally necessitates the use of highly efficient Abatement Pollution Control Devices (APCDs). The most commonly deployed technologies include catalytic converters and wet scrubbers, designed to break down or neutralize residual ETO from the sterilization chamber and aeration rooms before release into the atmosphere. Equipment manufacturers are focusing on integrating these systems directly into the sterilizer design to offer comprehensive, closed-loop solutions. Advancements are leading to highly efficient catalytic oxidation systems that can achieve ETO destruction efficiencies exceeding 99.9%, a benchmark increasingly demanded by leading industrial service providers seeking to minimize their environmental footprint and secure operating permits in highly regulated jurisdictions.

Moreover, process optimization technologies are gaining traction. This includes the development of ETO gas cartridges or specialized delivery systems that allow for precise, measured dosing, reducing the overall volume of ETO required per cycle. Enhanced aeration technologies are crucial, focusing on forced air circulation and controlled pressure changes within dedicated aeration rooms to rapidly remove ETO residue from sterilized products. Techniques like pulsed aeration and heated air circulation accelerate the degassing process, significantly reducing the post-sterilization quarantine time and enabling faster product release. This continuous effort in process refinement, supported by advanced engineering and materials science, ensures ETO sterilization remains a viable and highly regulated method for critical medical devices.

Regional Highlights

- North America: Dominates the global ETO sterilizers market, driven by the presence of major medical device manufacturing clusters, stringent regulatory environment demanding validated sterilization, and high adoption rates of advanced healthcare technologies. The U.S. remains the largest contributor, with a strong emphasis on continuous process improvement and significant investment in ETO abatement technologies due to rigorous EPA and OSHA oversight.

- Europe: A mature market characterized by robust healthcare spending and a large base of pharmaceutical and medical device companies, particularly in Germany, the UK, and France. Growth is moderate, focused mainly on replacing older equipment with newer, energy-efficient, and environmentally compliant ETO systems that meet complex EU directives regarding occupational safety and emissions (REACH regulations).

- Asia Pacific (APAC): Expected to be the fastest-growing region during the forecast period. This rapid expansion is attributed to massive government investments in developing healthcare infrastructure, rising medical tourism, and the establishment of numerous new local and international medical device production facilities in countries like China, India, and South Korea, driving high demand for industrial sterilization capacity.

- Latin America: Demonstrates stable growth fueled by improving economic conditions and increased accessibility to modern healthcare services, particularly in Brazil and Mexico. The market is primarily focused on the procurement of medium-capacity ETO units for regional hospitals and emerging contract sterilization facilities aimed at serving local device manufacturing.

- Middle East and Africa (MEA): Represents a nascent market with growth concentrated in high-income Gulf Cooperation Council (GCC) countries (Saudi Arabia, UAE). Market penetration is tied directly to large-scale infrastructure projects aimed at establishing world-class medical facilities and local pharmaceutical production hubs, requiring imported, certified sterilization technology.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the ETO Sterilizers Market.- Steris plc

- Getinge AB

- 3M Company

- Andersen Products Inc.

- Sotera Health Company (Sterigenics)

- Beta Star Life Science Equipment

- Cosmed Group

- DMB Apparatebau GmbH

- E-BEAM Services Inc.

- Nordion (Canada) Inc.

- TSO3 Inc.

- Tuttnauer

- Matachana Group

- Boekel Scientific

- PMS Instrumente GmbH

- Quallion LLC

- BMT Medical Technology

- Sakura Finetek

- Melag Medizintechnik

Frequently Asked Questions

Analyze common user questions about the ETO Sterilizers market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driver for the continued use of ETO sterilization despite toxicity concerns?

ETO sterilization remains indispensable because it is highly effective for sterilizing heat- and moisture-sensitive medical devices, such as specialized plastics, electronics, and complex catheters, which cannot withstand high-temperature steam or other harsh methods, ensuring device integrity and patient safety.

How are strict environmental regulations impacting the purchasing decisions for ETO sterilizers?

Regulations necessitate significant capital investment in advanced ETO abatement systems (e.g., catalytic converters) to minimize atmospheric emissions. This drives end-users, especially hospitals, to outsource sterilization to specialized Contract Sterilization Service Providers (CSSPs) who can absorb the high compliance costs associated with industrial-grade abatement technology.

Which geographical region is expected to show the fastest growth rate in the ETO Sterilizers Market?

The Asia Pacific (APAC) region is projected to register the fastest growth, primarily due to expanding healthcare infrastructure, increasing local medical device manufacturing, and rising government efforts to standardize sterilization practices across emerging economies like China and India.

What role does Artificial Intelligence play in optimizing ETO sterilization cycles?

AI is being implemented to analyze historical process data and optimize sterilization cycle parameters, including gas dosage and aeration times, in real-time. This dynamic adjustment reduces overall ETO usage, shortens turnaround times, and ensures residual ETO levels consistently meet regulatory safety thresholds.

What are the key technological advancements concerning ETO residue reduction?

Key advancements include enhanced aeration technologies, such as pulsed and heated air circulation systems, designed to accelerate the degassing process. Furthermore, manufacturers are developing highly efficient Abatement Pollution Control Devices (APCDs) to destroy ETO before atmospheric release, ensuring product and environmental safety.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager